Swagelok Bundle

How Does Swagelok Company Thrive in the Fluid Systems Industry?

Swagelok Company is a global leader, essential for the safe and efficient operation of critical industrial processes. Their high-quality and reliable Swagelok SWOT Analysis reveals the company's strengths. From the chemical industry to semiconductors, Swagelok products are vital. Understanding Swagelok's operations is key for investors, customers, and industry watchers.

This analysis explores the core of Swagelok's business, from its operational processes to its strategic positioning. We'll examine how Swagelok products, including tube fittings and valves, create value and drive revenue. Learn about Swagelok's history, manufacturing, and the competitive landscape, including how to choose the right Swagelok fitting. This will provide a comprehensive view of Swagelok's market dominance.

What Are the Key Operations Driving Swagelok’s Success?

Swagelok Company provides fluid system solutions, offering a wide range of components and services that are critical across various industries. Their core offerings include Swagelok products like fittings, valves, tubing, and hoses, all designed to ensure leak-tight performance. They serve key sectors such as chemical processing, oil and gas, and biotechnology, ensuring system integrity in demanding environments.

The company's operations center on vertically integrated manufacturing and a global distribution network. This approach enables them to maintain high-quality standards and ensure timely delivery of components worldwide. Swagelok emphasizes continuous innovation and invests heavily in research and development to meet evolving industry needs.

The value proposition of Swagelok Company lies in its commitment to quality, safety, and performance, coupled with a deep understanding of application-specific challenges. This focus translates into tangible benefits for customers, such as reduced downtime and optimized system performance. Their comprehensive training and support services further differentiate them, solidifying their position as a trusted partner.

Swagelok offers a comprehensive suite of fluid system solutions, including fittings, valves, tubing, hoses, and regulators. They also provide specialized services like assembly and training. These products are engineered for reliability and performance in critical applications.

Swagelok serves diverse industries such as chemical processing, oil and gas, and biotechnology. Other key sectors include pharmaceuticals, semiconductors, and alternative fuels. They provide solutions tailored to the specific needs of each industry.

Swagelok's operations are characterized by vertically integrated manufacturing, rigorous quality control, and a robust global distribution network. They focus on advanced machining, welding, and assembly. Their supply chain ensures timely delivery of components worldwide.

Customers benefit from reduced downtime, enhanced operational safety, and optimized system performance. Swagelok provides comprehensive training and support services. This holistic approach solidifies their position as a trusted partner.

Swagelok distinguishes itself through its unwavering focus on quality, safety, and performance. They offer a deep understanding of application-specific challenges. This commitment translates into tangible benefits for customers.

- Vertically integrated manufacturing ensures consistent quality.

- Global distribution network provides localized support.

- Continuous investment in R&D drives innovation.

- Comprehensive training and support services empower customers.

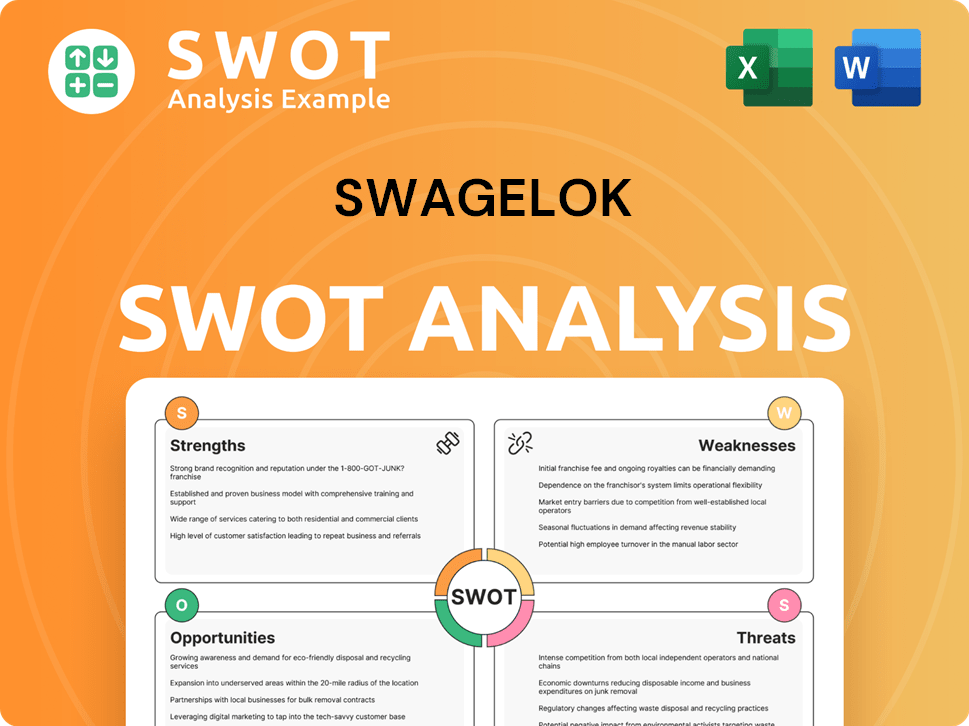

Swagelok SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Swagelok Make Money?

The core of Swagelok Company's revenue generation centers on the sale of its high-quality fluid system components and assemblies. This includes a broad array of products such as tube fittings, valves, and other essential components designed for various industrial applications. While specific financial figures for 2024-2025 are not publicly available due to its private status, the demand for precision-engineered components in sectors like semiconductors and pharmaceuticals likely sustains strong sales.

Beyond direct product sales,

The monetization strategy of Swagelok is largely based on a premium pricing model, justified by the high quality and reliability of its products. This approach allows the company to maintain profitability while meeting the stringent requirements of demanding industrial environments. The company leverages its global network of authorized sales and service centers to facilitate sales and provide localized support, ensuring widespread market penetration.

Swagelok's financial success is built on a combination of product sales and service offerings, supported by a robust global distribution network and a commitment to quality.

-

Product Sales: The primary revenue stream comes from selling a wide range of

, including tube fittings, valves, and other fluid system solutions. These products are essential in industries requiring high precision and reliability. - Custom Solutions and Assemblies: Swagelok designs and builds custom fluid system configurations to meet specific customer needs. This service adds value and caters to specialized requirements.

- Training and Education: The company offers training programs to help customers optimize their fluid systems. These programs enhance customer knowledge and support the proper installation and maintenance of Swagelok products.

- Premium Pricing Model: Swagelok employs a premium pricing model, reflecting the high quality, reliability, and performance of its products. This strategy is justified by the critical role these components play in ensuring safety and operational efficiency.

- Global Network: A global network of authorized sales and service centers facilitates sales and provides localized support, ensuring broad market penetration.

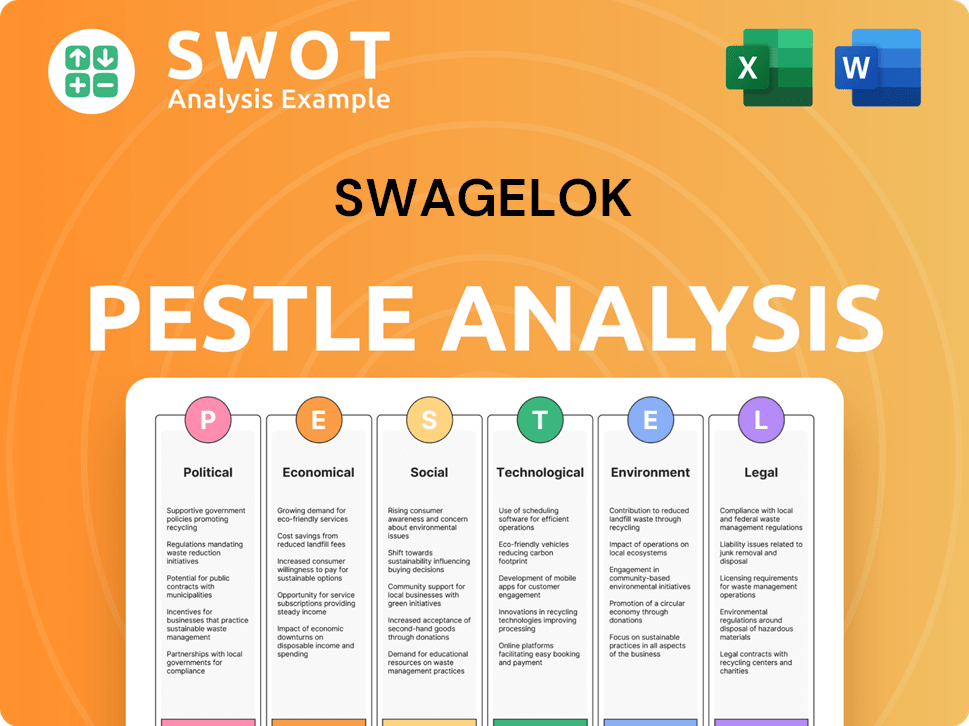

Swagelok PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Swagelok’s Business Model?

The journey of the Swagelok Company has been marked by a consistent focus on innovation, strategic market expansion, and an unwavering commitment to quality. While specific recent milestones for 2024-2025 are not extensively publicized due to the company's private ownership, its history reveals a pattern of continuous improvement and adaptation. Significant strategic moves have included the ongoing expansion of its global network of authorized sales and service centers, which allows for localized support and deeper market penetration, particularly in emerging industrial hubs.

The company has consistently invested in advanced manufacturing technologies and materials science to enhance product performance and reliability, crucial for demanding applications in industries like semiconductor manufacturing and alternative energy. Operational challenges often faced by companies in this sector include supply chain disruptions, fluctuating raw material costs, and the need to adapt to evolving industry standards and regulations. Swagelok's response has typically involved robust supply chain management, strategic inventory planning, and continuous investment in R&D to meet new performance benchmarks and compliance requirements. For instance, the increasing demand for ultra-high-purity components in semiconductor fabrication has likely driven further product development and manufacturing process refinements.

Swagelok products are known for their quality and reliability. This reputation is a key factor in the company's sustained success. The company's approach to fluid system solutions has allowed it to maintain a strong position in the market. For more details, you can read a Brief History of Swagelok.

Ongoing expansion of global sales and service centers. Continuous investment in advanced manufacturing and materials science. Adaptation to evolving industry standards and regulations.

Robust supply chain management and strategic inventory planning. Continuous investment in R&D. Focus on meeting new performance benchmarks and compliance requirements.

Strong brand recognition for quality and reliability. Technology leadership through innovative Swagelok products. Extensive global distribution network with technical expertise.

Supply chain disruptions and fluctuating raw material costs. Adapting to evolving industry standards. Meeting new performance benchmarks and compliance requirements.

Swagelok's competitive advantages are multifaceted. Its brand strength, built over decades, signifies unparalleled quality, reliability, and safety in fluid system components. This strong brand recognition translates into significant customer loyalty. Technology leadership is another key differentiator, as the company consistently introduces innovative products and solutions that address complex fluid system challenges.

- Brand strength and customer loyalty.

- Technology leadership with innovative products.

- Extensive global distribution network.

- Comprehensive support system.

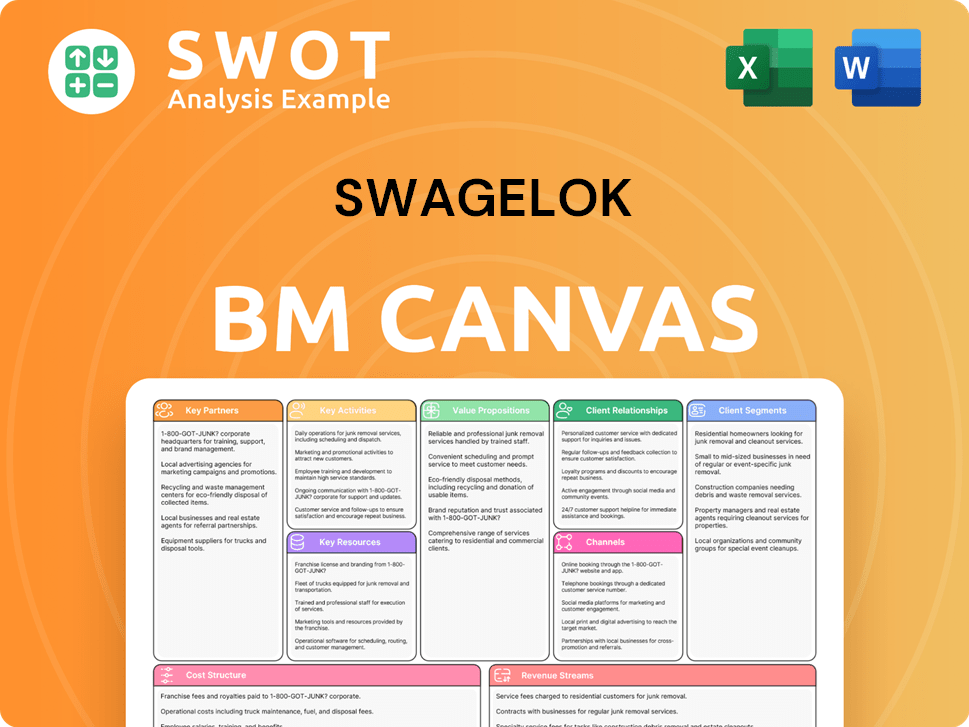

Swagelok Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Swagelok Positioning Itself for Continued Success?

The Swagelok Company holds a strong position in the fluid systems industry. It's known globally for its high quality and reliability. While specific market share data for 2024-2025 isn't available publicly, it's considered a market leader, especially in applications where system integrity is crucial. Its global reach, with authorized sales and service centers in over 100 countries, shows strong customer loyalty and market penetration.

However, Swagelok products face risks. Changes in environmental and safety regulations could require adjustments. New, lower-cost competitors could put pressure on prices. Technological advancements, like new materials and manufacturing techniques, could also be disruptive. Economic downturns and supply chain issues, as seen recently, remain persistent operational risks.

Swagelok Company is a leading provider of fluid system solutions. It has a global presence with a strong reputation for quality and reliability. The company serves diverse industries, including oil and gas, semiconductors, and renewable energy, with a wide range of Swagelok products.

The company faces risks from changing regulations and new competitors. Technological advancements and economic downturns also pose challenges. Supply chain vulnerabilities remain a concern. Adapting to these factors is crucial for the company's continued success.

Swagelok is focused on innovation and market expansion. It is expected to invest in research and development, particularly in areas like hydrogen infrastructure. The company aims to leverage its brand and global network to capitalize on growth opportunities. This includes enhancing its product portfolio and expanding service offerings.

The company is likely to focus on research and development to meet emerging industry needs. Swagelok emphasizes quality, safety, and customer satisfaction. It plans to sustain revenue and maintain its market leadership through operational excellence. This involves continuous improvement of Swagelok products and services.

Swagelok is likely to focus on several key strategies for future growth. These include expanding its product lines to meet evolving customer needs and increasing its global market presence. The company is also expected to invest in training and support to enhance customer satisfaction and loyalty. For more detailed insights, explore this article about Swagelok.

- Focus on innovation in fluid system solutions.

- Expand into new markets, particularly in renewable energy.

- Enhance customer service and support capabilities.

- Invest in research and development for new tube fittings and valves.

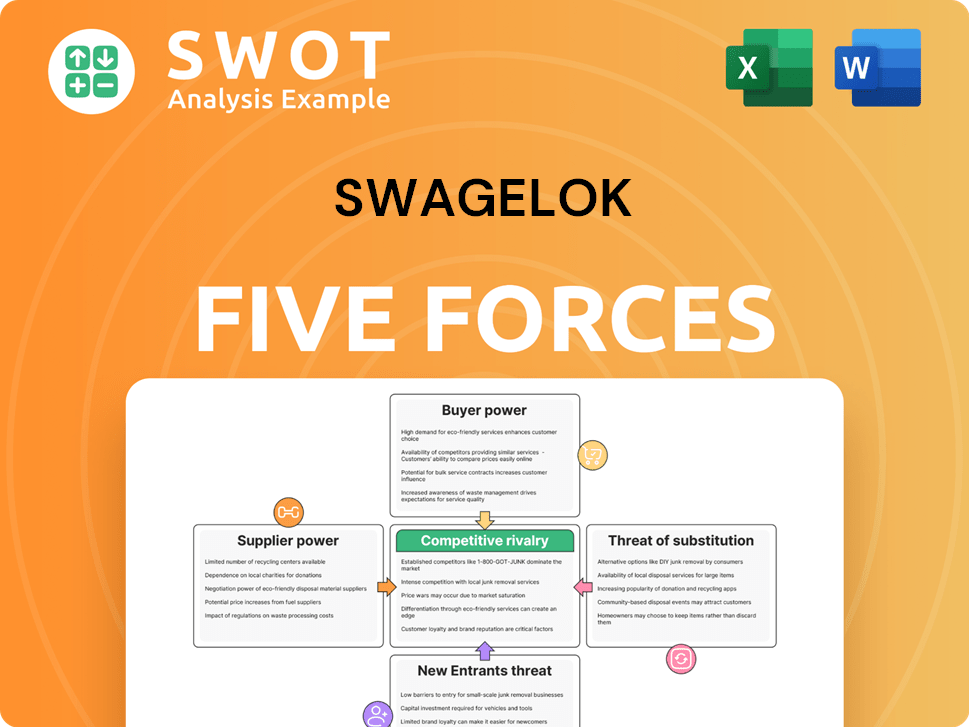

Swagelok Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Swagelok Company?

- What is Competitive Landscape of Swagelok Company?

- What is Growth Strategy and Future Prospects of Swagelok Company?

- What is Sales and Marketing Strategy of Swagelok Company?

- What is Brief History of Swagelok Company?

- Who Owns Swagelok Company?

- What is Customer Demographics and Target Market of Swagelok Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.