Tate & Lyle Bundle

How is Tate & Lyle Reshaping the Future of Food?

Tate & Lyle, a global powerhouse in food and drink, is not just adapting—it's leading the charge in food reformulation. Their strategic shift, highlighted by the recent acquisition of CP Kelco, positions them at the forefront of consumer trends. This transformation has reshaped their business model, making it essential to understand how this Tate & Lyle SWOT Analysis can help you stay informed.

With a global footprint spanning 39 countries and a focus on ingredient solutions, Tate & Lyle Company is a key player in the food ingredients industry. Their expertise in sugar production and other areas is driving innovation in healthier and more sustainable food options. Analyzing their operations, from their manufacturing process to their research and development, offers valuable insights into the evolving food landscape and their financial performance.

What Are the Key Operations Driving Tate & Lyle’s Success?

Tate & Lyle Company creates value by transforming agricultural products into high-quality food ingredients and solutions. The company focuses on sweetening, mouthfeel, and fortification platforms. These platforms enable solutions that reduce sugar, calories, and fat while enhancing fiber and protein content. The company serves a wide range of customer segments, including beverages, dairy, and bakery.

The operational processes involve sourcing, manufacturing, technology development, logistics, and sales. Tate & Lyle emphasizes its regional production model to supply customers globally. Strong research and development (R&D) capabilities drive growth through innovation. The 'solution selling' approach allows the company to partner with customers to create bespoke solutions. The acquisition of CP Kelco in November 2024 enhanced capabilities, particularly in mouthfeel solutions.

Tate & Lyle's commitment to sustainability is evident in its efforts to cut greenhouse gas emissions. This integrated approach, from sourcing to customer collaboration, allows the company to differentiate itself by offering innovative, healthier, and sustainable ingredient solutions. To learn more about the competitive environment, you can read about the Competitors Landscape of Tate & Lyle.

Tate & Lyle offers sweetening, mouthfeel, and fortification solutions. These food ingredients help reduce sugar, calories, and fat. They also improve texture and stability in various food and drink products.

The company serves diverse customer segments. These include beverages, dairy, bakery, snacks, soups, sauces, and dressings. This broad reach highlights Tate & Lyle's extensive market presence.

Tate & Lyle's operations include sourcing, manufacturing, and technology development. Logistics and sales channels are also crucial. Regional production supports global supply.

The company provides ingredient solutions that improve food products. It focuses on innovation, health, and sustainability. This approach differentiates Tate & Lyle in the market.

The acquisition of CP Kelco in November 2024 significantly enhanced Tate & Lyle's capabilities. This included integrating pectin and specialty gums, strengthening its position as a solutions partner. The company's commitment to sustainability is also a key aspect of its operations.

- Focus on sweetening, mouthfeel, and fortification platforms.

- Emphasis on regional production and global supply.

- Strong R&D capabilities driving innovation.

- Commitment to sustainability and reducing emissions.

Tate & Lyle SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tate & Lyle Make Money?

The Tate & Lyle Company generates revenue primarily by selling specialty food and beverage ingredients and solutions. Its revenue streams are largely derived from its Food & Beverage Solutions and Sucralose segments. The company's focus on innovation and 'solution selling' allows for value-based pricing and deeper customer relationships.

In the fiscal year ending March 31, 2025, Tate & Lyle reported group revenue of £1.73 billion, a 5% increase. Revenue from new products increased by 9% over the year, including contributions from CP Kelco since November 2024. The company's strategic shift towards a growth-focused specialty food and beverage solutions business is evident in its financial performance.

For the year ending March 31, 2024, Tate and Lyle's revenue from continuing operations totaled £1.65 billion. Within this, the Food & Beverage Solutions business generated £1.36 billion in revenue, while Sucralose contributed £174 million. The acquisition of CP Kelco is expected to generate revenue synergies, further accelerating top-line growth for the enlarged Tate & Lyle Company.

The main revenue streams come from Food & Beverage Solutions and Sucralose. These segments provide a diverse range of food ingredients and solutions to meet customer needs. The company's focus is on ingredient solutions.

Monetization is achieved through specialized ingredients that meet consumer demands. Value-based pricing and strong customer relationships are key. The company focuses on 'solution selling' to drive revenue.

The CP Kelco acquisition is expected to boost revenue. Revenue synergies of up to 10% of CP Kelco's revenue are anticipated. This acquisition is a key part of the company's growth strategy.

From April 1, 2025, the business will operate under a new regional framework. This framework includes the Americas, Europe, Middle East and Africa, and Asia Pacific. This structure aims to streamline operations and improve market focus.

The company anticipates revenue growth towards the higher end of its 4-6% annual range. This growth will be supported by EBITDA margin improvement and strong cash generation. The company's focus on Marketing Strategy of Tate & Lyle is key.

The Food & Beverage Solutions segment is a major revenue driver. Sucralose also contributes significantly to revenue. These segments are critical to the company's overall financial performance.

Tate & Lyle PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Tate & Lyle’s Business Model?

Over the past seven years, Tate & Lyle Company has undergone a significant transformation, marked by strategic shifts and key milestones. A pivotal move was the acquisition of CP Kelco in November 2024, which solidified its position as a growth-focused specialty food and beverage solutions provider. This acquisition, valued at US$1.8 billion (approximately £1.4 billion), enhanced its capabilities in sweetening, mouthfeel, and fortification platforms.

Prior to the CP Kelco acquisition, Tate & Lyle completed the sale of its remaining interest in Primient in June 2024, streamlining its focus on specialty ingredients. The net cash proceeds from the Primient sale, totaling £216 million (approximately US$270 million), were returned to shareholders through a share buyback program completed in January 2025. These strategic moves reflect the company's commitment to adapting to market trends and enhancing shareholder value.

Despite facing challenges such as muted consumer demand and geopolitical uncertainties, Tate and Lyle demonstrated robust financial performance in fiscal year 2025. The company's ability to navigate these headwinds underscores its resilience and strategic agility in a dynamic market environment. For a deeper understanding of the company's origins, consider reading the Brief History of Tate & Lyle.

The acquisition of CP Kelco in November 2024 was a major milestone, strengthening its ingredient solutions portfolio. The sale of Primient in June 2024 further streamlined operations towards specialty ingredients. A share buyback program, completed in January 2025, returned cash to shareholders.

The company has focused on specialty ingredients and solution selling. They have invested in R&D to create new products. They are adapting to consumer demand for healthier and more sustainable food and drink.

Strong R&D capabilities drive innovation, with a 13% increase in revenue from new products in fiscal 2024. Expertise in reformulation helps customers improve the nutritional balance of their food. Focus on 'solution selling' and scientific expertise builds strong customer relationships.

Fiscal year 2025 saw a 4% EBITDA growth. Free cash flow, excluding CP Kelco, was £190 million. These figures reflect the company's financial resilience and strategic success.

The company's competitive advantages include strong R&D and expertise in reformulation. Its focus on 'solution selling' and scientific expertise fosters strong customer relationships. Tate & Lyle is adapting to the growing demand for healthier and more sustainable food and drink.

- Innovation through R&D, leading to new product revenue growth.

- Reformulation capabilities to reduce sugar, calories, and fat.

- Customer-focused 'solution selling' approach.

- Strategic acquisitions and divestitures to streamline operations.

Tate & Lyle Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Tate & Lyle Positioning Itself for Continued Success?

The Tate & Lyle Company holds a significant position in the global food ingredient sector, known for providing innovative ingredient solutions. The acquisition of CP Kelco has strengthened its market share, especially in mouthfeel solutions, and expanded its global reach. The company's strategic focus on high-growth markets like Asia and others highlights its adaptability and responsiveness to changing consumer demands.

The company’s customer loyalty is reflected in a net promoter score of 61 in its 2024 annual brand equity survey, indicating strong customer satisfaction and brand perception. The company is well-positioned to capitalize on the growing demand for food ingredients, particularly in emerging markets. For more information on how the company is growing, check out the Growth Strategy of Tate & Lyle.

The Tate & Lyle Company is a leading player in the food ingredients market. It is recognized for its innovative ingredient solutions. The acquisition of CP Kelco has significantly strengthened its market position.

Geopolitical uncertainties, such as tariffs between the US and China, pose risks. The industry faces potential impacts from new weight loss drugs. Regulatory changes and new competitors also present ongoing challenges.

The company aims to achieve revenue growth towards the higher end of its 4-6% medium-term range annually. It is focused on delivering the benefits of the CP Kelco integration and accelerating top-line growth. Strategic initiatives include a five-year productivity target of US$150 million in savings by March 2028.

Asia represents a significant market opportunity. The region is valued at $7.2 billion in sales. The company is expanding its global reach, especially in higher-growth markets. These markets are expected to account for approximately 35% of combined sales.

The company is implementing several strategic initiatives to drive growth and profitability. These initiatives include investments in innovation, technology, and new capacity. The company is also focused on sustainability and aligning its purpose with business growth.

- Focus on healthy living, thriving communities, and caring for the planet.

- Five-year productivity target of US$150 million in savings by March 2028.

- Continued investment in innovation, technology, and new capacity.

- Expansion in higher-growth markets.

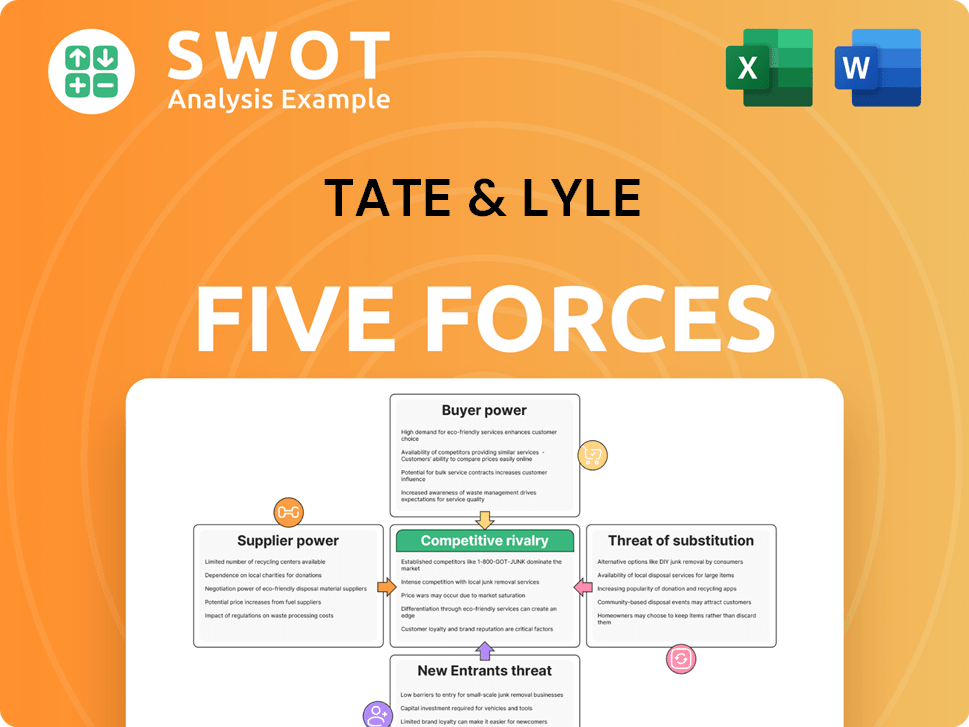

Tate & Lyle Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tate & Lyle Company?

- What is Competitive Landscape of Tate & Lyle Company?

- What is Growth Strategy and Future Prospects of Tate & Lyle Company?

- What is Sales and Marketing Strategy of Tate & Lyle Company?

- What is Brief History of Tate & Lyle Company?

- Who Owns Tate & Lyle Company?

- What is Customer Demographics and Target Market of Tate & Lyle Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.