Texas Roadhouse Bundle

How Has Texas Roadhouse Thrived?

In a restaurant industry facing numerous challenges, Texas Roadhouse (NASDAQ: TXRH) has not just survived, but thrived, demonstrating remarkable resilience and growth. Its stock surged an impressive 47.4% in 2024, significantly outperforming the broader market. This stellar performance begs the question: what's the secret behind Texas Roadhouse's success?

Texas Roadhouse, a prominent Texas Roadhouse SWOT Analysis, has carved a niche in the food service industry by focusing on quality, value, and a vibrant dining experience. Understanding the Texas Roadhouse business model and Texas Roadhouse operations is crucial for anyone looking to understand the restaurant chain's enduring appeal. This analysis will explore how this Steakhouse giant generates revenue, manages its operations, and maintains its competitive edge in a dynamic market, offering insights for investors, industry professionals, and enthusiasts alike.

What Are the Key Operations Driving Texas Roadhouse’s Success?

The core of the Texas Roadhouse business model revolves around delivering 'Legendary Food, Legendary Service' in a lively, family-friendly setting. This restaurant chain focuses on providing high-quality meals at affordable prices, with a menu centered on hand-cut steaks, ribs, and scratch-made sides. This approach aims to attract families and casual diners, creating a strong value proposition within the food service industry.

The company's operational strategy emphasizes on-site food preparation, which is critical to its value proposition of quality and freshness. This includes in-house meat cutting and freshly baked bread, which ensures both quality control and appeals to customers seeking a more authentic dining experience. The dine-in experience remains the primary focus, though the takeout segment has been growing, reflecting evolving consumer preferences.

Texas Roadhouse strategically uses its operational processes to support its value proposition. The company's supply chain, primarily reliant on a few key beef suppliers, is closely monitored to mitigate commodity price fluctuations. Logistics are designed to maintain freshness across a wide network of restaurants, while employee incentive programs contribute to superior customer service.

Texas Roadhouse operations are distinguished by the 'owner-operator partnership model,' fostering a local favorite atmosphere and emphasizing high-level hospitality. The company maintains direct control over the customer experience by not using third-party delivery services. This commitment to operational efficiency and direct customer engagement is a key part of its strategy.

Investments in technology, like the 'Roadie First' system for mobile accessibility for employees in Q2 2024 and digital kitchen upgrades, aim to streamline service. These upgrades are expected to be fully implemented by the end of 2025. These initiatives enhance efficiency and reduce wait times, improving the overall customer experience.

These core capabilities translate into customer benefits through consistent food quality and a welcoming environment. This drives repeat visits and strong brand loyalty, contributing to the company's financial success. This focus on customer satisfaction is a key driver of the company's performance.

In 2024, to-go sales increased by 13% year-over-year, showing the company's ability to adapt to changing consumer behaviors. This growth is a testament to the company's operational strategies and its ability to meet customer expectations. For more insights, check out the Owners & Shareholders of Texas Roadhouse.

Texas Roadhouse distinguishes itself through several key operational aspects.

- Emphasis on in-house food preparation, ensuring quality and freshness.

- The 'owner-operator partnership model' fosters a local, community-focused atmosphere.

- Strategic investments in technology to improve efficiency and customer service.

- A focus on direct customer engagement, avoiding third-party delivery services.

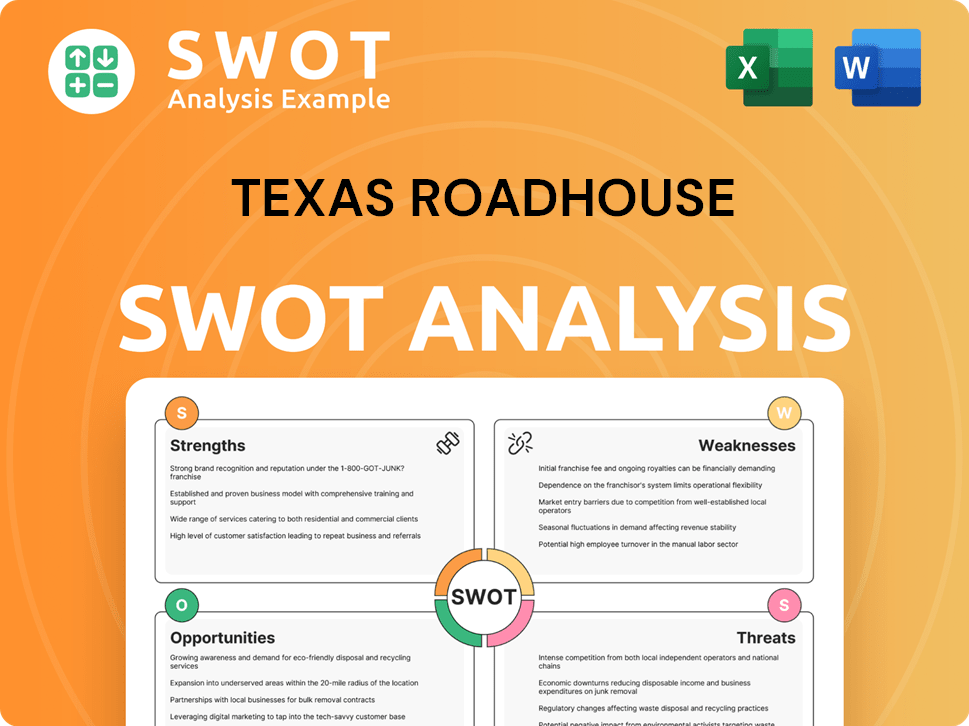

Texas Roadhouse SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Texas Roadhouse Make Money?

The primary revenue streams for the restaurant chain, Texas Roadhouse, are generated through its restaurant sales. These sales include both dine-in and takeout services across its three brands: Texas Roadhouse, Bubba's 33, and Jaggers. The company's financial success is significantly driven by its ability to attract and retain customers through consistent quality and value.

The Texas Roadhouse segment contributes the most to the company's revenue. This segment specializes in moderately priced, full-service casual dining, with a focus on steaks, ribs, and other entrees. The company's financial performance reflects its strong market position and effective operational strategies.

For the fiscal year that ended on December 31, 2024, the total revenue for Texas Roadhouse reached $5.37 billion. This marked a substantial increase of 16.0% compared to the previous year. In the first quarter of fiscal year 2025, the total revenue further increased by 9.6% to $1.45 billion, demonstrating continued growth and resilience in the food service industry.

Maintains an 'everyday value' proposition to manage menu price increases. This approach allows the company to implement modest menu price adjustments without deterring customers. For instance, a 1.4% menu price increase was planned for early April 2025.

Offers value-focused promotions to attract customers. These include early dine features with discounted items and an all-day $5 beverage menu at select locations. These promotions help maintain customer traffic and enhance the overall dining experience.

The to-go segment is an increasingly important revenue stream, growing by 13% year-over-year in 2024. This reflects the company's ability to adapt to changing consumer preferences and increase revenue through convenient service options.

Provides catering services for various events, though it is not a primary revenue stream. Catering services offer an additional source of income and help build brand awareness within the community.

Continued strategic unit growth directly contributes to overall revenue. Expanding the number of operating restaurants increases the company's market presence and revenue potential. This expansion is a key element of the Texas Roadhouse business model.

Strategic menu and pricing strategies are essential. The company balances inflationary pressures with customer affordability. This approach helps maintain profitability while ensuring customer satisfaction. For more details, you can explore the Target Market of Texas Roadhouse.

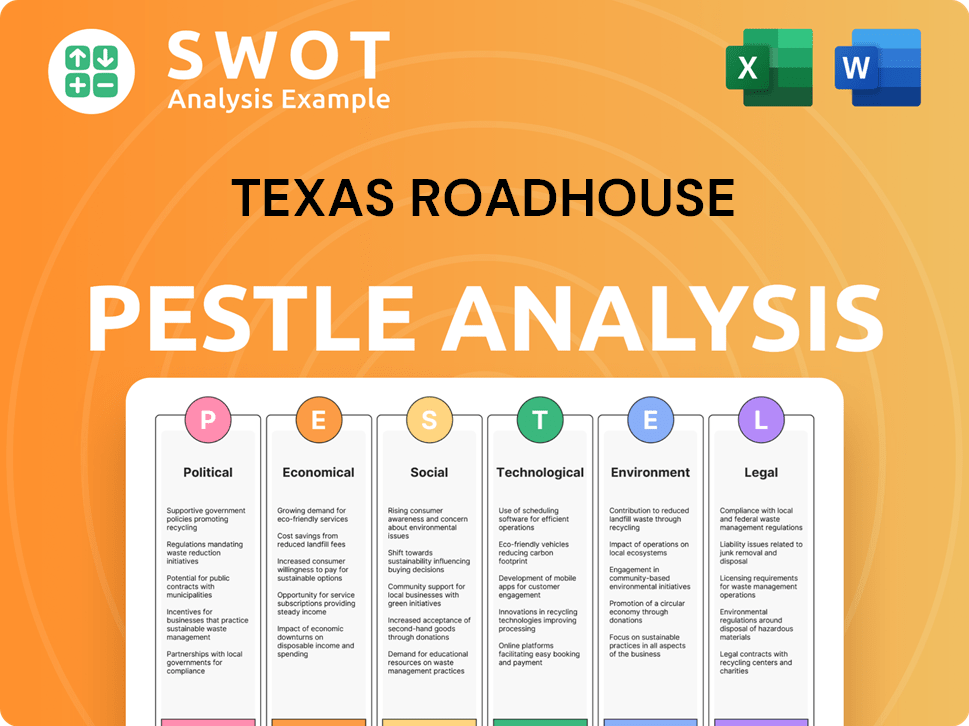

Texas Roadhouse PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Texas Roadhouse’s Business Model?

The Texas Roadhouse has shown significant growth and strategic development. Its financial performance in 2024 was marked by nearly $5.4 billion in revenue, with average unit volumes exceeding $8 million for the first time. This success is driven by consistent same-store sales growth, with an 8.5% increase in 2024, reflecting its strong market position within the food service industry.

Strategic moves have been key to the Texas Roadhouse business model. The company opened a total of 45 new restaurants in 2024, including both company-owned and franchise locations. Looking ahead to 2025, the company plans to open approximately 30 company-owned restaurants. These expansions are part of a broader strategy to increase its footprint and market share.

The company has also addressed operational challenges, such as rising costs, through strategic menu price adjustments, including a 1.4% increase in early Q2 2025. Furthermore, the Texas Roadhouse operations are being enhanced with investments in operational efficiency initiatives, including supply chain optimizations and digital kitchen upgrades, with a full rollout expected by 2025. These efforts are designed to maintain profitability and improve the customer experience.

The Texas Roadhouse hit nearly $5.4 billion in revenue in 2024. Same-store sales grew by 8.5% in 2024, driven by a 4.4% rise in traffic. The company opened 45 new restaurants in 2024, including company and franchise locations.

In early 2025, the acquisition of 13 domestic franchise restaurants was a key move. Menu price adjustments, including a 1.4% increase in early Q2 2025, were implemented. The company plans to open approximately 30 company-owned restaurants in 2025.

The company's strong brand equity, commitment to quality, and value proposition drive customer loyalty. Operational efficiency, supported by technology and the owner-operator model, is a key advantage. A debt-free balance sheet as of Q3 2024 provides financial flexibility.

The company is adapting to changing consumer preferences by introducing mocktails. It's also upgrading its guest management system to improve seating and reduce wait times. The expansion plans include approximately 30 company-owned restaurants in 2025.

The Texas Roadhouse focuses on a high-quality dining experience, fostering strong customer loyalty. The company's operational efficiency, supported by technology and the owner-operator model, strengthens its position in the competitive restaurant chain market. Disciplined expansion into underserved markets and a strong financial position are also key advantages.

- Strong brand equity and customer loyalty.

- Operational efficiency and owner-operator model.

- Disciplined expansion strategy.

- Strong financial health with a debt-free balance sheet.

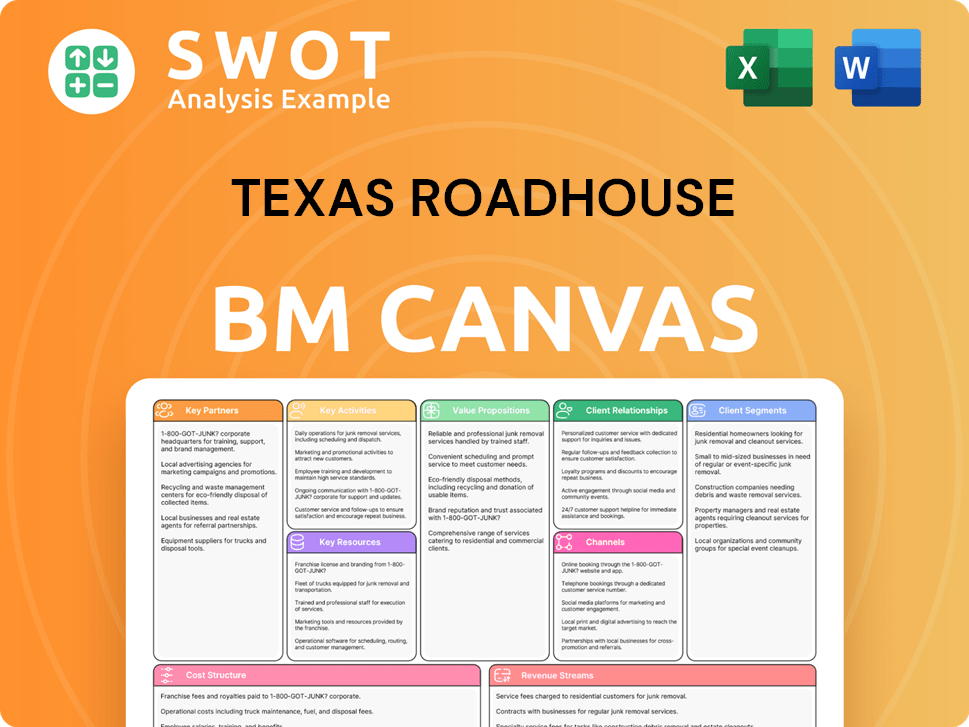

Texas Roadhouse Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Texas Roadhouse Positioning Itself for Continued Success?

The Texas Roadhouse maintains a strong position within the casual dining sector, particularly within the steakhouse market. Its Texas Roadhouse business model has proven successful, driving customer loyalty through consistent value and a distinctive dining experience. As of April 1, 2025, the company and its franchisees operate 792 restaurants across 49 states, one U.S. territory, and ten foreign countries, demonstrating its broad reach and operational capabilities within the food service industry.

However, the Texas Roadhouse operations face several risks. These include rising labor and food costs, especially beef inflation, which could impact profit margins. Economic uncertainty and competition from fast-casual chains also pose challenges. The company must also address regulatory changes and potential cybersecurity breaches.

In 2024, Texas Roadhouse demonstrated significant market penetration with positive traffic growth across all three of its brands. Despite having fewer locations than some competitors, Texas Roadhouse claimed a slightly larger share of combined visits in 2024, with 51.2% of visits compared to Chili's 48.8%. This highlights its strong competitive standing within the restaurant chain market.

Key risks include rising labor and food costs. Commodity inflation is anticipated to be 3% to 4% in 2025, with wage and other labor inflation at 4.6% in Q1 2025. The company also faces pressure to disclose a comprehensive strategy to reduce its total contribution to climate change, including achieving deforestation-free commodity supply chains by 2025.

Texas Roadhouse plans to open approximately 30 new company-owned restaurants in 2025, including benefiting from the acquisition of 13 domestic franchise restaurants. Capital expenditures for 2025 are projected at approximately $400 million. Strategic initiatives include continued investments in technology to improve operational efficiency and customer experience.

The company will return capital to shareholders through dividends, with an 11% increase to the quarterly dividend approved in February 2025, and a new $500 million share repurchase program. Texas Roadhouse aims to sustain its ability to make money by emphasizing its value proposition, fresh, made-from-scratch food, and high-level hospitality, while adapting to market shifts and expanding its footprint.

To maintain its competitive edge, Texas Roadhouse focuses on several key strategies. These include a strong emphasis on value, high-quality food, and exceptional customer service. For more detailed insights into their approach, consider reading the Marketing Strategy of Texas Roadhouse.

- Continued investment in technology to enhance operational efficiency.

- Expansion through new restaurant openings and strategic acquisitions.

- Returning capital to shareholders through dividends and share repurchases.

- Adapting to market changes and expanding its footprint.

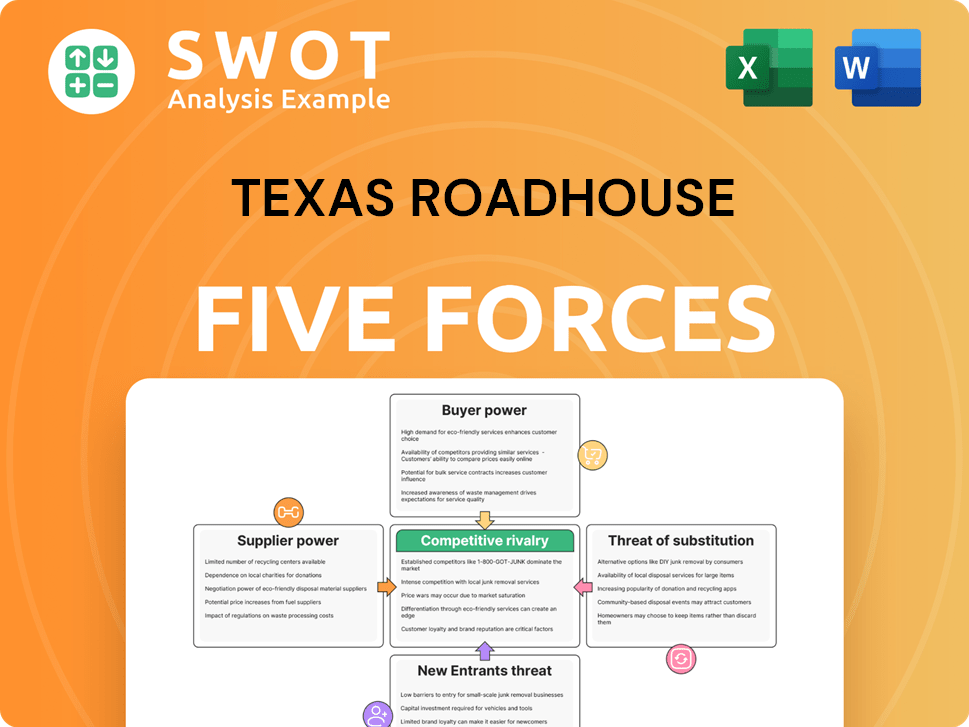

Texas Roadhouse Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Texas Roadhouse Company?

- What is Competitive Landscape of Texas Roadhouse Company?

- What is Growth Strategy and Future Prospects of Texas Roadhouse Company?

- What is Sales and Marketing Strategy of Texas Roadhouse Company?

- What is Brief History of Texas Roadhouse Company?

- Who Owns Texas Roadhouse Company?

- What is Customer Demographics and Target Market of Texas Roadhouse Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.