RealReal Bundle

How Does The RealReal Thrive in the Resale Market?

The RealReal company has revolutionized the luxury consignment landscape, transforming how we buy and sell high-end goods. As the leading online marketplace for authenticated luxury items, The RealReal offers a vast selection, from designer clothing to exquisite jewelry. Its impressive growth, marked by record-breaking revenue and improved profitability, demands a closer look at its inner workings.

Delving into RealReal SWOT Analysis reveals the strategies behind its success, particularly within the competitive resale market. With over 38 million members, understanding the RealReal's authentication process, selling process, and customer experience is key for anyone considering buying or selling luxury items. This analysis will explore the RealReal's business model, revenue streams, and competitive advantages in detail, providing actionable insights for both consumers and investors.

What Are the Key Operations Driving RealReal’s Success?

The RealReal, a prominent player in the luxury resale market, operates as a comprehensive online and brick-and-mortar marketplace. It facilitates the buying and selling of authenticated luxury goods, including clothing, jewelry, watches, art, and home decor. This dual-sided platform caters to both consignors (sellers) and buyers, providing a seamless and trustworthy experience within the luxury consignment sector.

The company's core value proposition lies in its ability to offer a full-service consignment experience for sellers. This includes services like free virtual appointments, in-home pickups, authentication, pricing, professional photography, listing, shipping, and customer service. For buyers, The RealReal provides access to a curated selection of authenticated luxury items at reduced prices, ensuring quality and authenticity through a rigorous inspection process.

The RealReal's success is built on a foundation of trust and efficiency, achieved through its robust authentication process and technology-driven operations. This approach not only attracts both buyers and sellers but also differentiates it from competitors in the competitive online consignment landscape. To get a better understanding of the market, you can check the Competitors Landscape of RealReal.

The RealReal employs a team of in-house experts, including gemologists, horologists, and brand authenticators. These specialists meticulously inspect thousands of items daily. This rigorous authentication process is a key differentiator, ensuring the legitimacy of goods and building trust among customers. This is a crucial factor for anyone asking 'Is RealReal legit?'

For consignors, The RealReal handles the entire selling process, from initial consultation to final sale. This full-service approach simplifies selling, allowing consignors to receive a portion of the sale price without the hassle of managing the process themselves. The company also offers a RealReal consignment calculator to help sellers estimate their potential earnings.

The RealReal leverages technology to streamline operations, including advanced algorithms for pricing and inventory management. In 2025, the 'Athena AI' initiative is expected to reduce processing times by up to 20% through image recognition for authentication and pre-populating item attributes. By the end of 2024, AI assisted in launching 85% of the items.

The company focuses on operational efficiencies, such as streamlining logistics and reducing overhead. Its supply chain primarily sources items from domestic closets, and partnerships with stylists and closet organizers expand its supply network. This focus improves inventory turnover and enhances the consignor experience, making the RealReal selling process more efficient.

The RealReal offers several key benefits to its customers. For buyers, it provides access to authenticated luxury goods at competitive prices, mitigating the risks associated with counterfeit items. Sellers benefit from a hassle-free selling experience, with the company handling all aspects of the consignment process.

- Access to authenticated luxury goods.

- Full-service consignment for sellers.

- Competitive pricing and market reach.

- Trust and reliability in the resale market.

RealReal SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does RealReal Make Money?

The RealReal company generates revenue primarily through consignment sales, where it takes a commission on items sold on behalf of consignors. This model forms the core of its business strategy. The company also generates revenue through direct sales, purchasing items outright and reselling them, and shipping services.

In Q1 2025, The RealReal's total revenue reached $160 million, marking an 11% increase year-over-year. The company's financial performance is bolstered by its ability to optimize pricing through AI and machine learning, which enhances both consignor payouts and its own revenue.

The RealReal's revenue streams are diversified, with consignment sales being the largest contributor. The company's approach to the resale market includes direct sales and shipping services, all contributing to its overall revenue.

Consignment sales are the main source of revenue for The RealReal. In Q1 2025, consignment revenue accounted for 77.4% of total revenue. This segment saw a 7% year-over-year increase, reaching $123.8 million.

The take rate, which is the percentage of Gross Merchandise Value (GMV) recognized as revenue, improved. In Q1 2025, the take rate was 38.6%, up from 38.4% in Q1 2024. This indicates increased efficiency in converting GMV into revenue.

Direct sales revenue showed significant growth. It increased by 61% compared to Q1 2024, reaching $20.5 million in Q1 2025. This growth is supported by the 'Get Paid Now' offerings and strategic inventory management.

Direct gross margins saw a substantial improvement. In Q1 2025, they reached 25.5%, a significant increase from 3.3% in Q1 2024. This improvement is due to the reimagined direct business model.

Shipping services also contribute to revenue. Shipping revenue was $15.8 million in Q1 2025, a 2% increase from the prior year. This shows the importance of logistics in The RealReal's business model.

The company projects full-year 2025 revenue to be in the range of $645 million to $660 million. This indicates confidence in continued growth and market performance. For more details, consider reading Brief History of RealReal.

The RealReal's revenue streams are diversified and show strong growth. The company's strategic approach to consignment sales and direct sales has contributed to its financial success. Here are some key metrics:

- Total Revenue Q1 2025: $160 million, an 11% increase year-over-year.

- GMV Growth: GMV increased by 9% to $490 million in Q1 2025.

- Consignment Revenue Share: 77.4% of total revenue in Q1 2025.

- Direct Revenue Growth: 61% increase year-over-year.

- Full Year 2024 Revenue: $600 million, a 9% increase versus 2023.

RealReal PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped RealReal’s Business Model?

The RealReal has navigated significant milestones and strategic shifts to solidify its position in the luxury resale market. A key achievement in 2024 was achieving positive Adjusted EBITDA, reaching $9 million, a substantial improvement from a $55 million loss in 2023. This financial turnaround, coupled with positive free cash flow for the full year 2024, highlights the company's progress in operational efficiency and financial management.

In early 2025, The RealReal restructured its debt, reducing total indebtedness by approximately $37 million and extending maturities. This move improved the company's financial flexibility and reduced interest expenses. These strategic financial maneuvers reflect a commitment to sustainable growth and enhanced shareholder value.

Operationally, The RealReal has responded to challenges in the luxury resale market by focusing on key strategic pillars. These include executing its growth playbook to unlock supply, driving operational efficiency, and prioritizing customer service. The company continues to adapt to new trends by enhancing its service offerings and forming partnerships.

Achieved positive Adjusted EBITDA of $9 million in 2024, a significant improvement from the $55 million loss in 2023. Restructured debt in early 2025, reducing total indebtedness by approximately $37 million. Focused on strategic pillars to navigate market challenges.

Deployed AI to optimize pricing algorithms and enhance authentication processes. Launched the 'Athena AI' initiative in 2025, expected to reduce processing times by up to 20%. Focused on operational efficiency and customer service to drive growth.

Employs rigorous authentication processes with in-house experts, including gemologists and horologists. Strong brand reputation, expert curation, and hands-on approach to sourcing inventory. Leverages technology and innovation, particularly AI and data analytics.

Operates in the competitive luxury resale market, facing competition from platforms like Poshmark and thredUP. Differentiates itself through rigorous authentication and a strong brand reputation. Continues to adapt to new trends by enhancing its service offerings and forming partnerships.

The RealReal's competitive advantage lies in its rigorous authentication process and the use of technology. The company employs hundreds of in-house experts, including gemologists and horologists, to ensure the authenticity of items. This rigorous process helps build trust with both buyers and sellers in the luxury consignment market.

- The 'Athena AI' initiative, launching in 2025, is expected to reduce processing times by up to 20%.

- AI is used to optimize pricing algorithms.

- Data analytics are used for inventory management.

- The company leverages technology to enhance the customer experience.

RealReal Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is RealReal Positioning Itself for Continued Success?

The RealReal company holds a significant position in the luxury resale market, recognized as the largest online marketplace for authenticated, resale luxury goods. Its market share is strengthened by a focus on high-end designer items and a robust authentication process. In Q1 2025, the active buyer count reached 985,000, reflecting its extensive reach and market leadership.

However, The RealReal faces challenges, including competition from platforms such as Vestiaire Collective and Poshmark. Macroeconomic factors and substantial debt also pose risks. Despite these challenges, The RealReal is implementing strategic initiatives to unlock profitable supply and drive operational efficiency.

The RealReal is a leader in the online consignment and luxury consignment market. Its focus on authenticating high-end goods gives it a competitive edge. The company's large customer base and strong brand recognition support its industry position.

The RealReal faces risks from competitors and economic downturns. High debt levels and reliance on capital markets are also potential concerns. Regulatory changes and evolving consumer preferences could impact the resale market.

The RealReal aims to expand profitability through operational efficiencies and AI. Management projects GMV between $1.96 billion and $1.99 billion and revenue between $645 million and $660 million for 2025. The company's strategic initiatives and unique market position support its growth prospects.

The RealReal is focused on unlocking profitable supply. They are driving operational efficiency and emphasizing service. They are deploying AI to optimize pricing and authentication processes.

The RealReal is targeting continued growth, with initiatives to improve efficiency and expand its market presence. For the full year 2025, the company anticipates Gross Merchandise Value (GMV) between $1.96 billion and $1.99 billion, reflecting an 8% year-over-year increase at the midpoint, and revenue between $645 million and $660 million, representing a 9% year-over-year growth at the midpoint. Adjusted EBITDA is projected to be between $20 million and $30 million.

- Focus on profitable supply through its growth playbook.

- Operational efficiency improvements.

- AI deployment for pricing and authentication, such as 'Athena AI'.

- Continued emphasis on its position at the intersection of luxury and value.

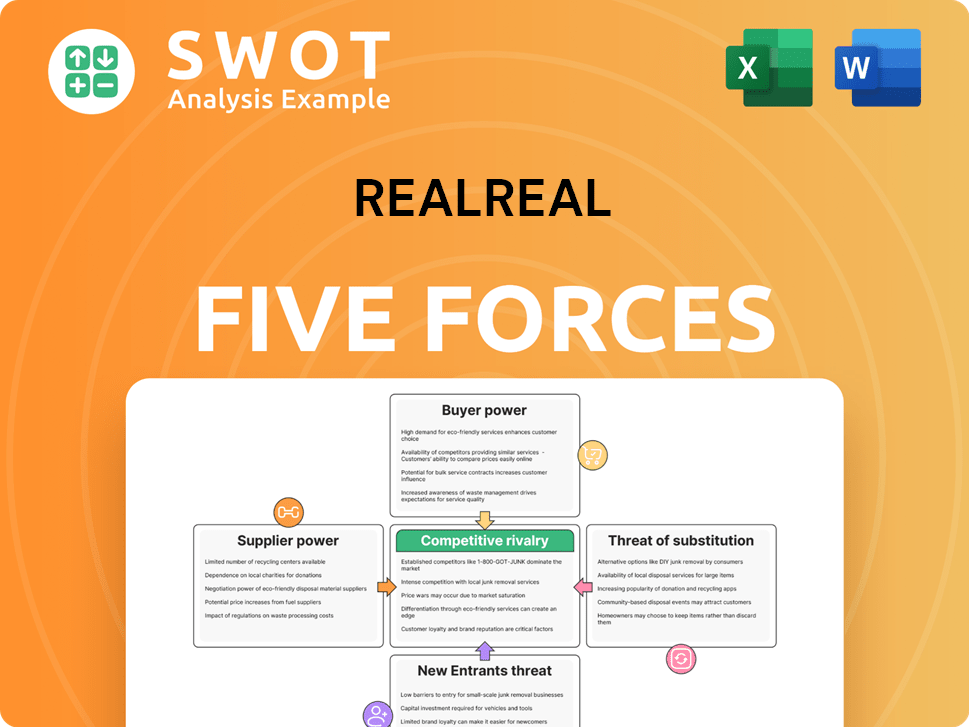

RealReal Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of RealReal Company?

- What is Competitive Landscape of RealReal Company?

- What is Growth Strategy and Future Prospects of RealReal Company?

- What is Sales and Marketing Strategy of RealReal Company?

- What is Brief History of RealReal Company?

- Who Owns RealReal Company?

- What is Customer Demographics and Target Market of RealReal Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.