Twin Disc Bundle

How Does the Twin Disc Company Thrive in a Dynamic Market?

Twin Disc, Inc. (NASDAQ: TWIN) is a key player in the power transmission equipment sector. The company's recent financial performance, including a significant year-over-year sales increase in its fiscal second quarter of 2025, highlights its strategic growth. With acquisitions like Katsa Oy and Kobelt Manufacturing, Twin Disc is expanding its global footprint and product offerings.

Twin Disc's specialized engineering and manufacturing of Twin Disc SWOT Analysis are integral to its success, serving diverse sectors like marine, land-based, and oil and gas. Understanding the intricacies of how Twin Disc operates, from its marine gears to its power transmission systems, is vital. This analysis will explore the company's core operations, revenue streams, and strategic moves to provide a comprehensive overview of this industrial equipment leader.

What Are the Key Operations Driving Twin Disc’s Success?

The core of the Twin Disc Company revolves around designing, manufacturing, and selling advanced power transmission equipment. This equipment is engineered for demanding applications across various sectors. Their focus is on delivering value through robust, reliable, and high-performance products.

Their primary offerings include marine transmissions, azimuth drives, surface drives, and boat management systems for the marine sector. For land-based and industrial applications, they provide power-shift transmissions, hydraulic torque converters, power take-offs, industrial clutches, and control systems. Their global customer base spans pleasure craft, commercial and military marine, energy, natural resources, government, and general industrial sectors.

The operational processes supporting these offerings involve sophisticated manufacturing, sourcing, and technology development. They emphasize quality and performance through stringent procedures to ensure product reliability. Their global supply chain and distribution networks, with manufacturing facilities in the U.S. and Europe, facilitate effective management of trade dynamics and capacity constraints.

Their operations are unique due to a focus on heavy-duty and harsh environment applications, requiring specialized engineering and robust product design. This focus allows them to differentiate themselves through deep engineering expertise and customization capabilities. They work closely with engine manufacturers to tailor products to specific customer needs.

The acquisition of Veth in fiscal 2019 significantly boosted the marine segment, particularly in North America. The recent acquisition of Kobelt Manufacturing in February 2025 further enhances the product portfolio with complementary brake, control, and steering systems, and provides vertical integration through Kobelt's in-house foundry.

This integrated approach and specialized product offerings translate into enhanced efficiency, reliability, and performance for customers. This creates a strong market differentiation for the company. They provide solutions that are critical for their customers’ operations.

With a global footprint, including significant sales in Europe (over 40%), Asia (nearly a quarter), and North America (about a quarter), the company effectively serves a diverse customer base. This widespread presence allows for efficient distribution and responsiveness to market demands.

The company's operational success is driven by its ability to deliver high-quality products and services. Their focus on innovation and strategic acquisitions, such as Kobelt Manufacturing, enhances their market position. This approach allows them to meet the evolving needs of their customers across various industries.

- Specialized engineering for demanding applications.

- Strategic acquisitions to broaden product offerings.

- Global supply chain and distribution networks.

- Focus on customer-specific solutions.

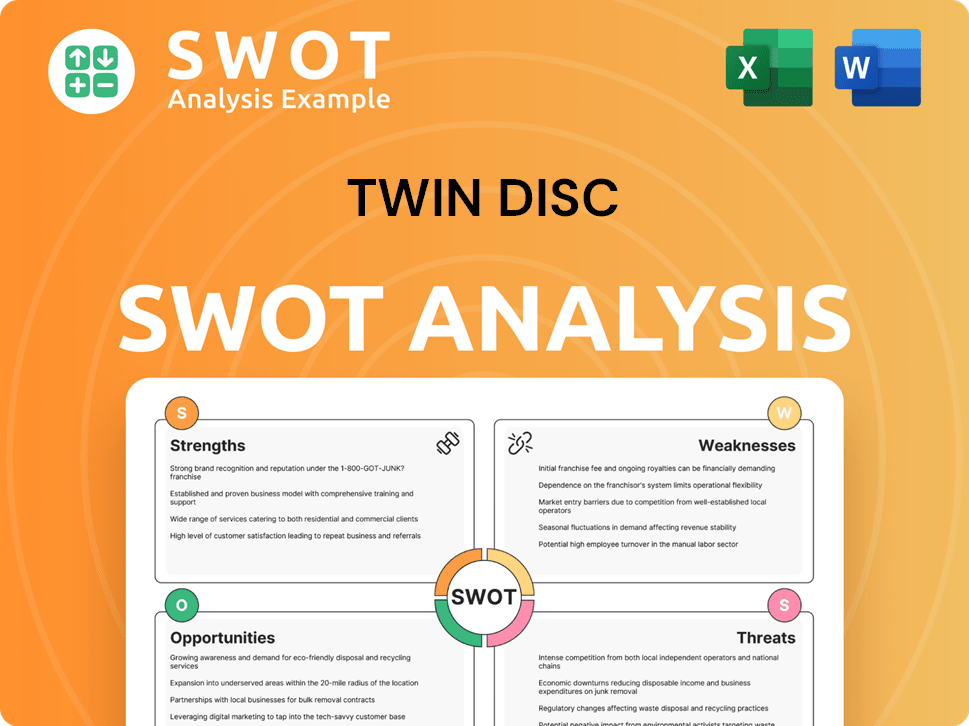

Twin Disc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Twin Disc Make Money?

The primary revenue streams for the Twin Disc Company are centered on the sale of its power transmission equipment and related products. The company's financial performance is significantly influenced by product sales across its Manufacturing and Distribution segments. The company's strategy involves leveraging direct product sales, enhanced by aftermarket services and strategic acquisitions to broaden its product offerings and market reach.

In the fiscal second quarter of 2025, total sales reached $89.9 million, marking a 23.2% increase year-over-year. This growth was supported by the acquisition of Katsa Oy, which added $10.0 million in sales. Organic sales also saw a positive increase of 10.1%, excluding acquisitions and foreign exchange impacts.

For the trailing twelve months ending March 31, 2025, Twin Disc Company's revenue was $328 million. The company focuses on capitalizing on cross-selling opportunities, particularly in Europe and North America, and advancing its hybrid and electric propulsion initiatives for long-term growth.

This segment is a key revenue driver for Twin Disc Company. Sales increased by 23.9% year-over-year to $56.7 million in Q2 fiscal 2025.

Revenues in this segment grew by 19.8% year-over-year, reaching $19 million in Q2 fiscal 2025. This growth was fueled by strong demand for transmissions used in airport rescue and firefighting vehicles.

The Industrial segment experienced substantial growth, with a 44.8% increase in Q2 FY25. This highlights the diversification within the company's product offerings and market reach.

Acquisitions like Katsa Oy (May 2024) and Kobelt Manufacturing (February 2025) are pivotal. These acquisitions help expand the product range and market penetration for Twin Disc marine transmission and other products.

Aftermarket services provide an additional revenue stream, helping sustain customer relationships and ensure the longevity of Twin Disc products. This includes parts and service.

The company's six-month backlog, which stood at $124.0 million as of December 27, 2024, provides insight into future revenue streams. This backlog helps in planning and anticipating future demand.

The company's focus on these areas is a key aspect of its overall growth strategy, ensuring sustained revenue generation and market competitiveness. Twin Disc also explores opportunities in areas such as Twin Disc marine gear ratios and Twin Disc hydraulic systems to further enhance its market position.

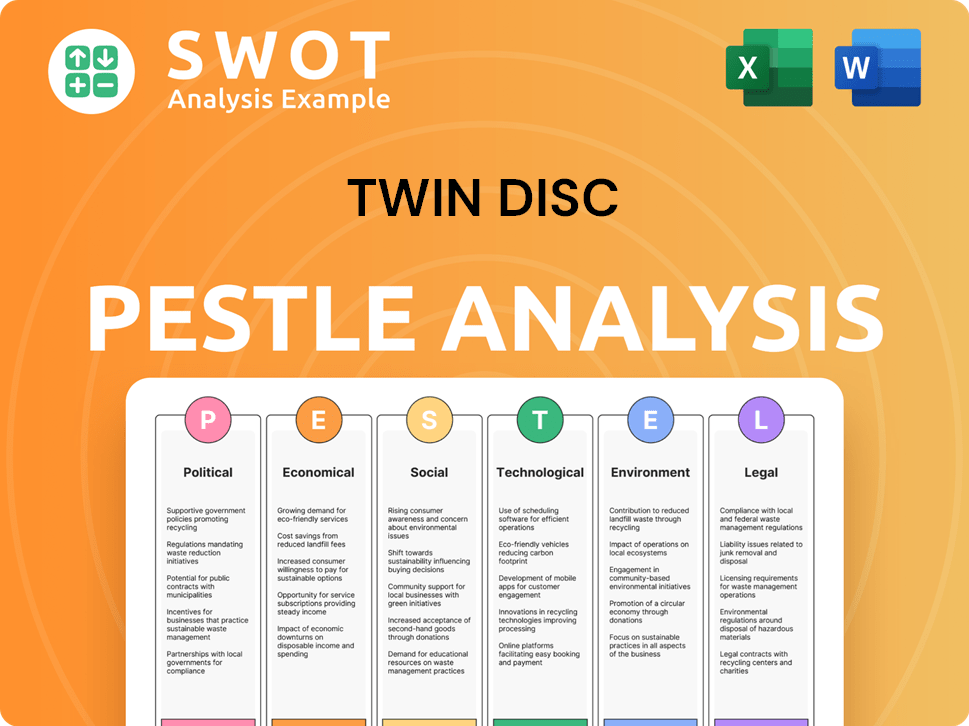

Twin Disc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Twin Disc’s Business Model?

The Twin Disc Company has strategically navigated market cycles, making key moves to strengthen its position in the power transmission and industrial equipment sectors. These actions have been crucial for its growth and adaptation. A significant part of this strategy involves acquisitions, such as Veth Propulsion in fiscal 2019, which boosted its marine segment and system controls capabilities. More recently, the company acquired Katsa Oy in May 2024 and Kobelt Manufacturing in February 2025, expanding its product lines and market reach.

These acquisitions highlight a focus on diversification and offering higher-value systems. The company has also faced challenges, including trade wars and economic downturns, which affected demand. Despite these hurdles, Twin Disc has concentrated on improving manufacturing efficiency and reducing costs. While gross profit margins saw fluctuations, management is optimistic about improving operational efficiencies in the coming quarters.

The company's competitive edge is built on its long-standing reputation for quality and performance. Its highly engineered products, global distribution network, and manufacturing footprint provide agility. The ongoing integration of recent acquisitions and a focus on hybrid and electric propulsion initiatives position Twin Disc for future growth, adapting to technological shifts in the industry. The ability to adapt to changing trade dynamics, supported by a flexible global supply chain and manufacturing network, enhances its confidence in delivering long-term value.

The acquisition of Veth Propulsion in fiscal 2019 significantly boosted the marine segment. The recent acquisition of Katsa Oy in May 2024 expanded the global industrial product line. The purchase of Kobelt Manufacturing in February 2025 for $16.5 million further broadened its product portfolio.

The company faced challenges from trade wars and economic downturns. Despite these, Twin Disc focused on improving manufacturing efficiency and reducing costs. Gross profit margins experienced fluctuations, with a decline in Q2 fiscal 2025.

Twin Disc's reputation for quality and performance is a key advantage. Its highly engineered products and global network provide a competitive edge. The company is adapting to technological shifts and trade dynamics.

The company is focused on integrating acquisitions and expanding its product offerings. Twin Disc is positioned for growth through hybrid and electric propulsion initiatives. The company's ability to adapt enhances its long-term value.

In Q2 fiscal 2025, gross profit margins declined by 420 basis points to 24.1%. The acquisition of Kobelt Manufacturing cost $16.5 million in February 2025. The company's global presence and product diversification are key to its strategy.

- Focus on improving manufacturing efficiency.

- Integration of recent acquisitions.

- Expansion into hybrid and electric propulsion.

- Adaptation to changing trade dynamics.

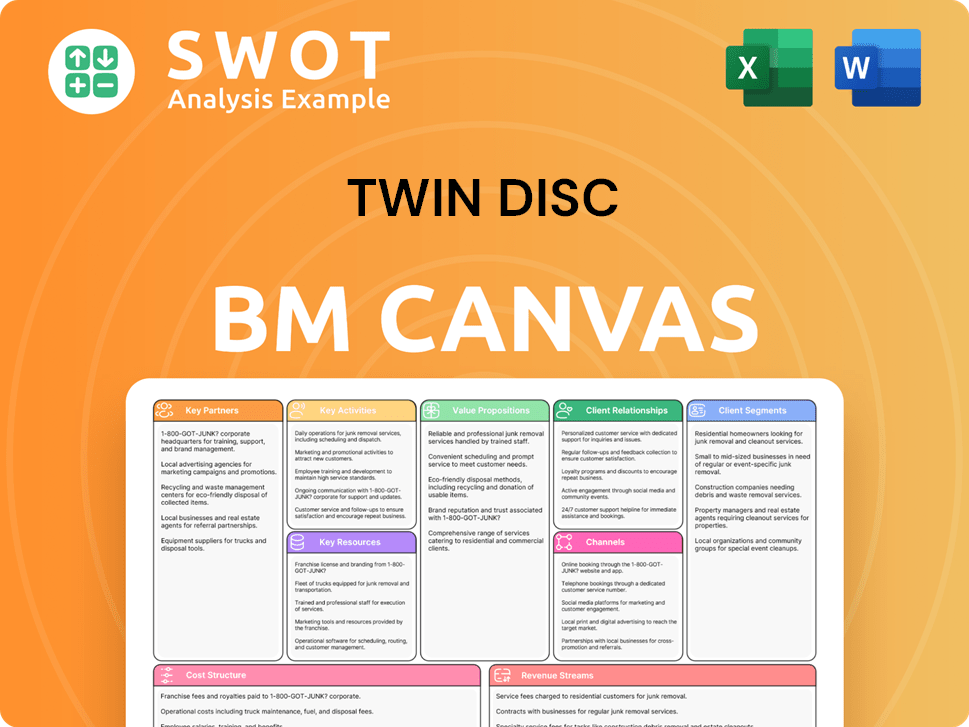

Twin Disc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Twin Disc Positioning Itself for Continued Success?

Twin Disc Company holds a strong industry position in the heavy-duty power transmission equipment market, especially for marine, land-based, and industrial sectors. Their reputation is built on reliable, high-performance products. Their global presence, with sales in Europe, North America, and Asia, helps to balance market fluctuations.

The company faces risks like economic uncertainty and supply chain issues. They are working to address these challenges through operational efficiencies and strategic initiatives. Their focus on innovation and expansion into sustainable technologies positions them well for future growth.

Twin Disc Company specializes in power transmission equipment, serving marine, land-based, and industrial markets globally. Their products are known for reliability, which fosters strong customer relationships. Their diversified geographical presence provides resilience against regional economic downturns.

Macroeconomic uncertainties pose a risk, including potential tariff impacts. Challenges exist in the Asian oil and gas markets, and North American new build activity is muted. Supply chain disruptions and rising input costs also present challenges. The company is managing these risks through strategic planning and operational adjustments.

Twin Disc is focused on integrating recent acquisitions like Katsa Oy and Kobelt to expand its product offerings. They are also investing in hybrid/electric solutions for niche marine and land-based applications. The company anticipates sustained demand and plans for capital expenditures in fiscal 2025, with an expected spend of between $12 million and $14 million.

Twin Disc aims for long-term revenue growth of around 4% and free cash flow margins between 3% and 5%. They have set ambitious targets, projecting approximately $500 million in revenue by 2030, with gross margins of 30% and a free cash flow conversion rate of at least 60%. Their six-month backlog of $133.7 million as of March 28, 2025, supports these goals.

Twin Disc is actively integrating recent acquisitions to broaden its product range and leverage cross-selling opportunities. They are also focusing on becoming a leading provider of hybrid/electric solutions. This strategic move demonstrates a commitment to innovation and expansion into sustainable technologies, which are increasingly important in the marine and industrial sectors.

- Emphasis on hybrid/electric solutions for marine and land-based applications.

- Integration of recent acquisitions to enhance product offerings.

- Investment in capital expenditures, particularly in the second half of fiscal 2025.

- Aiming for long-term revenue growth and strong free cash flow margins.

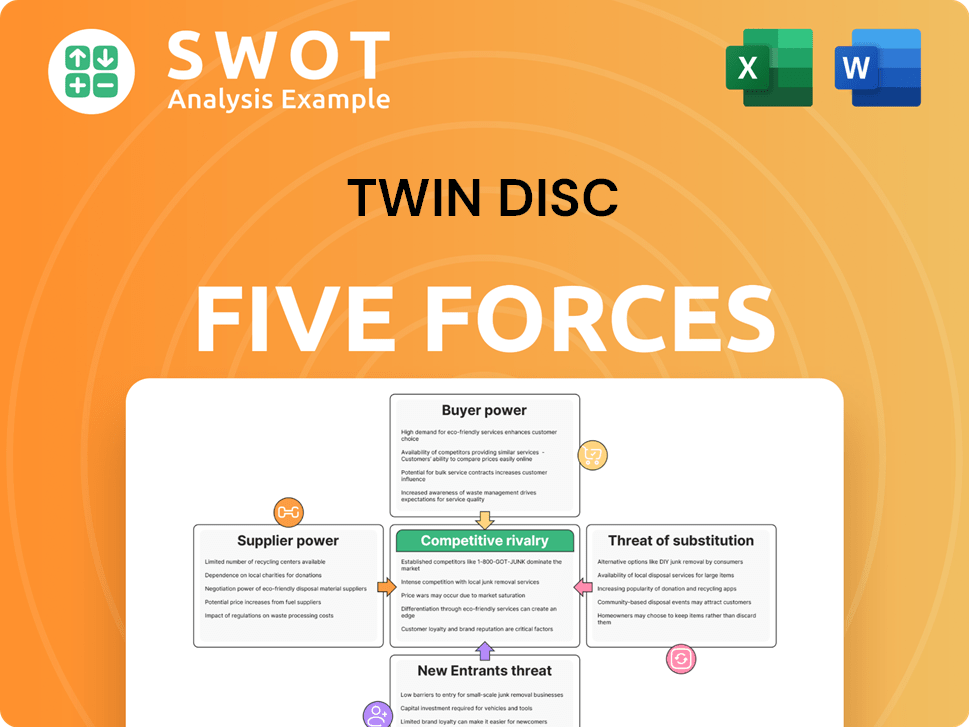

Twin Disc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Twin Disc Company?

- What is Competitive Landscape of Twin Disc Company?

- What is Growth Strategy and Future Prospects of Twin Disc Company?

- What is Sales and Marketing Strategy of Twin Disc Company?

- What is Brief History of Twin Disc Company?

- Who Owns Twin Disc Company?

- What is Customer Demographics and Target Market of Twin Disc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.