UKG Bundle

How Does UKG Thrive in the HCM Arena?

Since its inception in April 2020, the UKG SWOT Analysis has become a powerhouse in human capital management (HCM), transforming the HR technology landscape. With a remarkable revenue surge from $2.5 billion to $4.7 billion, the UKG company has cemented its position as a leading provider of cloud-based solutions. This success story highlights the company's ability to innovate and capture market share in a competitive environment.

Delving into the operational strategies of the UKG software reveals how it serves over 80,000 customers globally with its comprehensive suite, including UKG Pro and UKG Ready. Understanding UKG's approach to workforce management and its strategic investments in AI, such as UKG Bryte, is key to grasping its competitive edge. This analysis will explore how the UKG company continues to shape the future of HCM, focusing on its adaptability and growth strategies within the ever-evolving business landscape, including its focus on UKG UltiPro and the broader employee experience.

What Are the Key Operations Driving UKG’s Success?

The UKG company delivers value by providing cloud-based human capital management (HCM) solutions. These solutions streamline workforce management, HR, payroll, and talent acquisition for organizations of all sizes. The goal is to make work better for everyone.

The core products include UKG Pro, designed for mid-market, enterprise, and large enterprise organizations with over 500 employees, and UKG Ready, designed for North American SMBs and EMEA/ANZ mid-sized organizations. UKG One View offers multi-country payroll solutions, supporting over 117 countries and 150 currencies. This wide range of offerings allows UKG software to cater to diverse business needs.

UKG serves a wide range of customer segments, including healthcare (over 7,000 organizations), manufacturing (over 3,000 clients), and retail (over 5,000 customers), among others. The company's focus on human-centered technology and its ability to integrate innovations like UKG Bryte and UKG One View into its UKG Ready product provide a significant advantage over competitors.

UKG invests 20% of its annual revenue into research and development. This investment fuels innovations like UKG Bryte, an AI-powered assistant. The UKG FleX platform facilitates integrations and new capabilities, enhancing the overall user experience.

UKG's supply chain and distribution networks are supported by strategic partnerships. These include collaborations with Google Cloud, Eightfold AI, and PayPal. The PayPal partnership allows employees to deposit pay directly into PayPal accounts, sometimes up to two days early.

UKG focuses on making work better for everyone, setting it apart from competitors. The acquisition of Great Place to Work (GPTW) in 2021 provides unique insights. This drives product development and AI models, improving employee experiences.

UKG's solutions empower culture transformation and improve employee experiences. This leads to double-digit increases in employee retention for customers. The ability to adapt innovations into UKG Ready provides a significant advantage.

UKG's human-centered technology approach and strategic partnerships set it apart. The integration of GPTW data provides unique insights. This drives product development and improves employee experiences.

- Focus on employee experience and culture transformation.

- AI-powered tools like UKG Bryte for insights and guidance.

- Multi-country payroll solutions with extensive currency support.

- Strong partnerships enhancing product offerings and reach.

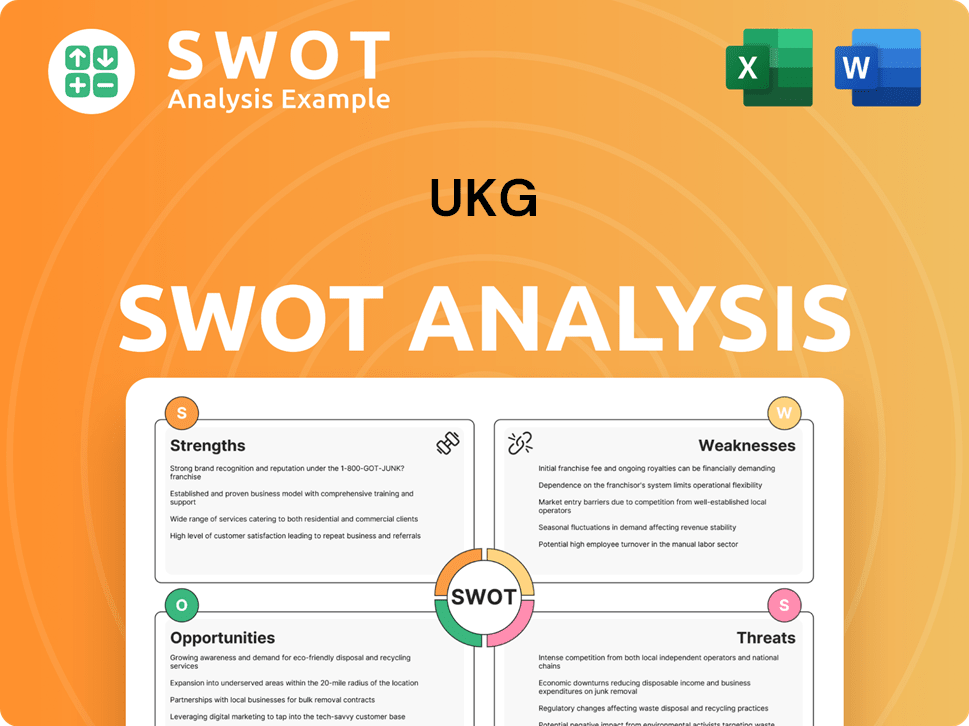

UKG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does UKG Make Money?

The UKG company generates revenue through its cloud-based human capital management (HCM) solutions. These solutions include workforce management, HR, payroll, and talent acquisition services. The company's financial performance demonstrates strong growth and profitability in the HCM market.

In fiscal year 2023, which ended on September 30, 2023, UKG reported approximately $4.3 billion in total revenue. The company's revenue for the first half of fiscal year 2024 was $2.3 billion. UKG aims to achieve $5 billion in revenue by the end of fiscal year 2025.

A significant portion of UKG's revenue comes from its payroll services. These services generated an estimated $2.0 billion in calendar year 2023. This revenue is primarily from SaaS delivery bundled with HR technology. The company's payroll services are a key focus for growth.

The primary revenue streams for UKG are:

- Payroll Services: A major revenue source, processing payroll for approximately 13 million client employees.

- Workforce Management: Solutions that help manage employee time and attendance.

- HR and Talent Acquisition: Services that support HR functions and talent acquisition.

- SaaS Delivery: UKG primarily uses a SaaS model, which is a key component of its services.

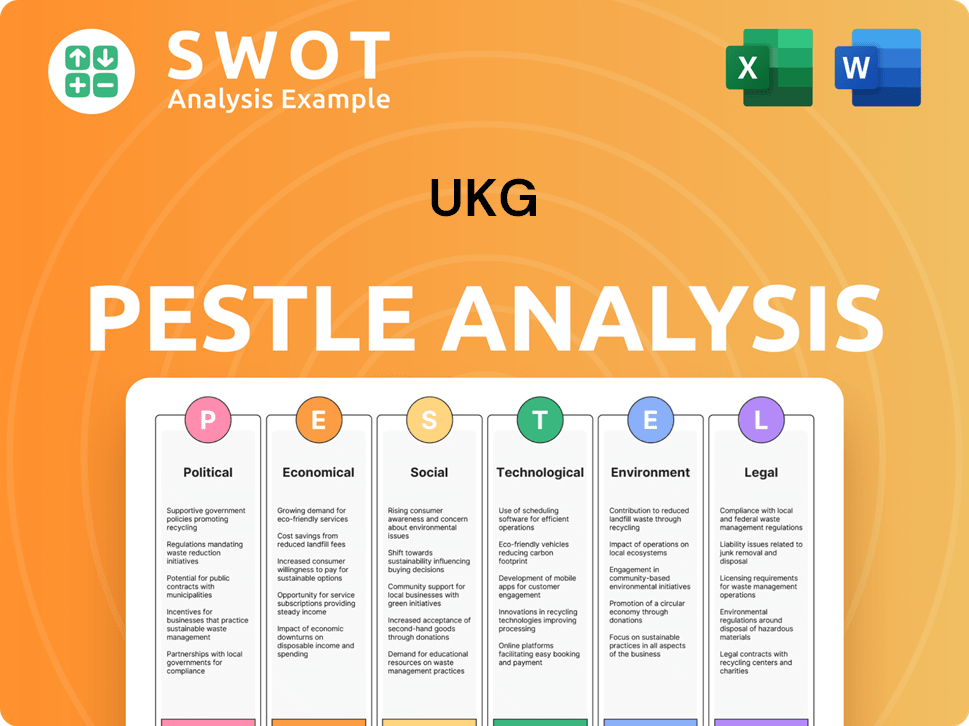

UKG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped UKG’s Business Model?

Examining the key milestones, strategic moves, and competitive edge of the UKG company reveals a dynamic trajectory. The company has strategically expanded its offerings and global reach, focusing on workforce management and human capital management solutions. This expansion is supported by innovative monetization strategies and targeted product development.

The acquisition of Immedis in 2023 was a pivotal move, enhancing its global payroll capabilities and expanding its service offerings. This, combined with a focus on different market segments through UKG Pro and UKG Ready, showcases a strategic approach to cater to diverse business needs. The company's ability to adapt and innovate has been crucial in maintaining its competitive edge.

UKG's strategic moves are geared toward sustained growth and market penetration. The company's focus on expanding its global footprint and catering to the needs of various market segments has been key to its success. The company continues to innovate and adapt to market changes, ensuring its competitive advantage.

UKG employs innovative monetization strategies, including platform fees, bundled services, and tiered pricing. This approach allows for flexibility across its product suites. UKG Pro is designed for large enterprises, while UKG Ready targets the SMB market, allowing for adaptable pricing models based on organizational size and complexity.

The company is actively expanding into new markets, such as the U.K. SME payroll market, which is expected to accelerate payroll service revenues. Regionally, North America accounts for the majority of UKG's revenue, at 95%. The company is growing its global footprint, with international revenue seeing a 15% increase in 2024, projected to grow by 18% in 2025.

UKG's competitive edge lies in its comprehensive workforce management solutions and strategic market positioning. The company's ability to integrate global payroll services and expand into new markets, such as the U.K. SME payroll market, showcases its adaptability and focus on growth. The company's focus on innovation and customer satisfaction is crucial.

- The acquisition of Immedis in 2023 enhanced its global payroll capabilities.

- UKG Pro caters to large enterprises, while UKG Ready serves the SMB market.

- International revenue saw a 15% increase in 2024.

- The company is expanding its global footprint with projected growth of 18% in 2025.

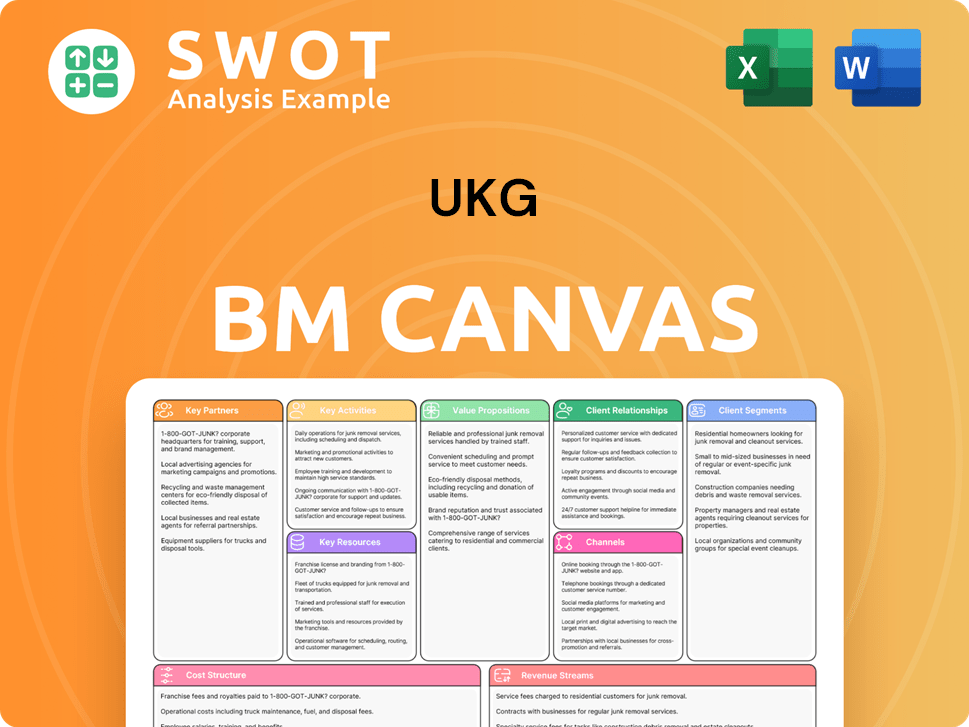

UKG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is UKG Positioning Itself for Continued Success?

The industry position, risks, and future outlook for the UKG company are shaped by its strategic moves, competitive advantages, and the evolving landscape of HR technology. As a leading provider of human capital management (HCM) solutions, UKG software faces both opportunities and challenges in a market increasingly driven by AI, global expansion, and the need for comprehensive employee experience platforms.

Understanding UKG's position requires examining its key milestones, strategic decisions, and how it differentiates itself from competitors in the HCM space. The company's ability to navigate risks, adapt to technological advancements, and capitalize on market trends will be crucial for its long-term success. This analysis delves into the specifics of UKG's operations, market performance, and future prospects.

A significant milestone was the April 2020 merger of Ultimate Software and Kronos, creating UKG, one of the largest HR software companies. The company's combined revenues were between $2.5-$2.6 billion at the time of the merger. Today, the revenue has grown to approximately $4.7 billion.

In 2021, UKG acquired Great Place to Work (GPTW) Institute, Inc., integrating workplace culture insights into its product development. The acquisition of Immedis in 2023, a global payroll provider, led to the launch of UKG One View. This move significantly enhanced its multi-country payroll capabilities.

UKG has a comprehensive cloud-based HCM suite, covering HR, payroll, and talent solutions, offering a streamlined employee experience. The company holds a leading market share in workforce management applications, at 24.2% in 2023, which showcases its strong market presence.

In July 2024, UKG announced a layoff of approximately 2,100 people, or 14% of its 15,000 employees. This was a strategic decision to invest in AI, customer success, branding, and the mid-market/SMB segment. The company is also facing the challenge of adapting to evolving labor market changes.

UKG is focusing on AI, with over 2,500 AI models in production and the launch of UKG Bryte, a generative AI guidance system. The company is expanding its global footprint and focusing on SMBs to address evolving labor market changes and employee well-being needs. The talent marketplace solution launched in November 2024 uses AI to fill labor gaps and provide career development opportunities.

- UKG continues to invest heavily in AI to transform the market.

- The company is expanding into new markets and focusing on SMBs.

- UKG is adapting to evolving labor market changes and employee well-being needs.

- The company's commitment to innovation is evident in its product developments. Learn more about the owners and shareholders of UKG by reading this article.

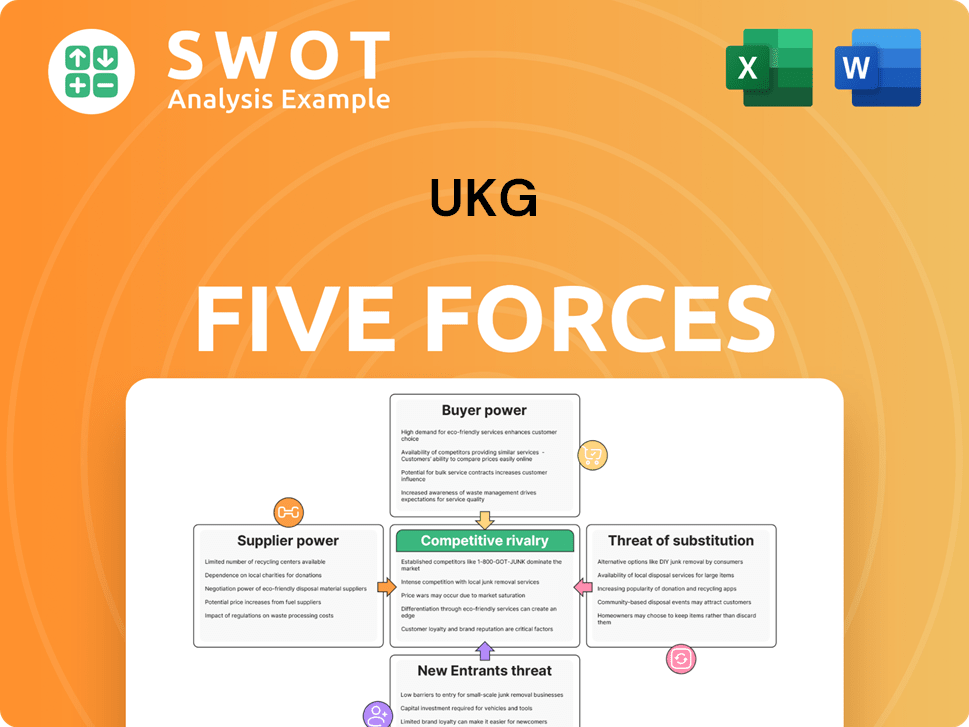

UKG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UKG Company?

- What is Competitive Landscape of UKG Company?

- What is Growth Strategy and Future Prospects of UKG Company?

- What is Sales and Marketing Strategy of UKG Company?

- What is Brief History of UKG Company?

- Who Owns UKG Company?

- What is Customer Demographics and Target Market of UKG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.