Volker Wessels Stevin NV Bundle

How Does VolkerWessels Stevin NV Thrive in the Construction Industry?

Ever wondered how a global construction powerhouse like VolkerWessels Stevin NV maintains its competitive edge? With a staggering €7.1 billion in revenue in 2024, this Dutch construction company is a major player in building, infrastructure, and more. Its decentralized structure, encompassing around 120 operating companies, allows for a 'think global, act local' strategy, fostering both innovation and adaptability. Understanding the inner workings of VolkerWessels is key to appreciating its market resilience.

For those seeking a deeper understanding, a detailed Volker Wessels Stevin NV SWOT Analysis can provide valuable insights into its strengths, weaknesses, opportunities, and threats. This analysis is crucial for investors, business strategists, and anyone interested in the dynamics of the construction and infrastructure sectors. Exploring how VolkerWessels manages its diverse portfolio of infrastructure projects and maintains financial performance offers crucial lessons in strategic business management. Furthermore, learning about the company's structure helps understand how VolkerWessels operates and its approach to sustainability and innovation.

What Are the Key Operations Driving Volker Wessels Stevin NV’s Success?

VolkerWessels Stevin NV, a prominent Dutch construction company, creates value through a comprehensive suite of integrated solutions and services. Its core operations span the entire lifecycle of infrastructure projects, including building, road construction, energy, telecom, and railway infrastructure. The company serves diverse customer segments, from housing and utility construction to industrial projects and property development, showcasing its versatility in the construction sector.

The operational model of VolkerWessels is underpinned by a decentralized, multi-company structure. This approach, with around 120 independent operating companies, fosters efficient project execution and strong local client relationships. This structure enables entrepreneurship and adaptability to various regional demands, enhancing the company's ability to meet specific project requirements effectively. The company's commitment to digital initiatives and process automation, such as Building Information Modeling (BIM), further enhances its operational efficiency.

The company's focus on sustainability and safe, sound solutions is a key part of its value proposition. VolkerWessels Stevin NV integrates local expertise with a centralized control and support structure, optimizing scale and knowledge across its various companies. This approach allows for integrated multidisciplinary projects, ensuring customer benefits through safe, sound, and sustainable solutions, as highlighted in the Growth Strategy of VolkerWessels Stevin NV.

VolkerWessels provides building, road construction, energy, telecom, and railway infrastructure services. They also engage in housing, utility construction, industrial projects, and property development. This diverse portfolio highlights the company's broad capabilities.

The company operates through a decentralized, multi-company model with about 120 independent operating companies. This structure promotes efficient project execution and local client relationships. It also fosters entrepreneurship and adaptability to regional needs.

VolkerWessels actively embraces digital initiatives and process automation. Technologies such as Building Information Modeling (BIM) are used to enhance efficiency and transparency across operations. This technological integration has improved project delivery times by 10% in 2024.

The company's supply chain and partnerships are crucial for project success. Collaborations have increased project efficiency by 15% in 2024. This focus on partnerships enhances overall project outcomes.

VolkerWessels offers integrated multidisciplinary projects, combining local expertise with centralized support. This approach results in safe, sound, and sustainable solutions for clients. The company's focus is on optimizing scale and knowledge across its various companies.

- Integrated Project Delivery

- Sustainable Solutions

- Local Expertise with Centralized Support

- Efficient Project Execution

Volker Wessels Stevin NV SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Volker Wessels Stevin NV Make Money?

VolkerWessels Stevin NV generates revenue through diverse construction and infrastructure projects. The company operates across several countries, including the Netherlands, the United Kingdom, North America, and Germany. In 2024, the company's revenue reached €7.1 billion, showcasing its substantial market presence.

The company's decentralized model contributed to €7.2 billion in revenue. Its UK operations alone reported revenue of £1.433 billion for the year ended December 31, 2023, a 6% increase from the previous year, demonstrating robust growth in key markets. This growth reflects the company's ability to secure and execute large-scale projects.

Major revenue streams are derived from various sectors, including housing construction, utility construction, industrial construction, property development, civil engineering, road construction, network infrastructure, telecommunications infrastructure, railway construction and maintenance, technical installations, traffic technology, plant and machinery management, park management, construction supplies, and consulting and services. For a deeper dive into the company's origins, consider reading the Brief History of Volker Wessels Stevin NV.

VolkerWessels employs several monetization strategies to optimize its financial performance. These include securing long-term framework agreements and focusing on innovation and digital transformation. The company's focus on innovation and digital transformation has led to cost savings and improved efficiency.

- Approximately 53% of the V&N Group's contracts include inflation protection on labor and material costs, mitigating financial risks.

- The company's innovation efforts, including automating procurement and cost management, have led to cost savings of at least 5% in indirect expenses.

- Significant improvements in work efficiency, equivalent to saving 4 full-time equivalent personnel costs, have been achieved.

- VolkerFitzpatrick, a UK subsidiary, saw its revenues marginally up at £679 million in 2023, driven by projects like HS2 and various rail initiatives.

- VolkerRail contributed £162 million to group revenues in 2023.

Volker Wessels Stevin NV PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Volker Wessels Stevin NV’s Business Model?

How does VolkerWessels Stevin NV operate? The company, a prominent construction company, has a history marked by significant milestones and strategic initiatives. These actions have shaped its operations and financial outcomes. VolkerWessels has consistently adapted to market dynamics, embracing digital transformation and forming strategic partnerships to enhance efficiency.

Stevin NV's commitment to sustainability is a key aspect of its strategy. The company aims for a 30% reduction in CO2 emissions by 2025, with a focus on increasing investments in green projects. This commitment reflects a broader trend toward environmental responsibility in the construction industry. Furthermore, the company is focused on social impact, aiming for a social return score of 1.9% by 2025, assisting individuals with barriers to employment.

The company's competitive edge is derived from its decentralized, multi-company model, which fosters entrepreneurship and local market responsiveness. Its strong presence in core markets, such as the Netherlands, the UK, North America, and Germany, provides operational stability. VolkerWessels also emphasizes brand strength, technology leadership, and an ecosystem effect through its numerous operating companies.

VolkerWessels Stevin NV has achieved several significant milestones. The company's commitment to sustainability includes a target of a 30% CO2 reduction by 2025. In 2024, it increased investments in green projects by 15% year-over-year, with ESG-focused projects accounting for 20% of its portfolio. The company is also focused on social impact, aiming for a social return score of 1.9% by 2025.

VolkerWessels has implemented strategic moves to enhance its operations. Investments in digital transformation increased by 15% in 2024, and BIM adoption improved project delivery times by 10% in the same year. Strategic partnerships increased project efficiency by 15% in 2024. The company has responded to market challenges by focusing on operational excellence and leveraging economies of scale.

VolkerWessels maintains a competitive edge through several factors. Its decentralized, multi-company model fosters entrepreneurship and local market responsiveness. A strong presence in core markets provides operational stability. The company emphasizes brand strength, technology leadership, and an ecosystem effect. VolkerWessels continues to adapt to new trends and technological shifts, expanding into renewable energy and telecom infrastructure.

Stevin NV faces challenges, including vulnerabilities due to its reliance on construction and infrastructure markets. Economic fluctuations and local authority funding cuts can impact the company. A 3.2% decrease in Dutch infrastructure spending in 2024 highlights these risks. The company addresses these challenges through operational excellence, continuous improvement, and economies of scale.

VolkerWessels Stevin NV's financial performance is influenced by market dynamics and strategic decisions. The company's investments in digital transformation and strategic partnerships have improved efficiency. However, it faces challenges from economic fluctuations and funding cuts. The company's focus on sustainability and social impact also impacts its financial profile.

- The company increased investments in green projects by 15% year-over-year in 2024.

- BIM adoption improved project delivery times by 10% in 2024.

- Strategic partnerships increased project efficiency by 15% in 2024.

- Dutch infrastructure spending decreased by 3.2% in 2024.

Volker Wessels Stevin NV Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Volker Wessels Stevin NV Positioning Itself for Continued Success?

As a leading international construction group, VolkerWessels Stevin NV holds a strong industry position. Its operations span across the Netherlands, the United Kingdom, North America, and Germany. The company’s decentralized model, comprising over 120 operating companies, facilitates diverse operations across building, road construction, energy, telecom, and railway infrastructure sectors, contributing to its market share and client relationships.

In 2024, the company achieved €7.1 billion in revenue, reflecting its significant standing in the construction sector. However, the company faces risks, including economic fluctuations affecting construction and infrastructure markets. Local authority funding cuts, such as a 3.2% decrease in Dutch infrastructure spending in 2024, also pose a risk. Cybersecurity threats, with the cost of cybercrime projected to reach $10.5 trillion annually by 2025, further complicate the landscape.

The company is a leading player in the international construction market. It has a strong presence in key markets like the Netherlands, the UK, North America, and Germany. Its decentralized structure supports diverse operations across various sectors.

The company is susceptible to economic fluctuations in construction and infrastructure markets. Funding cuts and project delays can impact operations. Cybersecurity threats represent a significant risk to the company.

The company is focused on sustainability, aiming for a 30% CO2 reduction by 2025. It is investing in green projects, which accounted for 20% of its portfolio in 2024. The company is also capitalizing on the growth in renewable energy and 5G rollout.

VolkerWessels plans to intensify its policy of working with 'own people' in crucial positions. Digital transformation and innovation are key for future revenue generation. The company is committed to sustainability and digital transformation.

The company is committed to sustainability, aiming to reduce CO2 emissions and increase investments in green projects. Renewable energy and 5G rollout are areas of growth. Digital transformation and innovation are also key priorities.

- Sustainability initiatives, with a focus on a 30% CO2 reduction by 2025.

- Increased investments in green projects, accounting for 20% of the portfolio in 2024.

- Capitalizing on the growth in renewable energy, with the global market projected to reach $1.977 trillion by 2030.

- Commitment to digital transformation and innovation to sustain future revenue generation.

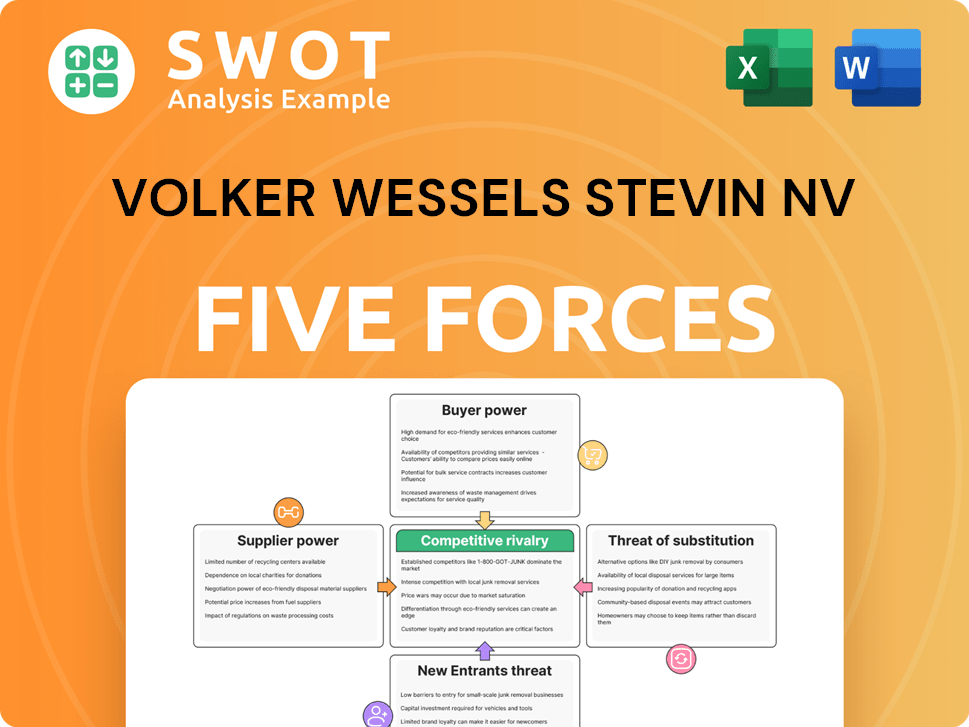

Volker Wessels Stevin NV Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Volker Wessels Stevin NV Company?

- What is Competitive Landscape of Volker Wessels Stevin NV Company?

- What is Growth Strategy and Future Prospects of Volker Wessels Stevin NV Company?

- What is Sales and Marketing Strategy of Volker Wessels Stevin NV Company?

- What is Brief History of Volker Wessels Stevin NV Company?

- Who Owns Volker Wessels Stevin NV Company?

- What is Customer Demographics and Target Market of Volker Wessels Stevin NV Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.