Western Alliance Bank Bundle

Decoding Western Alliance Bank: How Does It Thrive?

Western Alliance Bancorporation, a financial powerhouse with over $80 billion in assets as of March 31, 2025, consistently ranks among the best in the U.S. banking sector. Celebrated for its leadership and strategic prowess, Western Alliance (WA Bank) offers a compelling case study in modern banking. Its tailored commercial banking solutions and consumer products have solidified its position in the market.

This Western Alliance Bank SWOT Analysis offers a deep dive into the company's strengths, weaknesses, opportunities, and threats. Understanding the intricacies of this commercial bank is crucial for anyone looking to navigate the financial landscape, from individual investors to seasoned financial professionals. Explore how Western Alliance leverages its 'Local Touch, National Reach' strategy to deliver exceptional banking services.

What Are the Key Operations Driving Western Alliance Bank’s Success?

Western Alliance Bancorporation, operating as WA Bank, generates and delivers value through its core operations by providing a comprehensive suite of commercial banking solutions and consumer products. This financial institution primarily serves businesses and individuals in the western United States. The company's primary focus includes commercial banking, real estate lending, and treasury management services, tailored to meet the specific needs of various sectors.

The bank specializes in catering to specific industries such as technology, healthcare, and real estate, demonstrating a deep understanding of these sectors' unique financial needs. This targeted approach allows Western Alliance Bank to build strong relationships and offer customized solutions. The bank's operational strategy is designed to provide personalized attention and localized market knowledge.

Operationally, Western Alliance employs a 'Local Touch, National Reach' strategy, combining the resources of a national bank with personalized attention and localized market knowledge. This is facilitated by operating individual, full-service banking and financial brands with offices in key markets nationwide, while unifying these brands under the single name, Western Alliance Bank, in 2025 to maximize marketing resources and enhance client experience. The bank’s operational processes involve robust loan and deposit platforms, which contributed to loan growth of $1.1 billion and deposit growth of $3.0 billion in Q1 2025. The company also emphasizes risk management capabilities, having made significant foundational investments in risk and treasury management, as well as data reporting, to safeguard the bank against market disruptions.

WA Bank offers a wide array of banking services. These include commercial banking, real estate lending, and treasury management. They also provide specialized services for industries like technology and healthcare.

The bank uses a 'Local Touch, National Reach' approach. This combines local market knowledge with the resources of a national bank. It involves individual banking brands unified under the Western Alliance Bank name.

In Q1 2025, the bank experienced loan growth of $1.1 billion and deposit growth of $3.0 billion. This indicates strong financial performance. The bank focuses on risk management and data reporting.

Customers benefit from customized solutions and outstanding personalized service. The bank's strong capital and liquidity foundation ensures continued growth. The bank also benefits from greater credit-linked notes support.

Western Alliance distinguishes itself through its specialized business lines, expert bankers, and customized products. This approach fosters deeper client relationships and provides tailored solutions. The bank's focus on low- to no-loss categories contributes to a low-risk balance sheet profile.

- Specialized business lines with expert bankers.

- Customized products tailored to specific sectors.

- Strong credit-linked notes support.

- Low-risk balance sheet profile.

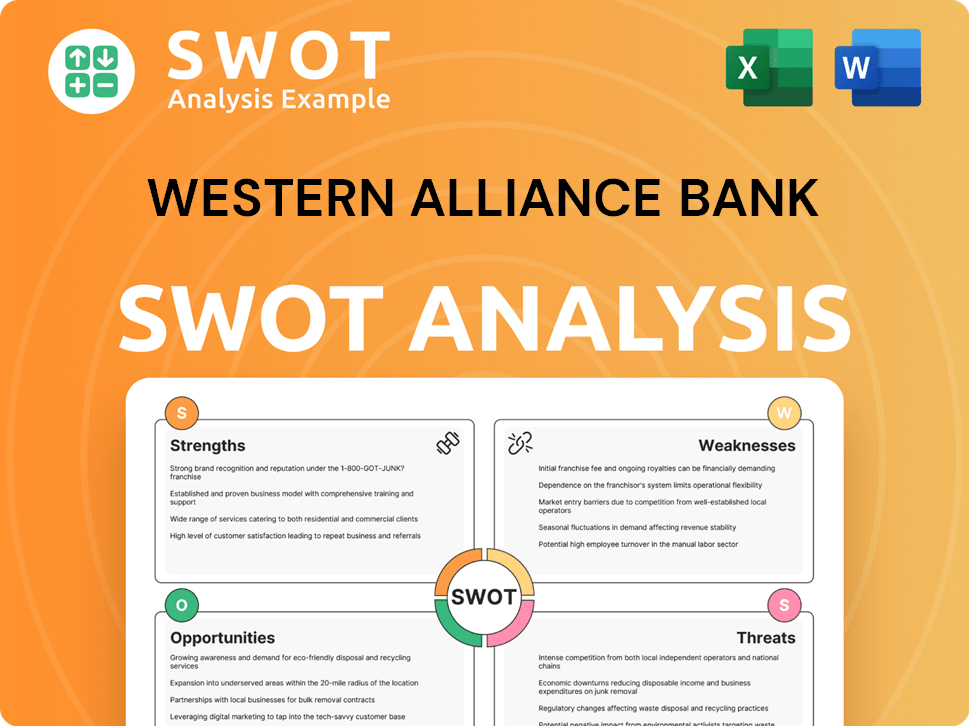

Western Alliance Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Western Alliance Bank Make Money?

Western Alliance Bancorporation, often referred to as Western Alliance Bank (WA Bank), generates revenue through a combination of interest and non-interest income streams. The primary source of revenue is net interest income, reflecting the difference between interest earned on loans and interest paid on deposits. The financial institution also earns income from various non-interest activities, including fees and service charges.

The bank employs several monetization strategies to maximize revenue and profitability. These include platform fees, bundled services, and cross-selling within its specialized banking services. WA Bank focuses on growing lower-cost deposit sources to improve its net interest margin, which is crucial for its financial performance.

For the twelve months ending March 31, 2025, total revenue was $3.21 billion, an 11.6% increase year-over-year. The company aims to continue growing both net interest and non-interest income in the coming years.

Net interest income is the core revenue driver for Western Alliance. In 2024, it reached $2.6 billion, a 12.0% increase year-over-year. For Q1 2025, this income rose 9% year-over-year to $651 million.

Non-interest income includes fees and other service charges. In 2024, this income increased by $263 million to $543 million, boosted by mortgage banking revenue. The bank aims to expand this income stream through treasury management and other services.

The net interest margin remained relatively stable. In Q1 2025, it was 3.47%, slightly down from 3.48% in Q4 2024. WA Bank focuses on managing this margin effectively.

A significant component of non-interest income. In 2024, mortgage banking revenue grew 10.8% year-over-year to $328 million. However, in Q1 2025, non-interest income saw a slight decline.

Western Alliance anticipates continued growth. Projections for 2025 include a 6-8% increase in both net interest income and non-interest income. This growth is supported by strategic initiatives.

The bank utilizes platform fees, bundled services, and cross-selling. It focuses on specialized banking services and growing lower-cost deposits. This approach supports long-term revenue growth.

Western Alliance Bank's (WA Bank) revenue model is built on net interest income and non-interest income, supported by strategic monetization efforts. For more insights into the bank's overall strategy, consider reading about the Marketing Strategy of Western Alliance Bank.

- Net Interest Income: The primary source, driven by interest earned on loans.

- Non-Interest Income: Includes fees from services like mortgage banking and commercial banking.

- Monetization: Strategies include platform fees, bundled services, and cross-selling.

- Deposit Growth: Focus on lower-cost deposits to improve the net interest margin.

- Future Growth: The bank anticipates growth in both net interest and non-interest income.

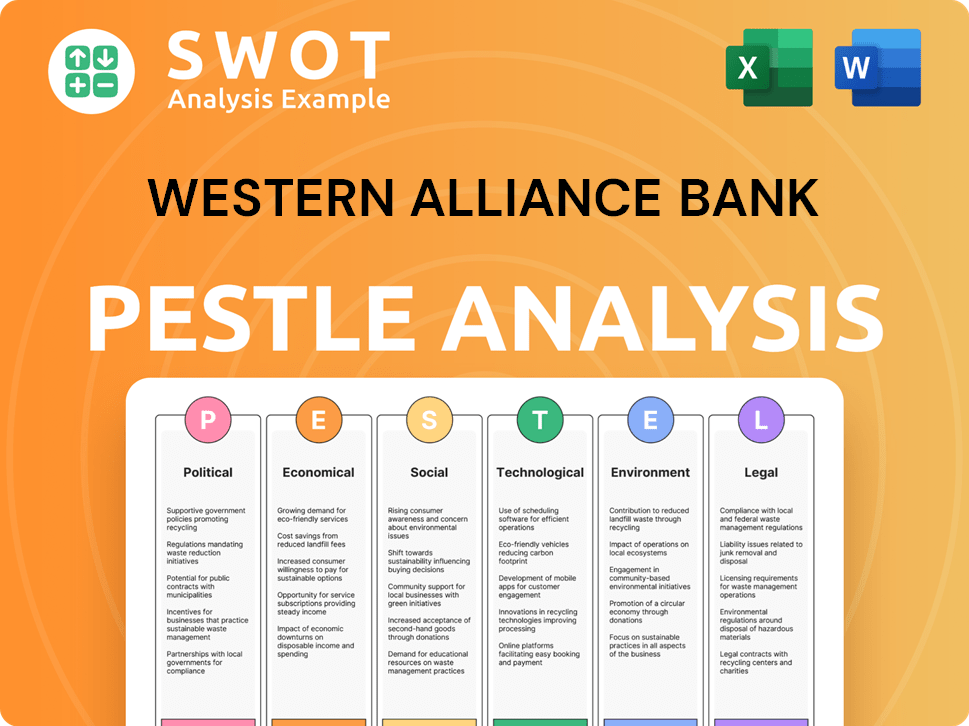

Western Alliance Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Western Alliance Bank’s Business Model?

Western Alliance Bancorporation, also known as WA Bank, has experienced significant growth and strategic shifts. A pivotal move in 2025 was consolidating its six banking brands under the single name of Western Alliance Bank. This decision aimed to optimize marketing efforts and enhance client experiences. The bank's focus on deposit growth and strategic asset allocation has been key to its recent performance.

The financial institution has demonstrated resilience by navigating challenges such as competitive pressures and changing interest rates. Investments in risk management and data reporting are crucial as Western Alliance prepares to become a Category IV bank. The company's strategic initiatives and operational adjustments have positioned it for continued success in the competitive banking sector.

In 2024, Western Alliance prioritized growing deposits, deploying excess liquidity into high-quality liquid assets (HQLA). This strategy led to an impressive increase of $11.0 billion (19.9%) in total deposits and a $3.4 billion (6.7%) increase in loans. The loan-to-deposit ratio decreased to 80.9%. The upward trend continued into Q1 2025, with deposits increasing by $3.0 billion and loans by $1.1 billion.

Western Alliance Bank unified its banking brands in 2025. The bank focused on growing deposits and deploying excess liquidity into high-quality liquid assets (HQLA) in 2024. The company has consistently adapted to new trends and competitive threats.

The company has invested heavily in risk management and data reporting. In 2024, Western Alliance increased total deposits by $11.0 billion (19.9%) and loans by $3.4 billion (6.7%). The bank is focused on customer-centric solutions.

Western Alliance's diversified business model and strong fee income are key advantages. The 'Local Touch, National Reach' approach differentiates the bank. The bank has a strong capital position, with a CET1 ratio of 11.1% as of March 31, 2025.

The bank has addressed competitive pressures and interest rate changes. Significant investments have been made in risk and treasury management. The company is preparing to become a Category IV bank.

Western Alliance Bank's competitive advantages include a diversified business model and strong fee income. The bank's focus on high-growth niches and customer-centric solutions supports its growth. The bank's history and background can be found in the Brief History of Western Alliance Bank.

- Diversified business model with strong fee income.

- Strong loan growth potential in high-growth niches.

- 'Local Touch, National Reach' approach.

- Strong capital position with a CET1 ratio of 11.1%.

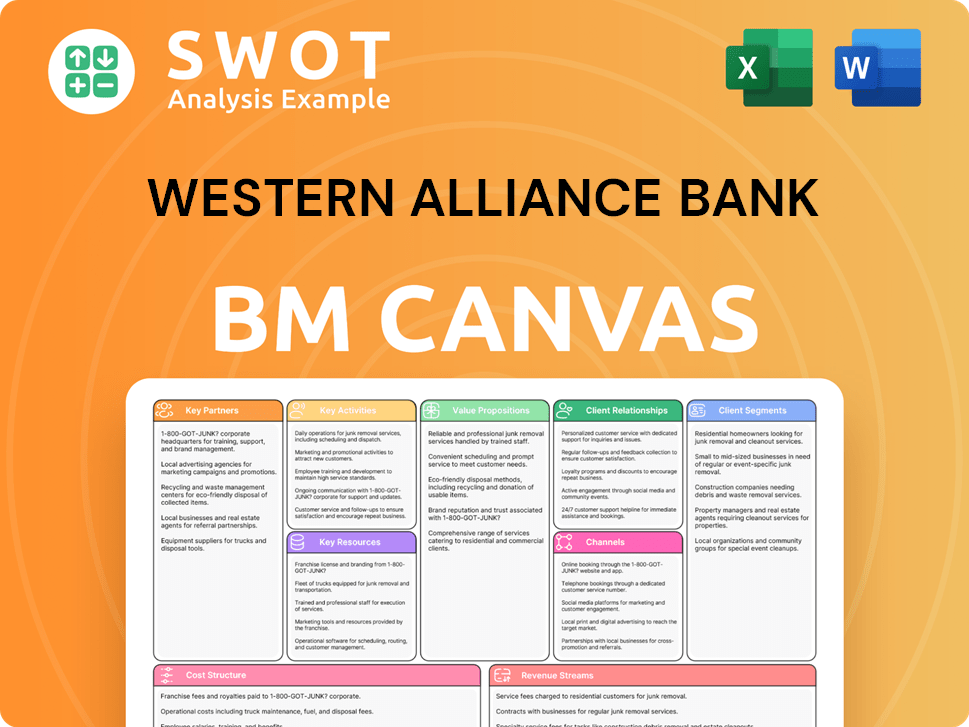

Western Alliance Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Western Alliance Bank Positioning Itself for Continued Success?

Western Alliance Bancorporation (WA Bank) holds a strong position in the U.S. banking sector. Recognized as a top U.S. bank in 2024 by American Banker and Bank Director, it has over $80 billion in assets as of March 31, 2025. The bank is a major player, especially in the western United States, focusing on commercial banking, real estate lending, and treasury management. Its market share is supported by a diverse business model and strong customer loyalty.

Key risks for Western Alliance include competitive pressures, potential loan defaults, and regulatory changes. Interest rate fluctuations and increased foreclosures also pose risks. While asset quality remained stable in Q1 2025, classified assets increased, indicating emerging credit concerns in certain sectors.

Western Alliance is a significant commercial bank in the U.S., particularly in the western states. It is recognized as a leading financial institution. The bank focuses on commercial banking, real estate lending, and treasury management to serve its customers.

Risks include competition, potential loan defaults, and regulatory changes. Interest rate fluctuations and increased foreclosures are also concerns. Asset quality is monitored closely, with classified assets showing emerging credit concerns.

The bank has an optimistic outlook, with strategic initiatives for balance sheet growth and improved profitability. Western Alliance projects loan and deposit growth for 2025. The company aims to reach the $100 billion asset level in the next few years.

Management anticipates a 6-8% increase in both net interest income and non-interest income for 2025. Non-interest expenses are expected to decrease by 0-5%. The bank plans for its CET1 capital ratio to remain above 11%.

Western Alliance is focused on balance sheet growth and improved profitability. The bank is expanding its lower-cost deposit sources to positively impact its net interest margin. For more details on the company's financial performance and ownership structure, you can review the information on Owners & Shareholders of Western Alliance Bank.

- Loan growth of $5 billion projected for 2025.

- Deposit growth of $8 billion projected for 2025.

- Target to reach $100 billion asset level in 2-3 years.

- CET1 capital ratio to remain above 11%.

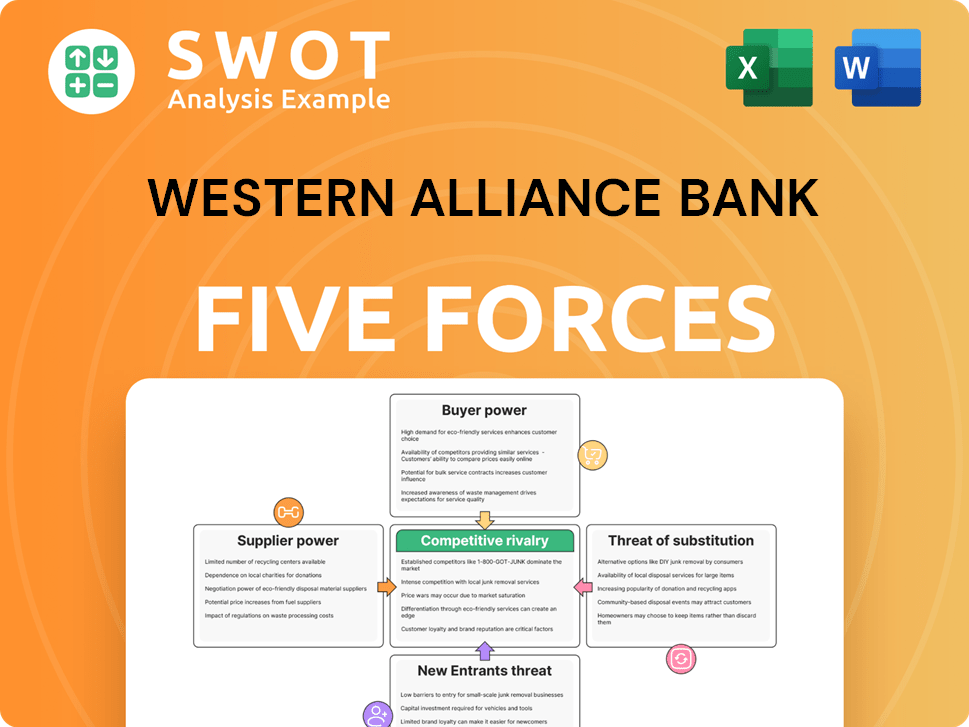

Western Alliance Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Western Alliance Bank Company?

- What is Competitive Landscape of Western Alliance Bank Company?

- What is Growth Strategy and Future Prospects of Western Alliance Bank Company?

- What is Sales and Marketing Strategy of Western Alliance Bank Company?

- What is Brief History of Western Alliance Bank Company?

- Who Owns Western Alliance Bank Company?

- What is Customer Demographics and Target Market of Western Alliance Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.