Latitude Financial Services Bundle

How is Latitude Financial Revolutionizing Sales and Marketing?

Latitude Financial Services, a leading consumer finance provider in Australia and New Zealand, has dramatically reshaped its sales and marketing strategies. From its roots in traditional phone sales to its current status as a digital-first lender, Latitude's evolution offers a compelling case study in adapting to the modern financial landscape. Discover how Latitude has built a powerful brand and customer-centric approach.

This deep dive explores Latitude's transformation, from its 'Partners in Money' campaign to its strategic investments in digital marketing. Learn about Latitude Financial's Latitude Financial Services SWOT Analysis, its customer acquisition strategies, and the innovative campaigns driving its growth. Understand the sales and marketing plan behind Australia and New Zealand's largest non-bank consumer lender, and gain insights into the future of financial services marketing.

How Does Latitude Financial Services Reach Its Customers?

The sales and marketing strategy of Latitude Financial Services focuses on a multi-channel approach to reach its customer base across Australia and New Zealand. This strategy integrates both online and offline channels to maximize customer acquisition and engagement. The company's reach extends to approximately 2 million customers, reflecting a broad market presence.

A significant portion of sales is generated through partnerships with major retailers and a network of accredited brokers. This strategy is designed to provide flexible financing options, including interest-free payment plans, which are a key driver of sales volume. The company's digital transformation efforts, including the use of Salesforce Marketing Cloud, further enhance its sales and marketing capabilities.

The company's sales strategy is designed to adapt to evolving market trends and customer preferences. By leveraging both established retail partnerships and digital channels, Latitude Financial aims to maintain a strong market position and drive sustainable growth. This approach involves continuous optimization of its sales processes and marketing campaigns to improve effectiveness and customer satisfaction.

Latitude Financial has a strong presence in retail, partnering with 5,600 outlets. Key partners include Harvey Norman, JB Hi-Fi, and The Good Guys. These partnerships are crucial for point-of-sale finance, especially for interest-free payment plans, which drive sales.

The company's distribution network includes over 4,500 accredited brokers. In 2024, brokers originated a larger volume of loans compared to direct channels. Broker-originated loans are expected to continue growing in 2025, with around 42% of personal loans and over 50% of motor loans being written via brokers.

Latitude Financial is enhancing its digital presence through its website and app. The website, latitudefinancial.com.au, saw over 2 million visits in November 2024. Digital marketing efforts are supported by Salesforce Marketing Cloud and Data Cloud, improving campaign efficiency.

Key partnerships with Apple (Upgrade+), JB Hi-Fi, and The Good Guys have been extended. New partnerships with brands like Officeworks, Amazon, and Coco Republic were added in 2024, contributing to market share growth. The acquisition of Symple Loans in late 2021 integrated a fintech, expanding product offerings.

Latitude Financial's sales and marketing strategy is designed to adapt to the evolving financial services landscape. The company continues to refine its approach to customer acquisition and retention. For more details on the company's history and development, you can read Brief History of Latitude Financial Services.

Latitude Financial employs a multi-channel strategy to reach its target audience. This includes retail partnerships, broker networks, and digital platforms. The focus is on providing flexible financing options and enhancing customer engagement through digital tools.

- Leveraging retail partnerships for point-of-sale finance.

- Utilizing a network of accredited brokers for loan distribution.

- Enhancing online sales and marketing through digital platforms.

- Expanding partnerships with major brands to increase market reach.

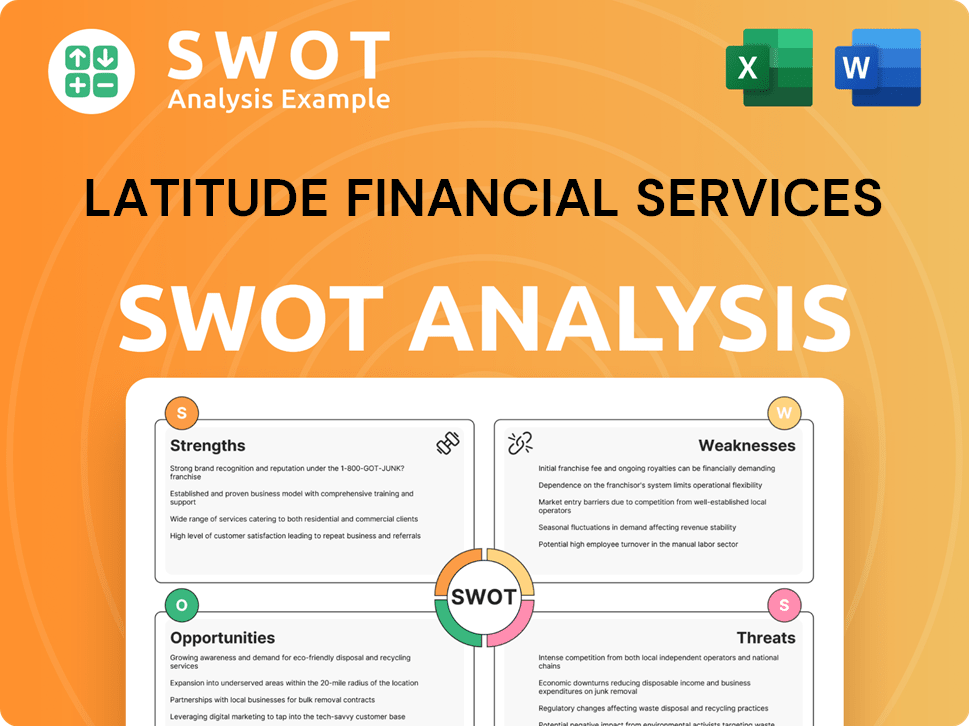

Latitude Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Latitude Financial Services Use?

The sales and marketing strategy of Latitude Financial Services is a multifaceted approach, leveraging data-driven insights and digital channels to boost brand awareness and drive sales. This strategy has evolved significantly, transitioning from traditional methods to advanced platforms like Salesforce Marketing Cloud and Data Cloud. The company's focus on personalization and targeted campaigns has yielded impressive results, demonstrating a commitment to innovation in the financial services marketing landscape.

Latitude Financial's marketing tactics are designed to enhance customer engagement and streamline the sales process. They use a combination of content marketing, paid advertising, and email marketing to reach and engage their target audience. The integration of AI tools further optimizes these efforts, leading to increased efficiency and improved customer experiences. This comprehensive approach reflects a forward-thinking strategy aimed at sustained growth and market leadership.

The company's marketing efforts are heavily influenced by data analysis and customer behavior insights. By using tools like Einstein GPT for Marketing, Latitude Financial personalizes customer communication and delivers targeted offers. This data-driven approach has led to significant improvements in campaign performance and customer engagement, indicating a strong return on investment in digital marketing initiatives.

Latitude Financial has significantly upgraded its digital marketing capabilities. They've moved from basic CRM to advanced platforms like Salesforce Marketing Cloud and Data Cloud.

The company uses Einstein GPT for Marketing to analyze customer behavior and create targeted campaigns. This helps in delivering personalized offers to customers.

Content marketing, including SEO articles and social animations, is used to redefine the brand identity. This helps position the company as a trusted partner in financial habits.

Paid advertising is a key component of the marketing strategy. Monthly advertising spend peaked at over $260,000 in October 2024, with YouTube being a significant channel.

Latitude focuses on improving email deliverability and engagement. They test and optimize send times, frequency, and subject lines.

The 'Partners in Money' masterbrand campaign, launched in late 2019, used an integrated approach across TV, digital video, OOH, and digital display.

The Competitors Landscape of Latitude Financial Services reveals that the company's digital marketing initiatives have led to measurable improvements. For example, the shift to advanced platforms resulted in a 2x increase in email open rates and a 7x faster time to market for campaigns. The use of AI for optimization contributed to a 10% increase in digital activation and a 4% increase in incremental volume for its credit card business. These figures highlight the effectiveness of their sales strategy Latitude Financial and marketing strategy Latitude Financial.

Latitude Financial's marketing strategy is multifaceted, incorporating various digital and traditional tactics to reach its target audience effectively. The company focuses on data-driven insights to personalize customer interactions and optimize campaign performance. This approach has led to significant improvements in customer engagement and sales, showcasing a commitment to innovation in financial services marketing.

- Content Marketing: Utilizing SEO articles, infographics, and social animations to build brand trust.

- Paid Advertising: Allocating a significant budget to digital channels, with YouTube as a key platform.

- Email Marketing: Improving deliverability and engagement through optimization.

- AI Integration: Employing AI to optimize marketing success, including send times and subject lines.

- Integrated Campaigns: Combining traditional and digital media for broader reach.

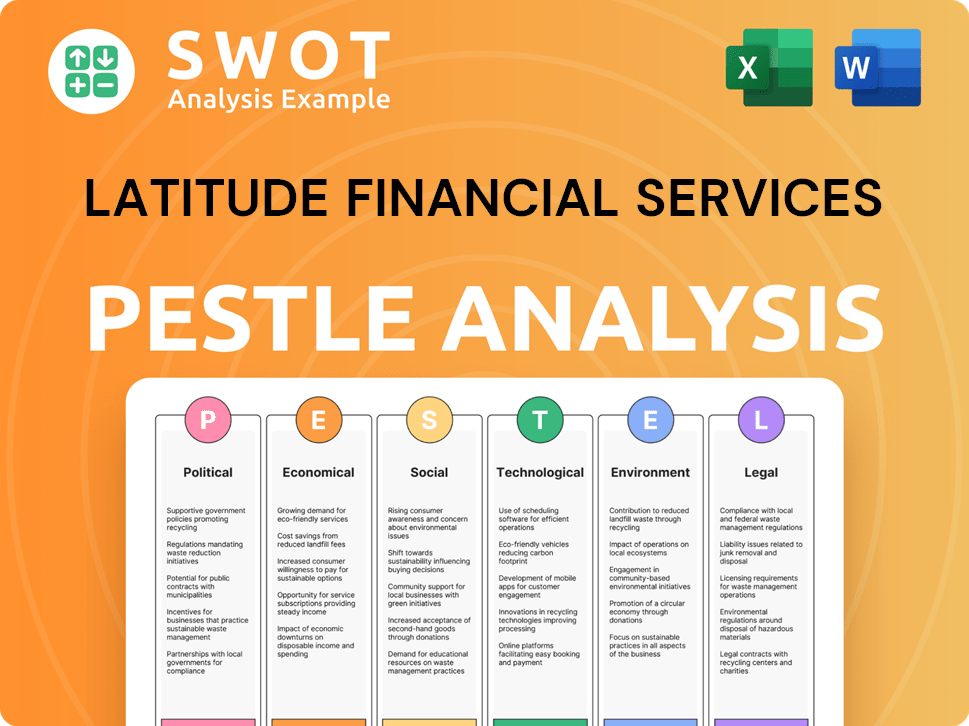

Latitude Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Latitude Financial Services Positioned in the Market?

Latitude Financial Services, a prominent non-bank consumer lender in Australia and New Zealand, strategically positions itself as 'Partners in Money'. This approach emphasizes collaboration, supporting customers in achieving their financial goals, whether for everyday purchases or significant life events. This positioning aims to differentiate Latitude from traditional banks, offering consumers more choices in the financial services market.

The brand's identity is built around empowering individuals to unlock opportunities, with a visual language of dots and lines representing customer journeys. This visual strategy, combined with a clear and consistent tone of voice, supports the sharing of customer stories across various channels. This consistency is crucial for maintaining brand recognition and trust across all touchpoints, from online platforms to retail partnerships.

Latitude's marketing and sales efforts are designed to resonate with its target audience by offering flexible financing solutions. This is achieved through a diverse product portfolio, including credit cards, personal loans, and interest-free payment plans. The company's success is evident in its sustained growth, with origination volumes up by 13% year-on-year in 2024, and receivables balances increasing by 8% year-on-year in 2024, showcasing effective brand strategy and market reception.

Latitude's sales strategy focuses on providing accessible and flexible financing options. This includes a wide range of products like credit cards, personal loans, and motor loans. The strategy is supported by partnerships with major retailers, enhancing customer reach and convenience.

The marketing strategy emphasizes a 'Partners in Money' approach, highlighting collaboration with customers. This involves consistent messaging across all channels, including digital platforms and retail partnerships. The brand uses visual elements to represent customer journeys.

The integration of sales and marketing at Latitude is designed to create a seamless customer experience. This involves using data-driven insights to personalize customer interactions and continuously innovate credit products. The company also leverages technology, like AI, to enhance customer service.

Financial services marketing at Latitude focuses on building trust and transparency. This is achieved through clear communication and consistent branding across all touchpoints. The company's marketing efforts also highlight the value of its flexible financial solutions.

Latitude Financial's approach to Owners & Shareholders of Latitude Financial Services includes a strong emphasis on digital marketing to reach a wider audience. This involves targeted advertising campaigns and content marketing strategies to engage potential customers. The company also focuses on customer relationship management to improve customer satisfaction and retention, which is crucial for long-term success in the competitive financial services market.

Latitude offers a diverse range of financial products to meet various customer needs. These include credit cards, personal loans, motor loans, and insurance options. Interest-free payment plans through retail partners are also a key offering.

The sales and marketing plan is centered around customer-centricity and flexibility. It involves a multi-channel approach, including digital marketing, retail partnerships, and direct sales. The plan is continuously refined based on market feedback and performance metrics.

Customer acquisition at Latitude involves a combination of digital marketing, partnerships, and direct sales efforts. Targeted advertising campaigns and content marketing strategies are used to attract new customers. Strategic partnerships with major retailers also play a key role.

The sales process at Latitude is designed to be straightforward and customer-friendly. This includes online applications, quick approvals, and flexible repayment options. The sales team focuses on providing clear information and excellent customer service.

Latitude employs various marketing campaigns, including digital advertising, social media marketing, and content marketing. These campaigns are designed to promote specific products and highlight the benefits of its financial solutions. The campaigns are data-driven and regularly optimized.

The target audience includes a broad range of consumers seeking flexible financing solutions. This includes individuals looking for credit cards, personal loans, and interest-free payment plans. The company tailors its products and marketing to meet the needs of this diverse group.

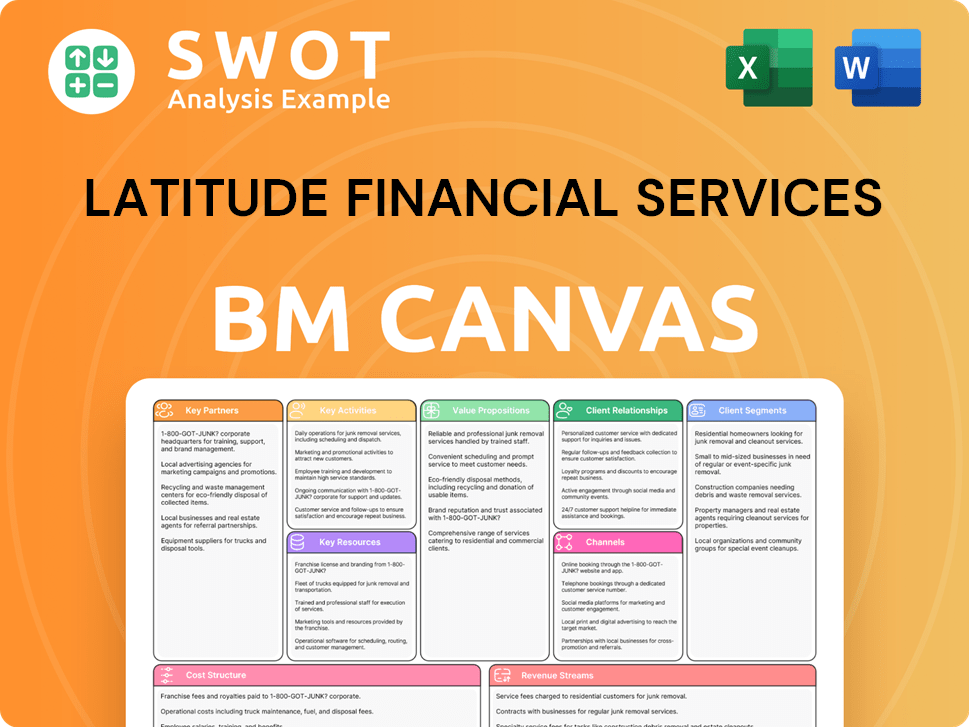

Latitude Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Latitude Financial Services’s Most Notable Campaigns?

The sales and marketing strategy of Latitude Financial has been shaped by key campaigns designed to enhance its brand presence and drive customer engagement. These initiatives have evolved with the company's growth, focusing on both traditional and digital marketing channels. The 'Partners in Money' campaign, launched in late 2019, marked a significant step towards unifying Latitude's diverse product offerings under a single brand identity.

More recently, Latitude Financial's focus on digital transformation has significantly impacted its marketing efforts. The company's adoption of advanced marketing technology and data-driven strategies has led to measurable improvements in campaign efficiency and customer engagement. These strategies are crucial in today's financial services marketing landscape, where personalization and data insights are key drivers of success.

The integration of AI in marketing, particularly in optimizing email campaigns, has yielded substantial benefits. This includes a 10% increase in digital activation and a 4% increase in incremental volume for its credit card business, showcasing the effectiveness of data-driven approaches. This is vital when considering Growth Strategy of Latitude Financial Services.

Launched in late 2019, the 'Partners in Money' campaign aimed to consolidate Latitude's brand identity. This masterbrand campaign was designed to showcase Latitude's evolution into an innovative online payments, installments, and lending business. The creative concept centered on the idea of partnership with Australians and New Zealanders, using the word 'Let's' to signify collaboration in financial journeys.

Latitude Financial has significantly enhanced its marketing capabilities through digital transformation initiatives. Partnerships with companies and the deployment of platforms like Salesforce Marketing Cloud and Data Cloud, starting in mid-2022, have been instrumental. These initiatives have led to a 2x increase in email open rates and a 7x faster time to market for campaigns.

The integration of AI in marketing has optimized send times, frequency, and email subject lines. This has resulted in a 10% increase in digital activation and a 4% increase in incremental volume for its credit card business. This AI-driven approach highlights the importance of leveraging technology for improved customer engagement and sales performance.

Latitude Financial has successfully launched new credit cards and managed significant customer migrations. In July 2024, the company launched new credit cards and migrated 130,000 customers. These campaigns demonstrate the company's ability to effectively execute product launches and manage customer transitions.

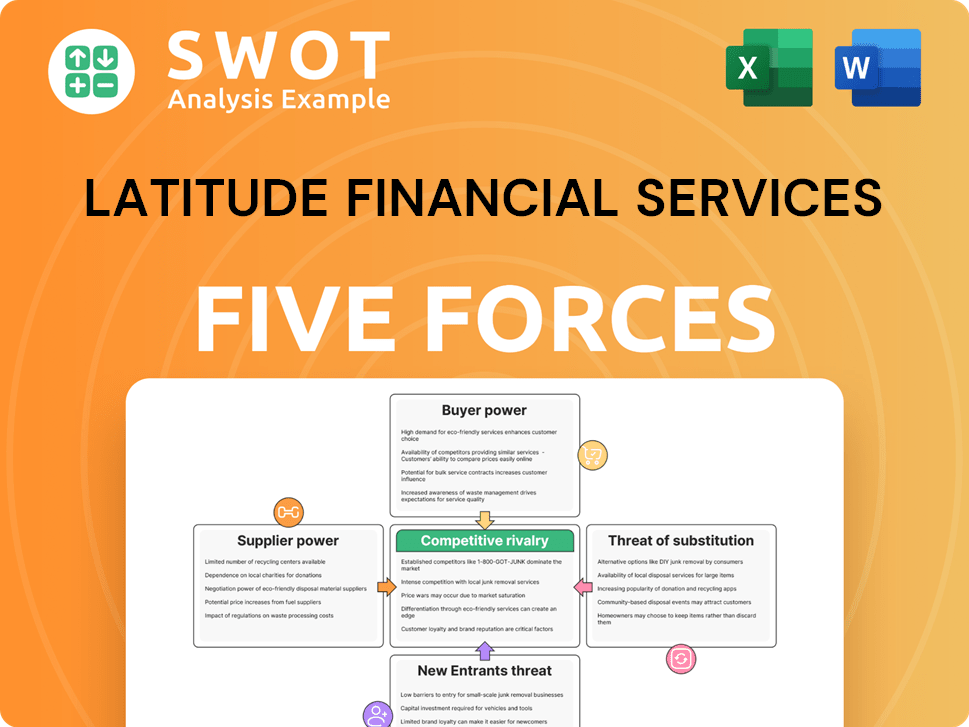

Latitude Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Latitude Financial Services Company?

- What is Competitive Landscape of Latitude Financial Services Company?

- What is Growth Strategy and Future Prospects of Latitude Financial Services Company?

- How Does Latitude Financial Services Company Work?

- What is Brief History of Latitude Financial Services Company?

- Who Owns Latitude Financial Services Company?

- What is Customer Demographics and Target Market of Latitude Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.