TVB Bundle

Can TVB Reclaim Its Hong Kong Entertainment Crown?

Television Broadcasts Limited (TVB), a cornerstone of the Hong Kong entertainment industry, is undergoing a significant transformation. After years of facing challenges, including consecutive annual losses, TVB is strategically pivoting its sales and marketing efforts. This shift is crucial for the company's survival and future growth prospects.

This article explores the TVB SWOT Analysis, delving into the evolving strategies that are shaping the company's future. We'll examine how TVB is adapting its TVB sales strategy and TVB marketing strategy to thrive in a competitive landscape, analyzing its TVB business model and how it generates revenue. From its content distribution methods to its digital marketing initiatives and TVB company brand building strategies, we'll uncover the key elements driving TVB's recent performance and future growth prospects, including its TVB market analysis within the Hong Kong entertainment industry.

How Does TVB Reach Its Customers?

The sales channels of the company, a major player in the Hong Kong entertainment industry, are designed to reach a wide audience through a mix of traditional and digital platforms. The company's approach includes its free-to-air television channels, which are still a key source of revenue, alongside a growing digital presence. This strategy aims to leverage both established broadcasting methods and modern digital technologies.

The company's strategy has evolved to include digital adoption and omnichannel integration. The launch of its over-the-top (OTT) streaming service, myTV SUPER, is a prime example of this shift. This platform provides both advertising and subscription revenue streams, highlighting the company's focus on adapting to changing consumer habits.

The company's sales strategy is multifaceted, relying on a blend of traditional broadcasting and digital platforms. This approach is designed to maximize reach and revenue generation in a competitive market. Understanding the company's sales channels is crucial for a comprehensive TVB market analysis.

The company's primary sales channel includes free-to-air television channels, such as TVB Jade and Pearl. These channels continue to be a significant source of advertising revenue in Hong Kong. In 2024, the company's self-operated terrestrial TV channels held a 79% market share of viewership in Hong Kong.

myTV SUPER, launched in 2016, is a key digital sales channel, offering advertising and subscription revenue streams. Digital advertising on myTV SUPER grew by 30% in 2024. The platform had over 23 million average monthly active users across its Hong Kong digital assets, including TVB.com and the TVB News mobile app, an 81% increase compared to 2023.

The Mainland China Operations segment, primarily driven by drama co-production activities, saw a 17% revenue increase in 2024, reaching HK$851 million. This includes partnerships with major mainland video platforms like Youku and Tencent Video, which serve as crucial distribution channels for the company's co-produced content. This highlights the company's international expansion strategy.

The International Operations segment encompasses program licensing to pay-TV partners and its TVB Anywhere streaming service, catering to an international audience. The company is adapting its strategy to integrate e-commerce more closely with its TV channels and programs. This shift aims to create a cross-platform, omni-channel ecosystem combining entertainment, information, and sales.

The company's sales strategy focuses on leveraging both traditional and digital platforms. The company is strategically shifting towards digital adoption and omnichannel integration. The company aims to create a cross-platform ecosystem combining entertainment, information, and sales.

- Expansion of myTV SUPER with new ad-supported free service tiers.

- Partnerships with major mainland video platforms.

- Integration of e-commerce with TV channels.

- Focus on cross-platform and omni-channel sales.

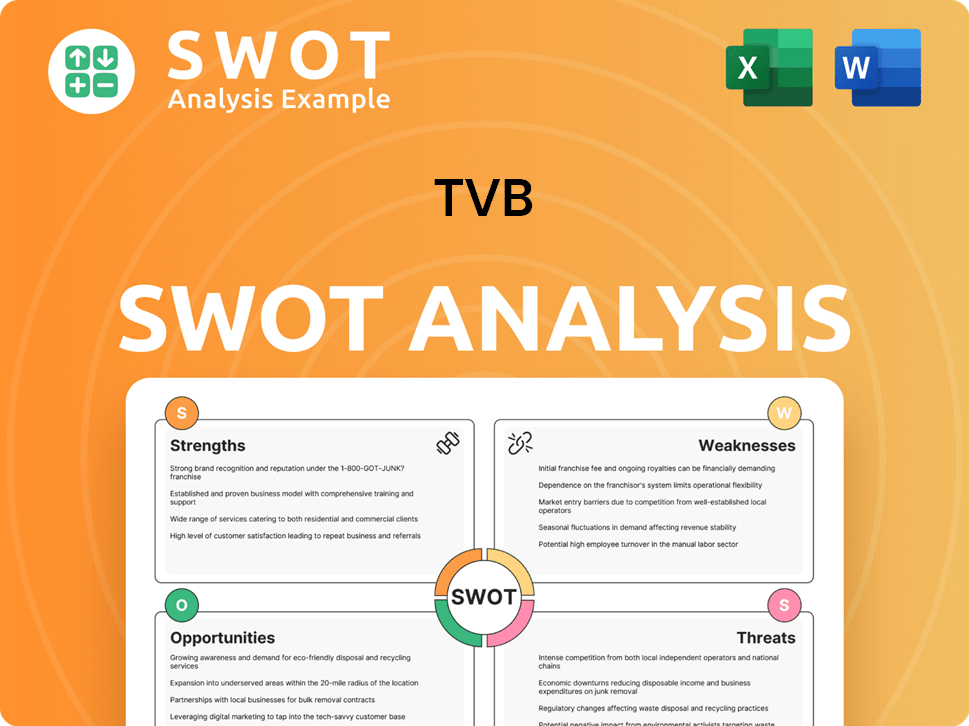

TVB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does TVB Use?

The [Company Name] employs a multifaceted marketing strategy to boost brand awareness, generate leads, and increase sales. This approach integrates both traditional and digital media, leveraging the company's extensive reach and digital assets. The company's strategy is data-driven, using business intelligence to refine campaigns and optimize promotional efforts.

In 2024, the company saw significant growth in advertising revenue, particularly in digital channels. This shift reflects a broader trend in the entertainment industry towards digital platforms and data-driven marketing. The company's focus on social media, influencer partnerships, and e-commerce integration demonstrates a commitment to adapting to evolving consumer behaviors.

The company continues to innovate, launching new services and expanding its advertising reach to target a wider audience. This includes initiatives such as new ad-supported tiers for its streaming service and the expansion of advertising opportunities to new markets.

The company utilizes its free-to-air channels for advertising. The company's Hong Kong TV Broadcasting segment saw a 14% increase in income from advertisers in 2024. This demonstrates the effectiveness of traditional media in reaching a broad audience.

The company's market share of total TV ad spending in Hong Kong grew from 75% in 2023 to 83% in 2024. This indicates a strong position in the Hong Kong entertainment industry. This growth reflects successful strategies in the competitive landscape.

Events, particularly those supported by government initiatives, generate significant revenue. Macao's cultural development drive brought in revenue through program sponsorships and event management in 2024. This diversification supports the company's revenue generation.

Digital advertising on its myTV SUPER streaming service grew by 30% in 2024. This growth highlights the importance of digital marketing initiatives. The company's digital strategy is a key component of its overall marketing efforts.

Digital assets, including TVB.com, the TVB News mobile app, and social media accounts, had over 23 million average monthly active users in 2024. This represents an 81% increase from 2023. The company's social media presence is a critical element of its marketing strategy.

The company utilizes influencer partnerships and livestream e-commerce through its MCN business. This MCN business achieved a total gross merchandise volume (GMV) of over RMB570 million from March to December 2023. This shows a strong focus on e-commerce integration.

The company uses business intelligence solutions to analyze program ratings and advertising data. This helps improve decision-making and create effective promotional campaigns. The sales staff can identify opportunities and design sales campaigns faster through self-service report generation. The company is also launching new ad-supported free service tiers for myTV SUPER in 2025. Furthermore, the company has begun selling advertising on its TVB Jade and Pearl channel feeds to Guangdong province starting January 2025. To learn more about the company's financial structure, consider reading about Owners & Shareholders of TVB.

- Focus on digital advertising and e-commerce integration.

- Use of business intelligence for data-driven decision-making.

- Expansion of advertising opportunities in the Greater Bay Area.

- Continuous innovation in content and advertising models.

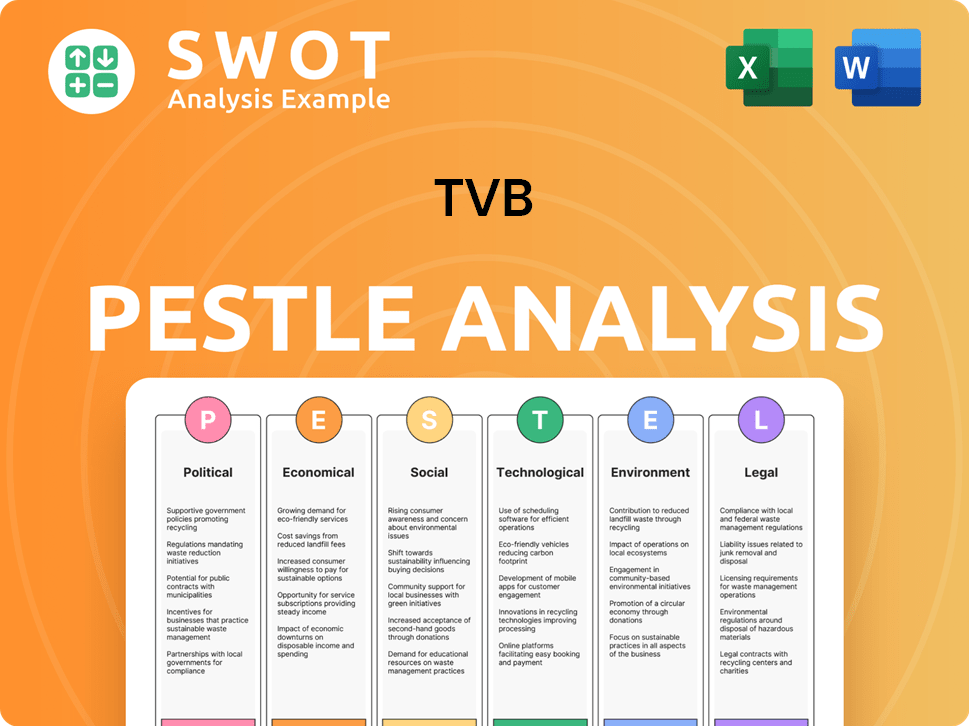

TVB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is TVB Positioned in the Market?

The brand positioning of TVB is deeply rooted in its long history as Hong Kong's leading free-to-air television broadcaster. In 2024, it maintained a significant market share, holding a 79% viewership in Hong Kong. This strong presence establishes it as the primary source of entertainment and information within the territory, shaping its brand identity.

TVB's core messaging centers on delivering high-quality Chinese-language programming. This focus has enabled it to secure a leading position in overseas markets for Chinese-language TV channels. Its visual identity consistently incorporates its distinctive logo and branding elements across various platforms, including traditional channels and digital offerings. This consistency helps maintain brand recognition and trust among its audience.

The company differentiates itself through its extensive content library, which includes classic Cantonese dramas and acquired programs, particularly appealing to Chinese-speaking communities. TVB also emphasizes 'brand safety' for advertisers, an important value proposition in the digital advertising landscape. This focus helps attract advertisers seeking a reliable and trustworthy platform for their campaigns. To understand the Competitors Landscape of TVB helps to understand its brand positioning.

TVB's core message is centered on providing high-quality Chinese-language programming. This strategy has helped it secure a leading position in overseas markets. The content is designed to resonate with Chinese-speaking communities globally.

TVB emphasizes 'brand safety' for advertisers, ensuring that advertising appears alongside appropriate content. This is a key value proposition in the evolving digital advertising landscape. It helps build trust with advertisers and maintain a positive brand image.

TVB's content strategy includes classic Cantonese dramas and acquired programs from around the world. This diverse content library caters to a broad audience. The company also focuses on specific programs to attract advertisers for premium goods and services.

TVB actively expands its digital presence and co-production efforts in Mainland China. This includes its myTV SUPER streaming service and social media accounts. This strategy helps to engage with viewers through online channels.

TVB's brand positioning is shaped by several key elements that define its market strategy and audience engagement.

- Market Share: TVB holds a substantial market share in Hong Kong, with 79% viewership in 2024, solidifying its position as a leading broadcaster.

- Content Focus: The company prioritizes high-quality Chinese-language programming to cater to a wide audience, both locally and internationally.

- Brand Safety: TVB emphasizes 'brand safety' to attract advertisers, ensuring their ads appear alongside appropriate content.

- Digital Expansion: TVB is actively expanding its digital presence through streaming services and social media to engage with viewers.

- Targeted Programming: The company focuses on specific programs to attract advertisers for premium goods and services.

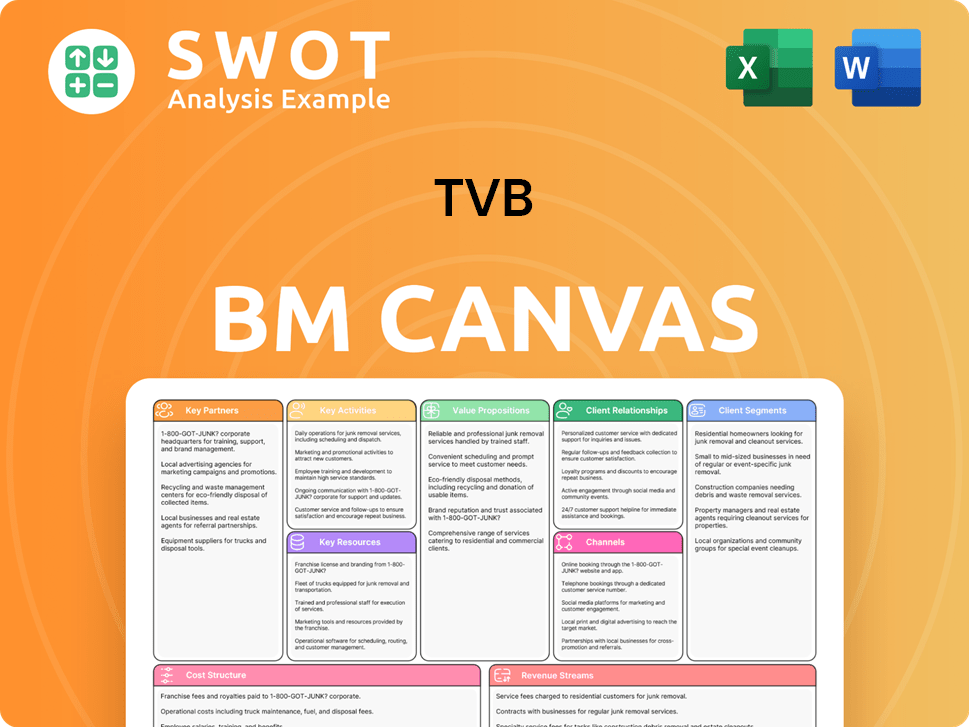

TVB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are TVB’s Most Notable Campaigns?

The Growth Strategy of TVB involves a multifaceted approach to boost revenue and strengthen its market position. Key campaigns focus on leveraging popular content, expanding digital advertising, and forming strategic partnerships. The company's ability to adapt and innovate is central to its ongoing success within the Hong Kong entertainment industry.

One of the primary goals is to revitalize advertising income through strategic initiatives. This includes attracting high-value advertisers by leveraging popular programming and expanding digital advertising capabilities. These efforts are crucial for maintaining and growing revenue streams in a competitive media landscape.

In 2024, TVB saw a 14% increase in income from advertisers in its Hong Kong TV Broadcasting segment, contributing to a 17% revenue growth for the segment. This success demonstrates the effectiveness of its sales and marketing strategy.

Successful content-driven campaigns, like 'Midlife, Sing & Shine!', attract substantial sponsorship and advertising. The third season of this program, which expanded to include contestants from Malaysia and Guangdong, saw significant advertising revenue. Similarly, 'The Queen of News' attracted advertisers for premium goods and financial services, highlighting TVB's ability to leverage popular programming.

TVB's digital sphere efforts include an 'early-bird' campaign for 2025 advertising packages. This campaign resulted in a double-digit percentage increase in pre-commitments. Digital ad revenue on myTV SUPER grew by 30% in 2024, with continued growth expected in 2025.

Co-production activities with mainland video platforms, such as Youku and Tencent Video, are a key part of TVB's strategy. Revenue from these co-productions contributed to a 17% increase in TVB's Mainland China Operations segment revenue in 2024. These collaborations boost brand visibility and generate new revenue streams.

Strategic restructuring in late 2023, including merging channels and downsizing e-commerce, aimed to optimize operations. This restructuring targeted savings of HK$100 million in content costs in 2024 and eliminated at least HK$50 million in annual fixed costs from the e-commerce business. These measures are part of a broader effort to improve financial performance.

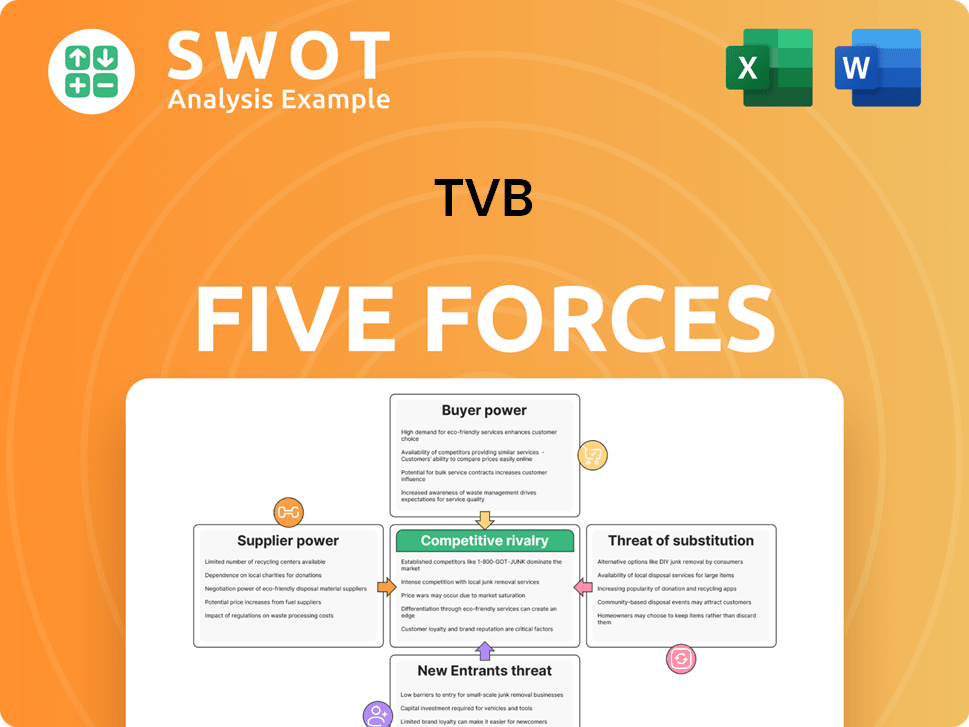

TVB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TVB Company?

- What is Competitive Landscape of TVB Company?

- What is Growth Strategy and Future Prospects of TVB Company?

- How Does TVB Company Work?

- What is Brief History of TVB Company?

- Who Owns TVB Company?

- What is Customer Demographics and Target Market of TVB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.