Woori Financial Group Bundle

How is Woori Financial Group Dominating the Korean Market?

Explore the dynamic sales and marketing strategies fueling Woori Financial Group's impressive growth. From its roots as Korea's first national capital bank to its current status as a financial powerhouse, Woori Financial Group has consistently adapted to the evolving financial landscape. A key element of its recent success involves a strategic partnership with a prominent brand ambassador, demonstrating a keen understanding of market trends. This analysis dives deep into how Woori Financial Group leverages its Woori Financial Group SWOT Analysis to stay ahead.

This exploration will dissect Woori Financial Group's sales strategy, examining its approach to customer acquisition and retention within the competitive Korean market. We'll also analyze its marketing strategy, including an examination of its digital marketing strategy and brand awareness campaigns, to understand how it resonates with its target audience. Furthermore, this analysis will provide insights into Woori Financial Group's sales performance analysis and its expansion plans in Southeast Asia, offering a comprehensive view of its business development initiatives.

How Does Woori Financial Group Reach Its Customers?

The sales channels of Woori Financial Group (WFG) are designed to reach a diverse customer base through a blend of traditional and digital methods. This approach allows WFG to cater to various customer preferences and adapt to changing market dynamics. The strategy is crucial for maintaining a competitive edge in the financial services industry.

WFG utilizes a multifaceted approach to sales, integrating both physical and digital channels. The company has invested heavily in digital transformation, including its website and mobile applications like the WON App, to enhance customer experience and streamline transactions. This strategy is essential for capturing and retaining customers in the competitive Korean market.

Woori Financial Group's Sales Strategy focuses on leveraging multiple channels to maximize customer reach and engagement. The company's marketing strategy includes a strong emphasis on digital platforms and strategic partnerships to drive growth and market share. This comprehensive approach supports Woori Financial Group's business development goals.

Woori Financial Group maintains an extensive network of physical retail locations, including branches and ATMs. As of 2024, Woori Bank has 474 overseas networks in 24 countries. These physical locations provide essential in-person services and consultations, critical for customer interaction and trust. This network supports the company's sales performance analysis.

WFG has significantly invested in digital transformation, with a KRW 3.2 trillion investment in technology infrastructure in 2024. This includes the WON App, facilitating digital account opening and online payments. The 'New WON Banking' platform is expected to leverage advanced technology. This digital push supports Woori Financial Group's digital marketing strategy.

Direct sales teams play a vital role, particularly for corporate and investment banking services. These teams ensure personalized engagement with large corporations and SMEs. This approach is crucial for building strong relationships and driving sales in the business-to-business segment. The sales team structure and management are key to this strategy.

Woori Card partnered with UOB in July 2024 to offer reciprocal card benefits to 12 million South Korean cardholders and 8 million ASEAN cardholders. The acquisition of Tongyang Life Insurance Co. and ABL Life Insurance Co., expected to expand Woori's footprint in the non-banking sector, is also a key strategy. These moves are part of Woori's expansion plans in Southeast Asia.

Woori Bank Vietnam signed a strategic cooperation agreement with LOTTE Finance in 2024. This partnership aims to expand market share in Vietnam's retail banking sector, which saw credit growth of 3.93% in Q1 2025. Woori Venture Partners invested in Carro in December 2024, facilitating expansion in Southeast Asia.

- These strategic partnerships support Woori Financial Group's sales process optimization.

- The focus on Southeast Asia is a key component of Woori Financial Group's expansion plans in the region.

- These initiatives are designed to increase Woori Financial Group's market share in the banking sector.

- The company's approach to customer relationship management (CRM) strategy is enhanced through these collaborations.

For a deeper understanding of the target market, consider reading about the Target Market of Woori Financial Group.

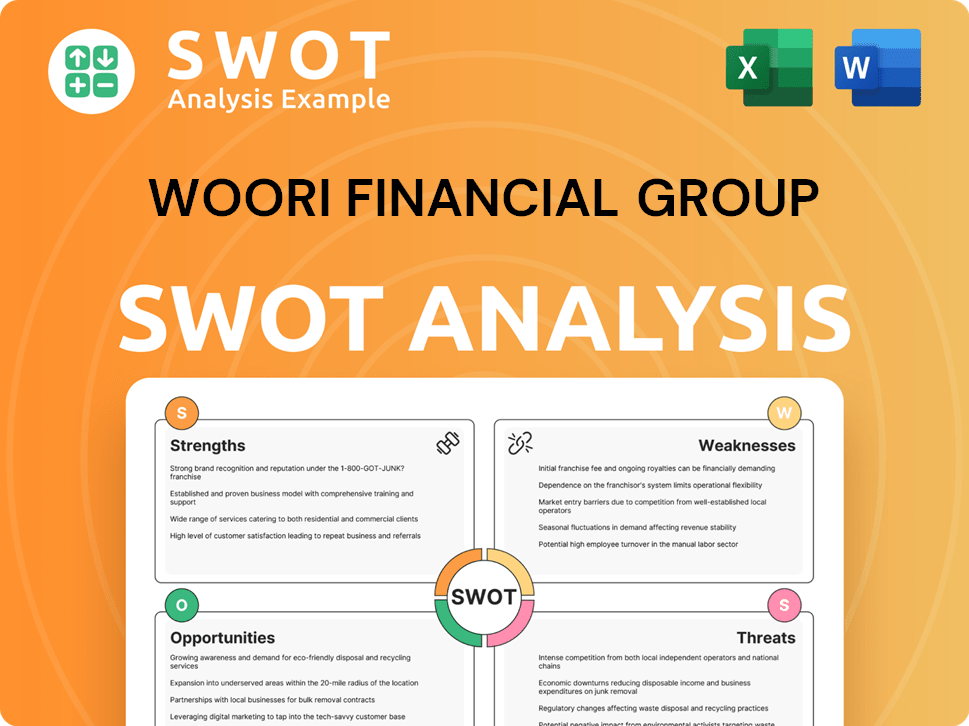

Woori Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Woori Financial Group Use?

Woori Financial Group's marketing tactics are designed to boost brand awareness, generate leads, and drive sales, utilizing a mix of digital and traditional approaches. Their strategy involves a strong emphasis on digital platforms, content marketing, and influencer partnerships, alongside traditional public relations and event-based marketing. This comprehensive approach supports the company's goals in the competitive financial services market.

The company's marketing strategy is data-driven, focusing on customer segmentation and personalization to enhance customer experience. Woori Financial Group's vision for 2024 includes a significant investment in technology infrastructure, indicating a commitment to leveraging analytics for tailored offerings. Digital transformation is a key focus, with projects like the 'Digital Universe' and the DinnoLab Vietnam Center supporting innovation and expansion.

These initiatives are part of a broader strategy to optimize sales performance and increase market share. By integrating digital and traditional marketing methods, Woori Financial Group aims to reach a wider audience and strengthen its position in both the Korean market and Southeast Asia. This approach is crucial for business development and achieving its strategic objectives.

Woori Financial Group actively uses digital platforms like Facebook, TikTok, Instagram, and YouTube for marketing. They also engage in paid advertising to promote digital banking products, such as offering incentives during Vietnam's National Digital Transformation Day in October 2024.

Influencer partnerships are a crucial part of the marketing strategy. The extension of IU's brand ambassadorship in April 2024 significantly boosted engagement and solidified Woori's brand position, particularly in international markets like Vietnam.

Woori Financial Group uses corporate public relations campaigns, including 'Woori First (2025),' 'Woori Rookie Project (2024),' and 'NEW YEAR (2024).' They also participate in events like the Banking Academy's 'Welcome Freshmen 2024' to engage with students.

The company emphasizes data-driven marketing, customer segmentation, and personalization. A KRW 3.2 trillion investment in technology infrastructure supports a focus on personalized customer experiences.

The 'Digital Universe' project, set for completion in 2028, will serve as a digital financial hub. The launch of the DinnoLab Vietnam Center in April 2024 supports the expansion of South Korean fintech startups into Southeast Asia.

Woori Bank's participation in events like 'Welcome Freshmen 2024' includes interactive activities and gifts to engage with students, showcasing a targeted approach to reaching younger demographics.

Woori Financial Group's marketing strategy combines digital and traditional methods to enhance brand awareness and drive sales. This includes leveraging social media, influencer partnerships, and data-driven customer experiences. The company's focus on digital transformation is supported by significant investments in technology and strategic initiatives.

- Digital Platforms: Active use of Facebook, TikTok, Instagram, and YouTube.

- Influencer Marketing: Partnerships like the extension of IU's ambassadorship.

- Paid Advertising: Promotional programs for digital banking products.

- Public Relations: Corporate campaigns such as 'Woori First' and 'Woori Rookie Project'.

- Events: Participation in events like 'Welcome Freshmen 2024' to engage with students.

- Data-Driven Marketing: Focus on customer segmentation and personalization.

- Technology Investment: KRW 3.2 trillion investment in technology infrastructure.

- Digital Transformation: 'Digital Universe' project and DinnoLab Vietnam Center.

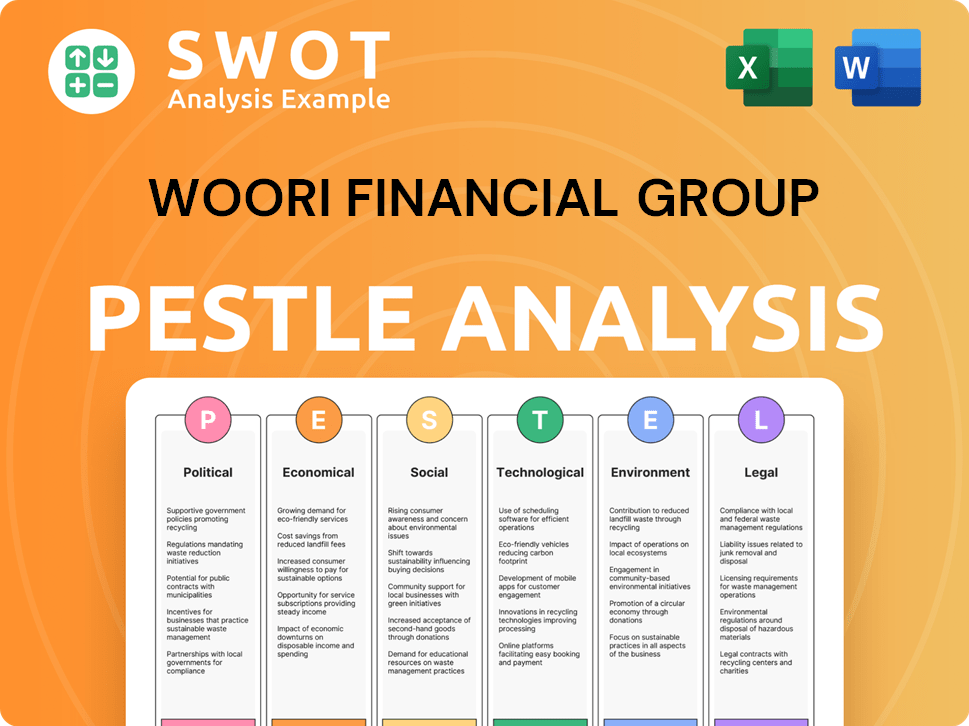

Woori Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Woori Financial Group Positioned in the Market?

Woori Financial Group positions itself as a leading financial institution, emphasizing trust and innovation. Its brand identity is rooted in its long history, dating back to 1899, making it a cornerstone of the Korean financial landscape. The company's core message focuses on providing reliable support with leading products and services, aiming to be 'The First Choice In Finance'.

The company differentiates itself through its extensive global network, boasting over 580 locations in 24 countries as of 2024, outperforming many competitors. This widespread presence enables the delivery of cutting-edge financial products and services to a diverse clientele. The visual identity and tone of voice convey professionalism and stability, while also embracing a modern, digitally-forward approach.

Customer experience is a priority, with convenience, security, and comprehensive financial solutions at the forefront, as demonstrated by products like the WON App and various tailored loan packages. This approach supports its overall sales strategy and helps in business development within the Korean market and beyond. For more insights, you can explore the details about Owners & Shareholders of Woori Financial Group.

Woori Financial Group emphasizes trust, stemming from its long history and commitment to customer service. This focus helps in building lasting relationships and securing a strong market position. This is a key element in their financial services offerings.

The company embraces innovation through digital platforms and services like the WON App. This strategy enhances customer experience and aligns with modern financial trends, supporting its sales strategy. This digital focus is crucial for the company's marketing strategy.

With over 580 locations across 24 countries, Woori Financial Group has a significant global reach. This extensive network supports its expansion plans and provides diverse financial product marketing opportunities. This global footprint supports its sales performance analysis.

Woori prioritizes its customers and communities, building trust and providing tailored financial solutions. This customer-centric approach drives loyalty and supports long-term growth. This approach is vital for customer relationship management (CRM) strategy.

Woori Financial Group's core values include prioritizing customers and community, building trust, and driving innovation. The company integrates ESG factors into its financial activities, aiming for net-zero greenhouse gas emissions by 2050. This commitment is recognized through accolades, such as receiving the highest rating of AAA in the MSCI ESG Ratings in 2023.

- Prioritizing Customers and Community: Focus on customer needs and community well-being.

- Building Trust: Based on strong principles and ethical practices.

- Market-Leading Expertise: Demonstrating proficiency in financial services.

- Shaping the Future: Through innovation and forward-thinking strategies.

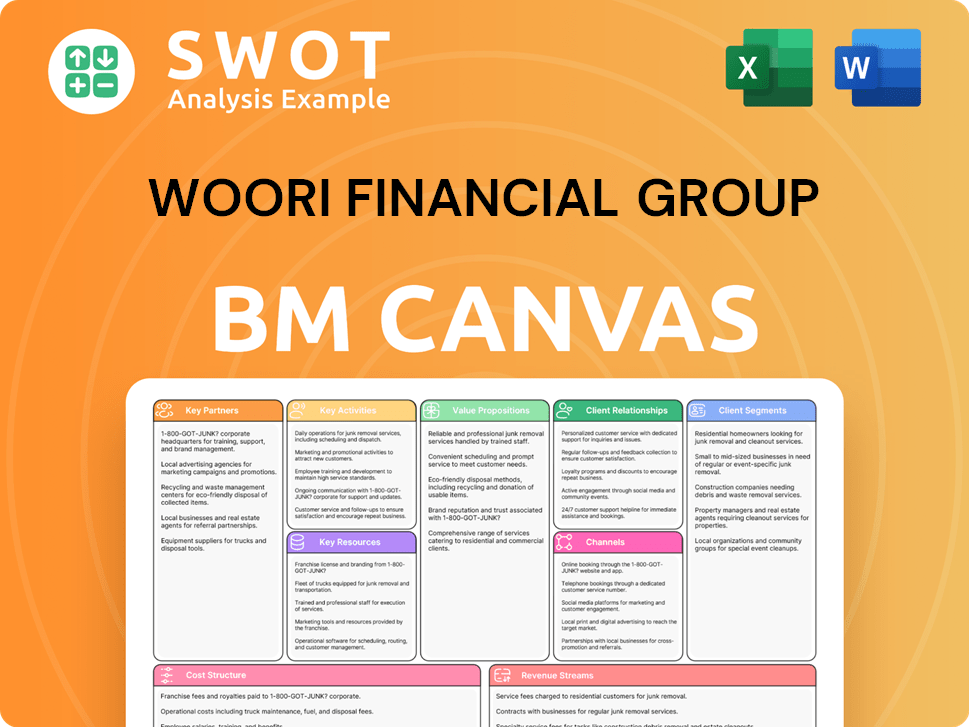

Woori Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Woori Financial Group’s Most Notable Campaigns?

The sales and marketing strategy of Woori Financial Group is marked by impactful campaigns that enhance brand visibility and drive customer engagement. These initiatives are crucial for business development and maintaining a strong presence in the Korean market and beyond. The company leverages various channels, including digital platforms and strategic partnerships, to reach its target audience effectively.

Recent years have seen a focus on digital transformation and customer-centric approaches. Woori Financial Group's marketing campaign examples showcase a commitment to innovation and adapting to evolving consumer behaviors. This strategy is designed to boost sales performance analysis and strengthen its competitive position.

Woori Financial Group has implemented a multi-faceted marketing approach. The company's strategies include celebrity endorsements, digital marketing, and community engagement. These efforts aim to enhance brand recognition and foster customer loyalty.

The 'IU x Wibee' campaign, featuring IU as brand ambassador, aims to boost brand visibility. IU's contract was extended in April 2024, making her Woori's first long-term brand ambassador. The campaign utilizes digital channels, with IU's video greeting Vietnamese audiences on Woori Bank's official Facebook page on June 28, 2024, driving significant engagement. This collaboration has strengthened Woori Bank's position, enhancing its competitiveness, especially in markets like Vietnam.

The 'Woori Rookie Project (2024)' and other corporate PR initiatives like 'Woori First (2025)' and 'NEW YEAR (2024)' aim to reinforce the company's image. These campaigns contribute to overall brand perception and internal morale. While specific metrics are not detailed, these initiatives are vital for attracting talent and communicating the company's vision.

Woori Bank Vietnam actively supported the National Digital Transformation Day 2024 in October 2024. The objective was to promote digital banking services and encourage adoption. The campaign offered promotional programs, including free e-vouchers for new account openings and discounts on e-commerce platforms. This approach successfully drove engagement by providing tangible benefits for digital banking usage.

Woori Bank participated in the 'Welcome Freshmen 2024' financial education event at the Banking Academy in October 2024. The goal was to introduce Gen Z-tailored financial solutions like the WON App and Visa Debit Z Card. Interactive booth activities, quizzes, and gifts attracted enthusiastic participation and successfully connected with the younger generation.

The release of the 2023 Sustainability Report in June 2024 highlighted ESG initiatives. The report communicated the group's ESG vision of 'a better world we create through finance' and its net-zero greenhouse gas emissions goal by 2050. Receiving the highest rating of AAA in the MSCI ESG Ratings in 2023 bolstered its reputation.

The company faced scrutiny regarding financial misconduct in 2023, intensifying calls for enhanced accountability. This suggests an ongoing need for robust internal controls and transparent communication to maintain public trust. This situation highlights the importance of effective crisis management strategies.

Woori Financial Group's digital marketing strategy focuses on engaging customers through various online channels. This includes social media marketing, content marketing, and search engine optimization. The goal is to enhance brand awareness and drive customer acquisition.

The company's CRM strategy focuses on building and maintaining strong customer relationships. This involves personalized communication, targeted promotions, and efficient customer service. The aim is to increase customer loyalty and lifetime value.

Woori Financial Group's financial product marketing involves promoting various financial services. This includes marketing strategies for loans, savings accounts, and investment products. The goal is to educate customers about the benefits of these products.

Woori Financial Group is expanding its presence in Southeast Asia. This involves strategic investments and partnerships to tap into new markets. The company's expansion plans are designed to drive growth and increase market share in the region.

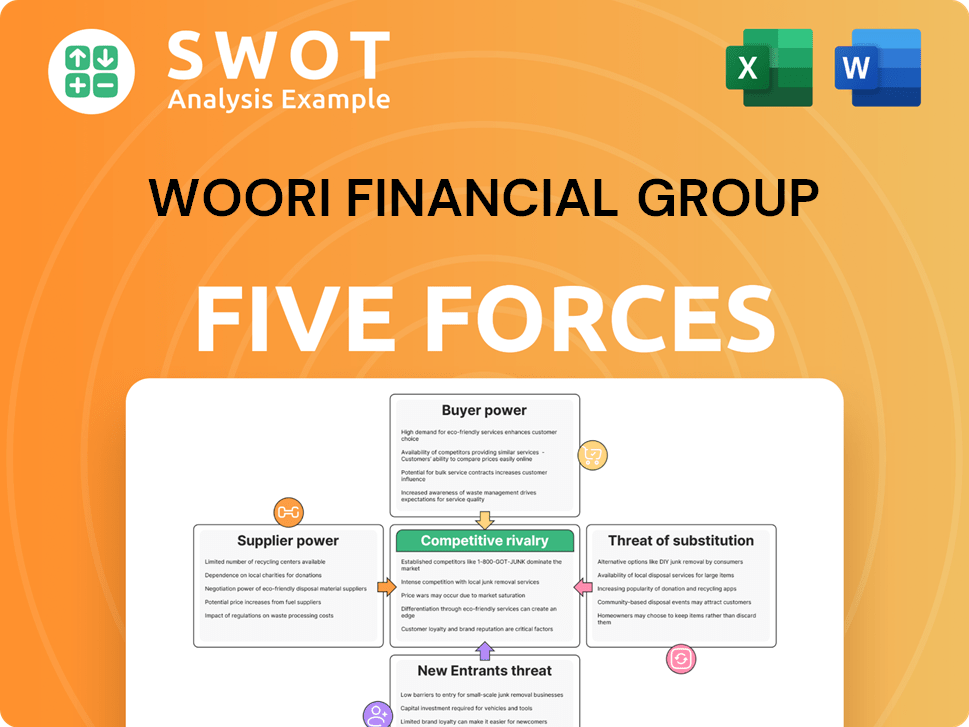

Woori Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Woori Financial Group Company?

- What is Competitive Landscape of Woori Financial Group Company?

- What is Growth Strategy and Future Prospects of Woori Financial Group Company?

- How Does Woori Financial Group Company Work?

- What is Brief History of Woori Financial Group Company?

- Who Owns Woori Financial Group Company?

- What is Customer Demographics and Target Market of Woori Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.