Zhongyuan Bank Bundle

How Does Zhongyuan Bank Navigate the Competitive Chinese Banking Landscape?

Established in 2014, Zhongyuan Bank has quickly become a major player in Henan province, offering a wide array of banking services. Facing pressure in a shifting financial climate, understanding its sales and marketing approach is key. This analysis explores how Zhongyuan Bank attracts and retains customers in a dynamic market.

To thrive, Zhongyuan Bank must employ a robust Zhongyuan Bank SWOT Analysis to understand its position. This article examines the bank's Zhongyuan Bank sales strategy and Zhongyuan Bank marketing strategy, revealing how it builds brand awareness and drives growth. We'll explore its Banking strategy, from sales channels to digital marketing, providing insights into Zhongyuan Bank's success in the competitive Chinese market, including its Sales and marketing efforts and customer relationship management.

How Does Zhongyuan Bank Reach Its Customers?

The sales and marketing strategy of Zhongyuan Bank leverages a multi-channel approach, blending traditional physical outlets with a growing digital presence. This strategy aims to reach a broad customer base, particularly in Henan province, where the bank has a significant footprint. The bank's focus on both physical and digital channels is crucial for its sales performance analysis and overall growth.

Zhongyuan Bank's approach includes an extensive network of branches and sub-branches, ensuring accessibility across various regions, including rural areas. Simultaneously, the bank is actively developing its digital capabilities to improve customer convenience and service efficiency. This dual strategy supports its customer relationship management and market share growth strategy.

The bank's sales channels are designed to cater to diverse customer needs, from individual consumers to corporate clients. Through its 'Yidiantong' platform, Zhongyuan Bank facilitates customer acquisition and integrates customer-facing channels, enhancing its digital marketing strategy. This comprehensive approach is vital for Zhongyuan Bank's brand building strategy and financial product promotion.

As of December 31, 2021, Zhongyuan Bank operated over 600 business outlets. These included branches, sub-branches, and township-level outlets, covering the entire Henan province. This extensive network supports the bank's sales team structure and its goal to serve a wide geographical area.

Zhongyuan Bank has focused on enhancing its digital and intelligent service capabilities. As of June 30, 2024, the cumulative number of corporate digital channel customers reached 294,200. This expansion aligns with the bank's digital marketing strategy and its efforts to optimize the sales process.

Zhongyuan Bank strategically partners with government authorities and key industrial chains. As of June 30, 2024, the balance of corporate deposits was RMB 336.232 billion, demonstrating the impact of these partnerships. These collaborations are essential for the bank's competitive analysis of marketing and market share growth strategy.

The bank is focused on serving government authorities, strategic customers, and industrial chains. This targeted approach supports the bank's target market segmentation and helps in its advertising campaigns. For more details, see Target Market of Zhongyuan Bank.

The bank's strategy revolves around a multi-channel approach, integrating physical and digital channels. This includes expanding its digital services and optimizing its physical outlet network. These efforts are designed to enhance customer convenience and service efficiency.

- Digital Transformation: Enhancing online channels for corporate customers.

- Physical Network: Maintaining and upgrading physical outlets.

- Strategic Partnerships: Collaborating with key entities to boost deposits.

- Customer Acquisition: Utilizing platforms like 'Yidiantong' for customer reach.

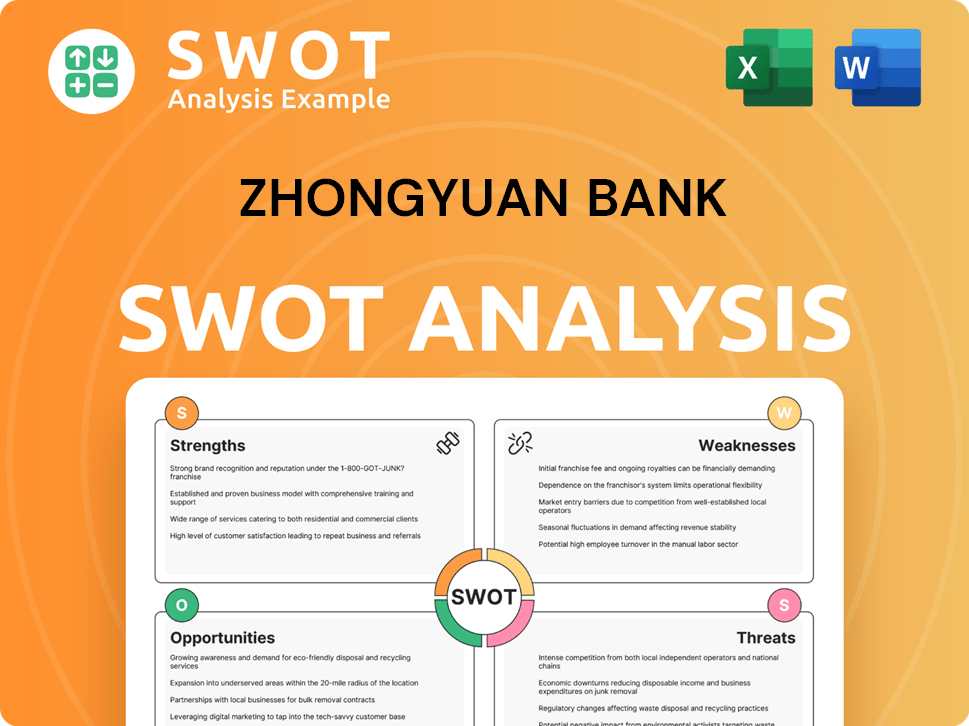

Zhongyuan Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Zhongyuan Bank Use?

The marketing tactics of the bank are multifaceted, blending digital and traditional approaches to enhance brand awareness, generate leads, and drive sales. The bank's strategy emphasizes data-driven decision-making and digital transformation to optimize its financial product lines, focusing on customer needs and integrating traditional customer service with intelligent technology to improve service response speed. This approach is designed to improve the customer experience and drive sales performance.

The bank's digital marketing efforts include website optimization and potentially SEO to increase online visibility for its products and services. Moreover, the enhancement of digital and intelligent service capabilities of online channels for corporate clients suggests the use of digital platforms for lead generation and customer engagement. By focusing on both online and offline channels, the bank aims to reach a broader audience and improve its market share.

The bank's marketing strategy includes a focus on 'chain marketing of financial funds' and 'deepening the comprehensive operation of credit customers' for corporate clients, indicating targeted outreach. For retail banking, the 'Internetization and Ruralization of Banking Services' strategy targets rural customer groups through mobile banking applications and localized online content. This strategy is designed to expand the bank's reach and provide financial services to underserved populations.

The bank leverages digital platforms for lead generation and customer engagement, including website optimization and SEO. This approach enhances online visibility and attracts potential customers.

For corporate clients, the bank focuses on 'chain marketing of financial funds' and 'deepening the comprehensive operation of credit customers,' indicating targeted marketing efforts. This approach helps in building strong relationships with corporate clients.

The 'Internetization and Ruralization of Banking Services' strategy targets rural customer groups through mobile banking applications and localized online content. This strategy aims to expand the bank's reach and provide financial services to underserved populations.

The bank implements data-driven marketing to deepen customer management and solidify the customer foundation, using analytics tools to understand customer behavior and personalize offerings. This approach improves customer satisfaction and loyalty.

The bank improves transparency and compliance of information disclosure through regular disclosures of annual reports, interim reports, and ESG reports, building trust and credibility with stakeholders. This approach enhances the bank's reputation and attracts investors.

The bank focuses on data-driven marketing and customer segmentation to tailor offerings and improve customer engagement. This approach helps in providing personalized services and products.

The bank's commitment to data-driven marketing and customer segmentation is evident in its strategy to 'implement data-driven marketing, deepen customer management and solidify the customer foundation' for retail business development. This includes using analytics tools to understand customer behavior and personalize offerings. The bank's continuous efforts to improve the transparency and compliance of information disclosure, including regular disclosures of annual reports, interim reports, and ESG reports, also serve as a form of marketing, building trust and credibility with stakeholders. For a deeper understanding of the financial aspects, you can explore the Revenue Streams & Business Model of Zhongyuan Bank.

The bank's marketing strategy is multifaceted, focusing on digital transformation, targeted outreach, and customer segmentation to enhance sales and market share. The bank's focus on digital channels and data-driven approaches reflects current trends in the banking sector.

- Digital Transformation: Emphasis on website optimization, SEO, and digital platforms for customer engagement.

- Targeted Marketing: Focused outreach to corporate clients through financial funds and credit services.

- Rural Banking: Expansion of services to rural areas via mobile banking and localized content.

- Data-Driven Marketing: Implementation of analytics tools to understand customer behavior and personalize offerings.

- Transparency and Compliance: Regular disclosures to build trust and credibility.

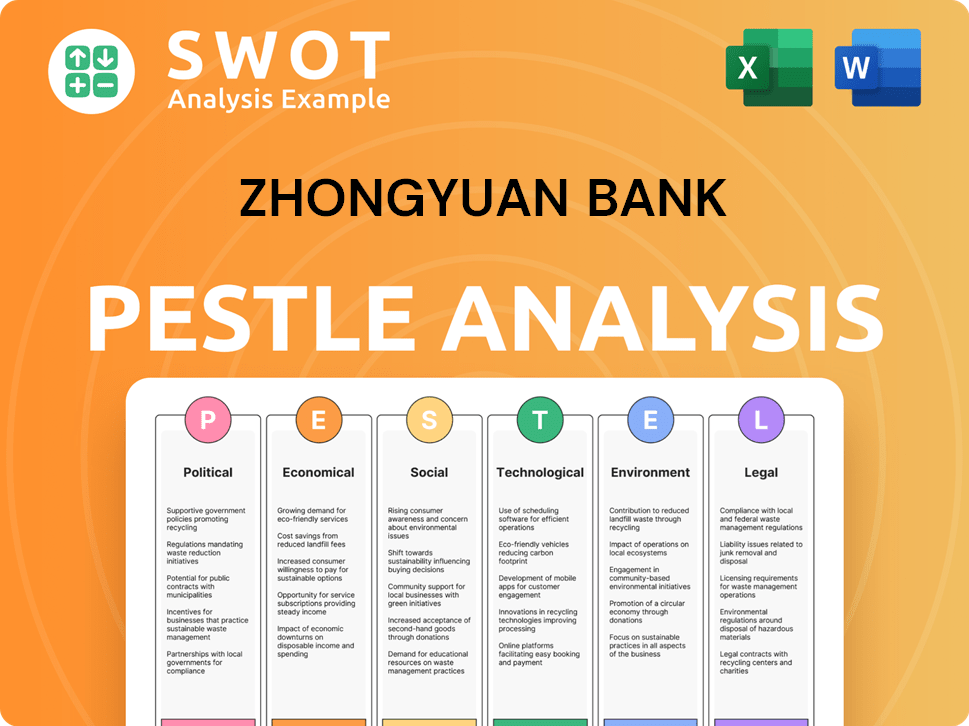

Zhongyuan Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Zhongyuan Bank Positioned in the Market?

The core of Zhongyuan Bank's brand positioning centers on its identity as a provincial corporate bank deeply embedded in Henan Province's economic and social development. This positioning emphasizes serving strategies, the real economy, enterprises, and the people. The bank's brand identity is built around its commitment to social responsibility and high-quality development, aiming to be a 'first-class city commercial bank' and 'the bank of people themselves in central China.'

This strategy differentiates the bank by highlighting its local roots and its role in supporting regional growth and modernization. The bank's approach aims to foster strong relationships with the local government and businesses, positioning itself as a key partner in Henan's economic progress. By focusing on these aspects, Zhongyuan Bank strives to build a strong brand image and gain a competitive edge in the banking sector.

The bank's brand strategy is further enhanced by its commitment to ESG principles, integrating environmental, social, and governance considerations into its corporate governance. This approach not only supports its brand image as a responsible financial institution but also aligns with the growing importance of sustainable practices in the financial industry. This focus is part of the overall Growth Strategy of Zhongyuan Bank, ensuring long-term value creation.

Zhongyuan Bank deepens cooperation with government authorities, supporting major provincial strategies. This involves aligning financial services with the government's economic development plans.

The bank aligns with Henan Province's economic restructuring and industrial development trends, providing tailored solutions for industrial chains. It focuses on supporting key sectors and industries.

Zhongyuan Bank aims to meet diverse financial needs of citizens through differentiated products and enhanced customer experience. This includes offering a wide range of retail banking services.

The bank focuses on building a distinctive county-level service system and enhancing financial services in rural areas. This supports agricultural development and rural economic growth.

Zhongyuan Bank's brand influence has been recognized with awards such as 'World's Best Banks by Forbes' and 'Award for Outstanding Brand Promotion' in January 2024. The bank's commitment to excellence and innovation has been consistently acknowledged.

- Best Pricing: Competitive interest rates and fees.

- Highest Efficiency: Streamlined processes and quick service.

- Best Service: Customer-centric approach and personalized solutions.

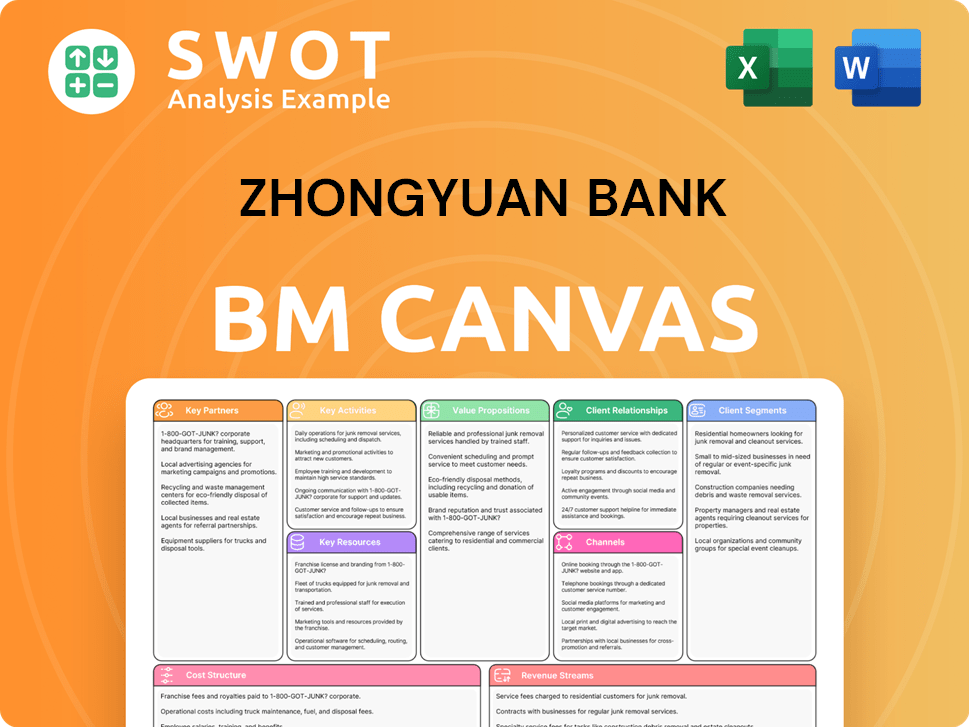

Zhongyuan Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Zhongyuan Bank’s Most Notable Campaigns?

The sales and marketing strategy of Zhongyuan Bank involves several key campaigns designed to enhance its market position and financial performance. These initiatives focus on aligning the bank's services with regional development goals, expanding its reach to underserved populations, and building a strong brand reputation through sustainable practices. The bank's approach combines direct engagement, digital innovation, and strategic partnerships to achieve its objectives.

A significant aspect of its strategy includes supporting Henan Province's economic initiatives, which involves substantial financial commitments and collaborative efforts with government entities and enterprises. Complementing this, the bank is actively working on expanding its services in rural areas through digital channels and tailored products. These efforts are supported by data-driven approaches to customer acquisition and market segmentation.

Furthermore, the bank's commitment to Environmental, Social, and Governance (ESG) principles, highlighted in its annual reports, serves as a crucial element of its brand-building strategy, attracting investors and customers who prioritize sustainability. The bank's sales and marketing efforts are designed to foster growth in key areas, including corporate deposits and market share, and to enhance its overall competitive position in the banking sector.

Zhongyuan Bank actively supports Henan Province's 'Ten Strategies' with a RMB 300 billion support plan. This initiative aims to boost the province's modernization efforts and attract strategic clients. The strategy includes direct engagement with government and corporate entities to align financial services with regional development goals.

The bank focuses on the 'Internetization and Ruralization of Banking Services' to cultivate rural markets. This strategy includes enriching online financial products, transforming business outlets, and utilizing digital channels. The objective is to increase the convenience of banking services in rural areas, solidifying its customer foundation.

Zhongyuan Bank publishes an annual Environmental, Social, and Governance (ESG) Report to highlight its commitment to social responsibility. The 2024 report, published in April 2025, details tailored financing solutions, such as the one provided by the Luoyang branch. This showcases the bank's innovative solutions and its contribution to the real economy.

The bank's focus on 'scenario-based customer acquisition' indicates a data-driven approach to marketing. This includes the continuous increase in coverage of digital channels. This approach is essential for effective Owners & Shareholders of Zhongyuan Bank to understand the bank's strategies.

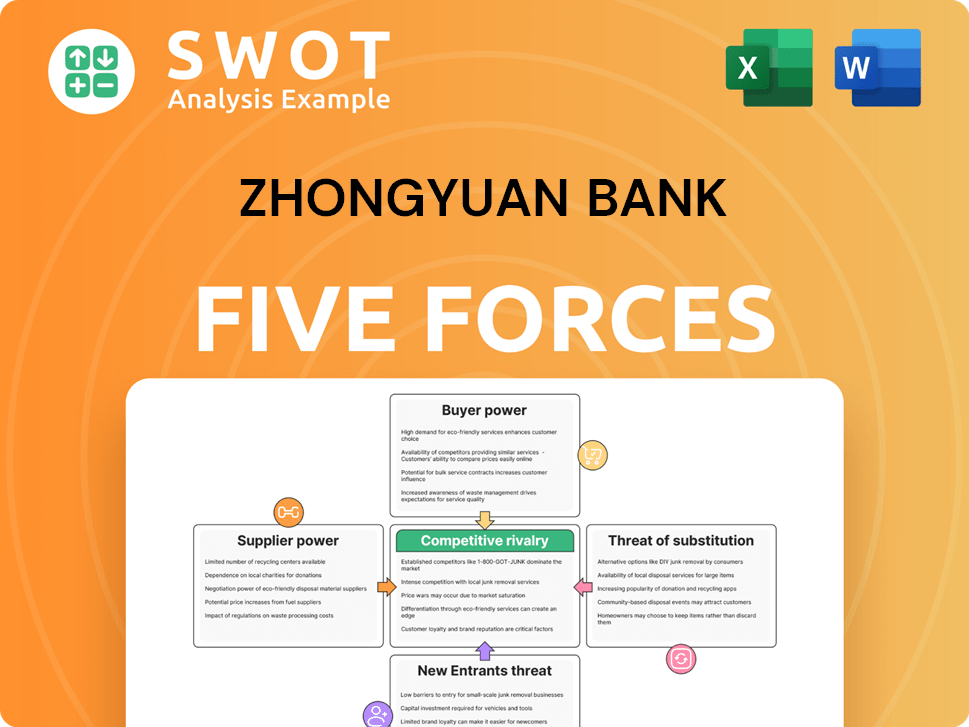

Zhongyuan Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zhongyuan Bank Company?

- What is Competitive Landscape of Zhongyuan Bank Company?

- What is Growth Strategy and Future Prospects of Zhongyuan Bank Company?

- How Does Zhongyuan Bank Company Work?

- What is Brief History of Zhongyuan Bank Company?

- Who Owns Zhongyuan Bank Company?

- What is Customer Demographics and Target Market of Zhongyuan Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.