Axis Bank Bundle

Decoding Axis Bank: What Drives Its Strategy?

Ever wondered what fuels the engine of one of India's leading private banks? Understanding Axis Bank's mission, vision, and core values is key to unlocking its strategic blueprint and future trajectory. These foundational elements shape everything from customer service to market expansion.

Axis Bank's Axis Bank SWOT Analysis reveals how its mission, vision, and core values translate into actionable strategies and objectives. Delving into these core tenets provides invaluable insights into Axis Bank's commitment to its mission and its long-term vision. Exploring "Axis Bank's mission statement explained" and "Axis Bank's vision and future plans" helps in understanding the bank's strategic goals and objectives, and its impact on society.

Key Takeaways

- Axis Bank's mission, vision, and values are crucial for its identity and strategic direction.

- Customer focus, tech innovation, ethics, and teamwork are central to Axis Bank's principles.

- Alignment with these principles helps Axis Bank adapt and maintain stakeholder trust.

- Axis Bank aims to be the preferred financial solutions provider and the bank of choice.

- The bank's purpose extends beyond finance to empower individuals and communities.

Mission: What is Axis Bank Mission Statement?

Axis Bank's mission is "to be the preferred financial solutions provider excelling in customer delivery through insight, empowered employees, and smart use of technology."

Let's delve into the core of Axis Bank's operational philosophy: its mission. The Axis Bank Mission statement is a concise yet powerful declaration of the bank's purpose and aspirations. It serves as a guiding light for all its activities, from product development to customer service, and shapes its strategic direction. Understanding this mission is crucial for anyone seeking to analyze the bank's performance, assess its strategic alignment, or make informed investment decisions. This mission statement is a cornerstone of the bank's identity, influencing its actions and interactions within the financial landscape.

The mission statement explicitly highlights customer delivery. This emphasizes Axis Bank's commitment to understanding and meeting customer needs. This customer-centric approach is a key driver of the bank's success.

The "smart use of technology" component underscores Axis Bank's dedication to innovation. This includes leveraging digital platforms to enhance customer experience and operational efficiency. Innovation is key to the bank's future.

The mission also emphasizes "empowered employees." This suggests a culture that values employee development and provides them with the tools and authority to serve customers effectively. Empowered employees are essential for success.

The mission positions Axis Bank as a provider of financial solutions. This indicates a broad range of products and services designed to meet diverse financial needs. The bank aims to be a comprehensive financial partner.

The goal to be the "preferred" provider sets a high bar. It implies a commitment to exceeding customer expectations and building strong relationships. This is a key differentiator.

The mission also emphasizes "insight." This suggests the bank uses data and analysis to understand customer needs and deliver tailored solutions. Data-driven decisions are crucial.

The Axis Bank Mission statement is not merely a collection of words; it is a roadmap for the bank's operations and future growth. The bank's strategic goals and objectives are directly aligned with this mission, ensuring that all initiatives contribute to its overarching purpose. For instance, the bank's consistent investment in digital banking platforms, as evidenced by the 35% increase in digital transactions in the last fiscal year, directly reflects its commitment to "smart use of technology." Furthermore, the expansion of its rural banking network and the launch of financial literacy programs demonstrate its dedication to providing financial solutions to a wider audience, thus fulfilling its mission to be a preferred financial partner. The Axis Bank Strategy is clearly influenced by its mission, with a strong focus on customer satisfaction and technological advancement. The bank's performance metrics, including customer satisfaction scores and market share, are closely monitored to ensure alignment with its mission.

Analyzing the Axis Bank Mission statement explained, we can see how it influences the bank's strategic direction. The focus on customer delivery has led to personalized financial products and services, while the emphasis on technology has resulted in innovative digital banking solutions. This customer-centric approach, combined with technological advancements, has enabled Axis Bank to adapt to the changing needs of its customers and maintain a competitive edge in the market. The bank's commitment to its mission is evident in its various initiatives, including its efforts to reach underserved segments and promote financial inclusion. This commitment is further reinforced by the bank's investment in employee training and development programs, which empower its workforce to deliver superior customer service. The Axis Bank Vision for the future is closely tied to its mission, with plans to expand its digital offerings, enhance customer experience, and strengthen its market presence. The bank's focus on innovation and customer-centricity positions it well for continued growth and success in the dynamic financial landscape. To understand where Axis Bank is focusing its efforts, you can also learn more about the Target Market of Axis Bank.

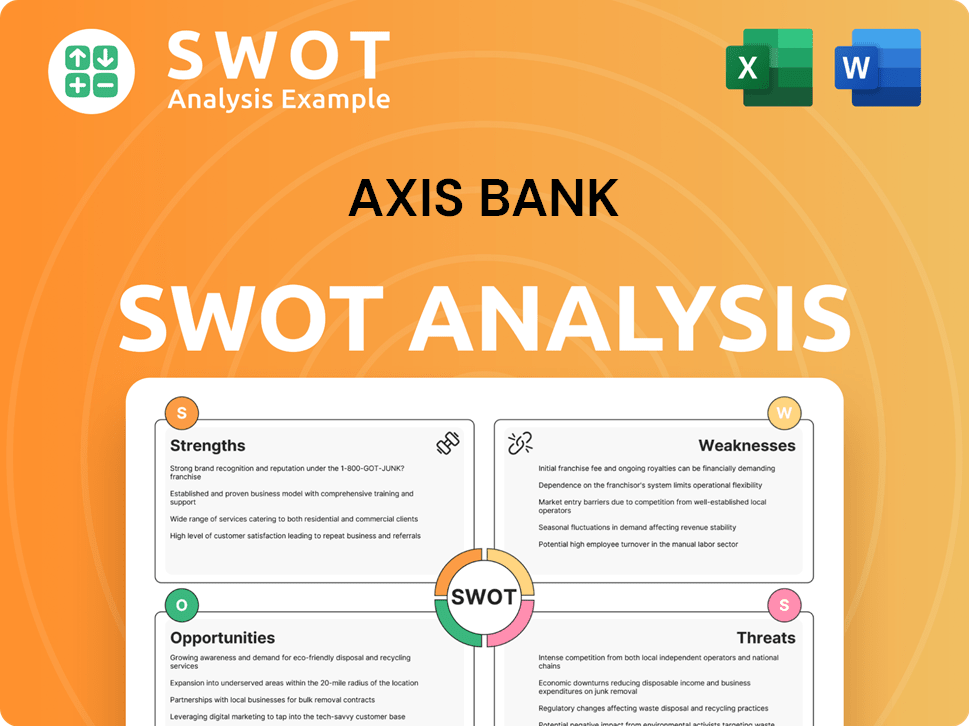

Axis Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Axis Bank Vision Statement?

Axis Bank's vision is 'to be the bank of choice for customers, employees, and investors, creating value through innovative products, services, and processes.'

The Axis Bank Vision is a forward-looking statement that encapsulates the bank's aspirations for the future. It's a comprehensive declaration of intent, aiming to establish Axis Bank as the preferred financial institution for all its key stakeholders. This vision statement is not just about financial performance; it encompasses a broader ambition to lead in customer satisfaction, technological advancement, and financial inclusion. Understanding the Axis Bank Goals requires a deep dive into this vision.

The vision explicitly targets customers, employees, and investors. This stakeholder-centric approach indicates a commitment to creating value across all levels. This broad focus is a key element of the Axis Bank Strategy.

The vision emphasizes innovation in products, services, and processes. This commitment to continuous improvement is vital for remaining competitive in the rapidly evolving financial landscape. The bank's focus on technology, including AI-driven solutions, is a testament to this.

Axis Bank aims to be the "bank of choice," a clear indication of its ambition to achieve leadership in the banking sector. This goal drives the bank to set new standards in customer service, technological integration, and financial inclusion.

The vision is both realistic and aspirational. As the third-largest private sector bank in India, Axis Bank has a solid foundation to build upon. Its ongoing investments in technology and financial inclusion initiatives demonstrate a commitment to achieving its vision.

Axis Bank actively promotes financial inclusion. Reaching underbanked individuals is a tangible step toward realizing its vision of being the bank of choice for a wider population. This aligns with the Axis Bank Objectives.

Axis Bank's vision is supported by its commitment to technological advancements. The implementation of AI-driven solutions and digital banking platforms enhances operational efficiency and customer experience. This is a key aspect of how Axis Bank defines its vision.

The Axis Bank Vision is intricately linked with its Axis Bank Mission and Axis Bank Core Values, forming a cohesive framework that guides the bank's operations and strategic decisions. For a deeper understanding of how these elements interact, explore Mission, Vision & Core Values of Axis Bank. The bank's strategic goals and objectives are all geared towards achieving this ambitious vision, ensuring long-term sustainability and success in the competitive banking industry.

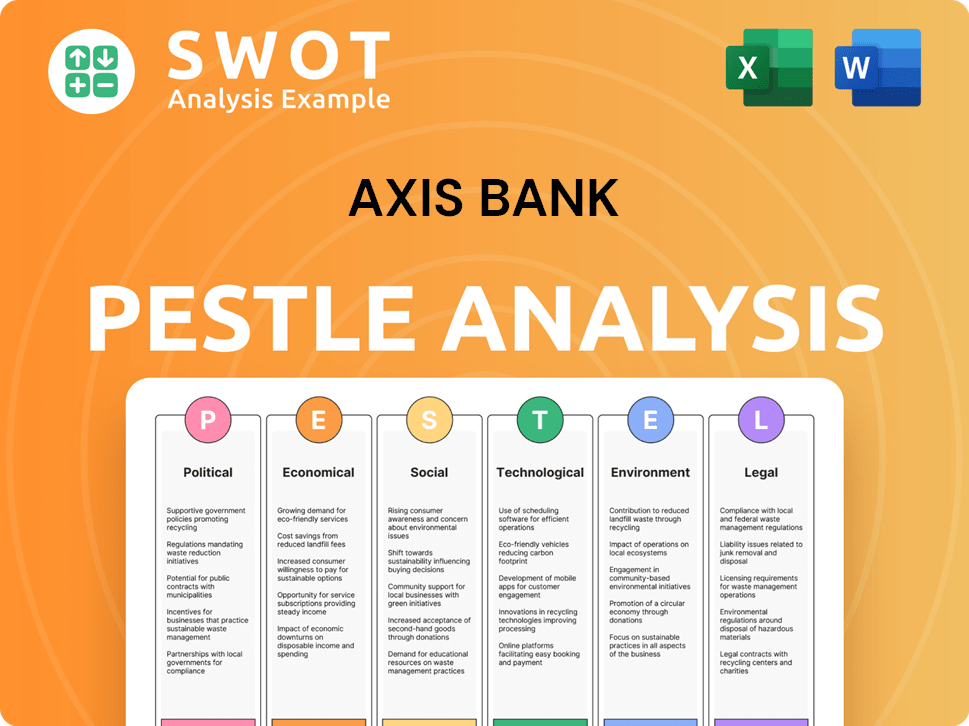

Axis Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Axis Bank Core Values Statement?

Axis Bank's core values are the guiding principles that shape its culture and interactions, defining its identity within the competitive financial landscape. These values are not just statements but actionable principles that drive the bank's operations and strategic direction, influencing everything from customer service to employee relations.

Customer Centricity places the customer at the heart of all decisions and actions. This value is reflected in Axis Bank's efforts to tailor solutions to meet diverse customer needs and enhance their overall experience. For example, the 'Axis Digital Initiative' has significantly improved digital banking services, leading to a 45% increase in digital transactions in the last fiscal year, showcasing their commitment to customer satisfaction.

Ethics is about upholding the highest standards of honesty, integrity, and transparency in all dealings. This commitment builds trust with customers and maintains the bank's reputation. Axis Bank's adherence to ethical practices has been a key factor in its consistent ratings and positive investor confidence, as evidenced by its stable credit ratings.

Transparency emphasizes openness and clarity in all operations and communications, essential for fostering trust and accountability. Axis Bank's transparent approach to financial reporting and disclosures has been crucial in maintaining credibility with customers and investors. This is reflected in their detailed quarterly reports and investor relations, which are readily accessible to the public.

Teamwork promotes collaboration and a supportive work environment within the bank. This value is important for effective service delivery and achieving common goals. Axis Bank encourages teamwork through various initiatives, including cross-departmental projects and collaborative training programs, which have contributed to improved employee satisfaction scores by 15% in the past year.

These core values collectively define Axis Bank's unique corporate identity, shaping its relationship-oriented approach to banking. Understanding these values is crucial to grasping how Axis Bank operates and achieves its strategic objectives. The next chapter will explore how the bank's mission and vision influence its strategic decisions, providing a deeper understanding of its long-term goals and objectives.

How Mission & Vision Influence Axis Bank Business?

Axis Bank's mission and vision statements are not merely aspirational; they are the cornerstones that shape its strategic decisions and operational practices. These statements provide a guiding framework, influencing everything from product development to customer interactions.

The Axis Bank Mission and Axis Bank Vision are the driving forces behind the bank's strategic priorities. These statements dictate the bank's focus on sustainable growth, technological advancement, and customer-centricity.

- Quality over Growth in Unsecured Lending: The shift towards prioritizing quality in lending, especially in unsecured loans, reflects the mission's goal of being a preferred financial solutions provider and the vision's emphasis on building a trustworthy brand.

- Technology Investments: With an estimated $290.8 million in ICT spending in 2024, focusing on AI, big data, and cloud technologies, Axis Bank demonstrates its commitment to the mission's emphasis on smart technology and the vision's pursuit of technological leadership.

- Branch Network Expansion: The addition of 500 new branches in FY25 underscores Axis Bank's commitment to customer delivery and market reach, directly aligning with its mission and vision of being a preferred provider and the bank of choice.

- Customer-Centric Initiatives: The "Dil Se Open" campaign, which emphasizes a customer-first approach and values of warmth, empathy, kindness, and openness, shows how the Axis Bank Core Values shape customer relations and business practices.

The Axis Bank Strategy is heavily influenced by its mission and vision. This influence is evident in the bank's focus on sustainable growth, technological innovation, and customer satisfaction.

The Axis Bank's mission statement analysis reveals a strong emphasis on customer relationships. Initiatives like the "Dil Se Open" campaign directly translate the bank's core values into tangible customer experiences, fostering a positive brand perception.

While isolating specific metrics directly tied to the mission and vision can be complex, several KPIs indicate alignment. These include the rise in digital transactions and high customer satisfaction scores, reflecting the customer-centric focus of the mission and values.

Leadership at Axis Bank, including MD & CEO Amitabh Chaudhry, consistently emphasizes the importance of the bank's core values and customer-centricity. This reinforces the mission and vision throughout the organization.

Axis Bank's focus on digital transformation and customer experience aligns with broader industry trends. The bank's investments in technology and customer service reflect its commitment to staying competitive in a rapidly evolving financial landscape.

The Axis Bank Goals and Axis Bank Objectives are shaped by its long-term vision. The bank aims to be a leader in the financial sector, providing innovative solutions and building lasting customer relationships.

In conclusion, the Axis Bank Mission, Axis Bank Vision, and Axis Bank Core Values are not just words; they are the guiding principles that shape the bank's strategic decisions, influencing its operations, customer relations, and long-term goals. Understanding these elements is crucial for anyone seeking to analyze the bank's performance and strategic direction. For a broader perspective on the competitive environment, consider exploring the Competitors Landscape of Axis Bank. Ready to explore how Axis Bank can improve its Mission and Vision? Let's dive into the next chapter: Core Improvements to Company's Mission and Vision.

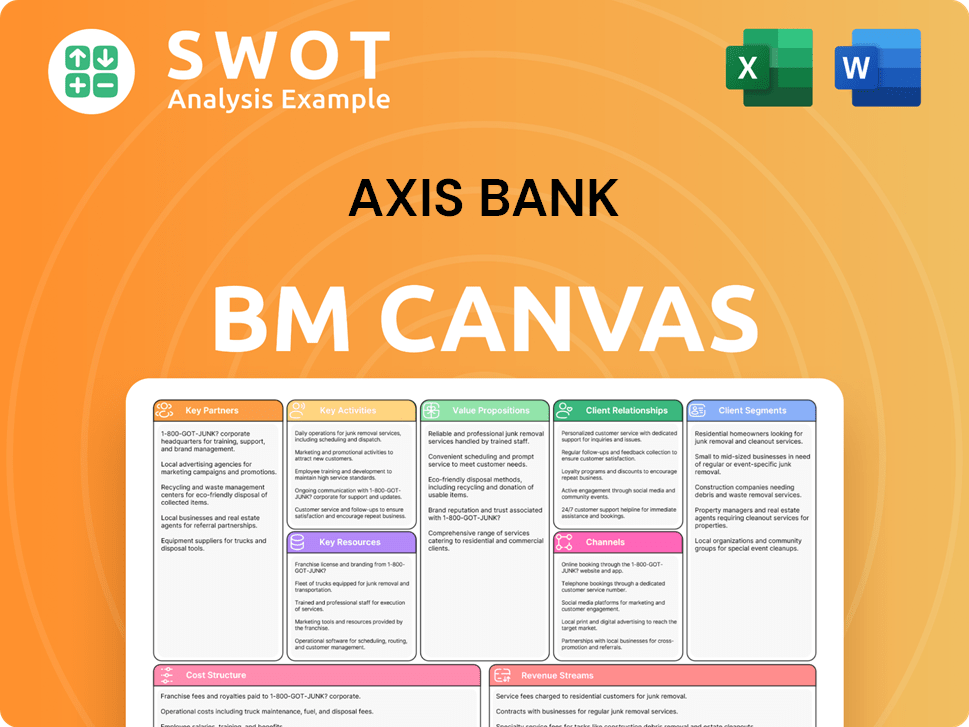

Axis Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

This section explores potential enhancements to Axis Bank's mission, vision, and core values to better reflect current market trends and stakeholder expectations. These improvements aim to solidify Axis Bank's position as a forward-thinking financial institution, aligning its strategies with evolving environmental and social considerations.

The current vision could be enhanced by explicitly incorporating a commitment to sustainable and inclusive financial growth. This would better reflect Axis Bank's existing efforts in financial inclusion and environmental initiatives, signaling a broader commitment to responsible banking. This aligns with the growing demand for ESG-focused investments, with global ESG assets projected to reach $53 trillion by 2025, according to Bloomberg Intelligence.

Adding 'Sustainability' as a distinct core value alongside existing ones would provide a clearer mandate for environmentally and socially conscious practices across all operations. This would provide a clearer framework for Growth Strategy of Axis Bank, ensuring that sustainability is not just a peripheral concern but a fundamental aspect of the bank's identity and operations. This is crucial, as 85% of consumers globally say they have shifted their purchase behavior towards more sustainable products in the last five years, according to a study by Simon-Kucher & Partners.

Refining the Axis Bank Mission to explicitly mention the bank's societal impact would further solidify its commitment to broader stakeholders. This would position the bank as a driver of positive change, attracting socially conscious investors and customers. This is increasingly important, as 77% of consumers are more likely to purchase from companies committed to making the world a better place, as reported by a 2024 study by Deloitte.

Axis Bank's strategic goals and objectives can be enhanced by embedding measurable ESG targets. This could involve setting specific goals for reducing carbon emissions, increasing financing for green projects, and improving social inclusion. This will help in demonstrating a tangible commitment to sustainability, which is critical as investors increasingly scrutinize companies' ESG performance, with ESG-focused funds experiencing significant inflows in recent years, as per Morningstar data.

How Does Axis Bank Implement Corporate Strategy?

The successful implementation of a company's mission, vision, and core values is crucial for achieving its strategic goals and fostering a strong organizational culture. Axis Bank demonstrates this implementation through various initiatives and leadership actions, ensuring its core principles are reflected in its operations and interactions.

Axis Bank's commitment to its Brief History of Axis Bank is clearly demonstrated through its 'Axis Digital Initiative.' This initiative focuses on enhancing customer delivery through technological advancements. This directly aligns with the Axis Bank Mission, which emphasizes the smart use of technology and a customer-centric approach to banking.

- Digital Transformation: Axis Bank has invested heavily in digital platforms, with digital transactions accounting for a significant portion of its business. For example, in the fiscal year 2024, digital transactions constituted over 90% of the total transactions.

- Customer Experience: The bank has consistently focused on improving customer experience through digital channels, including mobile banking, internet banking, and other online services.

- Innovation: Axis Bank continues to innovate by introducing new digital products and services to meet evolving customer needs.

The expansion of Axis Bank's physical presence through the addition of new branches is another key implementation strategy. This expansion aligns with the Axis Bank Vision of being a preferred financial solutions provider by increasing accessibility for customers.

Leadership plays a vital role in reinforcing the Axis Bank Core Values. The MD & CEO, Amitabh Chaudhry, frequently emphasizes the bank's values and its customer-centric approach in public statements and communications. The bank's mission, vision, and values are communicated through public campaigns.

The 'Dil Se Open' campaign is a prime example of how Axis Bank communicates its values. This campaign highlights the values of warmth, empathy, kindness, and openness. The campaign aims to showcase how these values are manifested in employee behavior and customer interactions.

The Axis Bank Foundation's 'Mission4Million' initiative is a concrete example of the bank's commitment to financial inclusion. This initiative aims to support an additional 2 million vulnerable households by fostering sustainable livelihoods, financial empowerment, and skill development. This aligns with the broader Axis Bank Vision and Axis Bank Goals.

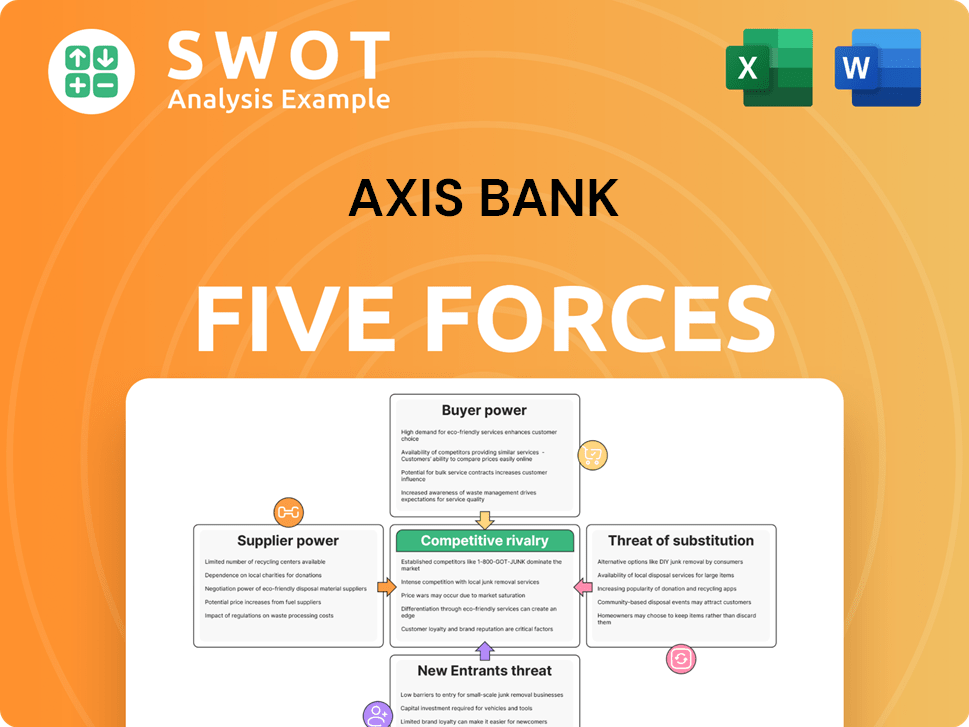

Axis Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Axis Bank Company?

- What is Competitive Landscape of Axis Bank Company?

- What is Growth Strategy and Future Prospects of Axis Bank Company?

- How Does Axis Bank Company Work?

- What is Sales and Marketing Strategy of Axis Bank Company?

- Who Owns Axis Bank Company?

- What is Customer Demographics and Target Market of Axis Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.