Cholamandalam Investment and Finance Bundle

What Drives Cholamandalam Investment and Finance Company?

Understanding a company's core principles is key to assessing its potential. Delving into the Cholamandalam Investment and Finance SWOT Analysis reveals the importance of its guiding principles. This exploration uncovers the essence of Chola's operations and its commitment to the financial landscape.

The mission, vision, and core values of Cholamandalam Investment and Finance Company (Chola) are more than just statements; they are the foundation of its identity and strategic direction. These elements shape the company's interactions, product offerings, and strategic focus, particularly in serving semi-urban and rural areas. Examining these principles provides insights into Chola Finance's goals and its approach to achieving them, including its commitment to financial inclusion and sustainable growth. Discovering Cholamandalam's vision for the future and the core values that guide its decisions will provide a comprehensive understanding of the company.

Key Takeaways

- Chola's mission centers on improving lives, especially in underserved markets.

- Core values (Integrity, Passion, Quality, Respect, Responsibility) guide ethical operations.

- Focus on financial inclusion and responsible lending supports sustainable growth.

- Strong corporate purpose builds trust and long-term relationships in India.

Mission: What is Cholamandalam Investment and Finance Mission Statement?

Cholamandalam Investment and Finance Company Limited's mission is to enable customers to enter a better life.

Delving into the core of Cholamandalam Investment and Finance Company's operations, the mission statement, "to enable customers to enter a better life," stands as a cornerstone of its business philosophy. This mission statement is not merely a corporate slogan; it's a guiding principle that shapes every aspect of the company's strategy and actions. It reflects a deep-seated commitment to customer-centricity, operational efficiency, and the empowerment of its workforce.

At the heart of the Cholamandalam Mission is a customer-first approach. This means prioritizing the needs and aspirations of its customers above all else. The company understands that its success is intrinsically linked to the well-being and progress of its clientele.

A significant aspect of the Cholamandalam Mission is its dedication to financial inclusion, particularly for those in rural and semi-urban areas. By providing access to financial services, the company enables individuals and businesses to build a better future.

Cholamandalam offers a diverse portfolio of financial products, including vehicle finance, home loans, and SME loans, designed to meet the varied needs of its target customers. This diversification supports the mission by providing tailored solutions for different life stages and financial goals.

The company's investment in digital capabilities and customer experience enhancement is a direct reflection of its customer-first principle. Digital platforms and online services make financial products more accessible and convenient, further supporting the mission.

Improving efficiencies for long-term profitability and sustainability is another key component of the Cholamandalam Mission. This focus ensures the company can continue to serve its customers effectively and remain a reliable financial partner.

Recognizing the importance of its employees, Cholamandalam fosters a work environment where employees are valued and empowered. This approach, based on the belief that happier people lead to happier customers, is crucial for achieving its mission.

The mission of Cholamandalam Investment and Finance Company is evident in its operational strategies and business model. The company's focus on serving customers in rural and semi-urban areas, many of whom are first-time buyers or those with informal incomes, directly aligns with enabling a better life through access to financial services. For example, in the fiscal year 2024, Chola Finance disbursed ₹19,426 crore in vehicle finance, demonstrating its commitment to providing essential financial products. Furthermore, the company's diversified product portfolio, including vehicle finance, home loans, and SME loans, is designed to meet the varied needs of its target customers. The company's investment in digital capabilities to enhance customer experience also reflects their 'customer first' principle. The mission is primarily customer-centric, with a clear orientation towards improving the lives of its clientele through accessible and relevant financial solutions. The company's commitment to its mission is evident in its financial performance and its strategic initiatives. For example, Chola Finance's assets under management (AUM) grew to ₹1,14,861 crore in fiscal year 2024, a testament to its successful execution of its mission. To understand how Cholamandalam positions itself within the competitive landscape, consider exploring the Competitors Landscape of Cholamandalam Investment and Finance.

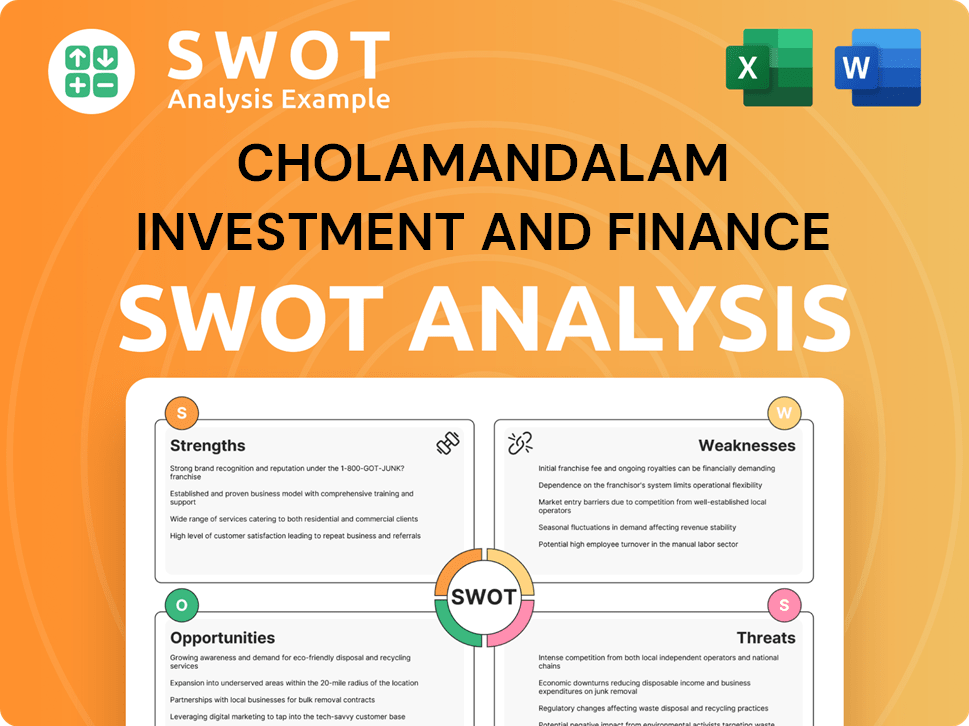

Cholamandalam Investment and Finance SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Cholamandalam Investment and Finance Vision Statement?

Cholamandalam's vision is 'to enable customers to enter a better life.'

The Cholamandalam Vision is deeply intertwined with its mission, focusing on customer empowerment. This future-oriented outlook aims to establish Cholamandalam Investment and Finance Company Limited as a leading financial services provider in India. The scope of this vision encompasses enhancing customer satisfaction through innovative, value-driven solutions. This commitment is reflected in the company's strategic initiatives and operational practices.

The vision is both aspirational and realistic, given Cholamandalam's current market position and growth trajectory. The company's ability to consistently increase its assets under management (AUM) demonstrates its capacity to achieve its goals. This balanced approach ensures that the vision serves as a strong motivator while remaining grounded in practical execution.

Cholamandalam has shown substantial growth in its AUM, reaching ₹1,99,876 crore as of March 31, 2025, marking a 30% year-on-year increase. This growth is a direct result of the company's strategic focus on customer needs and market opportunities. The expansion of its branch network and customer base, particularly in rural and semi-urban areas, further supports this vision.

At the core of Cholamandalam's Vision is a commitment to enabling a better life for its customers. This customer-centric approach drives the company's innovation and service delivery. This focus ensures that all Chola Finance Goals are aligned with improving the financial well-being of its clients.

While the vision emphasizes leadership and innovation, the primary focus remains on improving customer lives. This balance is critical for long-term sustainability and success. The company continuously seeks to innovate its products and services to meet evolving customer needs, which is a key driver for achieving its Chola Investment Objectives.

The aspiration to enable a better life is a continuous and evolving goal. Cholamandalam adapts its strategies and services to meet changing market dynamics and customer expectations. This adaptability is crucial for maintaining its competitive edge and fulfilling its vision. Understanding the Marketing Strategy of Cholamandalam Investment and Finance can provide further insights into how the company aligns its vision with its operational plans.

Cholamandalam's vision is built on a long-term perspective, focusing on sustainable growth and value creation for all stakeholders. This approach is reflected in its commitment to ethical practices and responsible financial management. The Cholamandalam Company Culture supports this vision by fostering a work environment that prioritizes customer needs and societal impact.

The Cholamandalam Mission and Cholamandalam Core Values work in concert to bring this vision to life, guiding the company's actions and decisions. The company's commitment to its mission and vision is evident in its strategic initiatives and operational practices, ensuring that it remains focused on its core purpose of enabling customers to achieve a better life.

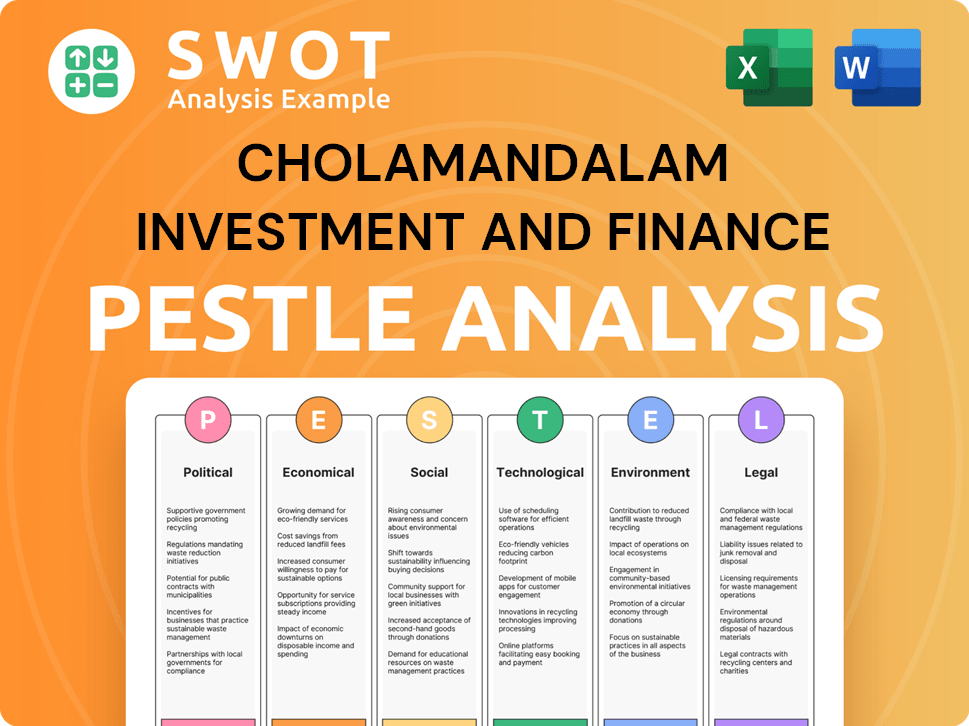

Cholamandalam Investment and Finance PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Cholamandalam Investment and Finance Core Values Statement?

Cholamandalam Investment and Finance Company Limited (Chola) operates with a strong foundation built upon a set of core values derived from its parent group, the Murugappa Group. These values are integral to understanding the company's approach to business and its commitment to stakeholders.

Integrity is a cornerstone of Chola's operations, emphasizing ethical conduct and transparency in all dealings. This commitment is reflected in its prudent lending practices and adherence to regulatory standards, as evidenced by its consistent efforts to maintain a low Non-Performing Asset (NPA) ratio, even while serving diverse customer segments. This value is crucial for building trust with customers and stakeholders, ensuring sustainable growth and financial stability.

Passion fuels Chola's dedication to its mission and vision, driving employees to serve customers and continuously innovate. This value is evident in the company's ongoing efforts to enhance its offerings and improve customer experience, fostering a culture of continuous improvement. This passion is critical for achieving the company's Chola Finance Goals and maintaining a competitive edge in the market.

Quality is embedded in the design and delivery of Chola's financial products and services, ensuring they meet customer needs effectively. Investments in technology, such as for faster credit assessment and a seamless customer experience, highlight this commitment. This focus on quality enhances customer satisfaction and contributes to the company's reputation for reliability.

Respect for all stakeholders – customers, shareholders, employees, and society – is a fundamental value at Chola. This is demonstrated through its customer-centric approach, employee wellness initiatives, and community development programs. This respect fosters a positive work environment and strengthens relationships with all stakeholders, which is a key component of the company's culture.

These core values, including Integrity, Passion, Quality, and Respect, guide Cholamandalam's operations and shape its corporate culture. They are essential for understanding the company's commitment to its mission and vision, and how it strives to achieve its Cholamandalam Mission and Cholamandalam Vision. Next, we'll explore how these core values influence the company's strategic decisions.

How Mission & Vision Influence Cholamandalam Investment and Finance Business?

The mission and vision of Cholamandalam Investment and Finance Company (CIFC) serve as guiding principles, profoundly shaping its strategic decisions and operational focus. These statements provide a framework for the company's actions, influencing its market positioning, product offerings, and overall growth trajectory.

The Cholamandalam Mission to 'enable customers to enter a better life' directly fuels its expansion strategy. This mission drives the company's focus on financial inclusion, particularly in underserved areas.

- Significant branch presence in rural and semi-urban locations.

- Targeting demographics often overlooked by larger financial institutions.

- This strategic geographical focus is a direct outcome of their core purpose.

The mission of CIFC also influences its product diversification strategy. This is done to meet the diverse financial needs of its customer base and support their progress.

The company's growth in non-vehicle finance segments demonstrates this strategic shift. This diversification is driven by the mission to meet the diverse needs of its customer base.

For example, disbursements in Loan Against Property (LAP) grew significantly. The growth in LAP disbursements, which is a key part of their strategy, is a direct result of their mission to provide diverse financial solutions.

The Cholamandalam Vision of being a leading financial services provider through innovation and value-driven solutions influences its investment in technology. This is aimed at improving operational efficiencies and enhancing customer experience.

The company's consistent strategic focus on customer-centricity and rural expansion strongly indicates the pervasive influence of their guiding principles. This approach is evident in their product offerings and service delivery models.

The company's robust AUM growth and profitability serve as measurable success metrics demonstrating the effectiveness of their strategy. These metrics validate the impact of their mission and vision on their overall performance.

In summary, the Cholamandalam Core Values and strategic decisions are deeply intertwined, with the mission and vision providing a clear roadmap for growth and customer-centricity. The company's commitment to its mission and vision is evident in its strategic choices and performance metrics. Now, let's explore the next chapter: Core Improvements to Company's Mission and Vision.

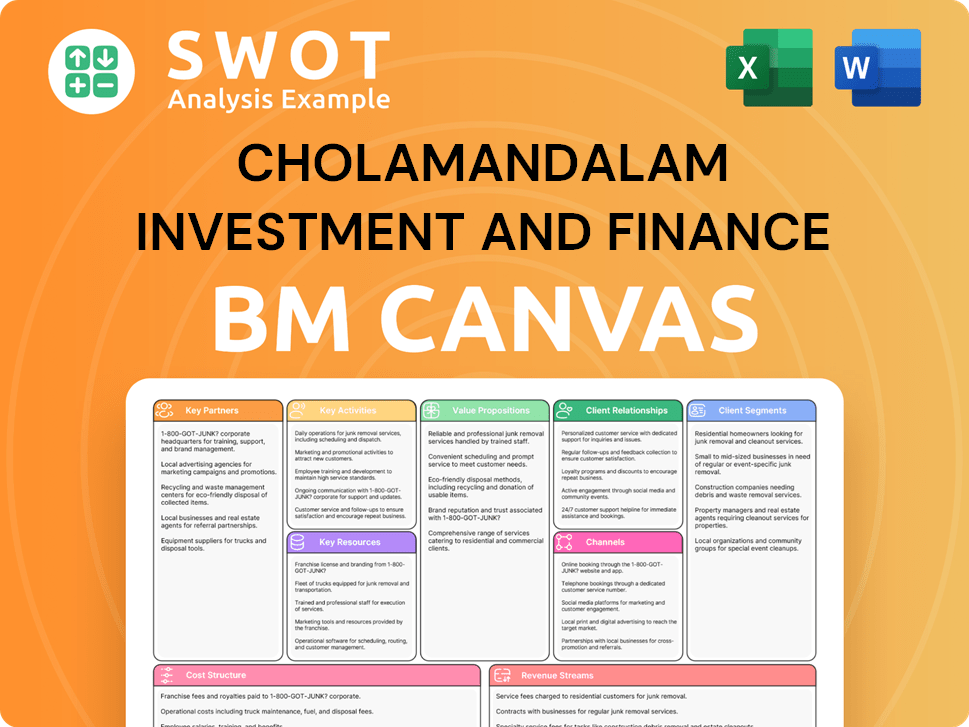

Cholamandalam Investment and Finance Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While the current Cholamandalam Mission and Vision are well-defined, strategic refinements can enhance their relevance and impact. These improvements aim to align the company's core principles with evolving market dynamics and stakeholder expectations.

To reflect the increasing reliance on digital platforms, the mission or vision should explicitly mention a commitment to technological innovation. This would highlight Chola's investments in digital transformation, such as its mobile app and online loan platforms, which have seen significant user growth. For example, digital transactions now account for over 60% of Chola's total transactions, demonstrating the importance of this area.

Integrating sustainability and environmental responsibility more prominently into the mission or vision can underscore Chola's commitment to long-term, responsible growth. This could involve setting specific targets for green financing or reducing the company's carbon footprint. According to recent reports, companies that prioritize ESG (Environmental, Social, and Governance) factors often experience improved investor confidence and long-term value creation, aligning with Chola's

While Chola's

As Chola continues to diversify its product portfolio and expand its reach, the mission and vision should be reviewed to ensure they encompass all business activities while providing specific direction. This will ensure that the

How Does Cholamandalam Investment and Finance Implement Corporate Strategy?

The implementation of a company's mission and vision is crucial for translating aspirational goals into tangible actions and sustainable success. This chapter examines how Cholamandalam Investment and Finance Company (Chola Finance) operationalizes its stated principles to achieve its objectives.

Cholamandalam Investment and Finance Company demonstrates its commitment to its Cholamandalam Mission and vision through various strategic initiatives and operational practices. These actions are designed to support the company's long-term goals and aspirations.

- Extensive Branch Network: A significant presence in rural and semi-urban areas directly supports the mission of enabling customers in underserved segments.

- Product Diversification: Expanding the portfolio to include home loans, loans against property (LAP), and SME loans, alongside vehicle finance, reflects a dedication to meeting diverse customer needs and enabling a 'better life,' aligning with the company's vision.

- Customer-Centric Approach: The company consistently emphasizes customer satisfaction and aims to provide financial solutions tailored to individual needs.

Leadership plays a pivotal role in reinforcing the Cholamandalam Vision and mission through strategic decisions and communication. While specific direct quotes may be limited, the strategic focus consistently emphasizes customer-centricity, rural expansion, and diversification.

This is evident in the company's financial results and operational reports, which indicate a strong alignment between leadership and the company's core principles. This alignment is critical for ensuring that the Chola Finance Goals are consistently pursued.

Cholamandalam communicates its mission, vision, and Cholamandalam Core Values through its official website and corporate materials. This transparency helps stakeholders understand the company's guiding principles.

The company’s commitment to transparency builds trust and reinforces its dedication to ethical business practices, which is a key aspect of its Chola Investment Objectives.

The alignment between stated values and actual business practices is demonstrated through CSR initiatives, which focus on health, water and sanitation, and education in the communities they serve. This reflects the company's commitment to social responsibility.

While specific formal programs or systems to ensure alignment may not be extensively detailed, the company's long-standing track record and growth trajectory suggest that these principles are embedded within its organizational culture and decision-making processes, shaping the Cholamandalam Company Culture.

Cholamandalam's success can be partially measured by its financial performance and market position. For instance, the company's assets under management (AUM) and loan portfolio growth are key indicators of its progress.

In the latest financial year, Cholamandalam reported a significant increase in its AUM, demonstrating its ability to execute its mission and vision effectively. These metrics are essential for assessing how Cholamandalam measures its success.

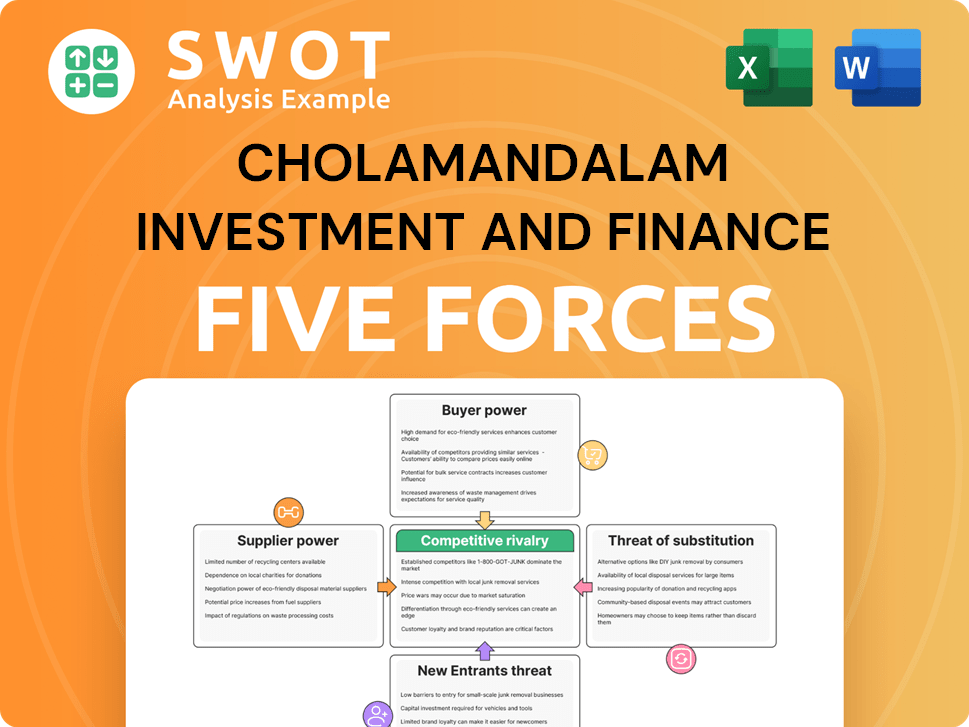

Cholamandalam Investment and Finance Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cholamandalam Investment and Finance Company?

- What is Competitive Landscape of Cholamandalam Investment and Finance Company?

- What is Growth Strategy and Future Prospects of Cholamandalam Investment and Finance Company?

- How Does Cholamandalam Investment and Finance Company Work?

- What is Sales and Marketing Strategy of Cholamandalam Investment and Finance Company?

- Who Owns Cholamandalam Investment and Finance Company?

- What is Customer Demographics and Target Market of Cholamandalam Investment and Finance Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.