4imprint Group Bundle

Who Really Owns 4imprint Group?

Unraveling the ownership structure of 4imprint Group is key to understanding its strategic moves and future potential. From its humble beginnings as William Gee company to its current status as an industry leader, 4imprint's journey is a fascinating case study in corporate evolution. Understanding the major players behind 4imprint ownership offers valuable insights for investors and business strategists alike.

This deep dive into 4imprint company ownership will uncover the key shareholders and their influence, while also exploring the company's history, including its 1921 founding and subsequent acquisition by Bemrose Corporation. Discover the impact of the Board of Directors and recent trends shaping the future of this promotional products giant. For a deeper dive into the company's strategic landscape, consider exploring the 4imprint Group SWOT Analysis.

Who Founded 4imprint Group?

The story of 4imprint, now a significant player in the promotional products market, began with the William Gee company, established way back in 1847. The company that would evolve into the current 4imprint was founded in 1985 by Dick Nelson under the name Nelson Marketing. This initial venture laid the groundwork for what 4imprint is today.

In 1996, Nelson Marketing was acquired by Bemrose Corporation, marking a crucial shift in its corporate journey. Bemrose Corporation later divested its paper products business and officially changed its name to 4imprint Group plc in 2000. This rebranding solidified its focus on promotional products, with its North American division becoming 4imprint Inc.

The details of the early ownership structure, including the specific equity split or shareholding percentages of Dick Nelson or other initial investors in Nelson Marketing, are not readily available in public records. However, the company's early strategy, starting in 1987, centered on direct sales of promotional items, primarily through catalogs and toll-free numbers. This approach aimed to offer customers cost savings by cutting out commissioned salespersons and streamlining the purchasing process.

The initial vision for the company involved direct sales of promotional items.

This model aimed to save customers money by eliminating commissioned salespersons.

Sales were primarily conducted through catalogs and toll-free numbers.

In 1996, Nelson Marketing was acquired by Bemrose Corporation.

Bemrose Corporation changed its name to 4imprint Group plc in 2000.

The North American division became 4imprint Inc.

A notable event in the evolution of 4imprint ownership occurred in 2003. Hanover Investors, a private equity firm, acquired over 25% of 4imprint within a month. This significant investment led to a shareholder dispute. Hanover Investors called for the removal of all non-executive directors after disagreements with 4imprint. This situation highlights how early, substantial investments can lead to governance challenges and differing visions for the company's future. For more insights into the company's business model, you can read about the Revenue Streams & Business Model of 4imprint Group.

The early ownership of 4imprint involved several key milestones.

- Founded in 1985 as Nelson Marketing by Dick Nelson.

- Acquired by Bemrose Corporation in 1996.

- Renamed to 4imprint Group plc in 2000.

- Hanover Investors acquired over 25% stake in 2003.

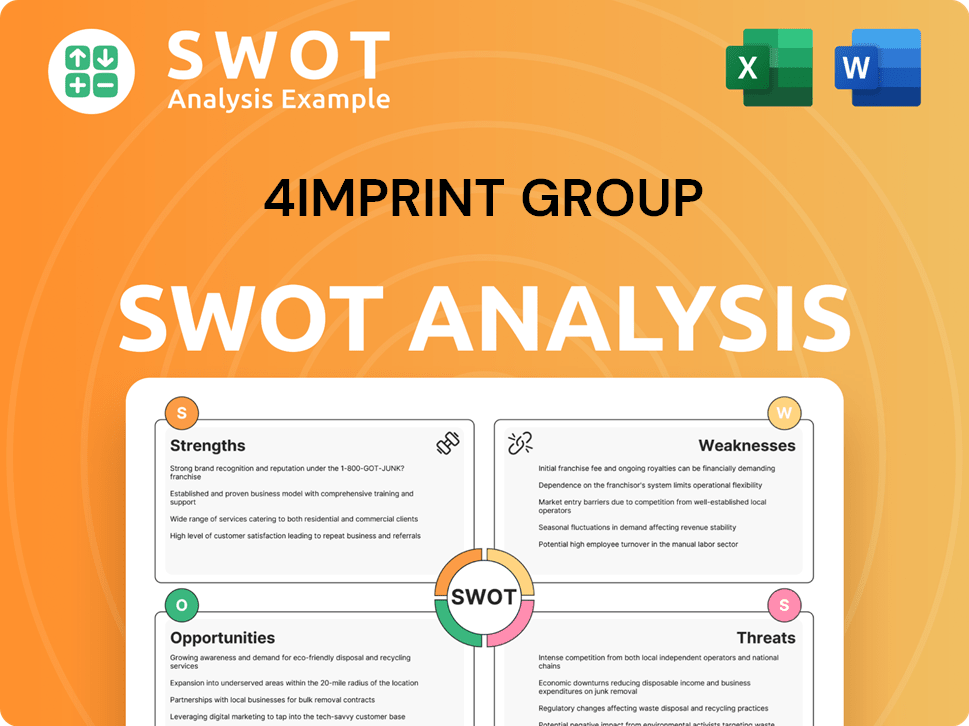

4imprint Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has 4imprint Group’s Ownership Changed Over Time?

The 4imprint Group plc, a company with a history rooted in the promotional products sector, has seen its ownership evolve since its listing on the London Stock Exchange in 1996. The company strategically divested non-core businesses in the early 2000s to focus on promotional products. A significant move was the sale of Kreyer Promotion Service GmbH and Brand Addition Limited in 2012 to European affiliates of H.I.G. Capital for £24 million, streamlining its operations further.

As a publicly traded entity, the ownership of 4imprint, or who owns 4imprint, is distributed among various institutional and individual investors. The company's journey reflects strategic decisions that have reshaped its focus and ownership structure over time. This makes it a dynamic case study for understanding the evolution of a publicly traded company.

| Shareholder | Approximate % of Shares (May/June 2025) | Approximate Shares Held (May 7, 2025) |

|---|---|---|

| Baillie Gifford & Co. | 10.52% | 2,963,850 |

| JPMorgan Asset Management (UK) Ltd. | 7.78% | 2,191,560 |

| BlackRock Investment Management (UK) Ltd. | 7.52% | 2,119,772 |

| The Vanguard Group, Inc. | 5.20% | 1,466,245 |

| Schroder Investment Management | 3.81% | 1,072,767 |

The shifts in major shareholding, such as the reported change in May 2024 where abrdn plc's affiliated entities decreased their holding to below the 5% threshold, demonstrate the dynamic nature of public company ownership. These changes in 4imprint ownership can influence company strategy and governance, as institutional investors often engage with management on various issues. The company's focus on organic growth, using data-driven marketing, is detailed in the Marketing Strategy of 4imprint Group. As of December 31, 2024, 4imprint Group reported a trailing 12-month revenue of $1.37 billion, and a net income of $117.2 million.

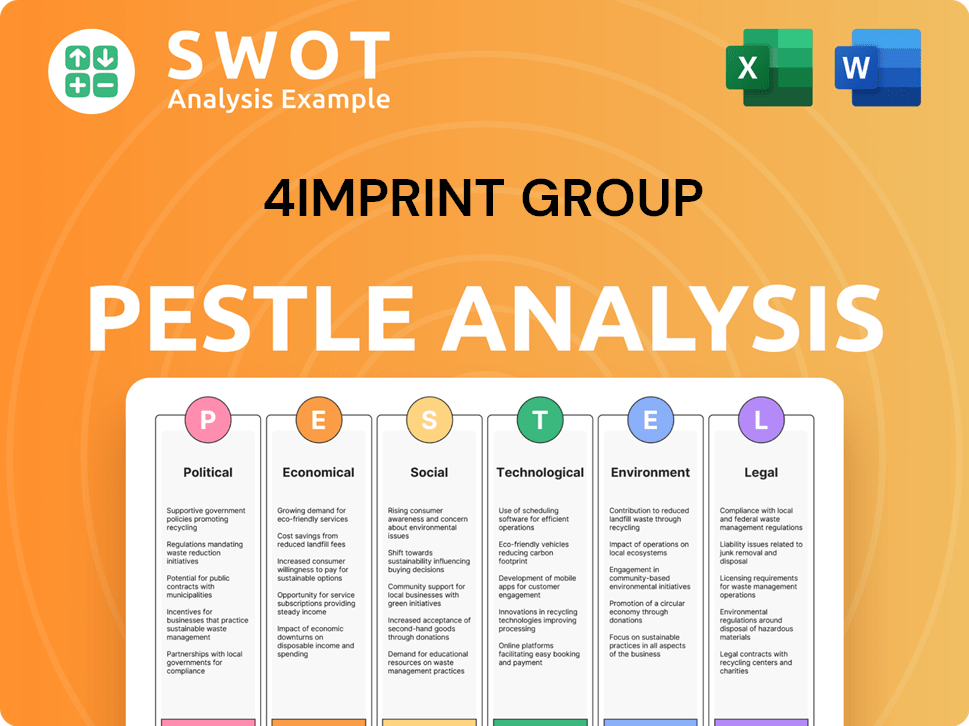

4imprint Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on 4imprint Group’s Board?

The current Board of Directors of 4imprint Group plays a crucial role in the company's governance. Paul Moody serves as the Chairman, and Kevin Lyons-Tarr is the CEO. As of June 2025, Michelle Brukwicki was appointed as a member of the Board and Chief Financial Officer, effective May 1, 2025, replacing David Seekings. Other directors include Mrs. Christina Dawn Southall, Ms. Lindsay Claire Beardsell, and Mr. John Michael Gibney.

This board is responsible for overseeing the strategic direction and financial performance of the company. Their decisions are critical for the company's future, especially considering the company's performance and market outlook. The composition of the board and its leadership are key aspects of understanding 4imprint ownership and how the company is managed.

| Director | Position | Date of Appointment (or Change) |

|---|---|---|

| Paul Moody | Chairman | Information not available |

| Kevin Lyons-Tarr | CEO | Information not available |

| Michelle Brukwicki | Board Member & CFO | May 1, 2025 |

| Mrs. Christina Dawn Southall | Director | Information not available |

| Ms. Lindsay Claire Beardsell | Director | Information not available |

| Mr. John Michael Gibney | Director | Information not available |

The voting structure of 4imprint Group, as a public limited company listed on the London Stock Exchange, generally operates on a one-share-one-vote basis for its ordinary shares. Major institutional investors, such as Baillie Gifford & Co., JPMorgan Asset Management, and BlackRock, hold significant voting power due to their substantial shareholdings, influencing the company's strategic decisions. Understanding who the 4imprint shareholders are provides insight into the company's governance.

The Board of Directors manages the company's strategic direction and financial performance.

- The company reported a profit before tax of $154.4 million in 2024.

- The Annual General Meeting (AGM) was held on May 21, 2025, in London.

- The company is listed on the London Stock Exchange.

- For more details, see the Brief History of 4imprint Group.

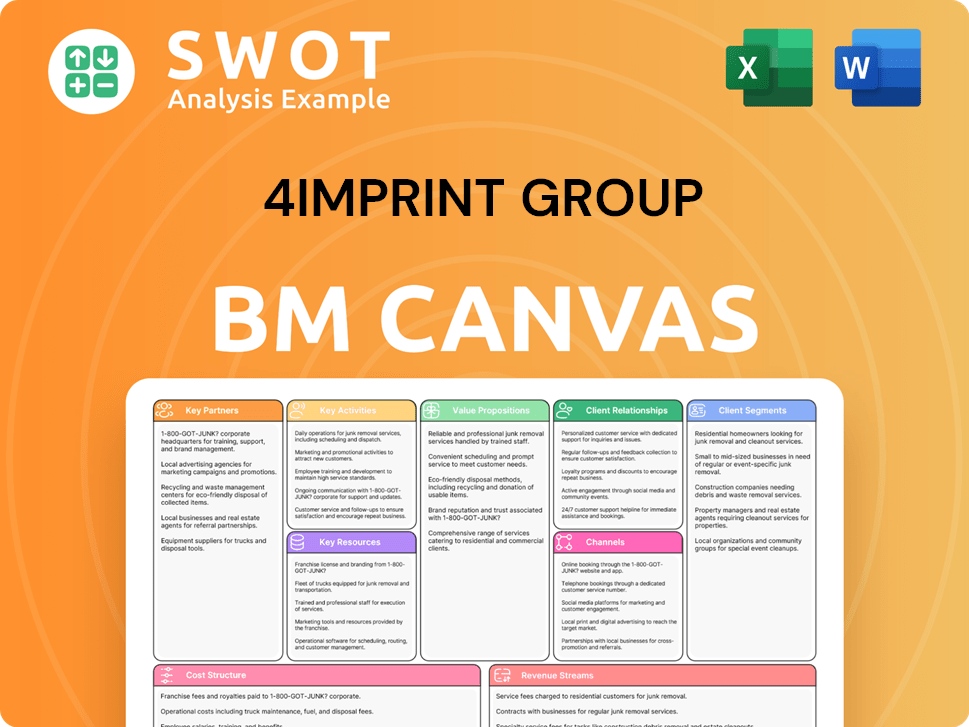

4imprint Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped 4imprint Group’s Ownership Landscape?

Over the past few years, 4imprint Group plc has demonstrated consistent financial growth. In 2024, unaudited group revenue was projected at $1.37 billion, a rise from $1.33 billion in 2023. The company also anticipated an unaudited profit before tax of not less than $153 million. This performance is backed by a strong operational model and a robust cash position, with cash and bank deposits reaching $148 million at the end of 2024. A significant investment of $20 million was made in 2024 to expand its Oshkosh distribution center, supporting growth, particularly in the apparel category. These factors contribute to the company's strong standing and future prospects.

Regarding 4imprint ownership, institutional investors continue to hold a significant stake. Major shareholders include Baillie Gifford & Co., JPMorgan Asset Management, BlackRock, and Vanguard Group as of May and June 2025. While there haven't been high-profile founder departures impacting ownership, the company has seen leadership changes, such as the appointment of Michelle Brukwicki as CFO effective May 1, 2025. These shifts reflect the ongoing evolution of the company's structure and management.

| Metric | Value | Year |

|---|---|---|

| Unaudited Group Revenue | $1.37 billion | 2024 (Projected) |

| Unaudited Profit Before Tax | Not less than $153 million | 2024 (Projected) |

| Cash and Bank Deposits | $148 million | 2024 (Year-end) |

| Special Dividend | 250.0 cents per share | 2024 (Recommended) |

| Regular Dividend | 240.0 cents per share | 2024 (Increased) |

The company's board recommended a special dividend of 250.0 cents per share for the year ended December 28, 2024, payable on June 3, 2025, alongside a regular dividend increase to 240.0 cents, showing a commitment to returning value to 4imprint shareholders. Despite external challenges, including macroeconomic uncertainty and potential tariff impacts in early 2025, the board remains confident in its strategy. Analyst sentiment towards 4imprint group is largely positive. For more insights into the company's growth trajectory, explore the Growth Strategy of 4imprint Group.

Institutional investors, including Baillie Gifford & Co., JPMorgan Asset Management, BlackRock, and Vanguard Group, are major shareholders.

Unaudited revenue for 2024 was projected at $1.37 billion, with a profit before tax of at least $153 million.

A special dividend of 250.0 cents per share was recommended for 2024, along with an increased regular dividend.

A $20 million investment was made to expand the Oshkosh distribution center, supporting growth in the apparel sector.

4imprint Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of 4imprint Group Company?

- What is Competitive Landscape of 4imprint Group Company?

- What is Growth Strategy and Future Prospects of 4imprint Group Company?

- How Does 4imprint Group Company Work?

- What is Sales and Marketing Strategy of 4imprint Group Company?

- What is Brief History of 4imprint Group Company?

- What is Customer Demographics and Target Market of 4imprint Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.