Academy Sports and Outdoors Bundle

Who Really Calls the Shots at Academy Sports and Outdoors?

Ever wondered who's steering the ship at one of the leading sporting goods retailers in the United States? Academy Sports and Outdoors, a name synonymous with outdoor adventures and athletic gear, has a fascinating ownership story. From its humble beginnings as a family-run business to its current status as a publicly traded company, the evolution of Academy Sports ownership is a compelling tale. Understanding the Academy Sports and Outdoors SWOT Analysis is key to seeing how ownership impacts its strategies.

The journey of the Academy Sports company from a family business to a publicly traded entity reveals significant shifts in its ownership structure. This transformation, marked by its IPO in 2020, has reshaped its strategic direction and market influence. This article will explore the key players in Academy Sports ownership, including institutional investors, public shareholders, and the board of directors, providing a comprehensive overview of who owns Academy Sports and how it impacts the company's future. Discover the Academy Sports owner and the evolution of its leadership team.

Who Founded Academy Sports and Outdoors?

The story of Academy Sports and Outdoors began in 1938, when Max Gochman established Academy Tire Shop in San Antonio, Texas. Initially, the business focused on selling tires. However, it quickly evolved to include military surplus items.

Early ownership of the company was exclusively within the Gochman family. Max Gochman and his family were the sole proprietors. They steered the company through its initial expansion. There's no public record of early external investors. This suggests a family-funded start.

As the business grew, it transitioned its focus to sports and outdoor products, leading to the rebranding as Academy Sports and Outdoors. The Gochman family maintained control for many years. They guided its growth across Texas and into neighboring states. There are no widely reported early ownership disputes. This indicates a stable internal structure during its formative years.

Max Gochman founded Academy Sports and Outdoors in 1938. The initial business was a tire shop in San Antonio, Texas.

The early business included military surplus items. This was a shift from its initial focus on tires.

The Gochman family held complete ownership during the early years. There were no external investors during this period.

The company shifted its focus to sports and outdoors products. This led to the rebranding as Academy Sports and Outdoors.

The Gochman family maintained control for many decades. They oversaw the company's expansion.

There were no reported ownership disputes within the founding family. This ensured a stable internal structure.

The Gochman family's vision of offering affordable sporting goods shaped the company's direction. This allowed for long-term, family-driven decision-making. If you're interested in learning more about the business, you can explore the Revenue Streams & Business Model of Academy Sports and Outdoors. This early phase set the stage for the company's future growth and its eventual transition to different ownership structures.

The early ownership of Academy Sports and Outdoors was firmly rooted in the Gochman family, starting with Max Gochman in 1938.

- The initial focus was on tires and military surplus items.

- The company's transition to sports and outdoors products marked a significant shift.

- The Gochman family's long-term control ensured stability.

- There were no external investors during the early years.

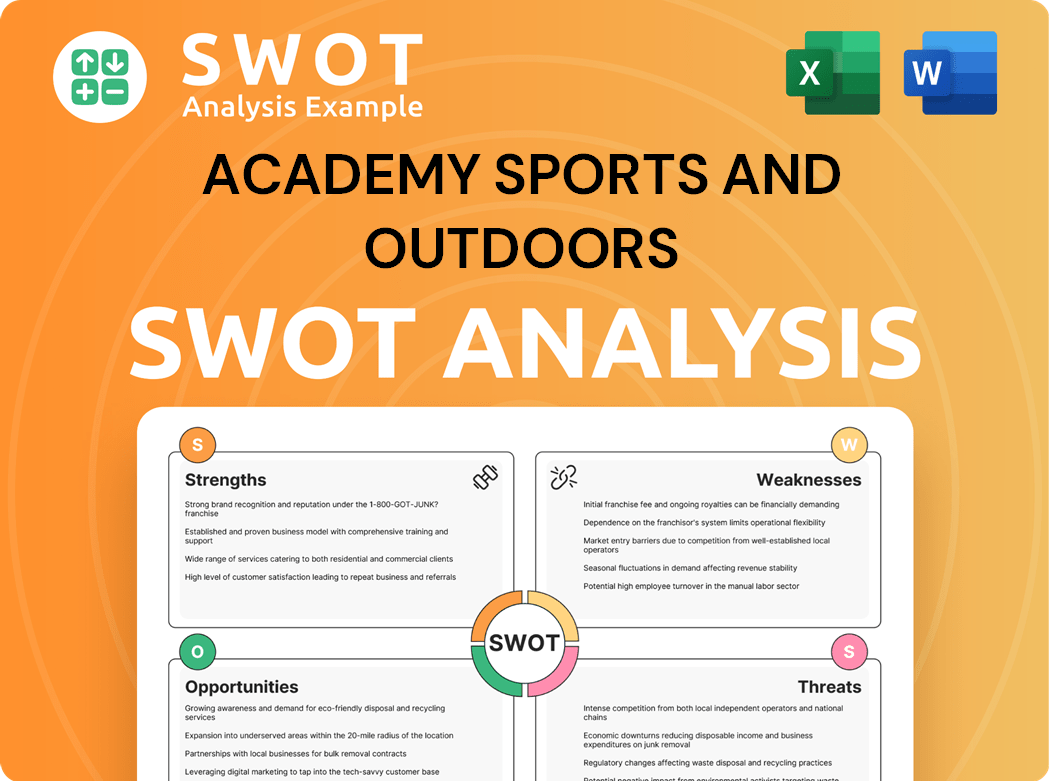

Academy Sports and Outdoors SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Academy Sports and Outdoors’s Ownership Changed Over Time?

The ownership of Academy Sports and Outdoors has seen major shifts over time. Initially, the Gochman family held the reins, but in August 2011, Kohlberg Kravis Roberts & Co. L.P. (KKR) acquired a majority stake. This move transitioned the company from private, family ownership to private equity control. KKR's goal was to boost the company's growth and expand its reach. During this period, Academy Sports + Outdoors focused on expanding its physical stores and improving its online presence.

A significant change occurred on October 2, 2020, when Academy Sports and Outdoors went public with its initial public offering (IPO). The company began trading on the NASDAQ Global Select Market under the ticker symbol 'ASO.' The IPO involved offering 15,625,000 shares at $13.00 per share. KKR reduced its stake but remained a key shareholder. Since the IPO, the ownership structure has become more diverse, involving institutional investors, mutual funds, and individual shareholders. This transition has influenced the company's strategy, emphasizing transparency and shareholder value.

| Event | Date | Impact |

|---|---|---|

| KKR Acquisition | August 2011 | Shift from family ownership to private equity control. |

| Initial Public Offering (IPO) | October 2, 2020 | Transition to public ownership, increased capital access. |

| Ongoing Ownership | Early 2024 | Institutional investors like The Vanguard Group and BlackRock Inc. hold significant shares. |

As of early 2024, the ownership of Academy Sports and Outdoors is largely held by institutional investors. For example, The Vanguard Group held approximately 9.9% of the shares, and BlackRock Inc. held around 8.4% as of March 31, 2024. These institutional holdings reflect a shift towards a more dispersed ownership model, typical of publicly traded companies. This evolution has shaped the company's strategic direction, increasing transparency and focusing on delivering value to shareholders. To learn more about the company's target audience, check out this article about the Target Market of Academy Sports and Outdoors.

The ownership of Academy Sports has evolved significantly, from family control to private equity and finally, public ownership.

- KKR acquired a majority stake in 2011.

- The IPO occurred in October 2020.

- Institutional investors now hold a significant portion of the shares.

- The shift to public ownership has increased transparency.

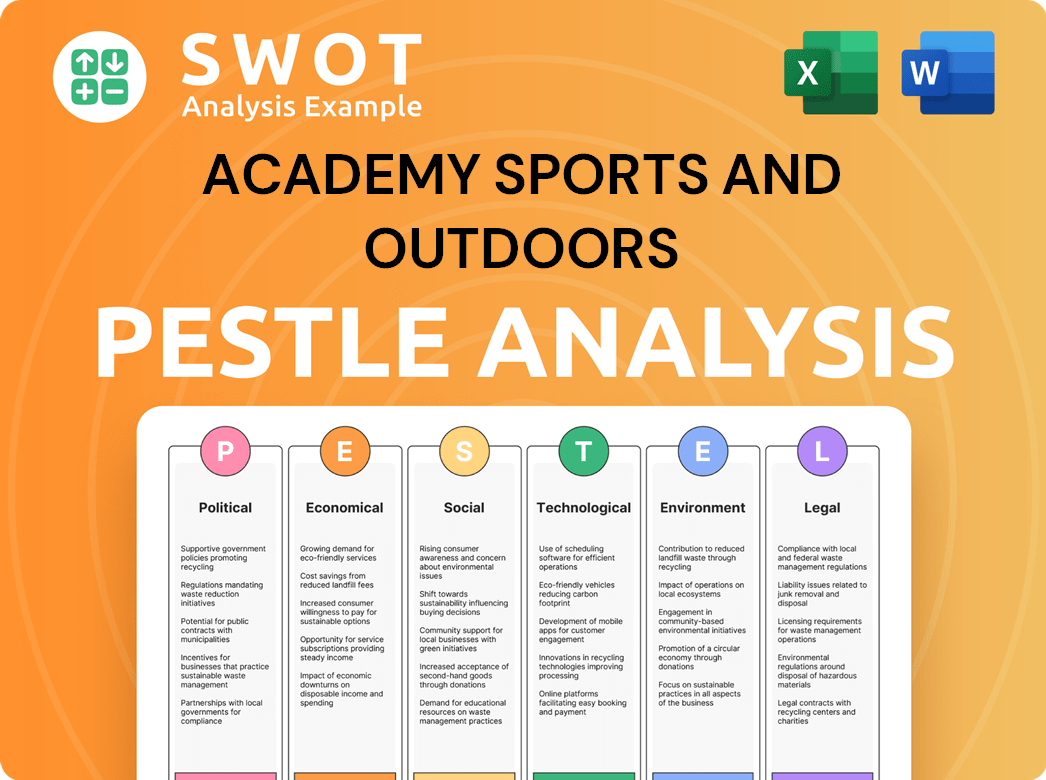

Academy Sports and Outdoors PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Academy Sports and Outdoors’s Board?

The current Board of Directors of Academy Sports and Outdoors plays a crucial role in the company's governance. As of early 2024, the board includes individuals with diverse backgrounds in retail, finance, and operations. The board typically includes several independent directors, who are not employees of the company and do not have material relationships with the company, enhancing objectivity and oversight. The composition reflects a mix of independent directors and representatives from significant past and present stakeholders. While KKR has significantly reduced its ownership post-IPO, some directors may have historical ties or expertise gained during KKR's stewardship. The board's responsibilities include overseeing corporate strategy, risk management, and executive compensation, ensuring alignment with shareholder interests.

The board's structure and the influence of various stakeholders are key aspects of understanding the Brief History of Academy Sports and Outdoors. The board's composition and decisions are subject to the scrutiny of its broad shareholder base, particularly large institutional investors who can collectively exert significant influence through their voting power and engagement with management.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Ken C. Hicks | Chairman of the Board | Extensive experience in retail and executive leadership. |

| Michael Mullican | Chief Executive Officer | Experience in retail and operational expertise. |

| J.K. Symancyk | Director | Background in retail and business management. |

The voting structure for Academy Sports and Outdoors' common stock is generally one-share-one-vote. This means that each share of common stock held by an investor grants them one vote on matters presented to shareholders. There are no publicly disclosed dual-class shares, special voting rights, or golden shares that would grant outsized control to any single individual or entity. This structure promotes a more democratic shareholder base where voting power is directly proportional to ownership stake.

Understanding the ownership structure is key to understanding Academy Sports. The company operates under a standard one-share-one-vote system. This structure ensures that voting power is proportional to the stake held.

- The board of directors oversees corporate strategy.

- The board manages risk and executive compensation.

- Shareholders have significant influence.

- Institutional investors play a key role.

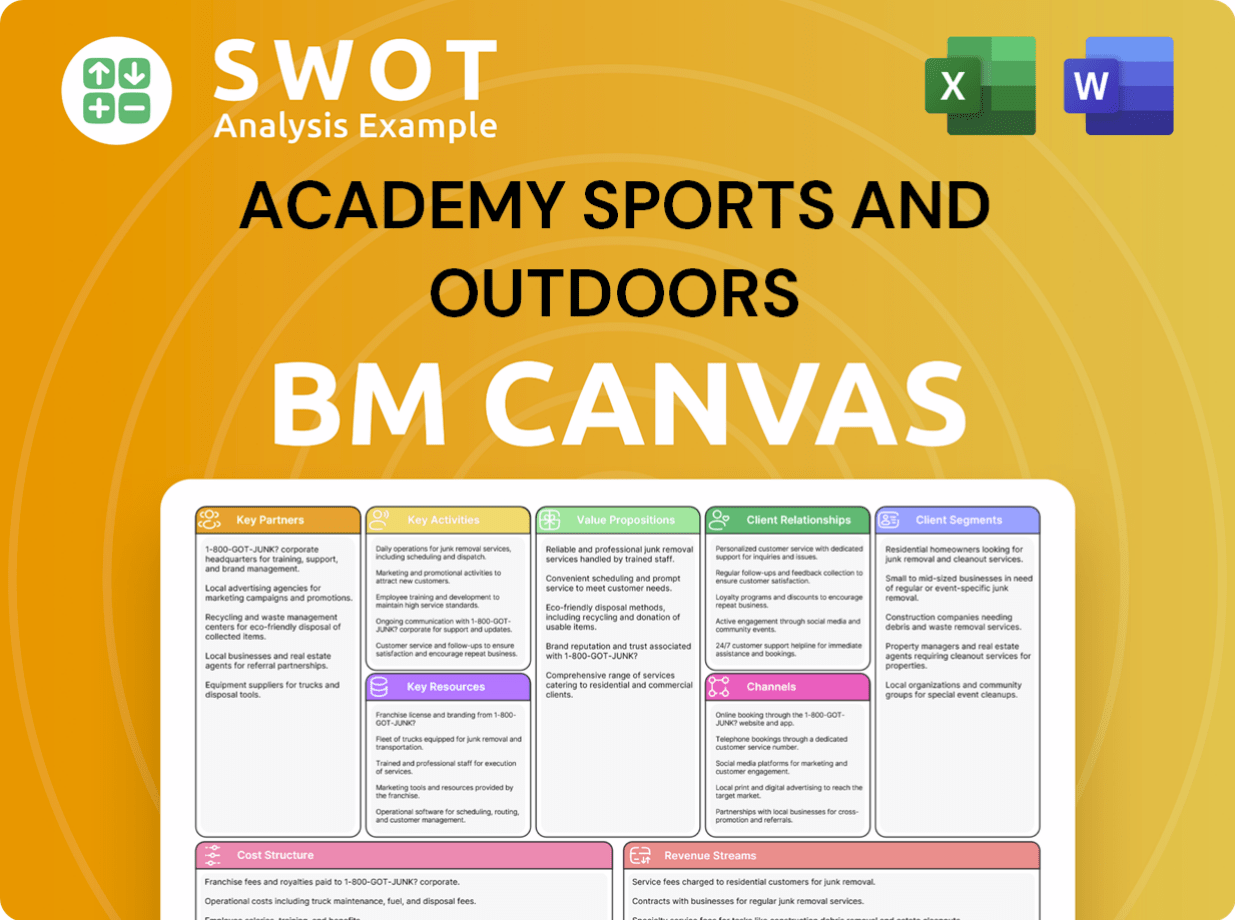

Academy Sports and Outdoors Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Academy Sports and Outdoors’s Ownership Landscape?

Over the past few years, the ownership of Academy Sports and Outdoors has seen significant shifts, largely due to its transition to a publicly traded company. Following its IPO in October 2020, the private equity firm KKR, which previously owned the company, gradually reduced its stake through secondary offerings. For example, in March 2021, KKR sold a significant portion of its remaining shares, which increased the public float and diversified the ownership base. This is a common trend as private equity firms exit their investments post-IPO, which allows them to realize returns and increase the stock's liquidity.

Current ownership trends for Academy Sports and Outdoors reflect broader market dynamics, including increased institutional ownership. Large asset managers like Vanguard and BlackRock have consistently held substantial positions, indicating confidence in the company's long-term prospects. As of early 2024, institutional ownership accounts for a significant majority of the outstanding shares, which is typical for established public companies. The company's share repurchase programs, such as the $200 million program authorized in March 2024, also influence ownership percentages. These buybacks show a management strategy focused on returning value to shareholders. If you're interested in a deeper dive into the competitive landscape, consider exploring the Competitors Landscape of Academy Sports and Outdoors.

| Metric | Details | Data (as of early 2024) |

|---|---|---|

| Institutional Ownership | Percentage of shares held by institutional investors | Substantial majority |

| Share Repurchase Program | Value of share repurchase program authorized in March 2024 | $200 million |

| IPO Date | Date of the initial public offering | October 2020 |

The focus of Academy Sports and Outdoors remains on maximizing shareholder value through operational excellence and market expansion. The company's financial performance and strategic initiatives, such as expanding its e-commerce presence and optimizing its store footprint, continue to influence investor sentiment and ownership interest. There have been no public statements about potential privatization or significant founder departures impacting ownership beyond the initial IPO.

Academy Sports' ownership has evolved significantly since its IPO. Institutional investors now hold a substantial majority of the shares. The company's stock performance and strategic initiatives influence investor sentiment.

The ownership structure has shifted from private equity to a more diversified public model. Key players include institutional investors like Vanguard and BlackRock. Share repurchase programs also impact the ownership percentages.

Recent trends include increasing institutional ownership and share buybacks. KKR, the former private equity owner, has reduced its stake. The company focuses on enhancing shareholder value through various strategies.

While there have been no major changes in the ownership structure, the company's financial performance and strategic initiatives continue to influence investor sentiment. The leadership team focuses on operational excellence and market expansion.

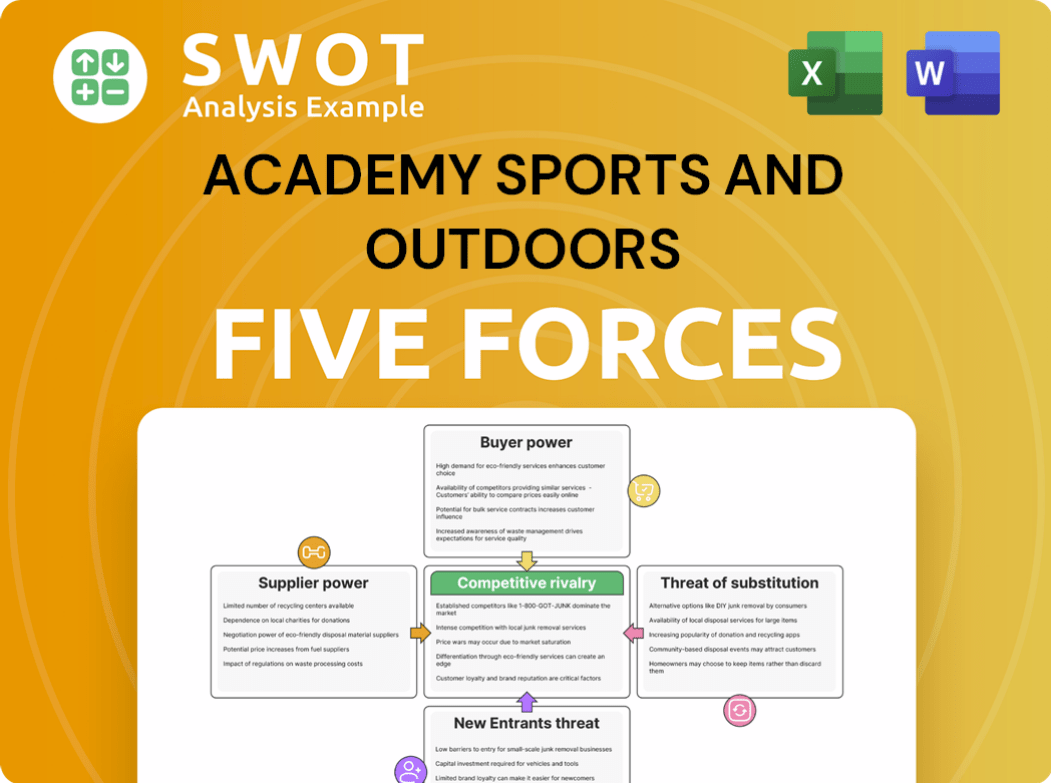

Academy Sports and Outdoors Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Academy Sports and Outdoors Company?

- What is Competitive Landscape of Academy Sports and Outdoors Company?

- What is Growth Strategy and Future Prospects of Academy Sports and Outdoors Company?

- How Does Academy Sports and Outdoors Company Work?

- What is Sales and Marketing Strategy of Academy Sports and Outdoors Company?

- What is Brief History of Academy Sports and Outdoors Company?

- What is Customer Demographics and Target Market of Academy Sports and Outdoors Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.