AIA Group Bundle

Who Really Owns AIA Group?

Unraveling the AIA Group SWOT Analysis reveals more than just market strategies; it demands a deep dive into its ownership. Understanding the AIA Group ownership structure is paramount for anyone seeking to grasp its strategic direction and financial performance. This exploration will illuminate the key players shaping the future of this financial powerhouse.

From its inception in 1919 to its current status as a publicly traded entity, the AIA Group history is interwoven with shifts in its ownership. This journey, from Cornelius Vander Starr's vision to its IPO, offers critical insights into who owns AIA and how that ownership influences its operations. Knowing the AIA Group parent company and the major shareholders provides a comprehensive understanding of its governance and long-term accountability.

Who Founded AIA Group?

The story of AIA Group's ownership begins with Cornelius Vander Starr, who founded American Asiatic Underwriters (AAU) in Shanghai, China, in 1919. Starr's vision and insurance expertise were the driving forces behind the company's early direction. Initially, Starr held complete ownership, operating under a sole proprietorship model.

As the company grew, it became part of American International Group (AIG). For a significant part of its history, what is now AIA functioned as a division or subsidiary within AIG. This meant that AIG's shareholders ultimately owned the company. Early agreements within AIG's structure determined how capital and resources were allocated to its Asian operations, which eventually evolved into AIA's various insurance offerings.

The founding vision of Starr, focused on the Asian market, was reflected in AIG's continued investment and expansion in the region through its insurance offerings that eventually became AIA. The Brief History of AIA Group offers additional context on the company's journey.

Understanding the early ownership of AIA Group is crucial for grasping its evolution.

- Initial Ownership: Cornelius Vander Starr founded the company and held complete ownership at its inception.

- AIG Integration: AIA operated as a division of AIG for many years, with AIG's shareholders as the ultimate owners.

- Focus on Asia: Starr's initial focus on the Asian market was a key factor in AIG's continued investment in the region.

- No Early External Investors: There is no public record of early external investors, suggesting Starr's sole control.

AIA Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has AIA Group’s Ownership Changed Over Time?

The most significant shift in AIA Group ownership came with its separation from American International Group (AIG). This separation was a direct response to AIG's financial challenges during the 2008 global financial crisis. The subsequent Initial Public Offering (IPO) on the Hong Kong Stock Exchange in October 2010 was a pivotal moment. This IPO, one of the largest globally at the time, raised approximately US$20.5 billion, transforming AIA from a wholly-owned subsidiary into a publicly traded company.

Following the IPO, AIA Group's structure changed, with ownership moving to institutional investors, mutual funds, and individual shareholders. The IPO marked a significant change in AIA Group history, moving away from a single parent company to a diversified shareholder base. This shift enhanced transparency and subjected AIA to greater market scrutiny and corporate governance standards, influencing its strategy towards sustainable growth and shareholder returns across its diverse Asian markets.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Separation from AIG | 2010 | Led to the IPO and public ownership. |

| Initial Public Offering (IPO) | October 2010 | Transitioned AIA to a publicly traded company with diverse shareholders. |

| Ongoing Market Activity | Late 2024 - Early 2025 | Fluctuations in ownership by institutional investors due to market dynamics. |

As of late 2024 and early 2025, major stakeholders in Who owns AIA primarily include large institutional investors. BlackRock, The Vanguard Group, and Fidelity Management & Research Company are consistently among the top institutional holders. These firms manage significant percentages of AIA's outstanding shares, often ranging from 1% to over 5% individually. For more insights into the company's strategic approach, consider reviewing the Marketing Strategy of AIA Group.

AIA Group's ownership has evolved significantly since its IPO in 2010. The shift from a subsidiary of AIG to a publicly traded company has brought in a diverse group of shareholders.

- The IPO raised approximately US$20.5 billion.

- Major shareholders include institutional investors like BlackRock and Vanguard.

- The changes have increased transparency and corporate governance.

- Founder stakes no longer exist in the traditional sense.

AIA Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on AIA Group’s Board?

The current board of directors of AIA Group Limited balances executive management, financial experts, and independent non-executive directors. This structure ensures good governance and provides oversight of executive decisions. As of early 2025, the board includes experienced professionals from finance, insurance, and regional business operations. Key figures include the Chairman of the Board and the Group Chief Executive and President. The presence of independent directors is a key aspect of the AIA Group ownership structure.

The composition of the board reflects the company's commitment to maintaining a strong and diverse leadership team. The board's decisions are made through a collective voting process, focusing on long-term shareholder value and compliance with regulations across its pan-Asian operations. This approach helps to ensure the stability and continued success of the company. For more insights, consider reading about the Growth Strategy of AIA Group.

| Board Role | Description | Key Responsibilities |

|---|---|---|

| Chairman | Oversees the board's activities. | Ensuring effective governance and leadership. |

| Group Chief Executive and President | Manages the day-to-day operations. | Implementing the company's strategic plans. |

| Independent Non-Executive Directors | Provide objective oversight. | Representing shareholder interests and ensuring accountability. |

AIA operates under a one-share-one-vote structure, which is standard for publicly listed companies. This means that each ordinary share has one voting right, so voting power directly reflects share ownership. There are no known special shares that would give any entity outsized control beyond their shareholding percentage. The company's stable performance and consistent dividend policy have likely contributed to its stability. Understanding the AIA Group ownership structure is key for investors.

AIA Group's voting structure is straightforward, with each share carrying one vote. This ensures that voting power is proportional to share ownership. This structure is common among major public companies. The company has not faced significant proxy battles, reflecting its stable governance.

- One-share-one-vote structure.

- No dual-class shares.

- Voting power proportional to shareholding.

- Stable governance and dividend policy.

AIA Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped AIA Group’s Ownership Landscape?

Over the past three to five years (2022-2025), the ownership of AIA Group has remained largely consistent as a publicly traded company, with a significant presence of institutional investors. While there hasn't been a major shift since its 2010 IPO, several trends and financial activities have shaped its ownership. A key aspect includes substantial share buyback programs, such as the US$10 billion program announced in 2022, which continued through 2023 and into 2024. These buybacks have the effect of increasing the ownership percentage of existing shareholders.

Industry trends in the insurance sector and broader financial markets also influence AIA. There's a general increase in institutional ownership in large, stable companies, as passive index funds and large asset managers continue to grow. This leads to a more consolidated yet diffuse ownership structure, where the top institutional holders collectively wield significant influence through their voting power. The ongoing share buybacks can be viewed as a form of value return to all shareholders. For more details, you can explore the Revenue Streams & Business Model of AIA Group.

AIA Group's focus remains on organic growth, strategic partnerships, and capital management, which indirectly influences its share price and, by extension, the value held by its diverse ownership base. The company's commitment to share buybacks, as seen with the US$10 billion program, demonstrates confidence in its valuation and a strategy to enhance shareholder value. As of the latest available data, AIA Group's financial performance and its impact on shareholders are key factors driving ownership dynamics.

AIA Group's shareholders primarily consist of institutional investors. These include large asset managers and passive index funds. The ownership structure is typical of a large, publicly traded company.

The ownership structure of AIA Group is characterized by a widely held public company model. There is no single controlling shareholder. The company's shares are traded on the Hong Kong Stock Exchange.

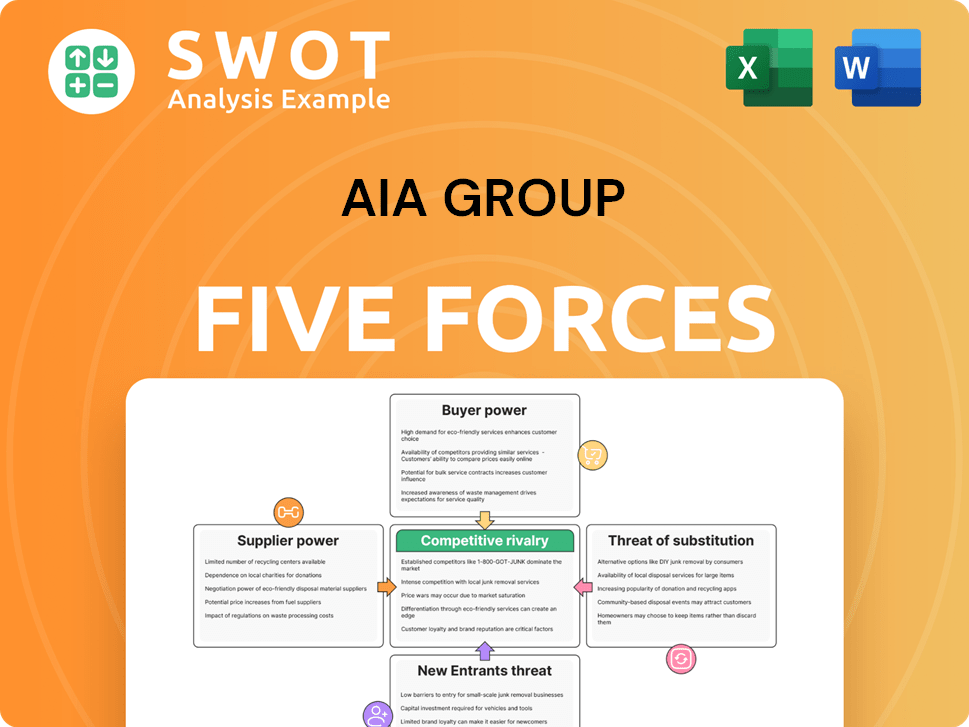

AIA Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AIA Group Company?

- What is Competitive Landscape of AIA Group Company?

- What is Growth Strategy and Future Prospects of AIA Group Company?

- How Does AIA Group Company Work?

- What is Sales and Marketing Strategy of AIA Group Company?

- What is Brief History of AIA Group Company?

- What is Customer Demographics and Target Market of AIA Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.