Amorepacific Bundle

Who Really Controls Amorepacific?

Ever wondered who steers the ship at one of the world's leading beauty giants? Understanding the Amorepacific SWOT Analysis is crucial, but knowing its ownership structure is paramount. Amorepacific, a powerhouse in the Korean beauty brands market, boasts a fascinating history and a complex ownership landscape. This deep dive will unravel the key players and their influence.

Delving into the Amorepacific ownership structure provides critical insights into the company's strategic direction and future prospects. From its roots as Pacific Chemical Co. Ltd. in 1945, founded by Sungwhan Suh, to its current status as a global leader, understanding who owns Amorepacific is essential. This analysis will explore the Amorepacific parent company, its major shareholders, and how these factors shape its operations and market strategies within the competitive landscape of Korean beauty brands.

Who Founded Amorepacific?

The story of Amorepacific, a prominent player among Korean beauty brands, began in the 1930s. Madame Dokjeong Yun, the mother of the founder, initiated the business by selling camellia oil in Kaesong village. Her son, Sungwhan Suh, later formalized the company in 1945, transforming it into a cosmetics 'chaebol' and naming it 'Taepyeongyang', which translates to 'Pacific Ocean'.

Sungwhan Suh's vision was to create beauty and health through technology and care. This led to the establishment of Korea's first cosmetics research laboratory. This focus on research and development (R&D) and innovation became a core element of the company's strategy. The company's early success was built on direct-to-consumer sales through house visits, which were very popular.

While specific equity splits from the company's inception aren't publicly available, it's clear that the founding family, particularly Sungwhan Suh, held primary ownership. The company expanded its product portfolio, launching Melody Cream in 1948 and ABC Pomade in 1951, the first plant-based pomade in South Korea. These early product introductions and the founder's commitment to quality and innovation set the stage for Amorepacific's future growth.

Madame Dokjeong Yun started the business in the 1930s. Her son, Sungwhan Suh, later established the company in 1945.

Sungwhan Suh aimed to contribute to humanity through beauty and health. This led to a focus on R&D and innovation.

The company introduced Melody Cream in 1948 and ABC Pomade in 1951. These products helped establish the company.

The Suh family held primary ownership and control. Early growth was fueled by direct-to-consumer sales.

The establishment of Korea's first cosmetics research lab was a key development. The company's commitment to quality and innovation was crucial.

The company's early focus on R&D and innovation was a key factor in its success. This focus continues to be a core part of its strategy.

Understanding who owns Amorepacific is crucial to understanding its direction. The company's history reveals a strong foundation rooted in family ownership and a commitment to innovation. Today, Amorepacific is a global company with a diverse portfolio of Amorepacific brands. For more detailed information on the company's strategic direction, you can read about the Growth Strategy of Amorepacific.

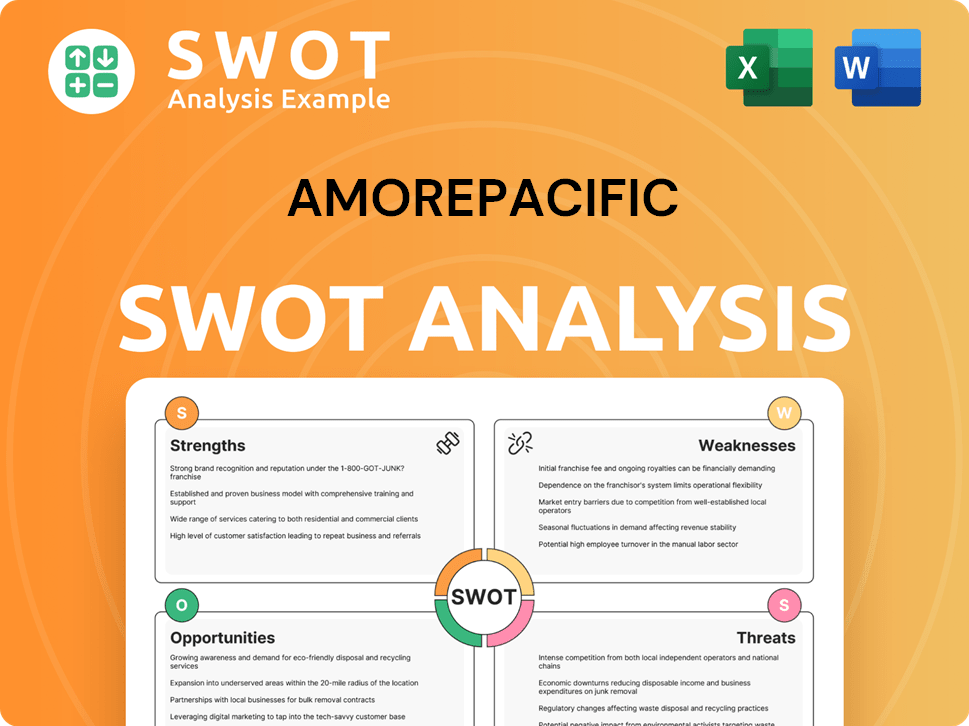

Amorepacific SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Amorepacific’s Ownership Changed Over Time?

The evolution of Amorepacific's ownership reflects its growth from a private family business to a publicly traded global entity. The company, originally founded by Sungwhan Suh, underwent significant changes, including the renaming to Amorepacific in 2002. A pivotal move was the establishment of Amorepacific Group in 2006, which adopted a holding company structure. This strategic shift aimed to bolster core business capabilities and improve corporate governance transparency, setting the stage for its expansion and the diversification of its shareholder base.

Today, the Amorepacific company is listed on the Korea Exchange (KRX: 090430), offering a window into its current ownership structure and the influence of key stakeholders. The founding family, through the Amorepacific Group, maintains a significant presence, with Kyungbae Suh, son of the founder, at the helm as Chairman and CEO since 1997. This continuity underscores the family's enduring role in shaping the company's direction, even as it navigates the complexities of the global market. This structure is key to understanding who owns Amorepacific.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Founding of the company | 1945 | Private, family-controlled |

| Renaming to Amorepacific | 2002 | Signaled a shift toward a broader market presence |

| Establishment of Amorepacific Group | 2006 | Creation of a holding company structure, strengthening corporate governance |

Institutional investors also play a crucial role in Amorepacific ownership. As of May 29, 2025, filings with the SEC revealed a substantial number of institutional owners holding a considerable number of shares. Major institutional shareholders include MFS International Growth Fund A (MGRAX), Fidelity Series Emerging Markets Opportunities Fund (FEMSX), Vanguard Total International Stock Index Fund Investor Shares (VGTSX), and iShares Core MSCI Emerging Markets ETF (IEMG). The involvement of these large-scale investment funds highlights the company's appeal to a diverse investor base and likely influences its strategic decisions, including its focus on global expansion and strengthening brand competitiveness. To learn more about the company's direction, you can explore the Target Market of Amorepacific.

Amorepacific's ownership structure is a blend of family control and institutional investment.

- The founding family, through the Amorepacific Group, maintains significant influence.

- Institutional investors hold a substantial portion of the shares.

- The company is listed on the Korea Exchange (KRX: 090430).

- Kyungbae Suh, the son of the founder, is the current Chairman and CEO.

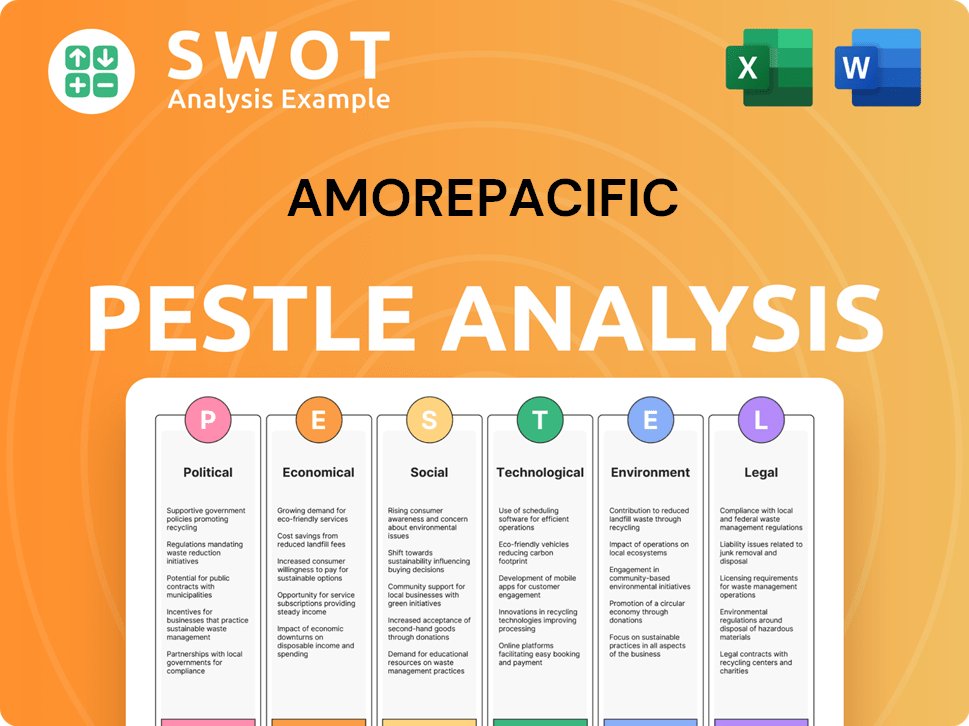

Amorepacific PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Amorepacific’s Board?

The current Board of Directors of the Amorepacific company plays a key role in its governance and strategic decisions. As of March 2024, the board is composed of both internal and independent directors. Kyungbae Suh, the Chairman and CEO, has been on the board since June 7, 2006, with his term lasting until March 15, 2027. Seunghwan Kim serves as CEO, with a term from March 17, 2023, to March 17, 2026. Other internal directors include Jong Mahn Park and Jiyoun Lee.

The independent directors include Seong Jin Jo, Hee-joon Ahn, In-a Choe, Jae Yeon Lee, Tae-jin Park, and Eui-kyung Lee. This mix of internal and independent directors helps ensure balanced governance. The continued leadership of Kyungbae Suh, son of the founder, indicates that the founding family retains significant control. The company's structure, including the holding company established in 2006, aims to enhance transparency and systematic management. Further insights into the Marketing Strategy of Amorepacific can provide additional context.

| Director | Position | Term End |

|---|---|---|

| Kyungbae Suh | Chairman & CEO | March 15, 2027 |

| Seunghwan Kim | CEO | March 17, 2026 |

| Jong Mahn Park | Vice President | N/A |

| Jiyoun Lee | Head of HERA Brand Division | N/A |

| Seong Jin Jo | Independent Director | N/A |

| Hee-joon Ahn | Independent Director | N/A |

| In-a Choe | Independent Director | N/A |

| Jae Yeon Lee | Independent Director | N/A |

| Tae-jin Park | Independent Director | N/A |

| Eui-kyung Lee | Independent Director | N/A |

Understanding Amorepacific's ownership structure involves knowing the roles of the Board of Directors and the influence of the founding family.

- Kyungbae Suh, son of the founder, is the Chairman and CEO, maintaining significant control.

- The board includes both internal and independent directors to ensure balanced governance.

- The company's structure, including the holding company, supports transparency.

- The presence of independent directors is crucial for representing a wider shareholder base.

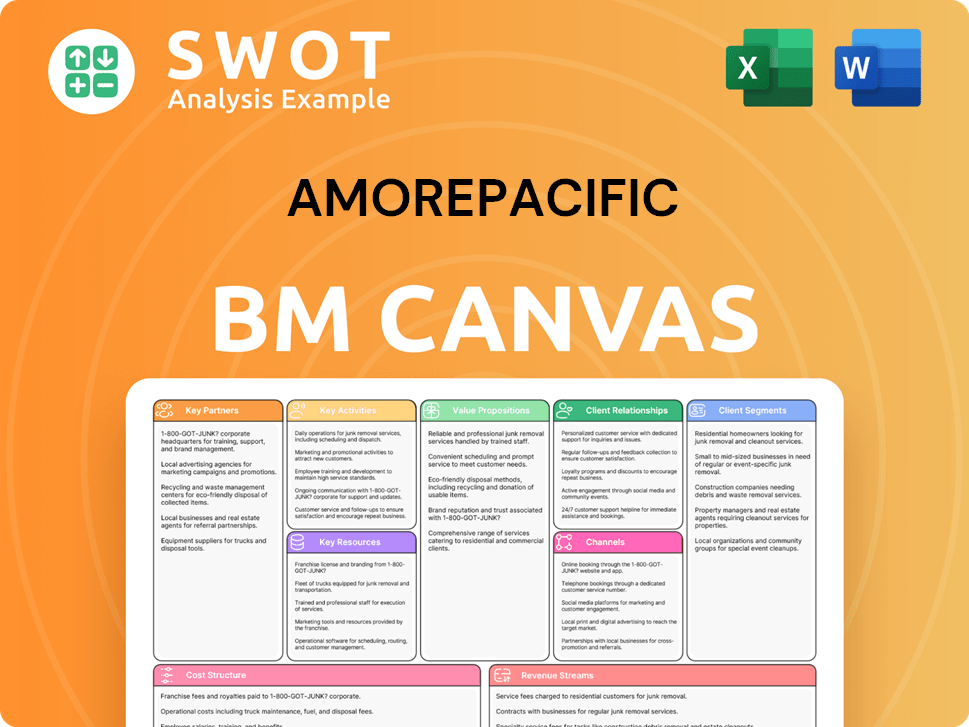

Amorepacific Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Amorepacific’s Ownership Landscape?

Over the past few years, several strategic moves have reshaped the ownership landscape of the Amorepacific company. A significant development includes the increased stake in Cosrx, a skincare brand, making it a subsidiary in October 2024. This move, along with the acquisition of Tata Harper Skincare in 2022, underscores a trend of strategic investments within the beauty industry. These acquisitions aim to strengthen market position and diversify product offerings, reflecting how Amorepacific ownership has evolved to adapt to market demands.

Financially, Amorepacific demonstrated robust performance in 2024, with sales reaching KRW 4.25 trillion (US$2.93 billion). The surge in the US market, surpassing Greater China in sales, highlights a shift towards a 'global rebalancing' strategy. This strategy, focusing on key markets like the US, Japan, Europe, India, and the Middle East, is a notable trend in Amorepacific's ownership and operational approach. The company's aim for an average annual sales growth of 10% and an operating profit margin of 12% by 2027 further indicates its strategic direction.

| Metric | Value | Year |

|---|---|---|

| Sales | KRW 4.25 trillion (US$2.93 billion) | 2024 |

| Operating Profit | KRW 249.3 billion | 2024 |

| Share Buyback | 3 million shares | February 2025 |

In February 2025, Amorepacific Group announced a share repurchase plan, targeting 3 million common shares (3.13% of issued shares). This share buyback aims to enhance corporate value and shareholder returns, which is a common practice among established companies. Leadership changes, such as Giovanni Valentini's appointment as CEO of the North America regional headquarters in June 2024, further align with the company's global strategy. These developments reflect ongoing efforts to optimize the company's structure and strengthen its presence in key international markets, influencing the dynamics of who owns Amorepacific.

The acquisition of Cosrx and Tata Harper Skincare demonstrates Amorepacific's commitment to expanding its portfolio of Korean beauty brands. These moves aim to capitalize on growing consumer interest in specialized skincare products.

The company's strong financial results in 2024, particularly in the US market, highlight the success of its global expansion strategy. This is a key factor in understanding the Amorepacific company.

The share repurchase plan indicates Amorepacific's focus on maximizing shareholder value. This strategy, along with leadership changes, reflects the company's commitment to improving its market position.

The shift away from a China-heavy model towards key markets like the US, Japan, and Europe is a central element of the company's current strategy. This will affect the future of Amorepacific and its brands.

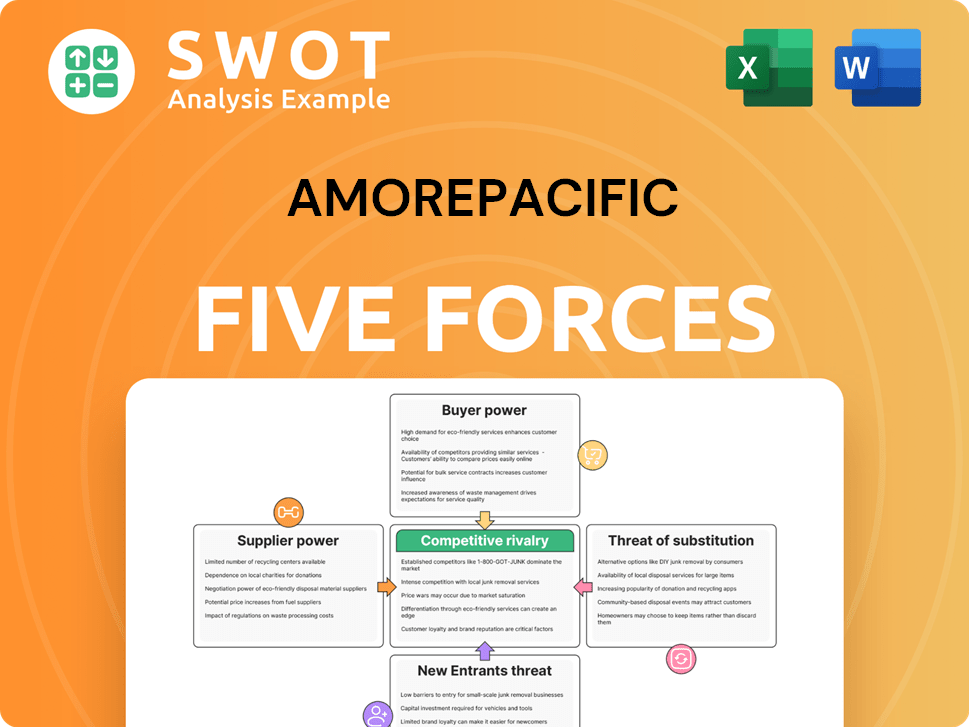

Amorepacific Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Amorepacific Company?

- What is Competitive Landscape of Amorepacific Company?

- What is Growth Strategy and Future Prospects of Amorepacific Company?

- How Does Amorepacific Company Work?

- What is Sales and Marketing Strategy of Amorepacific Company?

- What is Brief History of Amorepacific Company?

- What is Customer Demographics and Target Market of Amorepacific Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.