Avanza Externalización de Servicios Bundle

Who Really Owns Avanza Externalización de Servicios?

Understanding the Avanza Externalización de Servicios SWOT Analysis is essential for investors and strategists alike. Unveiling the Avanza ownership structure provides crucial insights into its strategic direction and long-term potential. This deep dive into Avanza company sheds light on its key stakeholders and the forces shaping its future in the dynamic BPO market.

Founded in 2003, Avanza Externalización de Servicios, a key player in the BPO sector, has experienced significant growth, reaching €150 million in revenue by 2024. This article meticulously examines the Avanza ownership, uncovering the major shareholders and any shifts in control that have influenced its trajectory. Knowing who owns Avanza is critical for anyone seeking to understand its market position and future prospects.

Who Founded Avanza Externalización de Servicios?

The foundation of Avanza Externalización de Servicios was laid in 2003 by Luis del Olmo Casalderrey. The early days saw the company focusing on establishing its presence in the business process outsourcing (BPO) sector.

While specific details on the initial ownership structure, including the exact shareholding percentages of the founders, are not publicly available, Luis del Olmo Casalderrey is acknowledged as the founder. The company started with a clear vision to provide services aimed at optimizing resources and reducing operational risks for its clients.

The company's primary focus from its inception was providing BPO services. These services encompassed consulting and outsourcing in areas such as contact center management, administrative processes, logistics, data collection, and corporate training. Early financial backers or angel investors are not explicitly detailed in the available public information. The early vision of Avanza Externalización de Servicios was to help clients optimize resources and reduce operational risk.

Avanza Externalización de Servicios, as a business, initially concentrated on offering a range of BPO services. These services were designed to support clients in various operational areas. The company's early services included:

- Contact center management.

- Administrative process outsourcing.

- Logistics support.

- Data collection and analysis.

- Corporate training programs.

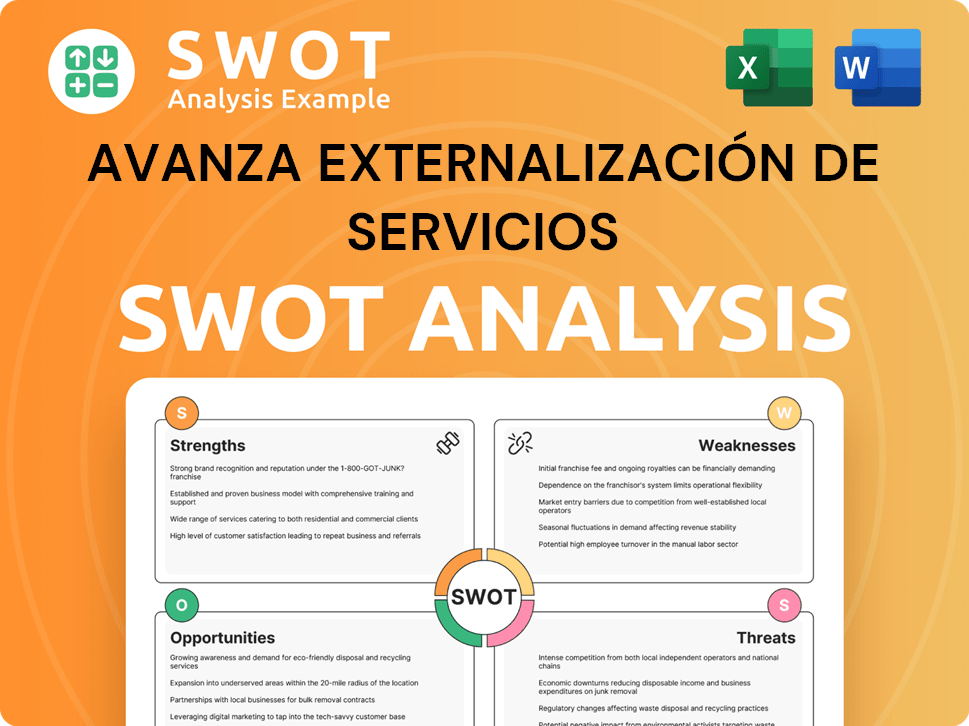

Avanza Externalización de Servicios SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Avanza Externalización de Servicios’s Ownership Changed Over Time?

The ownership structure of Avanza Externalización de Servicios has seen significant shifts, particularly highlighted by a venture round on October 28, 2012. This round saw the company secure $26 million in funding, with investments from Baring Private Equity Partners España and AXIS Participaciones Empresariales. The involvement of Baring Private Equity Partners, advised by Araoz & Rueda, marked a transition from initial founder ownership to include institutional investors. Although the exact ownership percentages of these private equity firms remain undisclosed, their investment was a pivotal moment in the evolution of Avanza's ownership, showcasing its growth and attracting external capital.

Another key event affecting the ownership of Avanza was the acquisition of its Uruguayan operations by SkyTel in late 2021, announced in January 2022. This multi-million dollar transaction led to the integration of Avanza in Uruguay with SkyTel, though it continued to operate under its existing structure. This strategic move represents a partial divestiture of Avanza's international operations. The global BPO market is projected to reach $447.6 billion by 2025, and the digital transformation market is projected to reach $767.8 billion by 2026, emphasizing the context of this acquisition within a rapidly evolving industry.

| Event | Date | Impact on Ownership |

|---|---|---|

| Venture Round | October 28, 2012 | Baring Private Equity Partners España and AXIS Participaciones Empresariales invested $26 million. |

| Acquisition of Uruguayan Operations | Late 2021 (announced January 2022) | SkyTel acquired Avanza's operations in Uruguay. |

| Market Growth | 2025/2026 | The global BPO market is projected to reach $447.6 billion by 2025, and the digital transformation market is projected to reach $767.8 billion by 2026. |

Avanza Externalización de Servicios, categorized as a privately held company, has evolved its ownership structure through strategic investments and acquisitions. The involvement of private equity firms and the sale of its Uruguayan operations to SkyTel demonstrate the company's adaptability within the competitive business landscape. Understanding the Competitors Landscape of Avanza Externalización de Servicios provides additional context to these strategic moves and the broader market dynamics impacting Avanza ownership.

The company's ownership has been shaped by key financial events, including venture capital investments and strategic acquisitions.

- Venture round in 2012 with investments from Baring Private Equity Partners España and AXIS Participaciones Empresariales.

- Acquisition of Uruguayan operations by SkyTel in late 2021.

- The global BPO market is projected to reach $447.6 billion by 2025.

- The digital transformation market is projected to reach $767.8 billion by 2026.

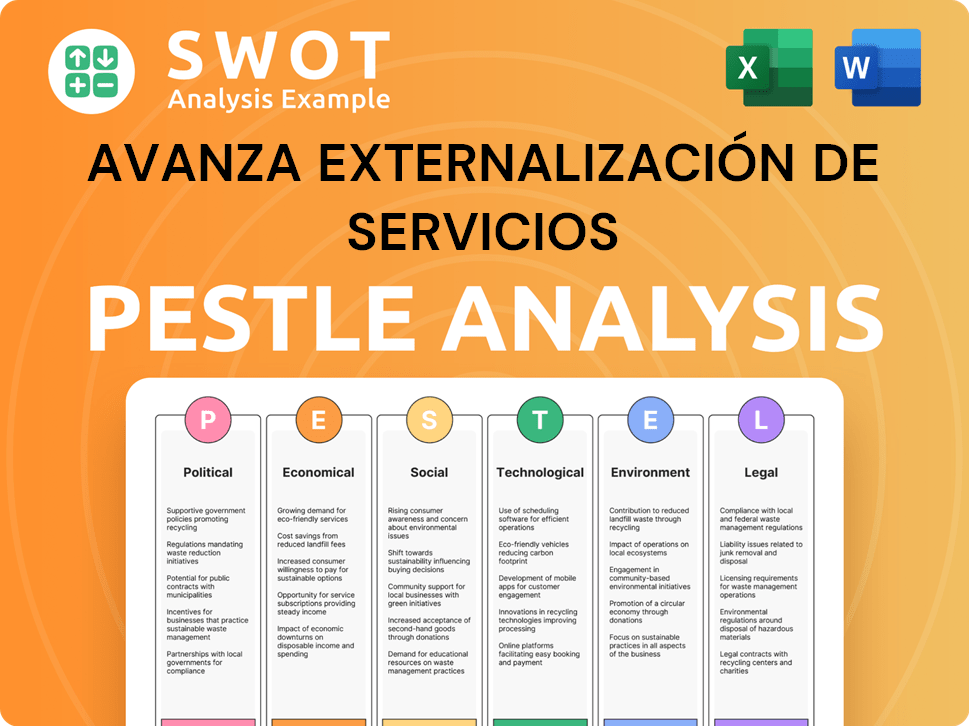

Avanza Externalización de Servicios PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Avanza Externalización de Servicios’s Board?

The current board of directors for Avanza Externalización de Servicios includes Álvaro Álvarez-Alonso Plaza as Chairman. He is also the founder of Ibermer and has held a position as an Independent Director at Bankinter SA since 2019. Eugeni Terré Ohme is another director, also associated with Inverpyme SCR. Carlos Ubaldo Moreno Martin serves as the CEO of Avanza Externalización de Servicios.

Understanding the complete Avanza ownership structure requires examining the composition of the board and the distribution of voting power among shareholders. Further details on the specific voting structure are not readily available in the provided information. Information about the company's financial reports and investor relations can provide more insight into the ownership.

| Board Member | Title | Additional Information |

|---|---|---|

| Álvaro Álvarez-Alonso Plaza | Chairman | Founder of Ibermer, Independent Director at Bankinter SA (since 2019) |

| Eugeni Terré Ohme | Director | Associated with Inverpyme SCR |

| Carlos Ubaldo Moreno Martin | CEO |

The available information does not detail the specific voting structure or any individuals or entities with outsized control due to special voting rights or golden shares. For more context, reading the Brief History of Avanza Externalización de Servicios can be beneficial.

The board of directors includes key figures like Álvaro Álvarez-Alonso Plaza and Carlos Ubaldo Moreno Martin.

- Álvaro Álvarez-Alonso Plaza is the Chairman and founder of Ibermer.

- Carlos Ubaldo Moreno Martin is the CEO.

- Further details on the voting structure are currently unavailable.

- Additional information can be found in the company's financial reports.

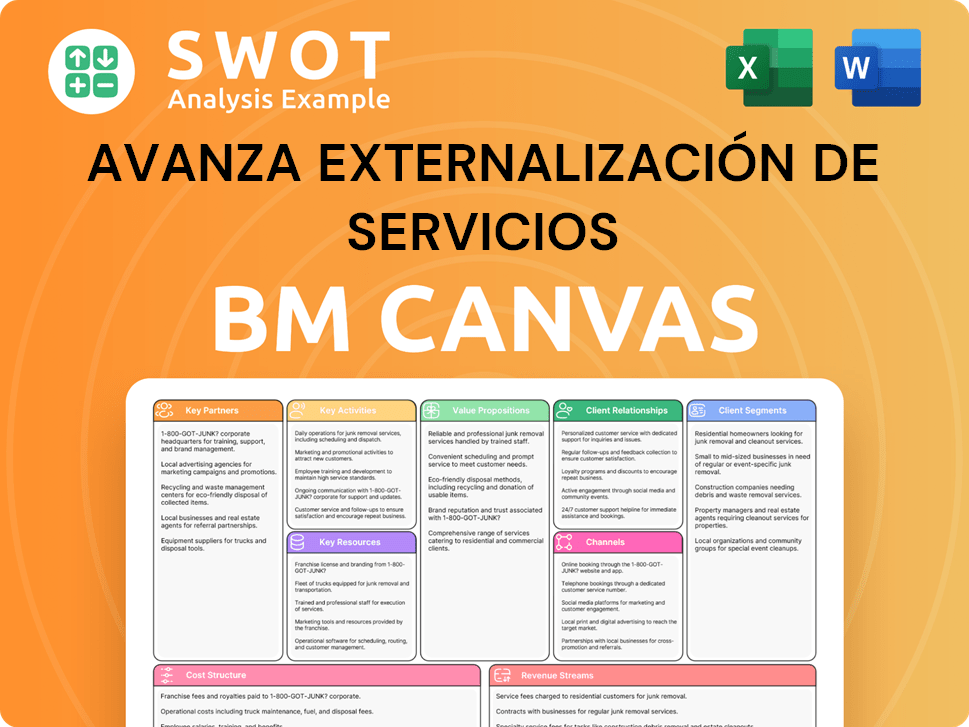

Avanza Externalización de Servicios Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Avanza Externalización de Servicios’s Ownership Landscape?

Over the past few years, Avanza Externalización de Servicios has demonstrated a consistent focus on its core business of Business Process Outsourcing (BPO) services, with a significant emphasis on digital transformation. This strategic direction has been evident in the company's integration of advanced technologies, including Artificial Intelligence (AI), Big Data, and Machine Learning, aimed at enhancing operational efficiency and improving client experiences. Investments in technology infrastructure saw a 20% increase in 2024, reflecting the company's commitment to staying at the forefront of technological advancements within the BPO sector. The global BPO market is projected to reach $447.5 billion in 2024, with an impressive Compound Annual Growth Rate (CAGR) of 9.1% from 2024 to 2032, indicating substantial growth potential for companies like Avanza.

A key trend influencing the company's trajectory is the increasing adoption of digital transformation across various industries. This market is projected to reach $767.8 billion by 2026. Avanza's strategic moves, such as the 2024 acquisition of AGRUPALIA, have broadened its service offerings and enhanced its market position. Furthermore, the company has expanded its international footprint, with a 15% increase in international contracts in 2024. This growth underscores the success of its expansion strategy across regions including Spain, Portugal, and Latin America. The BPO sector as a whole experienced a 7% growth in 2024. Companies with strong talent management practices reported a 15% higher client retention rate, highlighting the importance of employee development and retention in the competitive BPO landscape.

Understanding the ownership structure of Avanza Externalización de Servicios is crucial for investors and stakeholders. Analyzing the major shareholders and their influence provides insights into the company's strategic direction and financial stability. Information on Avanza's ownership structure is vital for assessing its long-term prospects.

Key personnel, including the CEO and other executives, play a significant role in shaping the company's strategy and performance. Knowing the key personnel provides insights into the leadership's experience and their vision for the future. Information about the key personnel is available in the company's annual reports and investor relations materials.

The financial performance of Avanza is a critical indicator of its success and stability. Analyzing financial reports, including revenue, profit margins, and key financial ratios, helps investors assess the company's financial health. Avanza's financial reports provide detailed information about the company's financial performance.

Strategic partnerships and acquisitions are important for expanding service offerings and market reach. These collaborations can enhance Avanza's capabilities and competitive position. Information on strategic partnerships and acquisitions can be found in the company's press releases and investor communications.

Avanza Externalización de Servicios Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Avanza Externalización de Servicios Company?

- What is Competitive Landscape of Avanza Externalización de Servicios Company?

- What is Growth Strategy and Future Prospects of Avanza Externalización de Servicios Company?

- How Does Avanza Externalización de Servicios Company Work?

- What is Sales and Marketing Strategy of Avanza Externalización de Servicios Company?

- What is Brief History of Avanza Externalización de Servicios Company?

- What is Customer Demographics and Target Market of Avanza Externalización de Servicios Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.