Bose Bundle

Who Really Controls Bose?

Ever wondered about the driving force behind the iconic sound of Bose? The question of "Who owns Bose Company?" goes beyond a simple name, revealing the very core of its innovation and strategic direction. Unlike many tech giants, Bose Corporation operates under a unique ownership model that has significantly shaped its journey. Understanding the Bose SWOT Analysis is crucial to understanding its market position.

Delving into the Bose ownership structure unveils a fascinating narrative, shaped by its founder, Amar G. Bose, and his commitment to audio excellence. This article will dissect the Bose company's history, exploring how its private status has influenced its product development, market strategies, and overall success. Discovering who owns Bose is key to understanding its past decisions and anticipating its future in the dynamic audio technology landscape.

Who Founded Bose?

The Bose Corporation was established in 1964. The company's origins are rooted in the vision of its founder, Amar G. Bose, an electrical engineer and professor at MIT. His academic background significantly influenced the company's early focus on research and development.

Initially, the ownership of the Bose company was largely concentrated with Dr. Bose. There isn't much publicly available information regarding the exact equity splits or the percentage of shares held by other individuals when the company started. This suggests a highly concentrated ownership structure, with Dr. Bose at the forefront.

Early on, Bose didn't seek external venture capital or angel investors. This decision allowed Dr. Bose to maintain significant control over the company's direction and product development. This approach fostered a culture of long-term investment in research rather than short-term profit maximization.

The initial ownership of Bose Corporation was primarily held by its founder, Amar G. Bose. This concentrated ownership allowed for a focus on long-term research and development.

- Amar G. Bose held the vast majority of the company's equity.

- There is no publicly available data on specific equity splits or shareholding percentages for other individuals at the company's inception.

- The company's early focus was on research and development due to Dr. Bose's background.

- The company did not seek external investors, allowing Dr. Bose to maintain control.

Bose SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Bose’s Ownership Changed Over Time?

The Bose company has a unique ownership structure, remaining privately held throughout its history. This structure shields it from the typical market pressures faced by publicly traded companies. The most pivotal moment in the Bose ownership occurred with the passing of its founder, Amar G. Bose, in 2013.

In 2011, Dr. Bose made a significant decision by bequeathing the majority of the non-voting shares of Bose Corporation to the Massachusetts Institute of Technology (MIT). This gift, revealed after his death, established MIT as the primary beneficiary of these shares, ensuring the company's profits would support MIT's educational and research endeavors. The voting shares, which control the company's operations, are held by a trust. This arrangement allows Bose to prioritize long-term innovation and philanthropic contributions over short-term financial gains.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Amar G. Bose's Bequest | 2011 (announced post-2013) | MIT became the primary beneficiary of non-voting shares. |

| Amar G. Bose's Death | 2013 | Formalized the transfer of non-voting shares to MIT. |

| Ongoing Operations | Present | Voting shares held by a trust, ensuring operational control. |

The current major stakeholders include MIT, as the beneficiary of non-voting shares, and the trust holding the voting shares. This structure supports the company's strategic direction, focusing on long-term innovation and philanthropic goals. This approach is a key part of the Bose history. Learn more about the Target Market of Bose.

Who owns Bose? The company is primarily owned by MIT through non-voting shares, with operational control held by a trust. This unique structure ensures that the company's profits support MIT's educational and research mission.

- MIT holds the majority of non-voting shares.

- A trust controls the voting shares.

- Bose remains a privately held company.

- Focus on long-term innovation and philanthropic contributions.

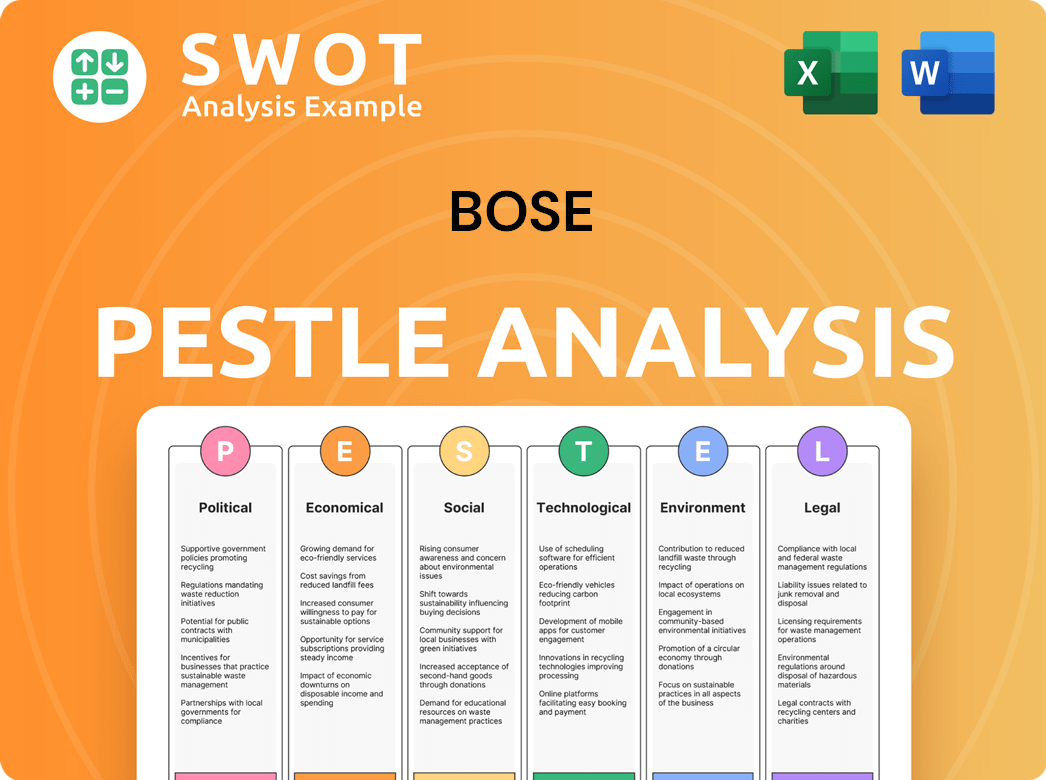

Bose PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Bose’s Board?

The current board of directors at Bose Corporation operates under a unique governance structure. This structure is significantly shaped by the company's private ownership and its ties to the Massachusetts Institute of Technology (MIT). While the specific composition of the board and their direct representation of major shareholders are not publicly available in the same detail as for publicly traded companies, it is understood that the voting shares, held by a trust, are key to controlling the company. The board's role is to guide the company's strategic direction and ensure the founder's vision is upheld.

The voting structure at Bose does not follow the typical 'one-share-one-vote' model seen in public companies. There are no publicly known dual-class shares or golden shares beyond the division between voting and non-voting shares. This structure allows the trust holding the voting shares to maintain significant control, ensuring the company aligns with its long-term goals and the philanthropic intentions of Dr. Amar Bose. As a private entity, Bose Corporation is not subject to the proxy battles or activist investor campaigns common in public markets. This insulation allows the board and leadership to focus on long-term research and product development, without the pressures of short-term financial results or external shareholder demands.

| Aspect | Details | Impact |

|---|---|---|

| Ownership Structure | Private, with voting shares held by a trust. | Protects against short-term pressures, enabling long-term strategic focus. |

| Board of Directors | Guides strategic direction, upholds founder's vision. | Ensures alignment with the company's core values and long-term objectives. |

| Public Market Influence | Not subject to proxy battles or activist investor campaigns. | Frees the company to prioritize research and development over quarterly earnings. |

The Bose company is privately held, with a unique ownership structure that grants significant control to a trust holding the voting shares. This structure helps maintain the founder's vision and allows for a focus on long-term goals. The company is not subject to the pressures of public markets, such as proxy battles.

- The founder, Dr. Amar Bose, established the company's unique structure.

- The trust holding voting shares ensures long-term strategic focus.

- Bose Corporation is not publicly traded.

- This structure supports innovation and long-term research and development.

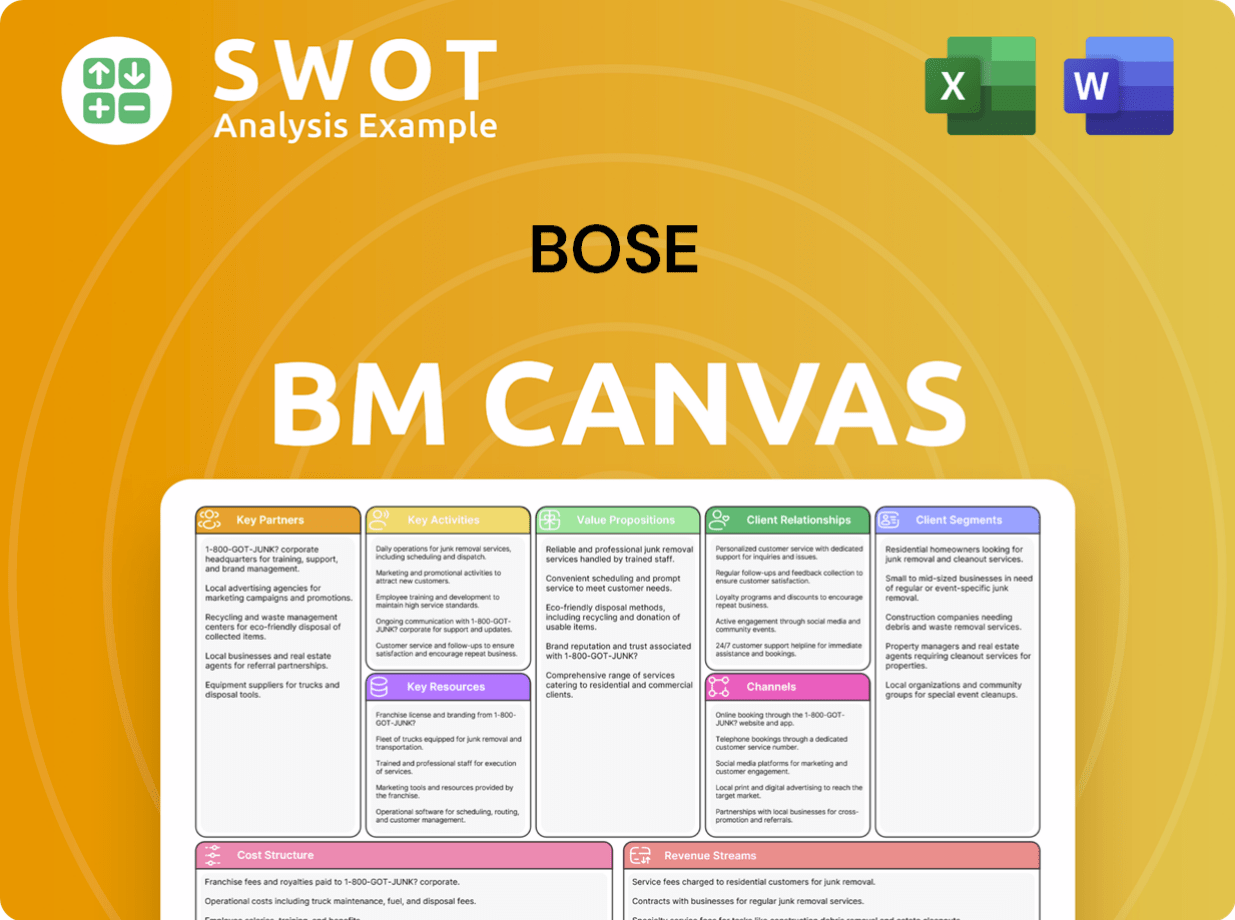

Bose Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Bose’s Ownership Landscape?

Over the past few years, the ownership structure of the Bose Corporation has remained consistent. As a privately held company, there haven't been significant changes like public share offerings or shifts in ownership. The unique arrangement, where MIT benefits from non-voting shares and a trust controls voting rights, has been maintained. This structure provides stability, insulating the company from the acquisition pressures often faced by public entities.

Recent developments at Bose have focused on product innovation and strategic partnerships rather than ownership changes. The company continues to introduce new audio products and expand its market presence. While there may be internal leadership or board adjustments, these do not typically alter the foundational ownership model. The company's private status means it is not subject to public statements about future ownership changes or potential privatization. The trend of consolidation in the audio industry certainly impacts the competitive landscape, but Bose's ownership structure provides a degree of insulation.

| Aspect | Details | Status |

|---|---|---|

| Ownership Type | Private | Ongoing |

| Key Stakeholders | MIT (beneficiary of non-voting shares), Trust (voting control) | Consistent |

| Recent Changes | Limited to product innovation and strategic partnerships | Ongoing |

Bose remains a privately held company, a fact that has shaped its trajectory and strategic decisions. Understanding the Marketing Strategy of Bose provides insights into how a privately-owned entity navigates the market.

Bose is privately held, with MIT and a trust playing key roles in the ownership. This structure has remained consistent, providing stability. This arrangement differs significantly from publicly traded companies.

Focus has been on product innovation and strategic partnerships. No major ownership changes have occurred recently. The company continues to expand its presence in various markets.

Not subject to public pressures for short-term gains. Provides insulation from immediate acquisition threats. Allows for long-term strategic planning and innovation.

Consolidation in the audio industry continues through mergers and acquisitions. Bose's private status offers protection. This structure provides a degree of stability and independence.

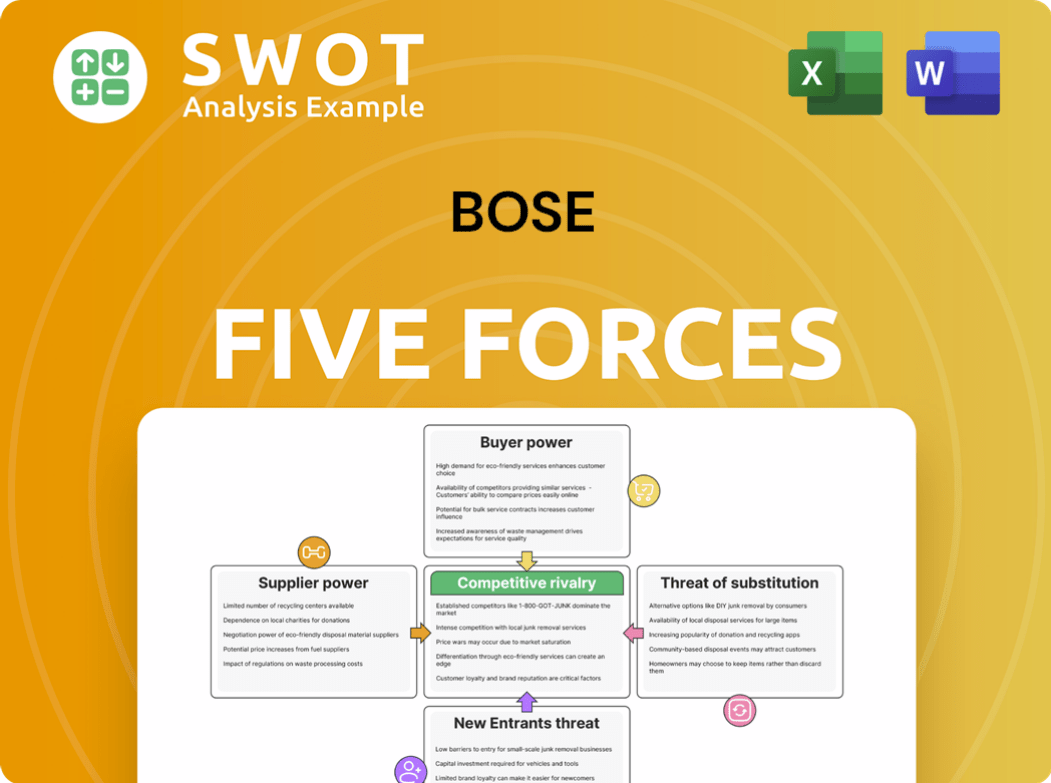

Bose Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bose Company?

- What is Competitive Landscape of Bose Company?

- What is Growth Strategy and Future Prospects of Bose Company?

- How Does Bose Company Work?

- What is Sales and Marketing Strategy of Bose Company?

- What is Brief History of Bose Company?

- What is Customer Demographics and Target Market of Bose Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.