Brinker International Bundle

Who Really Owns Brinker International?

Ever wondered who's truly steering the ship at Chili's Grill & Bar and Maggiano's Little Italy? The ownership structure of Brinker International, the parent company, is a key factor in understanding its strategic moves and future prospects within the competitive restaurant industry. From its origins as Chili's Grill & Bar to its current status as a global dining powerhouse, the story of Brinker International is a fascinating study in corporate evolution.

Understanding the dynamics of Brinker International SWOT Analysis, from its founders to its current stakeholders, is essential for anyone seeking to understand the company's trajectory. This exploration will dissect the evolution of Brinker International's ownership, revealing the key players and their influence on the company's performance, including both Chili's Grill & Bar and Maggiano's Little Italy. This analysis will provide crucial insights into the restaurant ownership landscape.

Who Founded Brinker International?

The story of Brinker International begins with Larry Lavine, who launched the first Chili's Grill & Bar in Dallas, Texas, in March 1975. Initially called Chili's Bar & Grill, Inc., and later Chili's Inc., Lavine aimed to create a casual dining experience featuring hamburgers at affordable prices in a relaxed setting. This concept proved successful, leading to the expansion of Chili's, with 22 more restaurants opening in the late 1970s and early 1980s.

A significant turning point occurred in 1983 when Norman E. Brinker acquired Chili's Inc. Brinker, a prominent figure in the restaurant industry with experience at Jack-in-the-Box and as the founder of Steak & Ale, took the company public in 1984. The company was then transformed into Brinker International, Inc. in 1991. While specific equity splits at the beginning are not readily available, Brinker's acquisition and the subsequent IPO were crucial in establishing the company's ownership structure as a publicly traded entity. Norman Brinker, who stepped down as company chairman in 2000, passed away in June 2009.

Today, Brinker International is a publicly traded company, and its ownership is distributed among institutional investors, mutual funds, and individual shareholders. Understanding the evolution of Brinker International's growth strategy helps to appreciate how the company has navigated changes in the restaurant industry.

Here are some key points regarding the ownership of Brinker International and its brands:

- 1975: Larry Lavine opens the first Chili's Grill & Bar.

- 1983: Norman E. Brinker acquires Chili's Inc.

- 1984: Brinker takes the company public.

- 1991: The company becomes Brinker International, Inc.

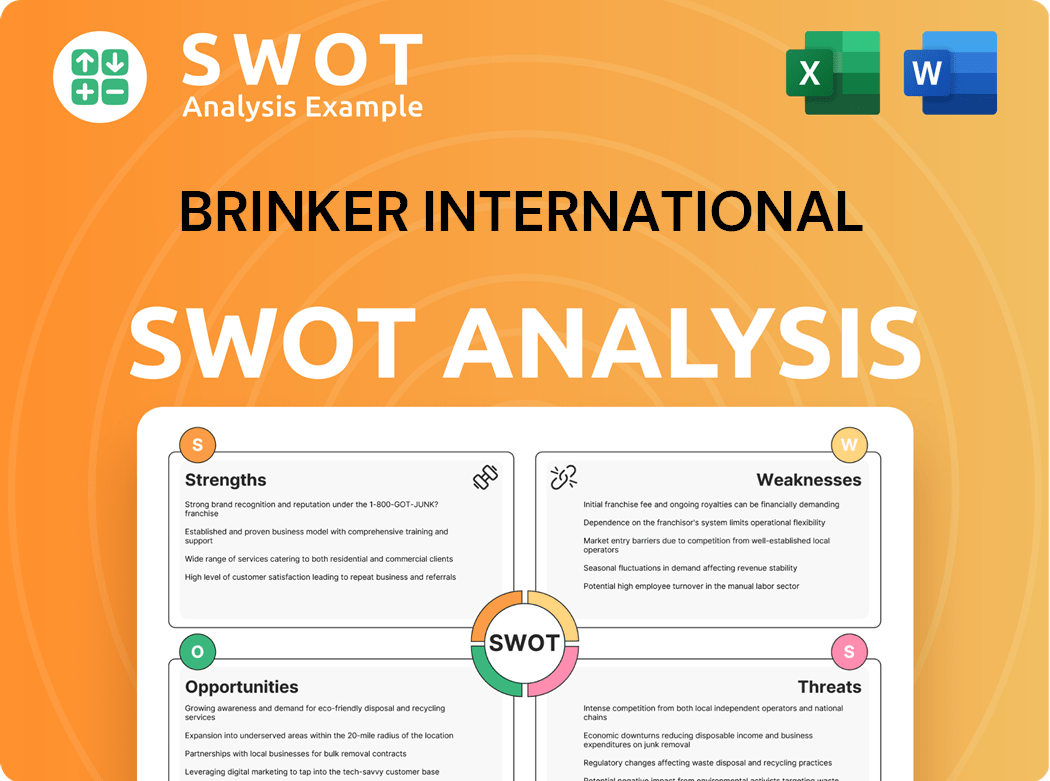

Brinker International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Brinker International’s Ownership Changed Over Time?

The journey of Brinker International (NYSE: EAT) from its inception to its current status as a publicly traded entity has been marked by significant shifts in ownership. Initially, the company was privately held. It went public in 1984, and its stock began trading on the New York Stock Exchange in 1990. This transition opened the door for a diverse ownership structure, with institutional investors gradually gaining prominence. The company's evolution reflects broader trends in the restaurant industry, where public ownership often fuels expansion and strategic initiatives.

As of April 2025, Brinker International boasts a substantial number of institutional owners, totaling 803 shareholders who have filed with the SEC. These entities collectively hold a significant portion of the company's shares, demonstrating the influence of institutional investors. The company's history, including its strategic decisions and financial performance, has been shaped by the dynamics of its ownership structure.

| Shareholder | Shares Held (as of March 31, 2025) | Percentage of Ownership (Approximate) |

|---|---|---|

| BlackRock, Inc. | 7,094,203 | Data Not Available |

| Vanguard Group Inc. | 4,965,829 | Data Not Available |

| Fmr LLC | 3,382,590 | Data Not Available |

The major stakeholders in Brinker International, including prominent institutional investors, significantly influence the company's strategic direction and governance. For instance, The Vanguard Group, Inc. increased its stake by 63,399 shares in Q4 2024, and BlackRock Fund Advisors increased its stake by 102,646 shares in Q4 2024. These adjustments reflect shifts in sentiment and strategic alignment. The company's capital allocation and acquisitions of franchisee operations are often influenced by these major investors, impacting the growth of brands like Chili's Grill & Bar and Maggiano's Little Italy.

The ownership structure of Brinker International, with its mix of institutional investors, insiders, and public shareholders, plays a crucial role in shaping the company's trajectory.

- Institutional investors hold a significant portion of the company's stock.

- Insiders, including executive management, hold a smaller but notable stake.

- Public companies and individual investors account for a portion of the ownership.

- The influence of these stakeholders affects company strategy and governance.

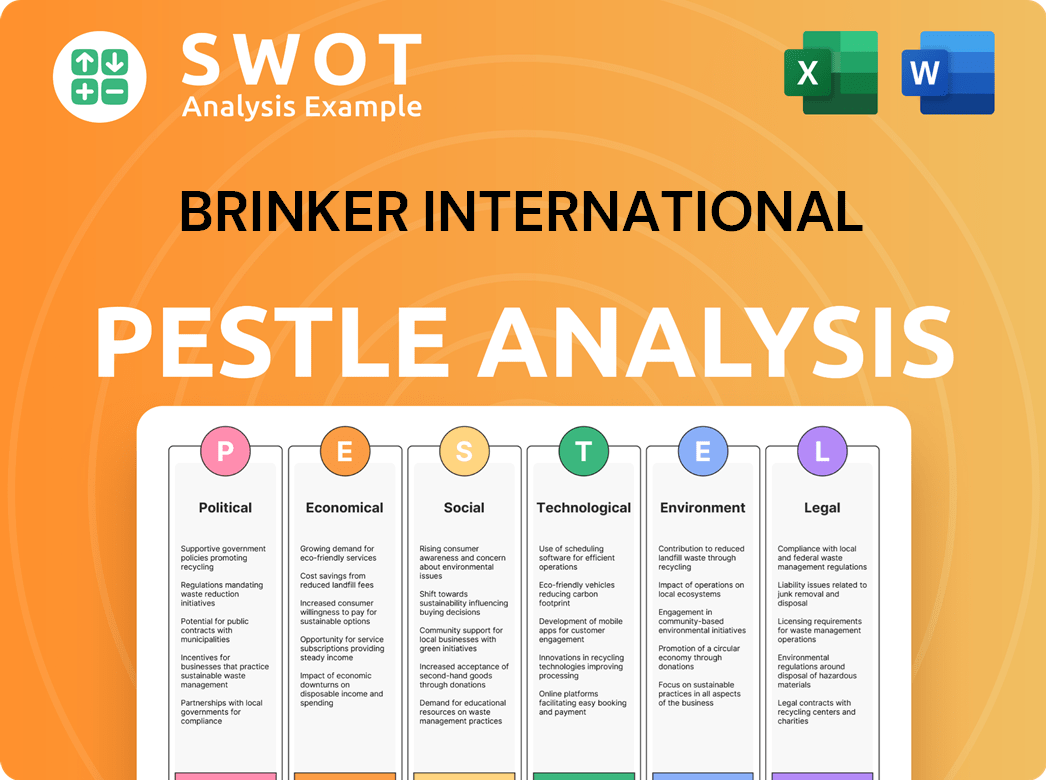

Brinker International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Brinker International’s Board?

The Board of Directors at Brinker International oversees the company's strategic direction and governance. As of February 2025, the board welcomed Timothy (TJ) Johnson. Frank Liberio, a technology expert, joined the board in July 2024. Joseph Michael DePinto serves as the Independent Chairman. Kevin Hochman holds the positions of President, Chief Executive Officer, and Director. Mika Ware, appointed as SVP and Chief Financial Officer on June 27, 2024, and Aaron M. White, promoted to Executive Vice President, Chief Operating Officer, and Chief People Officer on May 7, 2025, also play key roles.

Douglas H. Brooks is noted as the largest individual shareholder, holding 506,645 shares, representing 1.14% of the company as of 2025. The board's composition includes a mix of major shareholders, management, and independent voices, contributing to the oversight of restaurant brands like Chili's Grill & Bar and Maggiano's Little Italy. The company's structure ensures that voting power is generally proportionate to the number of shares held, providing a clear framework for shareholder influence.

| Board Member | Title | Notes |

|---|---|---|

| Joseph Michael DePinto | Independent Chairman of the Board | |

| Kevin Hochman | President, Chief Executive Officer, and Director | |

| Mika Ware | SVP and Chief Financial Officer | Appointed June 27, 2024 |

Brinker International operates under a one-share-one-vote structure. Insiders hold approximately 1.7% of the company's stock as of June 2025. Recent insider selling activity includes Joseph Michael DePinto selling approximately $1.7 million in shares in June 2025. For more insights into the competitive environment, consider exploring the Competitors Landscape of Brinker International.

Voting power at Brinker International is primarily determined by share ownership, reflecting a standard one-share-one-vote system. This structure ensures that shareholder influence aligns with the number of shares held.

- Douglas H. Brooks is the largest individual shareholder, owning 1.14% of the company.

- Insiders collectively hold about 1.7% of the stock.

- Recent insider transactions, like DePinto's share sale, are noted.

- The board includes independent directors and key executives.

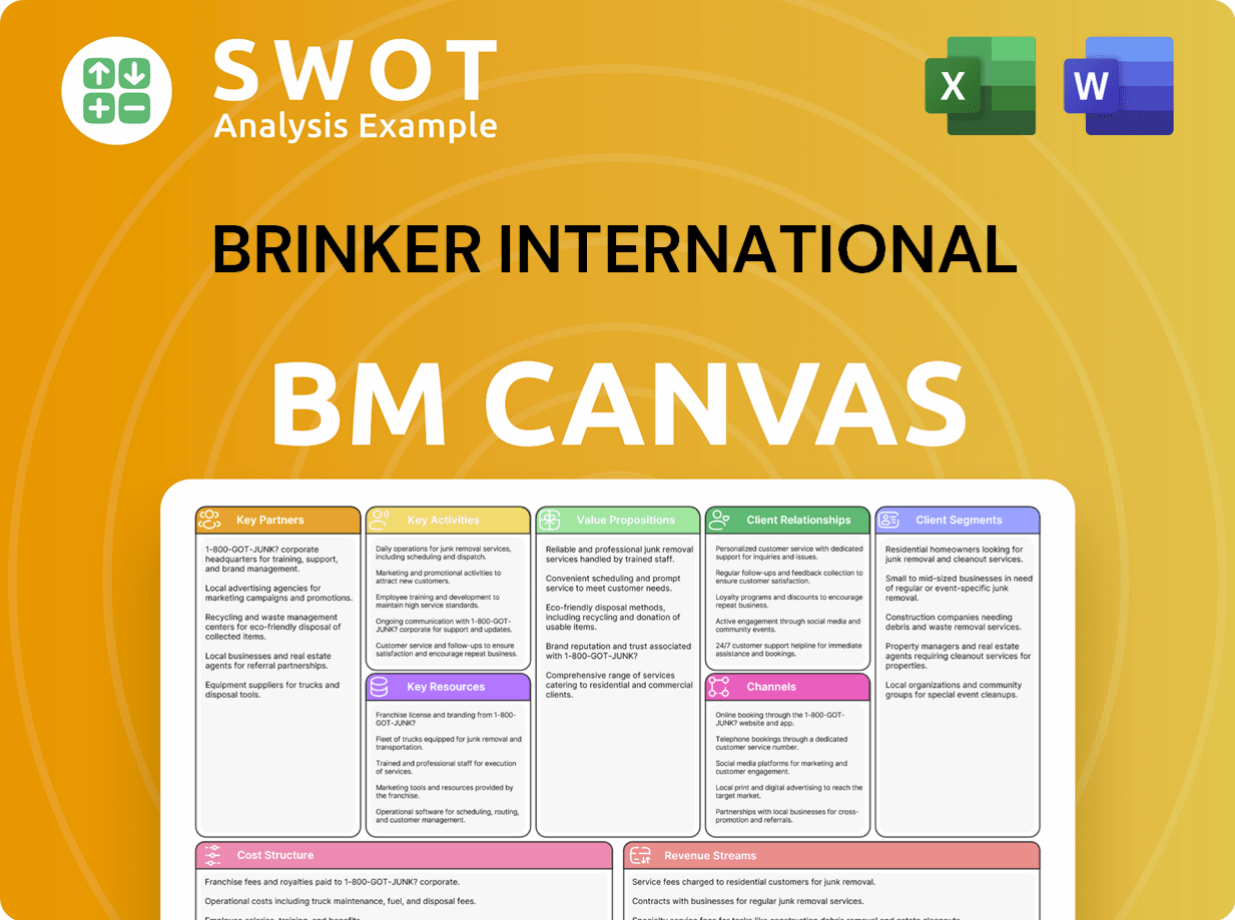

Brinker International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Brinker International’s Ownership Landscape?

Over the past few years, Brinker International has seen shifts in its executive leadership, reflecting broader industry trends. Kevin Hochman was appointed CEO and President in June 2022. More recently, Joe Taylor, the EVP and Chief Financial Officer, retired at the end of fiscal year 2024 (June 2024), and Mika Ware succeeded him, effective June 27, 2024. Additionally, Aaron M. White was promoted to Executive Vice President, Chief Operating Officer, and Chief People Officer on May 7, 2025. These changes indicate a strategic focus on operations and financial management within the company, which owns both Chili's Grill & Bar and Maggliano's Little Italy.

In terms of ownership, institutional investors remain a significant force. As of April 2025, institutional investors held a total of 58,326,982 shares, and as of May 2025, institutional holdings were reported at 103.73% of total shares. Major institutional investors like BlackRock, Inc., and Vanguard Group Inc continue to hold substantial positions. While institutional ownership has generally been high, there have been some minor decreases in holdings by 3.1890% in May 2025 and 3.5244% in April 2025. Insider holdings have remained relatively stable, at around 1.58% to 2.10% in early 2025, though there has been some insider selling activity. To learn more about the company's background, you can read a Brief History of Brinker International.

| Ownership Category | April 2025 | May 2025 |

|---|---|---|

| Institutional Ownership | 58,326,982 shares | 103.73% of total shares |

| Insider Holdings | 1.58% - 2.10% | N/A |

| Mutual Fund Holdings | Fluctuating | Fluctuating |

The company's financial performance and strategic initiatives continue to influence investor sentiment and ownership. For fiscal year 2025, total revenues are expected to be between $5.33 billion and $5.35 billion, with net income per diluted share (excluding special items) expected between $8.50 and $8.75. The focus remains on driving sustainable growth and enhancing shareholder value, as outlined in the fiscal 2024 annual report.

Institutional investors hold a majority stake, with holdings exceeding 100% due to reporting methods. Insider ownership is relatively stable. The company's performance and strategic initiatives influence investor decisions.

Kevin Hochman became CEO in June 2022, with recent appointments including Mika Ware as CFO and Aaron M. White as COO and Chief People Officer. These changes signal a focus on operational and financial optimization.

Fiscal year 2025 revenue is projected to be between $5.33 billion and $5.35 billion. Net income per diluted share (excluding special items) is expected to be between $8.50 and $8.75. These figures impact investor sentiment.

The restaurant industry sees increased institutional ownership. The influence of major institutional investors and the focus on shareholder value are critical for companies like Brinker International, which owns Chili's and Maggiano's.

Brinker International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Brinker International Company?

- What is Competitive Landscape of Brinker International Company?

- What is Growth Strategy and Future Prospects of Brinker International Company?

- How Does Brinker International Company Work?

- What is Sales and Marketing Strategy of Brinker International Company?

- What is Brief History of Brinker International Company?

- What is Customer Demographics and Target Market of Brinker International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.