Culligan International Bundle

Who Really Owns Culligan International?

Understanding the ownership structure of Culligan International is key to grasping its strategic direction and future prospects in the booming water treatment market. With the global water treatment industry valued at approximately $320 billion in 2024 and projected to reach $450 billion by 2029, knowing who controls a major player like Culligan is crucial. The company's evolution from its 1936 founding to its current global presence is a fascinating story of business and investment.

From its humble beginnings, Culligan International, initially known as Culligan Zeolite Company, has become a world leader in water softening and filtration. The Culligan International SWOT Analysis provides a deep dive into the company's strengths, weaknesses, opportunities, and threats, offering valuable insights. This exploration will uncover the details of Culligan ownership, including its major stakeholders and recent ownership trends, to help you understand the Culligan company's strategic focus and market position. Key questions to consider include: Who is the owner of Culligan International, and what does this mean for the future of water treatment?

Who Founded Culligan International?

The story of Culligan International begins with its founder, Emmett J. Culligan, in 1936. He launched the Culligan Zeolite Company, marking the start of a significant player in the water treatment industry. This initial venture laid the groundwork for what would become a global brand.

Emmett Culligan's vision was supported by his family. His brother, Dr. John M. Culligan, and his sister, Anna V. Culligan, provided financial backing. His brothers, Dr. John and Leo Culligan, were also partners in the early stages. The company's humble beginnings in a blacksmith shop reflect its innovative spirit.

Emmett's ingenuity was key to the company's early success. He developed a water filter using simple materials, which demonstrated the water-softening capabilities that would define Culligan's products. This innovation set the stage for the company's growth and expansion.

In 1938, Culligan opened its first franchised dealership in Wheaton, Illinois. This was followed by another in Hagerstown, Maryland. This marked the beginning of Culligan's franchise model.

Emmett Culligan dissolved the partnership with his brothers in 1945 and incorporated a new company. He remained president until 1950.

In 1950, Harold Werhane became president, while Emmett Culligan transitioned to chairman of the board. This marked a shift in leadership.

The company's name evolved over time. It changed to Culligan, Incorporated in 1962 and then to Culligan International Company in 1970.

The name change to Culligan International Company reflected its growing global reach. This expansion was key to its success.

Specific details on early equity splits or investor stakes beyond the initial family financing are not publicly available. The focus remains on the company's growth.

The early years of Culligan International, from its founding by Emmett J. Culligan to its expansion through franchising, set the stage for its future. The company's evolution, marked by leadership changes and name adjustments, reflects its growth and adaptation in the water treatment industry. For more details on the company's history, see Brief History of Culligan International.

Culligan's early ownership involved Emmett Culligan and his family. The company's initial investment was modest, but its impact was significant. The franchise model played a crucial role in Culligan's expansion.

- Founded in 1936 by Emmett J. Culligan.

- Initial investment of $50.

- First franchise opened in 1938.

- Name changed to Culligan International Company in 1970.

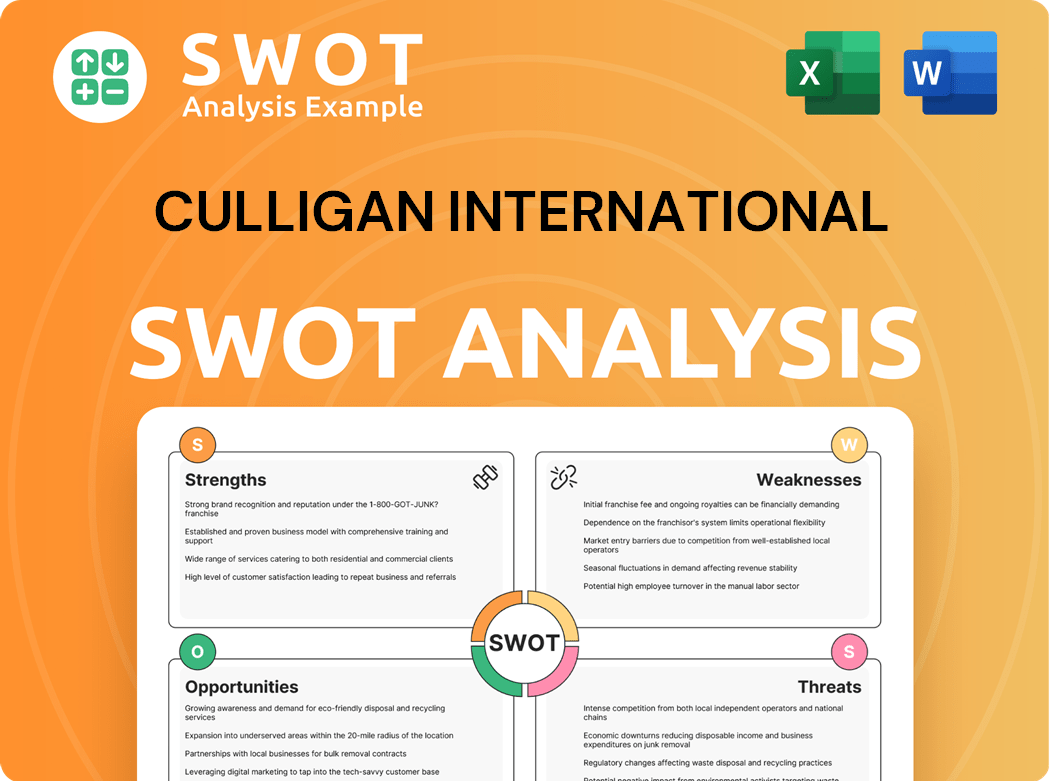

Culligan International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Culligan International’s Ownership Changed Over Time?

The ownership of Culligan International has seen significant shifts over the years, primarily influenced by private equity firms. Initially part of Culligan, Incorporated, and later Culligan International Company, it was acquired by Beatrice Foods in 1978. Subsequently, it was spun off and went through several ownership changes, including acquisitions by American Brands, United States Filter, and Vivendi. These changes reflect the dynamic nature of the water treatment industry and the strategic interests of various investment groups.

A major turning point occurred in 2021 when BDT Capital Partners acquired a majority stake in Culligan International. This transaction involved the acquisition from private equity investors Advent International and Centerbridge Partners. Mubadala Capital also provided significant capital, highlighting the growing interest in water solutions. In early 2022, Culligan combined with Waterlogic Group Holdings, with BDT Capital Partners and its co-investors becoming the majority shareholders of the combined entity, showcasing the consolidation within the water treatment sector.

| Year | Event | Owner |

|---|---|---|

| 1978 | Acquired by | Beatrice Foods |

| 1986 | Spun off into | E-II Holdings |

| 1988 | Acquired by | American Brands, Incorporated |

| 1995 | Spun off | Riklis Family Corporation |

| 1998 | Acquired by | United States Filter |

| 1999 | Acquired by | Vivendi |

| 2003 | Acquired by | Clayton, Dubilier & Rice |

| 2012 | Acquired by | Centerbridge Partners |

| 2021 | Majority stake acquired by | BDT Capital Partners |

| 2022 | Combined with | Waterlogic Group Holdings |

Currently, Culligan International's growth strategy is influenced by its private equity backing. Key investors include BDT & Company (Private Equity), Mubadala Capital, Torreal, and Advent International. The company's ownership structure reflects a focus on long-term value creation within the water filtration and water treatment markets, supported by substantial capital commitments from major investment firms.

The ownership of Culligan International has evolved significantly, primarily involving private equity firms.

- BDT Capital Partners currently holds a majority stake.

- Mubadala Capital and Advent International are also key investors.

- The company's structure reflects strategic shifts and industry consolidation.

- The current focus is on expanding water treatment solutions.

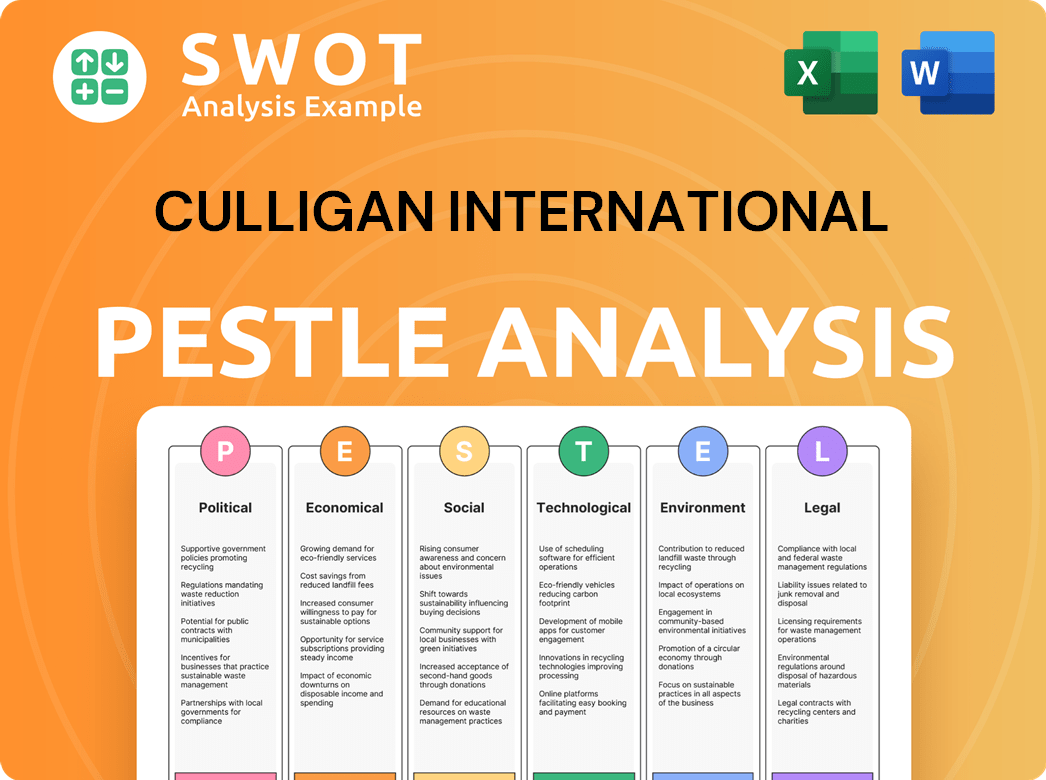

Culligan International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Culligan International’s Board?

Understanding the ownership structure of Culligan International involves examining its board of directors and voting power, which are not publicly disclosed like those of a public company. As a privately held entity, the specifics of its board composition and voting rights are not readily available. However, it is known that BDT Capital Partners holds a significant stake, alongside other private equity firms such as Advent International, Mubadala Capital, and Castik Capital, which acquired Waterlogic. These major investors likely have representation on Culligan's board.

The board's composition likely reflects the interests of these major shareholders, with a focus on strategic growth and operational efficiency. Scott Clawson serves as President and CEO of Culligan International. Following the combination with Waterlogic, Jeremy Ben-David, the founder and former Group CEO of Waterlogic, now serves as CEO of the Europe, Middle East and Africa region for Culligan and is a member of the Executive Leadership of Culligan Global. The voting structure would generally align with equity ownership, although specific arrangements are not publicly detailed for private companies.

| Board Member | Title | Affiliation |

|---|---|---|

| Scott Clawson | President and CEO | Culligan International |

| Jeremy Ben-David | CEO, EMEA region | Culligan International |

| Representatives | Board Members | BDT Capital Partners, Advent International, Mubadala Capital, Castik Capital |

The primary focus of the board is to oversee strategic initiatives and ensure operational efficiency, driven by the influence of the private equity firms. The voting power is generally aligned with the proportion of equity ownership, though specific details about voting arrangements remain private. The board's decisions are critical for the company's future, particularly in areas such as water treatment and water filtration.

Culligan International is privately held, with BDT Capital Partners as a major stakeholder.

- The board includes representatives from major investment firms.

- Scott Clawson is the President and CEO.

- Jeremy Ben-David is the CEO of the EMEA region.

- Voting power generally aligns with equity ownership.

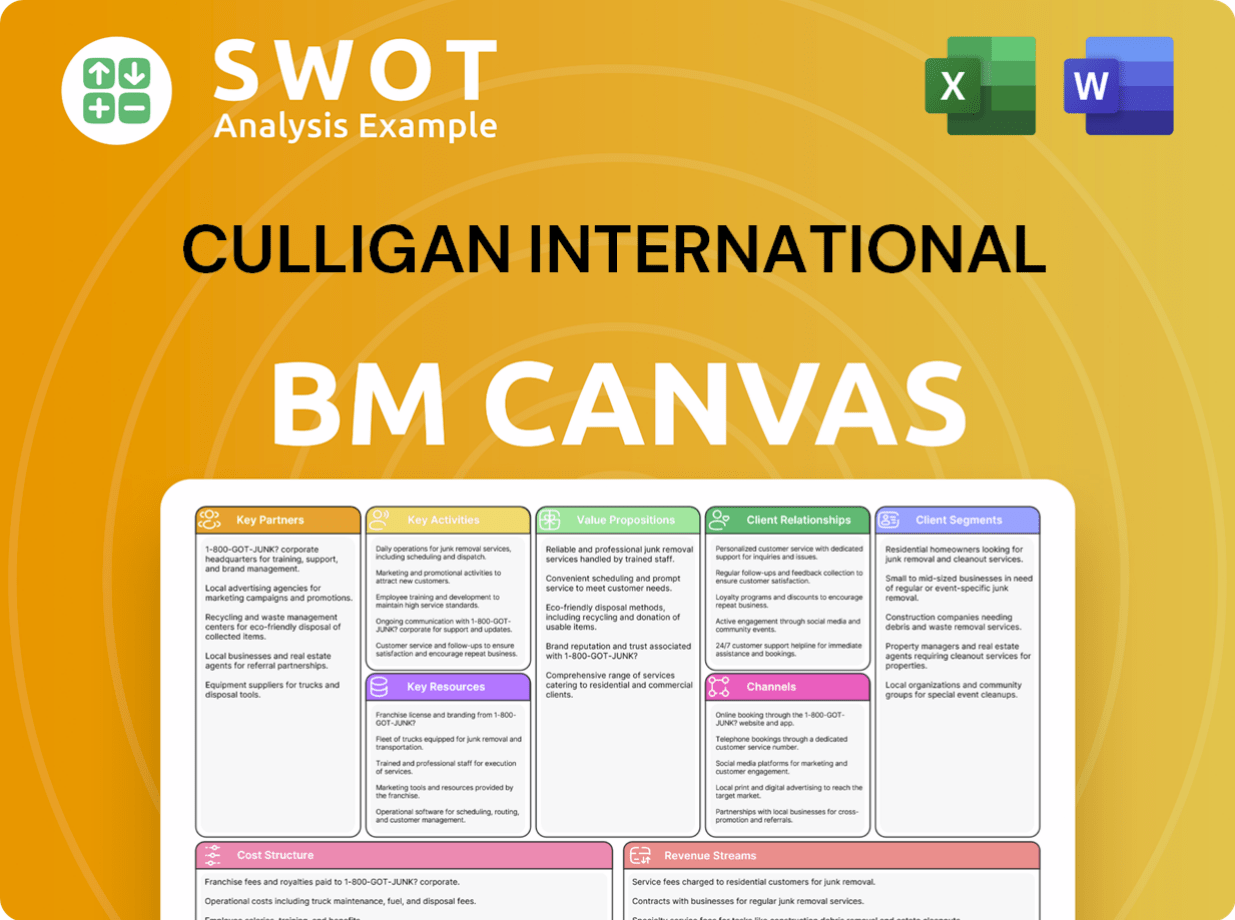

Culligan International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Culligan International’s Ownership Landscape?

Over the past few years, Culligan International has seen significant shifts in its ownership structure and strategic direction. In May 2021, BDT Capital Partners acquired a majority stake in the company from Advent International and Centerbridge Partners, with Advent reinvesting for a minority stake. This deal valued Culligan at roughly $6 billion, including debt. These changes reflect the company's growth strategy and its response to industry trends within the water treatment sector.

Further developments include the December 2022 combination of Culligan International with Waterlogic Group Holdings, creating a leader in sustainable drinking water solutions. The combined entity operates under the Culligan name, boasting over 11,000 employees and combined annual revenues of approximately $2.4 billion at the time. More recently, in June 2024, Grundfos acquired Culligan's Commercial & Industrial division in Europe, which had a turnover of over €100 million in 2023. Furthermore, in November 2023, Culligan agreed to acquire Primo Water Corporation's European business in an all-cash transaction valued at up to $575 million. These moves highlight Culligan's focus on refining its business segments and expanding its market presence.

| Event | Date | Details |

|---|---|---|

| Acquisition by BDT Capital Partners | May 2021 | BDT Capital Partners acquired a majority stake; valuation approximately $6 billion. |

| Combination with Waterlogic Group Holdings | December 2022 | Created a leader in sustainable drinking water solutions. |

| Divestiture of Commercial & Industrial division (Europe) | June 2024 | Sold to Grundfos; division had over €100 million in turnover in 2023. |

| Acquisition of Primo Water Corporation's European business | November 2023 | All-cash transaction valued up to $575 million. |

Culligan's current strategy involves active acquisitions, with plans to close five to ten deals in the first quarter of 2025, as stated by CEO Scott Clawson in December 2024. The company is especially focused on expanding its footprint in Latin America and has longer-term goals to enter Southeast Asian markets. These strategic moves are in line with the overall trends in the water treatment industry, which is experiencing increased institutional ownership and consolidation. The global water treatment market, valued at $320 billion in 2024, is projected to reach $450 billion by 2029, with the water softener market alone expected to hit $6.8 billion by 2033. This growth underscores the importance of

BDT Capital Partners currently holds a majority stake in Culligan International. The company has undergone several ownership changes and strategic acquisitions in recent years. These changes reflect the company's growth strategy and its response to industry trends.

Significant moves include the acquisition of Waterlogic Group Holdings and the divestiture of the Commercial & Industrial division in Europe. Culligan is actively pursuing bolt-on acquisitions across all segments, with a focus on international expansion. The company is focused on expanding its footprint in Latin America and has longer-term goals to enter Southeast Asian markets.

The water treatment market is experiencing significant growth. The global water treatment market was valued at $320 billion in 2024 and is projected to reach $450 billion by 2029. The water softener market is expected to reach $6.8 billion by 2033, highlighting the demand for sustainable water solutions.

Culligan plans to continue its acquisition strategy, with several deals planned for 2025. The company's focus on sustainability and ESG aligns with growing consumer demand. This strategic direction positions the company for continued growth in the evolving water treatment market.

Culligan International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Culligan International Company?

- What is Competitive Landscape of Culligan International Company?

- What is Growth Strategy and Future Prospects of Culligan International Company?

- How Does Culligan International Company Work?

- What is Sales and Marketing Strategy of Culligan International Company?

- What is Brief History of Culligan International Company?

- What is Customer Demographics and Target Market of Culligan International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.