Schenker-Joyau SAS Bundle

Who Really Calls the Shots at Schenker-Joyau SAS?

Unraveling the Schenker-Joyau SAS SWOT Analysis is just the beginning; the true power lies in understanding its ownership. Knowing who owns Schenker-Joyau SAS is paramount for anyone seeking to navigate the complexities of the French logistics market. This knowledge is crucial for making informed decisions in today's dynamic business environment.

The Schenker-Joyau SAS ownership structure profoundly impacts its strategic direction, making it a critical area of focus for investors and competitors alike. The Schenker-Joyau company, a key player in Schenker-Joyau France, has a fascinating ownership history that influences its competitive edge. This analysis will delve into the Schenker-Joyau SAS ownership details, providing a comprehensive overview of the company's shareholders and its overall structure.

Who Founded Schenker-Joyau SAS?

Determining the exact founders and initial ownership structure of Schenker-Joyau SAS requires delving into the company's history and its relationship with DB Schenker. Information regarding the early stages of Schenker-Joyau SAS ownership is not widely available in public records. However, understanding the context of its parent company, DB Schenker, provides valuable insights into the potential ownership dynamics.

The origins of DB Schenker, which has a significant impact on the structure of Schenker-Joyau SAS, can be traced back to 1872 when Gottfried Schenker established Schenker & Co. in Vienna, Austria. This historical background suggests that the early ownership of entities that would eventually form part of the DB Schenker network, including potentially Joyau before its integration, likely involved private or family ownership, typical of businesses during that period.

The current ownership of Schenker-Joyau SAS is closely linked to DB Schenker, a global logistics giant. This structure suggests a consolidation under a larger corporate entity, moving away from a fragmented early ownership model. The evolution of ownership reflects the growth and integration within the logistics industry.

Early ownership of Schenker-Joyau SAS, before its integration, likely involved private or family ownership.

DB Schenker's history, dating back to 1872, provides context for understanding Schenker-Joyau SAS's ownership.

The current structure of Schenker-Joyau SAS points towards consolidation under DB Schenker.

The evolution of ownership reflects the growth and integration within the logistics industry.

Early backers, angel investors, or friends and family likely used private agreements.

While specific early ownership disputes are not publicly detailed, such events are common.

The early stages of Schenker-Joyau SAS, like many companies, may have involved private agreements among founders and early investors. These agreements often included vesting schedules and buy-sell clauses to manage ownership transfers. While specific details about the early ownership of Schenker-Joyau SAS are not readily available, understanding the broader context of DB Schenker's history and the typical practices in the logistics industry provides valuable insights. For more information on the target market of Schenker-Joyau SAS, you can read the article: Target Market of Schenker-Joyau SAS. The logistics sector, including companies like Schenker-Joyau SAS, continues to evolve, with market sizes experiencing fluctuations. The global logistics market was valued at approximately $10.6 trillion in 2023, and it is projected to reach $14.5 trillion by 2027. This growth underscores the importance of understanding the ownership and structure of key players in this dynamic industry.

Understanding the ownership of Schenker-Joyau SAS involves considering its history and connection to DB Schenker.

- Early ownership likely involved private or family ownership.

- The current structure reflects consolidation under DB Schenker.

- Early agreements may have included vesting schedules and buy-sell clauses.

- The logistics market is experiencing significant growth, highlighting the importance of understanding ownership structures.

Schenker-Joyau SAS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Schenker-Joyau SAS’s Ownership Changed Over Time?

The Schenker-Joyau SAS ownership structure is fundamentally shaped by its integration into the global DB Schenker network. This means that the ultimate owner of Schenker-Joyau SAS is the German state, through Deutsche Bahn AG, the parent company of DB Schenker. The acquisition and integration of Joyau into DB Schenker's operations marked a significant shift in its ownership, transitioning it from a potentially private or localized entity to part of a large, state-owned multinational corporation. This transition has implications for governance, moving from potential individual or private equity interests to a corporate parent structure.

The Schenker-Joyau SAS company operates within the vast logistics network of DB Schenker. This structure means that decisions regarding investment, expansion, and strategic direction for Schenker-Joyau France are likely made at the DB Schenker global level. The financial performance of Schenker-Joyau SAS is consolidated into Deutsche Bahn's annual reports, providing transparency on the overall financial health and strategic direction of the parent entity. As of 2024, DB Schenker reported strong financial results within Deutsche Bahn's mobility and logistics segments, highlighting the strategic importance of its global operations.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Acquisition of Joyau by DB Schenker | Transition from potentially private or localized ownership to part of a state-owned multinational. | Historical |

| Integration into DB Schenker's Global Network | Alignment with DB Schenker's strategic goals and financial reporting. | Ongoing |

| Deutsche Bahn's Strategic Oversight | Strategic decisions and investments are influenced by the parent company, the German state. | Ongoing |

The major stakeholders are within Deutsche Bahn, specifically the divisions and strategic units that oversee DB Schenker's global operations. The Schenker-Joyau shareholders are indirectly the German state. For more insights into the strategic direction of DB Schenker, you can explore the Growth Strategy of Schenker-Joyau SAS. The financial performance of DB Schenker, including its subsidiaries like Schenker-Joyau SAS, is consolidated into Deutsche Bahn's annual reports, providing transparency on the overall financial health and strategic direction of the parent entity. In 2024, DB Schenker's revenue increased, reflecting its strong market position and operational efficiency.

The ownership of Schenker-Joyau SAS is vested in the German state through Deutsche Bahn.

- DB Schenker's global operations influence Schenker-Joyau SAS strategic decisions.

- Financial performance is reported within Deutsche Bahn's consolidated results.

- Major stakeholders are within Deutsche Bahn's strategic units.

- The acquisition by DB Schenker was a key event in shaping ownership.

Schenker-Joyau SAS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Schenker-Joyau SAS’s Board?

The Board of Directors for Schenker-Joyau SAS, as a subsidiary of DB Schenker, is primarily influenced by its parent company's structure. The board likely includes representatives appointed by DB Schenker to ensure alignment with the global strategy. These individuals represent the interests of the major shareholder, which is DB Schenker, and ultimately, Deutsche Bahn.

The management board or executive committee of Schenker-Joyau SAS focuses on day-to-day operations and strategic implementation within the French market. However, the overarching strategic direction and oversight come from DB Schenker and Deutsche Bahn. The voting structure is a one-share-one-vote system, with DB Schenker holding nearly all the voting power. This structure ensures that decisions are made through internal corporate hierarchies, with strategic directives flowing from Deutsche Bahn to DB Schenker and then to its subsidiaries like Schenker-Joyau SAS.

| Board Member | Role | Affiliation |

|---|---|---|

| To be confirmed | Chief Executive Officer | Schenker-Joyau SAS |

| To be confirmed | Chief Financial Officer | Schenker-Joyau SAS |

| To be confirmed | Representative | DB Schenker |

Understanding the Growth Strategy of Schenker-Joyau SAS requires recognizing that Schenker-Joyau SAS's operations are closely tied to DB Schenker's overall objectives. The board's composition reflects this, with key appointments designed to ensure that local operations support the broader corporate goals set by the parent company, Deutsche Bahn. This structure is typical for wholly-owned subsidiaries, where strategic decisions are centralized and aligned with the parent company's vision.

Schenker-Joyau SAS is a subsidiary of DB Schenker, which is wholly owned by Deutsche Bahn AG. This structure means that Deutsche Bahn has complete control over Schenker-Joyau SAS.

- DB Schenker's influence is paramount in the governance of Schenker-Joyau SAS.

- The board of directors includes representatives from DB Schenker.

- All strategic decisions are aligned with the goals of Deutsche Bahn.

- There are no external shareholders or public listings for Schenker-Joyau SAS.

Schenker-Joyau SAS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Schenker-Joyau SAS’s Ownership Landscape?

The most significant recent development concerning Schenker-Joyau SAS ownership, and the broader logistics landscape in 2024-2025, centers on the potential sale of its parent company, DB Schenker, by Deutsche Bahn AG. This has been a major topic of discussion within the industry, impacting the strategic direction of subsidiaries like Schenker-Joyau SAS. Deutsche Bahn's exploration of selling DB Schenker aims to reduce its debt and focus on its core railway operations. This potential shift represents the most substantial ownership trend affecting Schenker-Joyau SAS, potentially leading to a complete change in its ultimate beneficial owner.

Industry trends in logistics ownership, including Schenker-Joyau SAS, feature increased institutional ownership in public logistics firms, consolidation through mergers and acquisitions, and strategic investments by private equity firms capitalizing on strong demand for supply chain solutions. If DB Schenker is sold, a major logistics player, a large private equity firm, or a consortium of investors is likely to acquire it. This acquisition would significantly alter the strategic direction and operational focus of Schenker-Joyau SAS, aligning it with the new parent company's vision. As of early 2025, while no definitive sale has been announced, the ongoing evaluation of bids indicates Deutsche Bahn's clear intention to change the ownership of its logistics arm, which would reshape the ownership of Schenker-Joyau SAS. You can find more about the company in the Brief History of Schenker-Joyau SAS.

| Aspect | Details | Impact on Schenker-Joyau SAS |

|---|---|---|

| Parent Company | Deutsche Bahn AG | Controls strategic decisions and financial resources |

| Potential Sale | Deutsche Bahn exploring sale of DB Schenker | Could lead to new ownership and strategic shifts |

| Ownership Trends | Increased institutional ownership, M&A activity | May influence the strategic direction |

The potential sale of DB Schenker, and therefore its subsidiary Schenker-Joyau SAS, is driven by Deutsche Bahn's need to reduce debt, which stood at approximately €20 billion in 2024. The logistics industry is experiencing a surge in mergers and acquisitions, with deal values reaching billions of euros. Private equity firms are actively investing in logistics, aiming to capitalize on the growing demand for supply chain solutions. The ongoing process of evaluating bids and potential buyers indicates a clear intent by Deutsche Bahn to alter the ownership landscape of its logistics arm, which would reshape the ownership of Schenker-Joyau SAS.

The potential sale of DB Schenker by Deutsche Bahn is the primary driver of ownership changes.

Increased institutional investment and M&A activity are reshaping logistics ownership.

Deutsche Bahn aims to reduce its significant debt through the potential sale.

The sale could lead to a new owner for Schenker-Joyau SAS, altering its strategy.

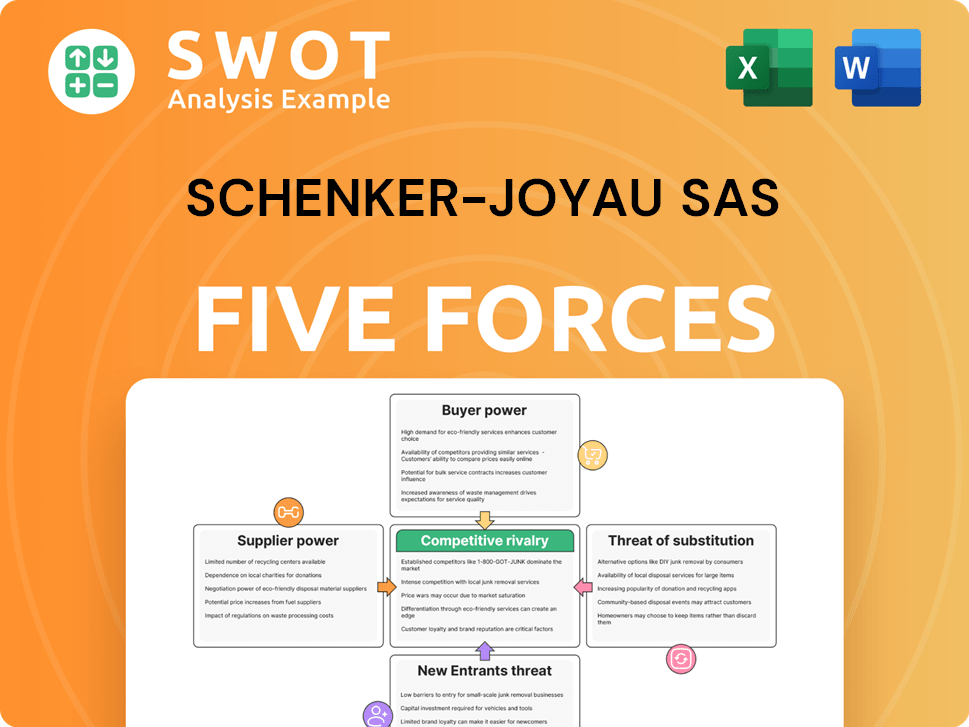

Schenker-Joyau SAS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Schenker-Joyau SAS Company?

- What is Competitive Landscape of Schenker-Joyau SAS Company?

- What is Growth Strategy and Future Prospects of Schenker-Joyau SAS Company?

- How Does Schenker-Joyau SAS Company Work?

- What is Sales and Marketing Strategy of Schenker-Joyau SAS Company?

- What is Brief History of Schenker-Joyau SAS Company?

- What is Customer Demographics and Target Market of Schenker-Joyau SAS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.