DP World Bundle

Who Really Controls DP World?

Unraveling the intricacies of DP World SWOT Analysis is essential for investors and strategists alike. Understanding DP World ownership provides critical insights into its strategic direction and financial performance. This examination will explore the evolution of this global port operator, from its origins to its current structure, shedding light on the key players shaping its future.

The question "Who owns DP World?" is more than just a matter of identifying shareholders; it's about understanding the power dynamics within a shipping company that moves approximately 10% of global container traffic. From its headquarters in Dubai to its extensive network of global ports, DP World's ownership structure has undergone significant changes. Examining DP World's history and background, including its financial performance and major shareholders, is crucial for anyone seeking to understand this logistics giant's trajectory.

Who Founded DP World?

The story of DP World begins with the merging of Dubai Ports International (DPI) and the Dubai Ports Authority (DPA). While specific founders aren't publicly detailed, it's important to note that the entities that formed DP World were initially state-owned. This laid the foundation for what would become a global leader in the port operator industry.

The company's early ventures included collaborations and operations in various locations. DPI's initial projects included collaborations at Jeddah Islamic Port in Saudi Arabia in 1999, followed by operations in Djibouti in 2000, Vizag, India in 2002, and Constanța, Romania in 2003. The formal merger in September 2005 officially established DP World as a unified entity.

A key moment in DP World's early history was the acquisition of CSX World Terminals (CSX WT) in January 2005. This move significantly expanded its presence in Asia, including major operations in Hong Kong and China. Further expansion happened in March 2006 with the acquisition of P&O, the fourth-largest ports operator globally, for £3.9 billion.

The origins of DP World are tied to the establishment of Dubai Ports International (DPI) and the Dubai Ports Authority (DPA) in 1999.

The core entities that merged to form DP World were state-owned, reflecting the involvement of the Dubai government.

DPI's early projects included collaborations at Jeddah Islamic Port in Saudi Arabia in 1999, followed by operations in Djibouti, India, and Romania.

The formal merger of Dubai Ports International and Dubai Ports Authority in September 2005 officially established DP World.

In January 2005, DP World acquired CSX World Terminals, which provided a strong foothold in Asia.

In March 2006, DP World acquired P&O, the fourth-largest ports operator globally.

The acquisition of P&O, while significant, also led to controversy, particularly in the United States. This resulted in DP World selling P&O's American operations. These early acquisitions and subsequent adjustments shaped DP World's initial global footprint. For a deeper understanding of DP World's strategic direction, consider reading about the Growth Strategy of DP World.

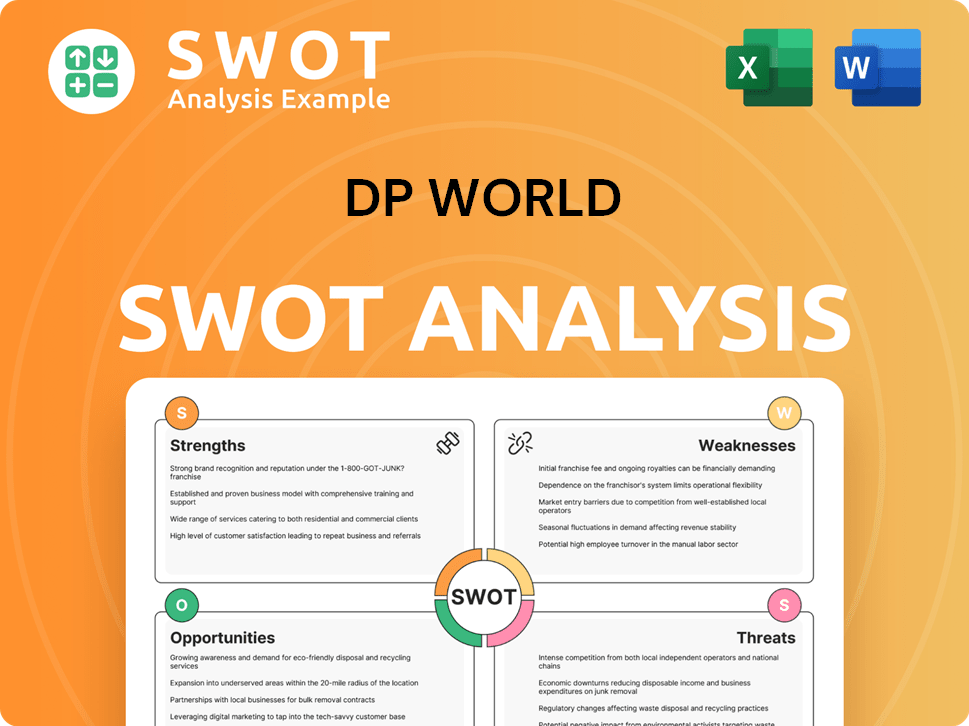

DP World SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has DP World’s Ownership Changed Over Time?

The ownership of DP World, a prominent port operator and shipping company, has seen significant shifts over time. Initially formed through the merger of state-owned entities, the company later went public, listing on Nasdaq Dubai. However, a major change occurred in February 2020 when DP World transitioned back to private ownership. This delisting was initiated by its parent company, Port and Free Zone World (PFZW), a subsidiary of Dubai World. PFZW offered to acquire the remaining shares of DP World traded on Nasdaq Dubai at $16.75 per share, a 29% premium over the market closing price. This move effectively returned DP World to full private ownership.

This strategic shift allowed DP World to focus on its long-term vision of becoming an infrastructure-led, end-to-end logistics provider. The decision to delist from public markets was driven by the company's desire to execute its long-term strategy without the short-term pressures often associated with public market scrutiny. This consolidation of ownership under Dubai World, ultimately controlled by the government of Dubai, provides DP World with the flexibility to pursue its strategic objectives and investments in global ports and cargo handling without the constraints of public market demands. This is a common strategy, as many companies, like DP World, find that private ownership allows for more strategic agility. For example, in 2023, the global ports market was valued at over $160 billion, with expectations for continued growth, highlighting the importance of strategic investments in this sector.

| Event | Date | Impact |

|---|---|---|

| Merger of state-owned entities | Early Formation | Foundation of DP World |

| Initial Public Offering | Undisclosed | Listing on Nasdaq Dubai |

| Delisting from Nasdaq Dubai | February 2020 | Return to private ownership by Dubai World |

Ultimately, the government of Dubai, through Dubai World, owns DP World. This structure places the company under the direct control of the Ruler of Dubai, Sheikh Mohammed bin Rashid Al Maktoum. This ownership model enables DP World to make long-term strategic decisions, such as expanding its global ports network and enhancing its cargo handling capabilities, without the immediate pressures of public market expectations. For those interested in the competitive landscape, you can explore the Competitors Landscape of DP World to understand its position in the market.

DP World is privately owned by the government of Dubai through Dubai World.

- The delisting from Nasdaq Dubai in 2020 allowed for a focus on long-term strategic goals.

- Sheikh Mohammed bin Rashid Al Maktoum, the Ruler of Dubai, ultimately controls the company.

- This structure enables strategic investments in areas like cargo handling and global ports.

- DP World's ownership structure supports its growth as a leading port operator.

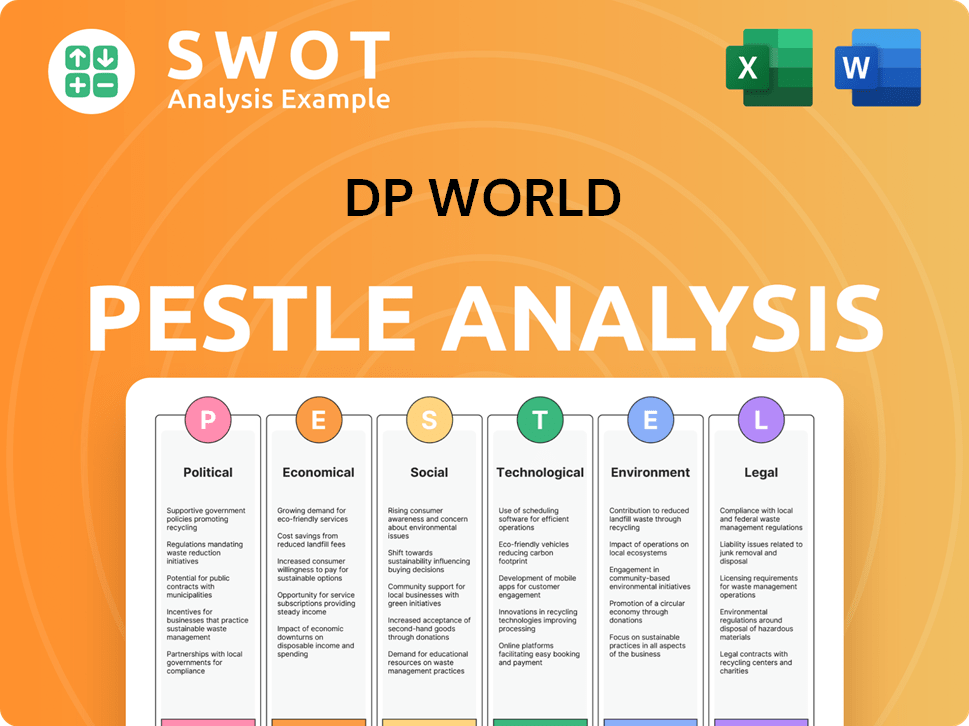

DP World PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on DP World’s Board?

The current board of directors of DP World is pivotal in steering the company's strategic path and operational strategies. Sultan Ahmed bin Sulayem serves as the Group Chairman and CEO of DP World, playing a central role in the company's leadership and strategic vision. Yuvraj Narayan holds the position of Deputy CEO and Group CFO. Specific details about the complete roster of board members, including those representing major shareholders or independent seats, are not readily available in the provided search results.

The board is responsible for overseeing and approving the strategic direction, business plans, annual budgets, and significant acquisitions and disposals. Furthermore, a formal board diversity policy is in place to govern diversity at the board level. This structure ensures that the company's governance aligns with its strategic objectives and operational efficiency.

| Board Member | Title | Key Role |

|---|---|---|

| Sultan Ahmed bin Sulayem | Group Chairman and CEO | Leadership and Strategic Vision |

| Yuvraj Narayan | Deputy CEO and Group CFO | Financial Oversight and Operations |

| Board Members | Various | Strategic Direction, Approvals |

Given that DP World is privately held, wholly owned by Port and Free Zone World, a subsidiary of Dubai World, the voting structure is consolidated under the ultimate state ownership. The government of Dubai, specifically the Ruler of Dubai, Sheikh Mohammed bin Rashid Al Maktoum, effectively controls the company. This structure implies that governmental bodies of Dubai hold the primary control, rather than individual shareholders. For more insights, you can read about the Marketing Strategy of DP World.

DP World's ownership is consolidated under Dubai World, with the government of Dubai holding effective control. This structure influences the company's strategic decisions and operational oversight. The board of directors, led by key figures like Sultan Ahmed bin Sulayem, guides the company's direction.

- Sultan Ahmed bin Sulayem is the Group Chairman and CEO.

- Yuvraj Narayan is the Deputy CEO and Group CFO.

- The government of Dubai controls DP World.

- The board approves strategic plans and budgets.

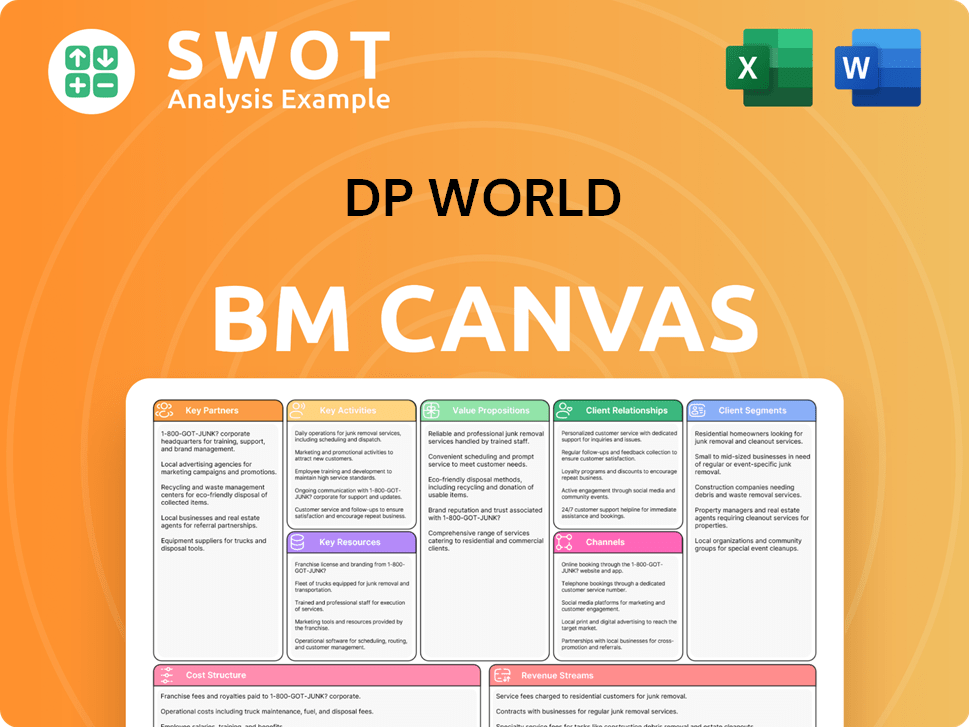

DP World Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped DP World’s Ownership Landscape?

In recent years, the ownership of DP World has seen a significant shift. The company, which operates as a global port operator and shipping company, transitioned to a privately held, state-owned entity. Its parent company, Port and Free Zone World, acquired the remaining public shares in 2020, solidifying the ownership structure.

This move has allowed DP World to focus on its long-term strategy. The company is transforming into an integrated end-to-end logistics provider. This strategic direction is reflected in its financial performance and expansion plans.

| Metric | Value | Year |

|---|---|---|

| Revenue | $20 billion | 2024 |

| Year-on-Year Revenue Increase | 9.7% | 2024 |

| Adjusted EBITDA | $5.5 billion | 2024 |

| Capital Expenditure | $2.2 billion | 2024 |

| Planned Capital Expenditure | Approximately $2.5 billion | 2025 |

| Global Container Handling Capacity | Exceeded 100 million TEUs | 2024 |

| Estimated Container Handling Capacity | 107.6 million TEUs | End of 2025 |

| Acquisitions Completed | 21 | Various |

| Average Acquisition Amount | $514 million | Various |

The DP World ownership structure reflects a strategic decision by the Dubai government. This move aims to facilitate long-term investment and transformation in the global trade landscape. The company continues to expand its global presence through acquisitions and infrastructure projects. For a deeper dive into how DP World generates revenue, check out this article about Revenue Streams & Business Model of DP World.

DP World completed four acquisitions in 2024. It has already made one acquisition in 2025, with Swissterminal being the most recent in March 2025. These acquisitions enhance its logistics portfolio.

DP World is investing in major infrastructure projects. These projects are located across India, Africa, South America, and Europe. Key sites include Jebel Ali (UAE), London Gateway (UK), and Tuna Tekra (India).

DP World allocated $2.2 billion for capital expenditure in 2024. The company plans to spend approximately $2.5 billion in 2025. These investments support its global logistics network expansion.

DP World's global container handling capacity surpassed 100 million TEUs in 2024. The company aims to increase this capacity to an estimated 107.6 million TEUs by the end of 2025.

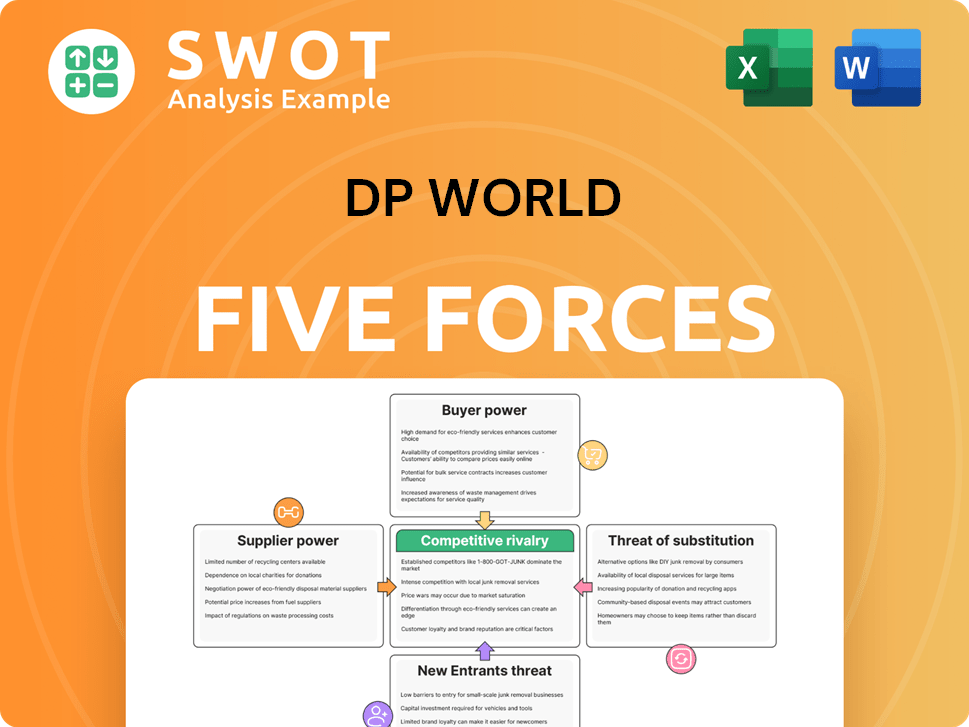

DP World Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DP World Company?

- What is Competitive Landscape of DP World Company?

- What is Growth Strategy and Future Prospects of DP World Company?

- How Does DP World Company Work?

- What is Sales and Marketing Strategy of DP World Company?

- What is Brief History of DP World Company?

- What is Customer Demographics and Target Market of DP World Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.