Enerpac Tool Group Bundle

Who Really Controls Enerpac Tool Group?

Understanding Enerpac Tool Group SWOT Analysis is crucial for investors and stakeholders. Knowing who owns a company provides insights into its strategic direction, financial performance, and long-term viability. This knowledge is essential for anyone looking to make informed decisions in the dynamic world of corporate ownership.

Enerpac Tool Group, a leading tool manufacturer, has a fascinating ownership story. From its roots as American Grinder and Manufacturing to its current status as a global player, the evolution of Enerpac ownership has shaped its identity and strategic focus. This article will delve into the intricate details of who owns Enerpac, exploring the key players and influences that drive this industrial giant. We will also look at Enerpac ownership and its impact on the company's future.

Who Founded Enerpac Tool Group?

The story of Enerpac Tool Group Corp. began in 1910, founded as American Grinder and Manufacturing by Leo Bethke, Frank Lueck, and Charles Krause. This marked the start of what would become a significant player in the industrial tool market. While specific details about the initial ownership structure among the founders are not available in the provided information, their collective efforts set the stage for the company's future.

The company's early years saw it evolve, including name changes and expansions into new areas like hydraulics. The introduction of hydraulic jacks in the 1920s was a key step, and the formal establishment of the Enerpac brand within the Industrial Products Division in the late 1950s further solidified its identity. This period of growth demonstrates the founders' vision and the company's adaptability.

The transition from private to public ownership was a crucial moment in Enerpac's history. The initial public offering (IPO) of Applied Power Industries on NASDAQ in 1987, followed by a move to the NYSE in 1992, opened the doors to public shareholders. This shift provided access to capital and marked a new phase for the company, impacting its corporate ownership structure and strategic direction.

The evolution of Enerpac ownership reflects its growth from a small manufacturing firm to a global tool manufacturer. The founders' initial contributions were crucial. The IPO in 1987 was a pivotal moment, transforming the Enerpac company into a publicly traded entity. This move changed the dynamics of corporate ownership.

- Founded in 1910 as American Grinder and Manufacturing.

- Name changed to Blackhawk Manufacturing in 1925.

- Became Applied Power Industries in 1961.

- IPO on NASDAQ in 1987.

- Moved to NYSE in 1992.

For further insights into the company's financial aspects and business model, you can explore Revenue Streams & Business Model of Enerpac Tool Group. This resource provides additional information on the company's operations and financial performance.

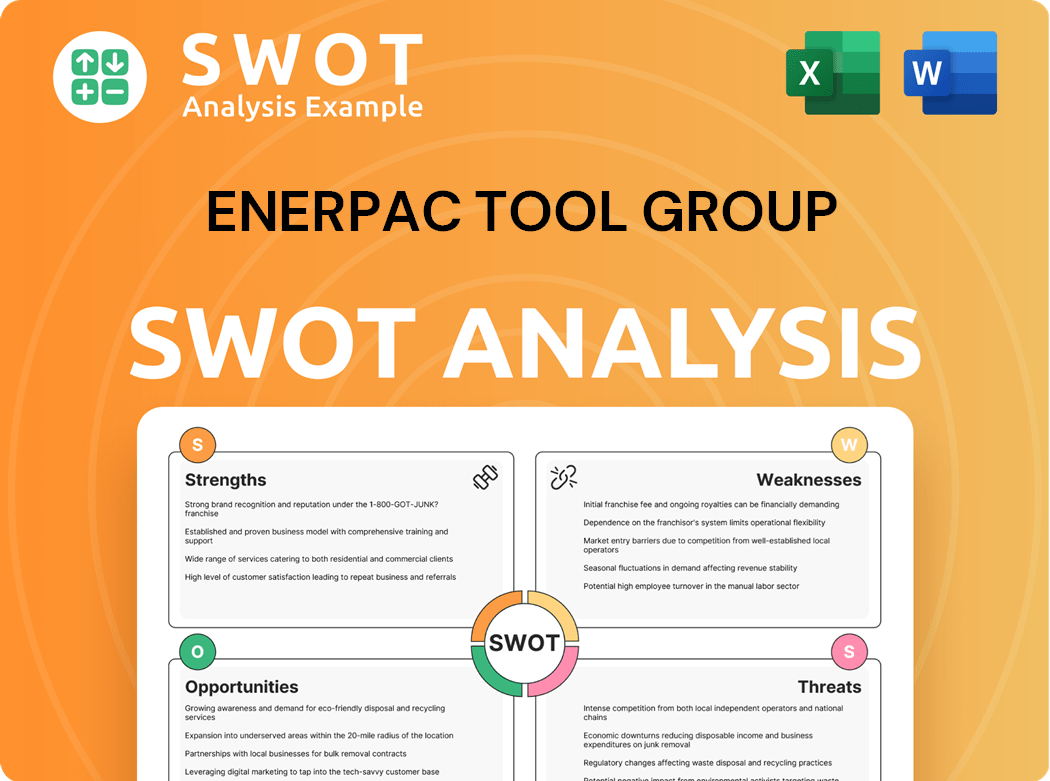

Enerpac Tool Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Enerpac Tool Group’s Ownership Changed Over Time?

The evolution of Enerpac Tool Group's ownership reflects its journey from a private entity to a publicly traded corporation. Initially known as Applied Power, the tool manufacturer went public in 1987 with an IPO on NASDAQ and later moved to the NYSE in 1992. This shift broadened its investor base, marking a significant change in Enerpac ownership.

The company's strategic focus on its core industrial tools and services was further solidified by its name change from Actuant Corporation to Enerpac Tool Group Corp. in January 2020, a decision approved by shareholders. This move underscores a commitment to its primary business and has shaped the current dynamic ownership landscape. Understanding who owns Enerpac is key to understanding the company's strategic direction.

| Shareholder Type | Approximate Ownership (March 2025) | Key Details |

|---|---|---|

| Institutional Investors | 71.23% to 44.76% | Includes BlackRock, Inc., Vanguard Group Inc, Kayne Anderson Rudnick Investment Management Llc, Capital International Investors, and State Street Corp. |

| Insiders | 1.36% to 1.45% | Includes the leadership team. |

| Public Companies & Individual Investors | 27.40% to 26.47% | Represents the remaining shares. |

As of the latest data, Enerpac Tool Group (NYSE: EPAC) is primarily owned by institutional investors. Prominent firms such as BlackRock, Inc. and Vanguard Group Inc. hold significant shares. For instance, BlackRock, Inc. held 8,288,186 shares as of March 31, 2025, and Vanguard Group Inc. held 6,120,411 shares as of December 31, 2024. The increasing institutional ownership, with mutual funds holding between 88.52% and 89.07% as of March 2025, highlights the influence of these investors. To learn more about the company's strategic moves, you can read about the Growth Strategy of Enerpac Tool Group.

Enerpac Tool Group is a publicly held company with a majority of shares owned by institutional investors.

- Institutional investors, such as BlackRock and Vanguard, hold a significant portion of the stock.

- Insiders and individual investors also have a stake in the company.

- The company's evolution reflects a strategic focus on its core business.

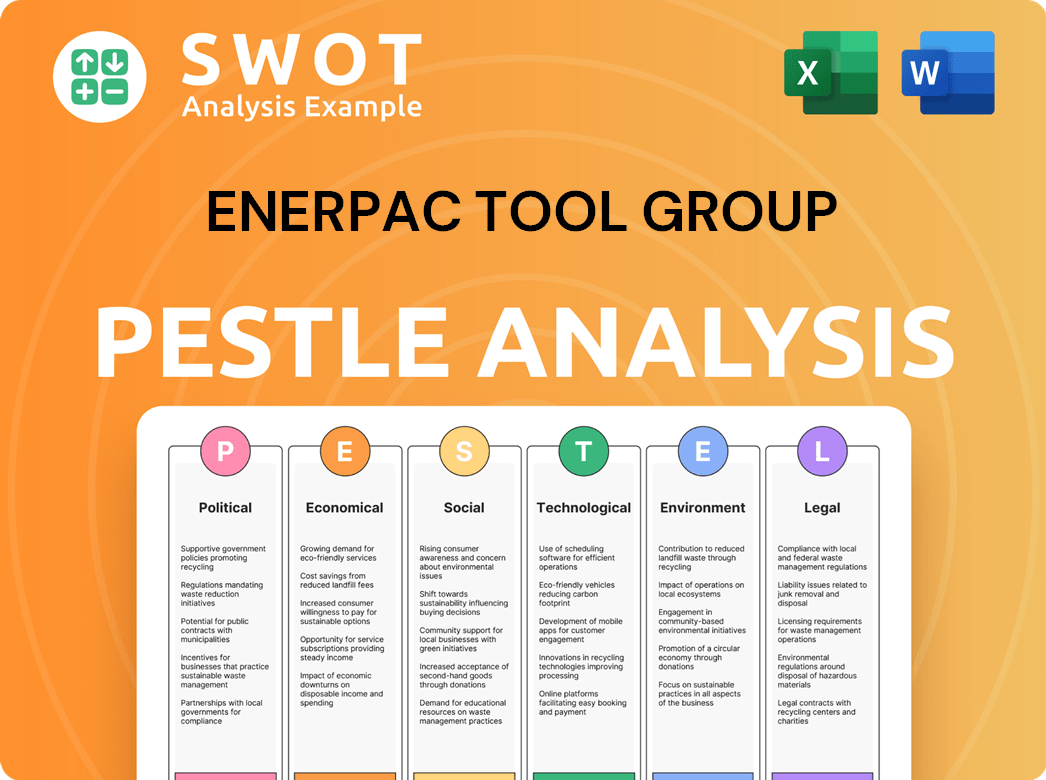

Enerpac Tool Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Enerpac Tool Group’s Board?

The Board of Directors of Enerpac Tool Group plays a critical role in guiding the company's strategic direction. As of recent reports, the board includes key figures such as Paul Sternlieb, the President and CEO, and other experienced professionals like Jim Ferland, Alfredo Altavilla, and Judy Altmaier. The board also includes members with backgrounds in finance and industrial sectors, such as Palmer Clarkson, Danny Cunningham, Colleen Healy, Richard Holder, Lynn Minella, and Sidney Simmons. The composition of the board suggests a blend of expertise aimed at representing various stakeholder interests within the Enerpac Tool Group's operations.

The board's diverse backgrounds in executive leadership, finance, and industrial sectors contribute to the company's governance. The presence of individuals with experience in large corporations and consulting firms indicates a board composed of seasoned professionals. This structure is likely to represent a mix of independent perspectives and potentially major shareholder interests, though specific affiliations for each director are not always detailed in public reports. The board's oversight is essential for the

| Board Member | Title | Background |

|---|---|---|

| Paul Sternlieb | President and CEO | Executive Leadership |

| Jim Ferland | Director | Former CEO of Babcock & Wilcox Enterprises, Inc. |

| Alfredo Altavilla | Director | Formerly of Fiat Chrysler Automobiles and Italia Trasporto Aerea S.p.A. |

With institutional ownership exceeding 70%, major institutional investors hold significant voting power in

The Board of Directors oversees

- Diverse backgrounds within the board.

- Experienced professionals in executive leadership and finance.

- Oversight of the

strategic initiatives. - Key role in

and governance.

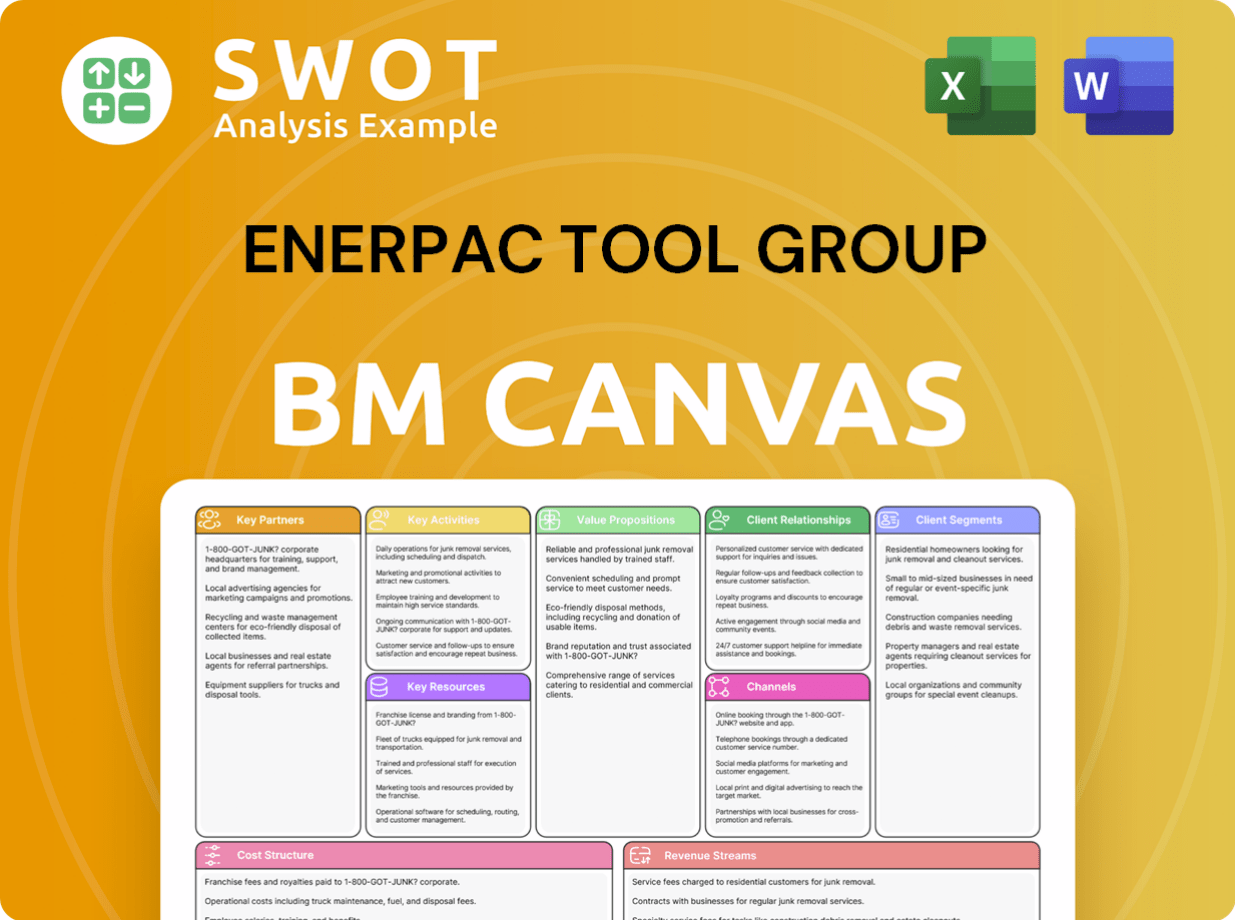

Enerpac Tool Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Enerpac Tool Group’s Ownership Landscape?

In the past few years, the ownership structure of Enerpac Tool Group has shown dynamic shifts. The company, listed on the NYSE under the ticker EPAC, experienced a notable performance in 2024, with a 32% increase in its stock price. This positive trend has continued into 2025, with shares increasing by 9% year-to-date. The company's commitment to shareholder value is evident through its share repurchase programs, which have significantly influenced the Enerpac ownership landscape.

Enerpac Tool Group's strategy includes active share repurchases, reflecting its dedication to returning capital to shareholders. A share repurchase program, approved in March 2022, authorized the repurchase of up to 10 million shares. By the end of fiscal year 2024, approximately 7.2 million shares were repurchased for $176.3 million. In the first half of fiscal 2025, the company repurchased about 330,000 shares for $14.6 million, with 110,000 shares repurchased in the first quarter of fiscal 2025 alone, totaling $4.4 million. These actions highlight the company's focus on enhancing shareholder value and managing its capital effectively.

| Metric | Details | Amount |

|---|---|---|

| Stock Performance (2024) | Increase in stock price | 32% |

| Stock Performance (YTD 2025) | Increase in stock price | 9% |

| Shares Repurchased (Through Fiscal 2024) | Number of shares | Approximately 7.2 million |

| Shares Repurchased (Fiscal 2024) | Amount spent | $176.3 million |

| Shares Repurchased (H1 Fiscal 2025) | Number of shares | Approximately 330,000 |

| Shares Repurchased (H1 Fiscal 2025) | Amount spent | $14.6 million |

| Shares Repurchased (Q1 Fiscal 2025) | Number of shares | 110,000 |

| Shares Repurchased (Q1 Fiscal 2025) | Amount spent | $4.4 million |

A significant recent development in the Enerpac ownership structure is the acquisition of DTA The Smart Move, S.A. in September 2024. This strategic move, with a purchase price of €24 million and a potential earn-out of up to €36 million, is expected to generate approximately €20 million in revenue for fiscal 2025. This acquisition is part of Enerpac's strategy to expand its Heavy Lifting Technology portfolio and capitalize on automation trends. Furthermore, industry trends indicate a rise in institutional ownership, with institutional investors holding a significant portion of Enerpac Tool Group's stock. While insider holdings have slightly decreased, mutual fund holdings have increased, reflecting broader market dynamics. Enerpac's management continues to focus on its 'ASCEND' transformation program, aiming for accelerated earnings growth and efficiency, with an expected incremental $40-$50 million of annual adjusted EBITDA.

Enerpac acquired DTA The Smart Move, S.A. in September 2024 for €24 million, with a potential earn-out of up to €36 million.

The acquisition is projected to generate approximately €20 million in revenue for fiscal 2025, contributing to the company's growth.

Institutional investors hold a substantial portion of Enerpac Tool Group's stock, reflecting a market trend.

The 'ASCEND' transformation program aims for accelerated earnings growth and efficiency, with an expected incremental $40-$50 million of annual adjusted EBITDA.

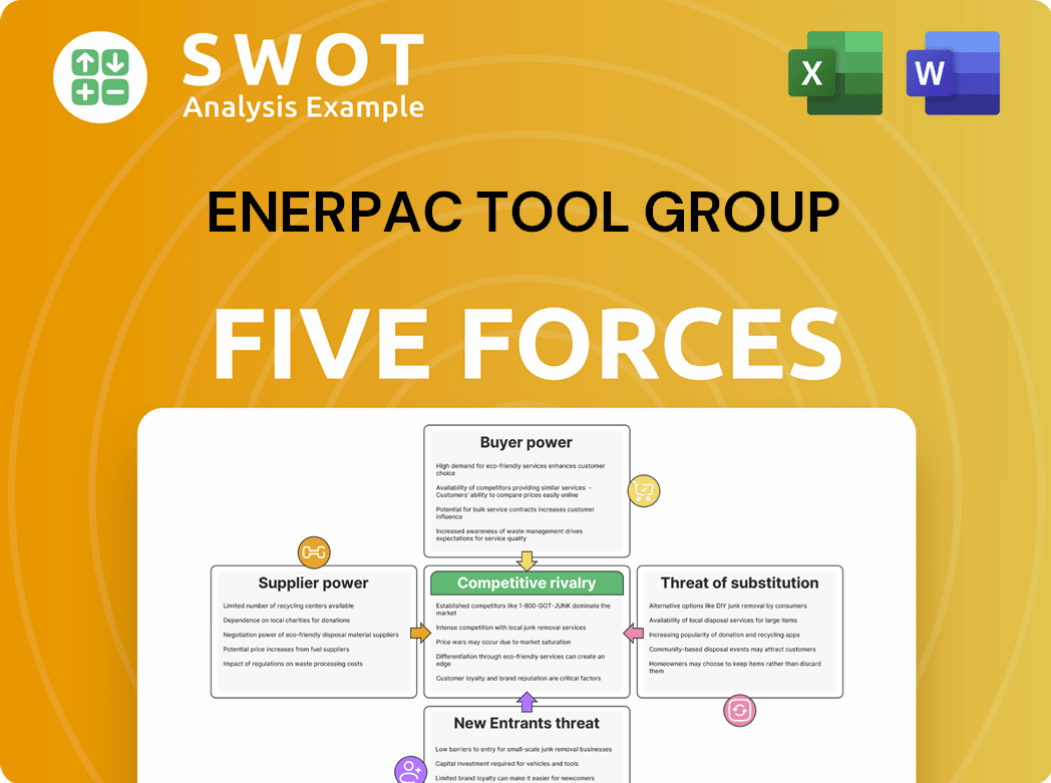

Enerpac Tool Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Enerpac Tool Group Company?

- What is Competitive Landscape of Enerpac Tool Group Company?

- What is Growth Strategy and Future Prospects of Enerpac Tool Group Company?

- How Does Enerpac Tool Group Company Work?

- What is Sales and Marketing Strategy of Enerpac Tool Group Company?

- What is Brief History of Enerpac Tool Group Company?

- What is Customer Demographics and Target Market of Enerpac Tool Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.