FAIST Bundle

Who Really Controls FAIST Anlagenbau GmbH?

Unraveling the FAIST SWOT Analysis, along with its ownership structure, is key to understanding its future trajectory in the competitive industrial landscape. The story of the

The

Who Founded FAIST?

The origins of the FAIST company trace back to 1904, when Michael Faist established FAIST Anlagenbau GmbH. Initially, the company's focus was on producing felt products, including items like felt slippers and asphalt felts. The company's evolution led to a significant shift in 1974 with the creation of the 'FAIST Anlagenbau' division.

This division concentrated on developing soundproofing cabins for industrial applications, marking a strategic move into a new market. The company's history reflects a long-term commitment to innovation and adaptation within the industrial sector. This expansion was a key step in the company's growth.

While specific details regarding the initial equity distribution among founders and early investors are not publicly available, Michael Faist was identified as the majority owner and one of the managing directors in earlier periods. The Faist family managed the business for nearly 120 years before its acquisition in 2020. This long tenure demonstrates the family's sustained influence and leadership.

The Faist family's ownership and management of the company spanned almost 120 years. The 'FAIST Anlagenbau' division was established in 1974, focusing on soundproofing cabins. The company's structure evolved, with the Anlagenbau division being spun off in 1996.

- Michael Faist founded the company in 1904.

- The Faist family maintained majority ownership for many years.

- The company's focus shifted over time from felt products to industrial solutions.

- The 1996 spin-off of the Anlagenbau division marked a strategic move.

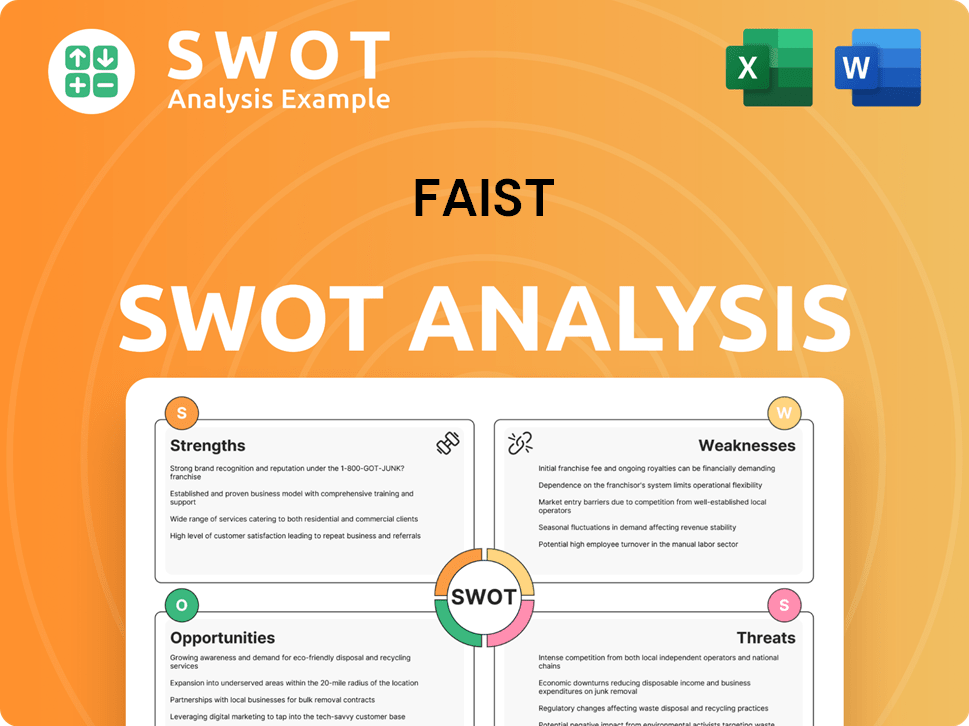

FAIST SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has FAIST’s Ownership Changed Over Time?

The FAIST company's ownership structure has seen a significant shift. For nearly 120 years, the company operated as a family-owned business. Key figures like Michael Faist, who held an 86% stake, and Ludwig Faist, with 14%, were central to its ownership. This long-standing family ownership shaped the company's trajectory until a major change occurred.

On December 15, 2020, the founding family sold their shares in FAIST Anlagenbau GmbH and its subsidiaries. This pivotal moment saw the transfer of ownership to Paguasca Holding AG, a strategic investor based in Zug, Switzerland. This move was driven by challenging market conditions, and the sale marked a transition from family ownership to being part of a larger industrial holding group. This change is a key element in understanding the current FAIST ownership structure.

| Event | Date | Details |

|---|---|---|

| Family Ownership | Prior to Dec 15, 2020 | Michael Faist held 86% stake; Ludwig Faist held 14%. |

| Sale to Paguasca Holding AG | December 15, 2020 | Founding family sold all shares to Paguasca Holding AG. |

| Current Ownership | Post December 15, 2020 | Paguasca Holding AG is the parent company. |

Paguasca Holding AG, the current parent company, has a strong presence in the energy sector and a deep understanding of the plant construction business. This strategic investment is geared towards facilitating a strategic reorientation and expanding into new markets for the FAIST Group. The acquisition's financial details were not disclosed, but the change signifies a major shift in the company's structure. You can learn more about the company's financial operations by reading about Revenue Streams & Business Model of FAIST.

The FAIST company transitioned from long-term family ownership to being part of a strategic holding group.

- Paguasca Holding AG acquired FAIST subsidiaries in December 2020.

- The change aimed to facilitate strategic reorientation and market expansion.

- The acquisition price was not disclosed.

- The current ownership structure is centered on Paguasca Holding AG.

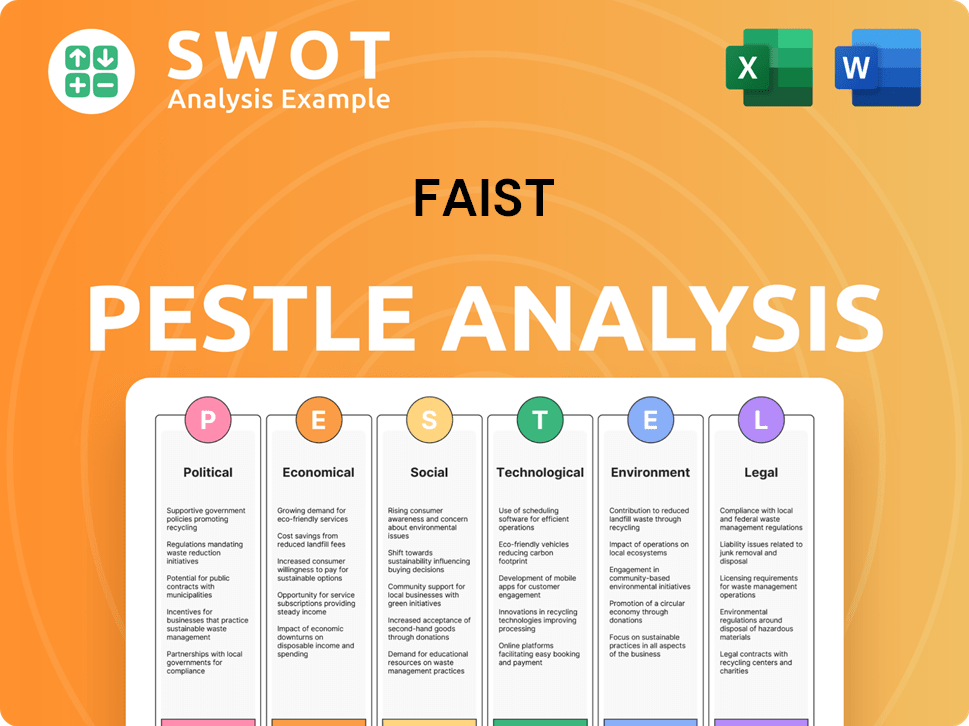

FAIST PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on FAIST’s Board?

Following the acquisition by Paguasca Holding AG, the current management team of the FAIST company includes Roger Schmidt as CEO and Wilfried Thies as CSO. Wilfried Thies also serves as a managing director. Florian Eheim and Georg Färber are authorized signatories. Hans Jörg Sauerwein is a member of the extended management team and also an authorized signatory. This structure reflects the leadership in place after the ownership transition.

While the full board of directors and detailed voting structures for FAIST Anlagenbau GmbH are not publicly available, the acquisition by Paguasca Holding AG indicates a significant shift in control. Paguasca Holding AG, as the sole owner, likely holds the predominant voting power within the FAIST Group. The current management team, including Roger Schmidt and Wilfried Thies, is working with Paguasca Holding AG to drive strategic realignment and market expansion. For more insights, you can explore the Competitors Landscape of FAIST.

| Position | Name | Role |

|---|---|---|

| CEO | Roger Schmidt | Chief Executive Officer |

| CSO | Wilfried Thies | Chief Sales Officer & Managing Director |

| Authorized Signatory | Florian Eheim | Authorized Signatory |

| Authorized Signatory | Georg Färber | Authorized Signatory |

| Extended Management Team | Hans Jörg Sauerwein | Authorized Signatory |

The FAIST company is privately held, and specific details on the board's composition and voting rights are not publicly accessible. The focus remains on the strategic direction set by the current management team in collaboration with Paguasca Holding AG, the FAIST parent company. There have been no publicly reported proxy battles, activist investor campaigns, or governance controversies.

Paguasca Holding AG is the primary owner of the FAIST company, influencing strategic decisions. The current management team, led by Roger Schmidt and Wilfried Thies, is actively involved in the company's direction. The company's structure is private, with no publicly available information on detailed voting structures.

- Paguasca Holding AG controls the predominant voting power.

- Roger Schmidt is the current CEO.

- Wilfried Thies is the CSO and Managing Director.

- No recent governance controversies have been reported.

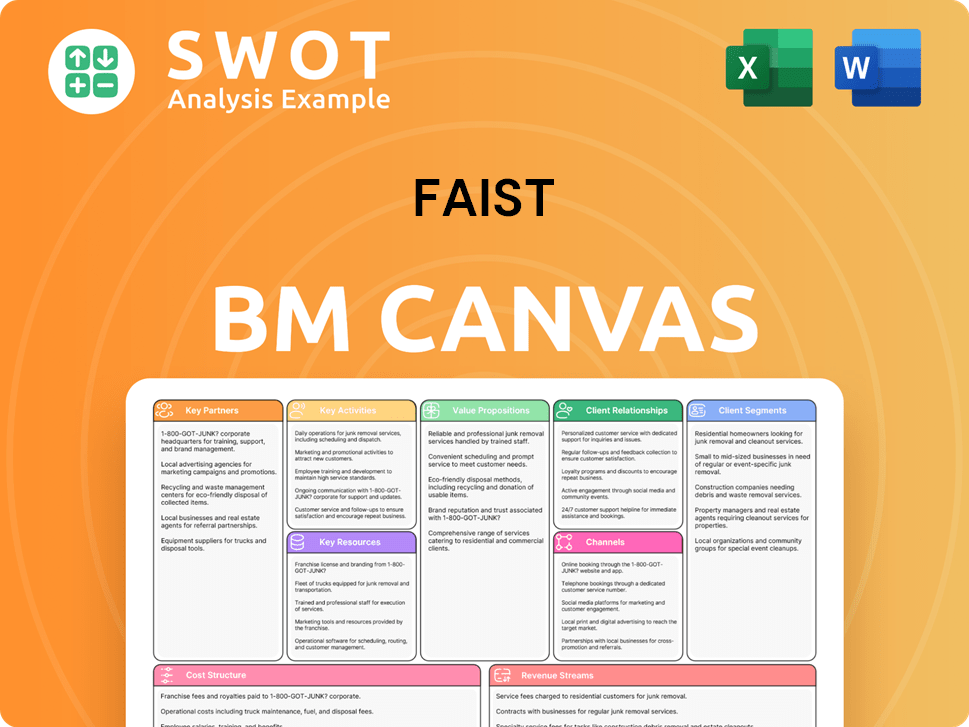

FAIST Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped FAIST’s Ownership Landscape?

The most significant shift in the ownership profile of the FAIST Anlagenbau GmbH occurred with the acquisition by Paguasca Holding AG on December 15, 2020. This transition marked a departure from nearly 120 years of family ownership. This strategic move aimed to secure the company's future growth and protect employment opportunities. The change was driven by the desire to adapt to evolving market dynamics.

Since the acquisition, the company's leadership has focused on strategic reorientation and market expansion. Projections for 2024 indicate FAIST's revenue will reach $150 million, reflecting a 5% increase from 2023. The company is targeting a turnover of €130 million, exploring new markets, and strengthening its market position in key areas. The company is also focusing on specialized expertise and a comprehensive product and service portfolio to maintain its competitive edge. You can learn more about the Target Market of FAIST.

FAIST is currently owned by Paguasca Holding AG. This strategic acquisition in 2020 marked a significant change in the company's ownership, moving away from its long-standing family ownership.

The demand for noise control solutions is valued at $4.8 billion in 2024, with projections reaching $6.2 billion by 2029. The cleanroom facilities market is also growing, expected to reach $7.3 billion by 2025. These trends present opportunities for FAIST.

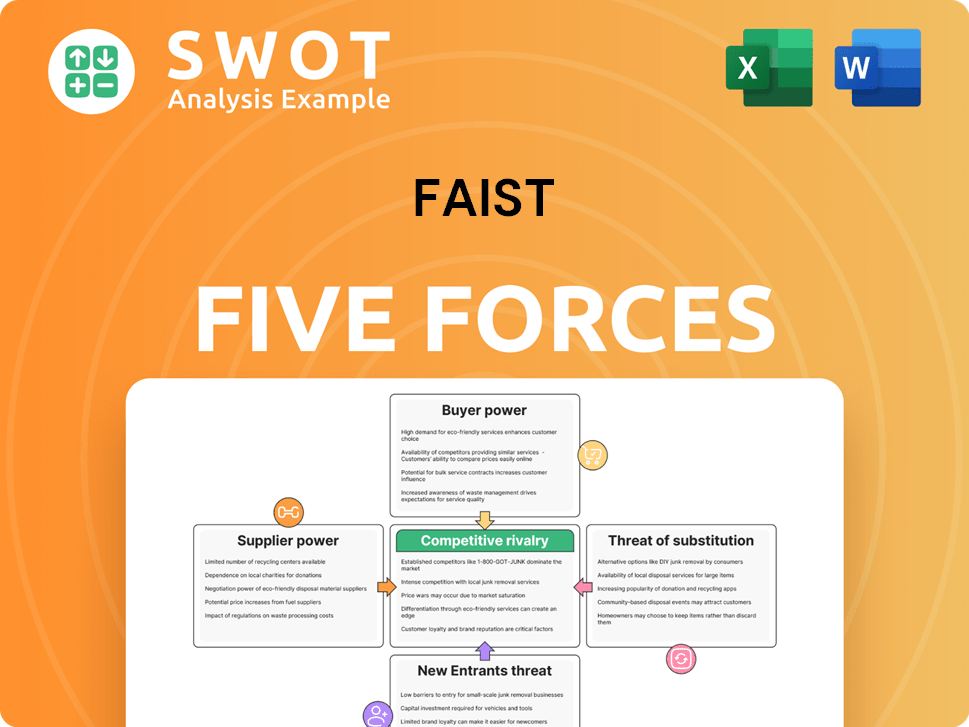

FAIST Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FAIST Company?

- What is Competitive Landscape of FAIST Company?

- What is Growth Strategy and Future Prospects of FAIST Company?

- How Does FAIST Company Work?

- What is Sales and Marketing Strategy of FAIST Company?

- What is Brief History of FAIST Company?

- What is Customer Demographics and Target Market of FAIST Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.