Giant Network Group Bundle

Who Really Owns Giant Network Group?

Unraveling the ownership structure of a company is crucial for understanding its strategic direction and potential. For Giant Network Group, a prominent player in China's online gaming market, understanding its ownership is key to grasping its market position and future trajectory. This analysis will explore the evolution of Giant Network Group ownership, from its inception to its current status.

Giant Network Group, originally known as Shanghai Zhengtu Network Technology Co., Ltd., has a fascinating history, including its IPO on the Shenzhen Stock Exchange. The company's Giant Network Group SWOT Analysis is crucial for any investor. Exploring Giant Group ownership sheds light on its relationship with other major players like Alibaba Group and the potential influence of figures like Jack Ma within the Chinese tech companies landscape. Understanding the company's financial performance and market capitalization is key to evaluating its long-term prospects.

Who Founded Giant Network Group?

The story of Giant Network Group's ownership begins with its founder, Shi Yuzhu. He played a crucial role in establishing the company and shaping its initial ownership structure. Understanding this early phase is key to grasping the evolution of Giant Network Group.

Giant Network Group started operations in 2004 as Shanghai Zhengtu Network Technology Co., Ltd. This marked the beginning of Shi Yuzhu's venture in the online gaming industry. The early ownership structure was designed to comply with Chinese regulations while allowing the company to grow.

In 2006, to comply with regulations, Shi Yuzhu and his daughter, Jing Shi, along with other shareholders, set up an offshore holding structure. This involved creating Giant Network Technology Limited in the Cayman Islands and a subsidiary in the British Virgin Islands.

Giant Network Group was founded in 2004 by Shi Yuzhu through Shanghai Zhengtu Network Technology Co., Ltd.

In 2006, an offshore holding structure was established in the Cayman Islands and British Virgin Islands to comply with regulations.

Through this structure, Shi Yuzhu beneficially owned or controlled 75% of Giant Network's equity interests.

Shi Yuzhu's control was achieved through Shanghai Lanlin Bio-Technology Co., Ltd., Giant Investment Co., Ltd., and additional agreements.

The offshore structure was designed to comply with Chinese laws restricting foreign ownership in the online game industry.

The early structure reflected the founding team's vision to maintain significant control, with Shi Yuzhu holding a majority stake.

The initial ownership structure of Giant Network Group, with Shi Yuzhu at the helm, was strategically designed to navigate regulatory landscapes and ensure control. This early framework set the stage for the company's future. To learn more about the company's journey, you can read a Brief History of Giant Network Group.

- Shi Yuzhu, the founder, established Giant Network Group in 2004.

- An offshore structure was created in 2006 to comply with Chinese regulations.

- Shi Yuzhu beneficially owned or controlled 75% of the company's equity.

- The structure allowed Shi Yuzhu to maintain significant control over the company.

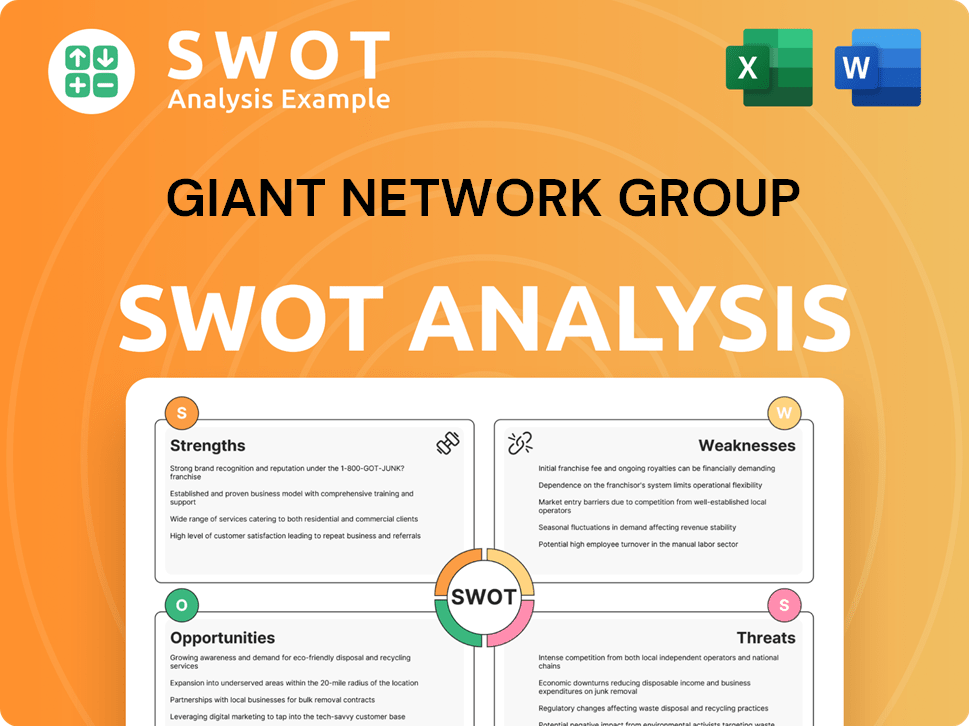

Giant Network Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Giant Network Group’s Ownership Changed Over Time?

The ownership structure of Giant Network Group has seen key shifts since its initial public offering (IPO) on the Shenzhen Stock Exchange (SZSE:002558) on March 2, 2011. The company's stock price as of March 28, 2025, was 14.66 CNY per share, reflecting a positive trend with a 17.75% increase from April 1, 2024. Its market capitalization as of March 2025, was approximately €3.60 billion. These figures highlight the company's performance and the evolution of its market valuation, influencing investor confidence and ownership dynamics.

The company's ownership landscape includes a mix of institutional and individual investors. As of March 2025, there are 30 institutional owners and shareholders who have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). These institutional investors collectively hold a total of 7,440,897 shares. The presence of major institutional investors such as Vanguard and WisdomTree, alongside other significant holders like Shanghai Zhongjin Yiyuan Investment Consultation Center (Limited Partnership), indicates a diverse investor base and the company's appeal to various investment strategies. This diverse ownership structure is a critical element in understanding the influence and direction of the company.

| Key Dates | Event | Impact on Ownership |

|---|---|---|

| March 2, 2011 | IPO on Shenzhen Stock Exchange | Public offering, increased shareholder base. |

| December 6, 2024 | Founder's Stake | Founder Shi Yuzhu held a significant indirect stake, influencing governance. |

| March 28, 2025 | Share Price and Market Cap | Reflects investor confidence and market valuation. |

Founder Shi Yuzhu maintains a substantial, albeit indirect, influence over Giant Network Group. As of December 6, 2024, Shi Yuzhu owned 97.86% of the economic interests of Giant Investment Co. Ltd., which in turn holds significant stakes in Shanghai Jukun and Giant Network Group through various subsidiary entities. This structure ensures the founder's enduring role in the company's strategy and decision-making processes. The overall ownership structure and the strategic direction of the company are also discussed in detail in this article about the Growth Strategy of Giant Network Group.

The ownership of Giant Network Group is a blend of institutional and founder-led interests, shaping its strategic direction.

- The founder, Shi Yuzhu, maintains a significant indirect stake, ensuring his influence.

- Institutional investors like Vanguard and WisdomTree are key shareholders.

- The company's market performance, reflected in its stock price and market capitalization, influences investor confidence.

- Understanding the ownership structure is crucial for assessing the company's governance and strategic focus.

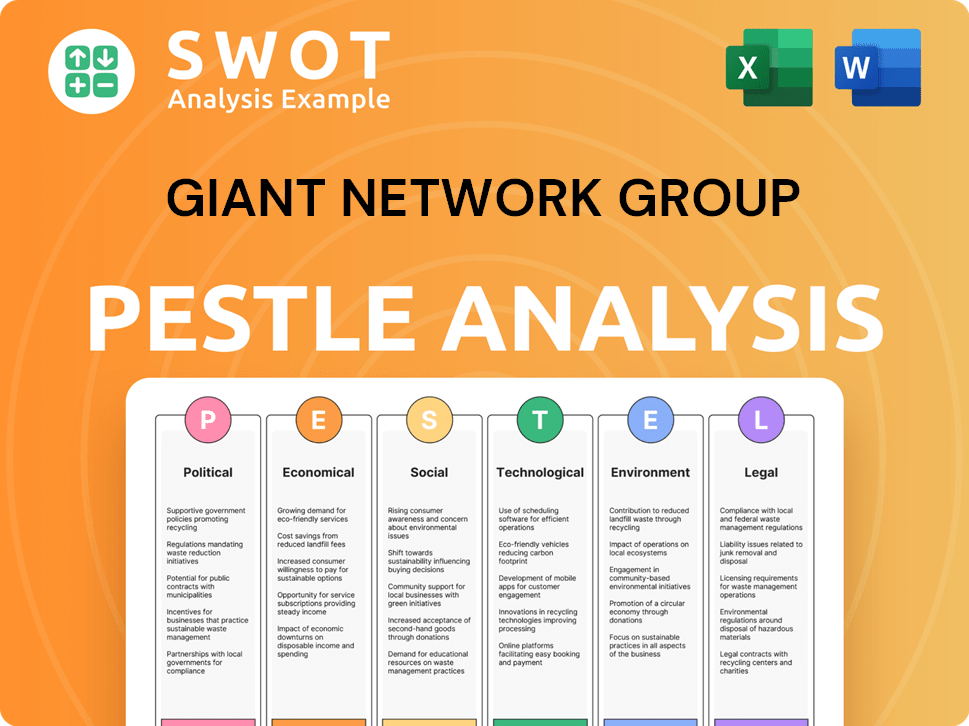

Giant Network Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Giant Network Group’s Board?

Specific details about the current board of directors for Giant Network Group (002558.SZ) are not readily available in the provided search results. However, insights can be drawn from leadership transitions within the broader 'Giant Group'. For instance, Bonnie Tu, who played a key role in Giant Manufacturing's IPO in 1994, continued to serve on the board after retiring as Chairperson in late 2024. This suggests a pattern where key figures maintain a board presence to offer strategic guidance. Further research into the company's filings would be needed to ascertain the current board members and their roles.

The composition of the board and its influence on the strategic direction of Giant Network Group is crucial for understanding its governance. The presence of key figures from the company's history, such as those involved in the IPO, can indicate the continuity of the company's vision and values. The board's structure and the representation of major shareholders or independent seats are essential factors in evaluating the company's corporate governance practices and its alignment with shareholder interests.

| Board Member | Role | Notes |

|---|---|---|

| Bonnie Tu | Former Chairperson, Board Member | Provided guidance after retirement. |

| Current CEO | CEO | Information not available in search results. |

| Other Board Members | Various | Information not available in search results. |

Regarding voting structure, companies like Giant Network Group may employ dual-class share structures. These structures often grant founders and executives superior voting rights, allowing them to retain substantial control over the company's strategic direction. While precise details for Giant Network Group's current voting structure are not explicitly stated, the potential for mechanisms that consolidate voting power is possible. Understanding the voting rights associated with different share classes is crucial for investors. For more information about the company's business model, consider reading Revenue Streams & Business Model of Giant Network Group.

Board composition and voting rights are critical aspects of corporate governance.

- The board's structure influences strategic direction.

- Dual-class share structures can concentrate voting power.

- Understanding these elements is essential for investors.

- Further research into Giant Network Group's filings is recommended.

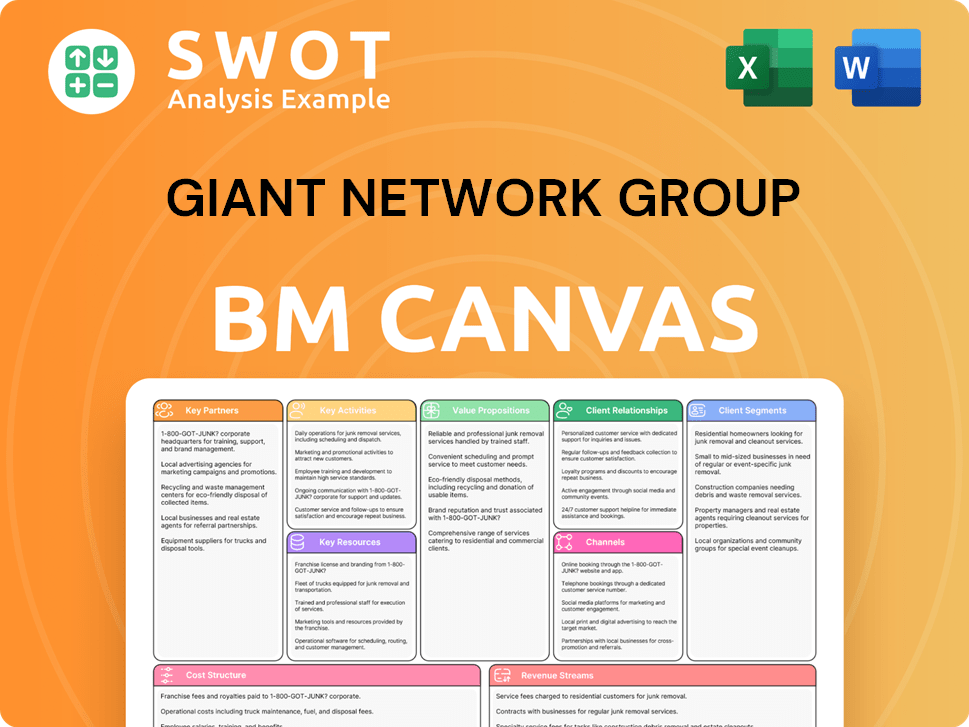

Giant Network Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Giant Network Group’s Ownership Landscape?

Over the past few years, Giant Network Group has maintained its focus on online gaming, with recent developments highlighting its engagement in AI innovation within the gaming sector. The company's commitment to the gaming industry is evident in its financial results. The company reported its full-year earnings for 2024 on April 24, 2025, with sales of CNY 2,918.61 million and a net income of CNY 1,424.9 million. Its Q1 2025 report showed a 4% rise in revenue, although profit decreased by 1.3%.

Institutional ownership remains a key aspect of Giant Network Group's ownership profile. As of March 28, 2025, institutional investors held a total of 7,440,897 shares. The company's stock price has increased by 17.75% between April 2024 and March 2025, reflecting positive investor sentiment. The company's founder, Shi Yuzhu, faced a freeze of assets in late 2021 related to personal guarantees, which the company stated was not directly related to its operations. This situation underscores the potential for the financial circumstances of key owners to have indirect effects.

| Metric | Value | Date |

|---|---|---|

| 2024 Sales | CNY 2,918.61 million | April 24, 2025 |

| 2024 Net Income | CNY 1,424.9 million | April 24, 2025 |

| Institutional Shares Held | 7,440,897 | March 28, 2025 |

| Stock Price Increase (Apr 2024-Mar 2025) | 17.75% | March 2025 |

While there were no major mergers or acquisitions reported for Giant Network Group in 2024-2025, the company did announce an equity buyback plan on December 26, 2023, which closed with 10,170,000 shares, representing 0.57% for CNY 100.02 million. For more insights into the gaming industry's competitive landscape and strategies, read about Marketing Strategy of Giant Network Group.

Institutional investors hold a significant portion of the shares, influencing the company's direction. The founder's financial situation highlights the potential impact of key individuals.

The company showed sales of CNY 2,918.61 million and a net income of CNY 1,424.9 million in 2024. Revenue increased by 4% in Q1 2025, although profits decreased slightly.

The stock price increased by 17.75% between April 2024 and March 2025, indicating positive investor confidence. The company's focus remains on online gaming and AI.

A buyback plan was completed in December 2023, but no major acquisitions or mergers were reported. The company is actively involved in the gaming industry.

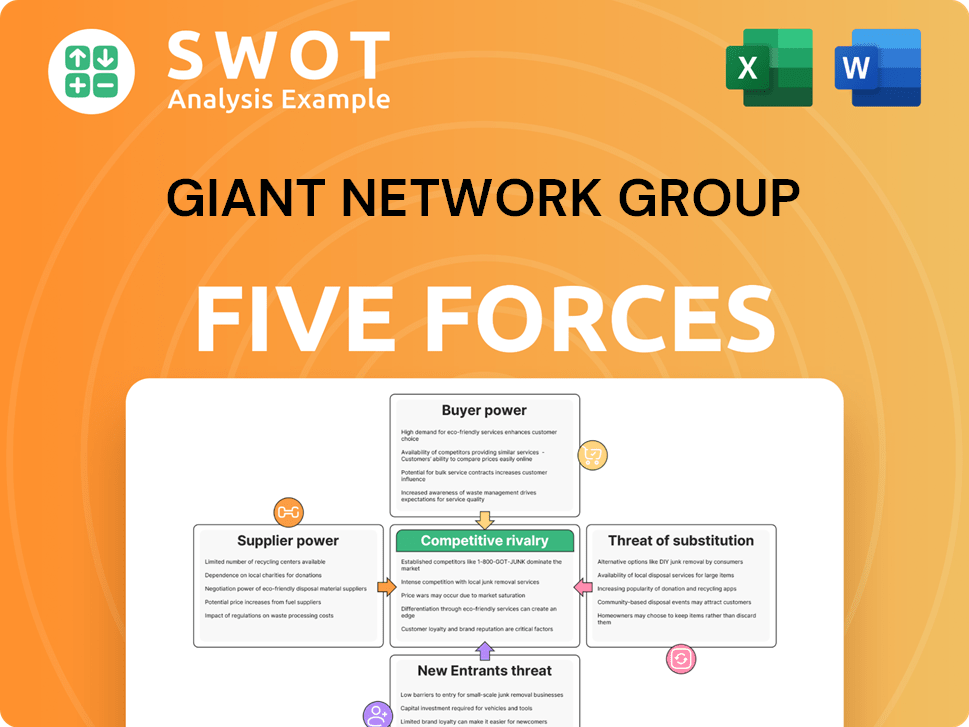

Giant Network Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Giant Network Group Company?

- What is Competitive Landscape of Giant Network Group Company?

- What is Growth Strategy and Future Prospects of Giant Network Group Company?

- How Does Giant Network Group Company Work?

- What is Sales and Marketing Strategy of Giant Network Group Company?

- What is Brief History of Giant Network Group Company?

- What is Customer Demographics and Target Market of Giant Network Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.