Jiashili Group Bundle

Who Really Owns Jiashili Group?

Unraveling the Jiashili Group SWOT Analysis is just the beginning; understanding its ownership structure is key to unlocking its future. From its humble beginnings to its current market position, the evolution of Jiashili Group's ownership tells a compelling story. Discover the key players and influences that shape this prominent biscuit manufacturer.

This exploration of Jiashili Group's ownership will provide critical insights for investors and business strategists alike. Understanding who owns Jiashili Group, including its early backers and current major stakeholders, is crucial for assessing its strategic direction and long-term potential. We'll examine the Jiashili Group company structure, board composition, and recent ownership trends to offer a comprehensive perspective on this influential player in the snack food industry. Find detailed answers to "Who owns Jiashili Group?" and other critical questions.

Who Founded Jiashili Group?

The story of Jiashili Group Company begins in 1956. At the time, it was known as the Kaiping County Sugar Biscuits Factory. This entity was formed through a unique collaboration.

The initial ownership structure of Jiashili Group was a joint venture. It involved a partnership between 17 biscuit workshops in the Kaiping region. This setup was a public-private partnership.

The arrangement combined private businesses with the local Kaiping County Administration. Details about the exact equity splits among the 17 workshops are not publicly available. This partnership shows a combined effort between private businesses and the local government to grow the biscuit industry.

The initial structure was a joint venture. It included 17 biscuit workshops. It was a public-private partnership.

This partnership involved private businesses. The local Kaiping County Administration was also involved. The goal was to expand the biscuit business.

Specific equity splits are not publicly available. The exact shareholding percentages for the initial workshops are not detailed.

In 2007, Mr. Huang Xianming acquired the business. He became the Chairman and owner. This was a significant shift in control.

The transition to Mr. Huang's ownership concentrated control. It reflected his vision for the company's future.

Early agreements for the initial public-private partnership are not disclosed. Specific vesting schedules are not available.

Understanding the evolution of Jiashili Group's ownership provides insights into its strategic direction. Here's a brief overview:

- 1956: The Kaiping County Sugar Biscuits Factory is established as a joint venture.

- Early Years: The company operates under a public-private partnership model.

- 2007: Mr. Huang Xianming acquires the business, becoming the Chairman and owner. This marks a shift to private ownership.

- Present: The company continues under Mr. Huang's leadership, focusing on growth and market expansion. For more details, you can explore Jiashili Group's company history.

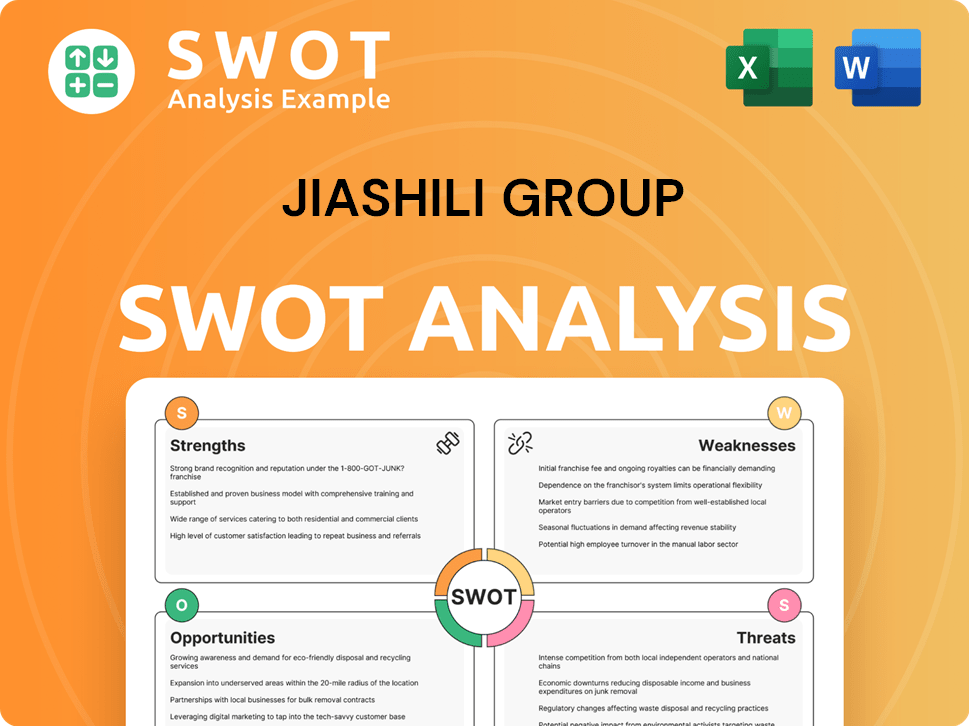

Jiashili Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Jiashili Group’s Ownership Changed Over Time?

The ownership of the Jiashili Group has evolved significantly since its inception. Initially established as a joint venture in 1956, a pivotal shift occurred in 2007 when Mr. Huang Xianming acquired the business, becoming its Chairman and owner. This marked the beginning of a new phase in the company's ownership structure.

In April 2014, Actis, a private equity investor, made a substantial investment of US$50 million in Jiashili Food Group. Another key event was the company's IPO on the Hong Kong Stock Exchange in September 2014, which aimed to raise HK$370 million. The IPO saw the issuance of 100 million shares, representing 25% of the total issued share capital. These events have shaped the current ownership landscape of Jiashili Group.

| Event | Date | Impact on Ownership |

|---|---|---|

| Mr. Huang Xianming's Acquisition | 2007 | Mr. Huang became Chairman and owner. |

| Actis Investment | April 2014 | Actis invested US$50 million in preferred shares and convertible debt. |

| IPO on HKEx | September 25, 2014 | Raised HK$370 million; 25% of shares offered to the public. |

| Private Placement of Convertible Bonds | September 2015 | Fosun Industrial Holdings Limited could hold up to 7.22% of the enlarged share capital upon full conversion. |

| China Investment Corp. Stake | May 27, 2025 | China Investment Corp. listed as a major shareholder with a 5.047% stake. |

As of December 31, 2024, Mr. Huang Xianming and his family are the ultimate controlling shareholders of Jiashili Group, holding a significant 74.8% of the company's shares. The remaining 25.2% is held by the public. Kaiyuan Investments Limited is the immediate and ultimate holding company, with Great Logistics Global Limited also noted as an ultimate holding company. The company's Growth Strategy of Jiashili Group has been influenced by these ownership dynamics.

Understanding the ownership structure of a company like Jiashili Group is crucial for investors and stakeholders.

- Mr. Huang Xianming and family control 74.8% of the shares.

- The IPO in 2014 brought in significant capital and public shareholders.

- China Investment Corp. holds a notable 5.047% stake as of May 2025.

- The ownership structure has evolved through acquisitions, investments, and public offerings.

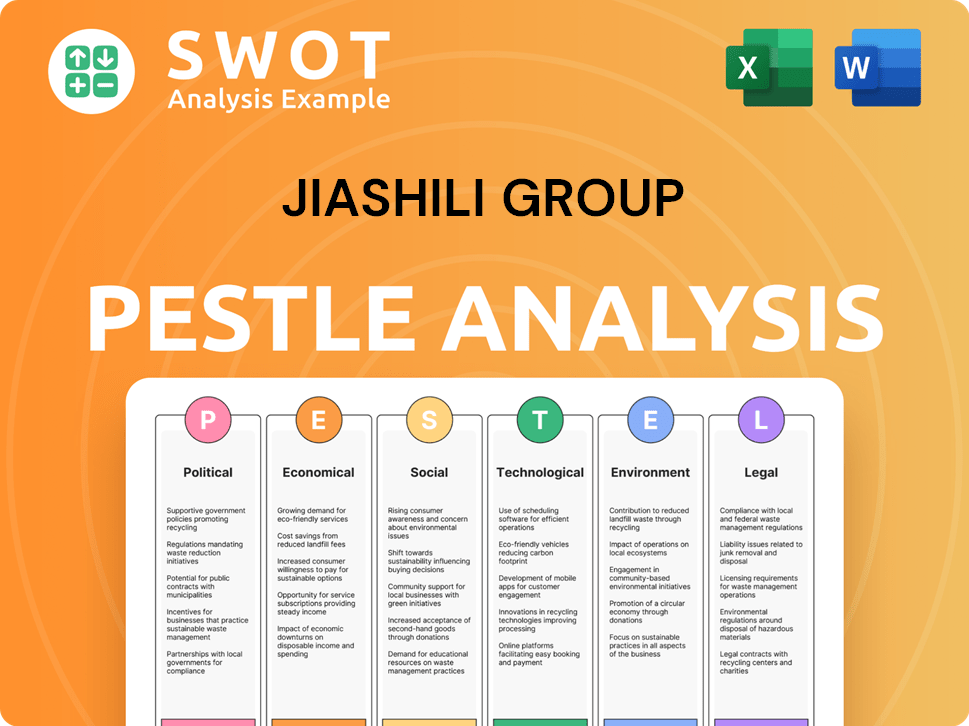

Jiashili Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Jiashili Group’s Board?

As of March 21, 2025, the Board of Directors of Jiashili Group Limited includes key figures steering the company. Mr. Huang Xianming holds the positions of Chairman, CEO, and Executive Director. Other executive directors include Mr. Tan Chaojun, Mr. Chen Songhuan, Mr. Li Fuliang, Mr. Lu Jianxiong, Dr. Zhao Gang, Ms. Rujiao Huang, and Mr. Zekun Huang. Independent Non-Executive Directors are Mr. Ting To Kam, Mr. Xiaoqiang Ma, and Mr. Ziwen Zhang.

The composition of the board reflects a mix of executive and independent directors, which is a common structure in corporate governance. The presence of independent directors is intended to provide oversight and ensure that the interests of all shareholders are considered in decision-making processes. This structure is typical for companies aiming to balance operational leadership with external perspectives.

| Director | Title | Role |

|---|---|---|

| Huang Xianming | Chairman, CEO | Executive Director |

| Tan Chaojun | Executive Director | Executive Director |

| Chen Songhuan | Executive Director | Executive Director |

| Li Fuliang | Executive Director | Executive Director |

| Lu Jianxiong | Executive Director | Executive Director |

| Dr. Zhao Gang | Executive Director | Executive Director |

| Huang Rujiao | Executive Director | Executive Director |

| Huang Zekun | Executive Director | Executive Director |

| Ting To Kam | Independent Non-Executive Director | Independent Director |

| Xiaoqiang Ma | Independent Non-Executive Director | Independent Director |

| Ziwen Zhang | Independent Non-Executive Director | Independent Director |

Regarding Jiashili Group ownership, Mr. Huang Xianming and his family are the ultimate controlling shareholders. As of December 31, 2024, they held 74.8% of the company's ownership. This significant stake gives the Huang family substantial voting power, influencing the company's strategic direction and governance. This concentration of ownership is a key factor in understanding the Jiashili Group structure and the decision-making processes within the company. For more insights, consider exploring the Marketing Strategy of Jiashili Group.

The Huang family's significant ownership stake in Jiashili Group gives them considerable control. This impacts the company's strategic decisions and overall direction.

- Huang Family Control: The Huang family's ownership is a crucial aspect of the company's structure.

- Voting Power: Their large stake translates into substantial voting rights.

- Strategic Influence: The family's control strongly influences the company's strategic direction.

- Governance: The ownership structure significantly affects the company's governance practices.

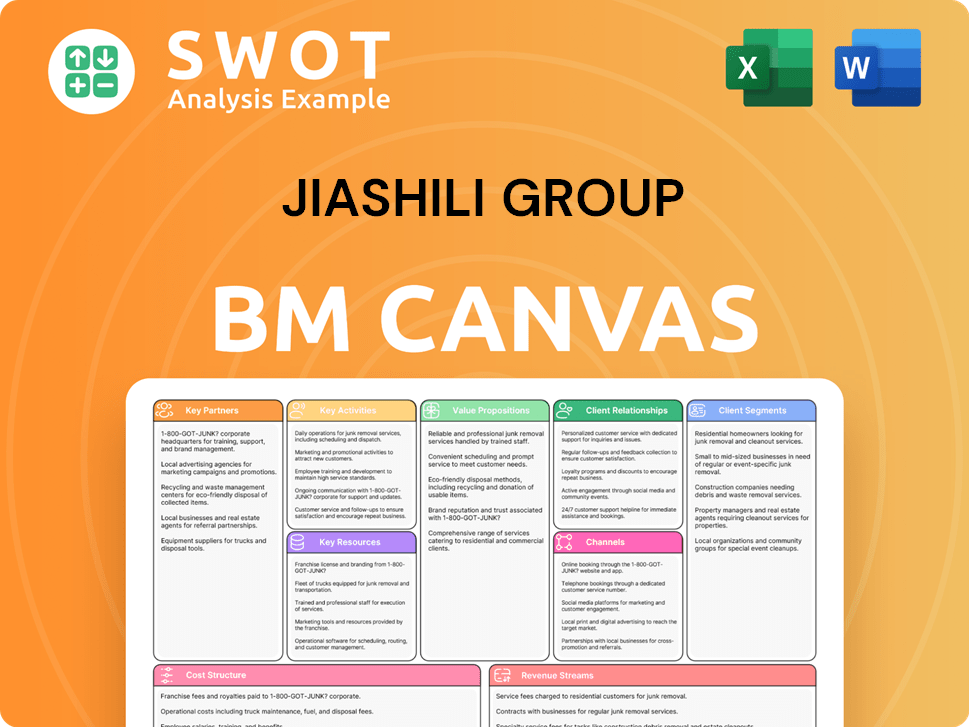

Jiashili Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Jiashili Group’s Ownership Landscape?

In the past few years, Jiashili Group has demonstrated growth in revenue, yet faced challenges in maintaining profitability. For the fiscal year ending December 31, 2024, the company's revenue increased by 6.9% to CNY 1,802.59 million, up from CNY 1,686.18 million in 2023. However, the net profit for the same period decreased by 21.0% to CNY 48.285 million. The profit attributable to the owners of the company also fell by 14.8% to CNY 54.461 million. Earnings per share decreased by 14.8% to RMB 13.12 cents. These figures highlight the financial performance and the need to address the declining profit margins.

As of June 12, 2025, the ownership structure of Jiashili Group remains heavily concentrated. The primary owner, Mr. Huang Xianming, and other insiders hold a significant majority of the company's shares, accounting for 74.8% of the ownership. The remaining 25.2% is held by the general public. There has been no significant dilution of shares in the past year, indicating that the existing ownership structure has been maintained. This concentrated ownership is a key aspect of understanding the company's strategic direction and potential future developments.

The current ownership structure of Jiashili Group, with its strong family control, is a notable aspect of the company. While there have been past investments from private equity firms and convertible bond placements, the founding family maintains significant control. This ownership model is common in many Asian companies. There have been no public announcements regarding any planned succession, potential privatization, or significant changes to the current ownership structure, which suggests a continuation of the status quo in the near future.

Mr. Huang Xianming and other insiders hold a significant 74.8% of shares. The general public owns the remaining 25.2%. This concentration of ownership indicates strong family control.

Revenue increased by 6.9% to CNY 1,802.59 million in 2024. However, net profit decreased by 21.0% to CNY 48.285 million. Earnings per share also decreased, reflecting challenges in profitability.

No significant share dilution has occurred in the past year. The company's ownership structure remains stable, with no announced changes. This suggests a consistent strategic direction.

There have been no public statements about succession or privatization. The current ownership structure is expected to continue. This indicates stability in the company's control.

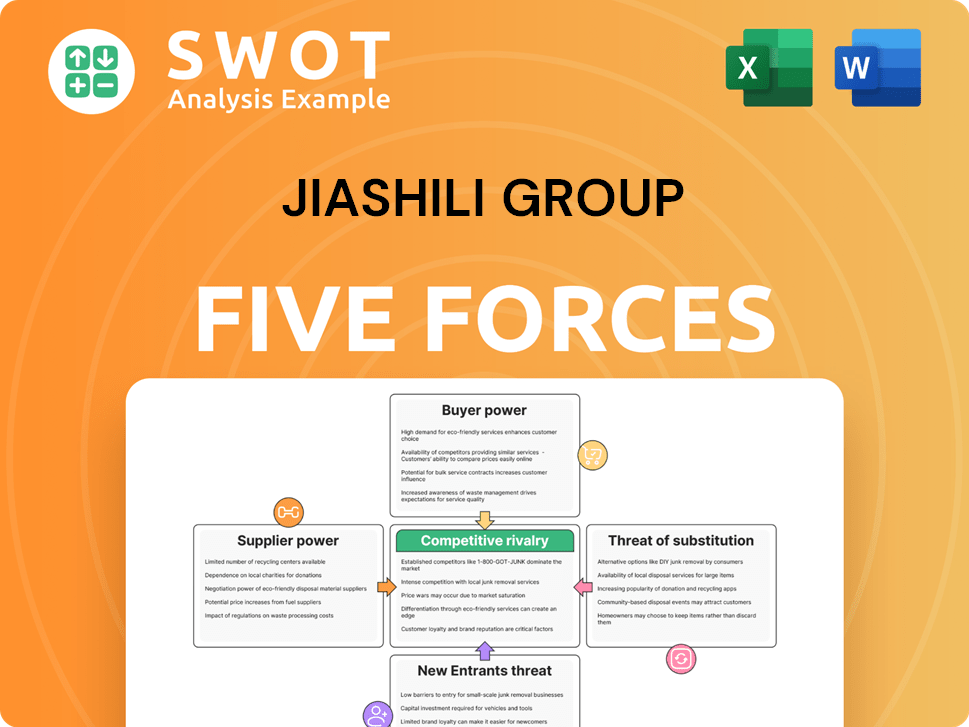

Jiashili Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Jiashili Group Company?

- What is Competitive Landscape of Jiashili Group Company?

- What is Growth Strategy and Future Prospects of Jiashili Group Company?

- How Does Jiashili Group Company Work?

- What is Sales and Marketing Strategy of Jiashili Group Company?

- What is Brief History of Jiashili Group Company?

- What is Customer Demographics and Target Market of Jiashili Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.