Genius Sports Bundle

Who Really Owns Genius Sports?

Understanding the ownership of a company is crucial for grasping its strategic vision and potential for growth. Genius Sports, a key player in the sports data and technology sector, has undergone a significant transformation since its inception. This exploration unveils the intricate details of Genius Sports SWOT Analysis, its evolution, and the key players who have shaped its trajectory.

From its roots as Betgenius to its current status as a publicly traded entity, the Genius Sports ownership structure has evolved dramatically. This analysis delves into the initial founders, early investors, and the impact of its public listing on the company's strategic direction. Learn about the major shareholders of Genius Sports and how their influence impacts the company's future, including its financial performance and market cap.

Who Founded Genius Sports?

The genesis of Genius Sports stems from its founding in 2000 by Mark Locke, who continues to serve as the company's CEO. Early details about the exact equity distribution from the company's inception are not publicly available. However, Locke's role was pivotal in establishing the company, initially branded as Betgenius, with a vision to transform the utilization of sports data.

Early ownership of Genius Sports likely comprised Locke and a select group of initial investors. This structure is typical of startups during the early 2000s tech boom. The company's early focus was on building its core technology and establishing a foothold in the nascent sports data market.

The early phase of the company's growth was marked by organic expansion and strategic partnerships. The company's focus during this period was on building its core technology and establishing its position in the emerging sports data market. Agreements such as vesting schedules or buy-sell clauses, common in startup environments, would have been in place to align the interests of the founding team and any early stakeholders.

The early ownership structure of Genius Sports, as with many startups, was likely concentrated among the founders and early investors. While specific equity splits are not publicly available, the company's trajectory has been significantly shaped by its initial leadership and strategic direction.

- Mark Locke, as the founder and CEO, played a central role in the company's early ownership and strategic vision.

- Early investors likely included individuals or smaller investment groups that provided seed funding.

- The company's early focus was on building its core technology and establishing its position in the sports data market.

- Agreements such as vesting schedules or buy-sell clauses would have been in place to align the interests of the founding team and any early stakeholders.

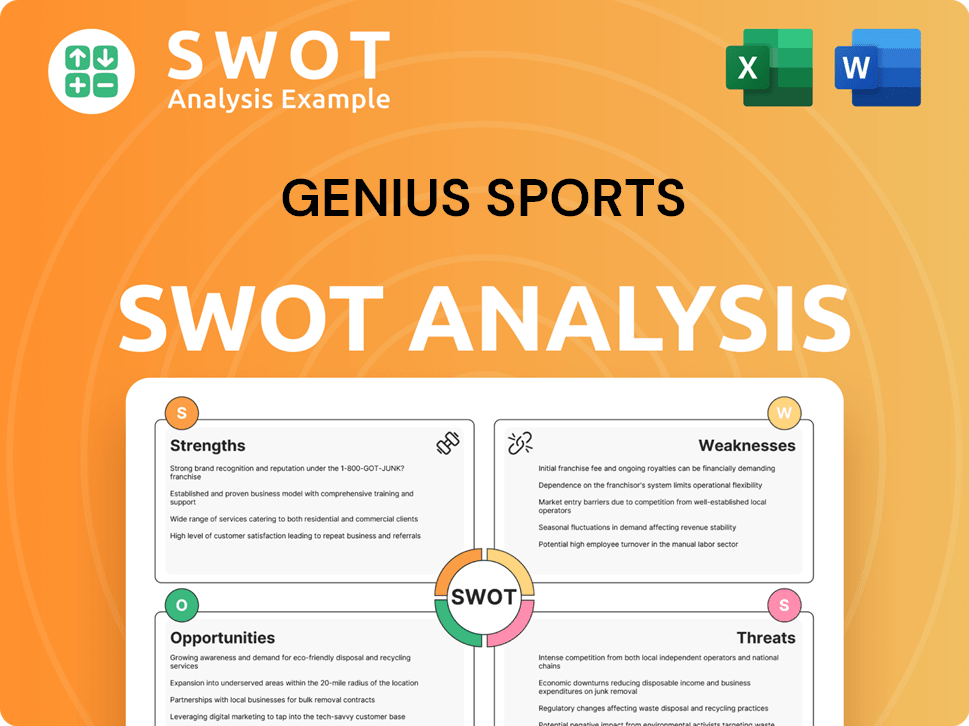

Genius Sports SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Genius Sports’s Ownership Changed Over Time?

The ownership structure of Genius Sports, a company in the sports data and technology sector, shifted dramatically with its public listing. This transition occurred on April 20, 2021, when the company completed its de-SPAC transaction and began trading on the New York Stock Exchange (NYSE) under the ticker 'GENI'. This move transformed Genius Sports from a privately held entity to one with a diverse base of public shareholders, significantly impacting its ownership dynamics.

This shift to public ownership has subjected the company to increased scrutiny from public markets and institutional investors, influencing its corporate governance and strategic decision-making. The company's financial performance and market position are closely watched by these stakeholders, who influence the company's direction regarding growth initiatives, market expansion, and profitability. For example, the company's revenue increased by 20% to $99.4 million in Q4 2023, with a full-year revenue increase of 21% to $413.2 million, demonstrating continued growth and attracting investor interest.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| De-SPAC Transaction and Public Listing | Transition from private to public ownership; broadened shareholder base. | April 20, 2021 |

| Subsequent Funding Rounds | Dilution of founder's stake; increased institutional investment. | Ongoing |

| Institutional Investment | Increased influence of institutional investors on company strategy. | Ongoing |

As of early 2025, the major stakeholders in Genius Sports include a mix of institutional investors, mutual funds, and individual insiders. Leading institutional investors with significant holdings include entities like BlackRock and The Vanguard Group. These institutional investors collectively hold a substantial portion of the company's outstanding shares. According to data from March 31, 2024, institutional ownership accounted for approximately 70.3% of Genius Sports' shares, with 309 institutional holders reporting positions. Mark Locke, the founder and CEO, retains a significant stake, though his overall percentage has diluted over time. If you're interested in learning more about the company's journey, you can read a Brief History of Genius Sports.

Genius Sports' ownership structure has evolved significantly since its public listing, with major stakeholders including institutional investors and company insiders.

- Institutional investors hold a substantial portion of the shares.

- Mark Locke, the CEO, remains a key individual shareholder.

- The company's financial performance attracts investor interest.

- The company's stock is traded on the NYSE under the ticker 'GENI'.

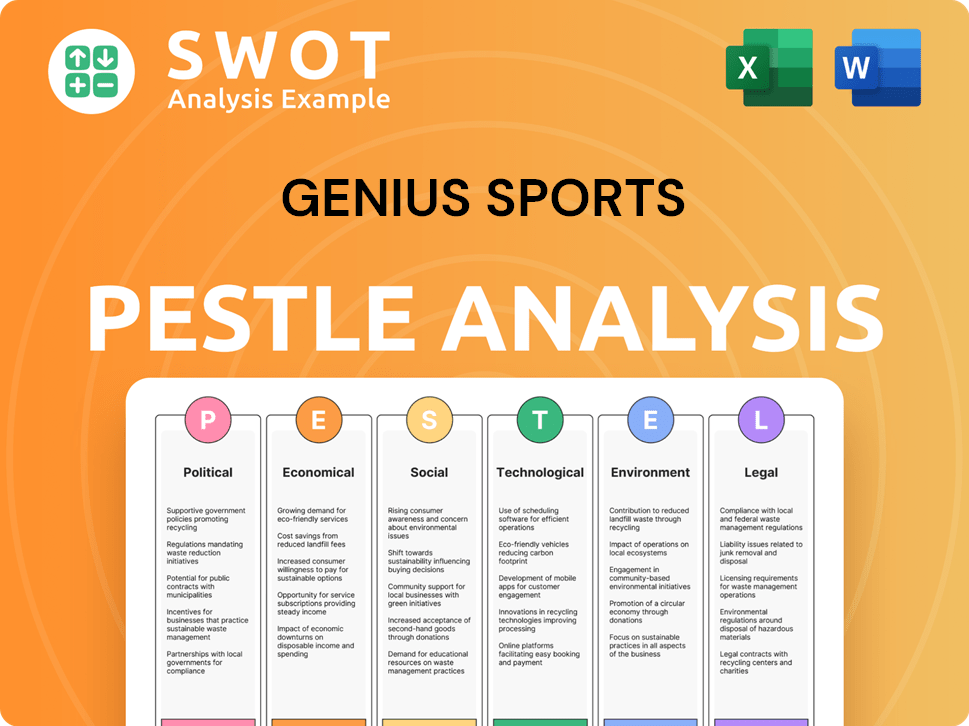

Genius Sports PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Genius Sports’s Board?

The Board of Directors of Genius Sports, as of early 2025, oversees the company's operations and strategic direction, reflecting its ownership structure. The board includes a mix of executive directors, representatives of major shareholders, and independent directors. Mark Locke, the CEO, is a key member, representing the executive leadership. Other board members bring experience from the sports, technology, and finance sectors. Some represent significant institutional investors or provide independent oversight.

The composition of the board is crucial for the company's governance. The board's decisions are influenced by the need to deliver value to a diverse base of public shareholders, balancing growth initiatives with profitability and risk management. The board's structure reflects the company's commitment to maintaining a strong governance framework suitable for a publicly traded entity.

| Board Member | Title | Affiliation |

|---|---|---|

| Mark Locke | CEO | Genius Sports |

| Adam Miller | Director | Institutional Investor Representative |

| John Hadden | Independent Director | Independent |

The voting structure of Genius Sports generally follows a one-share-one-vote principle, common for companies listed on major exchanges like the NYSE. This structure ensures that voting power is proportional to share ownership, aligning shareholder influence with their economic stake in the company. The company's approach to corporate governance is designed to protect shareholder interests.

Genius Sports' ownership structure is designed to ensure fair representation and alignment of interests. The board's composition reflects a balance of executive leadership, shareholder representation, and independent oversight, supporting the company's strategic goals. Learn more about the Growth Strategy of Genius Sports.

- The board includes executive directors, representatives of major shareholders, and independent directors.

- Voting typically follows a one-share-one-vote principle.

- The board is attentive to shareholder interests and corporate governance best practices.

- The company is publicly traded, which influences its governance approach.

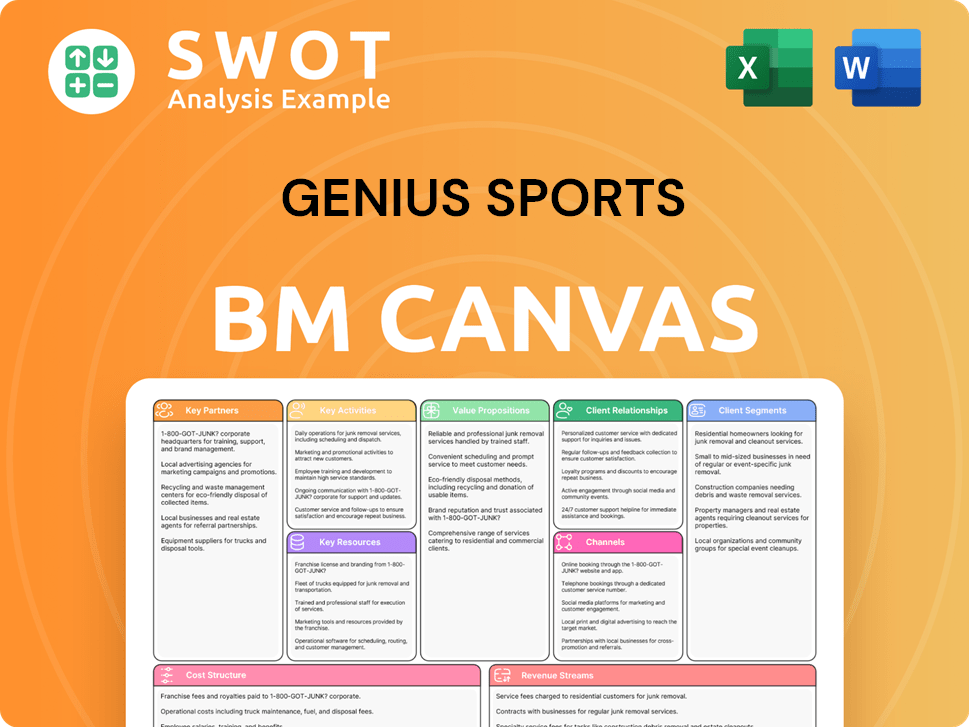

Genius Sports Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Genius Sports’s Ownership Landscape?

In the past few years, several key developments have reshaped the Genius Sports ownership landscape. The company's direct listing on the NYSE in April 2021 marked a pivotal shift, transforming its ownership structure from private to public. This move opened the door for wider investor participation and provided access to public capital markets, crucial for funding future growth initiatives. Following the initial public offering, there has been a notable increase in institutional ownership, with major asset managers and investment funds acquiring shares, a common trend for newly listed companies.

Genius Sports has also actively pursued strategic acquisitions, which can indirectly affect ownership through the integration of new entities and the potential issuance of shares as part of these deals. The company's acquisition strategy, including its focus on expanding its official data rights, such as the long-term partnership with the NFL, has significantly influenced its market position and investor interest. For example, the company reported a 20% increase in Q4 2023 revenue, reaching $99.4 million, demonstrating strong financial performance and investor appeal.

Industry trends in the sports technology and betting sectors also influence the Genius Sports ownership dynamics. There's a growing trend of institutional investment in profitable and expanding technology companies. Genius Sports fits this profile with its strong revenue growth and strategic partnerships. While founder dilution is a natural outcome of growth and public offerings, Mark Locke remains a key figure in the company's leadership. The company's focus on global expansion and technological advancements may involve future capital raises or strategic partnerships, which could further evolve its ownership structure. To learn more about the company's business model, explore the article on Genius Sports's business model.

The stock performance of Genius Sports has varied since its public listing. Investors often monitor key metrics like market capitalization and stock price history to assess the company's value. Understanding these trends is crucial for anyone considering how to invest in Genius Sports.

Identifying the major shareholders of Genius Sports provides insight into the company's ownership structure. Institutional investors often hold significant stakes, influencing strategic decisions. Knowing who owns Genius Sports helps in understanding the company's direction.

Genius Sports has made several acquisitions to expand its offerings and market reach. Strategic partnerships, such as the NFL deal, have also played a key role. These moves impact the company's value and the interests of Genius Sports investors.

The leadership team at Genius Sports, including the CEO, shapes the company's strategy and direction. Understanding the leadership's vision is essential for evaluating the company's potential. The leadership team has a significant influence on Genius Sports ownership.

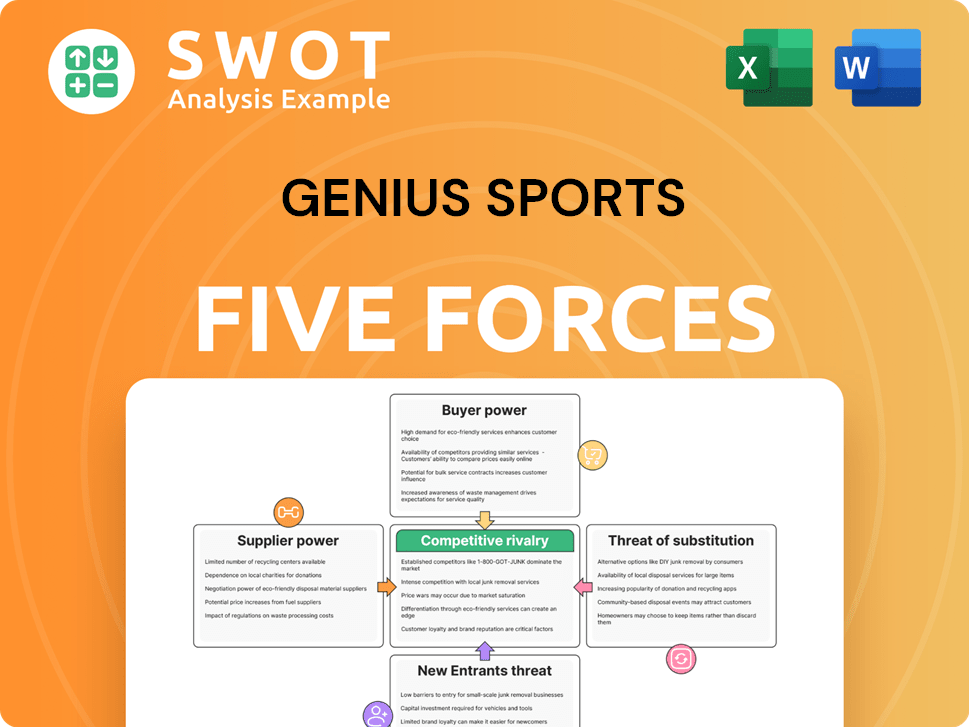

Genius Sports Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Genius Sports Company?

- What is Competitive Landscape of Genius Sports Company?

- What is Growth Strategy and Future Prospects of Genius Sports Company?

- How Does Genius Sports Company Work?

- What is Sales and Marketing Strategy of Genius Sports Company?

- What is Brief History of Genius Sports Company?

- What is Customer Demographics and Target Market of Genius Sports Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.