W. L. Gore & Associates Bundle

Who Really Owns W. L. Gore & Associates?

Ever wondered about the ownership behind the innovative W. L. Gore & Associates SWOT Analysis? The story of W. L. Gore & Associates, the parent company of Gore-Tex, is a fascinating blend of family legacy and employee empowerment. Understanding the Gore Company Ownership is key to grasping its unique corporate culture and long-term vision. This exploration unveils the secrets behind its privately held structure.

Delving into the Gore company history reveals a commitment to innovation and a distinctive organizational model. The company, founded by Wilbert and Genevieve Gore, operates with a structure that prioritizes its 'Associates'. Discover how this unique approach to who founded Gore and how it shapes the company's strategy, governance, and future, making it a compelling case study in modern business.

Who Founded W. L. Gore & Associates?

The origins of W. L. Gore & Associates, or the Gore Company, trace back to January 1, 1958. It was founded in the basement of Bill and Vieve Gore's home in Newark, Delaware. The company's inception was driven by Bill Gore's vision to explore the potential of fluorocarbon polymers, particularly PTFE, after his work at DuPont Corporation.

Bill Gore, a former senior research chemist, acquired the patent for PTFE and started the business independently. This was after he was unable to secure investment for his innovative ideas within DuPont. This marked the beginning of a unique company with a focus on innovation and employee empowerment.

The Gore family initially held the ownership of W. L. Gore & Associates. The company's structure and culture reflected the founders' values. The company's innovative 'lattice' organizational structure was designed to foster collaboration and decentralized decision-making.

W. L. Gore & Associates was established on January 1, 1958.

The company was founded by Wilbert L. 'Bill' Gore and Genevieve 'Vieve' Gore.

The company began in the basement of the Gore's home in Newark, Delaware.

The initial focus was on exploring market opportunities for fluorocarbon polymers, especially PTFE.

Initial ownership was held by the Gore family, with a focus on employee empowerment.

The company adopted a unique 'lattice' organizational structure, promoting peer-to-peer communication.

From its inception, W. L. Gore & Associates integrated an employee stock ownership plan (ESOP). This approach, where employees are known as 'Associates' and are part owners, has been a core element of the company's culture. This commitment to employee ownership has been a key factor in the company's long-term success. For more details, you can read a brief history of W. L. Gore & Associates.

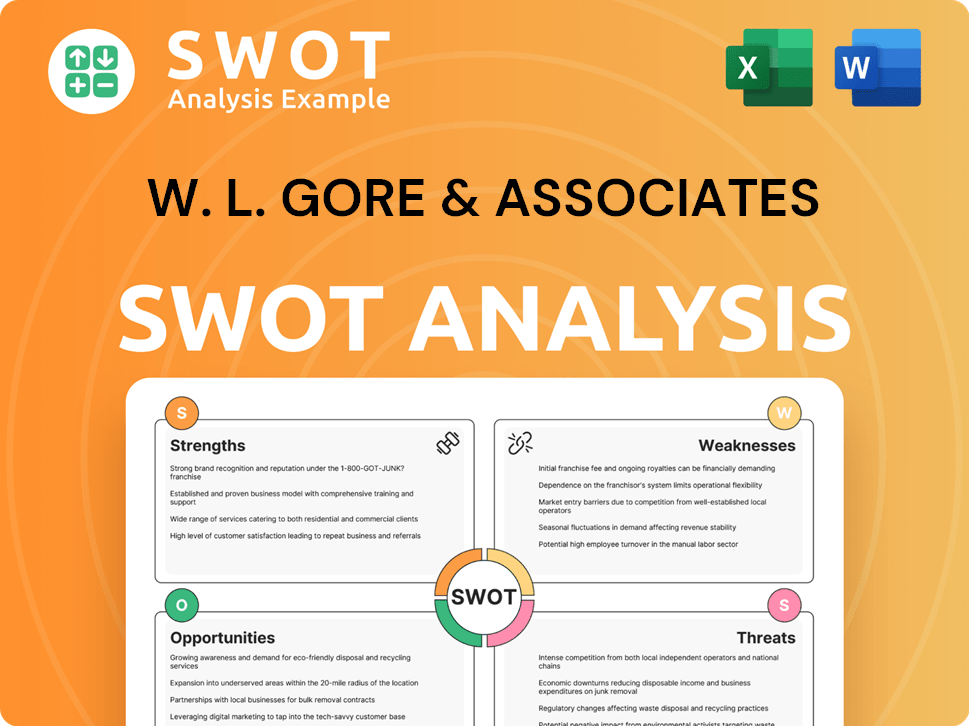

W. L. Gore & Associates SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has W. L. Gore & Associates’s Ownership Changed Over Time?

The Gore Company Ownership structure has remained private since its inception in 1958, setting it apart from publicly traded companies. This decision has allowed the company to focus on long-term strategies rather than being swayed by short-term market pressures. The ownership is primarily held by its Associates (employees) and the Gore family, reflecting a commitment to a unique corporate culture and internal decision-making processes.

A significant development in the ownership structure was the introduction of the Associate Stock Ownership Plan (ASOP) in the 1970s. This plan allows Associates worldwide to become part-owners of the enterprise. Every year, W. L. Gore contributes a percentage of an Associate's pay, up to 15%, to purchase company stock for each participating Associate. This broad-based employee ownership model is a key feature of the company's structure.

| Aspect | Details | Impact |

|---|---|---|

| Founding Year | 1958 | Established the foundation for private ownership. |

| ASOP Implementation | 1970s | Enabled employee ownership, fostering a unique corporate culture. |

| Current Status | Privately held | Allows for long-term strategic focus and independence from public market pressures. |

As of 2024-2025, W. L. Gore & Associates remains a privately held company, with annual revenues estimated between $4.8 billion to $5 billion. The company employs over 13,000 Associates globally. The major stakeholders are the Associates through the ASOP and the Gore family, ensuring that the company's values and long-term vision are maintained. This structure allows the company to prioritize innovation and its distinctive culture, making it a unique entity in the business world.

W. L. Gore & Associates is a privately held company, primarily owned by its Associates and the Gore family.

- The Associate Stock Ownership Plan (ASOP) is a key component, offering employees ownership.

- This structure supports a long-term focus, innovation, and a unique corporate culture.

- The company generates approximately $4.8 billion to $5 billion in annual revenue.

- W. L. Gore & Associates employs over 13,000 Associates globally.

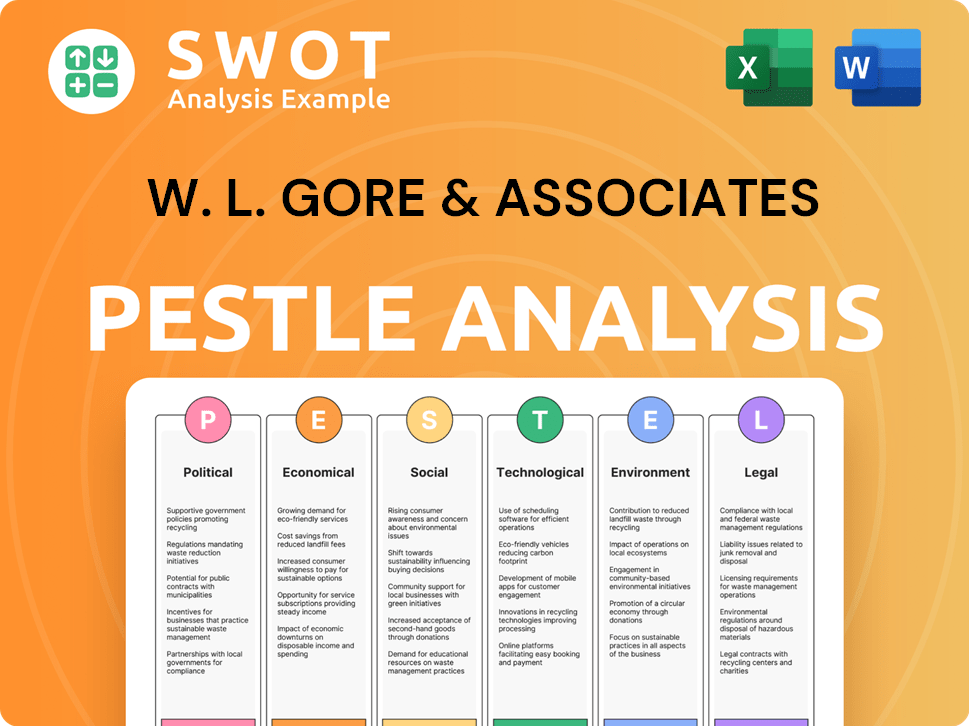

W. L. Gore & Associates PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on W. L. Gore & Associates’s Board?

W. L. Gore & Associates, the parent company of Gore-Tex, operates under a unique organizational structure, which influences its leadership and decision-making processes. Unlike traditional corporations, W. L. Gore & Associates doesn't have a conventional board of directors in the same way a public company does. However, it does have an executive leadership structure. Bret Snyder, a grandson of the founders, currently serves as CEO and Chairman of the Board of Directors, a role he assumed in 2020.

Key executives at W. L. Gore & Associates include individuals holding titles such as Executive Director, Vice President of Medical Division Supply Chain Strategy, and Chief Technical Officer, among others. External board affiliations also exist, such as Sherry L. Buck, who is the Chief Financial Officer of W. L. Gore & Associates Inc., and who serves on the board of directors for Lennox, appointed in July 2019. The company's approach emphasizes internal collaboration and peer-based accountability, which is typical for a privately held, employee-owned company.

| Executive Role | Name | Notes |

|---|---|---|

| CEO and Chairman of the Board | Bret Snyder | Grandson of founders, assumed role in 2020 |

| Chief Financial Officer | Sherry L. Buck | Also serves on the board of directors for Lennox |

| President of the AATCC Board of Directors (2025-2026) | Christina Rapa | Engineer in Gore's Fabrics division |

The ownership structure of W. L. Gore & Associates is primarily through its Associate Stock Ownership Plan (ASOP), with the Gore family holding the remaining shares. This arrangement gives Associates a direct stake in the company's performance, as the value of their stock is tied to the company's profitability. This model fosters a sense of shared responsibility and commitment among the Associates. To learn more about the company's strategic direction, you can read about the Growth Strategy of W. L. Gore & Associates.

W. L. Gore & Associates is a privately held company, with the majority owned by its Associates through the ASOP.

- The Gore family retains a portion of the ownership.

- Leadership is decentralized, with Associates influencing decisions.

- Bret Snyder is the current CEO and Chairman of the Board.

- The company's culture emphasizes internal collaboration and peer-based accountability.

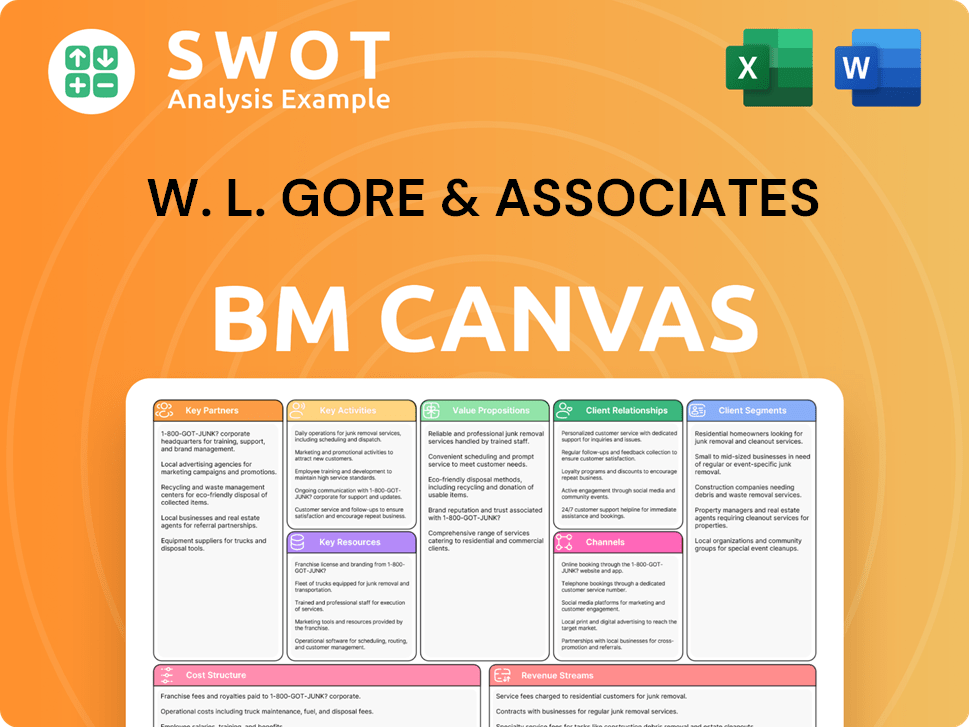

W. L. Gore & Associates Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped W. L. Gore & Associates’s Ownership Landscape?

In recent years, W. L. Gore & Associates, the company behind the Gore-Tex brand, has remained steadfast in its private, employee-owned structure. As of February 2025, the company reports a global workforce of approximately 13,000 Associates. This model allows the company to focus on long-term strategic goals, rather than being swayed by short-term market pressures. The company's consistent growth, with annual revenues of $5 billion, showcases the stability often associated with private ownership.

A significant trend in the company's history is the continued influence of the Gore family. In 2020, Bret Snyder, a grandson of the founders, assumed the roles of CEO and Chairman of the Board, signaling a commitment to the founders' vision and the company's unique culture. This succession highlights the enduring impact of the Gore family on the company's ownership and strategic direction. This is a key aspect of how the company, also known as Gore Company, is structured.

| Aspect | Details | Data (as of 2024/2025) |

|---|---|---|

| Ownership Structure | Private, Employee-Owned | Employee Stock Ownership Plan (ESOP/ASOP) |

| Revenue (2024 Projection) | Approximately | $4.5 billion |

| Number of Associates | Global Workforce | Approximately 13,000 (as of February 2025) |

The company's approach to ownership is distinct from industry trends seen in public companies. Instead of public stock offerings or buybacks, the company leverages its employee stock ownership plan. This structure fosters a culture of innovation and shared success, allowing employees to accumulate wealth tied to the company's performance. This structure is a key part of who founded Gore.

W. L. Gore & Associates remains a privately held entity. The company's commitment to private ownership allows it to prioritize long-term investments in research and development, especially in areas like environmental sustainability and human well-being.

The employee-owned model is central to the company's identity. This structure promotes a culture of innovation. The company consistently reiterates its preference for private ownership.

The company is primarily owned by its employees through an employee stock ownership plan. This structure allows the company to focus on long-term strategies. The Gore family continues to have a significant influence.

The Gore family's influence is evident in the leadership transitions. The family's continued involvement underscores its commitment to the company's values. Leadership transitions reflect a commitment to the founding vision.

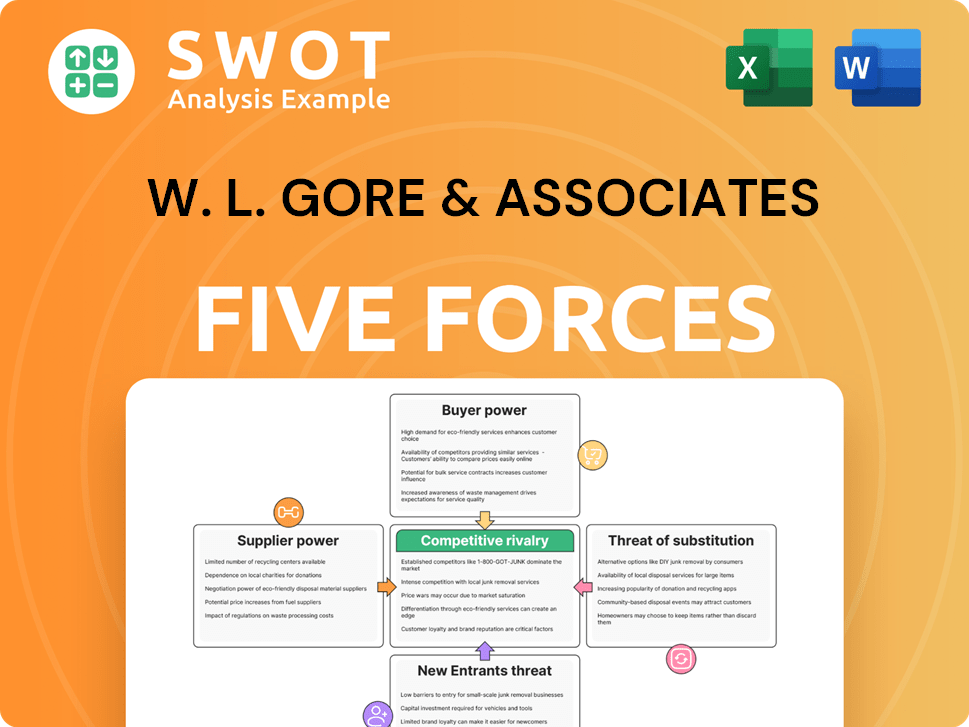

W. L. Gore & Associates Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of W. L. Gore & Associates Company?

- What is Competitive Landscape of W. L. Gore & Associates Company?

- What is Growth Strategy and Future Prospects of W. L. Gore & Associates Company?

- How Does W. L. Gore & Associates Company Work?

- What is Sales and Marketing Strategy of W. L. Gore & Associates Company?

- What is Brief History of W. L. Gore & Associates Company?

- What is Customer Demographics and Target Market of W. L. Gore & Associates Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.