Hong Leong Financial Bundle

Who Really Controls Hong Leong Financial?

Understanding the ownership structure of a financial powerhouse like Hong Leong Financial Company is crucial for investors and strategists alike. Unraveling the intricacies of who owns Hong Leong Financial reveals critical insights into its strategic direction, risk profile, and long-term prospects. This deep dive explores the evolution of its ownership, from its founding to the present day, providing a comprehensive view of its corporate landscape.

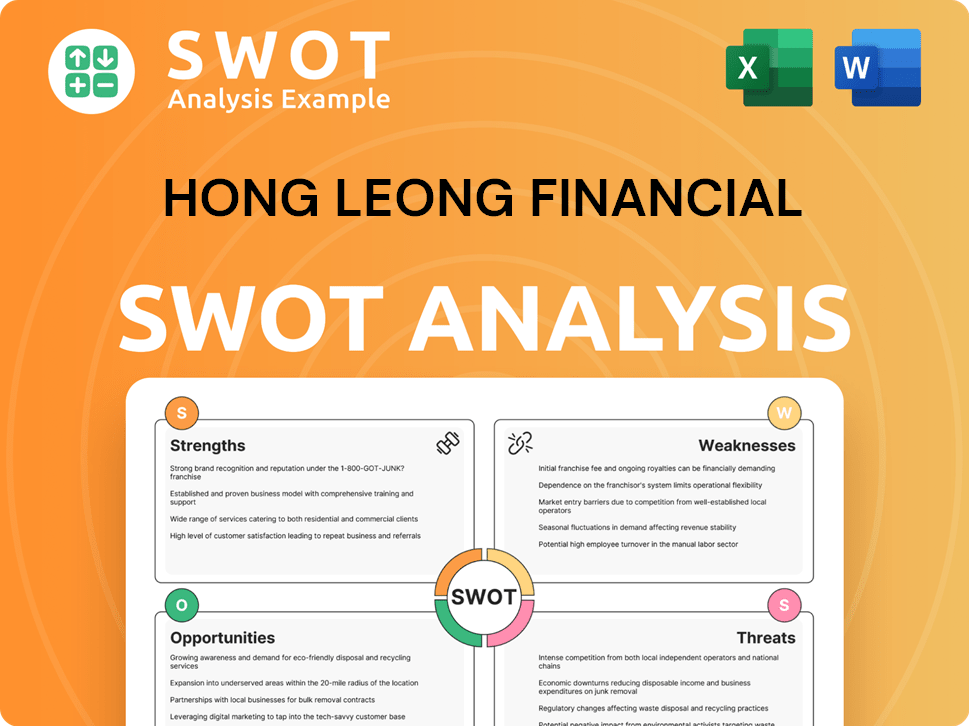

The Hong Leong Financial SWOT Analysis can provide valuable insights into the company's strengths, weaknesses, opportunities, and threats, further enriching your understanding of its position within the financial sector. This analysis will examine the relationship between Hong Leong Financial and its parent company, the Hong Leong Group, along with the influence of major stakeholders and public shareholders. We'll also explore the company's history, including the pivotal acquisition of MUI Bank Berhad, and its current market capitalization, offering a complete picture of this important financial institution.

Who Founded Hong Leong Financial?

The story of Hong Leong Financial Company ownership begins with the incorporation of Hong Leong Financial Group Berhad in 1968. However, the roots of its banking arm, Hong Leong Bank Berhad (HLB), stretch back to 1905, predating the financial group itself.

The early history of HLB is tied to the Kwong Lee Mortgage & Remittance Company, established in Kuching, Sarawak, by Cantonese brothers Lam Tee Chew and Lam Song Khee. This company played a crucial role in providing loans and facilitating remittances for overseas Chinese families.

The broader Hong Leong Group, which Hong Leong Financial Group is a part of, was co-founded in 1963 by Quek Leng Chan and Kwek Hong Png. Kwek Hong Png, who founded the Hong Leong Group in Singapore in 1941, started with a modest capital of $7,000 and included his brothers in the venture.

The Hong Leong Group was co-founded in 1963 by Quek Leng Chan and Kwek Hong Png.

Hong Leong Bank's origins can be traced back to 1905 with the Kwong Lee Mortgage & Remittance Company.

Kwek Hong Png started the Hong Leong Group in Singapore with $7,000 in 1941.

The Quek/Kwek family has maintained a strong influence over the Hong Leong Group.

The Kwong Lee Mortgage & Remittance Company focused on loans against export commodities and remittances.

Kwek Hong Png initially held a 35% stake in the Singapore-based Hong Leong Group, with his brothers receiving a 65% stake.

The initial ownership structure of Hong Leong Financial Company, and the identity of the ultimate beneficial owner, is closely linked to the broader Hong Leong Group, a family-owned conglomerate. While specific details on the initial equity split in 1968 are not readily available, the Quek/Kwek family has consistently maintained a significant influence over the company. Understanding the Marketing Strategy of Hong Leong Financial can also shed light on the company's direction and key stakeholders.

The Hong Leong Financial Company's ownership structure is deeply rooted in the history of the Hong Leong Group.

- The company's origins trace back to 1905 with the Kwong Lee Mortgage & Remittance Company.

- The Hong Leong Group was co-founded by Quek Leng Chan and Kwek Hong Png.

- The Quek/Kwek family has consistently held significant influence over the group.

- Understanding the historical context provides insights into the current ownership dynamics.

Hong Leong Financial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Hong Leong Financial’s Ownership Changed Over Time?

The Hong Leong Financial Company ownership structure has evolved significantly since its listing on the Bursa Malaysia on January 3, 2000. Initially, the company operated under the umbrella of Hong Leong Company (Malaysia) Berhad (HLCM), which remains the ultimate holding company. This structure reflects a blend of family control and institutional investment, shaping the company's strategic direction and governance. The Hong Leong Group's overarching vision continues to guide HLFG's diversified financial services.

A key event was the listing of Hong Leong Financial Group Berhad (HLFG) on the Bursa Malaysia. As of June 13, 2024, HLFG's market capitalization was approximately RM18.87 billion. This event marked a significant step in the company's evolution, allowing for greater access to capital and increased visibility in the financial market. The ongoing involvement of institutional investors further influences the company's operations and strategic decisions.

| Ownership Milestone | Date | Details |

|---|---|---|

| Listing on Bursa Malaysia | January 3, 2000 | HLFG listed, marking a key moment in its ownership journey. |

| HLCM as Ultimate Holding Company | Ongoing | Hong Leong Company (Malaysia) Berhad maintains its position. |

| EPF's Stake | March 28, 2024 | Employees Provident Fund held a 5.07% stake, becoming a substantial shareholder. |

The major stakeholders in Hong Leong Financial Company ownership include Hong Leong Company (Malaysia) Berhad, which maintains ultimate control. As of September 2023, Hong Leong Financial Group is the holding company of Hong Leong Bank Berhad with a 64.37% equity interest. Institutional investors also play a significant role. The Employees Provident Fund (EPF) held a 5.07% stake as of March 28, 2024. Guoco Group Limited is also an associated company of HLFG, holding a 25.4% shareholding. Other significant institutional owners include Vanguard and BlackRock, Inc. These institutional investors collectively hold a substantial number of shares, with 42 institutional owners holding a total of 11,599,044 shares as of a recent filing. This diverse ownership structure influences the company's strategic direction.

Understanding the Hong Leong Financial parent company is crucial for investors and stakeholders.

- Hong Leong Company (Malaysia) Berhad is the ultimate holding company.

- The Employees Provident Fund (EPF) is a significant institutional shareholder.

- Guoco Group Limited holds a substantial shareholding.

- Hong Leong Bank is a key subsidiary.

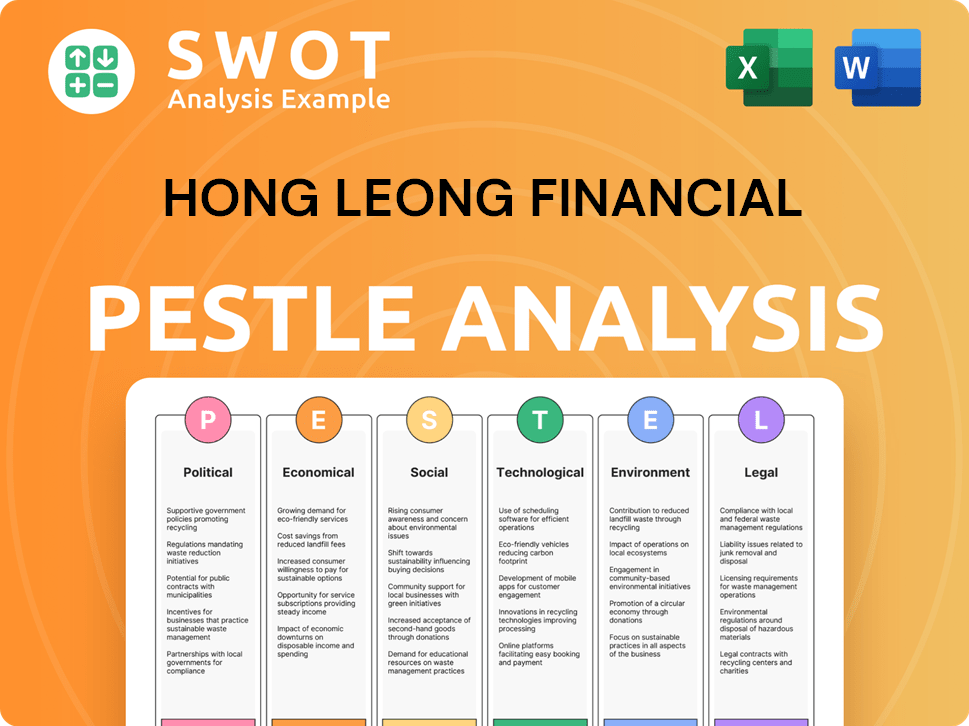

Hong Leong Financial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Hong Leong Financial’s Board?

The Board of Directors of Hong Leong Financial Group Berhad (HLFG) oversees the company's governance and strategic direction. Key figures include Tan Kong Khoon, who serves as the President & Chief Executive Officer. Quek Leng Chan, a co-founder of the Hong Leong Group Malaysia, holds significant positions as the executive chairman of HLFG and chairman of Hong Leong Bank. The board's composition reflects the influence of major shareholders and includes independent members to ensure a balance of interests.

The structure ensures that decision-making is centralized, reflecting the family's long-term strategic vision. Details on the board's composition and corporate governance practices can be found in the company's annual reports, such as those from 2024 and 2023. This structure is essential for understanding the dynamics of Growth Strategy of Hong Leong Financial and its relationship with the broader Hong Leong Group.

| Director | Position | Key Affiliations |

|---|---|---|

| Quek Leng Chan | Executive Chairman | Chairman of Hong Leong Bank, Co-founder of Hong Leong Group Malaysia |

| Tan Kong Khoon | President & Chief Executive Officer | Director of Hong Leong Company (Malaysia) Berhad (HLCM) |

| Other Directors | Various | Include independent directors and representatives from major shareholders |

The voting structure at HLFG typically follows a one-share-one-vote principle, common in publicly listed companies. However, the substantial shareholdings by Hong Leong Company (Malaysia) Berhad and the founding family provide significant control. This concentration of ownership influences the strategic direction and operational decisions of the company. Understanding the Hong Leong Financial Company ownership structure is crucial for investors and stakeholders to assess the company's governance and long-term strategy.

The primary Who owns Hong Leong Financial is the Hong Leong Group, with Quek Leng Chan playing a pivotal role. The Hong Leong Financial parent company is Hong Leong Company (Malaysia) Berhad (HLCM). The board includes key executives and independent directors.

- Quek Leng Chan is the Executive Chairman, indicating significant influence.

- Tan Kong Khoon is the President & CEO.

- HLCM's substantial holdings ensure a unified strategic direction.

- Annual reports detail corporate governance and board composition.

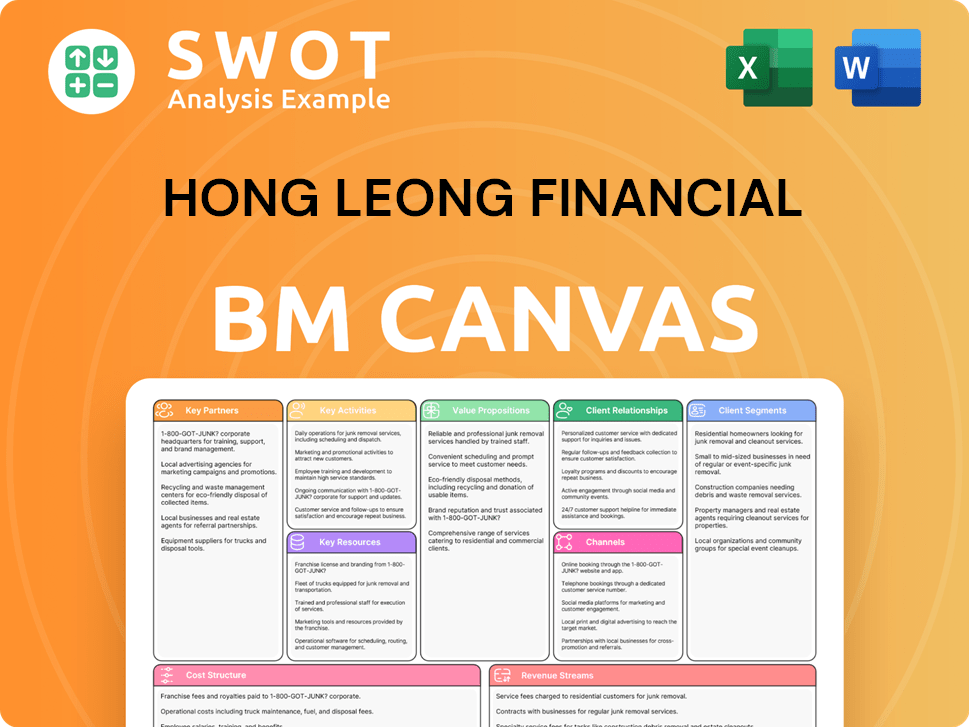

Hong Leong Financial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Hong Leong Financial’s Ownership Landscape?

In recent years, the ownership of Hong Leong Financial Group Berhad (HLFG) has seen shifts, particularly in institutional holdings. A notable development in late March 2025 was the re-emergence of the Employees Provident Fund (EPF) as a significant shareholder. The EPF acquired 57.72 million shares, representing a 5.03% stake on March 26, 2025, increasing its shareholding to 5.07% by March 28, 2025. This move signals renewed interest from a major Malaysian institutional investor, especially after EPF ceased to be a substantial shareholder in August 2024. This shows the dynamic nature of Hong Leong Financial Company ownership.

The market capitalization of HLFG has fluctuated. In 2025, it decreased by 9.75% to €3.98 billion, following a 20.17% increase in 2024 to €4.42 billion. As of June 2025, HLFG's market cap is approximately $4.38 billion USD, a 4.57% decrease in one year. This data is crucial for understanding Hong Leong Financial Company shareholders and their investment landscape. The company's financial performance remains strong, with pre-tax profit exceeding RM5 billion in FY2023, indicating robust financial health.

| Metric | 2024 | 2025 (as of June) |

|---|---|---|

| Market Cap (EUR Billion) | €4.42 | €3.98 |

| Market Cap (USD Billion) | N/A | $4.38 |

| EPF Stake | Ceased to be substantial shareholder (August 2024) | 5.07% (March 2025) |

The trend for HLFG indicates continued institutional interest, with major investors like Vanguard, Dimensional, and BlackRock maintaining positions. The company's ownership structure appears stable, with no immediate plans for privatization or public listing. For insights into the company's strategic direction, you can read more about it in this article about Growth Strategy of Hong Leong Financial.

Major institutional investors include Vanguard, Dimensional, and BlackRock. The Employees Provident Fund (EPF) is a significant shareholder.

The market capitalization decreased by 9.75% in 2025. The market cap is approximately $4.38 billion USD as of June 2025.

The company's ownership structure is stable, with no immediate plans for privatization or public listing.

Pre-tax profit surpassed RM5 billion in FY2023, indicating strong financial health.

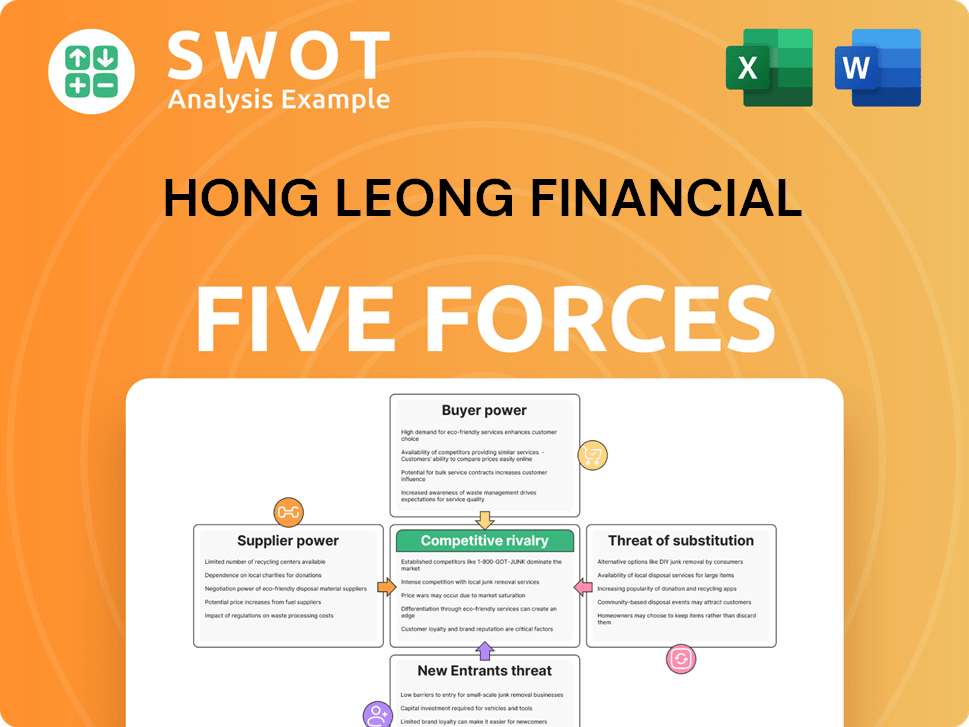

Hong Leong Financial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hong Leong Financial Company?

- What is Competitive Landscape of Hong Leong Financial Company?

- What is Growth Strategy and Future Prospects of Hong Leong Financial Company?

- How Does Hong Leong Financial Company Work?

- What is Sales and Marketing Strategy of Hong Leong Financial Company?

- What is Brief History of Hong Leong Financial Company?

- What is Customer Demographics and Target Market of Hong Leong Financial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.