JD Logistics Bundle

Who Really Controls JD Logistics?

Unraveling the ownership structure of JD Logistics is key to understanding its future in the dynamic world of e-commerce and logistics. This deep dive explores the evolution of JD Logistics, from its roots within JD.com to its current status as a publicly traded entity. Discover the key players and strategic shifts that have shaped this influential JD Logistics SWOT Analysis.

Understanding the ownership of JD Logistics, a leading logistics company, is vital for anyone tracking the industry's growth. From its inception as part of JD.com to its IPO, the evolution of JD Logistics ownership reflects its strategic ambitions and market positioning. This analysis will examine the JD Logistics parent company, major shareholders, and the impact of its public listing, offering insights into its governance and alliances within the global supply chain. The JD Group's influence and the company's market share are also crucial aspects of this exploration.

Who Founded JD Logistics?

The story of JD Logistics ownership begins with its integration within the e-commerce giant, JD.com. Founded by Liu Qiangdong in 1998, JD Logistics initially operated as an internal department. This structure meant that the early ownership of what would become JD Logistics was intrinsically tied to JD.com's founding and its initial investors.

As an internal department, JD Logistics did not have a separate equity structure or independent shareholders in its early stages. The development of its logistics network was funded through investments in JD.com. Early investors in JD.com, such as Tiger Global Management and DST Global, indirectly held stakes in the logistics operations.

The vision of an integrated, self-operated logistics network, driven by the founding team of JD.com, shaped the initial development of JD Logistics. This approach prioritized quality control and customer satisfaction, reflecting a commitment to vertical integration within the e-commerce model. This strategy has been a key factor in the company's growth and success.

JD Logistics started as an internal department of JD.com, founded by Liu Qiangdong. Early ownership was directly linked to JD.com's shareholders.

Initially, JD Logistics operated as a cost center within JD.com. There was no separate equity or shareholding structure for the logistics arm.

Early investors in JD.com, such as Tiger Global Management and DST Global, were indirect stakeholders. Their investments fueled the development of the logistics infrastructure.

The founding team's vision prioritized an integrated logistics network. This approach aimed to ensure quality control and enhance customer satisfaction.

JD Logistics wasn't a distinct legal entity in its early days. It was an integral part of JD.com, without its own shareholders or separate vesting schedules.

The commitment to vertical integration was a key part of JD.com's business model. This strategy helped in controlling the entire supply chain.

The evolution of JD Logistics's target market and ownership structure reflects its growth from an internal support function to a major player in the logistics industry. As of 2024, JD Logistics operates a vast network, including over 1,600 warehouses globally. In 2023, JD Logistics reported revenue of approximately $16.6 billion, showcasing its significant expansion and market presence. Understanding the

The initial ownership of JD Logistics was entirely held by JD.com, with Liu Qiangdong as the primary stakeholder.

- Early investments in JD.com by firms like Tiger Global Management and DST Global indirectly supported the logistics operations.

- JD Logistics was not a separate legal entity in its early stages, operating as an internal department.

- The founding team's vision emphasized an integrated logistics network to ensure quality and customer satisfaction.

- JD Logistics's revenue in 2023 was approximately $16.6 billion, highlighting its growth.

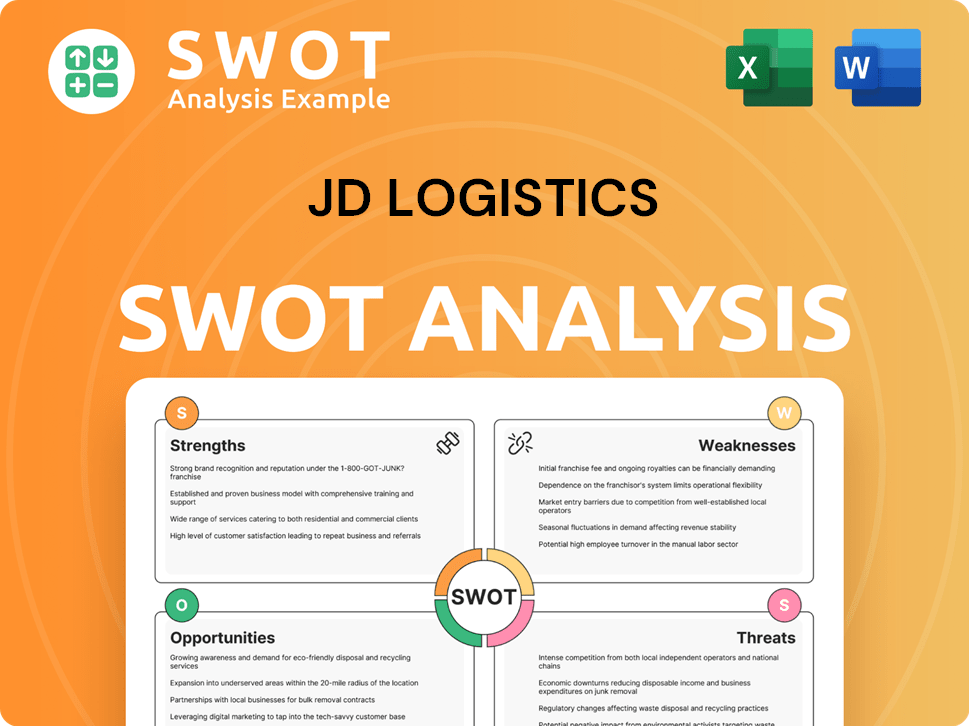

JD Logistics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has JD Logistics’s Ownership Changed Over Time?

The ownership structure of JD Logistics, a prominent logistics company, has evolved significantly since its inception. A pivotal moment occurred in 2017 when it was spun off from JD.com, enabling it to offer its services externally. This strategic move was crucial for its financial independence and growth trajectory. Prior to its IPO, JD Logistics secured substantial capital through private funding rounds, attracting notable investors.

In February 2018, JD Logistics completed its A round of financing, raising approximately $2.5 billion USD. This round involved investors like Hillhouse Capital, Sequoia China, and Tencent, valuing the company at around $13.5 billion USD. These strategic investments diversified the ownership base, setting the stage for its future public offering. The initial public offering (IPO) on the Hong Kong Stock Exchange (HKEX) in May 2021 was a major turning point, raising approximately $3.1 billion USD and establishing an initial market capitalization of about $32 billion USD.

| Event | Date | Impact |

|---|---|---|

| Spin-off from JD.com | 2017 | Enabled external service provision and financial independence. |

| A Round Financing | February 2018 | Raised $2.5 billion USD from investors, valuing the company at $13.5 billion USD. |

| IPO on HKEX | May 2021 | Raised $3.1 billion USD, with an initial market capitalization of $32 billion USD. |

Post-IPO, JD.com Inc. (HKEX: 9618, NASDAQ: JD) remains the largest shareholder of JD Logistics. As of early 2024, JD.com held approximately 63.47% of the shares, maintaining significant control over the company's strategic direction. Other major stakeholders include institutional investors. For example, as of December 31, 2023, major global asset managers held significant stakes in JD.com, which in turn owns a substantial portion of JD Logistics. This structure fosters a strong strategic alignment between the two entities, allowing JD Logistics to leverage JD.com's e-commerce ecosystem while expanding its presence in the broader logistics market. To learn more about the company, consider reading this article on the history of the company.

JD.com is the primary owner of JD Logistics, ensuring strategic alignment.

- The IPO in 2021 was a major event, raising billions of dollars.

- Institutional investors hold significant shares, enhancing the company's stability.

- JD Logistics continues to leverage JD.com's ecosystem for growth.

- The ownership structure supports its competitive edge in the logistics market.

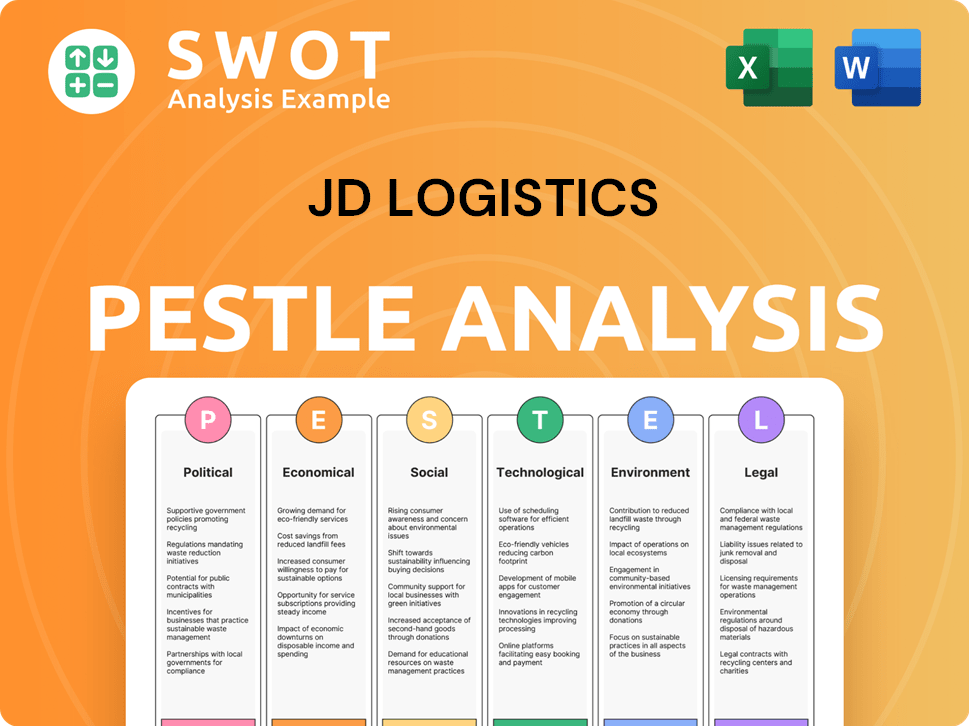

JD Logistics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on JD Logistics’s Board?

The Board of Directors of JD Logistics, as of early 2024, oversees the company's strategic direction and governance. The board includes executive directors, non-executive directors, and independent non-executive directors. Key figures from JD.com, the majority shareholder, hold significant positions, ensuring alignment with the parent company's objectives. This structure reflects a balance between JD.com's influence, independent oversight, and the expertise of the logistics company's management.

Mr. LIU Qiangdong (Richard Liu), the founder of JD.com, serves as a non-executive director of JD Logistics, underscoring his continued influence over the logistics arm. Other board members consist of executives from JD Logistics itself, along with representatives from major institutional investors and individuals with industry expertise. This composition aims to provide a diverse range of perspectives and skills to guide the company's growth and operational efficiency. The board's decisions are crucial for the Marketing Strategy of JD Logistics.

| Board Member Category | Role | Representative |

|---|---|---|

| Executive Directors | Oversee day-to-day operations | JD Logistics Executives |

| Non-Executive Directors | Provide strategic guidance | Richard Liu (JD.com Founder) |

| Independent Non-Executive Directors | Offer independent oversight | Industry Experts |

The voting structure of JD Logistics operates on a one-share-one-vote basis for its ordinary shares. However, the parent company, JD.com, utilizes a dual-class share structure where founder Richard Liu holds a significant portion of the voting power through Class B ordinary shares. This structure allows JD.com to maintain control over JD Logistics through its substantial equity stake. As of 2024, JD.com's ownership structure continues to solidify its influence over JD Logistics' strategic decisions and overall direction. This structure has facilitated JD Logistics' expansion, with the company investing approximately $1.5 billion in its infrastructure and technology in 2023.

JD.com, the parent company, significantly influences JD Logistics through its majority ownership and the board's composition. Richard Liu's role as a non-executive director ensures alignment with JD.com's strategic goals.

- JD.com's control is maintained through its substantial equity stake.

- The board includes a mix of executive directors, non-executive directors, and independent non-executive directors.

- The voting structure is primarily one-share-one-vote.

- This structure has facilitated JD Logistics' expansion, with the company investing approximately $1.5 billion in its infrastructure and technology in 2023.

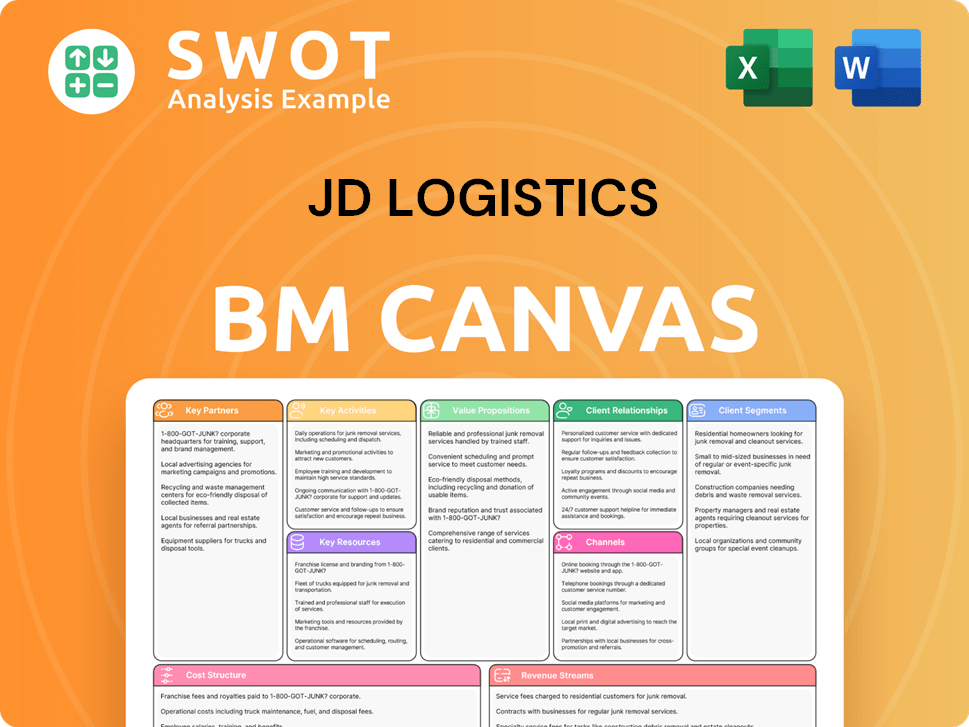

JD Logistics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped JD Logistics’s Ownership Landscape?

Over the past few years, the ownership structure of JD Logistics has seen interesting developments, with JD.com maintaining its controlling stake. A significant move was the acquisition of Deppon Logistics in July 2022. This strategic acquisition, valued at approximately 9 billion RMB (about $1.3 billion USD at the time), significantly boosted JD Logistics' network and service capabilities, particularly in less-than-truckload (LTL) and full-truckload (FTL) transportation. This expansion demonstrates JD Logistics' commitment to growth and its strategic focus on expanding its service offerings.

Industry trends also influence the ownership dynamics of JD Logistics. There's a growing presence of institutional investors in major Chinese technology and logistics firms, reflecting global interest in the expanding Chinese market. While founder dilution is common as companies mature, JD.com's significant ownership has largely kept control intact. Consolidation within the logistics sector, as seen with the Deppon acquisition, is another key trend, allowing companies to achieve economies of scale. For more insights into its growth trajectory, you can explore the Growth Strategy of JD Logistics. JD Logistics has not announced plans for privatization or a secondary public listing. The company continues to emphasize its strategic role within JD.com's ecosystem, enhancing customer experience and improving supply chain efficiency.

JD.com remains the primary owner of JD Logistics. The acquisition of Deppon Logistics in 2022 expanded its operational capabilities. Institutional investors are increasing their presence in the company.

JD Logistics is focused on leveraging technology and expanding its integrated supply chain solutions. The company aims to capture more market share in China and internationally. The Deppon acquisition highlights its aggressive growth strategy.

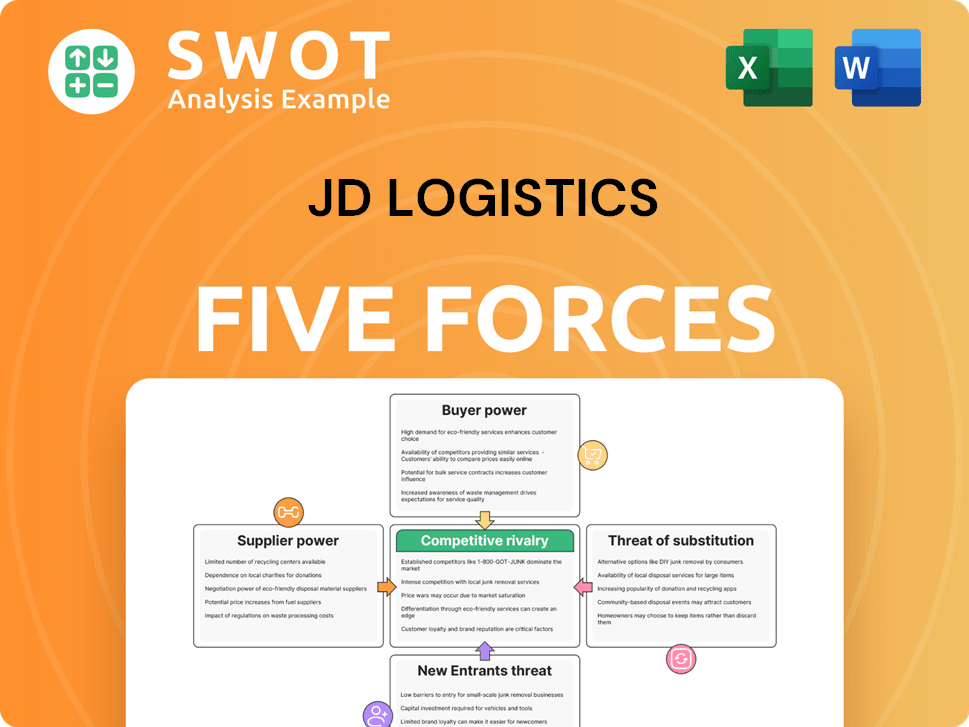

JD Logistics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JD Logistics Company?

- What is Competitive Landscape of JD Logistics Company?

- What is Growth Strategy and Future Prospects of JD Logistics Company?

- How Does JD Logistics Company Work?

- What is Sales and Marketing Strategy of JD Logistics Company?

- What is Brief History of JD Logistics Company?

- What is Customer Demographics and Target Market of JD Logistics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.