LeYa Bundle

Who Really Owns LeYa Company?

Understanding a company's ownership is crucial for investors and strategists alike. LeYa Company, a prominent name in Portuguese publishing, experienced a pivotal shift in its ownership structure. This deep dive into LeYa's ownership history, from its origins to its current status, will provide valuable insights. Discover the key players and the strategic implications of their involvement, including the impact of the Infinitas Learning acquisition.

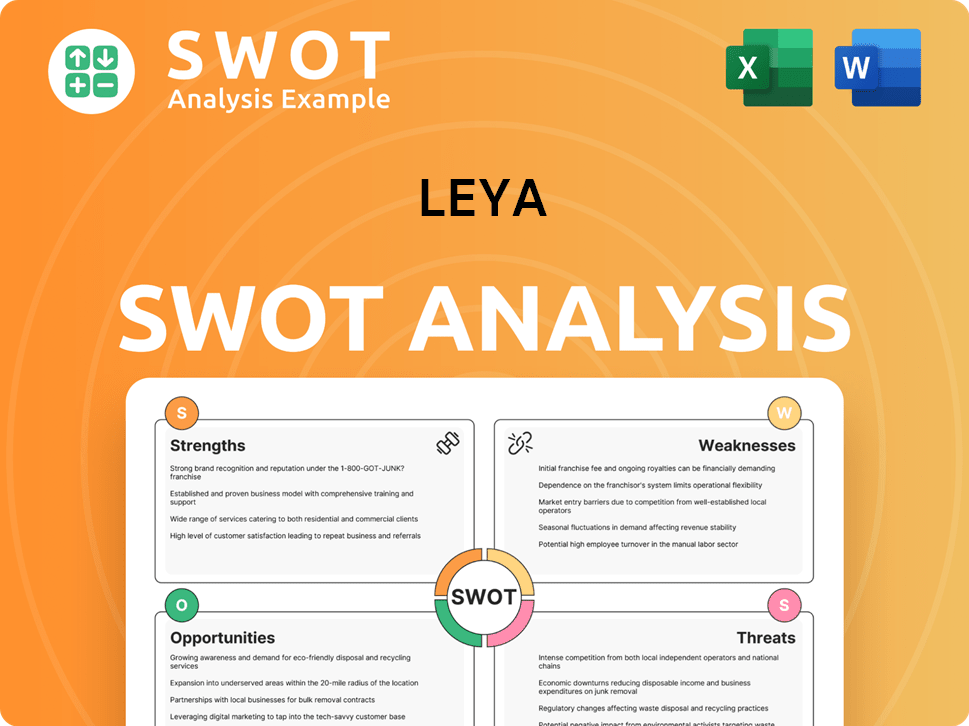

The LeYa SWOT Analysis provides a comprehensive overview of the company's strengths, weaknesses, opportunities, and threats. Unraveling the LeYa Company ownership structure reveals the driving forces behind its strategic decisions and market positioning. This analysis explores the LeYa parent company and its influence, offering a detailed look at the LeYa Group and its stakeholders to empower your investment and strategic planning.

Who Founded LeYa?

The establishment of LeYa, S.A. in 2008 marked a significant consolidation within the Portuguese publishing industry. This initiative involved the merger of seven publishing companies, setting the stage for the formation of a major player in the Portuguese-language publishing market. The early ownership structure and the specific initial shareholdings of the founders, however, are not publicly detailed.

LeYa's formation was spearheaded by key figures, including Chairman Miguel Pais do Amaral and CEO Isaías Gomes Teixeira. Their leadership, along with that of Tiago Morais and Pedro Marques Guedes, was crucial in building the foundation of the editorial group. These individuals were identified as shareholders of LeYa Global before the 2022 acquisition, highlighting their enduring involvement in the company's evolution.

Early financial backing played a critical role in LeYa's growth. Trilantic Capital Partners (TCP), a global private equity firm, committed up to €50 million in growth capital around 2009. This investment was aimed at supporting both acquisitions and organic growth, especially in e-learning and the expanding Brazilian educational market. Additional early investors included Atena Equity Partners and Miguel Pais Equity Partners, who contributed to the financial stability and strategic direction of The LeYa Group.

The early investments and strategic vision were pivotal in positioning LeYa as a leader in Portuguese-language publishing, with a global reach. The financial support from Trilantic Capital Partners and other investors enabled LeYa to pursue its expansion goals effectively. The focus on e-learning and the Brazilian market demonstrated a forward-thinking approach to growth. Understanding the Target Market of LeYa can provide further insights into the company's strategic direction.

- €50 million: Approximate growth capital commitment from Trilantic Capital Partners around 2009.

- Seven: Number of Portuguese publishing companies consolidated to form LeYa in 2008.

- Early 2009: The approximate time frame when Trilantic Capital Partners made their investment.

- Global Private Equity Firm: Trilantic Capital Partners' classification.

LeYa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has LeYa’s Ownership Changed Over Time?

The ownership of the LeYa Company underwent a significant shift in February 2022 when Infinitas Learning Holding B.V. acquired LeYa, S.A. This acquisition, valued at $121 million, brought LeYa under the umbrella of Infinitas Learning, a Netherlands-based provider of learning solutions. The deal, finalized in Q2 2022, marked a major change in the company's ownership structure.

Prior to the acquisition, LeYa's ownership included founders Isaías Gomes Teixeira, Tiago Morais, and Pedro Marques Guedes, along with private equity firms such as Trilantic Capital Partners and Atena Equity Partners. The acquisition by Infinitas Learning, supported by its main shareholder NPM Capital, signaled a move towards a larger European educational content group. The acquisition aimed to leverage Infinitas Learning's expertise in digital educational solutions, fostering innovation within the Portuguese education system. The Marketing Strategy of LeYa evolved with these ownership changes.

| Event | Date | Impact |

|---|---|---|

| Acquisition by Infinitas Learning Holding B.V. | February 2022 | Shifted ownership to Infinitas Learning, backed by NPM Capital. |

| Deal Closing | Q2 2022 | Finalized the acquisition, integrating LeYa into the Infinitas Group. |

| Pre-Acquisition Ownership | Before February 2022 | Included founders and private equity firms like Trilantic Capital Partners. |

Infinitas Learning now serves as the LeYa parent company. The acquisition aimed to enhance digital educational solutions. LeYa Group's ownership structure is now primarily influenced by Infinitas Learning and its stakeholders.

- Infinitas Learning is the current LeYa Company owner.

- The acquisition was valued at $121 million.

- The deal closed in Q2 2022.

- Former major stakeholders included founders and private equity firms.

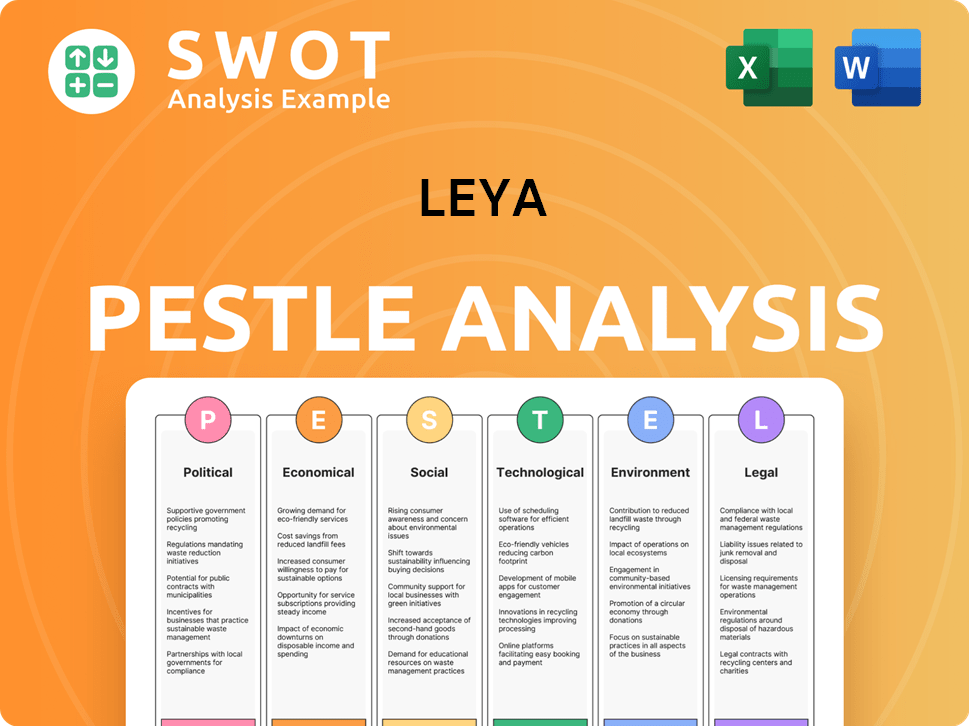

LeYa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on LeYa’s Board?

Following the 2022 acquisition of LeYa, S.A. by Infinitas Learning Holding B.V., the composition of the Board of Directors likely shifted to reflect the new ownership structure. Representatives from Infinitas Learning and its primary shareholder, NPM Capital, would most likely hold significant positions on the board. While a comprehensive, up-to-date list of current board members is not publicly available in the provided search results, Ana Rita Bessa remained as the CEO of LeYa, S.A. post-acquisition, ensuring continuity in operational leadership. Understanding the current board members is crucial for anyone researching LeYa Company ownership.

Generally, in acquisitions of this nature, board seats are allocated to align with the major shareholders' interests, ensuring their strategic vision and governance principles are integrated. The voting structure would typically follow a one-share-one-vote principle unless specific agreements for dual-class shares or other special voting rights were implemented during the acquisition. However, no specific information regarding voting structures, golden shares, or founder shares with outsized control for LeYa, S.A. is available in the provided context. Further information on the LeYa Company owner can be found through official filings.

| Board Member | Role | Affiliation |

|---|---|---|

| Ana Rita Bessa | CEO | LeYa, S.A. |

| (Information Not Available) | Board Member | Infinitas Learning |

| (Information Not Available) | Board Member | NPM Capital |

The voting structure at LeYa Group would likely follow a standard one-share-one-vote principle, reflecting the ownership distribution post-acquisition by Infinitas Learning. There is no available information regarding specific voting structures, golden shares, or founder shares. For more insights into the LeYa parent company and its strategic direction, consider reading Growth Strategy of LeYa.

Post-acquisition, the Board of Directors reflects Infinitas Learning and NPM Capital's influence.

- Ana Rita Bessa remains CEO, ensuring operational continuity.

- Voting rights likely follow a one-share-one-vote structure.

- Specific board member details post-acquisition are not readily available.

- Understanding the ownership structure is crucial for stakeholders.

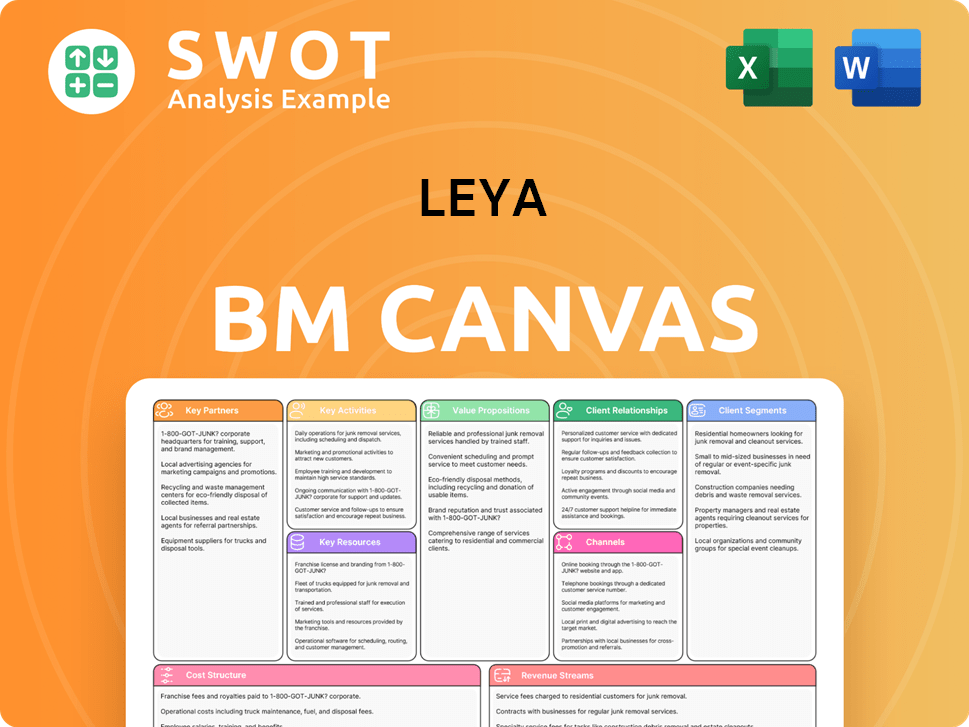

LeYa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped LeYa’s Ownership Landscape?

The most significant shift in LeYa Company ownership over the past few years was its acquisition by Infinitas Learning Holding B.V. in February 2022. This transaction, valued at $121 million, transferred the ownership of LeYa's operations in Portugal and Mozambique to Infinitas Learning. This marked a major change from its previous ownership, which included founders and private equity firms like Trilantic Capital Partners.

This acquisition highlights a trend towards consolidation in the educational and publishing sectors. Larger groups like Infinitas Learning are expanding their reach, potentially influencing the future of LeYa Group. The move signals a strategic focus on enhancing digital offerings, aligning with Infinitas Learning's expertise in digital educational solutions. The LeYa parent company's strategy emphasizes developing high-quality educational resources and learning platforms.

While there is no recent data on share buybacks or further mergers directly involving LeYa, the industry's focus on digital transformation and AI integration is evident. The acquisition by Infinitas Learning, with its digital education expertise, underscores this trend. For more insights into the business, you can explore the Revenue Streams & Business Model of LeYa.

| Aspect | Details | Recent Data |

|---|---|---|

| Acquisition Date | February 2022 | |

| Acquisition Value | $121 million | |

| New Owner | Infinitas Learning Holding B.V. |

Infinitas Learning's acquisition of LeYa in February 2022 was a pivotal moment. It shifted the ownership structure significantly. This move underscores the trend of consolidation in the educational publishing sector.

The acquisition emphasizes a focus on digital transformation. Infinitas Learning's expertise in digital solutions is a key factor. This indicates a strategic move to enhance LeYa's digital offerings.

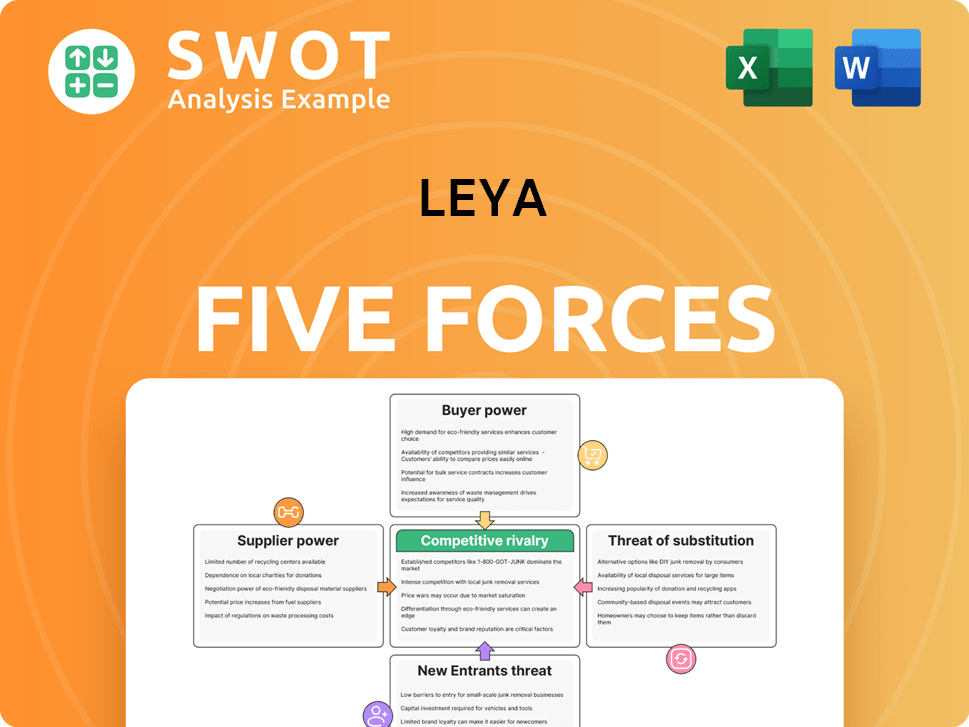

LeYa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LeYa Company?

- What is Competitive Landscape of LeYa Company?

- What is Growth Strategy and Future Prospects of LeYa Company?

- How Does LeYa Company Work?

- What is Sales and Marketing Strategy of LeYa Company?

- What is Brief History of LeYa Company?

- What is Customer Demographics and Target Market of LeYa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.