Michaels Companies Bundle

Who Really Calls the Shots at Michaels?

Ever wondered who pulls the strings behind the creative haven that is Michaels? The ownership structure of a company like Michaels, a leading arts and crafts retailer, is far more than just a formality; it's a roadmap to understanding its future. From its humble beginnings to its current status, the story of Michaels' ownership is a fascinating case study in business strategy and financial maneuvering.

Delving into Michaels Companies SWOT Analysis, and understanding the Michaels Stores Owner is key to grasping its market position and strategic direction. The Michaels parent company, currently under private ownership, operates differently than a publicly traded Michaels corporation. This shift has significantly influenced its operational strategies and financial decisions, making it a compelling subject for anyone interested in the dynamics of retail and private equity. Exploring the Michaels history of ownership changes unveils a complex narrative of growth, investment, and adaptation.

Who Founded Michaels Companies?

The Michaels Companies, Inc. was established in 1973 by Michael J. Dupey. The company began as a retail destination for arts and crafts, with Dupey's vision being central to its establishment. Initial ownership was primarily held by Dupey and possibly a small group of early investors.

During the initial years, the company likely depended on internal funding and potentially angel investments to support its early growth and expansion. The early agreements would have focused on setting up the operational framework and securing the necessary resources to scale the business. Over time, the ownership structure evolved, which eventually led to external investment and its initial public offering.

The early financial details, such as the exact equity split or shareholding percentages at the company's start, are not readily accessible in public records. However, it's understood that the initial capital came from Dupey and possibly a small group of initial investors, friends, or family who provided the foundational capital to launch the first Michaels store in Dallas.

Early funding likely included internal resources and angel investments. These investments were critical for the initial growth phase. The focus was on building the operational base and securing resources.

As the company expanded, the ownership structure naturally changed. This evolution paved the way for external investments. Eventually, this led to the company's initial public offering.

Michael J. Dupey was the founder and played a vital role in the company's initial success. His vision was key to establishing the company as a retail leader. Dupey's initial influence was critical.

The initial capital came from Dupey and possibly a small group of early investors. These early investors were crucial for the launch. The first store was in Dallas.

Specific details on the initial equity split or shareholding percentages are not readily available. Public records do not provide this information. The early financial details are not easily accessible.

The early focus was on establishing the operational framework and securing resources. This was critical for the initial phase. Scaling the business was the main goal.

The evolution of the ownership of Michaels has seen several changes over the years. The current ownership structure reflects a history of strategic investments and transitions. For more insights into the company's strategies, consider reading about the Marketing Strategy of Michaels Companies.

Michaels Companies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Michaels Companies’s Ownership Changed Over Time?

The ownership structure of The Michaels Companies, now known as Michaels, has seen significant shifts since its inception. The company's journey began with its initial public offering (IPO) on July 23, 1993, when it was listed on the NASDAQ under the ticker symbol MIK. This move allowed public shareholders to invest and provided capital for expansion. Institutional investors, mutual funds, and index funds later became major holders of Michaels' stock.

A major change occurred in April 2021, when funds managed by affiliates of Apollo Global Management, Inc. acquired The Michaels Companies, Inc. for roughly $5.0 billion. This acquisition took the company private, delisting it from the NASDAQ. As of early 2024, Apollo Global Management is the primary owner of Michaels. Their strategy often involves operational improvements and long-term growth initiatives before a potential future exit. This shift to private ownership means the major stakeholders are now the funds and limited partners associated with Apollo Global Management.

| Key Ownership Milestones | Date | Details |

|---|---|---|

| Initial Public Offering (IPO) | July 23, 1993 | The Michaels Companies, Inc. began trading on the NASDAQ under the ticker symbol MIK. |

| Acquisition by Apollo Global Management | April 2021 | Funds managed by affiliates of Apollo Global Management, Inc. acquired The Michaels Companies, Inc. for approximately $5.0 billion, taking the company private. |

| Current Ownership | Early 2024 | Apollo Global Management is the primary owner of The Michaels Companies, Inc. |

As of 2024, the current owner of Michaels stores is Apollo Global Management. The company is no longer publicly traded. Understanding the Growth Strategy of Michaels Companies provides further insights into its operational and financial performance under its current ownership. The Michaels parent company, Apollo, focuses on long-term value creation through strategic initiatives.

The Michaels Stores Owner has changed from public shareholders to Apollo Global Management. The company was taken private in April 2021. This shift impacts how the company is managed and its strategic direction.

- Apollo Global Management acquired Michaels in 2021 for about $5.0 billion.

- Michaels is no longer a publicly traded company.

- Apollo aims to improve operations and drive long-term growth.

- The company's headquarters are located in Irving, Texas.

Michaels Companies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Michaels Companies’s Board?

Understanding the ownership structure of the company, we find that the Board of Directors is primarily influenced by Apollo Global Management, the private equity firm that owns the company. While a detailed public list of all board members isn't readily available, it typically includes representatives from Apollo, independent directors with industry expertise, and key members of the company's senior management. This structure allows for more focused decision-making, often with a long-term value creation perspective, different from the quarterly pressures faced by publicly traded companies. The Michaels Stores Owner is therefore, indirectly, Apollo Global Management.

As the primary owner, Apollo Global Management wields significant voting power and influence over board appointments and strategic decisions. This setup allows for a more streamlined decision-making process. There are no public records of proxy battles or activist investor campaigns, which are common in publicly traded companies. The Michaels parent company, Apollo, maintains control over the company's direction through its voting rights.

| Board Member | Affiliation | Role |

|---|---|---|

| Representative | Apollo Global Management | Board Member |

| Independent Director | Industry Expert | Board Member |

| Senior Management | The Michaels Companies, Inc. | Board Member |

The dynamics of the board and the influence of the owner are crucial to understanding the company's strategic direction. The Michaels Company Ownership structure, with Apollo Global Management at the helm, shapes the company's approach to growth and market strategies. For a deeper dive into the company's background, consider reading the Brief History of Michaels Companies.

The Board of Directors is primarily influenced by Apollo Global Management.

- Apollo Global Management holds significant voting power.

- The board typically includes Apollo representatives, independent directors, and senior management.

- The focus is often on long-term value creation.

- There are no public records of proxy battles.

Michaels Companies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Michaels Companies’s Ownership Landscape?

The most significant shift in the ownership of The Michaels Companies in the last few years was its acquisition by Apollo Global Management in April 2021. This move took the company private, fundamentally changing its ownership structure. This trend reflects a broader pattern in the retail industry, where private equity firms acquire established retailers to drive strategic changes, optimize operations, and leverage financial strategies away from the scrutiny of public markets. The question 'Who owns Michaels' now has a clear answer: Apollo Global Management.

Since the acquisition, the focus has been on strategic initiatives. These include expanding the online presence, enhancing the loyalty program (Michaels Rewards), and optimizing the store footprint. The company has also partnered with DoorDash for on-demand delivery, aiming to improve customer convenience. While specific financial details are not publicly available for a private company, Apollo's ownership typically suggests a long-term investment approach. This involves maximizing value before a potential future exit, which could involve another sale or a return to public markets. The trend of increased consolidation and strategic investments in retail to adapt to the changing consumer landscape is one that Michaels, under Apollo's ownership, is actively participating in. For insights into their target demographic, consider reading about the Target Market of Michaels Companies.

Apollo Global Management acquired Michaels in April 2021. This acquisition marked a significant change in the company's ownership structure. The move took Michaels private, shifting it away from being a publicly traded company. This change has allowed Michaels to focus on strategic initiatives without the immediate pressures of public market scrutiny.

Currently, Apollo Global Management is the parent company of Michaels. The acquisition by Apollo has enabled Michaels to pursue long-term strategies. These strategies include expanding its online presence and enhancing its customer loyalty programs. The company is focused on adapting to the evolving consumer landscape.

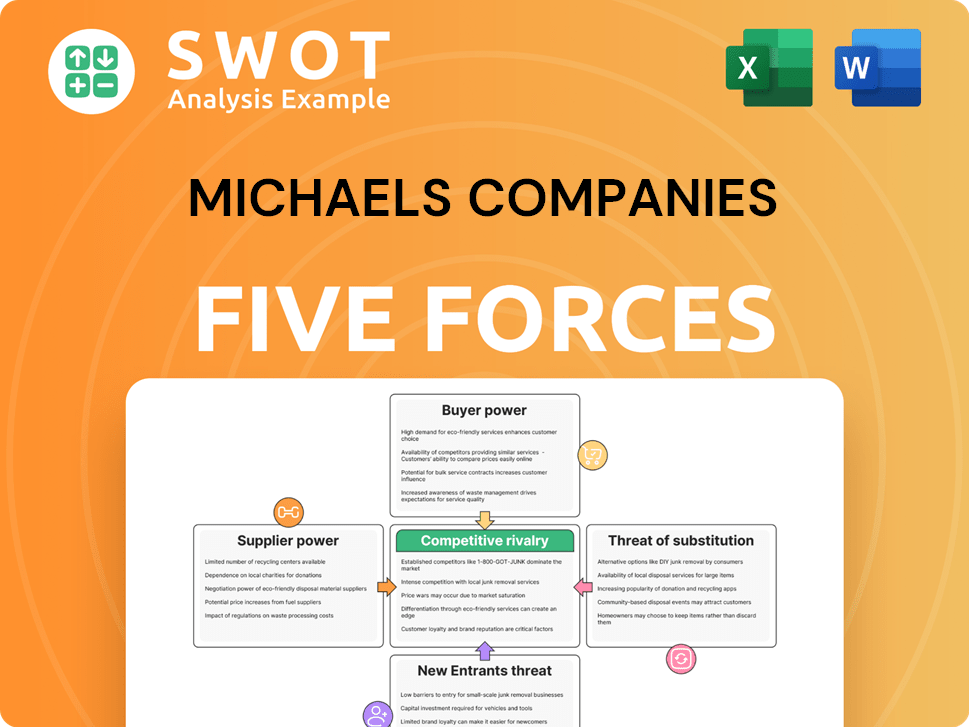

Michaels Companies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Michaels Companies Company?

- What is Competitive Landscape of Michaels Companies Company?

- What is Growth Strategy and Future Prospects of Michaels Companies Company?

- How Does Michaels Companies Company Work?

- What is Sales and Marketing Strategy of Michaels Companies Company?

- What is Brief History of Michaels Companies Company?

- What is Customer Demographics and Target Market of Michaels Companies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.