SEEK Bundle

Who Really Controls SEEK Company?

Unraveling the ownership of SEEK Limited is key to understanding its strategic moves and future potential. From its humble beginnings to its current status as a global leader, the evolution of SEEK SWOT Analysis reveals a fascinating story of growth and transformation. Knowing who owns SEEK provides critical insights into the company's direction and how it navigates the competitive landscape.

This exploration delves into the SEEK SWOT Analysis, examining the shifts in SEEK ownership since its IPO and the influence of key SEEK investors. We'll uncover the roles of major shareholders and how their interests have shaped SEEK's journey, from its headquarters in Australia to its global presence. Understanding the SEEK company structure is crucial for anyone interested in the SEEK stock price or the company's long-term prospects.

Who Founded SEEK?

The company, now known as SEEK Limited, was established in 1997. The founders were brothers Andrew and Paul Bassat, along with Matt Rockman. Their combined expertise in law, business, media, and technology was crucial in shaping the company's early direction and vision for an online job board.

At its inception, the ownership structure of SEEK reflected the founders' significant equity stakes. While the exact percentage breakdowns from 1997 are not publicly available, it is understood that the founders maintained substantial control. This initial ownership structure was fundamental in guiding the company through its formative years.

Early financial backing for the company primarily came from private sources. These included friends, family, and possibly angel investors who recognized the potential of the internet economy. These early investments provided the necessary capital for the company's initial development and expansion.

Andrew and Paul Bassat, with backgrounds in law and business, brought strategic and operational skills. Matt Rockman, with expertise in media and technology, contributed to product development and market positioning. Their combined skills were instrumental in the early success of the company.

Early funding came from private sources, including friends, family, and angel investors. These early investments were crucial for the company's initial development and expansion. The early financial support helped fuel the company's growth.

The founders held significant equity stakes, maintaining substantial control in the early years. Agreements common in early-stage ventures, such as vesting schedules and buy-sell clauses, likely played a role in shaping ownership dynamics. This structure allowed for cohesive decision-making.

The company faced the challenges of a nascent internet market. Their strategy focused on disrupting traditional recruitment methods. This involved building a user-friendly online platform.

The founders shared a vision for an online job board. Their focus was on connecting job seekers with employers. This vision was key to the company's early direction and success.

Early growth was driven by the increasing adoption of the internet. The company focused on expanding its user base and services. This period laid the groundwork for future market dominance.

The cohesive vision of the founding team, as detailed in the Growth Strategy of SEEK, was reflected in their collaborative approach. This collective control enabled them to steer the company through its formative years, setting the stage for its eventual market dominance and subsequent public listing. As of 2024, SEEK Limited's market capitalization reflects the success of this early strategy, demonstrating the long-term impact of the founders' vision and initial ownership structure. The company's history shows how effective leadership and strategic early decisions can lead to significant growth and market presence.

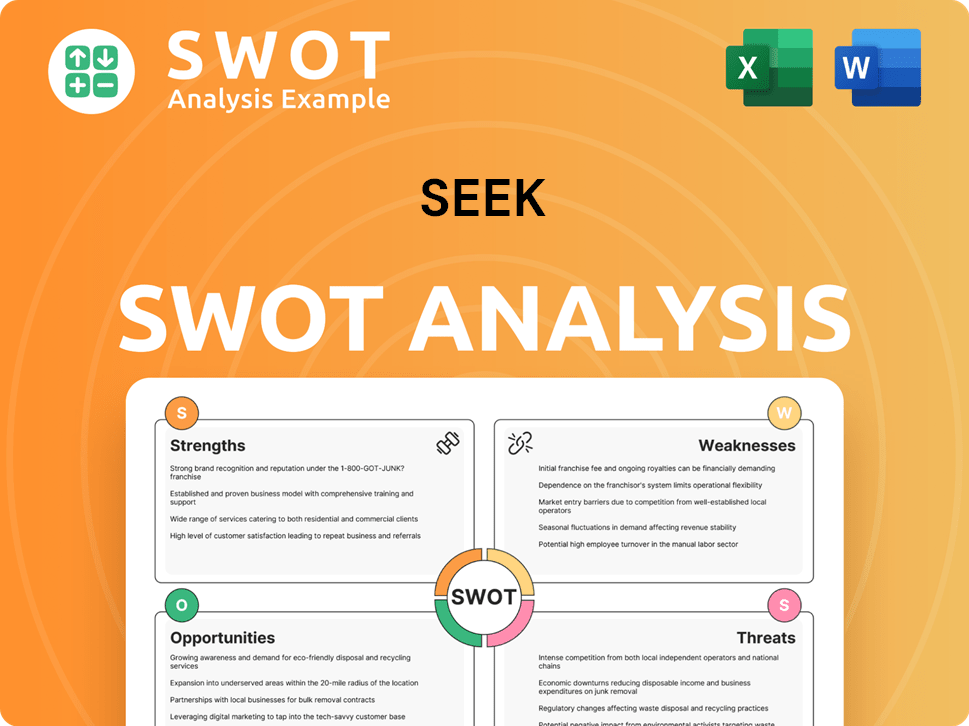

SEEK SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has SEEK’s Ownership Changed Over Time?

The evolution of SEEK Company's ownership has been marked by significant milestones, beginning with its Initial Public Offering (IPO) on the Australian Securities Exchange (ASX) in April 2005. This IPO, which valued the company at approximately A$490 million, was a critical step. It broadened the ownership base beyond the initial founders and early investors to include a diverse group of public shareholders. The transition from a private to a public entity fundamentally reshaped the company's structure and its stakeholders.

Since the IPO, the ownership structure of SEEK Limited has evolved. Major shifts have occurred, with institutional investors, mutual funds, and index funds now holding a substantial portion of the shares. In late 2024 and early 2025, prominent global and Australian investment management firms like BlackRock Inc. and Vanguard Group Inc. have consistently been among the top shareholders. AustralianSuper Pty Ltd and other large superannuation funds also play a significant role. These institutions collectively influence SEEK's governance through their substantial voting power. The founders, including Andrew and Paul Bassat, have gradually diluted their direct shareholdings through various capital raisings and share sales, common in successful public companies. Andrew Bassat, as of 2025, serves as Executive Chairman, maintaining a strategic role in the company.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Diversified ownership; increased public shareholders | April 2005 |

| Institutional Investment | Significant holdings by global and Australian investment firms | Late 2024 - Early 2025 |

| Founder Share Dilution | Gradual reduction of direct shareholdings by founders | Ongoing |

Strategic investments and partnerships have also played a role in shaping SEEK's ownership. The alliance with Zhaopin Limited in China, where SEEK held a majority stake for many years, significantly impacted its global footprint and financial performance. Investments in JobStreet and JobsDB in Southeast Asia, later consolidated under the SEEK Asia brand, further demonstrate the company's growth-oriented ownership strategy. These changes have consistently aimed to expand SEEK's market reach and enhance its overall value, influencing its strategic focus on global online employment marketplaces. For more details, consider reading the Brief History of SEEK.

SEEK's ownership has evolved significantly since its IPO in 2005, with a shift towards institutional investors. Major shareholders include firms like BlackRock and Vanguard. The founders have maintained influence through strategic roles, even with diluted direct shareholdings.

- Institutional investors hold a substantial portion of shares.

- Founders retain influence through strategic roles.

- Strategic partnerships have expanded SEEK's global reach.

- SEEK's market capitalization was approximately A$490 million at the IPO.

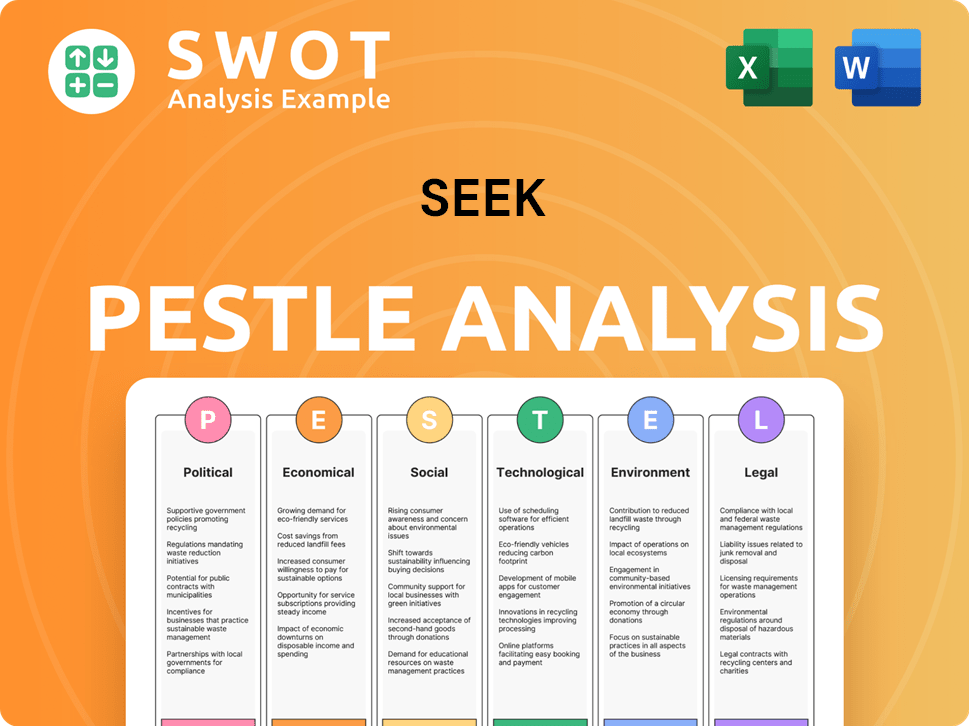

SEEK PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on SEEK’s Board?

As of early 2025, the Board of Directors of SEEK Limited (also known as SEEK Company) is structured to ensure a blend of founder influence, major shareholder representation, and independent oversight. Andrew Bassat, a co-founder, serves as Executive Chairman, maintaining a significant presence in the company's leadership. The board includes a mix of executive directors, non-executive directors, and independent non-executive directors, bringing diverse expertise in technology, finance, and international business. This composition aims to facilitate objective decision-making and effective governance, reflecting the company's commitment to shareholder value and corporate governance best practices.

The board's decisions are made with the collective interests of all shareholders in mind, guided by the one-share-one-vote principle. The board regularly reviews its composition, with changes occurring due to retirements or the appointment of new members to bring specific expertise or maintain a balance of skills and perspectives. The strong presence of institutional investors also ensures that the board is attentive to shareholder value and corporate governance best practices. This structure is designed to foster accountability and ensure that the company's strategic direction aligns with the interests of all stakeholders.

| Board Member | Role | Notes |

|---|---|---|

| Andrew Bassat | Executive Chairman | Co-founder |

| Other Directors | Non-Executive Directors | Diverse backgrounds |

| Independent Directors | Independent Oversight | Ensuring objective decision-making |

SEEK Limited operates under a one-share-one-vote structure, common for companies listed on the Australian Securities Exchange (ASX). This structure means that each ordinary share generally carries one vote, ensuring that voting power is directly proportional to the number of shares held. There are no publicly reported dual-class share structures or special voting arrangements that grant outsized control to specific individuals or entities beyond their direct shareholding. This structure promotes accountability to all shareholders, reinforcing the company's commitment to transparent governance. For more insights, consider exploring the Marketing Strategy of SEEK.

The Board of Directors at SEEK Company includes founder representation and independent directors.

- One-share-one-vote structure ensures equitable voting power.

- Board composition is regularly reviewed to maintain expertise.

- Strong institutional investor presence influences governance.

- Decisions are made with all shareholders' interests in mind.

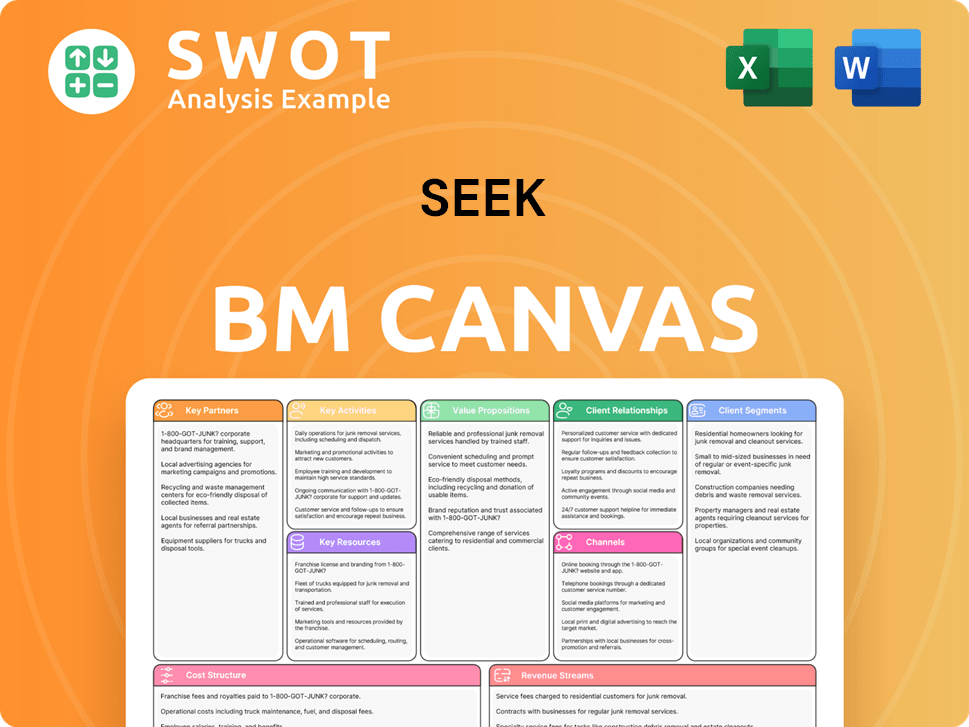

SEEK Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped SEEK’s Ownership Landscape?

Over the past few years, the ownership of SEEK Limited has evolved, reflecting both strategic decisions and broader industry trends. A key move was the 2021 sale of its remaining stake in Zhaopin Limited, a Chinese online recruitment platform, for approximately A$2.2 billion. This divestment allowed SEEK to reinvest in other growth areas and return capital to shareholders.

Share buybacks have been a consistent feature. In February 2024, SEEK announced an on-market share buy-back of up to A$200 million, following an earlier A$180 million buy-back program completed in late 2023. These actions aim to optimize capital structure and enhance shareholder returns. Such buybacks reduce the number of outstanding shares, potentially influencing the concentration of ownership among remaining shareholders.

| Aspect | Details | Recent Activity |

|---|---|---|

| Share Buybacks | Programs to repurchase company shares | A$200 million buy-back announced in February 2024; A$180 million completed in late 2023 |

| Strategic Focus | Areas of investment and growth | Increased focus on ANZ and Asia, strategic investments in AI and technology |

| Founder Influence | Impact of key individuals | Continued involvement of Andrew Bassat as Executive Chairman |

Industry trends, like increased institutional ownership and ESG investing, also impact SEEK. Institutional investors increasingly consider companies' ESG performance, influencing investment decisions. The strategic investments in AI and technology highlight a focus on long-term growth, which appeals to a stable investor base. For more insights into the competitive environment, consider reviewing the Competitors Landscape of SEEK.

SEEK's ownership structure is influenced by share buybacks and institutional investor behavior. The company's focus on core markets and strategic investments in technology also play a role. These factors contribute to the overall stability and direction of the company.

The sale of Zhaopin Limited and subsequent share buybacks have reshaped SEEK’s financial profile. These moves demonstrate the company's active management of capital and commitment to shareholder value. The involvement of the founder also ensures a degree of continuity.

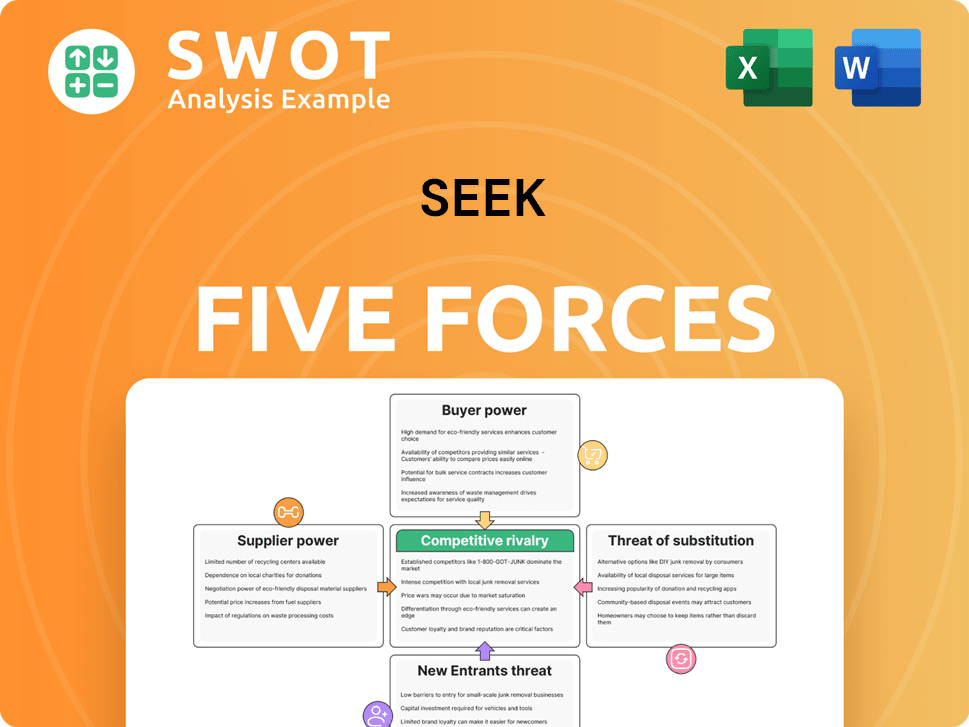

SEEK Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SEEK Company?

- What is Competitive Landscape of SEEK Company?

- What is Growth Strategy and Future Prospects of SEEK Company?

- How Does SEEK Company Work?

- What is Sales and Marketing Strategy of SEEK Company?

- What is Brief History of SEEK Company?

- What is Customer Demographics and Target Market of SEEK Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.