Roadrunner Transportation Bundle

Who Really Owns Roadrunner Transportation Company?

Unraveling the ownership of Roadrunner Transportation Company is key to understanding its strategic moves and future prospects. The company's journey through financial restructuring has dramatically altered its ownership landscape, making this a critical area of focus for investors and industry watchers. Discover the forces shaping this major player in the freight and logistics sector.

The evolution of Roadrunner Transportation SWOT Analysis, from its founding in 2005 to its current status, reveals a fascinating story of resilience and adaptation. Understanding who owns Roadrunner is essential for anyone looking to assess its market position and potential. This exploration will examine the shifts in ownership, from its founders to key investors, and the impact these changes have had on the company's direction. This deep dive provides insights into the company's operational strategies and market positioning, offering a comprehensive view of this transportation company's ownership structure.

Who Founded Roadrunner Transportation?

The story of Roadrunner Transportation Company begins in 2005. However, detailed information about the company's founders and initial ownership structure is limited in publicly available records. It's common for this kind of information to be kept private during a company's early stages.

Precise details regarding the initial equity split or the number of shares held by the founders are not readily accessible. Similarly, the backgrounds of the original founders and their roles in the company's early development are not extensively documented in public sources. This lack of readily available information is typical for privately held companies in their initial years of operation.

Early financial backers, such as angel investors or family members who may have acquired stakes during the initial phase, also have their details not widely disclosed. Agreements made early on, like vesting schedules, buy-sell clauses, or founder exits, which would have shaped the initial ownership, are also not publicly detailed. Any initial ownership disputes or buyouts, and how the founding team’s vision was reflected in the distribution of control, are not extensively documented in public sources from the company's early years.

Roadrunner Transportation Company was established in 2005. The company's early history is largely undocumented in public sources. Information about the founders and initial ownership is not widely available.

Many details about the initial equity split or shareholding percentages are not publicly available. The backgrounds of the original founders are also not extensively documented in public sources. This is common for privately held companies.

Specifics about early investors, such as angel investors or family members, are generally not disclosed. Details about early agreements, like vesting schedules, are also not widely available. Early agreements shaped the initial ownership.

Information on initial ownership disputes or buyouts is not extensively documented in public sources. The distribution of control and how the founding team's vision was reflected are also not widely known. Early company details are often kept private.

Details about the original founders, their roles, and the initial ownership structure are not widely available. This is typical for privately held companies. Much of this information remains private.

Early agreements, such as vesting schedules, are typically not disclosed to the public. These agreements play a crucial role in shaping the initial ownership structure. Private companies often keep these details confidential.

Understanding the Marketing Strategy of Roadrunner Transportation provides some insights into the company's overall operations, but specific details about the founders and early ownership of Roadrunner Transportation Company are not readily available in public records. The company's early history is largely undocumented, with much of the information about the founders and initial ownership structure remaining private.

The founding of Roadrunner Transportation Company in 2005 marks the beginning of its operations. However, detailed information about the founders and early ownership is limited in public records.

- The initial equity split and shareholding percentages are not publicly available.

- Details about the original founders and their backgrounds are not extensively documented.

- Information on early investors, such as angel investors or family members, is generally not disclosed.

- Early agreements, like vesting schedules, are typically not publicly available.

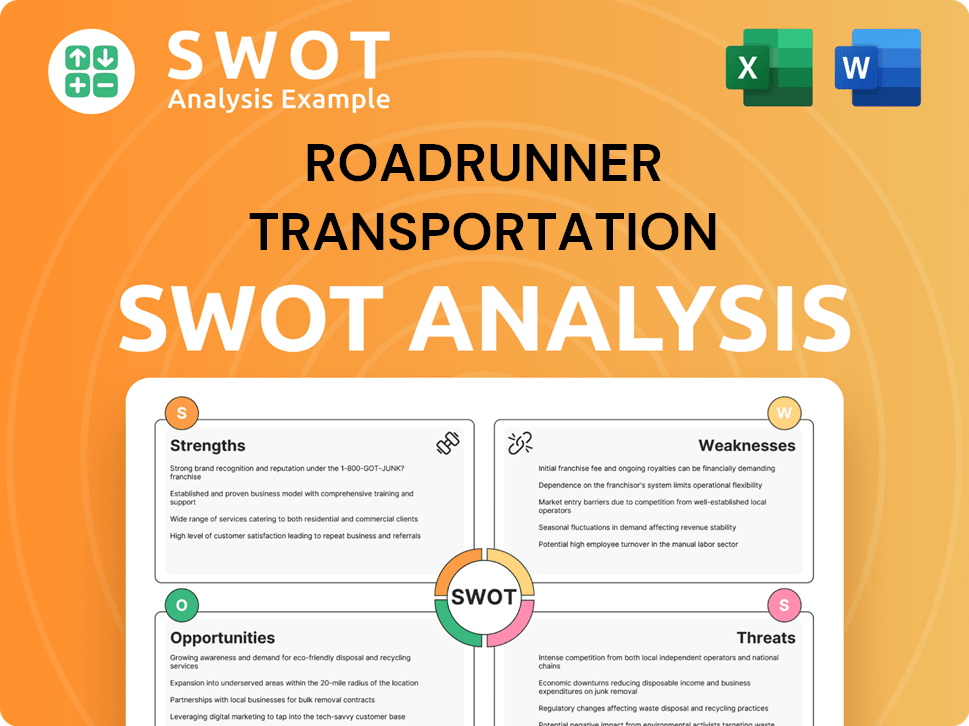

Roadrunner Transportation SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Roadrunner Transportation’s Ownership Changed Over Time?

The ownership structure of Roadrunner Transportation Company has seen substantial changes, especially in recent years. Initially a publicly traded entity on the NYSE under the ticker RRTS, the company navigated financial challenges that led to a significant restructuring. A pivotal moment in this evolution was its emergence from Chapter 11 bankruptcy in 2020. This restructuring fundamentally altered its ownership, transitioning the company to private ownership. The shift from public to private ownership allowed Roadrunner to concentrate on operational enhancements and refine its business strategy, freeing it from the demands of public market reporting.

As of late 2023 and early 2024, the ownership of Roadrunner Transportation is primarily vested in its lenders and creditors, who converted their debt into equity during the restructuring. A key player in this transition was Elliott Management Corporation, a prominent hedge fund, which became a major stakeholder. Other significant stakeholders include various institutional investors and funds that participated in the debt-to-equity conversion. While the exact percentage holdings of these entities are not always publicly disclosed for private companies, it's understood that these investment firms now wield considerable influence over the company's strategic direction and governance. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Roadrunner Transportation.

| Ownership Change | Details | Impact |

|---|---|---|

| Public to Private | Emergence from Chapter 11 bankruptcy in 2020 | Debt-to-equity conversion, significant shift in ownership |

| Key Stakeholders | Elliott Management Corporation and institutional investors | Control over strategic direction and governance |

| Focus Shift | Operational improvements and refined business strategy | Reduced pressure from public market reporting |

The transformation of Roadrunner Transportation's ownership reflects a strategic recalibration. The move away from public markets has enabled a more focused approach to operational efficiency and strategic planning. This shift is typical in the freight and logistics industry, where companies often undergo restructuring to adapt to market dynamics and financial pressures. The current ownership structure, dominated by institutional investors, suggests a long-term commitment to stabilizing and growing the company. This is a common strategy among transportation companies seeking to navigate complex market conditions and improve overall performance.

Roadrunner Transportation Company has transitioned from public to private ownership, primarily held by lenders and creditors. Elliott Management Corporation is a major stakeholder, along with other institutional investors.

- The company emerged from Chapter 11 bankruptcy in 2020.

- Debt-to-equity conversion led to significant ownership changes.

- Private ownership allows a focus on operational improvements.

- Institutional investors now influence strategic direction.

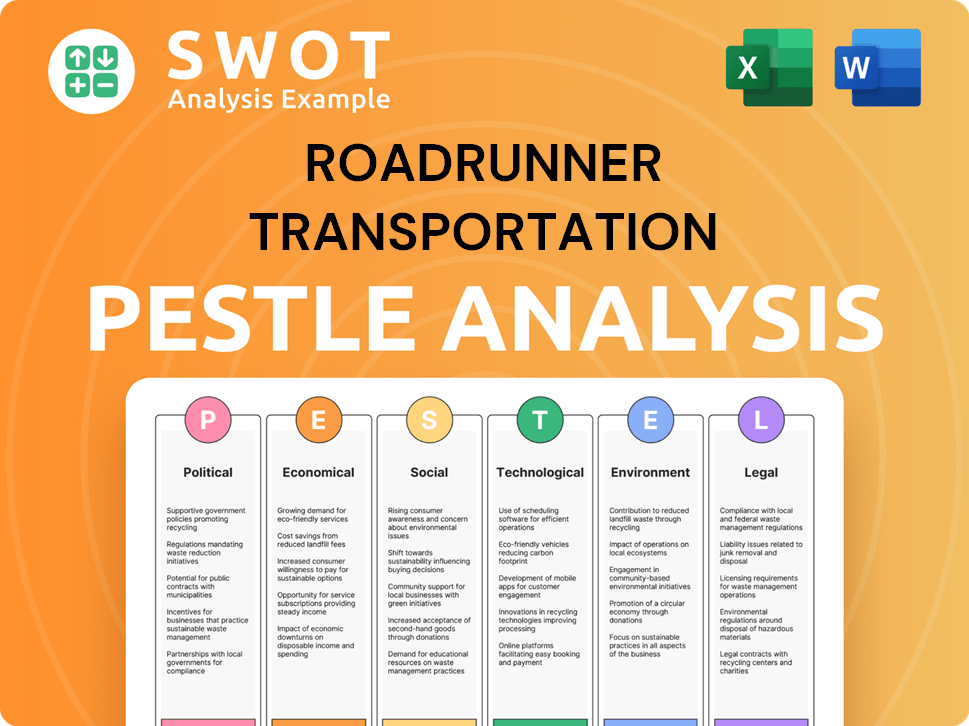

Roadrunner Transportation PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Roadrunner Transportation’s Board?

Following its emergence from bankruptcy and subsequent privatization, the composition of the Board of Directors for Roadrunner Transportation Company has been primarily influenced by its major shareholders. These shareholders are mainly investment firms that converted debt into equity during the restructuring. While a complete, real-time list of all board members and their specific affiliations is not consistently updated in publicly accessible databases for a private entity, it's typical for representatives of the largest equity holders to hold significant positions on the board. Understanding the Growth Strategy of Roadrunner Transportation also provides insights into the strategic direction the board likely prioritizes.

The voting structure for a privately held company like Roadrunner Transportation typically defaults to a one-share-one-vote system among its equity holders. Unless specific agreements for dual-class shares or other arrangements were established during the restructuring, the major investment firms effectively wield outsized control due to their substantial equity stakes. There have been no recent public proxy battles or activist investor campaigns since the company's privatization, as such actions are characteristic of publicly traded companies. The board's decisions are largely influenced by the strategic objectives of its primary investment firm owners, focusing on maximizing value for these stakeholders.

| Aspect | Details | Impact |

|---|---|---|

| Board Composition | Representatives from major equity holders (e.g., investment firms). | Strategic direction aligned with shareholder value. |

| Voting Rights | One-share-one-vote system is typical. | Major shareholders have significant control. |

| Activist Involvement | No recent public proxy battles or campaigns. | Focus on internal strategic objectives. |

The ownership of Roadrunner Transportation is concentrated among major investment firms. These firms exert significant control through their representation on the Board of Directors and their substantial equity stakes. This structure allows for focused strategic decision-making aimed at enhancing shareholder value within the freight company.

- Major shareholders influence board decisions.

- Voting power is typically based on share ownership.

- Focus on maximizing value for investment firm owners.

- No recent public proxy battles.

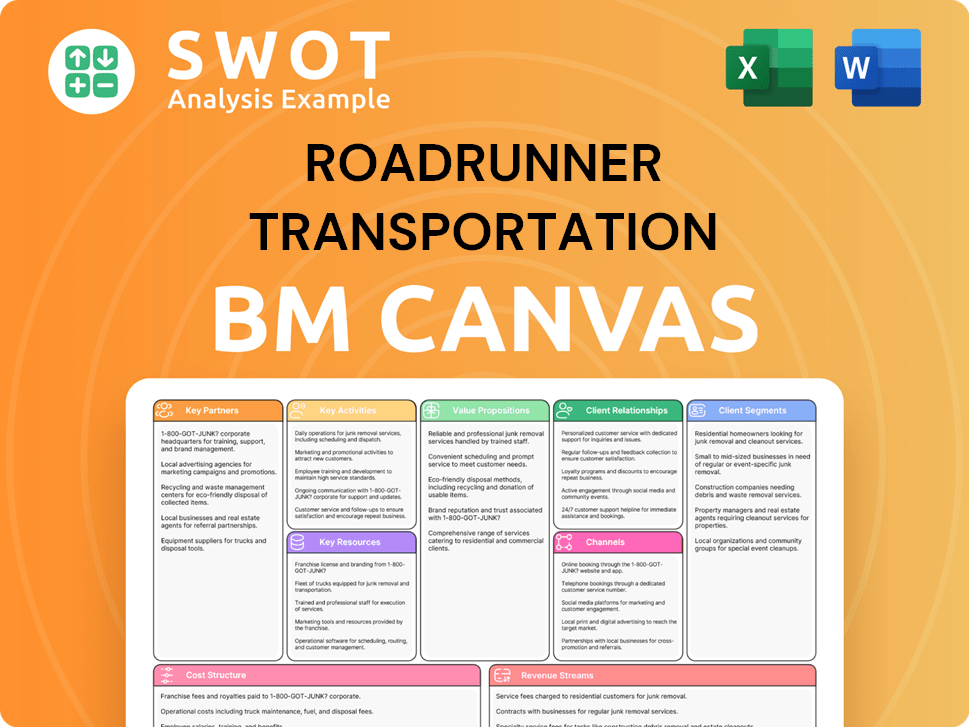

Roadrunner Transportation Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Roadrunner Transportation’s Ownership Landscape?

In the past few years, Roadrunner Transportation Company has significantly changed its ownership structure. The company transitioned from being publicly traded to private ownership in 2020, following a financial restructuring. This shift has allowed the company to focus on operational improvements within the less-than-truckload (LTL) market without the pressures of public market scrutiny. The focus is now on internal growth and efficiency, rather than public offerings or share buybacks.

The transportation and logistics industries have seen a rise in private equity involvement. This often involves operational turnarounds or strategic consolidation. The current ownership structure of Roadrunner Transportation by investment firms reflects this trend. It permits a long-term approach to value creation, which is less exposed to the short-term pressures of public markets. There have been no recent public statements regarding future ownership changes or potential re-privatization.

| Aspect | Details | Status |

|---|---|---|

| Ownership Type | Private | Current |

| Public Listing | Not Applicable | Current |

| Recent Activity | Focus on internal growth and operational efficiency | Current |

The current private ownership of Roadrunner Transportation Company is focused on maximizing returns for the existing equity holders. This approach is typical in private equity-backed companies, where the emphasis is on improving the business and increasing its value over a defined investment horizon. Information regarding the company's financial performance and specific ownership details is not typically released publicly due to its private status, but its business model is still worth examining.

The shift to private ownership in 2020 marked a significant change. This change allowed Roadrunner Transportation to concentrate on operational improvements and efficiency gains.

The transportation and logistics sector has seen increased private equity involvement. This is often driven by opportunities for operational improvements and strategic consolidation.

There have been no public announcements regarding future ownership changes. The focus remains on enhancing the company's value within its current structure.

The company is focused on internal growth and operational efficiency. This strategy is in line with private equity's long-term value creation approach.

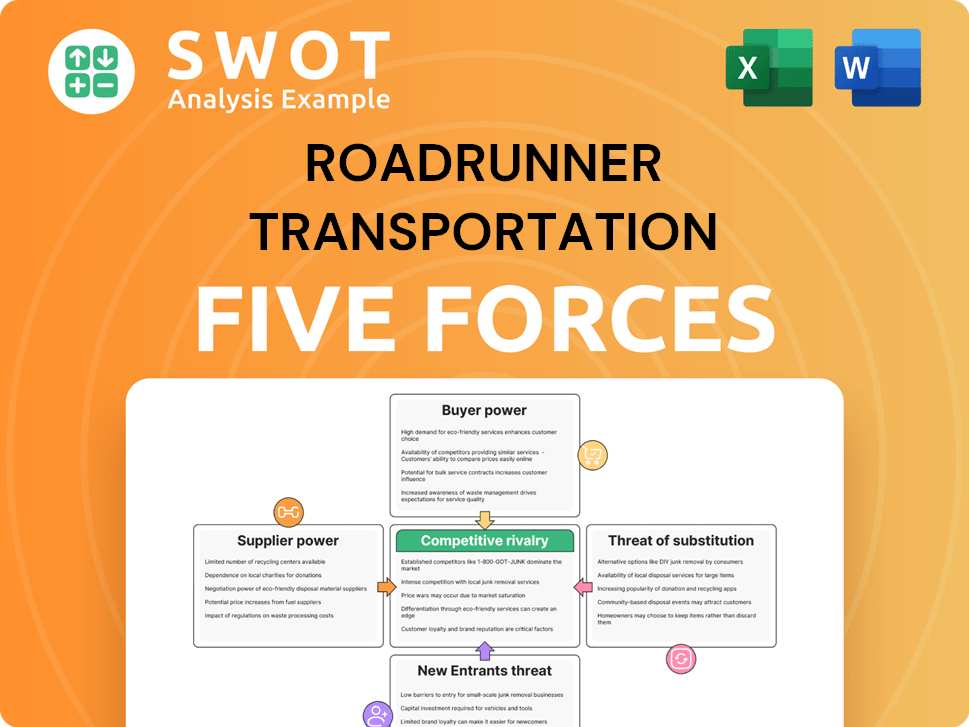

Roadrunner Transportation Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Roadrunner Transportation Company?

- What is Competitive Landscape of Roadrunner Transportation Company?

- What is Growth Strategy and Future Prospects of Roadrunner Transportation Company?

- How Does Roadrunner Transportation Company Work?

- What is Sales and Marketing Strategy of Roadrunner Transportation Company?

- What is Brief History of Roadrunner Transportation Company?

- What is Customer Demographics and Target Market of Roadrunner Transportation Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.