Smartbox Group Limited Bundle

Who Really Owns Smartbox Group Limited?

Understanding a company's ownership is paramount for investors and strategists alike. The ownership structure of Smartbox Group Limited, a leading provider of experience gifts, has evolved significantly. This evolution has shaped its strategic direction and market presence, making it crucial to dissect its ownership dynamics. This analysis will explore the key players and pivotal moments that have defined Smartbox's journey.

From its inception in 2003, Smartbox Group has navigated a complex landscape, experiencing transformations that have reshaped its operations. Key questions arise: Who are the primary stakeholders influencing Smartbox's future? How has the 2022 acquisition by Moonpig Group impacted the Smartbox Group Limited SWOT Analysis and overall strategy? This exploration will reveal the current Smartbox ownership structure and its implications for the Smartbox company's future, covering aspects like Smartbox business and Smartbox parent company.

Who Founded Smartbox Group Limited?

The genesis of the Smartbox Group Limited, a prominent player in the experience gifts sector, traces back to 2003. The company was founded by Pierre-Edouard Stérin, who initiated the concept in the French market.

Stérin's initial investment of €5,000 marked the beginning of what would become a significant business venture. Early success allowed the company to expand rapidly, including the acquisition of its Belgian franchisor within four years.

Understanding the ownership structure of Smartbox Group Limited involves recognizing the pivotal role of its founder and the subsequent involvement of investment entities. This includes the influence of Otium Capital, also founded by Stérin, which has significantly supported the company's growth.

Pierre-Edouard Stérin founded Smartbox Group Limited in 2003. The initial investment was €5,000, which launched the gift box concept in France.

The company experienced rapid growth in its early years. This led to the acquisition of its Belgian franchisor within four years of its founding.

Otium Capital, founded by Pierre-Edouard Stérin in 2009, is a key investor. It reinvests Smartbox dividends to support growth. As of April 2024, Otium Capital manages €1.5 billion in assets.

Smartbox AAC, a company focused on augmentative and alternative communication solutions, also has historical ties to a family company. This company was founded in 2000 by Paul, Alyson, Barney, and Dougal Hawes in the UK.

Dougal Hawes currently serves as the CEO of Smartbox Group Limited. It is important to note that the primary company in question for experience gifts, Smartbox Group, was founded by Pierre-Edouard Stérin.

Smartbox Group Limited specializes in experience gifts. The company has evolved significantly since its inception, with Pierre-Edouard Stérin as the primary founder.

The ownership structure of Smartbox Group Limited is primarily shaped by its founder, Pierre-Edouard Stérin, and the investment activities of Otium Capital. Understanding the history of Revenue Streams & Business Model of Smartbox Group Limited provides further context. Key points include:

- Pierre-Edouard Stérin initiated the company with a modest initial investment, driving early expansion.

- Otium Capital, with €1.5 billion in assets as of April 2024, has been a consistent supporter.

- Dougal Hawes leads the company as CEO, though Stérin is the primary founder.

- The company's focus remains on experience gifts, with a history of acquisitions and growth.

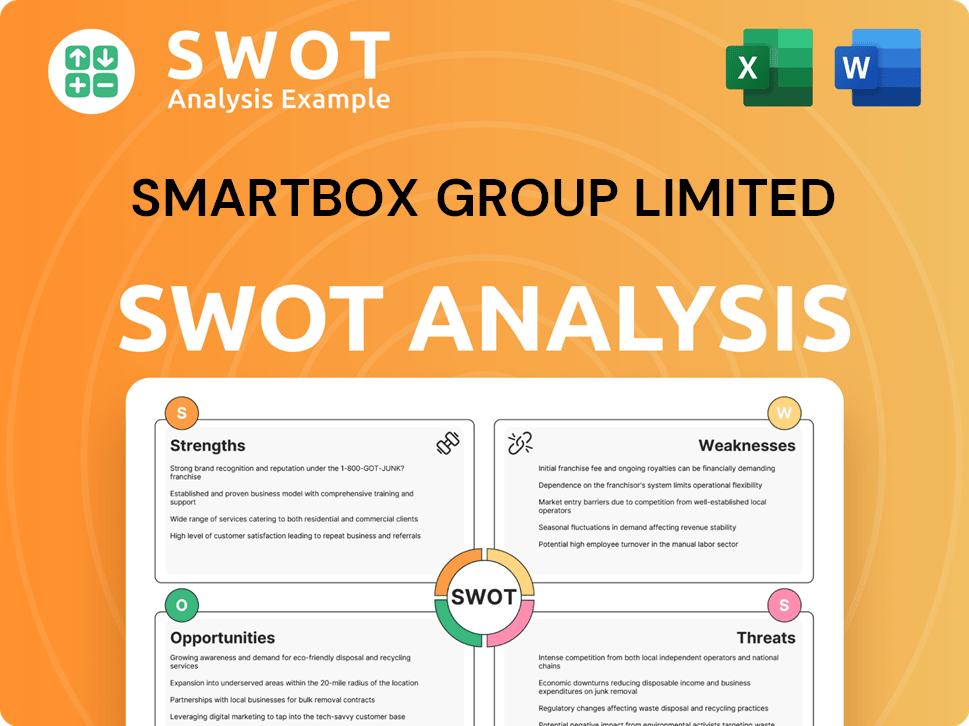

Smartbox Group Limited SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Smartbox Group Limited’s Ownership Changed Over Time?

The ownership of Smartbox Group Limited has undergone significant transformations since its inception. Initially founded by Pierre-Edouard Stérin, the company has seen various investors and major acquisitions. Otium Capital, also founded by Stérin, has been a long-term investor, using dividends to fund other ventures and maintaining a stake in the company. These shifts reflect the dynamic nature of the gift experience market and the strategic moves by key stakeholders to capitalize on growth opportunities.

A notable change occurred in May 2022, when Moonpig Group acquired Smartbox for $156 million, integrating its operations, including brands like Buyagift and Red Letter Days, into Moonpig's platform. This acquisition aimed to leverage the expanding gift experience market and create cross-selling opportunities. Prior to this, in October 2020, CareTech PLC acquired a different Smartbox entity for $12.3 billion, focused on assistive communication technology, which was later divested due to competition concerns. Furthermore, Smartbox Group (the experience gift provider) has also been involved in acquisitions, with its most recent being Live It in September 2023.

| Event | Date | Details |

|---|---|---|

| Acquisition by Moonpig Group | May 2022 | Acquired for $156 million, integrating Smartbox's brands into Moonpig's platform. |

| Acquisition by CareTech PLC (different entity) | October 2020 | Acquired for $12.3 billion, later divested. |

| Acquisition of Live It | September 2023 | Smartbox Group acquired Live It, a gift store and online platform. |

As of December 2024, Smartbox Group Company Limited has two shareholders, and Smartbox Group Limited has one shareholder. The largest shareholder of Smartbox Group Limited is Smartbox Group Company Limited, owning 10,000 ordinary shares valued at €10,000. TOPCO SA is a major shareholder of Smartbox Group Company Limited, holding 2,000,000 ordinary shares. Understanding the Marketing Strategy of Smartbox Group Limited can provide further insights into the company's growth and market positioning.

Smartbox Group Limited's ownership has evolved through acquisitions and strategic investments.

- Otium Capital, founded by Pierre-Edouard Stérin, has been a long-term investor.

- Moonpig Group acquired Smartbox in May 2022.

- Smartbox Group Company Limited and TOPCO SA are key shareholders as of December 2024.

- The company has also made acquisitions, such as Live It in September 2023.

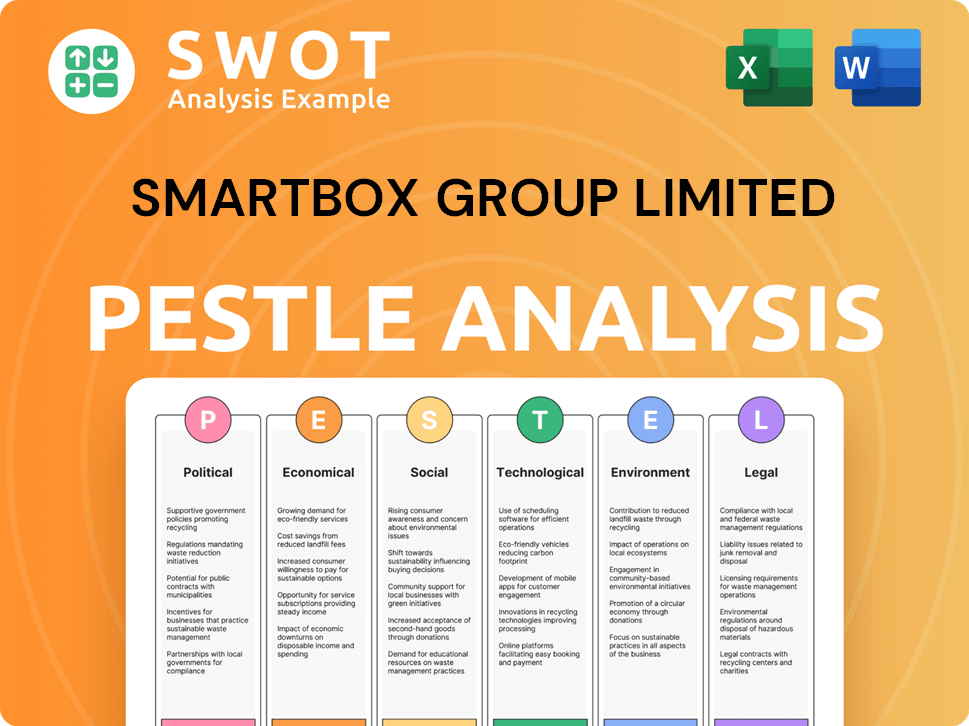

Smartbox Group Limited PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Smartbox Group Limited’s Board?

Information regarding the current board of directors of Smartbox Group Limited is limited in publicly available sources for 2024-2025. It's known that the company has directors, and as of April 30, 2021, Smartbox Group Company Limited reported having 100 directors. Patrick Lemaire and Paola Pianciola are listed as directors for Smartbox Group Company Limited. Mr. Lemaire has also been a Company Director of Smartbox Group Limited since 2022.

Due to the limited information available, specific details about individual relationships to major shareholders, founders, or independent seats are not extensively documented. However, the presence of directors suggests a structured governance framework within the company. For more detailed insights, one might consider consulting the Competitors Landscape of Smartbox Group Limited for a broader understanding of the company's structure and operations.

| Director | Role | Relationship |

|---|---|---|

| Patrick Lemaire | Company Director | Since 2022 |

| Paola Pianciola | Director | Listed as Director for Smartbox Group Company Limited |

| Unknown | Other Directors | As of April 30, 2021, Smartbox Group Company Limited reported 100 directors |

The voting structure, including details on one-share-one-vote or dual-class shares, is not explicitly available in the provided information. However, it is indicated that there is currently one person with significant control at Smartbox Group Limited. Similarly, Smartbox Group Company Limited also has one person with significant control. TOPCO SA, as a major shareholder in Smartbox Group Company Limited, holding 2,000,000 ordinary shares, would likely exert considerable influence. No recent proxy battles, activist investor campaigns, or governance controversies were found in the provided information.

Understanding the board of directors and voting power is crucial for assessing the company's governance and potential shareholder influence. While specific details are limited, the presence of directors and significant shareholders like TOPCO SA provides a glimpse into the company's structure. Further research into Smartbox ownership and the Smartbox parent company is recommended for a complete picture.

- Limited public information on the current board of directors.

- Patrick Lemaire is a Company Director since 2022.

- TOPCO SA holds 2,000,000 ordinary shares.

- One person with significant control is identified.

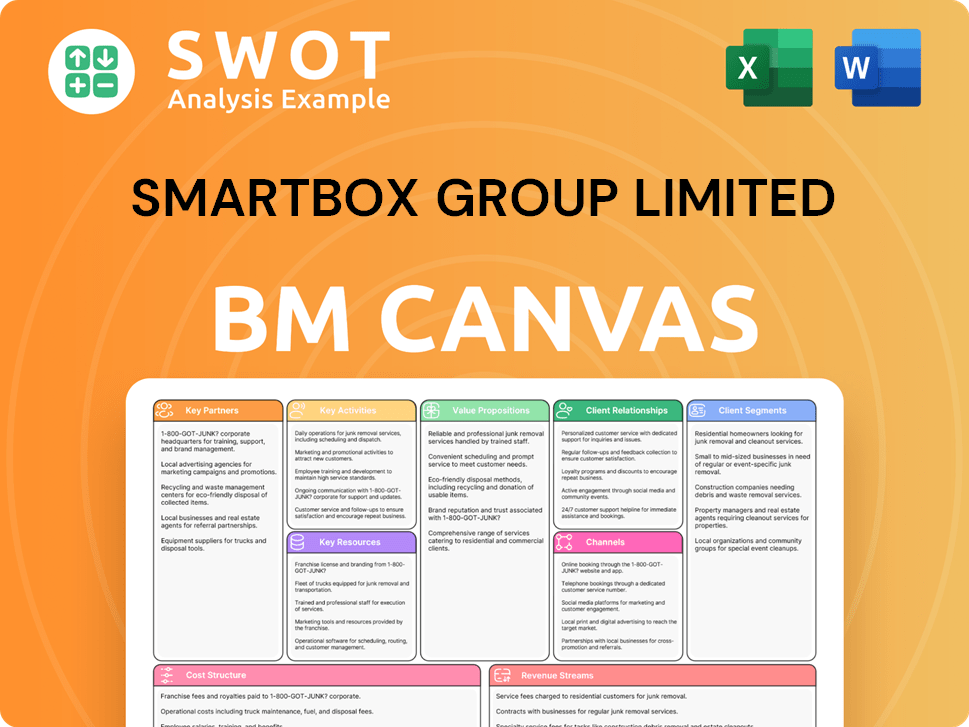

Smartbox Group Limited Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Smartbox Group Limited’s Ownership Landscape?

In recent years, the ownership of Smartbox Group Limited has seen significant changes. A major shift occurred in May 2022 when Moonpig Group acquired Smartbox for $156 million. This acquisition aimed to strengthen Moonpig's position in the gift experience market. The company has also been actively involved in strategic acquisitions to expand its market presence.

Smartbox Group's most recent acquisition was Live It, a gift store and online platform, in September 2023. This is part of a broader trend of strategic acquisitions, with Smartbox having completed four acquisitions to date, primarily in Denmark and Italy. These moves reflect a dynamic ownership landscape, adapting to evolving market demands and opportunities.

The experiential gifting market is projected to reach $85 billion by 2025, indicating a growing trend. The rise of e-commerce is also crucial, with global retail e-commerce sales expected to hit $8.1 trillion in 2024. This shift emphasizes the importance of a strong online presence for the company. Furthermore, consumer preferences are evolving, with eco-conscious consumers expected to drive a 20% rise in demand for sustainable products by 2025, potentially influencing future ownership trends focused on sustainability.

Smartbox Group Limited's ownership structure has evolved, with Moonpig Group's acquisition in 2022 being a key development. Strategic acquisitions, such as Live It in 2023, further shape its ownership profile. These changes reflect adaptation to market dynamics and growth strategies.

The experiential gifting market is expanding, with a projected value of $85 billion by 2025. E-commerce growth is significant, with global retail e-commerce sales expected to reach $8.1 trillion in 2024. Sustainability is gaining importance, influencing future ownership strategies.

Smartbox Group Limited Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Smartbox Group Limited Company?

- What is Competitive Landscape of Smartbox Group Limited Company?

- What is Growth Strategy and Future Prospects of Smartbox Group Limited Company?

- How Does Smartbox Group Limited Company Work?

- What is Sales and Marketing Strategy of Smartbox Group Limited Company?

- What is Brief History of Smartbox Group Limited Company?

- What is Customer Demographics and Target Market of Smartbox Group Limited Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.