Sodexo Bundle

Who Really Controls Sodexo?

Uncover the ownership secrets of Sodexo, a global giant in food services and facilities management. Understanding who owns the Sodexo SWOT Analysis is key to grasping its strategic moves and future potential. This exploration delves into the core of Sodexo's structure, revealing the key players shaping its destiny.

From its humble beginnings in Marseille, France, to its current status as a multinational corporation, the evolution of Sodexo's ownership tells a compelling story. Knowing the Sodexo ownership structure, including its major shareholders and the influence of the founding family, provides critical insights. This analysis will also examine the company's history, Sodexo headquarters location, and the impact of these ownership dynamics on Sodexo's financial performance and its strategic direction, including the roles of Sodexo executives.

Who Founded Sodexo?

The story of the Sodexo company begins in 1966, when Pierre Bellon established the company in Marseille, France. Bellon's initial vision centered on providing catering services, particularly for remote work sites in Africa and the Middle East. The early Sodexo ownership structure was largely private, with the Bellon family holding significant control from the outset.

At its inception, specific details about the equity split or shareholding percentages of the company are not publicly available. However, it's well-known that Pierre Bellon played a pivotal role in shaping the company's direction. This early ownership model laid the groundwork for a family-controlled enterprise that would later expand globally.

During Sodexo's initial phase, the Bellon family primarily held the ownership. There is no readily accessible information concerning early investors or details about early agreements, such as vesting schedules or buy-sell clauses. The emphasis on service excellence and operational efficiency, as envisioned by the founding team, was directly reflected in the centralized control maintained by Pierre Bellon and his family.

The company was founded in 1966 by Pierre Bellon.

The company's initial focus was providing catering services.

The Bellon family held significant control.

The company's early ownership details were not publicly disclosed.

Initially, Sodexo targeted remote work sites in Africa and the Middle East.

The company was set up as a family-controlled enterprise.

There were no significant public records of ownership disputes or buyouts during Sodexo's early years, indicating a stable founding ownership structure. The Bellon family's strong influence from the beginning allowed for a consistent strategic direction and the gradual expansion of services. This initial ownership model set the stage for the enduring family presence in Sodexo's governance. To understand more about the company's business model, you can check out Revenue Streams & Business Model of Sodexo.

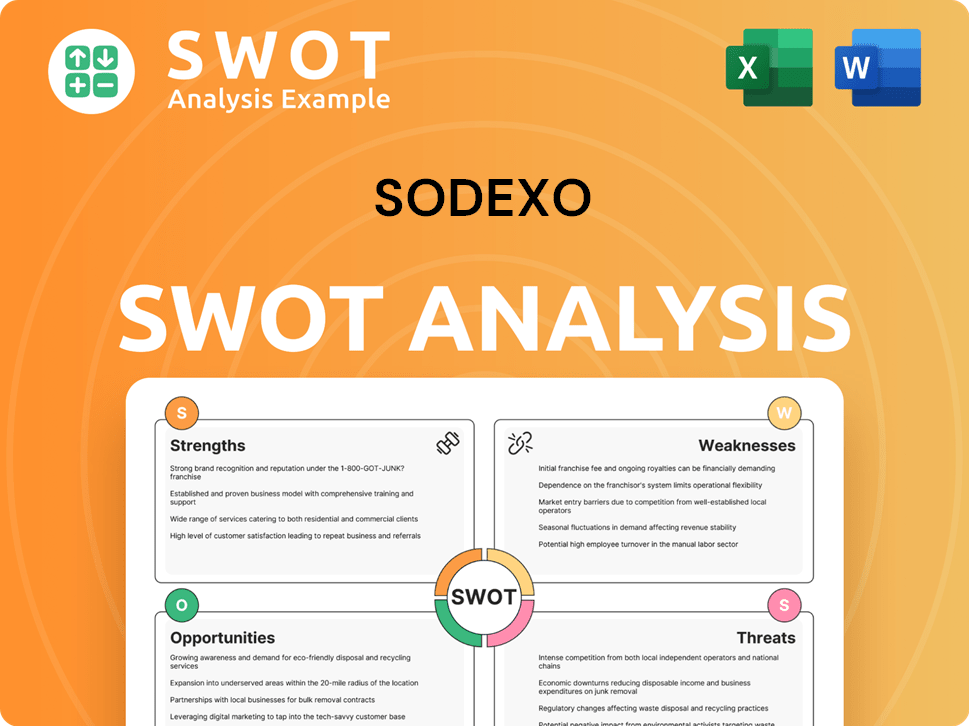

Sodexo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Sodexo’s Ownership Changed Over Time?

The evolution of Sodexo ownership is marked by its 1983 initial public offering (IPO) on the Paris Bourse, transforming it into a publicly traded entity. This move brought in external shareholders, yet the Bellon family has maintained substantial control. The company's history includes strategic shifts, such as the acquisition of Pluxee (formerly Sodexo Benefits & Rewards Services) in February 2024, which has influenced its ownership dynamics.

The Bellon family, through Bellon SA, remains the largest shareholder of the Sodexo company. As of August 31, 2024, Bellon SA holds 42.8% of the share capital and 58.7% of the exercisable voting rights. This dual-class share structure ensures the family's continued strategic influence. The ownership structure also includes institutional investors and employee shareholders, contributing to a diverse shareholder base. The Sodexo ownership structure reflects a balance between long-term family vision and public market demands.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Diversified ownership, introduced external shareholders | 1983 |

| Bellon Family Shareholding | Maintained significant control through Bellon SA | Ongoing |

| Acquisition of Pluxee | Strategic expansion, potential impact on ownership structure | February 2024 |

Institutional investors hold a significant portion of Sodexo's capital. Employee shareholders also play a role, holding 1.8% of the capital as of August 31, 2024. Recent changes show a slight decrease in the Bellon family's direct shareholding percentage due to capital increases and share-based compensation plans, though their control via voting rights remains strong. The influence of major institutional investors often involves engagement on governance and sustainability matters. The company's commitment to employee participation and strategic acquisitions showcases its adaptability.

The Bellon family's continued influence, combined with institutional and employee ownership, shapes Sodexo's strategic direction.

- Bellon SA holds a significant percentage of shares and voting rights.

- Institutional investors are a major part of the ownership structure.

- Employee shareholders also have a notable ownership stake.

- The company balances family vision with public market demands.

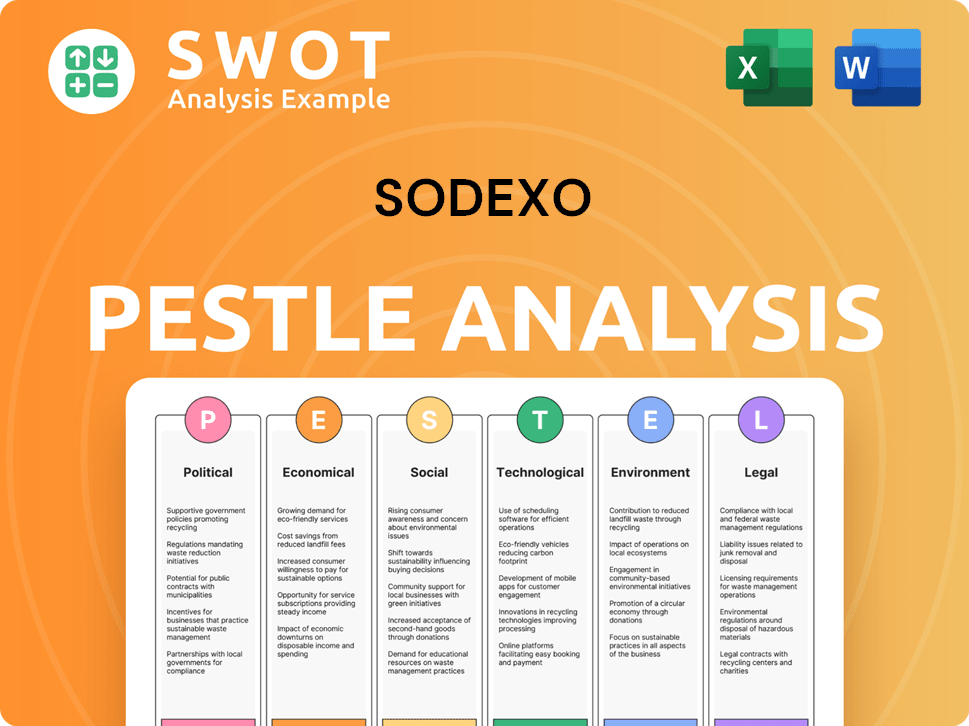

Sodexo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Sodexo’s Board?

The current Board of Directors of Sodexo, as of August 31, 2024, reflects its ownership structure, with a significant presence from the Bellon family, alongside independent directors and representatives of other major shareholders. Sophie Bellon, representing the founding family, serves as Chairwoman of the Board and CEO. The board's composition includes business leaders, financial experts, and individuals with experience in sustainability and corporate governance, ensuring a diverse range of perspectives.

The board's structure aims to balance family control with the transparency and accountability expected of a publicly listed company. This approach focuses on long-term value creation and sustainable development, ensuring that the interests of all shareholders are considered. The Growth Strategy of Sodexo is also a key factor in the board's decision-making process.

| Board Member | Position | Affiliation |

|---|---|---|

| Sophie Bellon | Chairwoman & CEO | Bellon Family |

| Members | Board Members | Diverse backgrounds |

| Independent Directors | Oversight | Ensuring shareholder interests |

The voting structure at Sodexo features a dual-class share system. Bellon SA, the family holding company, holds 42.8% of the capital but controls 58.7% of the exercisable voting rights as of August 31, 2024. This structure, which includes double voting rights for long-term registered shares, effectively ensures the Bellon family's control over strategic decisions, board appointments, and major corporate actions.

The Bellon family maintains significant control through a dual-class share system.

- Sophie Bellon is the Chairwoman and CEO, representing the family's continued leadership.

- Independent directors provide oversight and ensure shareholder interests are considered.

- The company focuses on long-term value creation and sustainable development.

- The Bellon family's voting power is disproportionate to their economic ownership.

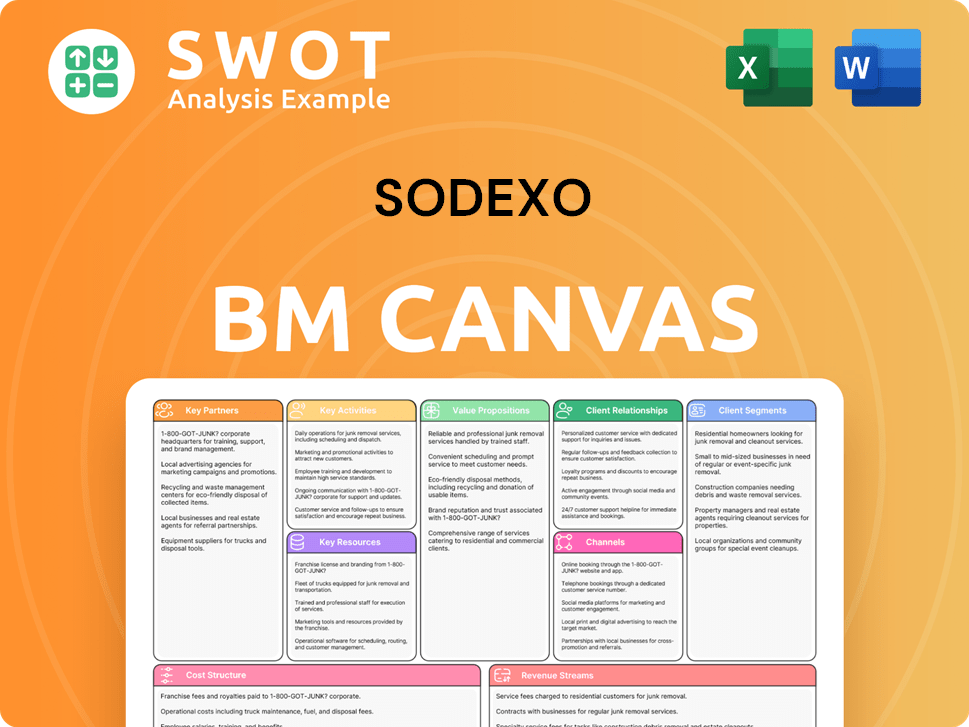

Sodexo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Sodexo’s Ownership Landscape?

In the past few years, the ownership landscape of Sodexo has seen notable shifts, primarily driven by strategic decisions. A significant development was the spin-off of its Benefits & Rewards Services division into Pluxee, which began trading on Euronext Paris in February 2024. This move aimed to unlock shareholder value by enabling each entity to pursue its independent growth strategies. As a result of this transaction, Sodexo distributed Pluxee shares to its existing shareholders, directly impacting the ownership structure of both companies. This strategic realignment is a key indicator of the evolving nature of Sodexo’s business portfolio and its approach to maximizing shareholder returns. This event highlights the company's proactive measures in adapting to market dynamics and optimizing its operational structure.

Industry trends, such as the increasing influence of institutional investors and the growing importance of Environmental, Social, and Governance (ESG) factors, also play a role in shaping Sodexo's ownership profile. While the Bellon family retains a controlling stake, institutional investors are increasingly engaged on sustainability and governance matters. Sodexo has responded by reinforcing its commitments to corporate responsibility, which can influence investor sentiment and attract long-term, responsible investors. These efforts reflect a broader trend in the corporate world where companies are aligning their strategies with investor priorities that go beyond financial performance.

| Aspect | Details | Impact |

|---|---|---|

| Spin-off of Pluxee | Independent entity listed on Euronext Paris in February 2024 | Altered ownership structure; strategic focus |

| Bellon Family | Maintains a controlling stake | Ensures long-term strategic vision |

| Institutional Investors | Increasingly focused on ESG factors | Influences corporate responsibility and investor sentiment |

Looking forward, Sodexo’s commitment to its current ownership structure remains firm, with the Bellon family as the anchor shareholder. The company continues to prioritize organic growth and strategic acquisitions within its core food services and facilities management businesses. There are no current public statements suggesting plans for a full privatization or a significant reduction in the Bellon family’s controlling interest. The spin-off of Pluxee is a strategic move rather than a fundamental change in the ownership philosophy of the parent company. This demonstrates the enduring vision of the Bellon family and their long-term commitment to the company. For more details on their target market, check out Target Market of Sodexo.

The Bellon family maintains a controlling stake, ensuring long-term strategic direction for the company. This structure allows for consistent decision-making and a clear vision for the future.

Key executives play a crucial role in guiding Sodexo's strategic direction and operational performance. Their leadership influences the company's ability to adapt to market changes.

The primary ownership is held by the Bellon family, which ensures stability and a long-term perspective. Institutional investors also hold significant shares.

Sodexo is a global leader in food services and facilities management, serving various sectors. The company's diverse operations and global presence are key to its success.

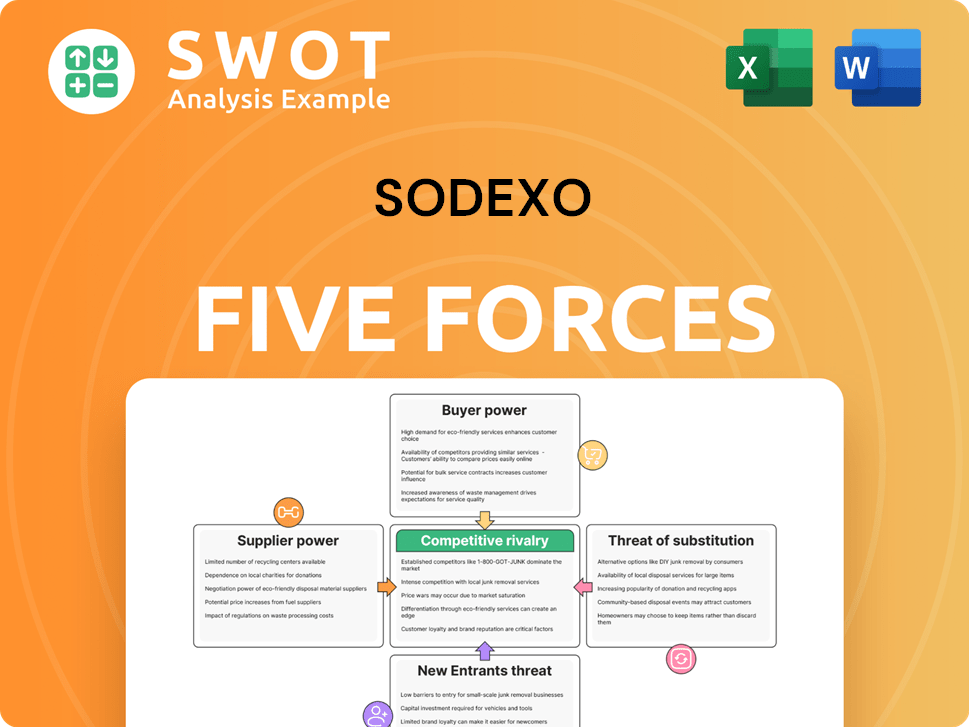

Sodexo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sodexo Company?

- What is Competitive Landscape of Sodexo Company?

- What is Growth Strategy and Future Prospects of Sodexo Company?

- How Does Sodexo Company Work?

- What is Sales and Marketing Strategy of Sodexo Company?

- What is Brief History of Sodexo Company?

- What is Customer Demographics and Target Market of Sodexo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.