Taboola Bundle

Who Really Owns Taboola?

In the ever-evolving digital advertising world, understanding the Taboola SWOT Analysis is crucial for investors and business strategists alike. Founded in 2007 by Adam Singolda, Taboola has become a global force in content discovery, but who exactly calls the shots at this massive company? Knowing the Taboola ownership structure provides key insights into its strategic direction and future potential.

This exploration into Who owns Taboola will unveil the company's journey from its inception to its current status as a publicly traded entity. We'll examine the roles of key Taboola investors, the influence of Taboola owner on the Taboola business, and how the Taboola company's ownership structure impacts its overall strategy and governance. Discover the answers to questions like: Is Taboola a public company? Who is the CEO of Taboola? What is Taboola's current market value?

Who Founded Taboola?

The genesis of the content recommendation platform, Taboola, began in 2007. It was founded by Adam Singolda, who brought his experience from the Israeli intelligence sector to the tech world. Singolda's vision was to create a 'search engine in reverse,' helping users discover content they might like.

The company's name, 'Taboola,' is derived from the Hebrew word 'taboul,' which translates to 'recommendation.' Initially, the platform was a simple widget for personalized content recommendations. It has since evolved into an AI-powered content discovery engine.

Early funding rounds were crucial in Taboola's growth. These included $1.5 million in November 2007, $4.5 million in November 2008, and $9 million in August 2011. These initial investments fueled the company's early development and expansion.

Early funding rounds were instrumental in the growth of the Taboola business. Initial investments provided the necessary capital to develop and expand the platform.

Taboola began as a simple widget and evolved significantly. The platform transformed into an AI-powered content discovery engine, enhancing its capabilities.

Adam Singolda's vision was key to Taboola's creation. Singolda aimed to build a 'search engine in reverse' to help users find relevant content.

The name 'Taboola' has a meaningful origin. It is derived from the Hebrew word 'taboul,' which means 'recommendation,' reflecting the company's core function.

The ownership structure has evolved. Adam Singolda, as the founder and CEO, holds a significant stake in the company.

Singolda's direct ownership includes a substantial number of shares. As of early March 2025, his holdings reflect his significant role in the company.

Taboola's financial journey has been marked by several key investment rounds. Early investors and the evolution of the company's ownership structure are critical to understanding its current position. Knowing Competitors Landscape of Taboola is also important.

- In February 2013, Taboola secured $15 million from investors like Evergreen Venture Partners, Marker, and Pitango Venture Capital.

- Fidelity Investments led a Series E round in February 2015, contributing $117 million to Taboola's funding.

- Adam Singolda, as founder and CEO, maintains a significant ownership stake.

- As of February 28, 2025, Singolda owned 14,462,943 shares, including ordinary shares and RSUs.

- By March 3, 2025, Singolda's ordinary share count increased to 14,586,714.

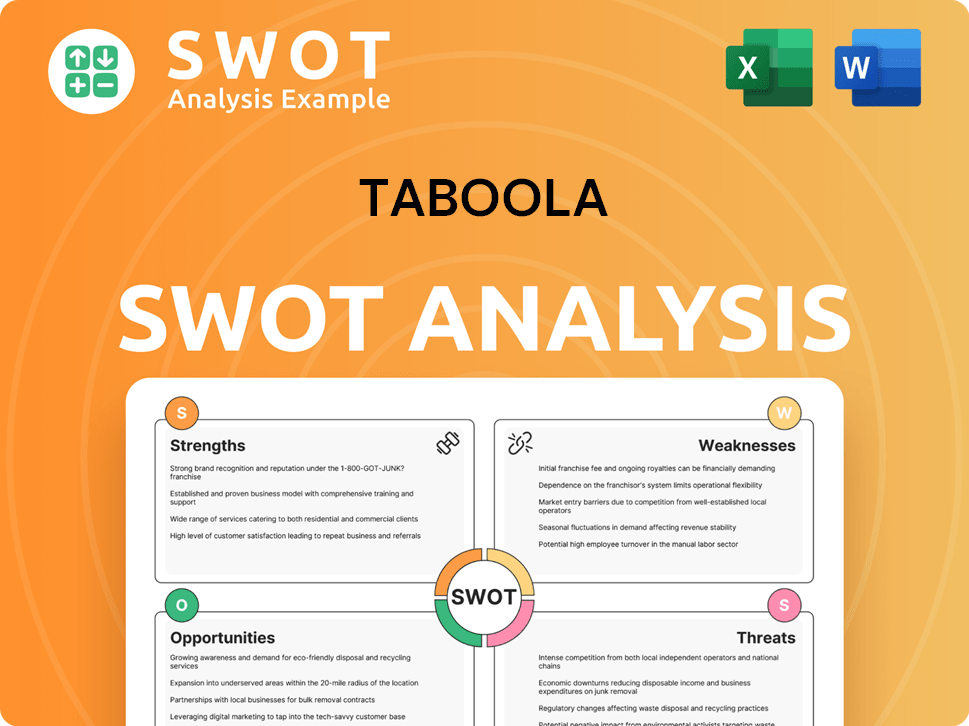

Taboola SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Taboola’s Ownership Changed Over Time?

The journey of Taboola's ownership transitioned significantly on June 29, 2021. This was when the company became publicly traded via a merger with ION Acquisition Corp. 1 Ltd., a special purpose acquisition company (SPAC). This strategic move involved a $285 million private investment in public equity (PIPE) from investors like Fidelity and Baron Capital Group. The SPAC merger aimed to raise $545 million, which valued the combined entity at $2.6 billion at the time.

As of April 2025, the ownership structure of Taboola.com (TBLA) stock is a blend of institutional, insider, and retail investors. Institutional investors hold approximately between 22.11% and 24.96% of the company's shares. Insiders own 49.56%, while public companies and individual investors account for 25.48%. Institutional ownership was at 33.24% in April 2025.

| Shareholder | Shares Held (as of March 31, 2025) | Percentage of Ownership |

|---|---|---|

| Evergreen Venture Partners Ltd. | 23,061,612 | Not Available |

| Siren, L.L.C. | 9,969,495 | Not Available |

| Phoenix Holdings Ltd. | 7,419,080 | Not Available |

| Wellington Management Group Llp | 5,541,096 | Not Available |

| Migdal Insurance & Financial Holdings Ltd. | 5,349,179 | Not Available |

| Menora Mivtachim Holdings Ltd. | 4,212,735 | Not Available |

Key institutional shareholders as of March 31, 2025, include Evergreen Venture Partners Ltd., Siren, L.L.C., and Phoenix Holdings Ltd. Other significant investors are Wellington Management Group Llp, Migdal Insurance & Financial Holdings Ltd., and Menora Mivtachim Holdings Ltd. Mutual funds saw an increase in their holdings, rising from 4.27% to 4.36% in April 2025.

The ownership of the Taboola company is split between institutional investors, insiders, and the public. The shift to a public company via a SPAC merger was a key event. Knowing who owns Taboola helps in understanding the company's direction.

- Institutional investors hold a significant portion of shares.

- Insiders maintain a substantial ownership stake.

- The public also has a considerable investment in the company.

- The ownership structure has evolved since the SPAC merger.

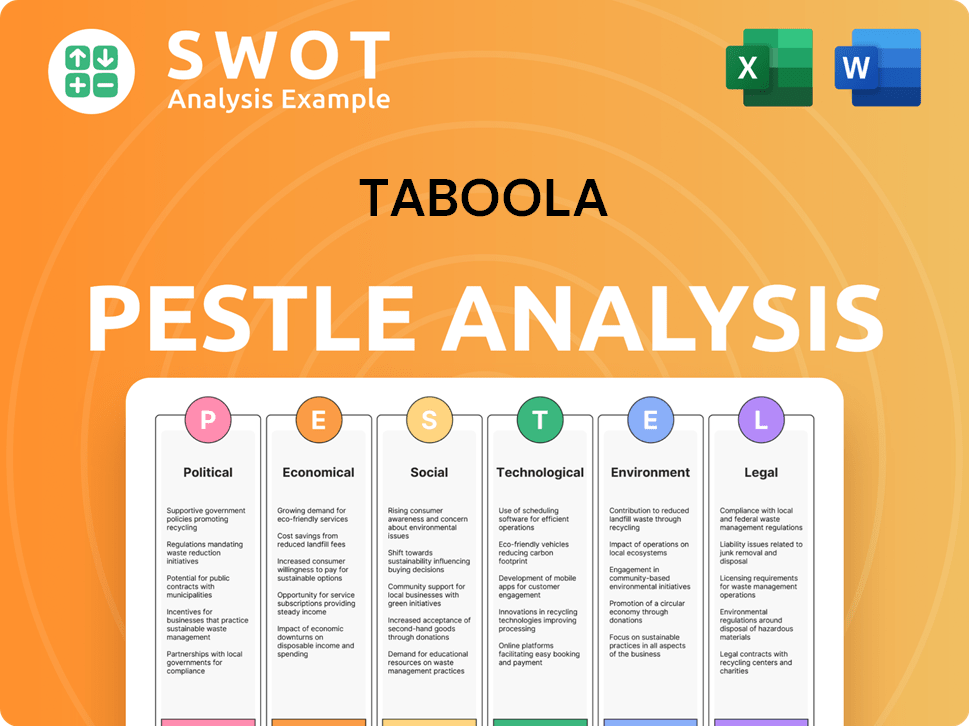

Taboola PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Taboola’s Board?

The current Board of Directors of the Taboola company plays a vital role in its governance and strategic direction. The board is composed of several key figures, including Adam Singolda, the founder and CEO, who also serves as a director. Other board members include Zvi Limon, Erez Shachar, Nechemia (Chemi) J. Peres, Rick Scanlon, Gilad Shany, and Monica Mijaleski. This group includes independent directors like Nechemia Peres, Erez Shachar, Zvika Limon (Independent Chairman of the Board), and Richard Scanlon, alongside a non-independent director, Monica Mijaleski.

As of May 28, 2024, the compensation package for non-employee directors was updated, including an annual cash retainer of $40,000 and an annual RSU award of $190,000, totaling $230,000 in annual board compensation. The Board of Directors has an average tenure of 12.4 years as of June 2025, indicating significant experience within the board. Understanding the Taboola ownership structure and the roles of these individuals is crucial for investors and stakeholders alike.

| Board Member | Role | Status |

|---|---|---|

| Adam Singolda | Founder & CEO | Director |

| Zvi Limon | Independent Chairman | Director |

| Erez Shachar | Director | Independent Director |

| Nechemia (Chemi) J. Peres | Director | Independent Director |

| Rick Scanlon | Director | Independent Director |

| Gilad Shany | Director | Independent Director |

| Monica Mijaleski | Director | Non-Independent Director |

Regarding voting power, as of February 21, 2025, Taboola had 338,875,848 outstanding shares, consisting of 294,665,442 ordinary shares and 44,210,406 non-voting ordinary shares. This structure suggests a potential for differentiated voting rights among shareholders. The board consistently recommends that shareholders vote on key proposals, including the re-election of directors and executive compensation. For more insights into Taboola's approach, explore the Marketing Strategy of Taboola.

The board consists of experienced members, including the founder and CEO, and independent directors.

- Non-employee directors receive an annual compensation of $230,000.

- The company has a dual-class share structure, which may affect voting power.

- The board recommends shareholder votes on important matters.

- Understanding the board's composition is essential for evaluating Taboola's governance.

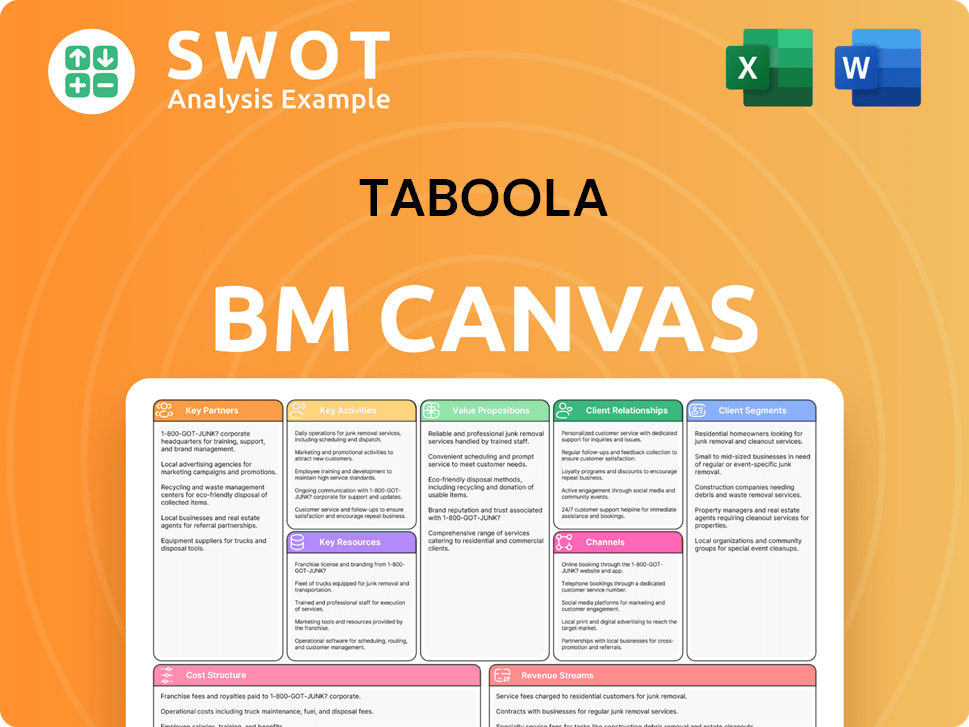

Taboola Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Taboola’s Ownership Landscape?

Recent developments significantly impact the ownership profile of the company. On February 26, 2025, a $200 million expansion to its share repurchase program was announced, increasing the total authorization to approximately $240 million. This move reflects confidence in the business and its free cash flow generation, allowing for share buybacks through open market purchases and other means. These actions are crucial in understanding the dynamics of Taboola ownership.

CEO Adam Singolda has consistently invested in the company, acquiring 60,229 ordinary shares on February 28, 2025, for $163,822, and an additional 123,771 ordinary shares on the same date, totaling $334,181. His direct ownership increased to 14,462,943 shares by February 28, 2025, and 14,586,714 shares by March 3, 2025, demonstrating strong insider confidence. As of June 12, 2025, Adam Singolda directly owns 3.86% of the company's shares, which provides insight into who owns Taboola.

| Metric | 2024 | Q1 2025 |

|---|---|---|

| Revenue | $1,766.2 million | $427 million |

| Gross Profit | $534.2 million | N/A |

| Net Loss | $3.8 million | N/A |

| Adjusted EBITDA | N/A | $36 million |

Institutional investors held between 22.11% and 42.89% of the company's stock as of early 2025. The company is focused on growth, including the launch of its 'Realize' platform in February 2025. Understanding the Taboola owner also involves recognizing the company's strategic initiatives and financial performance. For more information, read about the Target Market of Taboola.

The company expanded its share repurchase program by $200 million, bringing the total authorization to approximately $240 million. This reflects confidence in the company's financial health and future prospects.

CEO Adam Singolda has increased his stake in the company through multiple share purchases in February 2025. His direct ownership reached 3.86% as of June 12, 2025, reinforcing insider confidence.

Full-year 2024 revenues were $1,766.2 million, with a net loss of $3.8 million, an improvement from the $82 million loss in 2023. Q1 2025 revenues reached $427 million, a 3% increase year-over-year.

Institutional investors hold a significant portion of the company's stock, ranging between 22.11% and 42.89% as of early 2025. This indicates confidence from major investors.

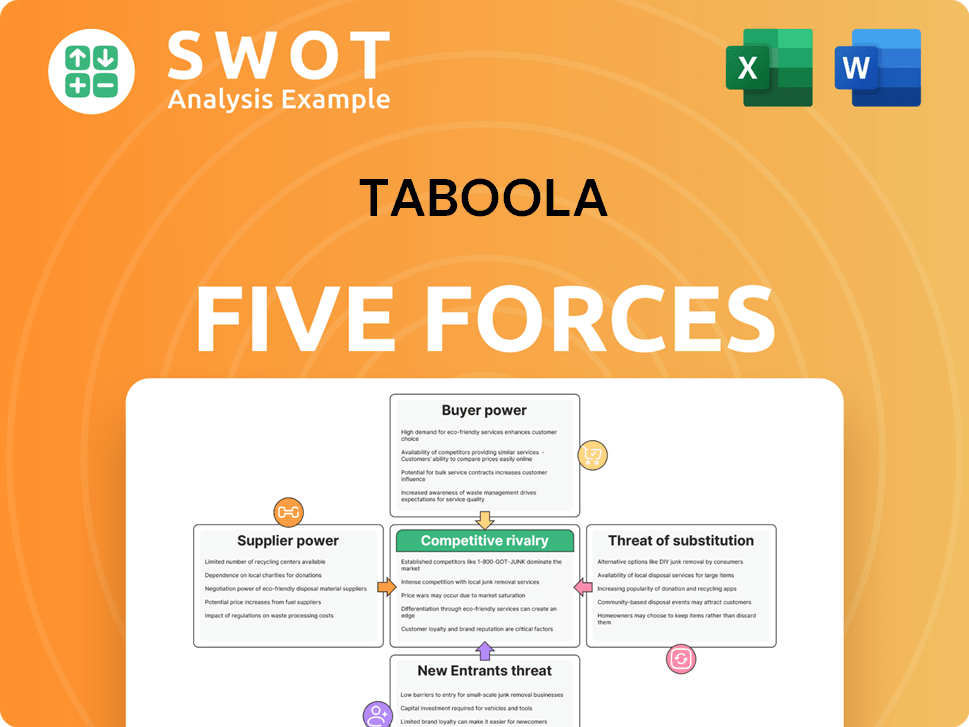

Taboola Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Taboola Company?

- What is Competitive Landscape of Taboola Company?

- What is Growth Strategy and Future Prospects of Taboola Company?

- How Does Taboola Company Work?

- What is Sales and Marketing Strategy of Taboola Company?

- What is Brief History of Taboola Company?

- What is Customer Demographics and Target Market of Taboola Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.