Works Bundle

Who Really Owns The Works Company?

Understanding a company's ownership is crucial for grasping its strategic direction and potential for growth. The Works Company, a familiar name in the UK and Ireland's retail landscape, has an intriguing ownership journey. From its humble beginnings to its current status, the story of Works Company ownership reveals key insights into its evolution and future prospects.

This exploration of Works SWOT Analysis will uncover the significant shifts in Works Company ownership, from its founders to its current shareholders. We'll examine the influence of key investors and the impact of these changes on Works Company's governance and strategic decisions. Discover the answers to questions such as: Who founded Works Company? Is Works Company a public company? And, who is the CEO of Works Company? This deep dive into Works Company Ownership provides a comprehensive look at this dynamic retailer.

Who Founded Works?

The story of the Works Company begins with Mike and Jane Crossley, who founded the business in 1981. They started by selling books from their home, eventually expanding into a retail chain known as Remainders Ltd. This early phase set the stage for the company's growth and evolution.

By 1984, the Crossleys had opened their first physical store, marking a significant step in their expansion. Over the next 16 years, they grew Remainders Ltd. to over 160 stores across the UK and Ireland. This period was crucial in establishing the company's presence in the market.

In 1999, Remainders Ltd. had a purpose-built base in Minworth, with a turnover of £60 million and a workforce of 1,200. The Crossleys further expanded in 2001 by acquiring 19 stores from First Stop Stationery for £1 million, rebranding them as The Works. This strategic move helped to increase the company's market share.

Mike and Jane Crossley founded the company in 1981, initially selling books from their home. They established their first physical store in 1984.

Remainders Ltd. expanded to over 160 stores by 1999. The company achieved a turnover of £60 million with a workforce of 1,200.

In 2001, the company acquired 19 stores from First Stop Stationery. These stores were rebranded as The Works.

Remainders Ltd. received the Birmingham Post's Business of the Month and Business of the Year awards in 2001.

In 2003, the Crossleys sold Remainders Ltd. to a management buyout for approximately £25 million.

At the time of the buyout, the chain had 176 stores, 1,500 staff, and an annual turnover of £70 million.

The Works Company underwent a significant ownership change in 2003 when Mike and Jane Crossley sold Remainders Ltd. to a management buyout. This transaction, valued at approximately £25 million, marked a transition in the company's leadership and ownership structure. The new management team was backed by Primary Capital, with Terry Norris taking on the role of Chairman. Understanding the Works Company History and the evolution of its Works Company Ownership is essential. To learn more about the Works Company Owner and its customers, check out the Target Market of Works.

- The Crossleys founded the company in 1981.

- Remainders Ltd. was sold to a management buyout in 2003.

- Primary Capital backed the new management team.

- Terry Norris became the Chairman after the buyout.

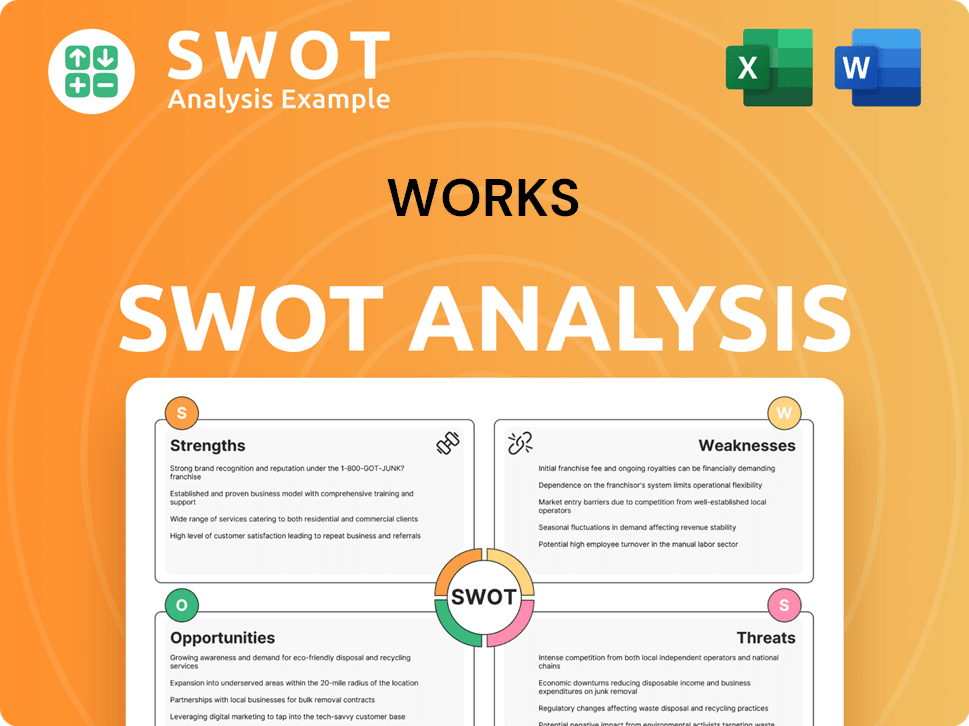

Works SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Works’s Ownership Changed Over Time?

The evolution of the Works Company Ownership has seen several pivotal shifts since its inception. Initially, a management buyout in 2003, supported by Primary Capital, marked an early transition. However, financial difficulties led to another management buyout in 2005, with Hermes Private Equity Partners acquiring a 79% stake. Despite these efforts, the company faced persistent challenges, culminating in administration in January 2008, with liabilities significantly exceeding assets.

In June 2008, retail entrepreneur Anthony Solomon and private equity firm Endless rescued the Works Company from administration for £15 million, initiating a period of recovery and expansion. Dean Hoyle, the founder of Card Factory, invested in July 2015, becoming Chairman. The most significant change occurred in July 2018, when the Works Company, then approximately one-third owned by Hoyle, went public on the London Stock Exchange, valued at £100 million. Hoyle retained the largest shareholding, holding 15% after the IPO. This transformation highlights the dynamic nature of the Works Company's ownership structure.

| Event | Date | Details |

|---|---|---|

| Management Buyout | 2003 | Backed by Primary Capital. |

| Management Buyout | 2005 | Hermes Private Equity Partners acquired 79% interest. |

| Administration | January 2008 | Liabilities exceeded £79.5 million against assets of £6.6 million. |

| Rescue from Administration | June 2008 | Anthony Solomon and Endless acquired the company for £15 million. |

| Dean Hoyle Investment | July 2015 | Hoyle invested and became Chairman. |

| Initial Public Offering (IPO) | July 2018 | Valuation of £100 million; Hoyle retained 15% shareholding. |

As of June 2025, TheWorks.co.uk PLC is a publicly held company with 60.2 million shares outstanding and a market capitalization of £35.6 million. Key institutional shareholders include Kelso Group Holdings Plc with 6.15% (3,845,000 shares), Hargreaves Lansdown Asset Management Ltd. with 5.18% (3,236,080 shares), and Apex Group Ltd. with 3.66% (2,287,350 shares). TheWorks.Co.Uk Employee Benefit Trust also holds a significant stake of 3.64% (2,271,907 shares). The company's primary business remains the retail of books, toys, games, arts and crafts, and stationery in the UK and Ireland. For a deeper dive into the company's marketing approach, check out the Marketing Strategy of Works.

The Works Company's ownership has evolved significantly, marked by buyouts, administration, and an IPO.

- Publicly listed with a market cap of £35.6 million as of June 2025.

- Major shareholders include Kelso Group Holdings Plc, Hargreaves Lansdown, and Apex Group Ltd.

- The company continues to operate as a retailer of books, toys, and stationery in the UK and Ireland.

- Dean Hoyle's influence was substantial, particularly before and after the IPO.

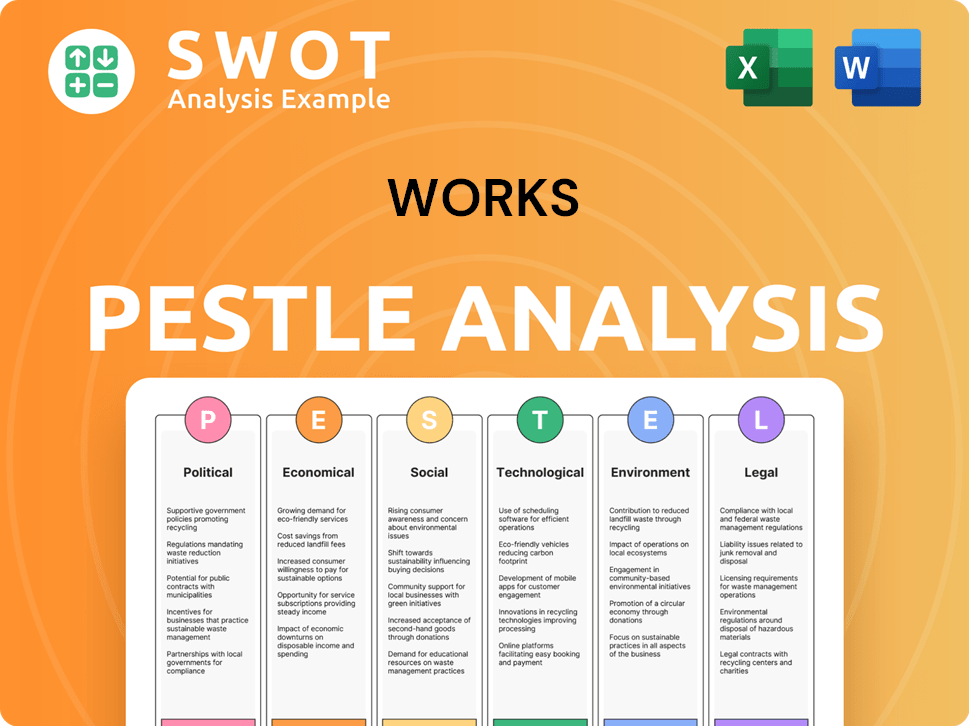

Works PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Works’s Board?

The current board of directors of TheWorks.co.uk plc is responsible for overseeing the company's strategy and governance. As of April 2024, the company's legal entity identifier is 894500W7PWBCCWBN9R03. The board comprises both executive and non-executive directors, ensuring a mix of operational expertise and independent oversight. This structure helps to guide the company’s direction and ensure accountability to shareholders.

Key individuals on the board include Gavin Peck, who serves as the Chief Executive Officer, and Rosie Fordham, who was appointed as the new Chief Financial Officer in 2024. Other important members of the operating board are Lynne Tooms as Chief Commercial Officer, Dean Hawkridge as Chief Supply Chain and Digital Officer, and Debbie McMinn as Chief People and Retail Officer. Steve Bellamy was appointed as the new Chair of the Board in 2024, succeeding Carolyn Bradley. The board also includes representatives from major shareholders, such as John Goold and Mark Kirkland from Kelso Group Holdings PLC, reflecting their stake in the company.

| Director | Role | Date of Appointment |

|---|---|---|

| Gavin Peck | Chief Executive Officer | 2020 |

| Rosie Fordham | Chief Financial Officer | 2024 |

| Steve Bellamy | Chair of the Board | 2024 |

The voting structure at TheWorks.co.uk plc is based on a one-share-one-vote principle, applicable to all Ordinary Shares. Shareholders can vote through proxy forms or electronically via the Registrar's online service, Shareview. The Annual General Meeting (AGM) is a crucial event where shareholders vote on resolutions, including the Directors' report and accounts, and remuneration. The 2024 AGM, held on October 31, 2024, saw all ordinary and special resolutions passed by way of a poll. The company provides detailed poll results, including votes for, against, and withheld, as well as the percentage of issued share capital voted. For more insights into the business, you can explore Revenue Streams & Business Model of Works.

The board of directors is crucial for the strategic direction of the Works Company. The board includes executive and non-executive directors, ensuring diverse expertise. Shareholders vote on key decisions at the Annual General Meeting.

- The CEO is Gavin Peck.

- Rosie Fordham is the CFO.

- Shareholders vote on key resolutions.

- Kelso Group Holdings PLC holds a significant stake.

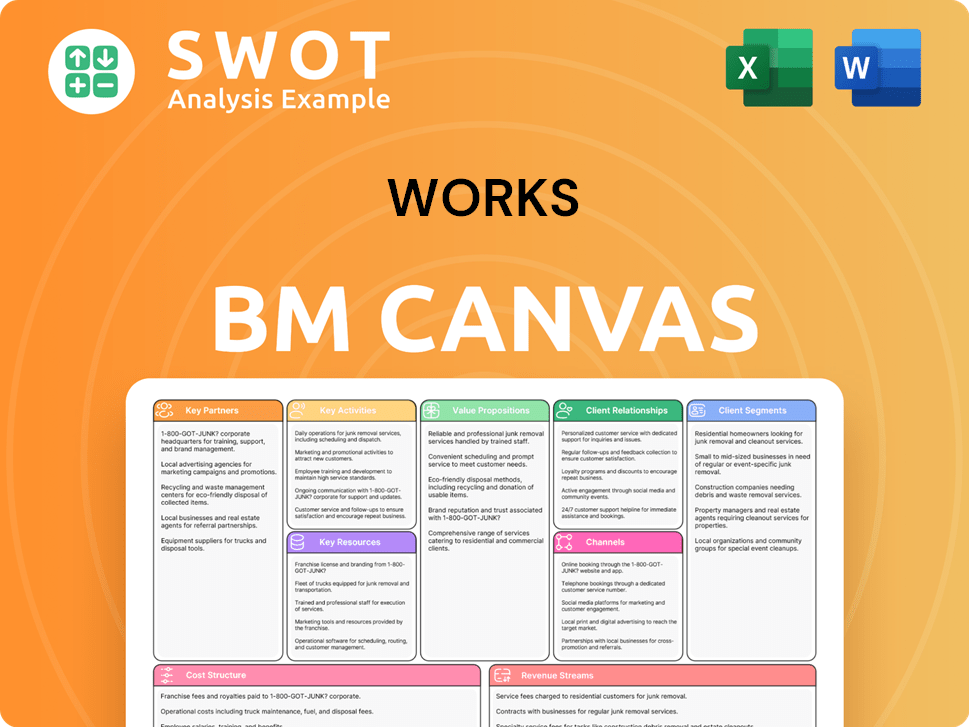

Works Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Works’s Ownership Landscape?

In recent years, the ownership structure of The Works Company has seen notable shifts. A key development was the company's decision in April 2024 to move its listing from the Main Market of the London Stock Exchange to the Alternative Investment Market (AIM). This strategic move, aimed at cost savings and enhanced shareholder value, was completed in May 2024. This shift underscores the company's ongoing efforts to optimize its financial operations and adapt to market dynamics. For more insights, check out the Brief History of Works.

Significant changes in shareholding have also taken place. In February 2024, Kelso Group Holdings PLC, an activist investor, increased its stake in The Works to 6.0%, up from 5.1%. This increase in ownership coincided with Kelso's CEO and CFO joining The Works' board. These changes reflect evolving relationships among the company's major shareholders and its leadership. The Works Company ownership structure continues to evolve, influenced by strategic decisions and investor actions.

| Metric | FY25 Performance | Notes |

|---|---|---|

| Total Revenue | £277 million | 2% decrease due to one less trading week and store optimizations |

| Q4 Like-for-like Sales Growth | 6.4% | Strong post-Christmas performance |

| Adjusted EBITDA (Projected) | Approximately £9.5 million | Exceeded earlier expectations |

| Store Count (May 2025) | 503 | Optimized store estate with new openings, closures, and relocations |

The company's strategic initiatives, particularly the 'Elevating The Works' strategy announced in January 2025, aim to drive sales growth and improve margins. For FY25, the company reported a 2% decrease in total revenue, but saw strong sales growth in Q4. Adjusted EBITDA for FY25 is projected at around £9.5 million. These figures highlight the company's focus on financial performance and strategic alignment.

The Works Company has seen shifts in its ownership, including a move to AIM and increased stakes by key investors. These changes reflect strategic financial decisions and investor confidence in the company's future. These moves are part of a larger strategy to increase shareholder value.

In FY25, the company reported a decrease in revenue but saw strong sales growth in Q4. Adjusted EBITDA is projected at approximately £9.5 million. These results demonstrate the company's resilience and strategic focus on improving financial outcomes. The company is focused on profit growth in FY26.

Works Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Works Company?

- What is Competitive Landscape of Works Company?

- What is Growth Strategy and Future Prospects of Works Company?

- How Does Works Company Work?

- What is Sales and Marketing Strategy of Works Company?

- What is Brief History of Works Company?

- What is Customer Demographics and Target Market of Works Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.