TOD'S Bundle

Who Really Controls the Iconic TOD'S Brand?

Unraveling the mystery of 'Who owns TOD'S?' is key to understanding the future of this renowned Italian luxury goods empire. The recent delisting from the Milan stock exchange in April 2024, following a takeover, has dramatically reshaped the company's ownership structure. This pivotal shift marks a new chapter for the brand, known for its exquisite shoes and leather goods.

Founded in the 1920s by Filippo Della Valle, and later expanded by Diego Della Valle, TOD'S has become synonymous with Italian craftsmanship and timeless design. Before the delisting, TOD'S reported impressive revenues, solidifying its position in the luxury market. Understanding the current TOD'S SWOT Analysis is crucial to grasp how the new ownership structure under L Catterton, backed by LVMH, will influence its strategic direction. This exploration will delve into the evolution of TOD'S ownership, examining the key stakeholders and their impact on the company's operational strategies and market standing, including the influence of Diego Della Valle and the broader family.

Who Founded TOD'S?

The story of TOD'S company history begins with Filippo Della Valle, who started a small shoe factory in the Marche region of Italy in the 1920s. This marked the initial ownership, entirely within the Della Valle family, showcasing a traditional Italian entrepreneurial model.

The transformation of the family business into a global luxury brand is largely credited to Filippo's grandson, Diego Della Valle. He introduced the TOD'S brand in the late 1970s and early 1980s. His vision and leadership were pivotal in shaping the company's early modern ownership structure.

Diego Della Valle, along with his brother Andrea Della Valle, played key roles in the early ownership of the company. The Della Valle family maintained a significant controlling stake, which was important for preserving the brand's heritage and strategic direction. Early financial backing came from reinvested family profits.

The early ownership of TOD'S was primarily held by the Della Valle family. This ensured that the founding vision of Italian craftsmanship and contemporary luxury remained central to the company's identity. The family's cohesive control was maintained as the company grew from a local manufacturer to an internationally recognized luxury goods producer.

- Diego Della Valle and his brother Andrea Della Valle were instrumental in shaping the company's modern ownership.

- The family's continued involvement was crucial in preserving the brand's heritage.

- Early funding came from reinvested family profits.

- The family maintained cohesive control during the company's international expansion.

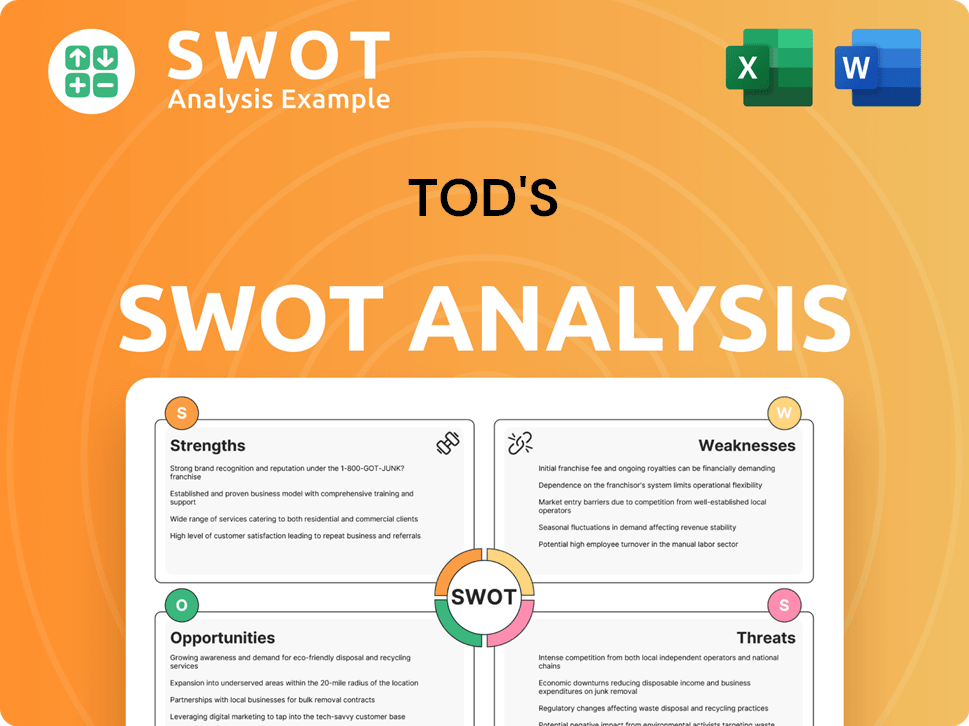

TOD'S SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has TOD'S’s Ownership Changed Over Time?

The evolution of TOD'S ownership has seen significant changes, particularly with its listing and subsequent delisting from the Milan Stock Exchange. Initially, the company went public in 2000. Before the recent delisting, the Della Valle family, through DI.VI. Finanziaria di Diego Della Valle & C. S.r.l., maintained a controlling stake. As of December 31, 2023, the Della Valle family held approximately 64.45% of the shares, with institutional and public shareholders owning the rest.

A major shift occurred in 2023 and 2024 when L Catterton, a private equity firm backed by LVMH, launched a takeover bid. The initial tender offer aimed to acquire shares not held by the Della Valle family or LVMH, with the goal of delisting the company. This offer concluded in April 2024, leading to the delisting of TOD'S from the Milan Stock Exchange. This transition moved TOD'S from a publicly traded to a privately held company. The primary stakeholders now include the Della Valle family and L Catterton, with LVMH having a strategic interest through its support of L Catterton. This change is expected to provide TOD'S with greater flexibility in long-term strategic planning and investments, without the pressure of quarterly reporting.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering | 2000 | TOD'S listed on the Milan Stock Exchange, introducing public shareholders. |

| L Catterton Takeover Bid | 2023-2024 | L Catterton, backed by LVMH, initiated a bid to acquire shares, aiming for delisting. |

| Delisting from Milan Stock Exchange | April 2024 | TOD'S transitioned from a publicly traded to a privately held company, with the Della Valle family and L Catterton as primary stakeholders. |

The ownership of TOD'S has evolved significantly, with the Della Valle family playing a central role. The delisting in April 2024 marked a major shift, making the company privately held.

- The Della Valle family, through DI.VI. Finanziaria, held a significant stake before delisting.

- L Catterton, backed by LVMH, led the takeover and delisting process.

- TOD'S is now primarily owned by the Della Valle family and L Catterton.

- This change is expected to give TOD'S more strategic flexibility.

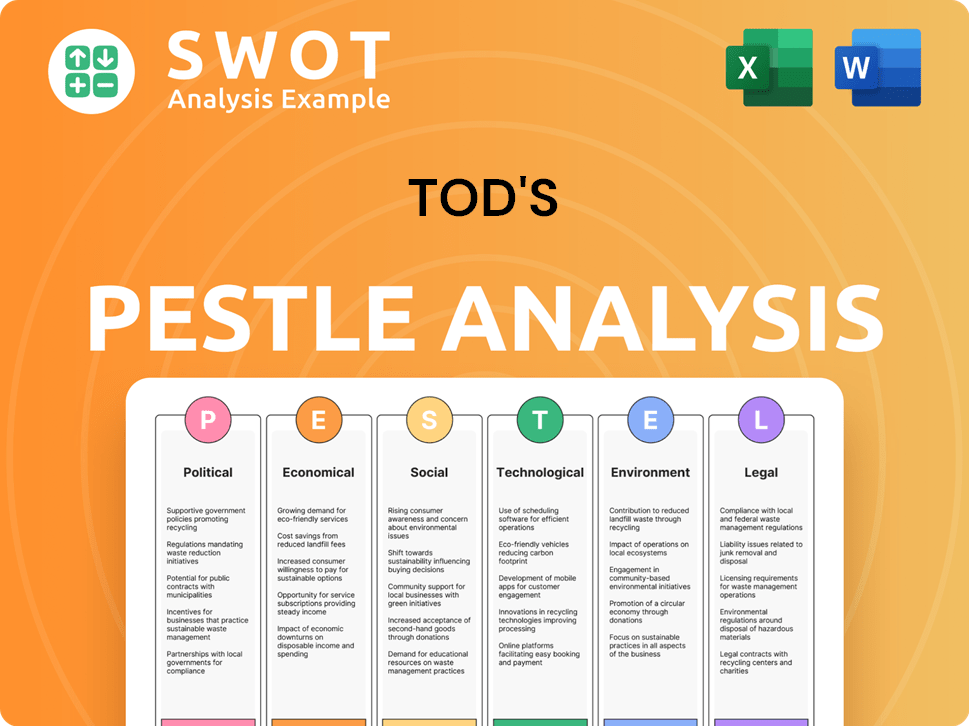

TOD'S PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on TOD'S’s Board?

Prior to its delisting in April 2024, the board of directors of the TOD'S brand included a mix of family members, long-term executives, and independent directors. Diego Della Valle, representing the founding family, held the positions of Chairman and CEO. Andrea Della Valle also served on the board, highlighting the family's continued influence. The board also typically included key executives and independent directors, ensuring oversight and governance.

The composition of the board reflected the company's structure, with family members playing a central role in decision-making. The presence of independent directors aimed to provide an unbiased perspective and ensure adherence to corporate governance best practices. The board's structure was designed to balance the family's control with the need for independent oversight, a common practice in companies with significant family ownership.

| Board Member | Role | Notes |

|---|---|---|

| Diego Della Valle | Chairman and CEO | Founding Family |

| Andrea Della Valle | Board Member | Founding Family |

| Other Executives | Various | Key to company operations |

| Independent Directors | Various | Oversight and Governance |

The voting structure of TOD'S, before its delisting, generally followed a one-share-one-vote principle for its ordinary shares. However, the Della Valle family, through their majority shareholding via DI.VI. Finanziaria di Diego Della Valle & C. S.r.l., maintained significant control. This concentrated ownership allowed the family to control strategic decisions and elect board members. The recent delisting under L Catterton's acquisition further solidified the control, moving decision-making into the private sphere shared by the Della Valle family and L Catterton. This structure has been consistent with the long-term ownership dynamics of the company, as highlighted in the Growth Strategy of TOD'S.

The Della Valle family, through DI.VI. Finanziaria, held a majority stake in TOD'S, ensuring significant control. This concentrated ownership allowed the family to steer strategic decisions and elect board members. The recent delisting under L Catterton further consolidated the family's influence.

- Diego Della Valle served as Chairman and CEO, with family representation on the board.

- The one-share-one-vote principle was in place, but the family's majority shareholding provided substantial control.

- The acquisition by L Catterton has further consolidated control within the family and the investment firm.

- The ownership structure has been stable, with the Della Valle family maintaining a strong grip on the company.

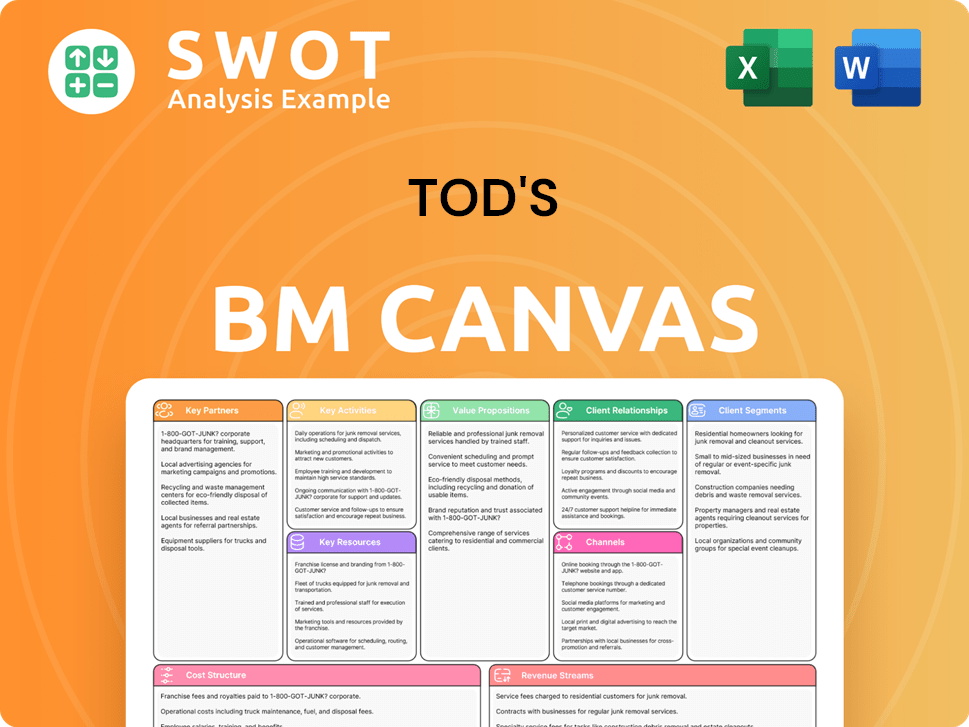

TOD'S Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped TOD'S’s Ownership Landscape?

The most significant recent development in the ownership of TOD'S has been its transition from a publicly listed company to a privately held entity. This shift culminated in April 2024 with the successful tender offer by Crown Bidco, a vehicle controlled by L Catterton. This led to the delisting of TOD'S from the Milan Stock Exchange. Prior to this, in 2023, L Catterton initiated its bid to acquire shares and delist the company, offering EUR 43 per share. Throughout this process, the Della Valle family maintained a substantial stake, indicating a collaborative decision to take the company private.

This move reflects a broader trend within the luxury sector, where brands, especially those with strong family legacies, are increasingly considering or undergoing privatization. The rationale often includes the desire for greater strategic flexibility. This allows for long-term investments without the immediate pressures of the public market. It also provides a buffer against volatile market conditions. For the TOD'S brand, privatization may facilitate restructuring, intensified brand development, and strategic partnerships without the need to meet quarterly earnings expectations. The current ownership structure suggests a focus on internal growth and brand consolidation under the combined influence of the Della Valle family and L Catterton. For more information on the target market of the company, read this article: TOD'S Target Market.

| Ownership Change | Details | Date |

|---|---|---|

| Delisting from Milan Stock Exchange | Successful tender offer by Crown Bidco, controlled by L Catterton. | April 2024 |

| Initial Bid by L Catterton | Offer to acquire shares and delist the company at EUR 43 per share. | 2023 |

| Della Valle Family Stake | Maintained a significant ownership stake throughout the privatization process. | Ongoing |

The company is now privately held. The ownership is primarily shared between the Della Valle family and L Catterton.

Privatization allows for long-term investments and strategic initiatives without the pressures of quarterly earnings reports.

Many luxury brands are opting for privatization to gain more control and navigate market volatility.

The current ownership structure suggests a focus on internal growth and brand consolidation.

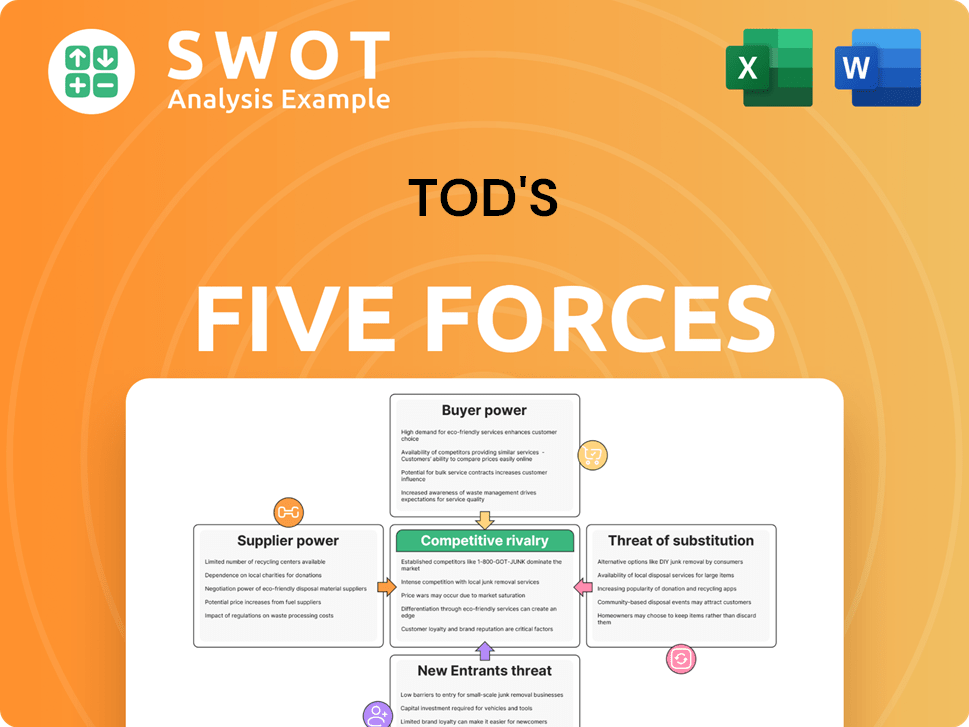

TOD'S Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TOD'S Company?

- What is Competitive Landscape of TOD'S Company?

- What is Growth Strategy and Future Prospects of TOD'S Company?

- How Does TOD'S Company Work?

- What is Sales and Marketing Strategy of TOD'S Company?

- What is Brief History of TOD'S Company?

- What is Customer Demographics and Target Market of TOD'S Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.