White & Case Bundle

Who Really Controls White & Case?

Unraveling the ownership structure of a global powerhouse like White & Case is crucial for understanding its strategic moves and long-term vision. Founded in 1901, this prominent White & Case SWOT Analysis law firm has evolved significantly, making its ownership a key factor in its success. But who are the White & Case owners shaping the future of this legal giant?

This exploration into White & Case ownership will reveal the intricacies of its partnership model, detailing the influence of its White & Case partners and key executives. From its White & Case history to its current operations, understanding the White & Case company structure is essential for grasping its market position and financial performance, including its impressive annual revenue and global presence. The answers to "Who owns White & Case" and "Who are the current White & Case partners" are essential for anyone interested in the firm's direction.

Who Founded White & Case?

The story of White & Case, a prominent law firm, began on May 1, 1901. The firm's inception involved two Wall Street lawyers, Justin DuPratt White and George B. Case, who each contributed $250 to establish the firm. This initial investment is equivalent to approximately $9,449 in 2024, highlighting the modest beginnings of a global legal powerhouse.

Justin DuPratt White, a graduate of Cornell Law School, and George B. Case, who attended Yale University and Columbia Law School, laid the foundation for the firm. Their backgrounds and connections played a crucial role in the early success of the firm. White & Case's early focus was on serving the financial services industry in New York, which shaped its initial distribution of control among the founding partners.

The firm's early success was significantly influenced by the founders' connections, particularly with Henry P. Davison, a key figure in the creation of the Federal Reserve and a senior partner at J.P. Morgan & Company. This relationship helped secure early clients, including Bankers Trust Company, which the firm assisted in establishing in 1903. The firm's structure as a limited liability partnership (LLP) from its inception indicates an ownership model centered on its partners.

The initial investment by each founder was $250. This amount is equivalent to approximately $9,449 in 2024, showing the initial capital.

Early clients included Bankers Trust Company, which the firm helped establish. This highlights the firm's early focus on the financial services industry.

The firm's structure as a limited liability partnership (LLP) from its inception suggests an ownership model centered on its partners. This structure is still in place today.

Justin DuPratt White was a Cornell Law School alumnus, and George B. Case attended Yale University and Columbia Law School. Their backgrounds were crucial for the firm's early success.

The firm's connection with Henry P. Davison, a banker, was instrumental in securing early clients. This relationship was key to the firm's initial growth.

The firm's early vision was to serve the financial services industry in New York. This vision shaped its early distribution of control among its founding partners.

Understanding the early Growth Strategy of White & Case helps to trace the evolution of White & Case ownership. The firm's initial ownership structure was based on a partnership model. While specific equity splits for the early partners are not publicly available, the LLP structure indicates that ownership and control were distributed among the partners. The firm's early focus on the financial sector in New York, coupled with its 'white shoe' reputation, helped shape its initial ownership and client base. As a private partnership, the details of White & Case owners and their shares are not disclosed. This structure has allowed the firm to maintain its focus on providing high-quality legal services.

- White & Case is a limited liability partnership (LLP).

- Ownership is distributed among the partners.

- The firm's early focus was on the financial services industry.

- The firm's initial investment by each founder was $250.

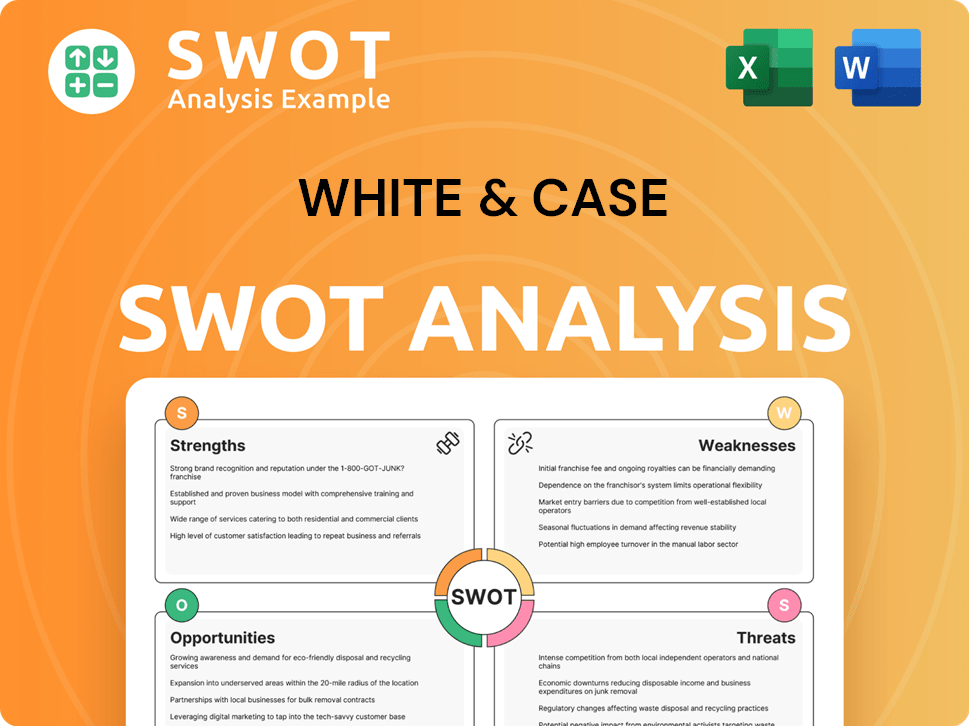

White & Case SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has White & Case’s Ownership Changed Over Time?

The ownership of the global law firm, which operates as a limited liability partnership (LLP), is primarily held by its partners. This structure means that the equity partners are the main stakeholders, driving the firm's operations and financial outcomes. The firm's evolution includes significant milestones that have shaped its ownership and global presence. Key moments in its history, such as the opening of its first foreign office in Paris in 1926, and subsequent expansions into Brussels in 1967 and Hong Kong in 1978, reflect a strategic focus on international growth. These expansions were crucial in establishing the firm's global footprint.

Under the leadership of chairmen like James Hurlock (1980-2000), the firm experienced substantial growth, tripling its lawyer roster and broadening its reach into global markets. The firm's strategic decisions and financial performance directly impact its partners. In 2024, the firm reported a total of 698 partners, with a notable shift in its partnership structure. The number of equity partners decreased by 7% to 349, potentially increasing the profit share for the remaining equity partners. This restructuring reflects the firm's adaptation to market dynamics and its focus on maximizing profitability for its partners.

| Metric | 2023 | 2024 |

|---|---|---|

| Total Partners | N/A | 698 |

| Equity Partners | N/A | 349 |

| Profit Per Equity Partner (PEP) | $3.15 million | $4 million |

| Revenue Per Lawyer | $1.17 million | $1.3 million |

In 2024, the firm's financial performance was robust, with profit per equity partner (PEP) reaching a record $4 million, a 27% increase from the previous year. Revenue per lawyer also increased by 10.6% to $1.3 million. These figures highlight the financial benefits and decision-making power of the equity partners. The firm's focus on advising leading global clients on complex cross-border matters, accounting for 52% of its revenue in 2024, underscores the strategic alignment between its partnership and its global service offerings. This strategic alignment is a key factor in the firm's financial success and its ability to attract and retain top legal talent. For more details on the firm's structure and performance, you can explore the information about White & Case ownership.

The primary owners of White & Case are its partners, especially the equity partners, who benefit directly from the firm's financial success.

- The firm's structure as an LLP means ownership is concentrated among the partners.

- Strategic expansions and leadership have shaped the firm's global presence.

- Financial metrics like PEP and revenue per lawyer demonstrate the firm's strong performance.

- The firm's focus on complex cross-border matters aligns with its partnership's interests.

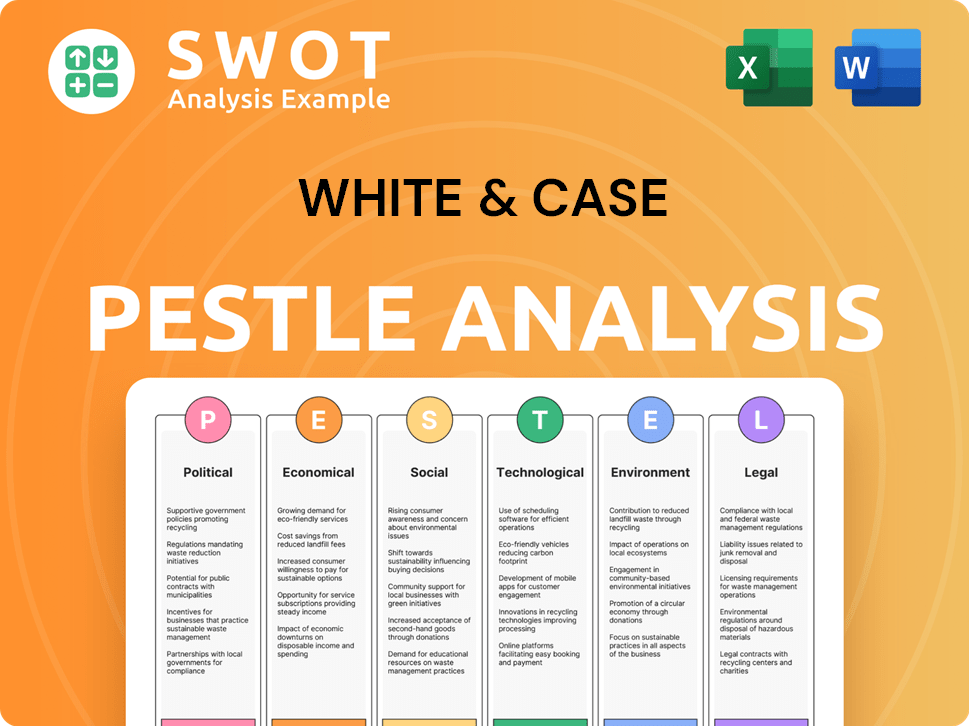

White & Case PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on White & Case’s Board?

Understanding White & Case's ownership structure is key to grasping its governance. As a limited liability partnership (LLP), the firm doesn't have a traditional board of directors. Instead, its leadership is vested in its partners, particularly the equity partners, and managed by an executive committee and firm leadership. The current Chair, Heather McDevitt, who took on the role in September 2023, and Vice-Chair Oliver Brettle, alongside the leadership team, steer the firm's strategic direction and operations.

The voting power within White & Case resides with its partners. While specific details of internal voting are not publicly available, significant decisions such as partner promotions and strategic investments are made through internal governance mechanisms. For 2024, the firm promoted 42 lawyers to partner, with an additional 37 promotions effective January 1, 2025, showcasing its investment in its partnership. The firm's Public Company Advisory Group, led by Gary Kashar in New York, further demonstrates its expertise in corporate governance, which likely informs its internal structures.

| Leadership Role | Name | Start Date |

|---|---|---|

| Chair | Heather McDevitt | September 2023 |

| Vice-Chair | Oliver Brettle | N/A |

| Chair of Public Company Advisory Group | Gary Kashar | N/A |

The firm's emphasis on a 'partnership culture' and client service guides its decision-making. This structure differs significantly from publicly traded companies, where proxy battles and activist investor campaigns are common. This structure means that the White & Case law firm's owners are its partners. The firm's focus remains on its partners and client service, rather than external shareholders, which is a key aspect of the White & Case ownership structure details.

White & Case operates as an LLP, meaning its partners hold the ownership and voting power.

- Heather McDevitt is the current Chair, leading the firm's strategic direction.

- Decisions, including partner promotions, are made through internal governance.

- The firm's structure emphasizes partnership culture and client service.

- The firm promoted 42 lawyers to partner for 2024, with another 37 promotions effective January 1, 2025.

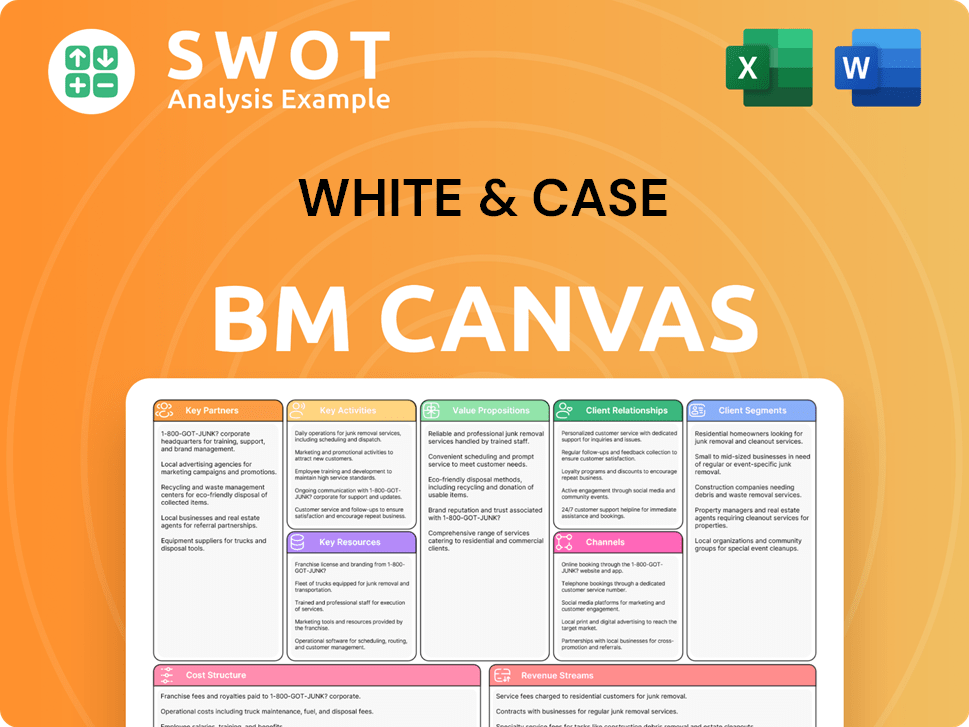

White & Case Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped White & Case’s Ownership Landscape?

In recent years, the ownership structure of White & Case, a prominent law firm, has remained primarily internal, reflecting its nature as a Limited Liability Partnership (LLP). The firm's financial performance in 2024 underscores this, with global revenue reaching a record $3.3 billion, a 12.5% increase, and profit per equity partner (PEP) surging by 27% to $4 million. This growth, particularly in key areas like M&A, private equity, and capital markets, showcases the collective success of its partners. The firm's focus on cross-border matters, which accounted for 52% of its revenue in 2024, highlights its strategic direction and the influence of its partners in driving the firm's global presence.

The internal dynamics of White & Case's ownership are further illustrated by the changes in its partner composition. While the total partner count increased slightly to 698 in 2024, the number of equity partners decreased by 7% to 349. This shift suggests a strategic focus on concentrating profits among a core group of equity partners. The firm's investment in talent, with 47 lateral partner-level hires in 2024 and 37 partner promotions effective January 1, 2025, indicates a continued commitment to its internal ownership structure. For more insights into the firm's operational focus, you can explore Target Market of White & Case.

| Metric | 2023 | 2024 |

|---|---|---|

| Global Revenue | $2.93 billion | $3.3 billion |

| Revenue Growth | 4.3% | 12.5% |

| Profit per Equity Partner (PEP) | $3.15 million | $4 million |

| PEP Growth | 12.7% | 27% |

| Total Partners | 689 | 698 |

| Equity Partners | 375 | 349 |

The firm's leadership, including Chair Heather McDevitt and Vice-Chair Oliver Brettle, plays a key role in shaping the firm's strategic direction, reinforcing the importance of internal ownership and collective performance. The anticipation of a strong 2025, with January performance already exceeding 2024 levels, reflects the confidence in the firm's internal ownership model and its ability to adapt to market dynamics.

White & Case operates as an LLP, meaning its ownership is primarily vested in its partners. This structure influences the firm's strategic decisions and financial outcomes, with profits distributed among the partners.

The firm's financial success, as evidenced by record revenues and increased PEP, directly reflects the collective performance of its partners. The reduction in equity partners, while overall partner count increased, shows a focus on maximizing profits for the core group.

The firm's focus on cross-border matters, M&A, and other key practice areas is driven by strategic decisions made by the partners. The firm's investments in talent and promotions further support this direction.

The positive outlook for 2025, with strong January performance, indicates the firm's confidence in its internal ownership model and ability to navigate the legal market. The focus is on maintaining and growing its global presence.

White & Case Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of White & Case Company?

- What is Competitive Landscape of White & Case Company?

- What is Growth Strategy and Future Prospects of White & Case Company?

- How Does White & Case Company Work?

- What is Sales and Marketing Strategy of White & Case Company?

- What is Brief History of White & Case Company?

- What is Customer Demographics and Target Market of White & Case Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.