Zucchetti s.p.a. Bundle

Who Really Owns Zucchetti S.p.A.?

Understanding a company's ownership is crucial for investors and strategists alike. Knowing the Zucchetti s.p.a. SWOT Analysis can be greatly influenced by its ownership structure. As Zucchetti S.p.A., an Italian software giant, continues its impressive growth, the question of its ownership becomes increasingly significant. This exploration will unravel the details of who owns Zucchetti, providing insights into its strategic direction and future prospects.

Zucchetti S.p.A.'s journey, from its roots in 1978, has been marked by significant developments. The evolution of the Zucchetti group and its ownership structure reflects its adaptability and strategic vision. This analysis will explore the key stakeholders and the historical context of the company's ownership, providing a comprehensive understanding of its corporate landscape. The ownership structure of Zucchetti s.p.a. is a key factor in understanding its success.

Who Founded Zucchetti s.p.a.?

The story of Zucchetti s.p.a. ownership begins in 1978 with Domenico Zucchetti, the founder. He laid the groundwork for what would become a significant player in the Italian IT sector. Understanding the early ownership structure is key to grasping the company's evolution.

Domenico Zucchetti, an accountant, developed software for automated tax returns in 1977. This innovation led him to establish the company to commercialize the software across Italy. While precise initial shareholding details are not publicly available, his pivotal role as founder indicates a substantial initial ownership stake.

The company's trajectory reflects the founder's vision. His initial focus on automating accounting procedures set the stage for expansion into broader IT solutions. Understanding the early ownership and the founder's vision is essential to understand the company's current structure and future plans. The Zucchetti group has expanded significantly since its inception.

Founded in 1978 by Domenico Zucchetti.

Commercialization of software for automated tax returns.

Founded in 1985 by Fabrizio Bernini, part of the group since 2000.

Evolved into a global multi-business management company.

Diversified into software, automation, robotics, and renewable energy.

Reflected in the company's initial focus and expansion into IT solutions.

Understanding the Zucchetti s.p.a. ownership structure involves looking at the founders and key figures. The company's history reveals how the initial vision has shaped its current form. The early decisions made by Domenico Zucchetti and the subsequent leadership have been crucial. To find more about the company's target market, you can read Target Market of Zucchetti s.p.a..

- Domenico Zucchetti: Founder of Zucchetti S.p.A.

- Fabrizio Bernini: Founder and CEO of ZCS, a part of the Zucchetti Group.

- The company's evolution is a testament to the founders' foresight and strategic decisions.

- The Zucchetti Italy group's growth reflects a commitment to innovation and expansion.

Zucchetti s.p.a. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Zucchetti s.p.a.’s Ownership Changed Over Time?

The ownership of Zucchetti S.p.A. has been primarily held by the Zucchetti family since its founding. In 2008, Domenico Zucchetti passed leadership to his children, Alessandro and Cristina Zucchetti. Their roles as Persons with Significant Control (PSCs) for Zucchetti UK Limited, a subsidiary, were established on February 14, 2020, highlighting their continued influence. Although Zucchetti S.p.A. was previously listed as a PSC for Zucchetti UK Limited, this role ceased on February 14, 2022. This evolution showcases a family-led structure, with strategic decisions likely influenced by the Zucchetti family, as the primary stakeholders.

The Brief History of Zucchetti s.p.a. underscores that the Zucchetti Group is family-run. While specific ownership percentages are not publicly available, the family's direct involvement in leadership and their PSC designations in subsidiaries strongly suggest a controlling interest. This structure has allowed the company to maintain a consistent strategic vision, particularly in its growth through acquisitions. These acquisitions have significantly shaped the company's market presence and offerings.

| Acquisition | Date | Details |

|---|---|---|

| Piteco | January 2023 | Acquired 100% of Piteco, a software house for corporate treasury and financial planning. |

| Argentea S.r.l. | March 2024 | Zucchetti Hospitality S.r.l. acquired 100% for approximately €99 million, with an additional €6 million earn-out. |

| AWMS | November 2024 | Acquired a majority stake in AWMS, aiming for 100% ownership by the end of 2024. |

| Easybooking | March 2025 | Acquired Easybooking. |

The Zucchetti Group's strategic acquisitions, such as the purchase of Piteco in January 2023, Argentea S.r.l. in March 2024 for about €105 million, and AWMS in November 2024, demonstrate its expansion strategy. These moves have contributed to a 15% increase in revenue in 2024. The Zucchetti family's continued leadership and strategic acquisitions highlight the company's focus on growth and market expansion, solidifying its position in the industry. The family's influence, combined with strategic acquisitions, shapes the company's direction and market position.

The Zucchetti family maintains primary ownership and leadership roles.

- Alessandro and Cristina Zucchetti are PSCs for Zucchetti UK Limited.

- Strategic acquisitions, such as Piteco, Argentea S.r.l., AWMS and Easybooking, have expanded the company's offerings.

- Revenue increased by 15% in 2024 due to acquisitions.

Zucchetti s.p.a. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Zucchetti s.p.a.’s Board?

While the complete composition of the Zucchetti S.p.A. board of directors isn't fully detailed in public records, the board of its subsidiary, Zucchetti Centro Sistemi S.p.A. (ZCS), offers some insight into the company's governance. The Ordinary Shareholders' Meeting appoints the Board of Directors for ZCS, which also has the power to appoint the Chairman. This board has full authority over both ordinary and extraordinary management of the company. Notably, the ZCS Board of Directors has a female majority, with women making up 66% of its members, exceeding industry standards. Fabrizio Bernini currently serves as the CEO of ZCS and also holds positions as a shareholder and President.

The Board of Directors of ZCS is appointed by the Ordinary Shareholders' Meeting, which also has the authority to appoint the Chairman. This board has full authority over both ordinary and extraordinary management of the company. The ZCS Board of Directors has a female majority, with women comprising 66% of its members. This is a significant point, reflecting a commitment to diversity within the Zucchetti group.

| Board Member | Position | Affiliation |

|---|---|---|

| Fabrizio Bernini | CEO and President | Zucchetti Centro Sistemi S.p.A., Shareholder |

| Alessandro Zucchetti | Shareholder | Zucchetti S.p.A. |

| Cristina Zucchetti | Shareholder | Zucchetti S.p.A. |

Regarding the voting structure and Zucchetti s.p.a. ownership, Italian corporate governance usually follows a one-share-one-vote system. There's no readily available public information suggesting that Zucchetti S.p.A. uses a dual-class share structure or similar arrangements that would give outsized control. The Zucchetti family, with Alessandro Zucchetti and Cristina Zucchetti as PSCs, likely wields substantial control through their ownership stake. To understand more about the company's strategic direction, you can read about the Growth Strategy of Zucchetti s.p.a.

The Zucchetti family holds significant influence, and the governance structure appears stable. The company's leadership is primarily family-led, which suggests a consistent approach to decision-making.

- The Zucchetti family likely exercises substantial control.

- ZCS has a female majority on its board.

- No evidence of dual-class shares or special voting rights.

- Fabrizio Bernini is the CEO of ZCS.

Zucchetti s.p.a. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Zucchetti s.p.a.’s Ownership Landscape?

Over the past few years, the ownership structure of Zucchetti S.p.A. has been marked by strategic acquisitions, indicating a growth-oriented strategy. In January 2023, Zucchetti acquired Piteco and its interest in Myrios. Further acquisitions in 2024 included Argentea S.r.l. and an increased stake in AWMS. These moves highlight Zucchetti's focus on expanding its market presence and diversifying its offerings. Recent actions align with Zucchetti's strategy to boost revenue through acquisitions, which contributed to a 15% increase in 2024.

The Zucchetti group has been actively investing in companies to enhance its offerings and market position. The acquisition of Easybooking in March 2025 further demonstrates this trend. Zucchetti's commitment to innovation is also evident in its investment in research and development, projected to grow by 10% in 2025. These actions reflect a forward-looking approach to capitalize on industry trends like digitalization and cloud solutions, as explored in detail in the Marketing Strategy of Zucchetti s.p.a..

| Acquisition | Date | Details |

|---|---|---|

| Piteco | January 2023 | Acquired 100% of Piteco and its interest in Myrios |

| Argentea S.r.l. | March 2024 | Acquired 100% for approximately €99 million |

| AWMS | November 2024 | Increased stake to a majority, aiming for 100% ownership by the end of 2024 |

| Easybooking | March 2025 | Acquired Easybooking |

Zucchetti's financial performance further reflects its growth strategy. The company's 2024 revenue was approximately €2.2 billion, with international revenue experiencing a 20% growth. The company's focus on integrating artificial intelligence (AI) into its solutions, aligning with the AI market projected to reach $2 trillion by 2030, also indicates a forward-looking ownership strategy. Despite these developments, the company remains privately held, with no public listing plans.

Piteco acquisition aimed to enhance offerings in the large corporate segment.

2024 revenue reached approximately €2.2 billion, demonstrating significant growth.

Expansion through acquisitions and investment in R&D, particularly in AI.

Zucchetti remains privately held with strong family leadership.

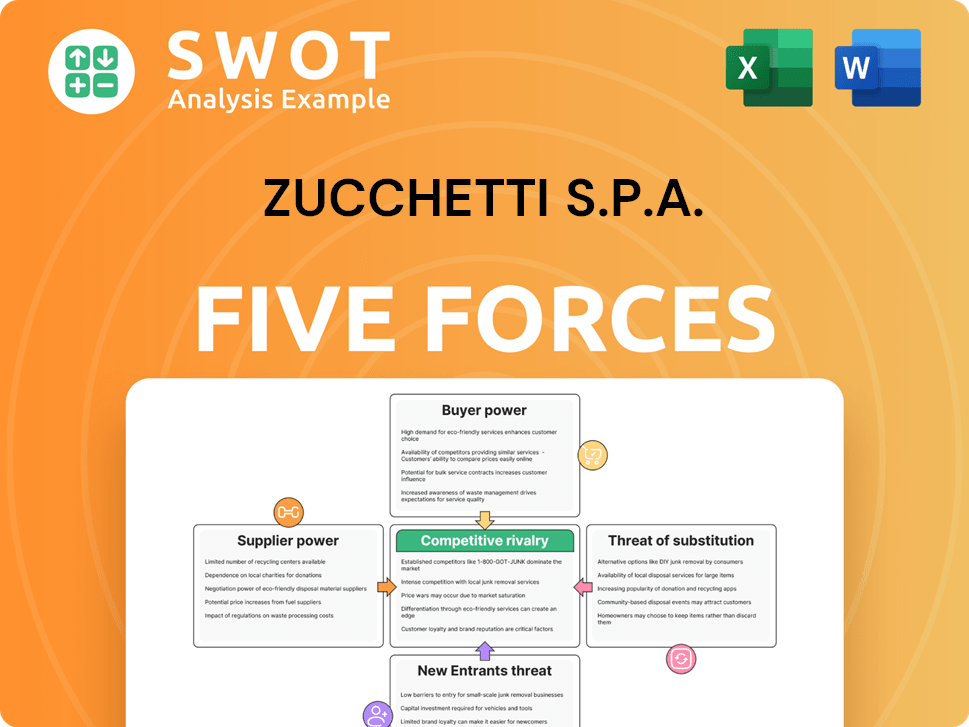

Zucchetti s.p.a. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zucchetti s.p.a. Company?

- What is Competitive Landscape of Zucchetti s.p.a. Company?

- What is Growth Strategy and Future Prospects of Zucchetti s.p.a. Company?

- How Does Zucchetti s.p.a. Company Work?

- What is Sales and Marketing Strategy of Zucchetti s.p.a. Company?

- What is Brief History of Zucchetti s.p.a. Company?

- What is Customer Demographics and Target Market of Zucchetti s.p.a. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.