Essex Property Trust Bundle

Who Does Essex Property Trust Serve?

Understanding the Essex Property Trust SWOT Analysis is crucial, but even more critical is knowing its customers. In the competitive world of real estate investment trusts (REITs), particularly in the apartment market, success hinges on a deep dive into customer demographics and the evolving target market. This exploration unveils the strategies Essex Property Trust employs to thrive in a dynamic landscape.

This analysis goes beyond simple property management, examining the nuances of who are the customers of Essex Property Trust, their needs, and how the company adapts. We'll explore the demographics of renters in Essex Property Trust properties, including age range, income levels, and education levels, alongside their preferred locations. This insight into Essex Property Trust customer profile will reveal how the company attracts renters and maintains customer satisfaction, all while navigating competitor analysis target market dynamics.

Who Are Essex Property Trust’s Main Customers?

The primary customer base for Essex Property Trust consists of individual consumers (B2C) seeking multifamily residential properties. Understanding the customer demographics and target market is crucial for a Real estate investment trust (REIT) like Essex. While specific demographic data for 2024-2025 isn't publicly available, general trends in their West Coast markets offer insights into their renter profile.

Essex Property Trust primarily focuses on renters in California and Washington. These locations attract a diverse group, including young professionals and tech industry employees. This apartment market often includes individuals in their late 20s to early 40s, with above-average incomes. Essex also targets young families and empty nesters/retirees.

Essex Property Trust's strategy of acquiring, developing, and managing properties allows them to cater to various income levels. The increasing cost of homeownership and the shift towards flexible work arrangements have likely increased the demand for high-quality rental options. This underscores the importance of continuously refining offerings to meet evolving renter needs.

This segment typically consists of individuals aged late 20s to early 40s. They often have higher-than-average income levels. They prefer urban or suburban locations with easy access to employment centers, public transportation, and amenities.

Young families represent another significant segment. They often seek properties with more space. They prioritize good school districts and community amenities. This group's needs influence property design and location choices.

This segment includes empty nesters or retirees. They may be downsizing from single-family homes. They often look for convenient, low-maintenance living options in desirable areas. Their preferences drive the demand for specific property features.

Essex Property Trust caters to a range of income levels. They offer properties from mid-market to luxury apartments. This approach allows them to serve diverse segments within their target market. Their property portfolio reflects this diversity.

Essex's target market is shaped by trends in the apartment market. Factors like the cost of homeownership and remote work influence demand. Essex Property Trust continuously adapts its offerings to meet the evolving needs of its tenants, focusing on high-quality rental options. For example, according to the National Multifamily Housing Council (NMHC), the national average occupancy rate for apartments was around 94.7% in early 2024, indicating strong demand. In the West Coast markets where Essex operates, occupancy rates often exceed this average, reflecting the desirability of these locations.

- Customer demographics analysis Essex Property Trust is essential for strategic decisions.

- Understanding Target market segmentation Essex Property Trust apartments helps in effective marketing.

- Knowing Who are the customers of Essex Property Trust guides property management strategies.

- Essex Property Trust customer profile informs property development and acquisition.

Essex Property Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Essex Property Trust’s Customers Want?

Understanding the needs and preferences of its customers is crucial for success in the competitive apartment market. For Essex Property Trust, this means focusing on what renters in California and Washington value most: location, lifestyle, and overall value. This customer-centric approach allows the company to tailor its offerings to meet the evolving demands of its target market.

The primary drivers for choosing an apartment with Essex Property Trust often include practical considerations like competitive pricing and efficient lease terms. Psychological factors, such as a desire for community and a hassle-free living experience, also play a significant role. By addressing these needs, the company aims to maintain high customer satisfaction and attract new residents.

Customer demographics, preferences, and needs are constantly evolving, especially in the dynamic real estate investment trust sector. The company must stay ahead of these trends to remain competitive. The following sections detail the key aspects of customer needs and preferences, highlighting how Essex Property Trust addresses them.

A prime location is a top priority for Essex Property Trust's customers. Renters seek easy access to employment centers, public transportation, and various amenities.

Modern amenities significantly influence renters' decisions. These include fitness centers, co-working spaces, package lockers, and pet-friendly policies.

The quality of property management and responsiveness to maintenance requests are critical. Renters expect well-maintained properties and efficient service.

A sense of community and security is a significant psychological driver. Renters seek a safe and welcoming environment.

Efficient digital resident services are increasingly important. This includes online portals for rent payments, maintenance requests, and communication.

Competitive pricing and flexible lease terms are essential. Renters look for value and options that fit their needs.

Essex Property Trust actively addresses common renter pain points to enhance customer satisfaction. This includes investing in property upgrades and providing excellent customer service.

- Property Upgrades: Continuous investment in property upgrades is a key strategy. This includes modernizing units, improving common areas, and adding desirable amenities.

- Efficient Digital Services: Implementing efficient digital resident services streamlines processes. This includes online portals for rent payments, maintenance requests, and communication.

- Proactive Maintenance: A focus on proactive maintenance ensures properties are well-maintained. This reduces the likelihood of issues and enhances the living experience.

- Feedback Mechanisms: Utilizing feedback mechanisms such as resident surveys and online reviews is essential. This helps the company understand customer needs and preferences.

- Smart Home Technology: The increasing demand for smart home technology and high-speed internet is influencing property upgrades. This enhances convenience and modern living.

- Outdoor Spaces: The desire for outdoor spaces is leading to more properties with balconies, patios, or shared green areas. This caters to lifestyle preferences.

Essex Property Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Essex Property Trust operate?

The geographical market presence of Essex Property Trust is strategically focused on the high-growth, high-demand West Coast markets. This strategic concentration allows the company to capitalize on the economic vitality and demographic trends of these regions. The primary areas of operation include California and Washington, specifically targeting metropolitan areas with significant job growth and high rental demand.

Within California, Essex Property Trust concentrates on the San Francisco Bay Area, Southern California (Los Angeles, Orange County, San Diego), and parts of the Sacramento metropolitan area. In Washington, the Seattle metropolitan area is the primary focus. These locations are characterized by robust economic activity, particularly in the technology and innovation sectors. The high cost of living in these areas makes renting a prevalent housing option, aligning with Essex's business model.

Essex Property Trust has established a strong market share and brand recognition in its core markets, leveraging its long-standing presence and deep understanding of local market dynamics. The company's approach includes tailoring property features, marketing campaigns, and community events to resonate with the specific demographics and lifestyle preferences of each submarket. This localized strategy enhances its ability to attract and retain tenants, contributing to its overall financial performance. For more information, you can read about Owners & Shareholders of Essex Property Trust.

The customer demographics of Essex Property Trust vary across its key markets. The San Francisco Bay Area and Seattle tend to attract tech professionals with higher disposable incomes. Southern California markets, on the other hand, have a broader demographic mix, including families and entertainment industry professionals. Understanding these differences is crucial for effective property management and marketing.

Essex Property Trust segments its target market based on location and lifestyle. In the San Francisco Bay Area and Seattle, the focus is often on luxury and amenity-rich properties to attract tech professionals. In Southern California, the company offers a wider range of properties to cater to diverse needs. This segmentation allows for targeted marketing and property development strategies.

Income levels of Essex Property Trust tenants are generally higher in the San Francisco Bay Area and Seattle, reflecting the high-paying tech industry jobs in these areas. Southern California tenants may have a more varied income distribution. The company's properties are often located in areas with strong employment and high average incomes, supporting its premium rental rates.

The age range of residents in Essex Property Trust properties varies by location. In areas like the San Francisco Bay Area and Seattle, there is a significant presence of young professionals. Southern California properties attract a broader age range, including families. Essex tailors its amenities and community events to cater to the specific age demographics of each location.

Essex Property Trust continuously analyzes market trends to refine its target market strategies. This includes monitoring job growth, population shifts, and changes in consumer preferences. The company uses this data to make informed decisions about property acquisitions, renovations, and marketing campaigns.

Marketing strategies are localized to appeal to specific customer demographics. Digital marketing, social media, and community events are used to reach potential renters. The company emphasizes the lifestyle benefits of its properties, such as proximity to jobs, amenities, and desirable neighborhoods.

Property features are tailored to meet the needs of the target market. Luxury amenities, such as fitness centers and swimming pools, are common in properties aimed at tech professionals. Family-friendly features, such as playgrounds and community spaces, are provided in properties located in family-oriented areas.

Customer satisfaction is a key focus, with the company using surveys and feedback to improve its services. This includes prompt maintenance, responsive management, and community-building activities. High customer satisfaction contributes to tenant retention and positive word-of-mouth referrals.

Essex Property Trust conducts regular competitor analysis to understand market trends and maintain a competitive edge. This includes monitoring rental rates, amenities, and marketing strategies of other apartment owners in its target markets. This analysis informs its strategic decisions.

Recent expansions and strategic acquisitions within these core markets aim to capitalize on continued population and job growth. Essex continues to invest in its existing properties through renovations and upgrades to maintain their appeal to the target market and improve its overall financial performance.

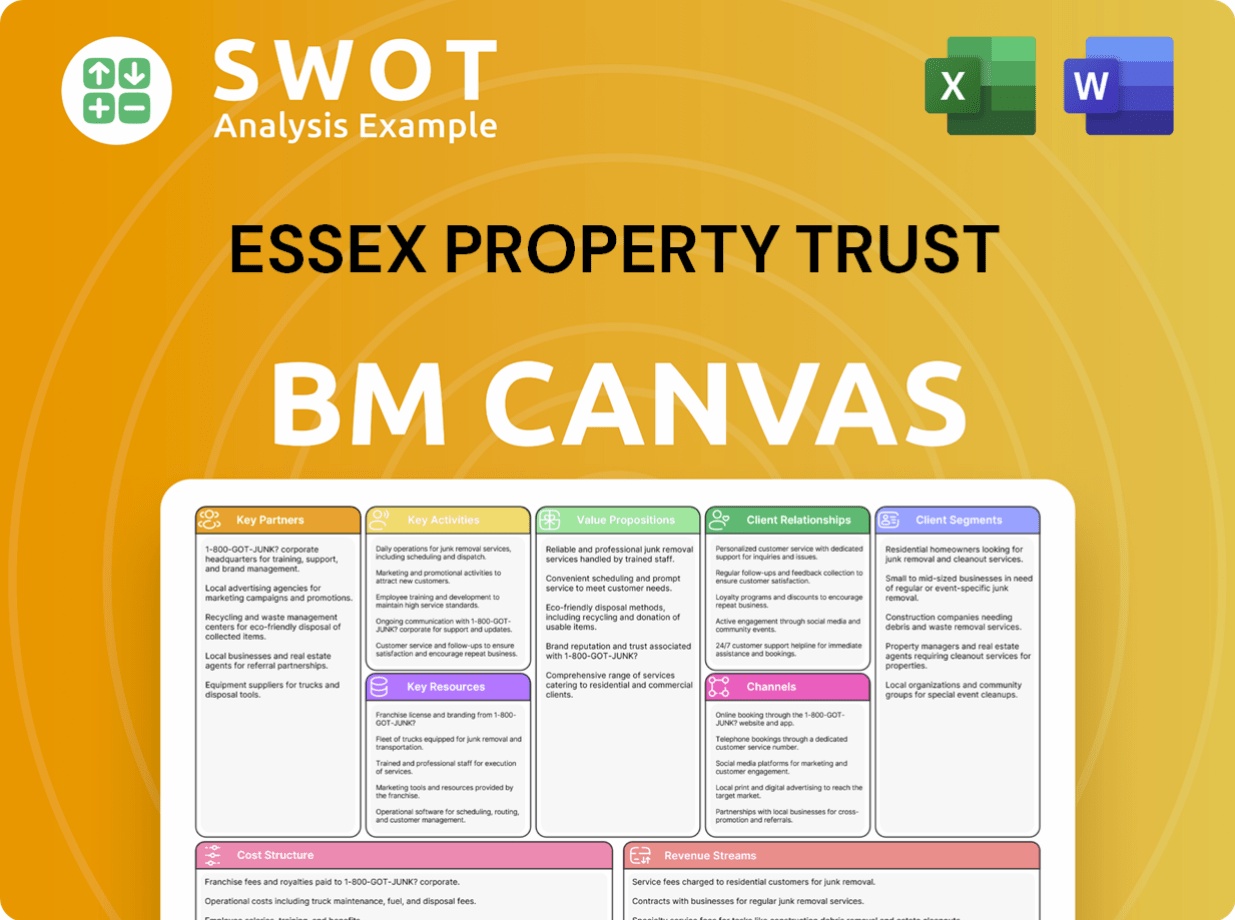

Essex Property Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Essex Property Trust Win & Keep Customers?

Customer acquisition and retention are critical strategies for success in the competitive real estate investment trust (REIT) sector, especially within the apartment market. Successful firms like Essex Property Trust employ a multi-faceted approach to attract and retain residents. These strategies combine digital and traditional marketing techniques, alongside a strong focus on resident services to build lasting relationships. Understanding the customer demographics is key to tailoring these strategies effectively.

For acquiring new customers, Essex Property Trust leverages various online platforms, including its website and targeted digital advertising campaigns. Social media engagement and online reputation management also play a significant role in attracting new residents. Traditional methods, such as local signage and community outreach, are still employed to generate leads. Professional leasing teams are present at each property to provide tours and guide potential tenants through the application process. A deep understanding of the target market allows for more efficient resource allocation and higher conversion rates.

Retention strategies are equally important in the multifamily market. Essex Property Trust focuses on providing exceptional resident experiences through responsive property management, timely maintenance, and community-building initiatives. Loyalty programs, often in the form of renewal incentives and resident referral programs, are implemented to maintain high occupancy rates. The company likely uses customer data and CRM systems to personalize communications and proactively address issues, improving resident satisfaction and reducing churn. All of this helps to create a strong customer profile.

Essex Property Trust utilizes a robust digital marketing strategy. This includes online listing platforms, a corporate website, and targeted digital advertising. Social media engagement and online reputation management are also critical for attracting new residents. Positive reviews and a strong online presence significantly impact lead generation.

Traditional advertising methods are still important. Local signage and community outreach contribute to lead generation. Professional leasing teams at each property provide tours, answer inquiries, and guide prospective tenants through the application process, ensuring a personalized experience.

Retention strategies focus on delivering exceptional resident experiences. This includes responsive property management, timely maintenance, and community-building initiatives. Loyalty programs, renewal incentives, and resident referral programs are often used. These programs aim to maintain high occupancy rates and resident satisfaction.

Customer data and CRM systems are likely used to personalize communications. This helps track resident preferences and proactively address potential issues. Implementing user-friendly online portals for rent payments and service requests is also a key strategy for enhancing resident satisfaction.

To gain more insight into the marketing strategies of the company, one can refer to Marketing Strategy of Essex Property Trust. The company's ability to adapt to changing market dynamics, including increased investment in digital tools and resident technology, impacts customer loyalty and lifetime value. These efforts aim to make the rental experience more seamless and enjoyable, ultimately driving long-term success. Understanding the demographics of renters is essential for tailoring these strategies.

Utilizing online listing platforms is a key part of the acquisition strategy. This ensures broad visibility for available properties, reaching a wide range of potential renters. These platforms often include detailed property information, photos, and virtual tours.

Targeted digital advertising campaigns help reach specific demographics and interests. This approach allows for efficient allocation of marketing resources, focusing on potential renters who are most likely to convert. These campaigns are often optimized using data analytics.

Social media engagement and online reputation management are crucial for attracting new residents. Positive reviews and a strong online presence significantly impact lead generation and brand perception. This includes active participation on relevant social platforms.

Resident referral programs incentivize current residents to recommend properties to their friends and family. This can be a cost-effective way to acquire new residents. Referrals often result in high-quality leads and increased resident satisfaction.

User-friendly online portals for rent payments and service requests streamline operations and enhance convenience. This improves resident satisfaction and reduces the administrative burden for both residents and property management. These portals often include features like maintenance request tracking.

Fostering a sense of community through organized events enhances resident satisfaction. These events create opportunities for social interaction and build a positive living environment. They can range from holiday gatherings to fitness classes.

Essex Property Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Essex Property Trust Company?

- What is Competitive Landscape of Essex Property Trust Company?

- What is Growth Strategy and Future Prospects of Essex Property Trust Company?

- How Does Essex Property Trust Company Work?

- What is Sales and Marketing Strategy of Essex Property Trust Company?

- What is Brief History of Essex Property Trust Company?

- Who Owns Essex Property Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.