Fiskars Bundle

Who Buys from Fiskars?

Unveiling the Fiskars SWOT Analysis is just the beginning; understanding the Fiskars company's customer base is crucial for investors and strategists. The strategic acquisition of Georg Jensen highlights Fiskars' commitment to understanding and adapting to evolving consumer preferences. Delving into Fiskars target market allows us to uncover the key drivers behind the company's success and future growth potential.

From its humble beginnings in 1649, Fiskars has evolved into a global powerhouse, offering a diverse portfolio of brands. This expansion necessitates a deep dive into customer demographics to understand who Fiskars is serving across the globe. Analyzing Fiskars consumer behavior, including their needs and wants, provides actionable insights for investment and strategic decision-making, revealing the company's ability to cater to a wide Fiskars audience.

Who Are Fiskars’s Main Customers?

Understanding the Fiskars company's customer demographics and target market requires examining its two primary business areas. These areas, Vita and Fiskars, each cater to distinct consumer segments. The Vita Business Area focuses on premium and luxury products, while the Fiskars Business Area targets a broader consumer base with gardening, outdoor, and crafting tools.

The Vita segment, which accounted for approximately 52% of net sales in 2024, is geared towards customers seeking high-quality, design-driven products. This includes items from brands like Georg Jensen, Royal Copenhagen, and Waterford. In contrast, the Fiskars segment, with net sales of EUR 547 million in 2024, serves a wider audience interested in home and outdoor activities. This strategic division, effective from April 1, 2025, allows for tailored strategies for each customer group.

The Fiskars target market is defined by its product offerings, which inherently shape its customer demographics. The Vita Business Area targets customers with higher disposable incomes, an appreciation for design, and a preference for direct purchasing channels. The Fiskars Business Area, on the other hand, aims at a broader demographic, including homeowners, gardening enthusiasts, and crafters. For a deeper dive into the competitive landscape, consider exploring the Competitors Landscape of Fiskars.

The Vita segment's Fiskars consumer base likely includes individuals with higher disposable income. They value design, heritage, and quality. Over 50% of Vita's sales come from its stores and e-commerce sites, indicating a preference for direct purchasing.

The Fiskars segment targets a broader Fiskars audience, including homeowners, gardening enthusiasts, and crafters. This segment's characteristics vary by age and lifestyle. The focus is on individuals and families involved in home and outdoor activities.

The strategic separation of the two business areas allows for tailored marketing and product development. This segmentation enables Fiskars company to better understand and serve its diverse customer base. This approach is critical for maximizing sales and customer satisfaction.

- Vita: High-income individuals valuing design and luxury.

- Fiskars: Homeowners, gardening enthusiasts, and crafters.

- Direct-to-consumer sales channels are significant for Vita.

- The strategic focus is on adapting to the specific needs of each group.

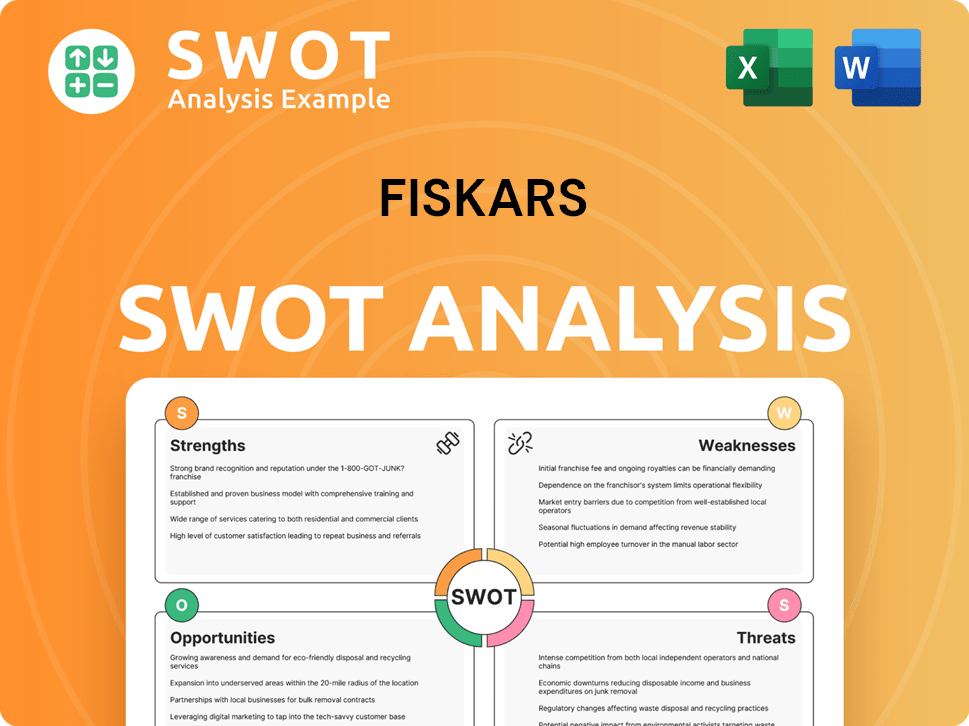

Fiskars SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Fiskars’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the company. The company's diverse brand portfolio caters to a wide range of customer needs, motivations, and preferences, from practical utility to aspirational luxury. This approach allows the company to effectively target different segments within its overall customer base.

For the Fiskars Business Area, the focus is on practical needs such as durability, ergonomic design, efficiency, and reliability. In contrast, the Vita Business Area caters to psychological and aspirational drivers, emphasizing design, heritage, craftsmanship, and the desire for premium products.

The company's focus on Direct-to-Consumer (DTC) channels, which saw a 9% increase in comparable sales in Q1 2025, indicates a preference among customers for direct engagement with the brands and a seamless purchasing experience.

The Fiskars Business Area, including gardening and outdoor tools, scissors, and cooking implements, prioritizes practical needs. Users seek durable, ergonomic, efficient, and reliable tools for their tasks. The company's innovation, such as expanding into indoor gardening, directly addresses evolving consumer interests.

The Vita Business Area, featuring brands like Georg Jensen, Royal Copenhagen, Wedgwood, and Iittala, caters to psychological and aspirational drivers. Customers are motivated by design, heritage, craftsmanship, and the desire for premium products. These customers prioritize brand reputation and aesthetic appeal.

Customers in the Vita Business Area often prioritize brand reputation, aesthetic appeal, and the emotional connection to the product. The strong performance of brands like Royal Copenhagen and Moomin Arabia in Q1 2025 highlights the importance of appealing to these preferences. Tailoring marketing and product features can significantly impact customer reception.

The company's emphasis on Direct-to-Consumer (DTC) channels, which saw a 9% increase in comparable sales in Q1 2025, reflects customer preference for direct engagement. This channel allows the company to gather direct feedback and adapt its strategies more effectively. This is a key part of the company's market segmentation strategy.

The strong performance of brands like Royal Copenhagen and Moomin Arabia in Q1 2025, driven by strong commercial execution, highlights the importance of appealing to customer preferences. The growth of Iittala following its brand renewal demonstrates how tailoring marketing and product features can significantly impact customer loyalty.

DTC channels provide the company with direct feedback and the ability to adapt strategies effectively. This direct engagement with the customer base is crucial for understanding their needs and wants. This helps the company to identify the ideal customer profile.

Understanding the needs and preferences of the company's customer demographics is vital for success. The company's approach involves:

- Focusing on practical needs like durability and efficiency for tools.

- Catering to aspirational drivers such as design and heritage for premium brands.

- Utilizing DTC channels for direct customer engagement and feedback.

- Adapting marketing and product features to specific segments.

- Analyzing customer behavior to improve product offerings and brand loyalty.

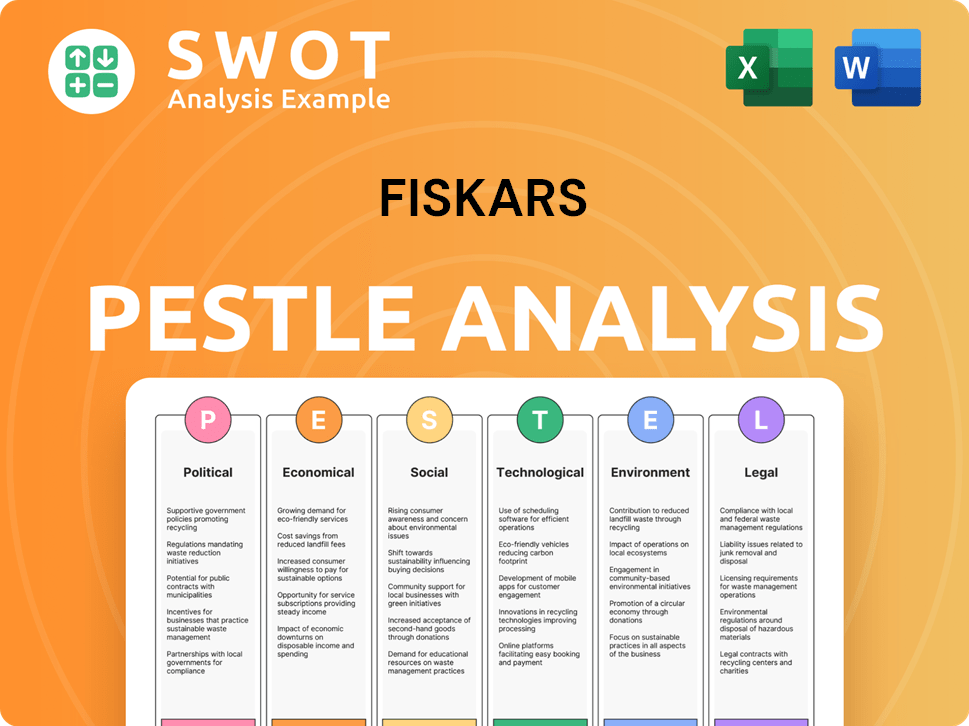

Fiskars PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Fiskars operate?

The geographical market presence of the company is extensive, with its brands available in over 100 countries. The company's reach spans across Asia-Pacific, Europe, and the Americas, showcasing a truly global footprint. This wide distribution network allows the company to cater to diverse customer demographics and market segments worldwide.

The U.S. is a critical market for the company, representing approximately 30% of its total net sales. For the Fiskars Business Area, the U.S. accounts for around 50% of net sales, emphasizing the strong market position in North America. Europe is another major market, with significant sales in countries like Finland and Germany. The company's strategic focus and localized offerings contribute to its success in these varied markets.

In Asia-Pacific, China is a key strategic market, although comparable net sales decreased by 7% in Q1 2025. The company is working to mitigate the impact of U.S. tariffs, which are expected to increase sourcing costs, particularly for products imported from China. This involves strategic sourcing diversification and potential price adjustments. The company's direct-to-consumer (DTC) channels, which saw a 9% growth in Q1 2025, also play a role in localization, allowing for tailored experiences in different regions.

The U.S. market is a cornerstone for the company, contributing significantly to its overall revenue. The strong brand recognition and market share in North America, especially for gardening and outdoor tools, highlight the importance of this region. Understanding the Growth Strategy of Fiskars is key to appreciating its market position.

Europe is a vital market, with notable performance in countries like Finland and Germany. The company's interim report for January-September 2024 showed a slight increase in comparable net sales in the European segment. This demonstrates the resilience and adaptability of the company in the face of varying economic conditions.

China is a key strategic market, despite recent challenges. The company is focused on expanding the Georg Jensen brand's presence in China. The company is actively working to mitigate the impact of U.S. tariffs, which are expected to increase sourcing costs, particularly for products imported from China.

The company localizes its offerings and marketing to succeed in diverse markets. The company's direct-to-consumer (DTC) channels, which saw a 9% growth in Q1 2025, also play a role in localization, allowing for tailored experiences in different regions. This approach enhances the customer experience and drives sales.

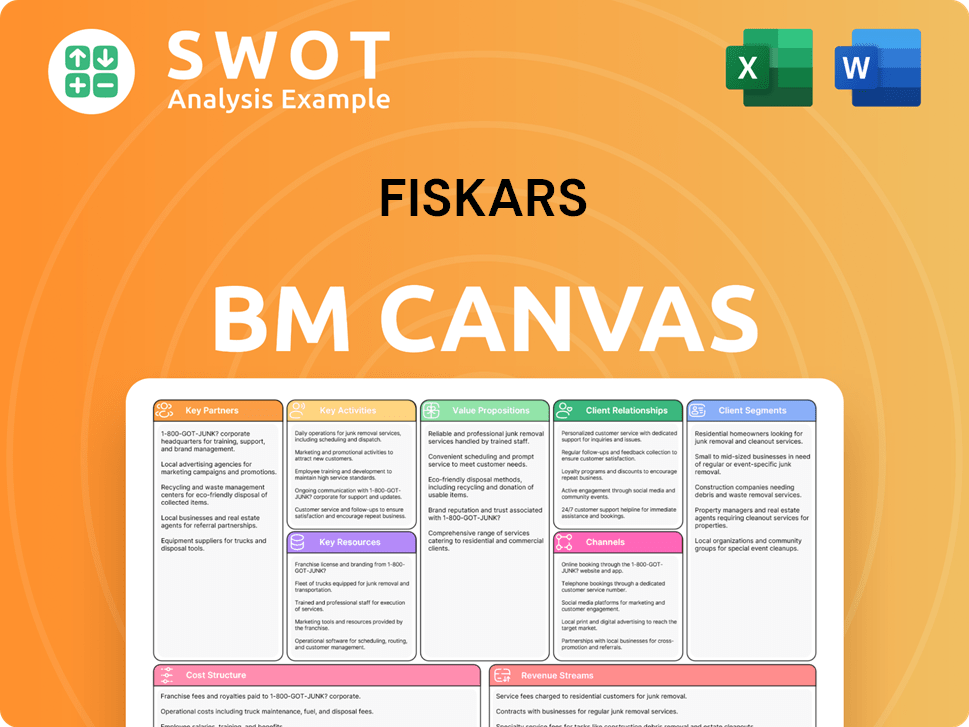

Fiskars Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Fiskars Win & Keep Customers?

The company employs a multi-faceted approach to customer acquisition and retention, focusing on its Direct-to-Consumer (DTC) channels and tailored marketing strategies. This approach is crucial for understanding the Fiskars target market and ensuring customer satisfaction. The growth in DTC sales, as evidenced by the 9% increase in Q1 2025, highlights the effectiveness of these strategies in reaching and retaining customers.

Marketing efforts are customized for two distinct Business Areas, Vita and Fiskars. Vita focuses on premium brands, using brand heritage and design to attract customers, while Fiskars emphasizes product utility and innovation. A deep understanding of Fiskars consumer needs is essential for effective marketing campaigns.

Customer retention is supported through employee ownership and commitment, commercial excellence, and a 'brands-first' approach. Investing in IT and supply chain projects also contributes to customer satisfaction. The planned separation of Business Areas aims to enable more agile customer acquisition and retention strategies. For more insights, explore the Marketing Strategy of Fiskars.

DTC channels, including retail and e-commerce, are key for acquiring and retaining customers. In Q1 2025, DTC sales increased by 9%, with e-commerce growing by 10%. This growth underscores the importance of these channels in reaching the Fiskars audience.

For premium brands, marketing emphasizes brand heritage and design. This approach targets discerning consumers through digital and social media. The success of brands like Royal Copenhagen and Moomin Arabia demonstrates the effectiveness of this strategy.

Marketing for the Fiskars Business Area focuses on product utility and innovation. This includes expansion into areas like indoor gardening. Distribution gains are particularly important in key markets such as the U.S. and Germany.

The 'MyFiskars' employee share savings plan encourages employee ownership and commitment. This indirectly supports customer experience through a dedicated workforce. This commitment helps in understanding Fiskars users and their needs.

The company's approach to customer acquisition and retention is comprehensive, focusing on multiple channels and initiatives. The success of DTC channels, tailored marketing strategies, and loyalty programs demonstrates a deep understanding of the customer demographics and their preferences. The separation of Business Areas is expected to further enhance these efforts, leading to more focused and effective strategies. This comprehensive approach is designed to ensure customer satisfaction and drive long-term growth.

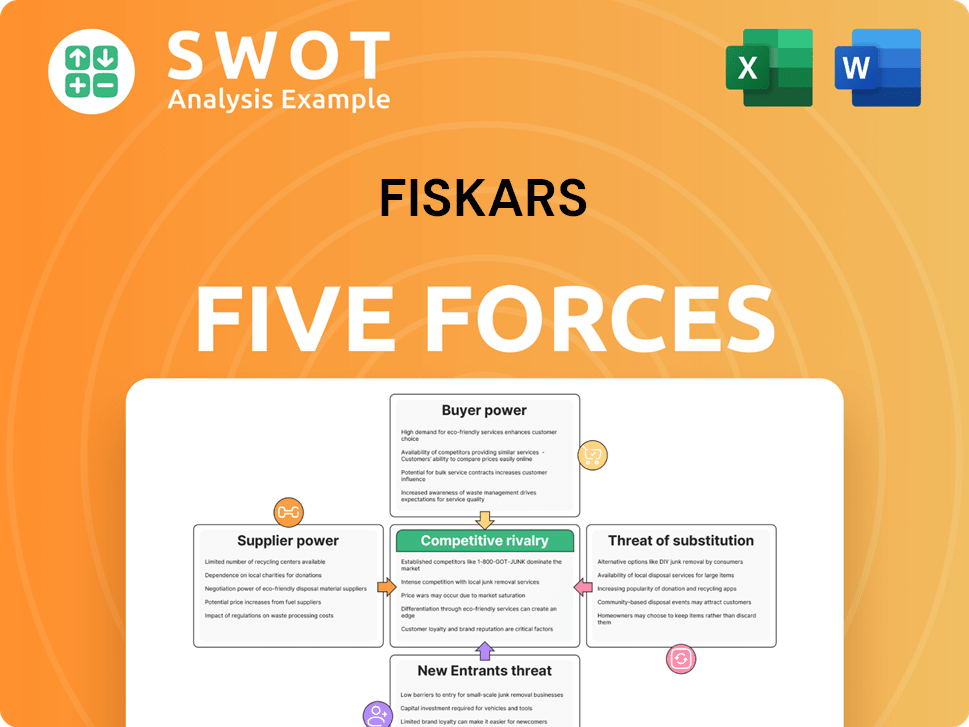

Fiskars Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fiskars Company?

- What is Competitive Landscape of Fiskars Company?

- What is Growth Strategy and Future Prospects of Fiskars Company?

- How Does Fiskars Company Work?

- What is Sales and Marketing Strategy of Fiskars Company?

- What is Brief History of Fiskars Company?

- Who Owns Fiskars Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.