Marex Bundle

Who Does Marex Serve? Unveiling Its Customer Base.

In the ever-evolving financial landscape, understanding your customer is paramount. For a global financial services platform like Marex, knowing its Marex SWOT Analysis is crucial for success. This analysis delves into the crucial aspects of Marex's customer base, offering insights into their demographics and strategic positioning.

This exploration into the Marex SWOT Analysis will cover vital aspects of Marex's business strategy, including market segmentation. We will examine Marex's customers, analyzing their demographic data to understand the firm's strategic approach. This analysis provides a comprehensive view of Marex's target market, helping to answer questions like "What are the key demographics of Marex's clients?" and "How does Marex define its target market segments?".

Who Are Marex’s Main Customers?

Understanding the customer demographics and target market is crucial for businesses like Marex. Marex primarily operates in a business-to-business (B2B) model, serving a sophisticated clientele with specific financial needs. This focus allows Marex to tailor its services effectively and maintain a competitive edge in the financial markets.

A thorough target market analysis helps in refining strategies and ensuring that services align with client requirements. Marex's ability to adapt to market changes and expand its offerings, as seen with the acquisition of ED&F Man Capital Markets, reflects a deep understanding of its customer base and the evolving financial landscape. This strategic approach is key to sustained growth and market penetration.

The Marex company focuses on institutional clients and commercial entities. This targeted approach enables Marex to deliver specialized financial services, including execution, clearing, and market infrastructure. The company's strategic moves, such as the ED&F Man Capital Markets acquisition, have broadened its reach and capabilities, enhancing its ability to serve a wider range of financial market participants.

Institutional clients form the core of Marex's customer base. These include hedge funds, asset managers, banks, and other financial institutions. These clients require sophisticated financial services and generate high trading volumes.

Commercial entities involved in physical commodities, such as producers, consumers, and traders, also make up a significant portion of Marex's clientele. These clients rely on Marex for hedging solutions and market access to manage price risk effectively.

Market segmentation allows Marex to tailor its services and marketing efforts. This involves understanding the specific needs and behaviors of different client groups. The company's approach ensures that it can effectively meet the diverse requirements of its customer base.

Marex's strategic moves, like the acquisition of ED&F Man Capital Markets in 2022, have broadened its service offerings. This expansion reflects a proactive response to market opportunities and a desire to provide a more holistic service offering to its institutional clients. This has helped the company to diversify its revenue streams.

The demographic data of Marex's clients are defined more by their organizational structure and financial needs than by traditional demographic factors like age or gender. Understanding these characteristics is critical for effective service delivery and client relationship management.

- Organizational Structure: Marex serves institutions with complex structures.

- Regulatory Environment: Clients operate within strict regulatory frameworks.

- Trading Strategies: Clients employ diverse trading strategies.

- Risk Appetites: Clients have varying risk tolerance levels.

For a deeper dive into how Marex approaches its marketing, consider reading about the Marketing Strategy of Marex. This provides further insights into how the company targets and engages its key customer segments.

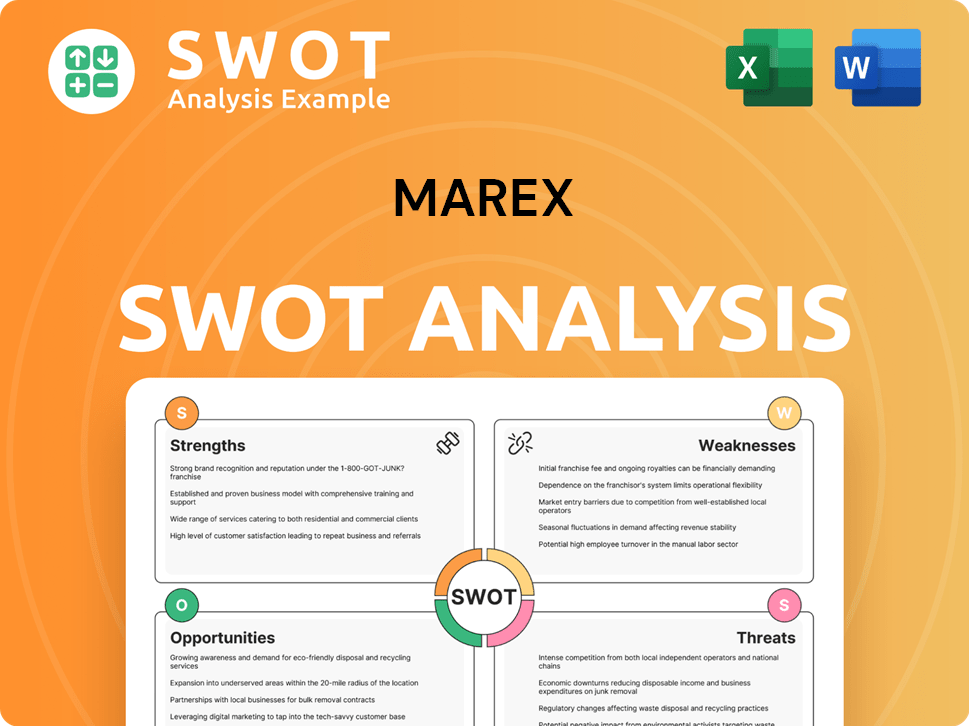

Marex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Marex’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any financial services provider. For the Marex company, this involves a deep dive into the specific demands of its diverse clientele, which include hedge funds, corporations, and other financial institutions. This analysis helps tailor services, enhance client satisfaction, and maintain a competitive edge in the global financial markets.

The primary drivers behind customer choices at Marex are efficiency, reliability, and access to global markets. These clients seek robust trading infrastructure, competitive pricing, and deep liquidity across various asset classes. Decision-making often hinges on factors such as counterparty risk, technological capabilities, and regulatory compliance. By focusing on these elements, Marex aims to build strong, lasting relationships with its customers.

Marex's customers are driven by a complex set of needs and preferences centered on efficiency, reliability, and access to global markets. Their purchasing behaviors are primarily influenced by the need for robust trading infrastructure, competitive pricing on execution and clearing, and access to deep liquidity across various asset classes. Decision-making criteria often revolve around counterparty risk, technological capabilities, regulatory compliance, and the breadth of product offerings.

Clients, particularly hedge funds, prioritize the speed of execution and access to sophisticated algorithmic trading capabilities. This demand is met through advanced technological platforms.

Corporations involved in commodities value effective hedging strategies to mitigate price volatility. Marex provides tailored solutions to address these specific risk management needs.

Clients seek seamless access to exchanges and a broad range of financial instruments. Marex facilitates this through its extensive global network and clearing services.

Customers benefit from expert market insights and tailored solutions. Marex provides in-depth analysis and personalized services to address their challenges.

Clients require partners that ensure regulatory compliance. Marex adheres to stringent regulatory standards to provide a secure and reliable trading environment.

The breadth of product offerings is a key factor. Marex offers a wide range of financial instruments to meet diverse trading needs.

The company continuously integrates client feedback and monitors market trends to influence its product development and service enhancements. For instance, the ongoing development of its technology platform to enhance trading efficiency and the expansion of its clearing services to accommodate a wider range of financial instruments, directly tailoring its offerings to meet the evolving demands of its sophisticated client base. Marex's customer profile and ideal client are defined by their need for sophisticated financial solutions, efficient execution, and global market access. Understanding these elements is essential for effective target market analysis.

Marex addresses several key pain points for its clients. These include market fragmentation, regulatory complexities, and the need for efficient capital deployment. By providing integrated solutions, Marex helps its clients navigate these challenges effectively.

- Market Fragmentation: Providing access to multiple exchanges and liquidity pools.

- Regulatory Compliance: Ensuring adherence to global regulatory standards.

- Efficient Capital Deployment: Offering clearing services and optimized trading solutions.

- Risk Management: Offering hedging strategies and risk management tools.

- Technological Capabilities: Developing advanced trading platforms and algorithmic trading capabilities.

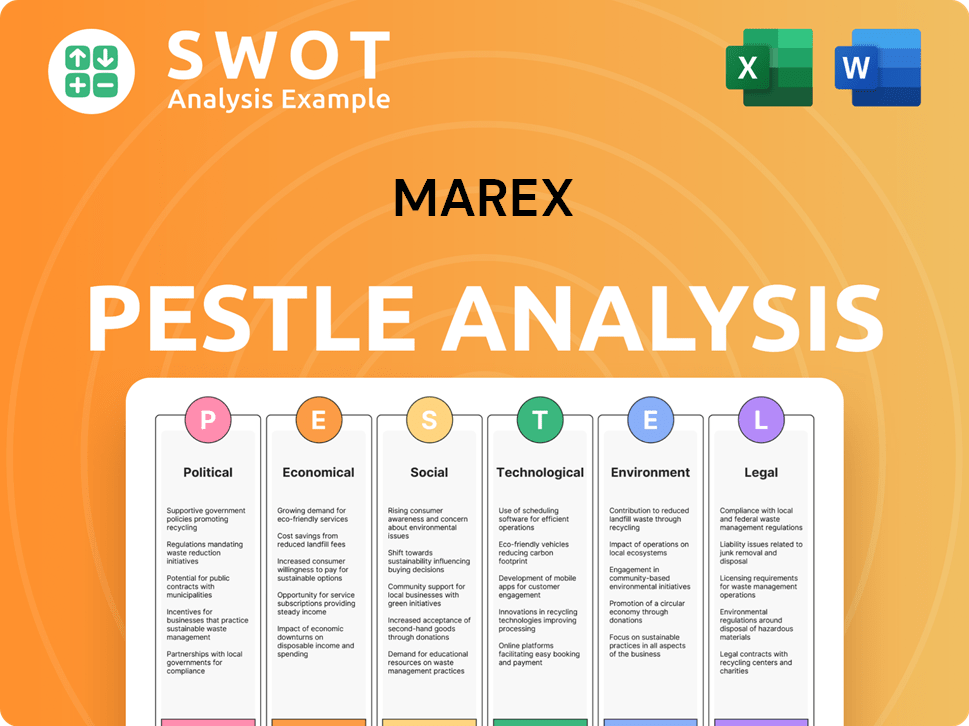

Marex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Marex operate?

The geographical market presence of the company is extensive, with major operations spanning key financial hubs across North America, Europe, and Asia. Its strongest market share and brand recognition are typically found in major financial centers such as London, New York, and Chicago. These locations serve as critical nodes for commodities, fixed income, and equities trading. Understanding the Owners & Shareholders of Marex is crucial for grasping the company's strategic direction and market positioning.

The company's presence extends to other significant markets, including Houston, Calgary, Singapore, and Hong Kong, reflecting its global reach and diversified client base. This wide distribution allows the company to cater to a broad range of customer demographics and market segments. The strategic expansion, including acquisitions, has further solidified its global footprint and enhanced its capabilities in diverse markets, contributing to a broader geographic distribution of its revenue and growth.

The company localizes its offerings and partnerships by establishing regional offices with dedicated teams. This ensures compliance with local regulations and tailors its sales and marketing efforts to resonate with regional market dynamics. This approach is essential for effectively targeting diverse customer demographics and understanding the nuances of each market.

The company's primary presence is concentrated in major financial centers like London, New York, and Chicago. These locations are pivotal for trading activities, including commodities, fixed income, and equities. These hubs are crucial for the company's operations and revenue generation.

Regional offices are strategically located to ensure compliance with local regulations and to tailor sales and marketing efforts. Dedicated teams in these offices focus on understanding and meeting the specific needs of regional markets. This localized approach enhances customer engagement.

The company's global presence allows for effective market segmentation, catering to diverse customer demographics. This segmentation helps in tailoring services to meet specific regional demands and preferences. Understanding customer behavior and purchasing patterns is key.

Strategic acquisitions, such as the acquisition of ED&F Man Capital Markets, have expanded the company's global footprint. These moves enhance capabilities in diverse markets, contributing to broader geographic revenue distribution. This expansion supports the company's growth strategy.

The fundamental needs of institutional clients for liquidity and market access remain consistent across regions. However, preferences and buying power can vary. The company addresses these needs by providing tailored services and expertise.

The company's geographic focus includes North America, Europe, and Asia, with a strong presence in major financial centers. This broad coverage allows the company to serve a diverse customer base and capitalize on global market opportunities. This strategic presence is crucial.

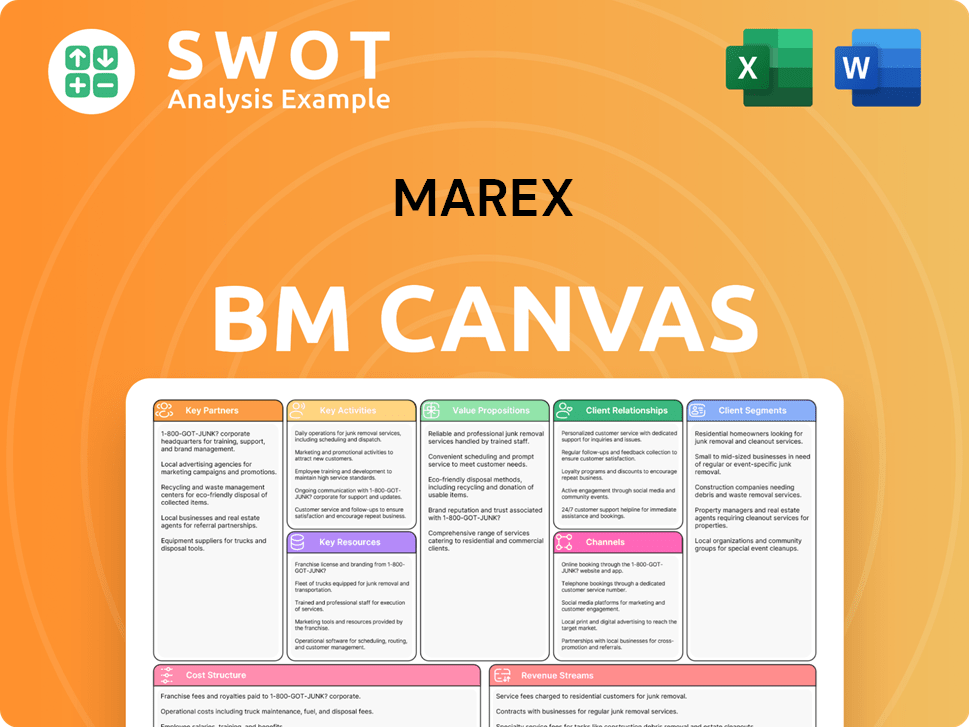

Marex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Marex Win & Keep Customers?

Understanding the strategies of customer acquisition and retention is crucial for financial institutions like the company. This involves a deep dive into their customer demographics and how they target their market. Effective strategies lead to a stronger customer base and improved financial performance. The customer demographics of the company play a significant role in shaping their marketing and service strategies.

The company, focuses on attracting and keeping sophisticated institutional clients. They use direct sales, relationship management, and thought leadership. They aim to build long-term relationships through expert advice and tailored solutions. This approach helps them understand and meet the specific needs of their clients.

The company's approach to customer acquisition and retention is multi-faceted, emphasizing long-term relationships and tailored solutions. They use a mix of direct sales, relationship management, and thought leadership. They also focus on providing high-quality service and adapting their platform to meet evolving client needs. This strategy helps them maintain a strong customer base.

The company heavily relies on direct sales to acquire new clients. They emphasize building strong relationships with clients. This involves offering expert consultation and providing tailored solutions to meet client needs. This approach ensures a personalized experience.

The company uses targeted digital campaigns and participates in industry events to reach potential clients. They also distribute market insights and research. These marketing efforts help them attract and engage with their target audience. The company aims to be seen as a thought leader in the industry.

The company retains clients through consistent, high-quality service and reliable execution. They also focus on continuous innovation in their platform. This includes providing dedicated support teams and robust technological infrastructure. These efforts enhance client experience and operational efficiency.

The company uses customer data and CRM systems to segment clients effectively. This helps them personalize interactions and proactively address evolving client needs. This data-driven approach supports their ability to tailor services. This in turn enhances customer satisfaction.

The company's customer acquisition and retention strategies are designed to create long-term value. They achieve this by focusing on building strong relationships, providing excellent service, and adapting to client needs. For more details on how the company approaches its mission, you can read about the Growth Strategy of Marex.

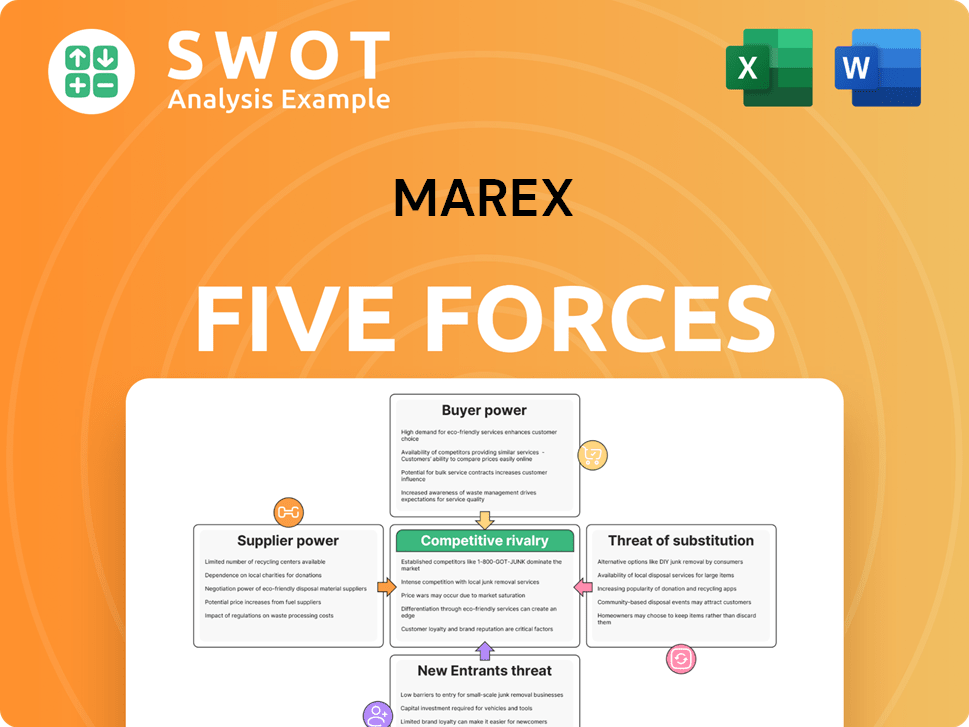

Marex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Marex Company?

- What is Competitive Landscape of Marex Company?

- What is Growth Strategy and Future Prospects of Marex Company?

- How Does Marex Company Work?

- What is Sales and Marketing Strategy of Marex Company?

- What is Brief History of Marex Company?

- Who Owns Marex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.