Samsonite International Bundle

Who Buys Samsonite Luggage?

Embark on a journey to understand the core of Samsonite International's success: its customers. From its humble beginnings crafting durable trunks to its current status as a global luggage leader, Samsonite's evolution hinges on understanding its Samsonite International SWOT Analysis and, crucially, its target market. This exploration delves into the customer demographics and Samsonite target market, providing insights into who buys Samsonite luggage and why.

Understanding the consumer profile is essential for any business aiming for sustained growth, and Samsonite is no exception. This analysis will uncover the Samsonite customer age range, Samsonite customer income levels, and Samsonite customer location, providing a comprehensive view of the brand's appeal. We'll also examine Samsonite customer lifestyle and Samsonite customer preferences, revealing how Samsonite's brand positioning resonates with its diverse customer base within the dynamic luggage industry.

Who Are Samsonite International’s Main Customers?

The primary customer segments for Samsonite International encompass a broad spectrum, reflecting its diverse brand portfolio and market positioning. The company operates in both B2C and B2B capacities, catering to varied consumer needs and preferences within the luggage and travel goods industry. Understanding the customer demographics is crucial for analyzing the company's market strategies and growth potential.

The company's approach involves segmenting its offerings to target different demographics. For instance, the core brand targets a wide range of travelers seeking quality and durability. American Tourister focuses on budget-conscious travelers, while Tumi caters to business professionals and affluent individuals. This segmentation strategy is evident in the different price points, design aesthetics, and marketing approaches for each brand, reflecting a deep understanding of the Samsonite target market.

While specific demographic breakdowns by age, gender, income, or education for each brand in 2024-2025 are not explicitly detailed in publicly available reports, the company's strategy clearly indicates segmentation. The company's acquisition of brands like High Sierra (targeting active lifestyle consumers) and Hartmann (recognized for luxury) further exemplifies its strategy to serve diverse customer groups.

The core Samsonite brand attracts a broad audience. These customers prioritize quality, durability, and design in their luggage and travel accessories. They are generally willing to invest in reliable products for both leisure and business travel. This segment represents a significant portion of the company's revenue.

American Tourister targets budget-conscious travelers and families. This segment is price-sensitive, seeking affordable yet functional luggage solutions. The brand focuses on offering value for money, appealing to a wide demographic including families and younger travelers. This segment is critical for market share.

Tumi is positioned as a performance luxury brand, targeting business professionals and affluent individuals. These customers prioritize high quality, functionality, and innovative design. They are willing to pay a premium for premium materials and features. This segment is key for profitability.

Samsonite's non-travel segment, which includes backpacks and bags, represented 34.3% of net sales in 2024, up from 33.8% in 2023. This indicates a growing focus on everyday carry solutions beyond traditional luggage. This segment is also more profitable than the core travel business in terms of gross margin, highlighting its strategic importance and a shift in target segments over time.

Analyzing the customer profile for each brand reveals distinct preferences and buying behaviors. Understanding these differences is crucial for effective marketing and product development. The luggage industry relies heavily on understanding these nuances to maintain a competitive edge.

- Samsonite customer location: The company's international presence caters to a global customer base.

- Samsonite customer lifestyle: The product appeal varies depending on the brand, with Tumi focusing on business travel and Samsonite on a broader audience.

- Samsonite customer preferences: Customers' preferences are influenced by factors like price, design, and functionality.

- Samsonite international customer base: The company's global reach is supported by a strong international customer base.

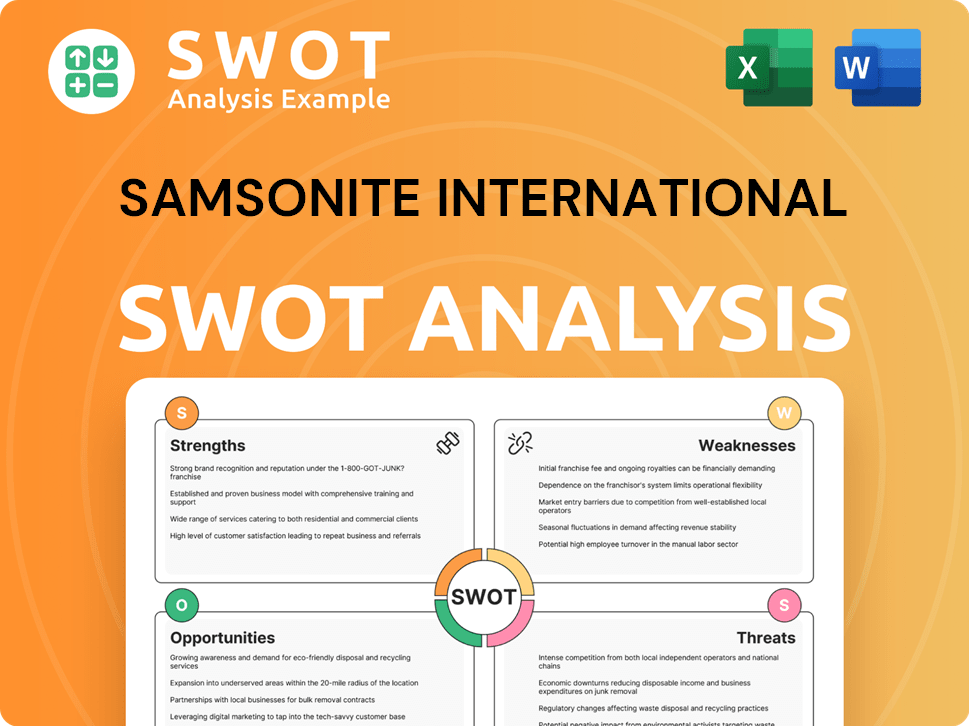

Samsonite International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Samsonite International’s Customers Want?

Understanding the customer needs and preferences is critical for the success of any business, and for the luggage industry, this is particularly true. The Samsonite target market is diverse, with a wide range of needs and expectations. Key factors influencing their choices include durability, functionality, design, and innovation.

Travelers seek reliable luggage that can withstand the rigors of transit, making durability a core value for the brand. The demand for lightweight materials and smart luggage technology, like Bluetooth tracking and built-in USB ports, reflects a preference for practical and technologically advanced solutions. As of 2024, over 20% of the product offerings feature innovative designs or technological advancements, directly addressing modern travelers' needs.

Purchasing decisions are also influenced by aspirational drivers, particularly for premium brands. The company addresses common pain points such as the need for sustainable options; in 2024, approximately 40% of the net sales came from products incorporating recycled materials, up from 34% in 2023, demonstrating a response to growing consumer demand for eco-friendly choices.

Customer demographics often prioritize luggage that can withstand frequent travel and rough handling. This need for durability is a fundamental aspect of the brand's appeal. The company's focus on robust materials and construction techniques directly addresses this core requirement.

Travelers seek luggage that offers ease of use and efficient packing solutions. Features like multiple compartments, spinner wheels, and lightweight designs are highly valued. The integration of smart luggage technology, such as built-in USB ports and Bluetooth tracking, further enhances the travel experience.

The aesthetic appeal of luggage plays a significant role in purchasing decisions, with consumers preferring stylish and contemporary designs. The brand offers a wide range of designs to cater to diverse tastes, from classic to modern styles. The brand positioning is also influenced by the design.

Customers are increasingly drawn to innovative features that enhance convenience and efficiency. This includes lightweight materials, smart luggage technology, and sustainable options. The company's investment in research and development reflects its commitment to meeting these evolving needs.

A growing segment of the customer base prioritizes environmentally friendly products. The company's efforts to incorporate recycled materials and promote circular solutions resonate with these consumers. The launch of the 'Eco' series and the Eco logo has led to a 15% increase in eco-friendly product sales in Q1 2024.

The brand's reputation for quality and reliability is a key factor in customer loyalty. Positive reviews, strong warranties, and excellent customer service build trust and encourage repeat purchases. The company's long-standing presence in the luggage industry contributes to this trust.

The company tailors its marketing and product features to specific segments. For instance, the launch of the 'Eco' series and the Eco logo has led to a 15% increase in eco-friendly product sales in Q1 2024. The company also emphasizes repairability and circular solutions to extend product lifespans, aligning with consumer preferences for sustainable and long-lasting goods. Understanding the Samsonite customer buying behavior is crucial for the company's success. The company's strategy to meet customer needs is further detailed in this article about Growth Strategy of Samsonite International.

- Durability: Products are designed to withstand the rigors of travel.

- Functionality: Features like multiple compartments and spinner wheels enhance usability.

- Design: A wide range of styles caters to diverse aesthetic preferences.

- Innovation: Incorporation of smart luggage technology and lightweight materials.

- Sustainability: Use of recycled materials and promotion of circular solutions.

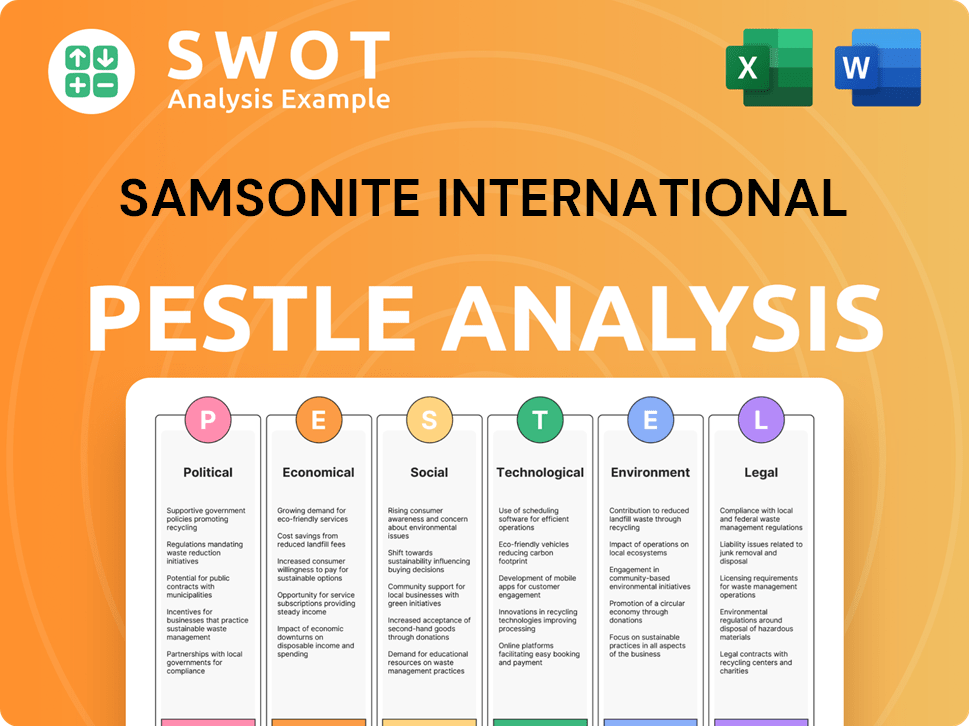

Samsonite International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Samsonite International operate?

The geographical market presence of the company is a key factor in its global strategy. The company has a significant presence across North America, Asia, Europe, and Latin America, demonstrating its ability to cater to diverse customer demographics worldwide. This broad reach allows the company to leverage various market opportunities and adapt to regional consumer preferences.

In the fiscal year ending December 2023, North America accounted for approximately 40% of the total sales revenue. Asia remains a high-margin region and a significant contributor to sales, representing 38.5% of net sales in Q1 2025. The company's strategic focus on store openings in key markets, particularly in Asia and Europe, enhances brand visibility and customer experience.

The company's ability to adapt to varying customer demographics, preferences, and buying power across these regions is crucial. This is achieved through a diverse brand portfolio, including Tumi, which allows for growth in underpenetrated markets in Asia and Europe. The company’s approach is to succeed in diverse markets by localizing offerings and marketing.

North America is a crucial market for the company, contributing a substantial portion of its revenue. Despite facing some challenges, such as lower consumer confidence impacting direct-to-consumer (DTC) traffic in Q1 2025, the company maintains a strong foothold. The company's ability to adapt to changing consumer behavior is essential for continued success in this region.

Asia remains a high-margin region and a significant contributor to sales, representing 38.5% of net sales in Q1 2025. The company focuses on store openings in key markets across Asia to enhance brand visibility and customer experience. Despite a decrease in sales for the brand in Q1 2025, Asia remains a strategically important market.

Europe has shown resilience, with sales growth driven by the American Tourister and Tumi brands. The company's diverse brand portfolio allows it to cater to varying customer preferences across Europe. This demonstrates the effectiveness of its brand strategy in different regional markets.

Latin America has shown strong growth, with a 55% increase in e-commerce sales in 2024. This expansion highlights the company's success in adapting its strategies to the specific needs of this market. The company's localized offerings and marketing efforts are key to its success in Latin America.

The company's approach includes adapting to specific market dynamics. For instance, the American Tourister brand faces increased competition in India, which requires localized strategies. This demonstrates the importance of understanding local market conditions and tailoring strategies accordingly.

- The company's ability to adapt to varying customer demographics is crucial.

- The company uses brands like Tumi for growth in underpenetrated markets.

- The company localizes its offerings and marketing to succeed in diverse markets.

- The company’s geographical market presence is a key factor in its global strategy.

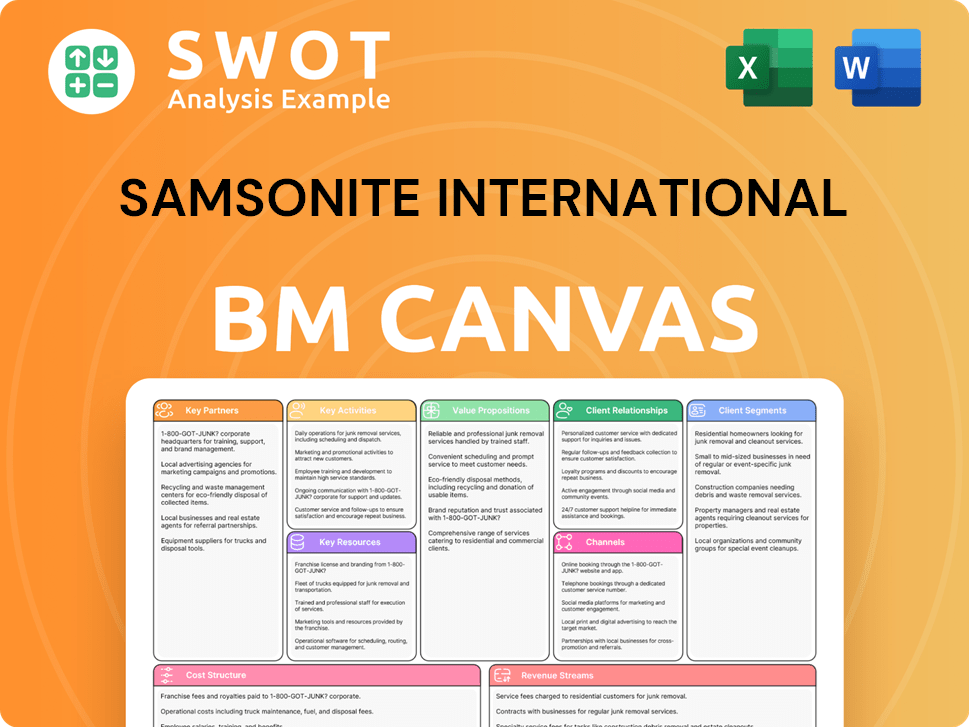

Samsonite International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Samsonite International Win & Keep Customers?

The customer acquisition and retention strategies of the company, a prominent player in the luggage industry, are multifaceted, focusing on a blend of digital and traditional marketing to reach its target market. The company strategically uses various channels, including digital platforms, social media, and influencer collaborations. This comprehensive approach aims to broaden its reach and cater to diverse consumer profiles.

A key component of the company's strategy involves enhancing its online sales channels. The company has significantly invested in its e-commerce platform, with e-commerce sales reaching $411.1 million in 2024, a growth of 5.8%. Additionally, the company leverages third-party e-commerce platforms such as Amazon, which accounted for 19.4% of total revenue in 2024. This is up from 18.2% in 2023, indicating a strong emphasis on digital presence and adapting to evolving consumer shopping habits. The brand's direct-to-consumer (DTC) channel, encompassing company-operated retail stores and e-commerce, contributed 39.8% of net sales in 2024, up from 38.9% in 2023.

For customer retention, the company prioritizes product durability and sustainability. The company's commitment to using recycled materials is a significant aspect of its strategy, with roughly 40% of net sales in 2024 derived from products with recycled content. The focus on repairability further strengthens customer loyalty, aligning with the growing consumer demand for sustainable and long-lasting products. The company’s expanding DTC channels, including its retail stores and e-commerce, are also crucial for building direct customer relationships. The addition of nine net new company-operated retail stores in Q1 2025, bringing the global retail network to 1,128 stores, demonstrates the brand's dedication to strengthening its customer base.

The company heavily invests in digital marketing to acquire customers. This includes a strong focus on e-commerce, which saw sales increase to $411.1 million in 2024. The expansion of online sales channels is a key strategy to reach the Samsonite target market.

- E-commerce sales grew by 5.8% in 2024.

- Sales through third-party platforms like Amazon accounted for 19.4% of total revenue in 2024.

- DTC channel contributed 39.8% of net sales in 2024.

Customer retention is enhanced by the company's commitment to sustainability and product longevity. This approach aligns with evolving consumer preferences and helps build brand loyalty. The focus on durable products and sustainable materials supports a positive consumer profile.

- Approximately 40% of net sales in 2024 came from products with recycled content.

- Repairability initiatives enhance product lifespan.

- These efforts align with the increasing consumer demand for sustainable and long-lasting products.

The company's DTC strategy plays a crucial role in customer acquisition and retention. By expanding its retail network and e-commerce presence, the company aims to foster direct relationships with customers. This approach allows for better engagement and personalized experiences, improving customer loyalty within the luggage industry.

- DTC channel includes company-operated retail stores and e-commerce.

- DTC contributed 39.8% of net sales in 2024.

- Nine net new company-operated retail stores were added in Q1 2025.

While specific loyalty programs are not detailed, the emphasis on product quality, innovation, and sustainability, along with expanding DTC channels, serves as a retention strategy to foster long-term customer relationships and lifetime value. Understanding the nuances of the Samsonite customer buying behavior is key.

- Focus on product quality and innovation.

- Emphasis on sustainability initiatives.

- Expanding DTC channels to build direct customer relationships.

The company uses a multi-faceted approach, employing digital marketing, traditional advertising, social media, and influencer collaborations. This strategy aims to reach a broad audience and effectively communicate the brand's value proposition, supporting its brand positioning. For more insights, explore the Marketing Strategy of Samsonite International.

- Utilizes digital platforms for e-commerce and advertising.

- Employs social media and influencer marketing.

- Focuses on a diverse range of marketing channels.

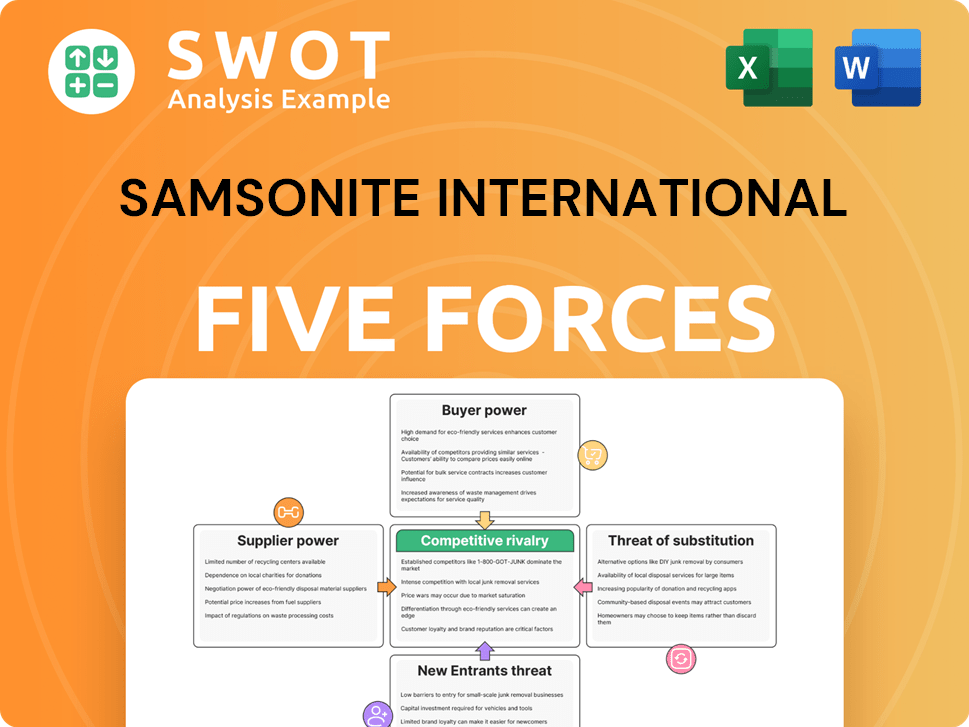

Samsonite International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsonite International Company?

- What is Competitive Landscape of Samsonite International Company?

- What is Growth Strategy and Future Prospects of Samsonite International Company?

- How Does Samsonite International Company Work?

- What is Sales and Marketing Strategy of Samsonite International Company?

- What is Brief History of Samsonite International Company?

- Who Owns Samsonite International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.