Trainline Bundle

Who Rides the Rails with Trainline?

In today's fast-paced travel landscape, understanding Trainline SWOT Analysis is critical for success. Trainline, the leading independent rail platform in Europe, has seen remarkable growth, but who exactly are the people fueling this expansion? This exploration dives deep into Trainline's

From its UK roots to its pan-European presence, Trainline's customer base has transformed, making market segmentation a key focus. This analysis will unpack the

Who Are Trainline’s Main Customers?

Understanding the customer demographics and target market of Trainline is crucial for assessing its business strategy. Trainline operates in both the B2C and B2B sectors, with a focus on providing convenient train travel solutions. This analysis delves into the primary customer segments that drive its revenue and growth.

Trainline's customer base is diverse, encompassing individual travelers within the UK and internationally, as well as businesses through its solutions platform. The company's success hinges on understanding the unique needs and behaviors of each segment. This approach allows Trainline to tailor its services and marketing efforts effectively, driving customer satisfaction and loyalty.

The UK Consumer segment is a significant revenue driver for Trainline. In FY2025, net ticket sales reached £3.9 billion, reflecting a 13% year-on-year increase. This segment focuses on individual travelers within the United Kingdom, offering a wide range of services to meet their needs.

The International Consumer segment caters to individual travelers for journeys outside the UK. This segment has shown strong growth, becoming a £1 billion business in FY2024. Trainline is expanding its presence in key markets like Spain and Italy.

Trainline Solutions provides travel portal platforms for its own branded business units, as well as external corporates, travel management companies, and white-label e-commerce platforms for train operating companies. This segment serves the B2B market, offering comprehensive travel solutions.

Trainline actively targets younger demographics. The share of railcard users aged 16-25 and 26-30 reached 43% in FY2025, partly due to a partnership with Monzo. This focus on younger customers highlights Trainline's strategy to capture frequent and loyal travelers.

Trainline's customer base is segmented to target different user groups effectively. The company's focus on the UK Consumer segment has been successful, with its share of the commuter segment rising significantly. The International Consumer segment is also experiencing substantial growth, particularly in Spain and Italy. Understanding the passenger profile allows Trainline to tailor its services. For more insights, see the Growth Strategy of Trainline.

- Customer Age Range: Trainline targets a broad age range, with a notable focus on younger demographics (16-30 years old).

- Geographic Location: Primarily focuses on the UK and international travelers, with a strong presence in European markets.

- Customer Behavior: Frequent travelers, commuters, and those seeking convenient travel solutions are key.

- Market Segmentation: UK Consumer, International Consumer, and Trainline Solutions (B2B).

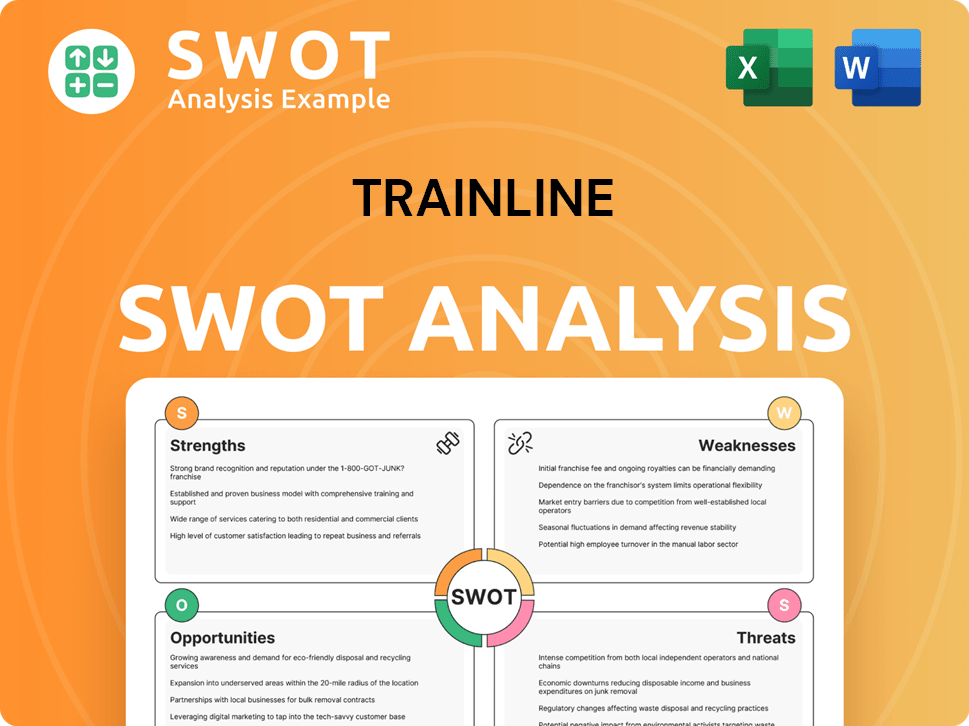

Trainline SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Trainline’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For Owners & Shareholders of Trainline, this involves recognizing the evolving demands of its users. The core of their customer focus revolves around providing value, convenience, and increasingly, sustainable travel options.

Customers of Trainline prioritize ease of use when searching, comparing, and booking travel. They also value real-time information and personalized journey planning. The platform addresses the common pain point of navigating complex rail networks and fragmented ticketing systems by offering a single, streamlined solution.

Purchasing behaviors highlight a strong preference for digital solutions. This is evident in the increasing adoption of e-tickets and mobile app usage, indicating a clear shift towards digital-first experiences. Trainline's ability to adapt to these preferences is key to retaining and attracting customers.

E-ticket penetration increased to 47% of total industry sales in FY2024, up from 43% in FY2023. This showcases the growing preference for digital tickets.

The percentage of transactions through the Trainline mobile app for International Consumers increased to 62% in FY2024, and 69% in FY2025. Italy saw 73% of transactions through the app in FY2024.

Digital season ticket customers exhibit more than double the retention levels of its overall UK customer base. This highlights the value of digital solutions.

Trainline tailors its offerings to specific segments, providing features that address various customer needs. These features aim to enhance the overall customer experience and drive loyalty.

- Best Price Guarantee: Offered in the UK, Italy, Spain, and France, this feature refunds the difference if a customer finds a cheaper ticket elsewhere.

- 'TopCombo' in Spain: Allows customers to combine different carriers for multi-leg journeys, optimizing for price and convenience.

- Auto-applied Promo Codes in Italy: Automatically finds and applies discounts to save customers money.

- 'Super Routes': Highlights routes that save customers time, money, and carbon emissions.

- 'Your Sustainability Story': Shows CO2 emissions saved by taking the train, catering to environmentally conscious travelers.

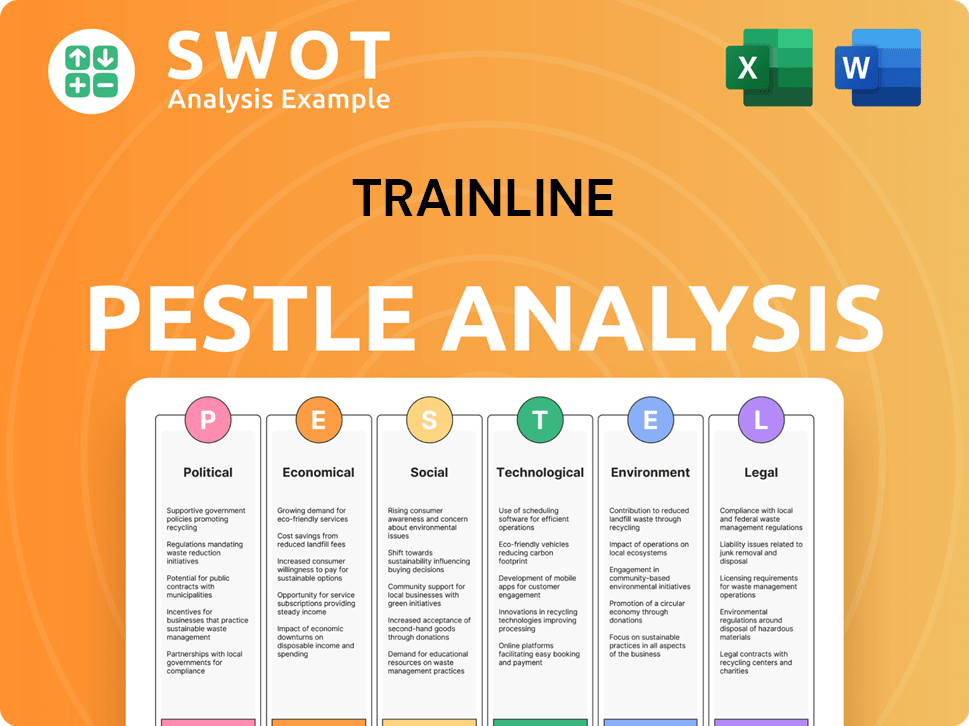

Trainline PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Trainline operate?

The geographical market presence of the company, focuses on Europe, with a strategic emphasis on markets with considerable carrier competition, particularly Spain and Italy. These domestic markets are valued at around €6 billion. The company also targets foreign travel, a market worth approximately €4 billion.

In the first half of fiscal year 2025 (H1 FY2025), the combined net ticket sales growth across Spain and Italy was 23%. Spain has demonstrated strong performance, with domestic ticket sales more than doubling for two consecutive years leading up to FY2024, and growing 41% in FY2025.

The company has more than doubled its market share on aggregated Spanish routes in the past two years, accounting for 1 out of every 6 transactions on routes like Madrid-Valencia. This expansion highlights the effectiveness of its strategies in key European markets. To learn more about the company's origins, you can read a Brief History of Trainline.

While the UK remains the largest market for the company by mobile app monthly active users (MAUs) at 58% through H1 FY2025, the company is actively diversifying its footprint. This indicates a strong base in its home market while simultaneously pursuing international growth.

Italy and Spain have experienced increases in MAU share by 2 percentage points each in H1 FY2025 compared to H1 FY2022. This growth demonstrates the success of its international expansion efforts. This expansion is a key part of the company's strategy.

The company localizes its offerings by deeply integrating with different carrier APIs and tailoring features within its app. This includes overhauling fare presentation to provide clear information about each carrier and carriage class, enhancing the user experience.

Recent expansions include integrating Cercanias in Spain and Pass Rail in France to create a unique aggregator offering. These integrations expand the company's service offerings and market reach, providing more comprehensive travel options for users.

The company is positioning itself as the aggregator of choice in Europe. This strategic positioning aims to capture a larger share of the market by offering a comprehensive and user-friendly platform for train travel across various carriers.

The company anticipates further carrier competition in markets like France and Germany in the coming years. This anticipation suggests a proactive approach to adapting and expanding its services in response to evolving market dynamics.

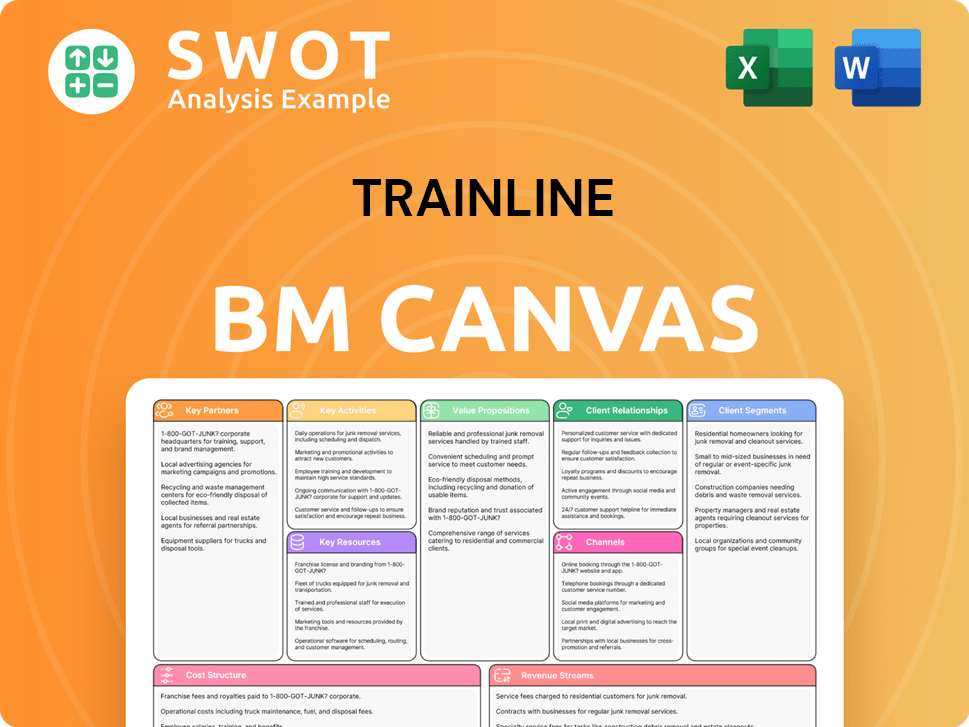

Trainline Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Trainline Win & Keep Customers?

The company, formerly known as Trainline, employs multifaceted strategies for acquiring and retaining customers. These strategies leverage digital and traditional marketing alongside continuous product innovation and customer service enhancements. A crucial aspect of customer acquisition involves strategic marketing investments aimed at driving demand and increasing brand awareness, especially across Europe. In the fiscal year 2024, the company saw a 13% year-on-year increase in active customers.

For customer retention, the focus is on improving the overall customer experience and boosting customer lifetime value. The expansion of digital season tickets has proven highly effective, with these customers demonstrating more than double the retention rates compared to the general customer base in the UK. The company aims to inform customers about potential savings. The 'great journeys start with Trainline' campaign highlights savings opportunities, with an average saving of 35% available through features like SplitSave, railcards, and advance tickets.

The company's approach to customer acquisition and retention is multifaceted. It is Europe's most downloaded rail app, with nearly twice as many downloads as competitors like SNCF and Deutsche Bahn. The company also focuses on growing foreign travel sales, which typically yield higher margins, and introduces ancillary products such as hotels in partnership with Booking.com. To learn more about the company's business model, you can read Revenue Streams & Business Model of Trainline.

Invests in efficient marketing to drive customer demand and increase brand awareness. This is particularly focused on the European market. The company aims to drive demand and grow brand awareness.

The 'great journeys start with Trainline' campaign informs customers about potential savings. Features like SplitSave, railcards, and advance tickets help customers save money. The average saving through these features is 35%.

The scaling of digital season tickets has proven highly effective. Customers using these tickets show more than double the retention levels compared to the overall customer base in the UK. This strategy significantly boosts customer retention rates.

The company focuses on improving customer experience and increasing customer lifetime value. Features such as Best Price Guarantee and TopCombo in Spain are implemented. The personalized search function enhances booking.

The company plans to implement Quality Management and Analytics systems. This will provide insights into customer behaviors and preferences. Data-driven decisions will be used for product development and service tailoring.

A new £75 million share buyback program was announced in May 2024. This demonstrates a commitment to shareholder value. Shareholder value indirectly supports customer-focused investments.

The company focuses on growing foreign travel sales. These sales typically have higher margins. Ancillary products like hotels are offered in partnership with Booking.com.

Features include Best Price Guarantee, offering refunds if a cheaper ticket is found elsewhere. TopCombo in Spain optimizes multi-leg journeys. A new app homescreen features a personalized search function.

Personalized experiences are enhanced through a new app homescreen. It features a personalized search function. Machine learning and geo-location technology are used for quicker bookings.

The company is Europe's most downloaded rail app. It has almost twice as many downloads as SNCF and Deutsche Bahn. This strong market position supports customer acquisition.

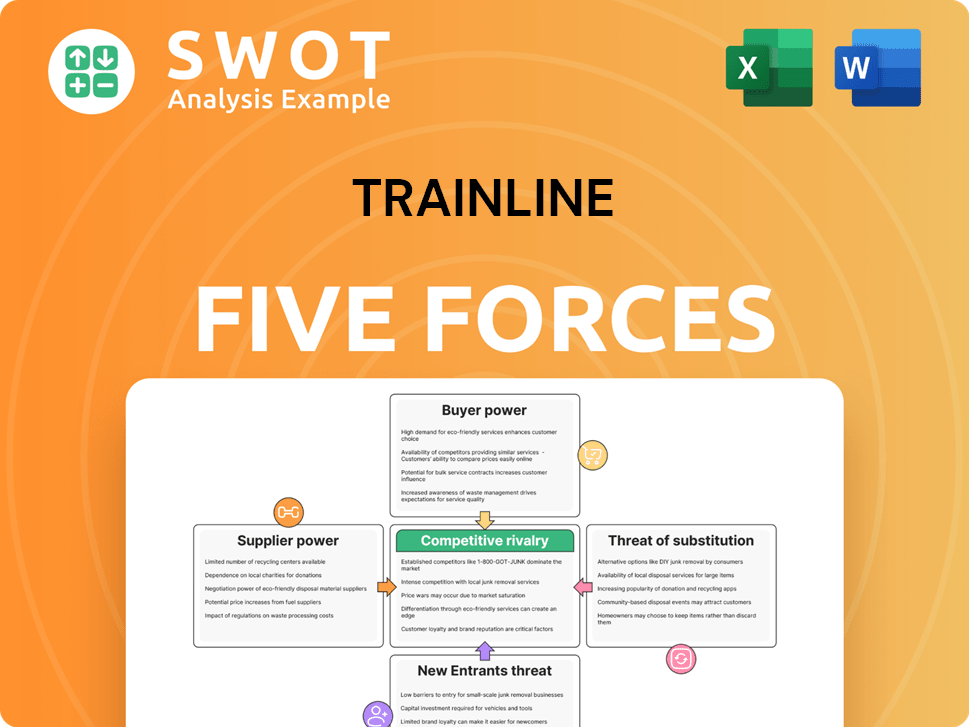

Trainline Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Trainline Company?

- What is Competitive Landscape of Trainline Company?

- What is Growth Strategy and Future Prospects of Trainline Company?

- How Does Trainline Company Work?

- What is Sales and Marketing Strategy of Trainline Company?

- What is Brief History of Trainline Company?

- Who Owns Trainline Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.