Toll Brothers Bundle

Who Buys Luxury Homes from Toll Brothers?

In the ever-shifting landscape of the real estate market, understanding the customer demographics is crucial for success, especially for luxury homebuilders like Toll Brothers. With the median age of homebuyers climbing and market dynamics evolving, knowing who your customer is becomes paramount. This deep dive explores the Toll Brothers SWOT Analysis to uncover the specifics of their target market.

This analysis will dissect the demographic trends of Toll Brothers buyers, including age range, income levels, and geographic preferences. We'll explore the company's customer acquisition strategies and how they cater to the evolving needs of luxury homebuyers. By understanding the Toll Brothers customer profile, we can gain valuable insights into the competitive dynamics of the luxury homes market and the factors driving customer buying behavior.

Who Are Toll Brothers’s Main Customers?

Understanding the customer demographics and target market of the company is crucial for assessing its business strategy. The company primarily focuses on affluent buyers, specifically within the luxury home market. This focus allows the company to cater to a specific niche with distinct preferences and financial capabilities.

The company's target market includes several key segments, each with unique characteristics. These segments include luxury move-up buyers, empty-nesters, active-adult buyers, second-home buyers, and affluent first-time buyers. This diversified approach allows the company to capture a wide range of customers within the high-end real estate market.

In fiscal year 2024, the company adapted to market changes, broadening its price points and increasing its emphasis on the production and sale of spec homes. This strategic shift allowed the company to compete more effectively in the existing home market and cater to buyers seeking quicker move-in options.

The company's primary customer segments include luxury move-up buyers, empty-nesters, active-adult buyers, and second-home buyers. These segments represent the core of the company's business, accounting for a significant portion of its sales. This focus allows the company to target a specific niche within the high-end real estate market.

A notable portion of the company's customer base consists of affluent first-time buyers, particularly older millennials. These buyers are financially secure and often purchase their first home later in life. This segment contributes to the company's diverse customer portfolio and supports its growth strategy.

In fiscal year 2024, approximately 28% of the company's buyers paid cash for their homes, a significant increase from the long-term average. For those who used mortgages, the average loan-to-value ratio was around 69%. This financial stability indicates that the company's customer base is less sensitive to interest rate fluctuations.

The company has broadened its price points and increased its focus on spec homes, which made up 49% of deliveries in fiscal 2024. These changes allow the company to compete with existing homes and cater to buyers seeking quicker move-in options. These adjustments were driven by market research and a need to adapt to changing demand patterns.

The company's customer base is primarily composed of affluent individuals and families. The focus on the luxury market allows the company to cater to a specific demographic with high purchasing power. Understanding these customer demographics is essential for the company's success. For more insights, consider reading about the Growth Strategy of Toll Brothers.

- Luxury move-up buyers represent a significant portion of the customer base.

- Empty-nesters and active-adult buyers are key segments.

- Affluent first-time buyers contribute to the company's diverse portfolio.

- The financial stability of buyers is demonstrated by a high percentage of cash purchases.

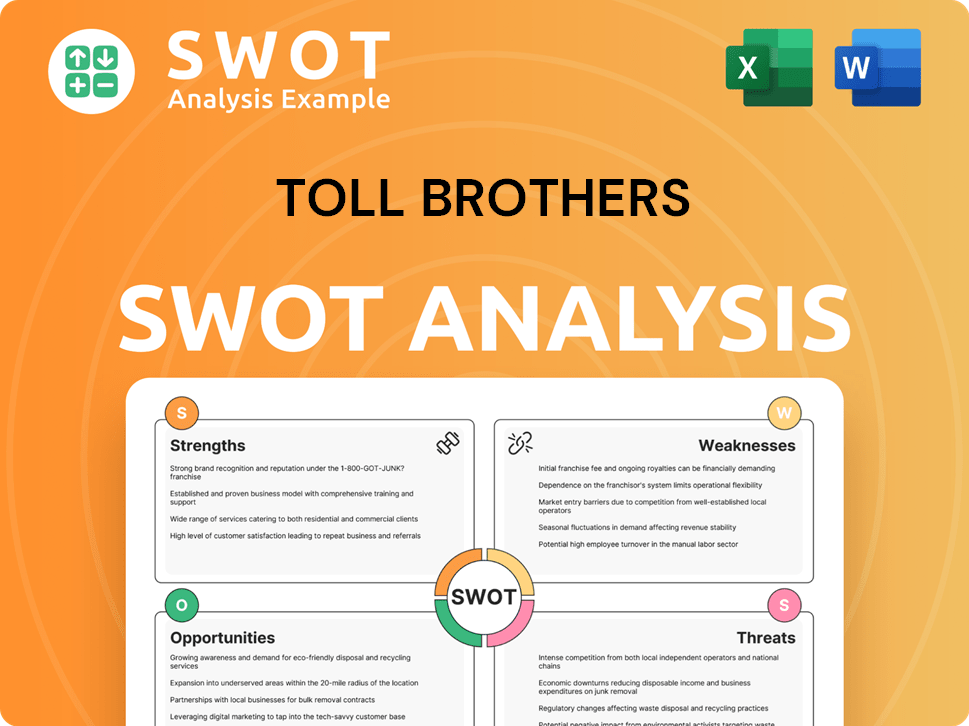

Toll Brothers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Toll Brothers’s Customers Want?

The needs and preferences of customers looking at properties from the company are centered around quality, lifestyle, and personalization. These affluent homebuyers seek homes that are ready for immediate use, valuing convenience and a high quality of life. Their purchasing decisions are often less affected by economic factors like interest rates due to their financial stability.

These customers are attracted to homes with modern, open layouts, smart technology, sustainable designs, and wellness-focused spaces. They also value convenient locations near amenities like restaurants, parks, and cultural attractions. The company addresses these preferences by offering highly personalized homes through their Design Studios, which generated over $1 billion in revenues in fiscal 2024.

The company's approach includes incorporating 'spec homes' that still allow for significant buyer customization. This strategy meets the demand for quicker move-in options while maintaining personalization, which also benefits their margins, as Design Studio upgrades are highly accretive. The company's adaptability is evident in its focus on 'life happens' buyers, whose motivations to move are driven by life-stage milestones.

Customers prefer homes that are ready for immediate enjoyment, reflecting a desire for convenience and time savings. This preference is a key factor in the company's appeal to its target market.

The target market is often less deterred by economic factors due to their financial wherewithal. Many leverage existing home equity or make substantial cash payments.

The Design Studios generated over $1 billion in revenues in fiscal 2024, highlighting the importance of personalization. Buyers can choose finishing selections and add structural and design options.

Customers spend an average of approximately $203,000 in upgrades per home in fiscal year 2024. This demonstrates the value placed on customization.

The company focuses on 'life happens' buyers, whose motivations to move are driven by life-stage milestones. These buyers are less sensitive to market fluctuations.

The company incorporates 'spec homes' that still allow for significant buyer customization. This strategy meets the demand for quicker move-in options while maintaining personalization.

The company's customer base, which includes those looking for luxury homes, values customization and convenience. Their preferences drive the company's offerings, from design choices to location. Understanding the customer demographics and the company's target market is crucial for success in the real estate market. For more insights, consider exploring the Competitors Landscape of Toll Brothers.

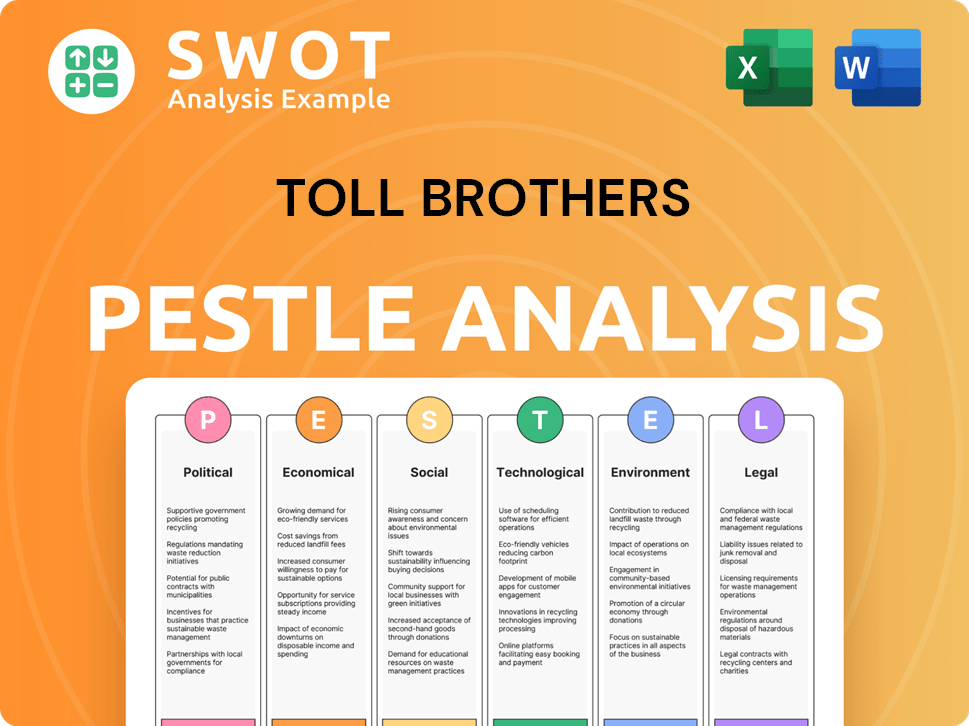

Toll Brothers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Toll Brothers operate?

The geographical market presence of Toll Brothers spans across the United States, with operations in over 60 markets. These markets are spread across 24 states and the District of Columbia. This widespread presence allows the company to cater to a diverse range of homebuyers and adapt to varying regional preferences.

Key markets for Toll Brothers include major metropolitan areas such as Boston, New York, Philadelphia, and Washington, D.C. The company also has a significant presence in states like California, Florida, and Texas. This strategic distribution enables Toll Brothers to capture a substantial share of the luxury homes and real estate market across the country.

The company's ability to adapt to local demands is crucial for its success. The Revenue Streams & Business Model of Toll Brothers highlights how the company tailors its offerings to suit regional preferences, ensuring it meets the needs of its target market.

Toll Brothers focuses on expanding its geographic reach and price points. This strategy allows the company to serve a diverse customer base and respond to specific local demands, increasing its market share.

The company offers a diverse product mix, including luxury move-up homes, millennial-focused luxury first-time homes, and active-adult communities. They also develop master-planned communities and urban low-, mid-, and high-rise communities through Toll Brothers City Living.

Toll Brothers localizes its offerings by adapting product lines and community types to suit regional preferences and market conditions. This includes catering to the growing trend towards smaller, more luxurious homes in certain markets.

In fiscal year 2024, Toll Brothers delivered 10,813 homes from 527 communities. At the end of FY 2024, they had 408 selling communities. As of May 2025, the company anticipates operating from 430 communities by the end of Q3 FY 2025 and 440 to 450 communities by the end of fiscal year 2025.

The company addresses differences in customer demographics and buying power across regions through its diverse product offerings. This approach allows Toll Brothers to cater to various segments within the luxury homes market.

Toll Brothers holds a strong market share and brand recognition within the luxury homebuilding sector in its key regions. This reputation helps the company attract and retain customers.

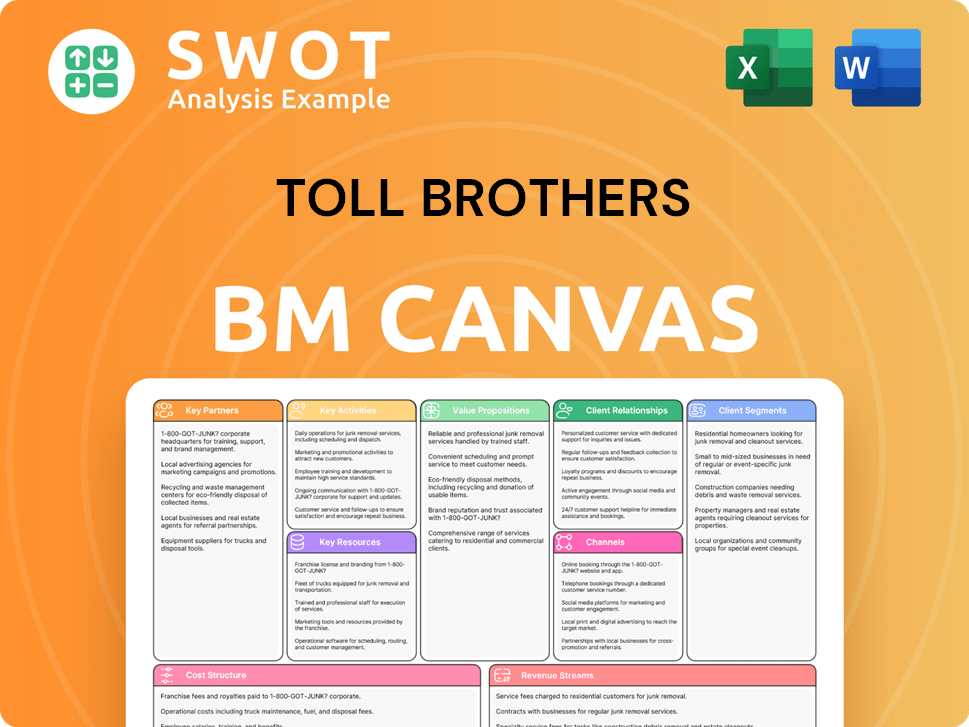

Toll Brothers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Toll Brothers Win & Keep Customers?

Customer acquisition and retention strategies for the company center on its strong brand reputation, which appeals to its specific customer demographics. The company uses a multi-faceted approach, including digital platforms, traditional advertising, and Design Studios, which are key to sales by allowing for extensive personalization. This focus on luxury and quality is a significant draw for its target market of affluent homebuyers.

The ability for buyers to add significant value through customization, with an average of approximately $203,000 in fiscal year 2024, highlights the importance of personalization. The company also utilizes 'spec homes' to attract buyers with immediate housing needs, offering quicker move-in options with significant customization possibilities. This adaptability enables the company to reach a broader segment of affluent buyers.

Retention strategies emphasize high-quality construction and responsive after-sales service, crucial for maintaining customer satisfaction in the luxury homes market. The company's customer base often includes repeat buyers, benefiting from its established reputation. The company's strategic shift to include more spec homes and a broader price point range has impacted customer acquisition by enabling them to reach a wider segment of affluent buyers, including older millennials. Read more about the Marketing Strategy of Toll Brothers.

The company leverages digital platforms for marketing. This includes targeted advertising, social media campaigns, and search engine optimization to reach potential homebuyers. Digital marketing efforts are crucial for showcasing luxury homes and attracting the target audience.

Design Studios play a critical role in the sales process, allowing extensive personalization. This feature enables buyers to customize their homes, adding significant value. Personalization is a key factor in attracting and satisfying customers.

The company strategically uses 'spec homes' as an acquisition tool. These homes offer quicker move-in options while still allowing for buyer customization. Spec homes appeal to buyers with immediate housing needs, expanding the market reach.

High-quality construction and responsive after-sales service are essential for customer retention. Addressing customer needs promptly and effectively fosters loyalty. Excellent customer service is a cornerstone of the company's strategy.

The company adapts its product offerings and sales tactics. This includes a shift towards more spec homes and a broader price range. This adaptability allows the company to cater to a wider segment of affluent buyers.

In fiscal year 2024, the company signed 10,070 net contracts, a 27% increase in units and dollars compared to fiscal year 2023. In Q3 2024, the company signed 2,490 net contracts for $2.4 billion, up approximately 11% in both units and dollars year-over-year.

The company's customer base often includes repeat or move-up buyers. This loyalty is a result of the company's established reputation for quality. The company's focus on luxury homes attracts a specific segment of homebuyers.

In Q2 2025, net agreements were 2,650 for $2.6 billion, down 13% in units and 11% in dollars compared to Q2 2024, with an average price of contracts signed at approximately $983,000. This highlights the company's ability to adapt to changing market conditions.

The company targets affluent homebuyers with a focus on luxury homes. The company's marketing efforts are designed to reach this specific demographic. The strategic focus on luxury homes helps the company to maintain a strong customer base.

The ability to add significant value through customization is a key feature. Buyers can add approximately $203,000 in lot premiums and structural options. Customization enhances customer satisfaction and drives sales.

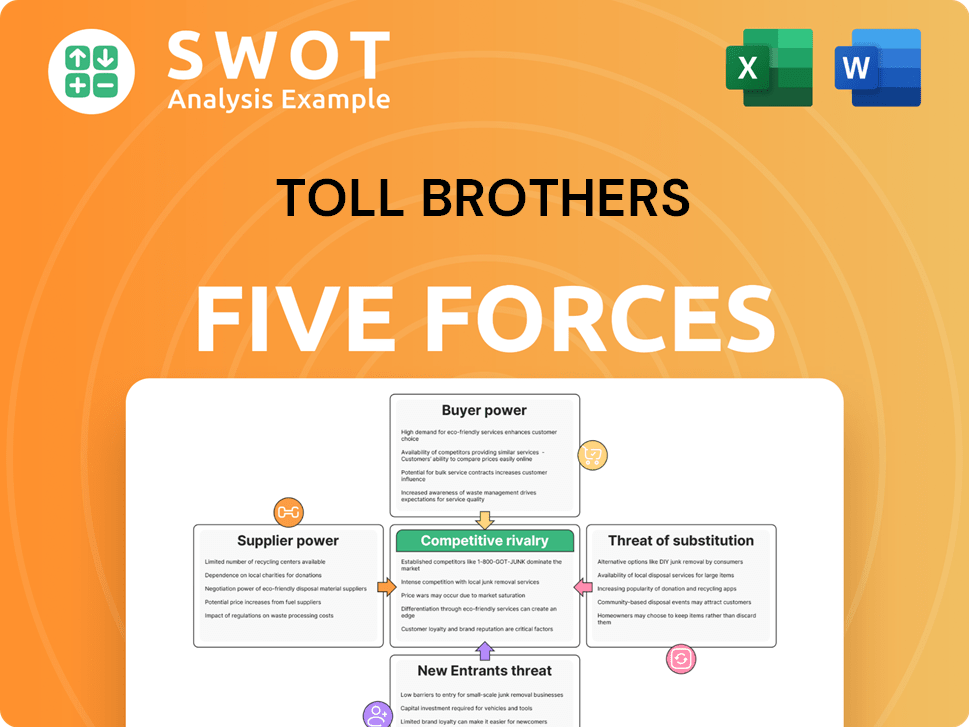

Toll Brothers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Toll Brothers Company?

- What is Competitive Landscape of Toll Brothers Company?

- What is Growth Strategy and Future Prospects of Toll Brothers Company?

- How Does Toll Brothers Company Work?

- What is Sales and Marketing Strategy of Toll Brothers Company?

- What is Brief History of Toll Brothers Company?

- Who Owns Toll Brothers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.