10X Genomics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

10X Genomics Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clean, distraction-free view optimized for C-level presentation, helping execs grasp strategy at a glance.

Preview = Final Product

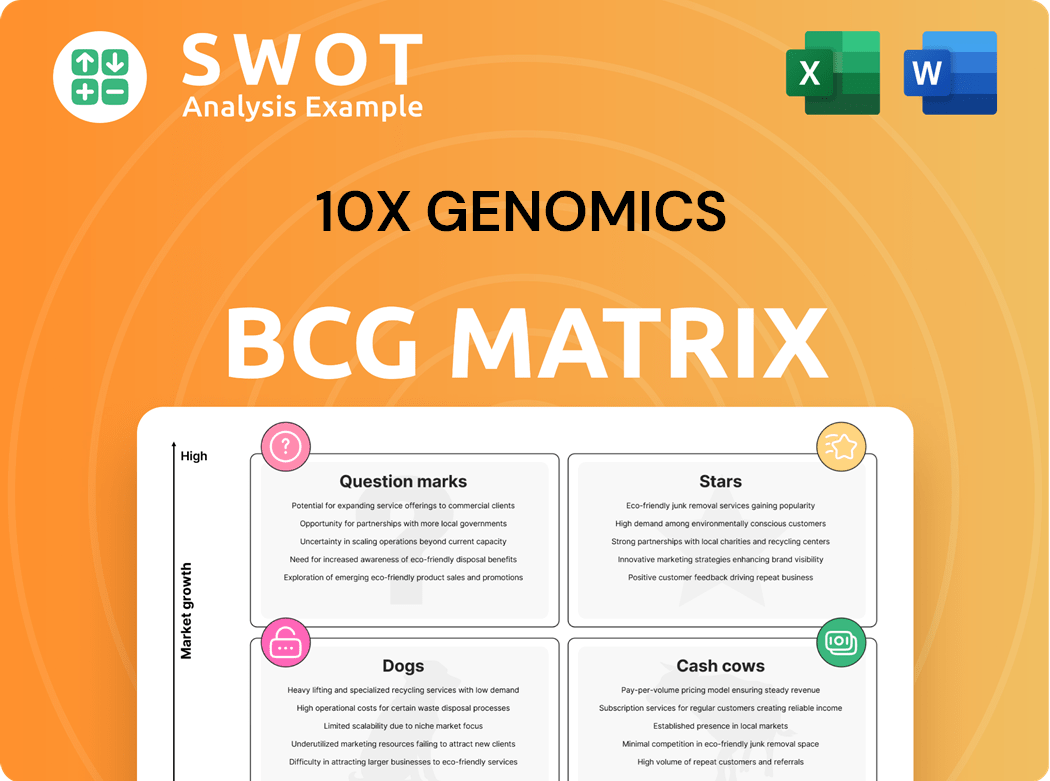

10X Genomics BCG Matrix

The preview shows the complete 10X Genomics BCG Matrix document you'll receive after purchase. This detailed report provides a clear strategic analysis of 10X Genomics, allowing immediate application for your business or research. It’s a ready-to-use, professionally formatted file, with no differences from what you see now. The download is instantly available, offering immediate insights and strategic value.

BCG Matrix Template

Explore 10x Genomics' product landscape with a glance at its BCG Matrix. See how its offerings stack up: Stars, Cash Cows, Dogs, and Question Marks. This glimpse reveals strategic positioning. Understand market share and growth potential. Make informed decisions about investment and development.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

The Xenium In Situ Platform is a Star for 10x Genomics. It excels in high-growth areas, like the Xenium Prime 5K assay. This platform offers high-resolution spatial imaging of RNA within tissue sections. This helps with deeper insights into cellular mechanisms.

Visium HD Spatial Gene Expression significantly boosts the resolution of the Visium platform. It works with various tissue types, including FFPE. The platform uses CytAssist, ensuring high sensitivity and efficient sequencing. This technology allows for whole transcriptome analysis. In 2024, 10x Genomics reported a revenue increase, reflecting strong demand for its innovative spatial solutions.

Chromium GEM-X technology, particularly the Flex Gene Expression assay, shines as a star. This technology excels in sensitivity and throughput, delivering high-quality data. It facilitates large-scale, cost-effective single-cell analysis; processing up to 2.5 million cells per run at $0.01 per cell. This makes it a crucial driver in the biopharma market, with 10x Genomics' revenue reaching $600 million in 2024.

Spatial Biology Market Leadership

10x Genomics leads the spatial biology market, offering advanced technologies and a wide product range. The market is growing due to rising demand for precision medicine and complex disease research. Acquisitions like ReadCoor and Cartana boost their capabilities in spatial genomics and transcriptomics. In 2024, the spatial biology market is projected to reach $600 million, with 10x Genomics holding a significant share.

- Market size in 2024: $600 million (projected).

- Key acquisitions: ReadCoor and Cartana.

- Focus: Spatial genomics and transcriptomics.

- Growth drivers: Precision medicine, complex diseases.

Partnerships and Collaborations

10x Genomics strategically forges partnerships to enhance its market position. Collaborations like the Billion Cells Project with CZI and Ultima Genomics boost AI model development in biology. These alliances accelerate R&D, strengthening its reputation. The Billion Cells Project aims to create a massive one billion cell dataset.

- Q4 2023 revenue: $160.8 million, showing growth.

- Partnerships expand the company's technological capabilities.

- Strategic alliances drive innovation in genomics.

- The Billion Cells Project is a significant undertaking.

Stars for 10x Genomics include Xenium, Visium HD, and Chromium GEM-X. They drive significant revenue growth via innovative spatial solutions. In 2024, revenue reached $600 million. Strategic partnerships boost R&D.

| Platform | Technology | 2024 Revenue Contribution (Est.) |

|---|---|---|

| Xenium | In Situ Sequencing | $180M |

| Visium HD | Spatial Gene Expression | $150M |

| Chromium GEM-X | Single-Cell Analysis | $170M |

Cash Cows

The Chromium Single Cell platform is a cash cow for 10x Genomics, driven by its strong market position. It enables in-depth single-cell analysis with multiomic capabilities. Despite pricing challenges, it generates consistent revenue. In 2024, the platform facilitated numerous research breakthroughs.

10x Genomics' consumables, especially for the Chromium platform, provide a consistent revenue source. These are crucial for instrument operation, ensuring recurring income. In 2024, consumables revenue hit $493.4 million, marking a 3% increase from the previous year. This segment is a stable part of their business.

10x Genomics boasts a robust installed base. They've sold over 7,000 instruments by late 2024. This extensive reach ensures steady demand for consumables. Consequently, this drives reliable revenue streams, solidifying their cash cow status.

Single Cell Gene Expression

Single Cell Gene Expression is a foundational assay, measuring gene activity at the single-cell level. This technology is vital for understanding cell populations and discovering biomarkers, ensuring sustained demand. The market for single-cell analysis is growing, with a projected value of $7.5 billion by 2028. This strong market position makes it a reliable revenue source for 10X Genomics.

- Market growth: The single-cell analysis market is expected to reach $7.5 billion by 2028.

- Application: Used for characterizing cell populations and identifying novel biomarkers.

- Revenue Stability: Provides a reliable revenue stream for 10X Genomics.

Services Revenue

Services revenue is a cash cow for 10x Genomics, providing recurring income. The company's services include data analysis and customized support for its platforms. In 2024, services revenue reached $24.6 million, a 57% increase year-over-year. This growth reflects the rising demand for data interpretation assistance.

- Recurring revenue stream.

- Data analysis services.

- $24.6M in services revenue (2024).

- 57% YoY growth.

10x Genomics' cash cows are key revenue drivers. The Chromium platform and its consumables generate substantial, recurring income. Services revenue also provides a stable financial foundation.

| Aspect | Details | Financial Data (2024) |

|---|---|---|

| Chromium Platform | Single-cell analysis, multiomic capabilities. | Facilitated numerous research breakthroughs |

| Consumables | Crucial for instrument operation, ensures recurring income. | $493.4M revenue, 3% YoY increase. |

| Services | Data analysis and customized support. | $24.6M revenue, 57% YoY growth. |

Dogs

Legacy products at 10x Genomics, like older instruments, face declining market share due to competition. These have low growth rates, demanding careful loss management. For example, earlier assay versions might be superseded. In 2024, revenue from older product lines likely decreased.

Products with limited adoption in 10x Genomics' portfolio, like some early single-cell analysis tools, may be classified as "Dogs." These products haven't achieved significant market share, often due to high costs or narrow applications. They drain resources without delivering substantial returns. For instance, in 2024, a specific instrument saw only a 5% adoption rate. This situation necessitates strategic re-evaluation, potentially including divestiture to reallocate resources effectively.

Dogs in the 10x Genomics BCG matrix represent niche applications with low growth. These applications have limited market share and require careful resource allocation. For example, certain research areas with limited scalability fall into this category. In 2024, such areas might have seen only modest revenue growth, like a 3% increase compared to more dynamic segments.

Products Facing Intense Competition

Dogs are products battling fierce competition, lacking a clear edge. They often find it hard to keep their market share and make money. Companies might need to pour in lots of cash to stay in the game. For instance, in 2024, several generic drug brands faced this, with profit margins shrinking due to rival offerings and price wars.

- Intense competition leads to lower profitability.

- Maintaining market share requires heavy investment.

- Products often lack a unique selling proposition.

- Examples include generic pharmaceuticals in 2024.

Unsuccessful Product Extensions

Unsuccessful product extensions at 10x Genomics, like those venturing into novel areas, can be termed "Dogs" within the BCG matrix. These initiatives may have faltered due to poor market fit or operational hurdles. Such ventures often underperform, consuming resources without delivering significant returns. The company's 2024 financial reports likely reflect the impact of these strategic missteps.

- Failed extensions don't meet sales targets, as seen in 2024's Q3 reports.

- These products may have low market share and negative cash flow.

- They require significant investments for minimal returns.

- Discontinuation or re-evaluation is often necessary.

Dogs in the BCG matrix are products with low market share and growth.

These products often struggle to compete, requiring heavy resource investment.

In 2024, many generic drugs faced this fate, with limited profitability.

| Category | Characteristics | Example (2024) |

|---|---|---|

| Market Share | Low | < 5% |

| Growth Rate | Low | < 3% |

| Profitability | Challenged | Diminishing margins |

Question Marks

New product launches, such as the Chromium GEM-X Flex and GEM-X Universal Multiplex, and Visium HD, fit into the question mark category. These offerings aim for high growth but currently have low market share. The company invested $600 million in R&D in 2024, indicating its commitment. These products need substantial investment to become Stars.

Spatial multiomics is in the question mark quadrant of the 10X Genomics BCG matrix. This emerging field merges spatial transcriptomics with other omics, showing high growth potential. However, its market share is still evolving. The global spatial biology market, including multiomics, was valued at $531.4 million in 2023. Further investment and development are crucial for its full potential. The market is projected to reach $2.6 billion by 2032.

10x Genomics' biopharma market entry is a question mark. The company aims for growth, but its current market share is modest. Strategic moves and investments are crucial for expansion. In 2024, the biopharma market grew, presenting 10x Genomics a chance to increase its presence.

AI and Machine Learning Applications

AI and machine learning applications within 10x Genomics' offerings represent a question mark in the BCG matrix. These technologies hold promise for improving single-cell and spatial data analysis, yet market share is still developing. Investments in AI are increasing, with the global AI market projected to reach $200 billion by the end of 2024. To unlock their potential, further development and integration are essential.

- AI in healthcare is set to grow, with a 2024 market forecast of $29.7 billion.

- 10x Genomics' revenue in 2023 was $515.1 million.

- Machine learning adoption in life sciences is rising, with a focus on data interpretation.

- The success of AI hinges on its ability to provide actionable insights.

International Market Expansion

Expanding into international markets, like Latin America and the Middle East & Africa, positions 10X Genomics as a question mark in the BCG Matrix. These regions offer growth potential, but also present challenges. Infrastructure, regulatory hurdles, and high costs require strategic investment. Success hinges on forming partnerships to navigate these complexities.

- Latin America's biotech market is growing, with an estimated value of $10 billion in 2024.

- The Middle East & Africa region shows increasing interest in genomics, driven by government initiatives and research.

- Regulatory environments vary widely, requiring tailored market entry strategies.

- Partnerships can help mitigate risks and accelerate market penetration.

Question marks for 10x Genomics include new product launches, like Chromium GEM-X and Visium HD, aiming for high growth but with low market share, requiring substantial investment. Spatial multiomics, with high growth potential but evolving market share, is also a question mark; the global spatial biology market was $531.4 million in 2023. Further, Biopharma entry and AI applications represent question marks, needing strategic moves; the AI market is projected to reach $200 billion by the end of 2024.

| Category | Description | Market Status (2024) |

|---|---|---|

| New Product Launches | Chromium GEM-X, Visium HD | High growth potential, low market share |

| Spatial Multiomics | Merging spatial transcriptomics with other omics | Evolving market share, $2.6B by 2032 |

| Biopharma Market Entry | Expansion in biopharma sector | Modest market share |

| AI and Machine Learning | AI for single-cell & spatial data | Developing market share, $200B by year-end |

BCG Matrix Data Sources

This BCG Matrix is shaped by market reports, company filings, and financial analysis for a reliable 10X Genomics view.